What is the Bonded Abrasives Market Size?

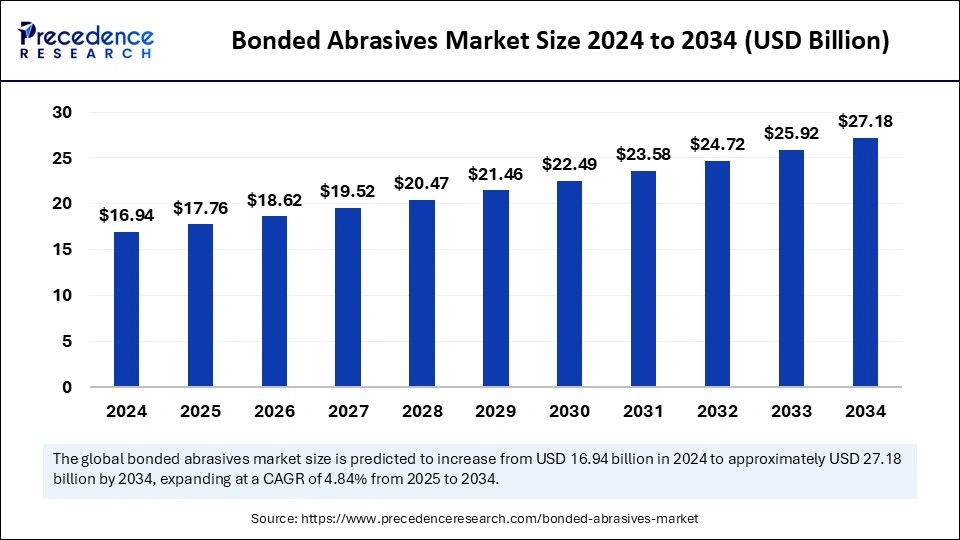

The global bonded abrasives market size accounted for USD 17.76 billion in 2025 and is predicted to increase from USD 18.62 billion in 2026 to approximately USD 28.40 billion by 2035, expanding at a CAGR of 4.81% from 2026 to 2035. The market is driven by increasing industrial requirements, technical innovation, and new industrial applications in the construction, automotive, and manufacturing fields.

Bonded Abrasives Market Key Takeaways

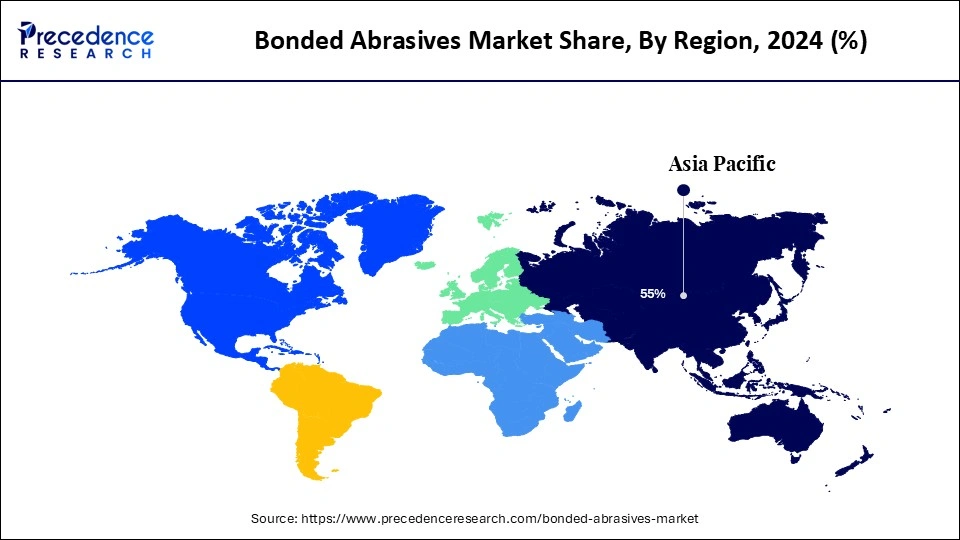

- Asia Pacific dominated the global market with the largest market share of 55% in 2025.

- North America is anticipated to witness the fastest growth during the forecasted years.

- Europe is emerging as a significant player in the market.

- By product type, the grinding wheels segment held a significant market share of 52% in 2025.

- By product type, the polishing wheels segment is anticipated to show considerable growth over the forecast period.

- By end-use, the automotive segment donated the largest market share of 41% in 2025.

- By end-use, the aerospace segment is anticipated to show considerable growth in the market over the forecast period.

Artificial Intelligence Integration in the Bonded Abrasives Market

Artificial Intelligence revolutionizes bonded abrasives market operations through its integration, which leads to better product performance and advanced manufacturing systems. Manufacturers use AI technologies to improve product quality control while achieving optimal manufacturing parameters and higher manufacturing efficiency in abrasive production. AI systems currently operate in automotive and metal fabrication end-user sectors by conducting real-time assessments of tools by analyzing both tool wear and grinding performance and surface finish quality.

Market Overview

Bonded abrasives are crucial instruments in the industry used for various tasks, including surface finishing, material cutting, grinding, and polishing. Bonded abrasives play crucial roles because of their precise cutting capabilities and the robust material structure required for industrial applications. Manufacturers supply bonded abrasives designed as wheels and cones tailored for diverse industrial uses and materials. These bonding abrasives are essential for the automotive, metalworking, electronics, aerospace, and construction sectors.

The growth of the construction sector primarily fuels the bonded abrasives market, which is largely dependent on bonded abrasives for surface preparation and finishing tasks in residential and commercial projects. The automotive industry and metal fabrication utilize bonded abrasives for grinding components as well as for cutting and finishing processes. Advancements in manufacturing and automation technologies prompt industries to shift from human-driven labor to automated processes, thereby necessitating advanced abrasive tools. Bonded abrasives continue to propel the market because they offer electrical and electronics manufacturers precise component-shaping abilities.

Bonded Abrasives Market Growth Factor

- Growth in the construction sector: These are vital instruments that carry out grinding, cutting tasks, and surface polishing functions in concrete, stone, and metalwork for both residential and commercial projects. The market growth due to construction and renovation activities demands durable and efficient abrasive tools amid increasing urbanization and industrial expansion.

- Rising usage in the automotive sector: The growth of automobile production plants and electric vehicle manufacturing, fueled by automation, consistent demand for bonded abrasives due to their dependable high-performance characteristics. The automotive industry relies on bonded abrasives for tasks such as shaping, grinding, and finishing surfaces.

- Enhanced automation in industrial operations: Bonded abrasives ensure consistent system performance and precise measurements in automated grinding and cutting processes. The growing investment in robotic equipment by factories and production facilities boosts the demand for high-strength abrasives that meet their specifications, thereby broadening market access to aerospace, metalworking, and electronics industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 28.40 Billion |

| Market Size in 2026 | USD 18.62 Billion |

| Market Size in 2025 | USD 17.76 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.81% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drives

Increasing demand from the construction industry

The bonded abrasives market gains momentum from the construction industry because these abrasives serve crucial purposes in surface grinding, cutting, and polishing for smooth texture development. Bonded abrasives serve essential functions in fabricating materials, including metal, concrete, and wood, before construction projects. The global trend of urban growth leads to rising demands for constructing buildings and infrastructure. The growth of the economy and improved living conditions in countries like China and India have led to significant rises in infrastructure and real estate developments. The need for high-performance abrasive tools gains further traction from emerging trends in building renovation and remodeling within urban regions.

Restraint

Improper storage leading to technical issues

The bonded abrasives market faces limited expansion since improper material storage damages its operational efficiency. Operational problems during bonded abrasive storage appear due to environmental conditions, which include extreme temperature variations and elevated moisture content. Bonds within the abrasive weaken when they face improper storage conditions, causing brittleness and breakage deficiencies. Moisture absorption with extreme dryness causes adhesive bond structures to change, leading to inflexibility and cupping defects. These technical problems particularly affect the metal fabrication sector, the transportation industry, and the electrical and electronics sector because they depend on bonded abrasives in grinding, cutting, polishing, and finishing applications. Manufacturers and users need to establish strict storage systems that include steady temperature and humidity control to reduce safety risks.

Opportunity

Increasing adoption of environmentally friendly products

The bonded abrasives market will benefit from substantial growth because manufacturers and consumers actively pursue environment-friendly products due to sustainability demands. Due to growing public environmental consciousness and enhanced regulatory constraints, the production market requires abrasives that lower pollutant output while cutting down waste products and employing either recycled or biodegradable materials. Product development incorporates biodegradable bonding agents and eco-friendly raw materials to reduce the environmental and carbon footprint effects of abrasive tools on manufacturing processes. Eco-friendly options have begun to gain traction in sectors like automotive, aerospace, and electronics as sustainable practices have become key priorities.

Segment Insights

Product Type Insights

The grinding wheels segment held a significant bonded abrasives market share in 2024. Various sectors such as automotive, aerospace, metalworking, and construction fields depend on these grinding tools. The primary task of such wheels consists of material elimination through abrasive grain contact with the surface of the target object. With the incorporation of bonding substances such as resin, ceramics, and metals, grinding wheels maintain their properties such as heat resistance, strength, and durability.

The creation of advanced abrasive materials and better bonding systems has increased the demand for grinding wheels in the market. Manufacturers continuously seek grinding wheels for automated production systems that require high speed and precision. Thus, market growth continues.

The polishing wheels segment is anticipated to show considerable growth over the forecast period. The wide-ranging industries, such as automotive, aerospace, electronics, and metal fabrication, depend on polishing wheels to produce consistent, high-quality, smooth finishes on their products. The demand has increased because of advancements in manufacturing technology in industries that prioritize precision and visual appeal.

The demand for accurate surface finishes is required by product standards in the automotive and electronics industries. Factors such as automation and advanced machining technologies have made the expansion of polishing wheels possible. The incorporation of these machines increases the process reliability and reduces costs of operations, enhances production speed in finishing processes, and streamlines operations.

End-Use Insights

The automotive segment donated the largest bonded abrasives market share in 2024. Bonded abrasives serve critical functions within automotive manufacturing and maintenance by fixing engine components, producing auto body finishes, and cleaning interior and exterior surfaces. These abrasives execute fundamental procedures such as weld finishing, pipe inner cleaning, and surface preparation before applying oil or fitting the parts for painting or polishing work. The automotive industry strongly requires bonded abrasives because workshops use these products to handle various applications within powered system components and non-motorized system areas.

The aerospace segment is anticipated to show considerable growth in the market over the forecast period. The aerospace industry requires high-performance bonded abrasives because lightweight composites continue to gain popularity among manufacturers. The aerospace components demand bonded abrasives since these tools are necessary for creating precise forms on turbine blades, landing gear, and structural elements.

The bonded abrasives enable these components to operate at optimal performance levels because they provide precise dimensions and smooth surfaces and enhance durability in extreme conditions. The development of aerospace technology and increasing air travel will maintain the market desire for bonded abrasives.

Regional Insights

What is the Asia Pacific Bonded Abrasives Market Size?

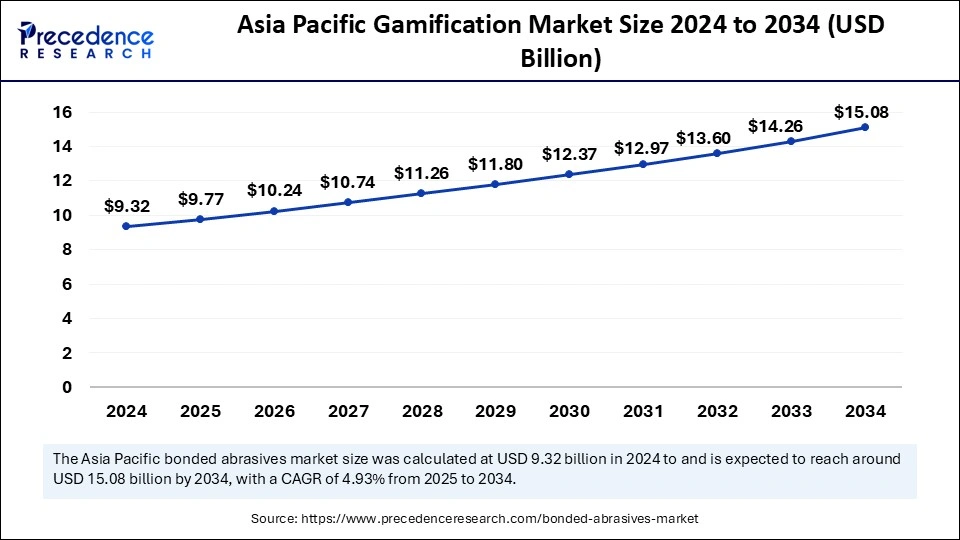

The Asia Pacific bonded abrasives market size was exhibited at USD 9.77 billion in 2025 and is projected to be worth around USD 15.79 billion by 2035, growing at a CAGR of 4.92% from 2026 to 2035.

Asia Pacific accounted for the largest share of the bonded abrasives market in 2024. The rapid expansion of the bonded abrasives market stems from emerging technology with developing industries and expanding construction markets throughout China, Japan, and India. Industrialization drives increased usage of bonded abrasives, which serve sectoral applications, including automotive, metal fabrication, machinery, and consumer electronics.

The rapid industrial growth and expanding manufacturing operations in China have created a global leadership role in bonded abrasive consumption. The market demand for high-performance abrasives is increasing rapidly as China expands its manufacturing sector and, specifically, its automotive production facilities.

North America is anticipated to witness the fastest growth in the bonded abrasives market during the forecasted years because of the high degree of technology used in the automobile and airplane industries, as well as the manufacturing of metals. The demand for bonded abrasives in North America has grown due to the increased need for high-precision tools in advanced manufacturing facilities that are automated.

The United States dominates the bonded abrasives market of North America as it occupies the foremost position in this region. Industrial activities across the country thrive through its diverse sectors, which include automotive, aerospace, and defense manufacturing industries. Electric and autonomous vehicles have driven up bonded abrasive demand because these technologies need complex finishing solutions to achieve quality component manufacturing.

- In October 2023, Tyrolit Group purchased Acme Holding Company, which operates as a Michigan-based manufacturer of abrasives. Through this business expansion, the company integrates specialty abrasives solutions alongside grinding systems to increase its operational range.

Europe is emerging as a significant market. The bonded abrasives market expansion occurs through the automotive, aerospace, and construction sectors. The automotive production centers in Europe, particularly in Germany, France, and Italy, demonstrate rising bonded abrasive demand since they play essential roles in vehicle production and maintenance processes. The European industries' push for precision and sustainability with their ongoing demand for bonded abrasives will maintain stability across relevant sectors for the entire forecast duration.

Bonded Abrasives Market-- Value Chain Analysis

- Abrasive Manufacturing & Processing

Bonded abrasives are produced through processes such as abrasive grain selection (aluminum oxide, silicon carbide, zirconia), bonding material formulation (resin, vitrified, rubber bonds), mixing, molding, pressing, curing or firing, finishing, and balancing to achieve the required grinding and cutting performance.

Key Players: Saint-Gobain Abrasives, 3M Company, Tyrolit Group, Carborundum Universal Limited. - Quality Testing & Certification

Bonded abrasives require certifications ensuring product safety, dimensional accuracy, mechanical strength, and performance consistency. Key certifications include ISO 9001 quality management systems, EN and ANSI safety standards, FEPA specifications, and product safety testing certifications.

Key Players: ISO (International Organization for Standardization), FEPA, ANSI, TÜV SÜD. - Distribution to End-Use Industries

Bonded abrasives are distributed to metal fabrication shops, automotive manufacturing plants, construction and infrastructure projects, machinery manufacturers, aerospace component producers, and maintenance, repair, and operations (MRO) providers.

Key Players: Saint-Gobain Abrasives, 3M Company, Tyrolit Group.

Bonded Abrasives Market Companies

- 3M Company:

3M is a global leader in industrial abrasives, offering a wide range of bonded abrasive products, including grinding wheels, cutting discs, and polishing wheels. Known for high-performance ceramic and advanced abrasive grain technologies, 3M's solutions support automotive, aerospace, metal fabrication, and precision machining applications. - Saint-Gobain Abrasives:

Saint-Gobain, through its Norton Abrasives brand, supplies a comprehensive portfolio of bonded grinding and cutting wheels tailored for high-precision industrial applications. The company emphasizes durable, energy-efficient products and is expanding facilities and technology capabilities globally. - Tyrolit Group:

Tyrolit is one of the world's largest producers of bonded abrasives, offering grinding wheels, cutting wheels, and superabrasive solutions. It serves construction, automotive, metalworking, and industrial sectors with innovative bonding technologies and a global manufacturing presence. - Carborundum Universal Limited (CUMI):

CUMI is a major bonded abrasives manufacturer with a broad product range, including vitrified, resin-bond, and cutting solutions. The company supports automotive, engineering, construction, and general industrial markets with high-quality abrasives and strong backward integration. - SIA Abrasives Industries AG:

SIA Abrasives supplies bonded abrasive wheels and precision grinding products for metalworking, aerospace, and heavy machinery applications. Known for quality and innovation, its offerings include ceramic and conventional bonded products optimized for productivity.

Other Major Key Players

- Nippon Resibon Corporation

- Buffalo Abrasives

- Abrasives Manhattan

- Marrose Abrasives

- Grinding Techniques Ltd

- SAK Abrasives Limited

- Flexovit

- Saint-Gobain

Recent Developments

- In November 2025, Finish Thompson Inc. (FTI) announced the launch of its SX Series, introducing a new line of economical. These series are two-speed explosion-proof electric motors specifically designed for drum and barrel pump applications.(Source: https://www.worldpumps.com )

- In October 2023, Tyrolit Group acquired Acme Holding Company by purchasing this U.S.-based manufacturer, which operates from Michigan. The acquisition brings specialty abrasives solutions together with grinding operations under an expanded business framework for the company. This strategy provides the company with seven U.S. facilities while making their services better suitable for foundry steel and rail sectors.

- In July 2023, Saint-Gobain Abrasives presented a new lineup of bonded abrasives that were made for aerospace sector requirements. The products have undergone engineering to meet aerospace requirements.

- In May 2023, the Indian industrial company SAK Abrasives purchased Jowitt and Rodgers Co. as its U.S.-based division manufacturing custom abrasive products. Through this acquisition, SAK Abrasives will expand its operations to make compatible products at facilities throughout India and the United States, boosting its market domination and product selection.

Segments Covered in the Market

By product type

- Grinding wheels

- Cutting wheels

- Polishing wheels

- Other product types

By end use

- Automotive

- Aerospace

- Metalworking

- Other end uses

By region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting