What is the Blood Culture Test Market Size?

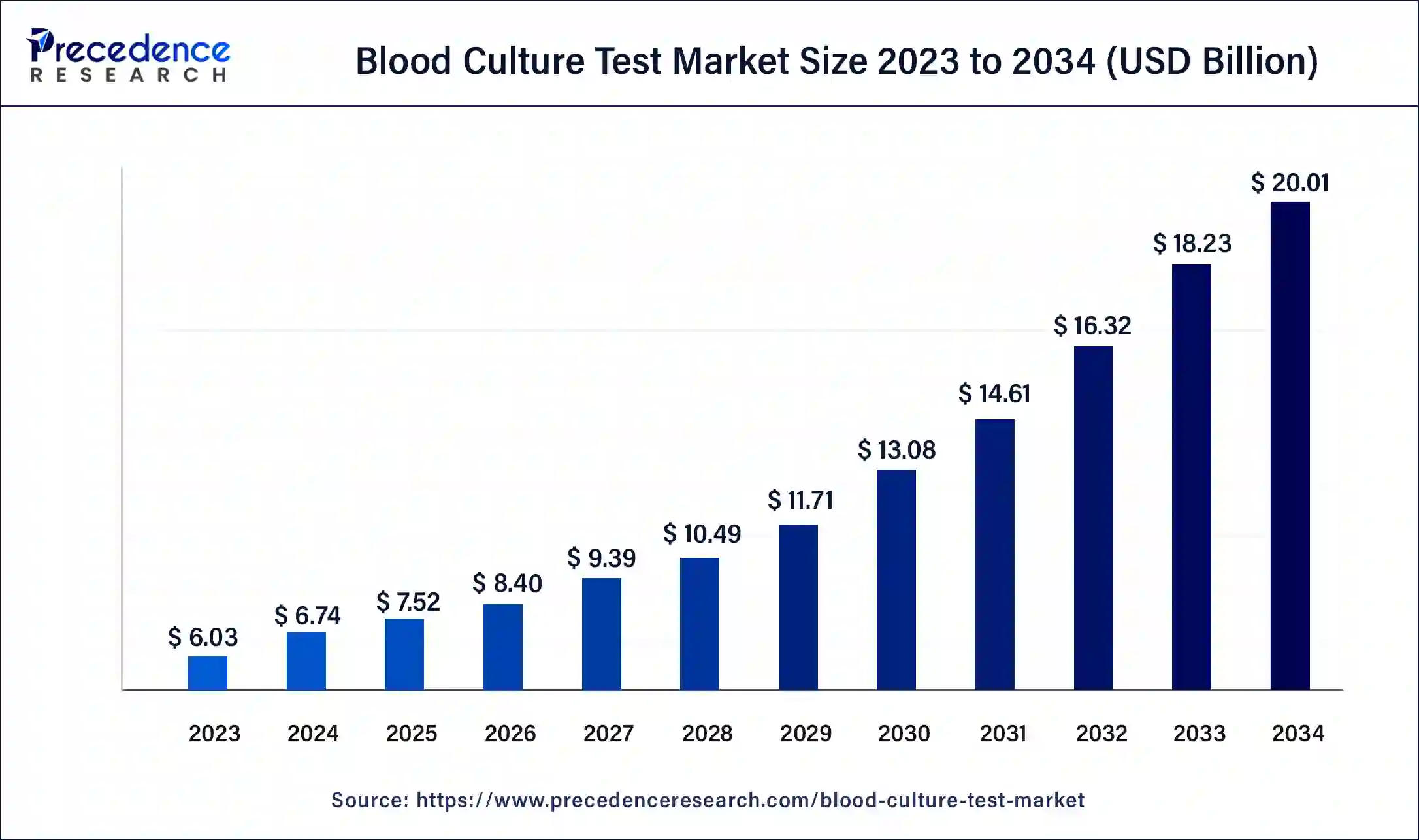

The global blood culture test market size accounted at USD 7.52 billion in 2025 and is predicted to reach around USD 20.01 billion by 2034, growing at a CAGR of 11.50% from 2025 to 2034.

Market Highlights

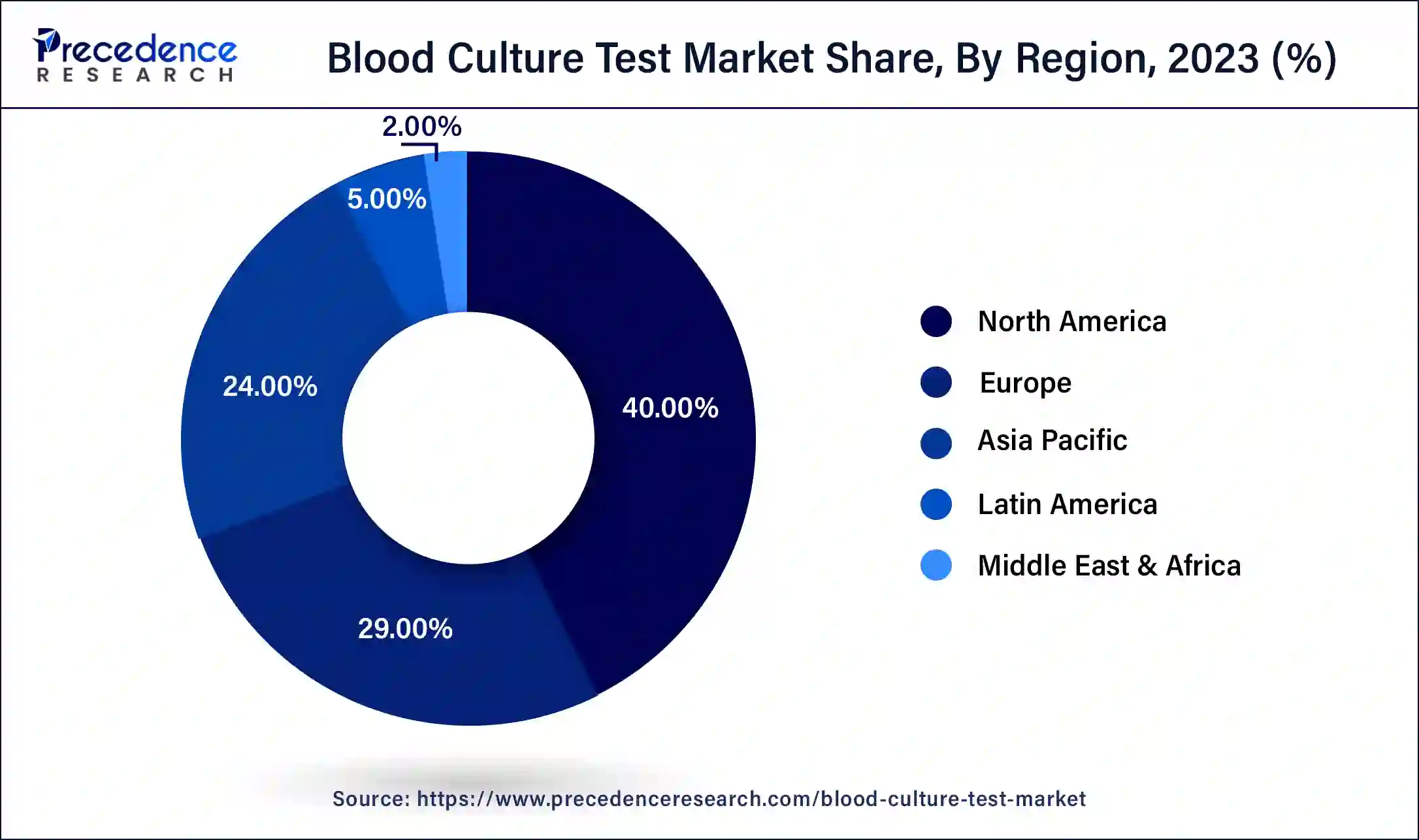

- North America region contributed more than 40% of revenue share in 2024

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the consumables segment has held the largest market share of 59% in 2024.

- By product, the instruments segment is anticipated to grow at a remarkable CAGR of 12.5% between 2025 and 2034.

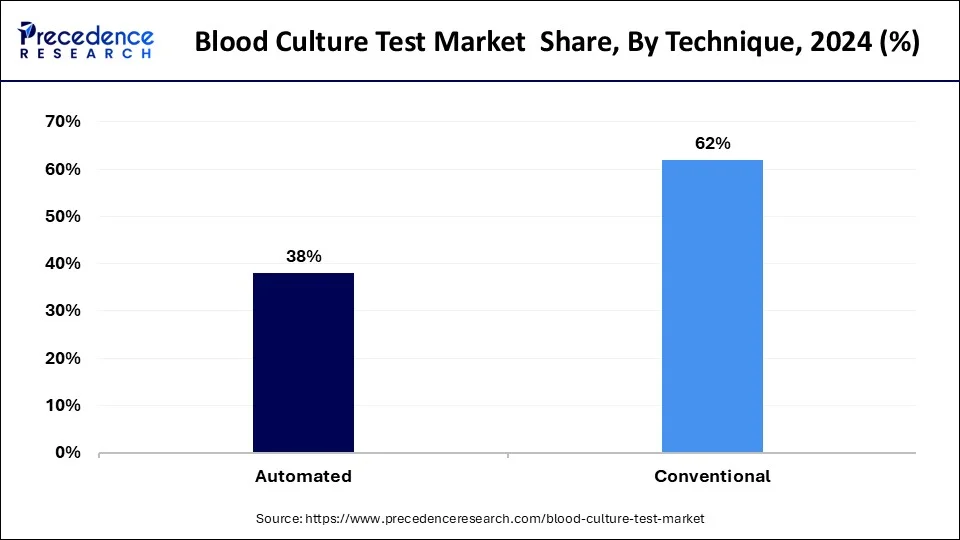

- By technique, the conventional segment generated over 62% of revenue share in 2024.

- By technique, the automated segment is expected to expand at the fastest CAGR over the projected period.

- By application, the bacterial infections segment generated over 70% of revenue share in 2024.

- By application, the mycobacterial infections segment is expected to expand at the fastest CAGR over the projected period.

- By technology, the culture-based segment generated over 67% of revenue share in 2024.

- By technology, the proteomic technology segment is expected to expand at the fastest CAGR over the projected period.

Blood Culture Test Market Overview

A blood culture test is a medical examination designed to identify harmful microorganisms, such as bacteria or fungi, in the bloodstream. This procedure involves extracting a small sample of blood and placing it in a sterile environment conducive to the growth of these microorganisms. By facilitating their growth, the test aids in pinpointing potential infections within the bloodstream, particularly those with the potential to cause serious conditions like sepsis.

Physicians typically order blood culture tests when patients exhibit symptoms of severe infections, like high fever, chills, or low blood pressure. The results of these tests are crucial in guiding healthcare providers to prescribe targeted antimicrobial treatments tailored to combat the specific pathogens causing the infection. Swift and accurate identification of these causative agents is imperative for effective patient care, allowing for timely and precise interventions to curb the spread of infections and enhance overall patient recovery.

Blood Culture Test Market Growth Factors

- Increasing Incidence of Infectious Diseases: The rising prevalence of infectious diseases worldwide drives the demand for blood culture tests, as they are crucial for accurate diagnosis and effective treatment.

- Technological Advancements: Ongoing advancements in blood culture testing technologies, such as automated systems and improved detection methods, contribute to the market's growth by enhancing accuracy and efficiency.

- Growing Aging Population: The expanding elderly population is more susceptible to infections, necessitating frequent blood culture tests for early detection and management of potential health risks.

- Rising Awareness of Sepsis: Increased awareness about sepsis and its life-threatening implications propels the demand for blood culture tests, as they play a pivotal role in diagnosing and monitoring septic conditions.

- Global Spread of Antimicrobial Resistance: The escalating challenge of antimicrobial resistance worldwide underscores the importance of precise pathogen identification through blood culture tests for appropriate antibiotic selection.

- Increased Healthcare Expenditure: Higher healthcare spending, especially in developed regions, supports the adoption of advanced diagnostic techniques like blood culture testing for improved patient outcomes.

- Growing Demand for Point-of-Care Testing: The trend toward point-of-care testing in healthcare settings accelerates market growth, as it enables faster diagnosis and timely initiation of treatment.

- Expanding Access to Healthcare: Improved access to healthcare services in developing regions amplifies the demand for diagnostic tools like blood culture tests, aiding in the early detection of infections.

- Rise in Surgical Procedures: The increasing number of surgical interventions globally boosts the need for blood culture testing to prevent and manage postoperative infections effectively.

