What is the 3D Injection-Molded Plastic Market Size?

The growth of the market is driven by the increasing demand for 3D molded plastics and durable and economical solutions in various sectors, the packaging, automotive, medical, and electronics.

3D Injection-Molded Plastic Market Key Takeaways

- Asia Pacific dominated the global 3D injection-molded plastic market in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By material, the polypropylene (PP) segment captured largest market share in 2024.

- By material, the acrylonitrile butadiene styrene (ABS) segment is expected to expand at a significant CAGR during the forecast period.

- By application, the packaging segment contributed the biggest market share in 2024.

- By application, the automotive segment is expected to grow at a significant CAGR over the upcoming period.

Strategic Overview of the Global 3D Injection-Molded Plastic Industry

The 3D injection-molded plastic market revolves around the production of plastics using injection molding. In this process, plastic material is injected into a mold cavity under pressure, which then cools and solidifies, creating a part with the desired shape. There is a high demand for injection molded plastics in various industries due to their versatility, cost-effectiveness, and capability to produce complex parts with high precision. 3D injection-molded plastic is beneficial in the mass production of complex parts with high efficiency, reducing waste generation. Increased adoption of additive manufacturing across industries contributes to market expansion.

What is the Role of Artificial Intelligence in the 3D Injection-Molded Plastic Market?

Artificial intelligence (AI) is revolutionizing the market for 3D injection-molded plastic by automating numerous processes, optimizing designs, and boosting manufacturing efficiency. AI-powered systems are employed for predictive maintenance, quality control, and process optimization, resulting in quicker production cycles and minimized waste. AI-driven defect detection and quality control systems can identify and address defects early, leading to higher-quality products. Additionally, AI analyzes sensor data to continually fine-tune injection molding parameters, maximizing efficiency and minimizing waste. Overall, the market is on an upward trajectory due to AI.

What Are the Key Trends in the 3D Injection-Molded Plastic Market?

- Mass Production: 3D injection molding enables the mass production of plastic parts with high efficiency and low waste. This is supported by the fact that the automotive, aerospace, and other industries are increasingly looking for lighter and fuel-efficient solutions, leading to mass production.

- Flexible Customization: 3D printing allows for the development of custom molds by allowing manufacturers to produce parts with unique shapes and features with automated processes. It further increased efficiency and cost savings, too.

- Wider range of Applications: The use of 3D injection-molded plastics is also expanding into a wider range of applications, such as medical devices, consumer electronics, and industrial applications, contributing to market expansion.

- Demand for Sustainable Solutions: The rising demand for sustainable and eco-friendly solutions is also fostering the adoption of bio-based and recycled plastic in 3D injection molding in various industries, creating an area of growth.

- Technological Advancements: Improvements in 3D printing and injection molding technologies allow the production of complex geometries and customized parts. Also, automation and the integration of smart manufacturing technologies are enhancing efficiency and productivity in injection molding processes, driving growth.

Market Outlook

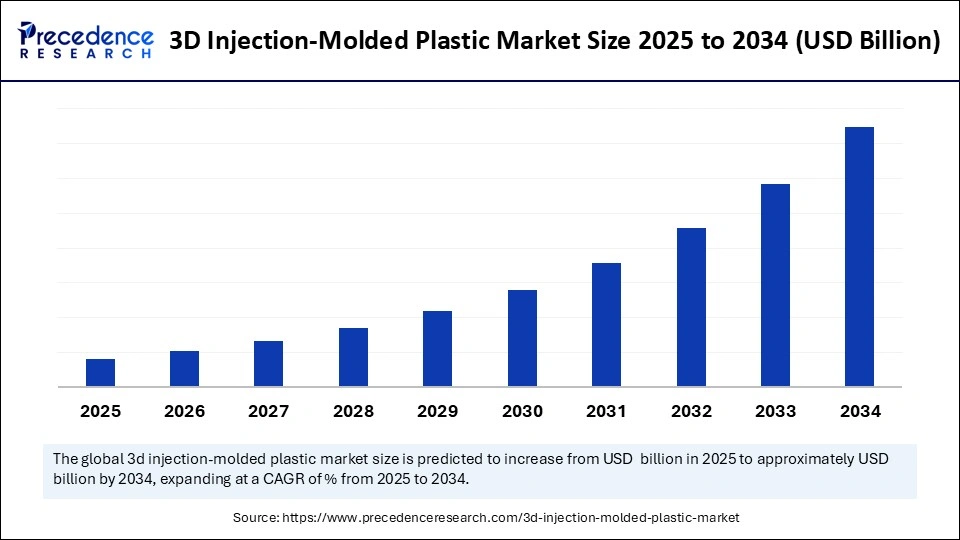

- Market Growth Overview: The 3D Injection-Molded Plastic market is expected to grow significantly between 2025 and 2034, driven by the cost-effective production, faster turnaround times, and 3D printing allows for greater design freedom and customization, enabling complex geometries like conformal cooling channels that are difficult or impossible with traditional methods.

- Sustainability Trends: Sustainability trends involve a hybrid approach that reduces waste and optimizes design, adoption of sustainable materials, and circular economy and lifecycle management.

- Major Investors: Major investors in the market include Stratasys, HP Inc., and Materialise NV.

- Startup Economy: The startup economy is niche-focused on tooling and materials, rapid prototyping services, and innovation in material science.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Customized Products and Rapid Prototyping

The primary catalyst in the 3D injection-molded plastic market is the rising need for rapid prototyping across various industries, especially for producing parts featuring complex geometries and high-volume requirements. This manufacturing process provides rapid prototyping, enabling quick iteration and change in design and reducing production cycles. 3D injection-molded plastic is specifically suitable for short-run and on-demand production needs. The rising demand for customized products, especially in the automotive, aerospace, and consumer goods sectors, propels the growth of the market.

Restraint

Higher Initial & Ongoing Maintenance Costs and the Availability of Alternative Technologies

The main challenge facing the 3D injection-molded plastic market is the higher initial investment and ongoing maintenance costs linked to injection molding equipment. Handling the injection molding process requires skilled expertise, as designing molds for complex shapes is challenging. Thus, the lack of skilled workforce in some areas limits the adoption of injection molding. The upfront investment in specialized machinery and molds, coupled with the need for skilled personnel, poses a significant barrier for small enterprises. Additionally, the availability of alternative technologies like thermoforming and blow molding hampers the growth of the market.

Opportunity

Integration of 3D Printing Technologies with Conventional Injection Molding

A key future opportunity in the 3D injection-molded plastic market lies in the integration of 3D printing technologies with conventional injection molding to enhance customization, facilitate on-demand manufacturing, and reduce lead times. 3D printing enables faster creation and modification of molds, allowing for the efficient production of highly complex geometries and customized parts across industries such as healthcare and automotive. Moreover, advancements in injection molding technology open up new growth avenues. Integrating technologies like IoT and data analytics improves efficiency and performance by enabling automation. These technologies also lead to the development of smart injection molding technology.

Segment Insights

Material Insights

Why Polypropylene (PP) Segment Dominated the 3D Injection-Molded Plastic Market In 2024?

The polypropylene (PP) segment dominated the market by capturing the largest revenue share in 2024. This is mainly due to its superior properties like durability, chemical resistance, and ease of processing, making it suitable for a wide range of applications. Its recyclability also aligns with sustainability goals. Additionally, it can withstand wear and tear, maintain strength across a temperature range, and resist moisture and chemicals, making it ideal for automotive, consumer goods, and packaging applications. Additionally, superior properties and low cost of polypropylene make it a preferred choice across various industries.

The acrylonitrile butadiene styrene (ABS) segment is expected to expand at a significant CAGR during the forecast period. This is due to its excellent properties, cost-effectiveness, and ease of processing, making it ideal for a wide range of applications, including consumer electronics, automotive parts, toys, and more. Additionally, it is considered a popular material for 3D injection molding due to its dimensional stability, heat resistance, and ability to be painted or glued, which provides flexibility in manufacturing processes.

Application Insights

Why did the Packaging Segment Dominate the 3D Injection-Molded Plastic Market in 2024?

The packaging segment dominated the market with a majority share in 2024. This is due to a heightened demand for protective packaging in diverse industries such as food & beverages, consumer goods, and healthcare. Injection molded plastics are suitable for packaging applications due to their leak-resistance and durability. Furthermore, 3D injection molding offers cost-effective and high-speed production of various packaging components, including thin-walled containers, beverage closures, and specialty closures. The increased demand for robust packaging solutions from the food & beverage industry to reduce spoilage during transportation bolstered the segmental growth.

The automotive segment is expected to grow at a significant CAGR over the upcoming period, driven by the increasing demand for lightweight, durable, and high-precision components. The rising adoption of 3D printing for rapid prototyping and mass production contributes to segmental growth. Automakers are increasingly preferring injection molded plastics for their versatility and lightweight nature. The rising reliance of the automotive industry on 3D injection molding for complex, precise components, coupled with the increasing electric vehicle production, further supports market growth.

Regional Insights

How does Asia Pacific Dominated the 3D Injection-Molded Plastic Market in 2024?

Asia Pacific registered dominance in the market by capturing the largest revenue share in 2024. This is mainly due to its rapid industrialization, specifically in countries like China, India, and Japan, leading to increased demand for 3D injection-molded plastics across various sectors. Additionally, governments across the region have been investing in infrastructure development, supporting the market. Governments of various Asian countries have been making efforts to promote local manufacturing through various initiatives to bolster plastic production. Furthermore, the region has well-established automotive and packaging industries, boosting the demand for robust plastics.

China: A Key Force in the 3D Injection-Molded Plastic Market

China plays a distinctive role in the 3D injection molded plastic market within Asia Pacific. Its position in the market is reinforced by its strong manufacturing capabilities, rapid industrialization, and technological advancements. Initiatives like China National Petroleum Corporation, a major producer of molded plastics, demonstrate the significant role of the country in the global market. Moreover, the country has a robust automotive industry, coupled with the rising production of vehicles, supporting market expansion.

- In February 2023, Injection molding equipment manufacturer Sumitomo Demag China broke ground last month on the construction of a new 4,000-square-meter production facility at its Ningbo site in China. The new plant has doubled the production capacity for Asian markets and serves the rising demand for higher-tonnage machines as the primary strategic rationale for the expansion.

(Source: https://www.plasticstoday.com)

Indian 3D Injection-Molded Plastic Market Trends

India is a significant force in the market. This is because of rising infrastructure development, rising automobile production, and an emphasis on domestic manufacturing. Reliance Industries, a major player in polymer and polypropylene production, highlights the significance of the country in the market. The rapid expansion of the automotive and packaging industries further contributes to market expansion.

What are the Major Trends in the North American 3D Injection-Molded Plastic Market?

North America is expected to grow at the fastest CAGR during the forecast period. This is due to rapid technological advancements and a strong need for protective packaging from end-use industries. Specifically, the region benefits from a robust manufacturing infrastructure, particularly in the automotive, packaging, and healthcare sectors, and is experiencing significant growth in the electronics industry. Moreover, investments in 3D printing technology and the shift toward sustainable and eco-friendly practices are also driving growth.

The U.S 3D Injection-Molded Plastic Market Trends

The U.S. plays a crucial role in the market. The U.S. boasts a robust manufacturing landscape, including a significant number of businesses involved in contract injection molding in the development of innovative technologies. The country is a major producer of injection molded plastics, improving the widespread accessibility. The rising demand from industries like automotive, medical, and construction further contributes to market expansion.

Europe: A Notable Region in the 3D Injection-Molded Plastic Market in 2024

Europe is expected to grow at a significant rate in the coming period. This is due to its robust infrastructure, commitment to technological innovation, and rising production of vehicles. High adoption rates of 3D printing technology across various industries are also driving the growth of the market. In addition, initiatives like the European Green Deal are advocating for a circular economy and sustainable manufacturing practices, encouraging the use of recycled and bio-based plastics in injection molding.

Germany 3D Injection-Molded Plastic Trends

Germany's 3D Injection-Molded market is integrating 3D printing for tooling. Germany's commitment to smart manufacturing means greater adoption of automation, robotics, and AI-driven process optimization within injection molding facilities. Sustainability and circular economy focus and high demand from the automotive industry.

Value Chain Analysis

- Materials Research and Production

This initial stage involves developing and producing the specialized thermoplastic and composite materials used for both 3D printing the molds/inserts and for the final injection molding process.

Key Players: BASF SE, Covestro AG, SABIC, DuPont de Nemours, Inc., Stratasys, HP Inc. - Tooling Design and 3D Printing

In this critical, innovative stage, digital designs for custom injection molds or mold inserts are created using CAD software and then produced rapidly using additive manufacturing (3D printing) technologies.

Key Players: Stratasys, HP Inc., Formlabs, EOS GmbH, Materialise NV, SolidWorks (CAD software), Autodesk (CAD software). - Injection Molding Production

This stage involves the actual plastic part production using the 3D-printed molds within standard injection molding machines.

Key Players: Large manufacturing service providers (e.g., Protolabs), traditional injection molding companies leveraging 3D printed molds, custom plastic injection molders in automotive and medical sectors. - Assembly and Finishing

Following molding, parts often require secondary processes such as trimming, assembly of multiple components, painting, surface finishing, and quality assurance testing.

Key Players: In-house operations of manufacturing companies, specialized finishing service providers, and contract manufacturers in various industries. - Distribution, Sales, and End-Use

The finished plastic components are distributed through sales channels to various end-user industries, including automotive, medical devices, consumer electronics, and industrial equipment.

Key Players: Global logistics providers (e.g., DHL, Kuehne+Nagel), industry-specific distributors, major OEMs that use these components in their final products (e.g., BMW, Siemens, Medtronic).

3D Injection-Molded Plastic Market Companies

- ExxonMobil Corporation: ExxonMobil is a major supplier of basic plastic feedstocks and polymers (e.g., polyethylene, polypropylene), providing the raw materials essential for the injection molding process.

- BASF SE: A leading chemical company, BASF contributes advanced engineering plastics and performance polymers, as well as materials for 3D printing of molds, enabling high-performance components across various industries.

- DuPont de Nemours, Inc.: DuPont supplies specialized high-performance materials and composites crucial for demanding applications in automotive and electronics, offering materials suitable for both 3D tooling and final part production.

- Dow, Inc.: Dow provides a wide range of basic and specialty polymers used in large-volume injection molding applications, focusing on material science innovations for durable and efficient products.

- Huntsman International LLC.: This company specializes in polyurethanes and advanced materials, contributing to the development of unique composite solutions and materials used in tooling and final part production for complex industrial needs.

- Eastman Chemical Company: Eastman provides specialty plastics and advanced polymers, including some with sustainable properties, used in high-value injection-molded products across consumer and medical sectors.

- INEOS Group: A major producer of petrochemicals and commodity plastics, INEOS supplies basic raw materials like polypropylene and polyethylene for mass-market injection molding operations globally.

- LyondellBasell Industries Holdings B.V.: This company is a significant global producer of polyolefins, providing essential base materials that are widely used for a vast array of injection-molded consumer and industrial products.

- SABIC: SABIC is a global leader in engineering thermoplastics and composites, contributing advanced material solutions that enable lightweight and high-strength components in automotive and aerospace applications.

- Magna International, Inc.: As a major automotive supplier, Magna utilizes advanced manufacturing including potentially 3D-printed tools for rapid prototyping and producing complex injection-molded components for vehicles.

- IAC Group: IAC specializes in automotive interiors and likely uses advanced plastic manufacturing processes, including potential applications of 3D tooling for prototyping, to create sophisticated interior components.

- Berry Global, Inc.: Berry is a large producer of plastic packaging and engineered products, leveraging mass-production injection molding technologies to meet global consumer goods and industrial demands.

- Master Molded Products Corporation: This company provides custom injection molding services, likely using 3D-printed inserts for prototyping and low-volume production to offer clients rapid and cost-effective solutions.

- HTI Plastics Inc.: HTI offers custom plastic injection molding with a focus on advanced engineering and design, likely integrating 3D printing in their tooling processes to optimize product development cycles.

- Rutland Plastics: As a custom injection molder, Rutland Plastics likely employs 3D printing for mold inserts or rapid prototyping, focusing on delivering specific, high-quality plastic components to diverse industries.

- AptarGroup, Inc.: Aptar specializes in consumer packaging and dispensing solutions, using high-volume, precision injection molding where 3D-printed tools could optimize prototyping and new product introductions.

- LACKS ENTERPRISES, INC.: Lacks is a major supplier of automotive components and finishes, using advanced injection molding and potentially 3D-printed tooling to produce highly complex and decorative parts for vehicles.

- The Rodon Group: This is a high-volume, custom injection molding company focused on efficiency and scale, potentially using 3D printing to quickly test mold designs and ensure production quality.

- Heppner Molds: As a mold maker, Heppner likely integrates 3D printing technologies to produce complex, cost-effective tooling or inserts faster than traditional methods, serving clients needing innovative mold solutions.

Recent Developments

- In March 2025, the Italian injection molding specialist Sapa Group acquired Megatech Industries, including its German facilities. This acquisition aims to strengthen Sapa Group's leading position in the plastic injection molding sector while expanding its international customer base and footprint and further scaling its one-shot technology.(Source: https://www.medicaldesignandoutsourcing.com)

- In May 2024, Husky Technologies launched its next-generation HyPET6e platform. Building on the industry-leading technology of the company's flagship PET preform injection molding system, HyPET6e combines proven technology and innovation engineered to proactively develop circular solutions addressing plastic waste management.(Source: https://www.husky.co)

- In April 2024, plastics industry veterans Benjamin Harp and Tom Rybicki launched Polymer Medical Inc. to provide healthcare and biosciences clients with contract injection-molding and assembly services, focusing on producing critical drug-delivery systems, medical disposables such as syringes, home healthcare medical devices to orthopedics, specialty packaging, and pharmaceutical disposables, among other services. (Source:https://www.etmm-online.com)

- In April 2023, Polymer 3D-printing company Nexa3D finalized its acquisition of Addifab, the developer of Freeform Injection Molding, a proprietary and patented digital tooling process that merges the design freedom of 3D printing with the mechanical performance of injection molding, utilizing a full range of engineering materials to produce complex tools compatible with any injection molding feedstock. (Source: https://www.plasticstoday.com)

Segments Covered in the Report

By Material

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Others

By Application

- Packaging

- Automotive

- Electronics

- Medical Devices

- Consumer Goods

- Construction

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting