What is the Breast Ultrasound Market Size?

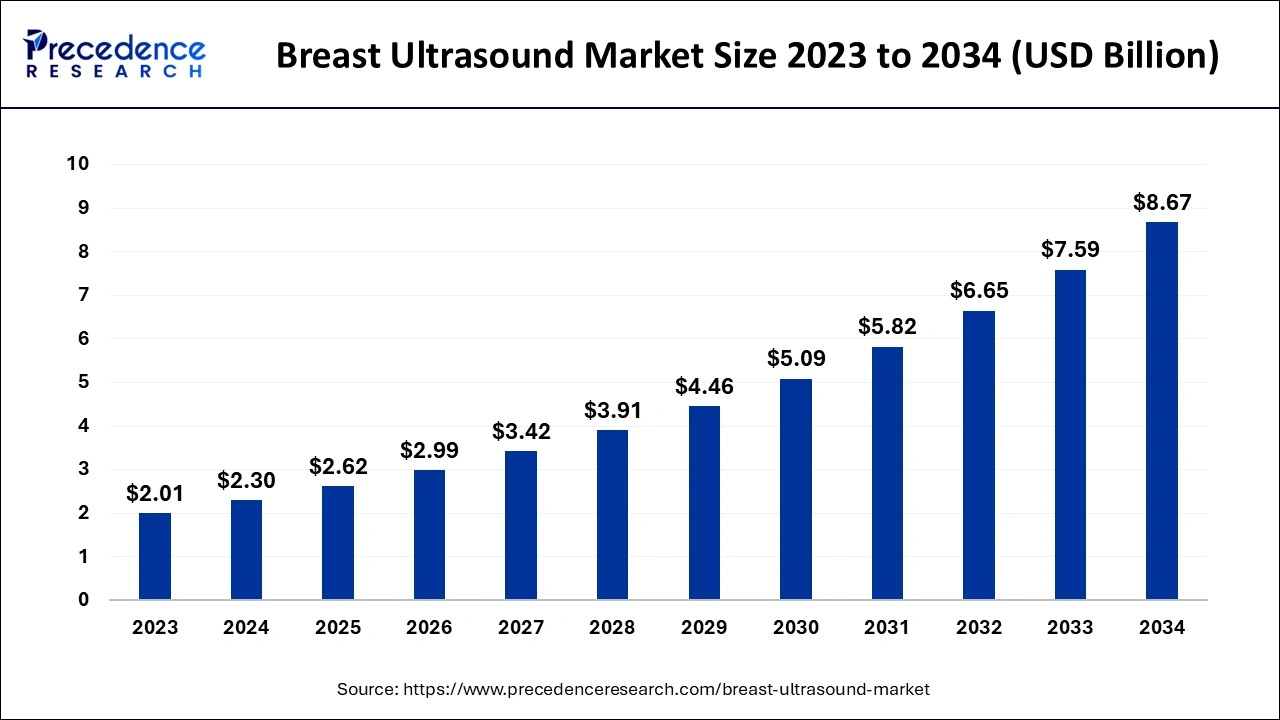

The global breast ultrasound market size is calculated at USD 2.62 billion in 2025 and is predicted to increase from USD 2.99 billion in 2026 to approximately USD 8.67 billion by 2034, expanding at a CAGR of 14.21% from 2025 to 2034. The rising prevalence of breast cancer is the key factor driving market growth. The increase in demand for breast ultrasound, along with technological advancements, can fuel market growth further.

Breast Ultrasound Market Key Takeaways

- The global breast ultrasound market was valued at USD 2.30 billion in 2024.

- It is projected to reach USD 8.67 billion by 2034.

- The breast ultrasound market is expected to grow at a CAGR of 14.21% from 2025 to 2034.

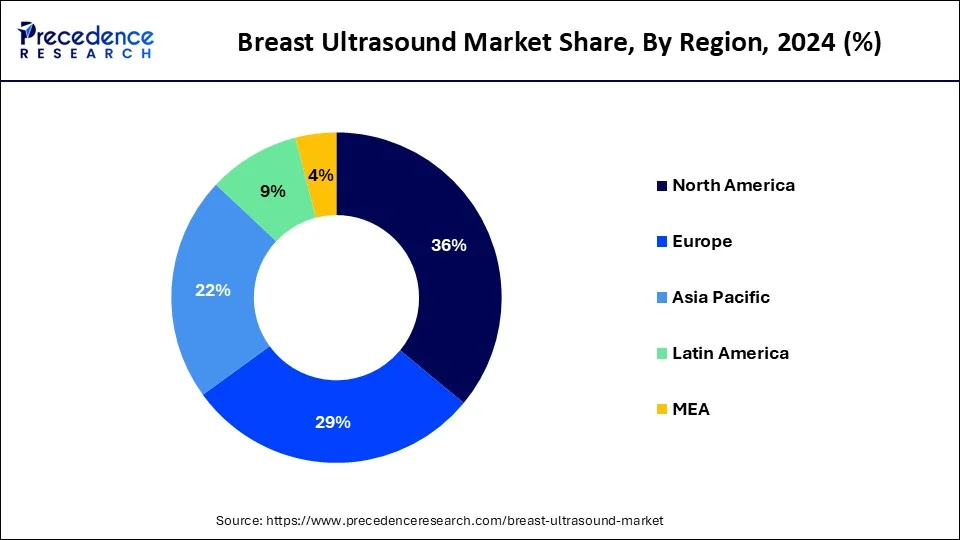

- North America dominated the breast ultrasound market with the largest market share of 36% in 2024.

- Asia Pacific region is expected to expand at the fastest CAGR of 15.41% over the forecast period.

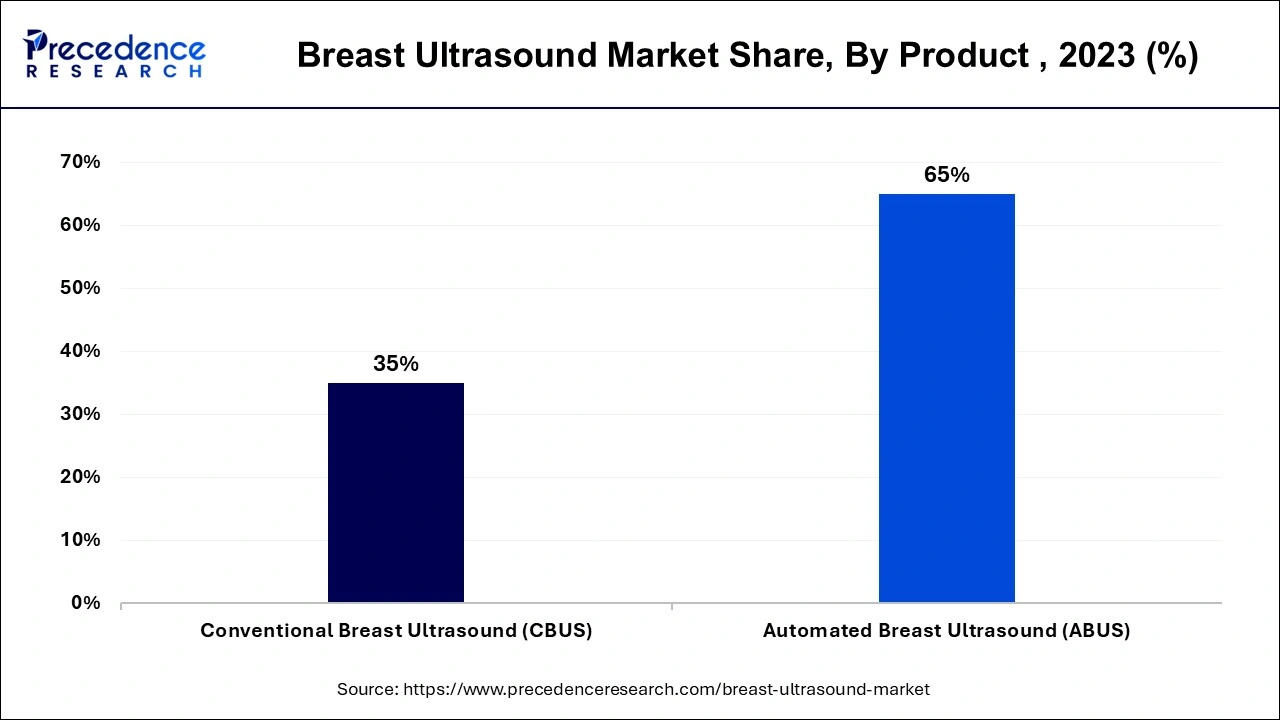

- By product, the automated breast ultrasound (ABUS) segment contributed the highest market share of 65% in 2024.

- By product, the conventional breast ultrasound (CBUS) segment is anticipated to grow at the fastest rate during the forecast period.

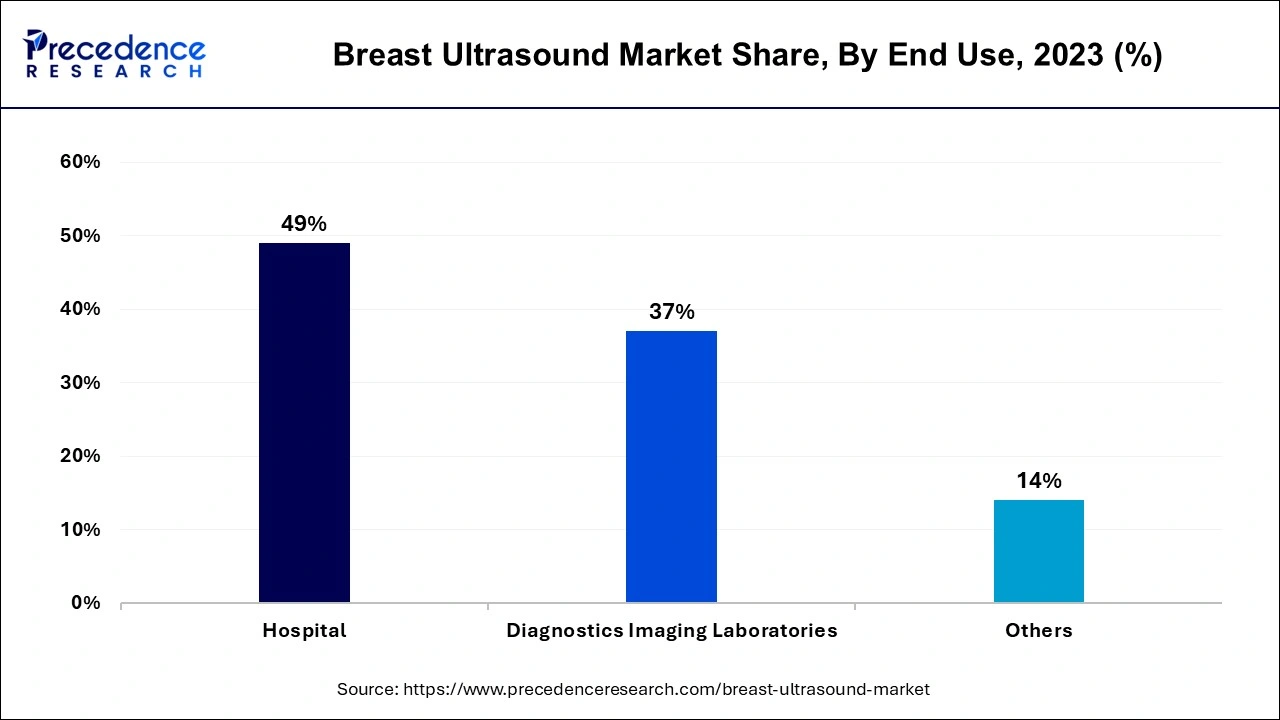

- By end use, the hospitals segment accounted for the largest market share of 49% in 2024.

- By end use, the diagnostics imaging laboratories segment is anticipated to grow at a notable CAGR of 14.51% over the projected period.

Role of Artificial Intelligence in Breast Ultrasound

Artificial Intelligence (AI) is gaining popularity in the detection of various images. Hence, it has been widely used in the ultrasound of the breast to do a quantitative assessment, which helps maintain the diagnosis's precision. Furthermore, AI in ultrasound can distinguish between benign and malignant tumors in the breast. Upgrading and standardizing workflow, identifying issues, and reducing monotonous tasks can transform the breast ultrasound market.

- In August 2024, Medical imaging technology firm Rezolut launched its SecondReadAI mammography reading technology, which utilizes AI algorithms developed by Lunit.SecondReadAI offers an analysis to identify details on mammograms that could be overlooked by interpreting physicians, which serves as a second option in mammography reading.

- In June 2024, the Korean firm Lunit Eyes announced the launch of pilot programs in developing nations to provide its AI cancer diagnostic software in a year. Our goal is to use AI to facilitate early diagnosis of breast cancer and lower the related mortalities in developing economies, which lack healthcare infrastructure, said the CEO of the company.

Market Overview

Breast ultrasound is a non-invasive diagnostic technique that utilizes high-frequency sound waves to create images of the breast tissue. The market includes products like probes, ultrasound systems, and other accessories. Government initiatives coupled with the help of some NGOs to increase awareness about breast health are also an important element of women's healthcare. As the need for early detection increases, the breast ultrasound market can play a crucial role in enhancing breast cancer outcomes.

Breast Cancer Number Statistics (2022)

The following table shows the total global breast cancer incidence in 2022 for women.

| Rank (women) | Country | Number |

| 1 | China | 357,161 |

| 2 | United States of America | 274,375 |

| 3 | India | 192,020 |

| 4 | Brazil | 94,728 |

| 5 | Japan | 91,916 |

| 6 | Russian Federation | 78,839 |

| 7 | Germany | 74,016 |

| 8 | Indonesia | 66,271 |

| 9 | France (metropolitan) | 65,659 |

| 10 | United Kingdom | 58,756 |

| World | 2,296,840 |

Breast Ultrasound Market Growth Factors

- The upsurge in alcohol consumption is expected to boost the growth of the breast ultrasound market shortly.

- The occurrence of major key players in the market can propel the market growth over the forecast period.

- Major players and research organizations are introducing technologically advanced products. Which is likely to strengthen the market presence in upcoming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.67 Billion |

| Market Size in 2026 | USD 2.99 Billion |

| Market Size in 2025 | USD 2.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.21% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Integration of telemedicine

The integration of breast ultrasound systems with telemedicine platforms, especially for remote consultations, is an emerging breast ultrasound market trend. By conducting remote consultations between healthcare professionals and patients, BUS can optimize expert interpretations and timely screenings. Additionally, this approach provides the ability for more sophisticated utilization of healthcare resources and decreased patient wait times.

- In February 2024, Yellowcross Healthcare Commerce, a telemedicine practice management firm, unveiled a new consultancy service to help medical groups and healthcare facilities grow their remote care capabilities. Yellowcross works with clinics, medical groups, hospitals, and entrepreneurial physicians throughout the United States.

- In May 2022, Jefferson Radiology employed innovative telemedicine software for its diagnostic ultrasound appointments. Collaboration Live, a tela-ultrasound software by Philips, can dramatically enhance patient access by connecting radiologists with patients virtually and in real time.

Restraint

Economic challenges faced by breast imaging centers

Sometimes, breast imaging centers confront major economic challenges in the form of reduced reimbursement, rising patient demand, and stringent federal regulations. However, the density of the breast can be a significant diagnostic challenge, decreasing the sensitivity of ultrasound techniques. Dense breast tissue can make it challenging to interpret mammograms, leading to missed cancer diagnoses.

Opportunity

Increasing preference for non-ionizing diagnostic techniques

An emerging trend in the global breast ultrasound market is the rising preference for non-ionizing imaging techniques because of increasing health concerns related to radiation exposure. Hence, non-ionizing diagnostic techniques are becoming favorable as they offer a safer alternative to conventional mammography for breast cancer screening, especially among young generations. Furthermore, this inclination towards free diagnostic techniques is anticipated to fuel the growth of the market.

- In May 2024, BSC introduced clinical validation of radiation-free breast cancer diagnostic techniques at Vall d'Hebron.This new technology is totally harmless to patients because it does not use radiation and will provide high image quality and better monitoring of tumors, among other benefits.

Product Insights

The automated breast ultrasound (ABUS) segment led the breast ultrasound market in 2024. The dominance of the segment can be attributed to the ongoing technological advancements, user-friendly features offered by this device, and regulatory approvals. Additionally, ABUS provides high-resolution and detailed breast evaluations necessary for the early detection of anomalies. Healthcare settings are also adopting automated whole-breast ultrasound systems due to their efficient features and performance.

- In June 2024, The Boob Bus announced it had secured a contract with Select Health, a top health plan provider in Utah, Idaho, Nevada, and Colorado. As part of this contract, The Boob Bus can use its brand-new mobile facility to offer breast cancer screening to Utah communities. Equipped with automated breast ultrasound (ABUS).

The conventional breast ultrasound (CBUS) segment is anticipated to grow at the fastest rate in the breast ultrasound market during the forecast period. The growth of the segment can be linked to the increasing adoption of CBUS from various organizations as it detects breast abnormalities more effectively. However, many diagnostic centers and hospitals still use conventional breast ultrasound because of numerous other reasons. Which can impact positively the segment growth in the market.

End Use Insights

In 2024, the hospitals segment dominated the breast ultrasound market by holding the largest market share. The dominance of the segment can be credited to the increasing adoption of advanced diagnostic tools by hospitals, like automated whole-breast ultrasound systems, to improve the precision of breast health diagnoses. The integration of this innovative system within hospitals is important for the management and early detection of breast conditions, which makes them essential in healthcare scenarios.

- In February 2023, Abdul Latif Jameel Health declared a new distribution agreement with iSono Health, a healthcare technology company in San Francisco, USA, for introducing a 3D ultrasound portable breast imaging scanner that utilizes automated imaging and artificial intelligence (AI).

- In January 2022, UE LifeSciences entered into a distribution agreement with Siemens Healthineers, adding to its flagship device breast exam to Siemens's 360-degree breast care product portfolio for the United States market.

The diagnostics imaging laboratories segment is anticipated to grow at the fastest rate in the breast ultrasound market over the projected period. The growth of the segment is linked to the rising number of diagnostic centers across the globe, the high incidence of breast cancer disease, and the increasing need for imaging techniques. In addition, diagnostic imaging centers offer specialized diagnostic services coupled with innovative imaging technologies, resolving the demand for standardized diagnostic services beyond conventional hospital environments.

- In June 2024, Fujifilm India Healthcare Division, in partnership with NM Medical Mumbai, unveiled its first Fujifilm Skill Lab aimed at offering cutting-edge training in FFDM (full-field digital mammography) technologies for radiographers and radiologists. The inaugural session experienced the participation of eight candidates, including four radiologists and four radiographers.

- In August 2024, Siemens Healthineers, a medical diagnostics company, unveiled India's first AI-improved eco-friendly multi-testing diagnostic analyzer, the Atellica CI, at Mahajan Imaging & Labs. This technology aims to transform patient care by offering faster and more precise diagnostic results.

Regional Insights

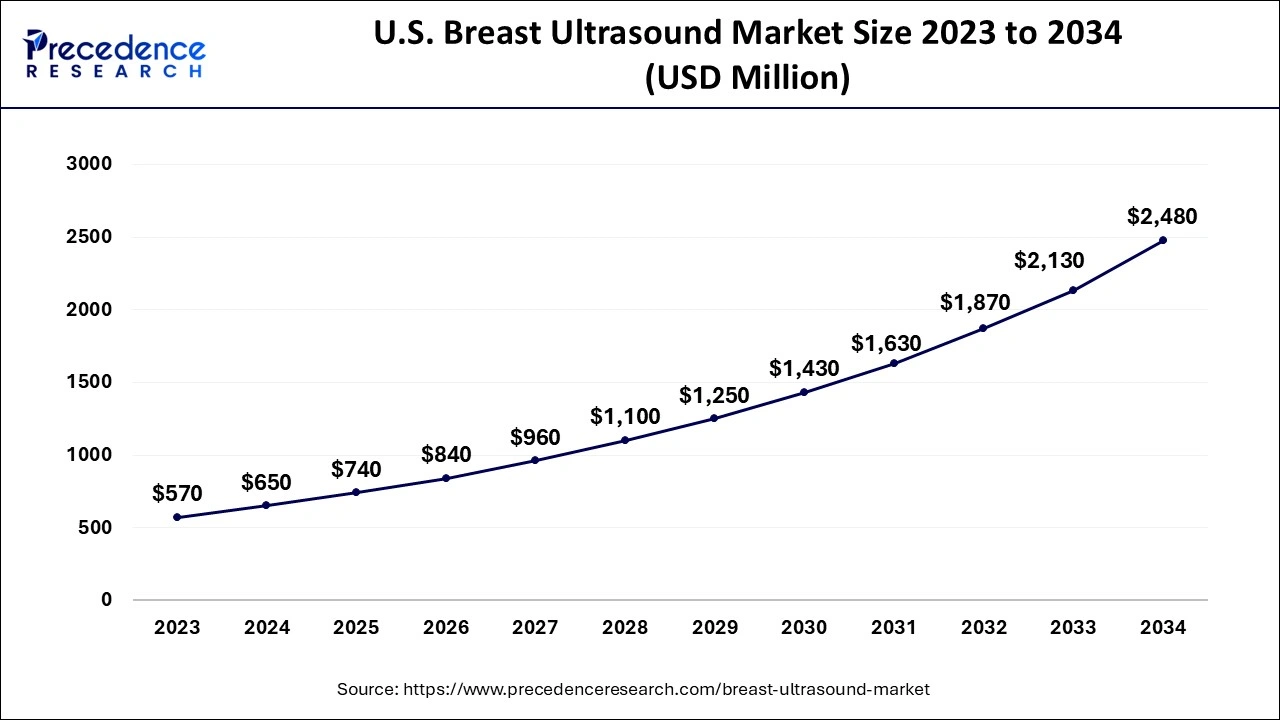

U.S. Breast Ultrasound Market Size and Growth 2025 to 2034

The U.S. breast ultrasound market size was exhibited at USD 740 million in 2024 and is predicted to reach around USD 2,480 million by 2034, growing at a CAGR of 14.33% from 2025 to 2034.

North America dominated the breast ultrasound market in 2024. The dominance of the segment can be attributed to the strong presence of developed infrastructure in the healthcare industry, along with the increasing cases of breast cancer in the region. Furthermore, the presence of major market players, along with significant investments in R&D, will propel the market growth soon. Also, favorable reimbursement initiatives aimed at optimizing the early identification of breast cancer have facilitated the widespread acceptance of the breast ultrasound market in the region.

- In August 2023, Izotropic announced that it is following a regulatory strategy in the United States and European Union to unveil IzoView as a diagnostic device in patients with dense breast tissue.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be driven by increasing awareness about breast cancer and its treatment in the region. However, nations like China, Japan, and South Korea are adopting the ABUS more rapidly. These countries have an increasing number of breast cancer cases due to a substantial population rise driving the breast ultrasound market growth in the region.

Breast Ultrasound Market Companies

- GE HealthCare.

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- CANON MEDICAL SYSTEMS CORPORATION

- Telemed Medical Systems Srl

- Hologic, Inc.

- FUKUDA DENSHI

- Supersonic Imagine

- Lunit Inc.

- Delphinus Medical Technologies, Inc.

Recent Developments

- In February 2024, Butterfly Network introduced the iQ3TM handheld ultrasound device, which featured enhanced 3D imaging technology, advanced image processing, and artificial intelligence (AI) capabilities.

- In October 2023, Philips Healthcare introduced a novel breast ultrasound imaging system that combined software and hardware into a single, integrated unit.

- In November 2023, The Genius AI Detection 2.0 solution was introduced by Hologic, Inc. to improve the detection of breast cancer and reduce false-positive results.

Segments Covered in the Report

By Product

- Conventional Breast Ultrasound (CBUS)

- Automated Breast Ultrasound (ABUS)

By End Use

- Hospital

- Diagnostics Imaging Laboratories

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting