What is the Blow Molded Plastics Market Size?

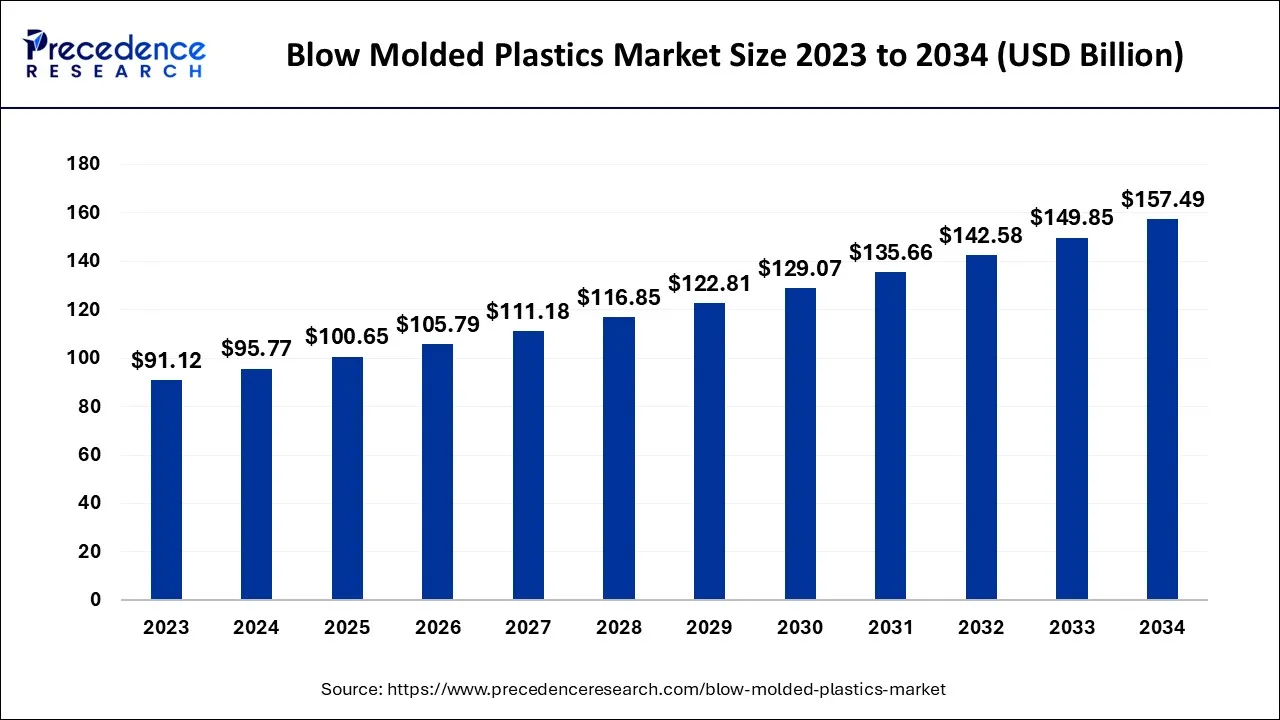

The global blow molded plastics market size is valued at USD 100.65 billion in 2025 and is predicted to increase from USD 105.79 billion in 2026 to approximately USD 165.13 billion by 2035, expanding at a CAGR of 5.08% from 2026 to 2035.

Blow Molded Plastics Market Key Takeaways

- Asia Pacific generated for more than 39% of the total revenue share in 2025.

- By technology, injection blow molding segment has captured 29% of the overall revenue share in 2025.

- By product, polyethylene (PE) segment has held revenue share of 21% in 2025.

- By application, packaging segment has accounted for more than 40% of revenue share in 2025.

- Automotive & transportation segment emerged as the leading application segment with over 21% revenue share in 2025.

Market Overview

Blow molding is building empty plastic portions by creating and gluing them together to produce glass bottles and open containers. The parison maintains the form of the metal mold, and then it demolds and trims the constructed portion to pull out the flash or trim. Extrusion blow formation, injection blow formation and injection stretch blow blowing are three types of blow formations.

The benefits of extrusion-blowing molding are low product cost, simple process, and high efficiency. However, its significant drawback is the wall thickness and yield uniformity. Extrusion blow molding usage has a lower pressure level, reducing manufacturing costs and making the product cost-efficient. In addition, using the blow molding procedure will permit producers to reduce high labour expenses.

Blow Molded Plastics Market Growth Factors

The medical field is projected to bolster the utilization of blow-molded plastic bottles as they are used for wrapping medicines and maintaining the property of the drugs without damage or degradation. The healthcare sector's expansion has vastly aided the development of the blow molding plastics market. Plastic packaging encourages hygienic practices and is less susceptible to detriment and drips than glass packaging. Syringes, cylinders, bottles, and medical vessels are healthcare supplies.

The rise in pharmaceutical equipment has led to an increase in the approval of blow-molded plastic bottles, contributing to the overall development of the blow-molded plastic bottle market. The experts also estimate that regulating and fulfilling regulation laws in the use of plastics have affected the general packing industry, with a rising need for more lasting solutions, pressuring producers to invest severely in biodegradable and economical packing solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 100.65 Billion |

| Market Size by 2035 | USD 165.13 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.08% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The food and beverage sector accounts for over 70% of the blow molded container market worldwide, attributed to changing customer preferences for more eco-friendly and convenient packing solutions. Molded plastics are mainly utilized in the packaging and automobile sector, and the packaging manufacturing industry is a significant user of molded plastics.

The commonly used molded plastics in packing applications comprise PE, PET and PP. These rigid or flexible products rely on the end-user requirements and are used in various packaging usages, for example, food and beverage, cosmetics, and pharmaceutical.

Different molding technologies cover blow molding, injection molding, and extrusion molding, offering various advantages like durability, food preservation, medical safety and effectiveness. Plastic packaging has found universal use due to these benefits over other materials, and products manufactured over blow molding methods replace traditional materials.

Restraints

Plastic waste damages the ecological system as it takes decades to break down. Governments address this matter worldwide by imposing rigid laws that the plastics industry must adhere to. European governments have undertaken several measures to address packaging waste and recycling issues.

Opportunities

The growing approval of 3D printing methods in commercial uses supports the development of 3D printing plastic combined worldwide that grades perform optimistically in highly corrosive and high temperature/ pressure environments. After some value additions like carbon fibres, the composite grades of plastics offer improved performance. Usually used molded plastics comprise PC, ABS, and PA. Some popular qualities of 3D printing plastic composites cover carbon fiber-PLA and.

Significant producers of molded plastics, like SABIC, have started manufacturing 3D printing plastics with advanced integration in recent years. The advancement in the need for 3D printing plastic composites will provide growth provisions for the molded plastics market. The blow molding procedure affects quality output, so it is one of the most used in plastic production globally. With machines with 3D molding capacity, blow molding can help makers yield many units quickly.

Technology Insights

The injection blow molding section accounted for the maximum revenue of the overall market share. The expense of extrusion blow mold is less than the injection blow as per the lower pressure needed. The machinery expenses are also less for extrusion blow mold, which is an advantage.

The stretch blow molding method makes high-quality and high-clarity bottles with application limitations. It is applied for producing soda bottles, household cleaners, and personal care containers, and they are made mainly on customized orders from consumers.

Product Insights

The polyethylene (PE)section accounted for the overall market share in the revenue. PE compounds are commonly used in the packaging and electrical and electronics industries. The primary packaging uses of PE compounds comprise various grades of bottles for packing a wide range of food and chemical products.

It has numerous uses in the packaging industry, such as manufacturing bottles to pack food and beverage products. The requirement for polypropylene and polyethylene terephthalate is anticipated to grow due to the rising need for protective gowns, face masks, and packaging bottles for hand sanitizers during the pandemic.

Application Insights

Packaging evolved as the leading application section with a maximum revenue share of the entire blow-molded plastics market. The packaging industry is chiefly impelled by high consumerism in emergent economies. Expanding the packaging sector will likely boost the need for plastic compounds like polyethylene and PET in the upcoming years. The upsurge for blow molding plastics is growing primarily in packaging applications. This is due to the increasing demand for plastic bottles for disinfectants, household cleaning liquids, hand sanitizers, and others to tackle the pandemic.

Automotive & transportation was the second-largest application section with a volume share. The rising integration of plastics in automotive elements and the simultaneous growth in the manufacture of electric passenger cars and heavy-duty automobiles, particularly in Asia and Central and South America, are predicted to propel the development of the automotive & transportation application section over the estimated period.

Regional Insights

What Made Asia Pacific the Dominant Region in the Blow Molded Plastics Market?

Asia Pacific dominated the market with the largest share in 2024. This is mainly driven by rapid urbanization, population growth, and increased food and beverage consumption. Growing demand for affordable plastic packaging, along with expansion in pharmaceuticals and consumer goods manufacturing, supports market growth. Rising investments in manufacturing capacity and export-focused production further reinforces the region's leadership in the market.

India

The Indian blow molded plastics market is experiencing robust growth, driven by escalating demand from the packaging, automotive, and construction sectors. Other key growth drivers include rising consumerism, urbanization, and the need for efficient, durable, and cost-effective solutions, amid sustainability pressures and rising raw material costs. The growing initiatives in domestic manufacturing and innovation further fuel market growth.

What Potentiates the Blow Molded Plastics Market within North America?

The market in North America is driven by strong demand from the packaging, automotive, healthcare, and consumer goods industries. The region emphasizes lightweight, recyclable, and high-performance plastic containers, particularly for food, beverages, and pharmaceuticals. Regulatory pressure on sustainability is accelerating the adoption of recycled and bio-based blow-molded plastics across industrial and consumer applications.

U.S.

The U.S. dominates the North American blow molded plastics market due to its large packaging industry, advanced manufacturing infrastructure, and high consumption of plastic containers. Strong demand from the food and beverage, personal care, and pharmaceutical sectors drives production volumes. Investments in automation, multilayer blow-molding technologies, and the use of recycled resin further strengthen the country's market position.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate in the blow molded plastics market, driven by strict environmental regulations, circular economy initiatives, and high sustainability awareness. Demand is strong for recyclable, lightweight, and reusable plastic packaging in food, household chemicals, and personal care segments. Manufacturers are increasingly adopting advanced blow-molding technologies and incorporating recycled content to comply with EU directives and sustainability targets.

Germany

Germany is a major player in the European blow molded plastics market, backed by its strong automotive, industrial packaging, and chemical industries. The country focuses on precision manufacturing and producing high-quality plastic parts, especially for automotive fluids and industrial containers. Robust R&D capabilities and early adoption of recycled plastics boost Germany's competitiveness in the regional market.

Blow Molded Plastics Market - Value Chain Analysis

- Raw Material Sourcing:

This stage involves the sourcing of polymer resins such as HDPE, LDPE, PET, PP, and PVC that serve as the base materials for blow molded products.

Key Players: ExxonMobil, LyondellBasell, SABIC, Dow, BASF - Research & Product Design:

Manufacturers focus on material innovation, lightweighting, barrier properties, and sustainable designs to meet packaging, automotive, and industrial requirements.

Key Players: Amcor, Berry Global, Graham Packaging, Silgan Holdings - Blow Molding Equipment & Tooling:

This stage includes the production of extrusion, injection, and injection stretch blow molding machines and molds used in manufacturing plastic containers.

Key Players: Bekum Maschinenfabriken, Sidel Group, Krones AG, Jomar Corporation - Manufacturing & Processing:

Blow molding companies convert plastic resins into bottles, containers, tanks, and industrial parts through automated and high-volume production processes.

Key Players: Berry Global, Plastipak Holdings, Graham Packaging, Alpla Group - Distribution & Logistics:

Finished blow molded plastic products are transported to brand owners, OEMs, and end-use industries through regional and global distribution networks.

Key Players: Alpla Group, Berry Global, Amcor, Silgan Holdings

Blow Molded Plastics Market Companies

- Rutland Plastics Ltd.

- The Plastic Forming Company, Inc.

- Agri-Industrial Plastics

- Garrtech Inc.

- Creative Blow Mold Tooling

- North American Plastics, Ltd.

- Machinery Center, Inc.

- Magna International, Inc.

- International Automotive Components Group, S.L. (IAC Group)

- Berry Global, Inc.

- Pet All Manufacturing, Inc.

- Inpress Plastics Ltd.

- Dow, Inc.

- Comar, LLC

- Custom-Pak, Inc.

- APEX Plastics

- INEOS Group

- LyondellBasell Industries Holdings B.V.

- Exxon Mobil Corporation

- Gemini Group, Inc.

Recent Developments

- In February 2023,NOVA Circular Solutions – a new channel of business operating upon less-emission, recyclable solutions and home to the corporation SYNDIGO-brand recycled polyethylene was established by NOVA Chemicals Corporation.

- In November 2022, the National Research Council of Canada (NRC) celebrated 30 years of collaboration to enhance blow molding design processes.

- In July 2022,The Canadian corporation Heartland Polymers entirely ordered its polypropylene (PP) plant at the Heartland Petrochemical Complex in Alberta, Canada, with a scheduled production power of 525,000 tons/year of polypropylene.

- In March 2022,Mauser Packaging Solutions reported receiving UN certification for the compound intermediate bulk vessel manufactured from post-customer resin.

Segments Covered in the Report

By Technology

- Extrusion Blow Molding

- Injection Blow Molding

- Stretch Blow Molding

- Compound Blow Molding

By Product

- Polypropylene

- Acrylonitrile Butadiene Styrene

- Polyethylene

- Polystyrene Polyvinyl Chloride

- Polyethylene Terephthalate

- Polyamide

- Polyamide 6

- Polyamide 66

- Others

By Application

- Packaging

- Consumables & Electronics

- Automotive & Transport

- Building & Construction

- Medical

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting