What is the C5ISR Market Size?

The global c5isr market size was calculated at USD 151.04 billion in 2025 and is predicted to increase from USD 161.46 billion in 2026 to approximately USD 294.35 billion by 2035, expanding at a CAGR of 6.9% from 2026 to 2035. This market is growing due to the rising demand for advanced defense communication and surveillance systems.

Market Highlights

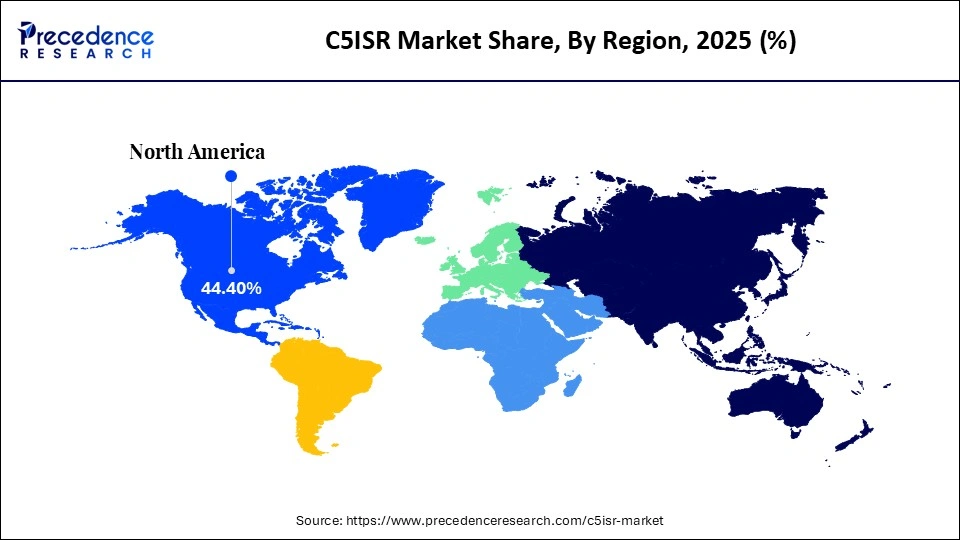

- North America dominated the market, holding the largest market share of 44.4% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 7.2% in the C5ISR market between 2026 and 2035.

- By component, the hardware segment held the largest market share of 55.3% in 2025.

- By component, the software segment is expected to grow at a remarkable CAGR of 6.0% between 2026 and 2035.

- By installation type, the new installation segment held the largest market share of 68.4% in 2025.

- By installation type, the retrofit/upgrade segment is expected to grow at a remarkable CAGR of 6.2% between 2026 and 2035.

- By application, the intelligence, surveillance & reconnaissance (ISR) segment held the largest share of 34.4% in the C5ISR market during 2025.

- By application, the command & control is set to grow at a remarkable share of 6.2% CAGR between 2026 and 2035.

- By end user, the defense/military segment held the largest market share of 52.5% in 2025.

- By end user, the homeland security/government segment is expected to expand at a remarkable growth rate of 6.4% CAGR between 2026 and 2035.

Empowering Modern Warfare: The Rapid Rise of the Global C5ISR Market

The global C5ISR (Command, Control, Communications, Computers, Cyber, Intelligence, Surveillance & Reconnaissance) market is witnessing robust growth as countries bolster their capacity for digital warfare and defense intelligence. Demand is being driven by the need for real-time battlefield awareness, growing geopolitical tensions, and developments in cybersecurity and artificial intelligence. As a result of swift military modernization initiatives. Asia Pacific is becoming the fastest-growing hub despite North America's superiority in technology.

Growth is reinforced by procurement programs led by defense ministries such as the U.S. Department of Defense, which is integrating joint all-domain command and control architectures across air, land, sea, space, and cyber operations. NATO members are also upgrading interoperable ISR and secure communications systems to meet alliance readiness requirements and data-sharing standards. In Asia Pacific, countries including China, India, and Australia are investing in satellite-based surveillance, unmanned systems, and AI-enabled command platforms to strengthen border security and maritime domain awareness. These initiatives are supported by rising defense budgets and domestic defense industrial policies that prioritize network-centric warfare capabilities.

- In February 2025, Shipcom AI unveiled its Quantum C5ISR platforms, combining AI and quantum-secure communication to enhance defense operations.

C5ISR Market Growth Drivers

- Rising defense allocations by the U.S. Department of Defense, NATO member states, and Asia Pacific defense ministries are accelerating procurement of integrated command, control, and intelligence systems to support multi-domain operations.

- Government-led modernization programs such as the U.S. Joint All-Domain Command and Control (JADC2) initiative are driving sustained demand for interoperable C5ISR architectures across air, land, sea, space, and cyber domains.

- Increased frequency of geopolitical conflicts and border tensions is pushing countries such as India, China, and Japan to expand surveillance coverage through satellite ISR, unmanned platforms, and secure battlefield networks.

- Growing reliance on real-time situational awareness for missile defense, electronic warfare, and maritime security operations is reinforcing long-term investment in C5ISR platforms and supporting infrastructure.

Key Technological Shifts

- AI/ML Integration: Transition from passive data systems to intelligent, AI-powered platforms that automate threat detection and speed up decision-making.

- Edge Computing: Shift from centralized data processing to localized analysis at the tactical edge to reduce latency and improve real-time situational awareness.

- Multi-Domain Operations (MDO): Integration of capabilities across land, sea, air, space, and cyber to create a unified operational picture.

- Space-Based ISR: Increasing use of satellite constellations, especially in low earth orbit, for persistent, global surveillance and connectivity.

- Enhanced Cybersecurity: Embedding zero-trust architecture and quantum-resistant encryption into tactical networks to counter escalating cyber threats.

- Autonomous Systems: Expanded use of unmanned aerial and ground vehicles (UAVs and UGVs) to act as extended sensors and provide persistent reconnaissance.

Recent Trends in the C5ISR Market

- Defense agencies are increasingly integrating artificial intelligence and machine learning into ISR systems to enable automated threat detection, data fusion, and faster command decision cycles.

- Satellite-based ISR and space-domain awareness capabilities are expanding rapidly, with military programs deploying low-earth orbit constellations to improve persistent surveillance and secure communications.

- Cyber-resilient C5ISR architectures are gaining priority as defense organizations strengthen encryption, network hardening, and cyber defense layers to protect command networks from electronic and cyber attacks.

- Governments are promoting indigenous C5ISR development through domestic defense manufacturing policies, including India's Make in India and similar localization mandates in Asia Pacific and Europe.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 151.04Billion |

| Market Size in 2026 | USD 161.46 Billion |

| Market Size by 2035 | USD 294.35Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.9% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Installation Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Why Did the Hardware Segment Dominate the C5ISR Industry in 2025?

The hardware segment dominated the C5ISR industry by holding a share of 55.3%, driven by the increased need for sophisticated sensors, radars, surveillance equipment, and communication systems in defense operations. The C5ISR infrastructure is built on hardware that guarantees secure communication, real-time data collection, and operational effectiveness during challenging missions. The leadership of this segment is further reinforced by ongoing advancements in radar technologies, satellite systems, and tactical communication devices.

The software segment is set to be the fastest growing in the C5ISR market, with a CAGR of 6.0% the growth is attributed to the rising integration of AI, machine learning, and data analytics in command and control systems. Software solutions enhance data fusion, predictive analysis, and decision-making capabilities, enabling faster and more coordinated defense operations. The increasing shifts toward digital command platforms and networked defense systems are fueling the segments of rapid expansion.

Installation Type Insights

What Made the New Installation Segment Dominate the Market in 2025?

The new installation segment dominated the C5ISR market by holding a share of 68.4%, propelled by extensive defense modernization initiatives and the introduction of new infrastructure in developed nations. To improve situational awareness, interoperability, and mission readiness, governments are making significant investments in the new C5ISR configurations. The leadership of this segment is further strengthened by the launch of new satellite networks and ground-based communication systems.

Retrofit/upgrade is expected to be the fastest growing in the C5ISR industry during the forecasted period, with a CAGR of 6.2%, motivated by the growing demand to update current military systems with more affordable cutting-edge technologies. To increase network efficiency and operational lifespans, numerous defense organizations are modernizing their legacy systems with new software-defined radios, digital command tools, and AI-powered analysis systems.

Application Insights

What Made the Intelligence, Surveillance & Reconnaissance (ISR) Segment Lead the Market in 2025?

The intelligence, surveillance & reconnaissance (ISR) segment led the C5ISR market by holding a share of 34.4%, bolstered by military operations increasing demand for precise threat detection and real-time situational awareness. Better battlefield judgments and national security plans are made possible by the collection, analysis, and transmission of data made possible by ISR systems.

The command & control segment is expected to be the fastest growing in the C5ISR market in the period between 2026 and 2035, with a CAGR of 6.2%, driven by the increasing demand for integrated communication platforms that connect multiple defense units and agencies. Enhanced use of digital command centers, cloud-based data sharing, and AI-based coordination tools is accelerating adoption in this segment.

End User Insights

What Made the Defense/Military Segment Hold the Largest Share in the Market for C5ISR in 2025?

The defense/military segment is dominating the C5ISR market by holding a share of 52.5%, driven by its widespread use for strategic operations, threat analysis, and mission planning, which accounts for its dominance. These technologies are used by defense organizations worldwide to boost national security, guarantee information superiority, and increase combat effectiveness.

The homeland security/government segment is set to be the fastest growing in the C5ISR market with a CAGR of 6.4%, propelled by the growing demand for counterterrorism operations and disaster response coordination and border surveillance. To improve overall situational awareness and security readiness, governments are implementing cutting-edge C5ISR technologies for emergency management and critical infrastructure protection.

Regional Insights

How Big is the North America C5ISR Market Size?

The North America C5ISR market size is estimated at USD 0.44 billion in 2025 and is projected to reach approximately USD 132.16 billion by 2035, with a 7.02% CAGR from 2026 to 2035.

What Made North America Dominate the C5ISR Market in 2025?

North America dominates the C5ISR market, holding a 44.4% share, supported by strong defense investments, cutting-edge research facilities, and the existence of significant defense technology firms. North America's leadership in the global C5ISR environment has been reinforced by ongoing innovation in communication, surveillance, and command systems, which is backed by government modernization initiatives.

This dominance is anchored in large-scale programs led by the U.S. Department of Defense, including Joint All-Domain Command and Control, which integrates sensors, shooters, and decision systems across services. Federal research organizations such as DARPA and the U.S. Air Force Research Laboratory continue to fund AI-enabled ISR, secure communications, and cyber-resilient command architectures. Canada further strengthens regional leadership through defense intelligence modernization programs focused on Arctic surveillance and NORAD interoperability. Long-term procurement stability, classified testing infrastructure, and close coordination between military branches and domestic defense contractors sustain North America's operational and technological advantage.

What is the Size of the U.S. C5ISR Market?

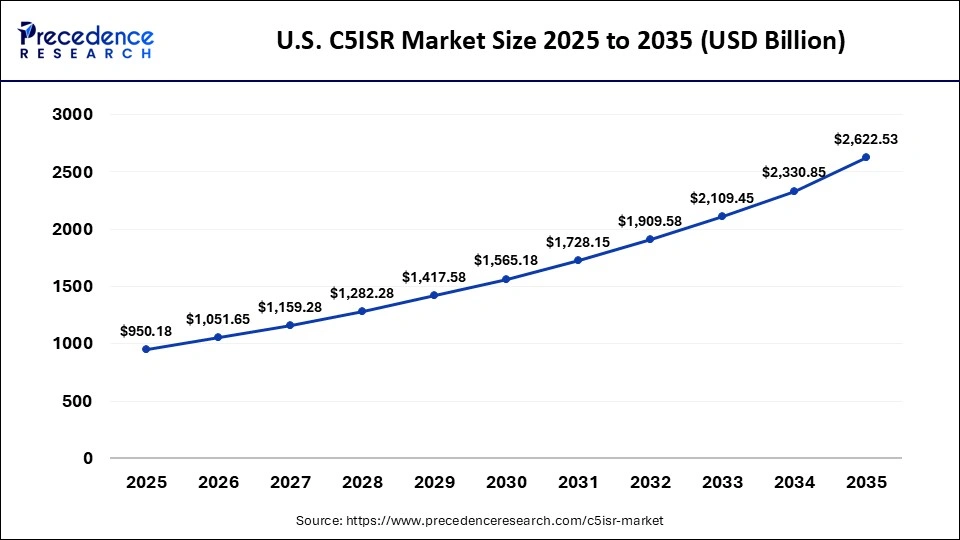

The U.S. C5ISR market size is calculated at USD 0.33 billion in 2025 and is expected to reach nearly USD 99.778 billion in 2035, accelerating at a strong CAGR of 7.09% between 2026 and 2035.

U.S. C5ISR Market Trends

The U.S. dominates the global C5ISR market due to the existence of large defense companies, high defense spending, and advanced R&D hardware that dominates the market thanks to significant investments in radar sensors and tactical systems, while software is expanding at the fastest rate thanks to the integration of AI and cybersecurity, which improves real-time intelligence. Constant modernization maintains the U.S. at the forefront of innovation in C5ISR.

Why Is Asia Pacific Expected to Be the Fastest-Growing Region for the C5ISR Market Between 2026 and 2035?

Asia Pacific is the fastest-growing region in the C5ISR market, with a CAGR of 7.2%. The growth is primarily fueled by rising defense budgets, increasing focus on modernizing command and control systems, and the adoption of advanced surveillance technologies. Growing emphasis on developing indigenous C5ISR capabilities and expanding defense networks is further propelling the region's market expansion.

Countries such as China, India, Japan, and South Korea are implementing long-term defense modernization programs that prioritize network-centric warfare, integrated ISR platforms, and secure military communications. Ministries of defense across the region are investing in satellite reconnaissance, unmanned aerial systems, and AI-enabled data fusion to strengthen border security and maritime domain awareness. Regional cooperation frameworks and domestic defense manufacturing policies are also supporting localized production of C5ISR subsystems, reducing reliance on foreign suppliers and accelerating deployment timelines.

India C5ISR Market Trends

India is growing rapidly, driven by the Make in India campaign, digital integration, and defense modernization. While software is growing at the fastest rate due to automation and artificial intelligence, improving command and surveillance hardware is still in the lead due to the increased purchases of domestic systems. India is becoming more prominent in the global defense technology ecosystem due to growing local partnerships.

This momentum is reinforced by procurement and development programs led by the Ministry of Defence and the Defence Research and Development Organisation, which are advancing indigenous radar, battlefield management, and secure communications platforms. Increased collaboration between public sector units and private defense manufacturers is accelerating deployment across the Army, Navy, and Air Force, particularly for border surveillance and maritime domain awareness missions.

Who are the Major Players in the Global C5ISR Market?

The major players in the c5isr market include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies / RTX, General Dynamics Corporation, BAE Systems plc, Thales Group, L3Harris Technologies, Inc., Elbit Systems Ltd., Airbus Defence & Space / Airbus, Leonardo S.p.A., Saab AB / Saab Surveillance, Kratos Defense & Security Solutions, Inc., ManTech International Corporation, CACI International, Inc., Israel Aerospace Industries (IAI)

Recent Developments

- In January 2026, General Dynamics Information Technology received a U.S. Navy contract worth $988 million to modernize and integrate command, control, communications, computers, combat, intelligence, surveillance, and reconnaissance, or C5ISR, systems across the service branch's surface combatant ships to help improve naval forces' readiness.(Source: https://www.govconwire.com)

- In February 2025, WISeKey International Holding Ltd. (via subsidiary WISeSat Space) announced a set of 2025 satellite launches equipped with post-quantum-ready technology.(Source: https://www.globenewswire.com)

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Installation Type

- New Installation

- Retrofit/Upgrade

By Application

- Command & Control (C2)

- Communications

- Intelligence, Surveillance & Reconnaissance (ISR)

- Electronic Warfare (EW)

- Computers

- Combat Systems

By End User

- Defense/Military

- Homeland Security/Government

- Commercial Security

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content