- Strategic Collaborations and Partnerships: Collaborations between key market players and healthcare institutions drive research and development, fostering the introduction of innovative blood culture testing solutions.

- Surge in Bloodstream Infections: The growing incidence of bloodstream infections, often associated with invasive medical procedures, fuels the demand for blood culture tests for timely intervention.

- Government Initiatives for Infection Control: Supportive government initiatives focused on infection prevention and control contribute to the growth of the blood culture test market by promoting routine diagnostic practices.

- Expanding Application in Pediatric Care: Increasing recognition of the importance of blood culture testing in pediatric care for timely diagnosis and treatment of infections in children.

- Rapid Growth of the Diagnostic Services Sector: The diagnostic services sector's rapid expansion, driven by an increasing emphasis on preventive healthcare, boosts the demand for blood culture tests.

- Growing Adoption of Molecular Diagnostics: The rising adoption of molecular diagnostic techniques in blood culture testing enhances sensitivity and specificity, thereby fostering market growth.

- Demand for Multiplex Testing: Increasing preference for multiplex blood culture tests, capable of detecting multiple pathogens simultaneously, as they offer comprehensive diagnostic information.

- Focus on Early Disease Detection: Growing emphasis on early detection of infectious diseases and sepsis supports the utilization of blood culture tests as a critical diagnostic tool.

- Integration of Artificial Intelligence (AI): The integration of AI in blood culture testing processes improves result interpretation and diagnostic accuracy, driving market growth.

- Expansion of Healthcare Infrastructure: Ongoing expansion and modernization of healthcare infrastructure, particularly in emerging economies, contribute to increased accessibility and adoption of blood culture tests.

- Patient-Centric Healthcare Approach: The shift towards patient-centric healthcare, emphasizing personalized and targeted treatments, boosts the demand for precise diagnostic tools like blood culture tests.

- Siemens Healthineers AG's revenue in 2021 was $20,951 million, which was an increase from the previous year's $16,925 million. In 2022, the company's revenue was over $21.7 billion.

Blood Culture Test MarketTrends

- Rising cases of sepsis and bloodstream infections are increasing the need for fast and accurate blood culture testing in hospitals

- Antibiotic resistance is becoming a major concern, pushing healthcare providers to use blood culture tests to identify the exact bacteria before prescribing antibiotics.

- Automation is becoming common, with labs shifting from manual culture bottles to advanced automated systems that give faster and more reliable results.

- Rapid molecular testing methods—such as PCR and genetic panels—are being added after culture steps to speed up pathogen detection.

- Point-of-care blood culture tools are gaining traction, especially in emergency and critical care units where quick diagnosis can save lives.

- Mass spectrometry (MALDI-TOF) is being widely used to identify organisms quickly once a culture turns positive, reducing turnaround time.

- Faster result times are becoming a key priority, and new systems are reducing analysis time from days to hours.

- Developing countries are investing more in diagnostic labs, making advanced blood culture tests more accessible beyond major hospitals.

- The aging population worldwide is contributing to higher demand because older adults are more vulnerable to infections.

Market Outlook

- Industry Growth Overview: Due to an increase in bloodstream infections and the demand for quick, precise diagnosis, the market for blood culture tests is expanding. These tests are used by hospitals and laboratories to identify sepsis early and begin prompt treatment. As healthcare systems concentrate more on quick detection to lower mortality rates, adoption is rising

- Sustainability Trends: Manufacturers are shifting toward automated systems that reduce sample waste and energy use. Labs are also adopting eco-friendly consumables wherever possible. Digital reporting and automated workflows help cut down on paper use and manual errors.

- Major investors include leading diagnostic companies like BD, bioMérieux, Thermo Fisher Scientific, and Roche, who continue to expand R&D and instrument upgrades. Funding also flows into AI-based infection detection technologies. These companies invest heavily to develop faster, more sensitive culture systems for hospitals.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.52 Billion |

| Market Size in 2026 | USD 8.40 Billion |

| Market Size by 2034 | USD 20.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technique, Application, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global spread of antimicrobial resistance and focus on early disease detection

The global spread of antimicrobial resistance (AMR) significantly amplifies the demand for blood culture tests. As pathogens become more resistant to traditional antibiotics, precise identification of the infecting microorganism becomes paramount. Blood culture tests play a pivotal role in determining the specific pathogens causing infections, aiding healthcare professionals in prescribing targeted and effective antibiotic treatments. This necessity is underscored by the urgency to combat the increasing threat of treatment-resistant infections, driving the adoption of blood culture tests as a critical diagnostic tool in the era of rising AMR.

Simultaneously, the focus on early disease detection fuels the demand for blood culture tests. Timely identification of infectious diseases, including sepsis, is crucial for initiating prompt and appropriate interventions. Blood culture tests enable healthcare providers to swiftly diagnose infections, supporting early disease detection initiatives. The emphasis on early intervention aligns with broader healthcare goals of improving patient outcomes and reducing the overall burden of infectious diseases, making blood culture tests indispensable in the landscape of proactive and preventative healthcare strategies.

Restraint

Complexity of testing procedures and turnaround time

The complexity of blood culture testing procedures poses a restraint on market demand. These tests often involve intricate laboratory protocols, requiring skilled personnel and specialized training. The complexity may result in a shortage of qualified professionals, hindering routine use in healthcare facilities. This challenge is particularly pronounced in regions with limited access to well-trained laboratory staff, impacting the overall adoption of blood culture tests.

Additionally, the extended turnaround time associated with some blood culture tests acts as a significant restraint. Despite technological advancements, certain tests still require substantial processing time, delaying the delivery of critical diagnostic information. In scenarios where swift clinical decisions are imperative, such delays may lead to suboptimal patient outcomes. The market demand for blood culture tests is thus influenced by the need for continuous efforts to streamline testing procedures, reduce complexity, and enhance the speed of obtaining reliable results.

Opportunity

Advancements in technology and point-of-care testing (POCT)

Advancements in technology and the evolution of point-of-care testing (POCT) are pivotal in creating opportunities within the blood culture test market. Technological innovations, such as automated systems and improved detection methods, enhance the precision and efficiency of blood culture tests. The integration of molecular diagnostics and novel detection technologies allows for faster and more accurate identification of pathogens, addressing historical challenges associated with complex testing procedures. Furthermore, the rise of point-of-care testing is transforming the landscape by offering immediate, on-site diagnostic results.

POCT enables healthcare professionals to perform blood culture tests at the bedside, eliminating the need for centralized laboratories and significantly reducing turnaround times. This paradigm shift enhances accessibility, particularly in remote or resource-limited settings, and facilitates prompt clinical decision-making. The convergence of technological advancements and the expansion of point-of-care testing creates a synergistic opportunity, fostering the development of more efficient and accessible blood culture testing solutions to meet evolving healthcare demands.

Segment Insights

Product Insights

In 2024, the consumables segment had the highest market share of 59% based on the product. In the blood culture test market, the consumables segment encompasses the essential materials used in testing processes, including culture media, vials, and blood culture bottles. Trends in this segment focus on the development of advanced culture media formulations, offering improved sensitivity and quicker detection of pathogens. Additionally, manufacturers are working towards the integration of innovative materials in blood culture bottles, enhancing the overall efficiency of the testing process. These trends emphasize the continuous refinement of consumables to optimize blood culture tests for more accurate and timely diagnostic outcomes.

The instruments segment is anticipated to expand at a significant CAGR of 12.5% during the projected period. In the blood culture test market, the "instruments" category refers to the tools utilized for processing and analyzing blood samples to identify microbial infections. This includes automated blood culture systems, incubators, and detection devices. A notable trend involves incorporating advanced technologies like continuous monitoring and real-time data analysis into these instruments, aiming to improve the efficiency and accuracy of results. The market is witnessing a demand for user-friendly, efficient, and cost-effective instruments, leading to the development of next-gen systems that enhance diagnostic capabilities in detecting infectious pathogens.

Technique Insights

According to the technique, the conventional segment has held 62% revenue share in 2024. In the blood culture test market, the conventional segment refers to traditional culturing techniques where blood samples are incubated in a culture medium to identify microbial growth. Despite ongoing technological advancements, conventional methods remain prevalent due to their established reliability. However, there is a growing trend towards faster and automated techniques, driven by the need for quicker results and reduced turnaround times. This shift reflects a broader industry push for efficiency and enhanced diagnostic capabilities in the rapidly evolving landscape of blood culture testing.

The automated segment is anticipated to expand fastest over the projected period. Automated blood culture testing utilizes advanced systems to streamline the identification of pathogens in blood samples, automating crucial steps like incubation and detection. This technique reduces manual effort, enhances efficiency, and is increasingly favored in the market. The trend reflects a growing preference for automated systems due to their capacity to deliver quicker and more accurate results. Automation not only minimizes the risk of contamination but also improves workflow in clinical laboratories. This is particularly crucial in addressing the demand for rapid and dependable diagnostics, especially in the context of sepsis and other bloodstream infections.

Application Insights

According to the application, the bacterial infections segment has held a 70% revenue share in 2024. The bacterial infections segment in the blood culture test market focuses on identifying and characterizing bacterial pathogens in the bloodstream. This application is critical for diagnosing various bacterial infections, including sepsis. A notable trend in this segment involves the development of rapid and automated blood culture systems that enhance the speed and accuracy of bacterial detection. Advances in technology and the quest for quicker results are driving innovation, making it more efficient for healthcare professionals to diagnose and treat bacterial infections promptly, improving patient outcomes.

The mycobacterial infections segment is anticipated to expand fastest over the projected period. The mycobacterial infections segment in the blood culture test market focuses on detecting microorganisms belonging to the mycobacterium genus, including mycobacterium tuberculosis. Trends indicate a rising demand for blood culture tests to diagnose tuberculosis and other mycobacterial infections promptly. With advancements in testing technologies, there's a growing emphasis on improving the sensitivity and specificity of these tests. The mycobacterial infections segment reflects the market's commitment to addressing the global burden of tuberculosis and other mycobacterial diseases through enhanced diagnostic accuracy and timely intervention.

Technology Insights

According to the technology, the culture-based technology segment has held a 67% revenue share in 2024. In blood culture testing, culture-based technology involves isolating and cultivating microorganisms from a patient's blood sample to identify potential infections. Traditional culture methods rely on the growth of bacteria or fungi in a controlled environment. Recent trends in culture-based technology for blood culture tests include increased automation, reducing turnaround times. Additionally, advancements in molecular diagnostics within culture-based methods enhance sensitivity and specificity, allowing for more precise identification of pathogens. These trends contribute to improved diagnostic accuracy and efficiency in identifying bloodstream infections.

The proteomic technology segment is anticipated to expand fastest over the projected period. Proteomic technology in the blood culture test market involves the study of proteins expressed by microorganisms in blood samples. It identifies and analyzes unique protein profiles to pinpoint specific pathogens. Trends in this segment include the integration of mass spectrometry and advanced bioinformatics, enabling rapid and precise pathogen identification. Additionally, the adoption of proteomic technology facilitates the development of personalized antibiotic treatments, contributing to more effective infection management and a growing focus on precision medicine within the blood culture test market.

Regional Insights

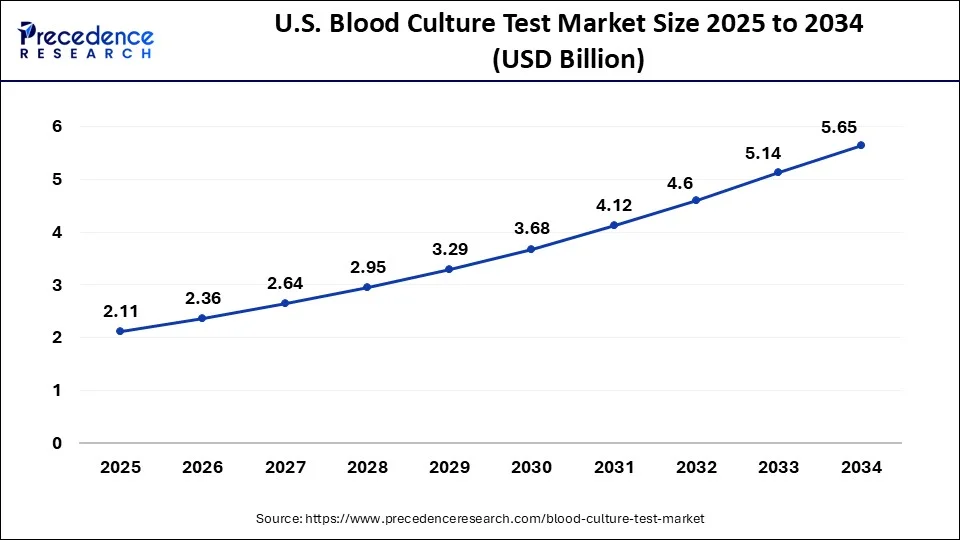

U.S. Blood Culture Test Market Size and Growth 2025 to 2034

The U.S. blood culture test market size is valued at USD 2.11 billion in 2025 and is expected to reach USD 5.65 billion by 2034, at a CAGR of 11.57% from 2025 to 2034.

North America has held the largest revenue share of 40% in 2024. North America dominates the blood culture test market due to advanced healthcare infrastructure, extensive research and development activities, and high healthcare expenditure in the region. The presence of key market players, robust regulatory frameworks, and a proactive approach to infectious disease management contribute to the region's significant market share. Additionally, a rising awareness of the importance of early disease detection and a strong emphasis on healthcare quality and safety further drives the adoption of blood culture tests in North America.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds a significant share in the blood culture test market due to the region's large and diverse population, increasing prevalence of infectious diseases, and rising healthcare expenditure. The growing awareness of the importance of early disease detection, along with advancements in healthcare infrastructure, contributes to the increased adoption of blood culture tests. Additionally, collaborations between key market players and government initiatives to improve healthcare access further drive the market's expansion in the Asia-Pacific region.

Value Chain Analysis

- R&D: In the blood culture test market, R&D is concentrated on improving the speed and precision of infection detection. To enable doctors to begin treatment sooner, companies are developing rapid identification tools, automation systems, and culture bottles. Additionally, new technologies are being tested to increase overall diagnostic efficiency and decrease false results.

- Distribution to Hospitals, Pharmacies: Since the majority of testing takes place in clinical settings, blood culture test kits are primarily supplied through hospital pharmacy networks and labs. Hospitals and suppliers collaborate closely to guarantee that bottles, media, and automated systems are consistently available. Reliable distribution is crucial because any disruptions in the supply can have an immediate effect on testing capacity.

- Patient Support and Services: Patient support in this market centers on quicker diagnosis and timely treatment. Faster test systems help doctors choose the right antibiotics sooner, improving patient recovery and reducing hospital stays. Hospitals are also adopting digital tools to track results and ensure patients receive proper follow-up care.

Blood Culture Test Market Companies

- Becton, Dickinson and Company (BD)

- bioMérieux

- Thermo Fisher Scientific

- Roche Diagnostics

- Beckman Coulter (a subsidiary of Danaher Corporation)

- Bruker Corporation

- Cepheid (a Danaher company)

- Luminex Corporation

- Bio-Rad Laboratories

- Siemens Healthineers

- Accelerate Diagnostics

- Alere Inc. (now part of Abbott)

- COPAN Diagnostics, Inc.

- Nanosphere (acquired by Luminex Corporation)

- T2 Biosystems

Recent Developments

- In 2023, BioMérieux disclosed its submission of a 510(k) premarket notification to the US Food and Drug Administration (FDA) for VITEK REVEAL, previously recognized as SPECIFIC REVEAL Rapid AST System. This advanced antimicrobial-susceptibility test platform provides swift results for Gram-negative bacteria directly from positive blood cultures, enabling clinicians to make same-day treatment decisions for patients with bacteremia sepsis in just over five hours.

- In 2022, Beckman Coulter collaborated with Germany's Smart4Diagnostics to address preanalytical challenges in the blood testing process. The partnership aimed to bridge the data gap between blood collection and laboratory analysis, focusing on mitigating errors occurring before the sample reaches the laboratory, including sample collection, patient identification, handling, transportation, and potential sample loss.

- In 2020, Becton, Dickinson and Company secured CE mark approval for the BD Vacutainer UltraTouch Push Button Blood Collection Set (BCS) with Preattached Holder. Noteworthy for its one-handed safety activation, the push-button design enables clinicians to activate safety measures while tending to the patient and venipuncture site.

Segments Covered in the Report

By Product

- Consumables

- Software & Services

- Instruments

By Technique

- Conventional

- Automated

By Application

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

By Technology

- Culture-based Technology

- Molecular Technology

- Proteomic Technology

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting