What is the Cannabis Beverages Market Size?

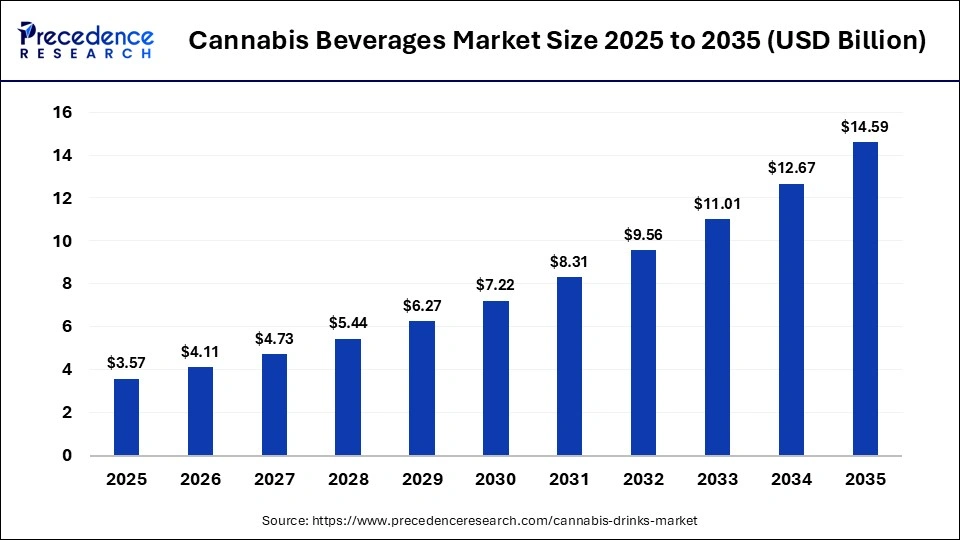

The global cannabis beverages market size accounted for USD 3.57 billion in 2025 and is predicted to increase from USD 4.11 billion in 2026 to approximately USD 14.59 billion by 2035, expanding at a CAGR of 15.12% from 2026 to 2035. The market is driven by growing consumer preference for functional beverages and widespread cannabis legalization.

Market Highlights

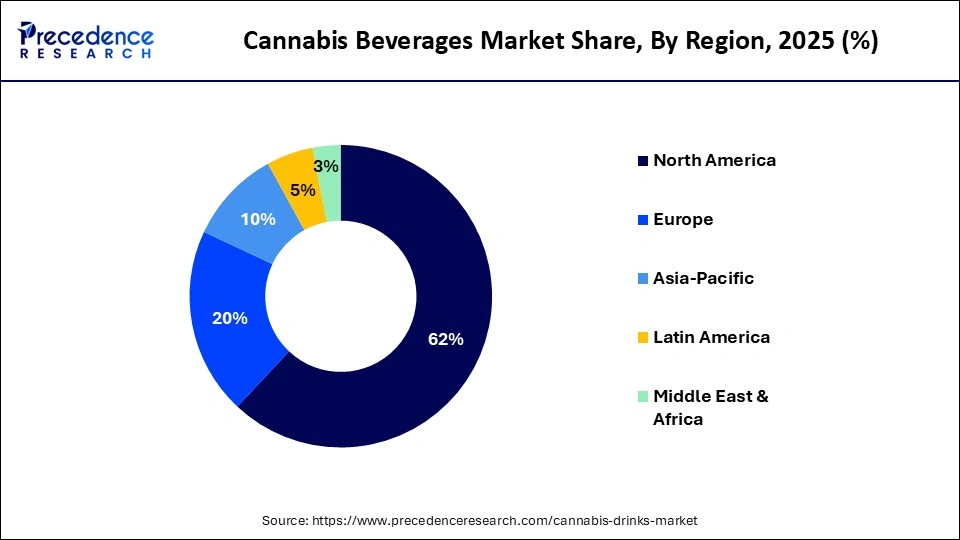

- North America dominated the cannabis beverages market, holding the largest share of 62% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR of 15.4% between 2026 and 2035.

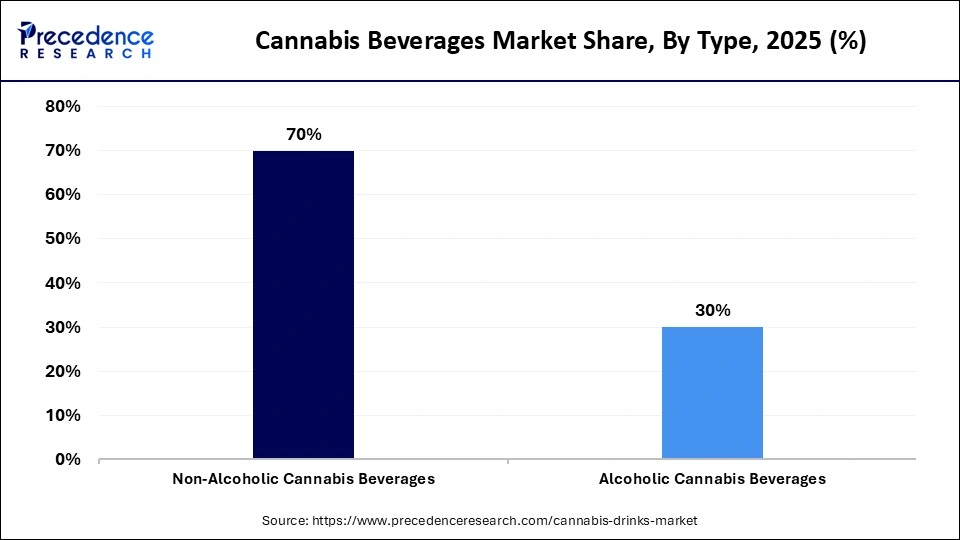

- By type, the non-alcoholic cannabis beverages segment held the largest market share of 70% in 2025.

- By type, the alcoholic cannabis beverages segment is expected to grow at the fastest CAGR of 13.3% between 2026 and 2035.

- By component/cannabinoid, the CBD-infused beverages segment held the largest market share of 58% in 2025.

- By component/cannabinoid, the THC-infused beverages segment is expected to grow at the highest CAGR of 13.7% between 2026 and 2035.

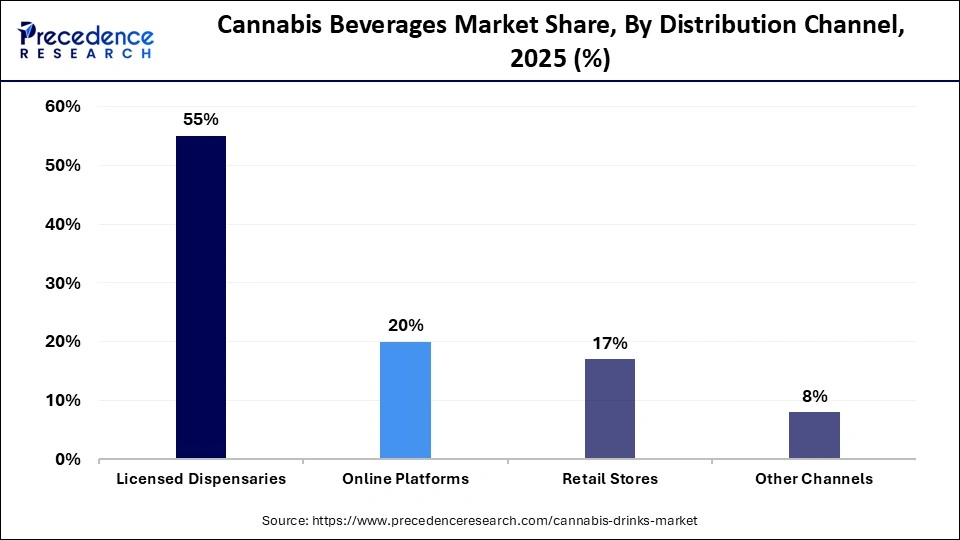

- By distribution channel, the licensed dispensaries segment held the largest market share of 55% in 2025.

- By distribution channel, the online platforms segment is expected to grow at the fastest CAGR of 13.8% between 2026 and 2035.

- By product format, the sparkling water & sodas segment held the largest market share of 55% in 2025.

- By product format, the juices & functional drinks segment is expected to grow at a CAGR of 14.1% between 2026 and 2035.

Market Overview

The cannabis beverages market is a sub-segment of the broader cannabis industry. These drinks are infused with cannabidiol (cannabidiol) and tetrahydrocannabinol (THC), which are available in both alcoholic and non-alcoholic forms. These products are positioned across wellness, recreational, and lifestyle segments and serve as an alternative to traditional cannabis consumption methods by combining the familiar beverage format with the functional and psychoactive effects of cannabis. The market is growing rapidly with the legalization of more and more cannabis products, the rising preference of consumers for smoke-free products, and growing health and wellness trends. Favorable regulatory environment in various regions and the rising awareness of functional beverages among consumers are likely to ensure the long-term growth of the market.

How is AI Influencing the Cannabis Beveages Market?

AI is significantly changing the landscape of the market in several ways. AI-generated predictive analytics is helpful in forecasting demand, optimizing supply chains, and reducing operational difficulties to ensure production is based on market trends. Furthermore, AI technologies support precision cannabis cultivation by optimizing plant growth conditions, cannabinoid composition, and crop yields while minimizing the use of resources such as water, energy, and nutrients. In addition, AI-driven robotics and automation are increasingly applied in beverage manufacturing to improve production efficiency, ensure accurate cannabinoid infusion, and enhance packaging precision, thereby maintaining product consistency and compliance with regulatory standards.

Cannabis Beverages Market Trends

- The increased desire of consumers to use smoke-free options of cannabis is boosting the demand for beverages enriched with CBD and THC.

- The global legalization of cannabis is encouraging the entry of new market players and expanding product availability across regions.

- Formulation innovations, including low-sugar, functional, and flavored beverages, are enhancing consumer appeal and aligning with the growing trend toward health-conscious consumption.

- Rising acceptance of cannabis-infused beverages is supported by the expanding medical and therapeutic use of cannabis in pain management, neurological disorders, and stress-related conditions.

- Strategic partnerships between beverage companies and cannabis cultivators are accelerating product development, strengthening distribution networks, and improving brand visibility across both mass and niche markets.

- Increasing consumer demand for edibles and functional beverages is driving the adoption and market expansion of cannabis-infused drinks, particularly among non-traditional cannabis users.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.57 Billion |

| Market Size in 2026 | USD 4.11 Billion |

| Market Size by 2035 | USD 14.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Component/Cannabinoid, Distribution Channel, Product Format, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Non-Alcoholic Cannabis Beverages Segment Dominate the Market in 2025?

The non-alcoholic cannabis beverages segment dominated the cannabis beverages market with the largest share of 70% in 2025. This is mainly due to the increased consumer interest in less harmful and healthier versions of traditional alcoholic drinks. Non-alcoholic cannabis drinks, including CBD-infused teas, water, and soft drinks, are sold to a large number of consumers. The growing urbanization rate, increasing health awareness, and the rising interest in functional and natural ingredients are stimulating demand. Moreover, regulatory frameworks for the commercialization of CBD products in some regions are likely to ensure the long-term growth of the segment.

The alcoholic cannabis beverages segment is expected to grow at the fastest CAGR of 13.3% over the forecast period. The segmental growth is attributed to regulatory approvals in Canada, some parts of the U.S., and Europe, which permit controlled production and sale. This significantly encourages beverage manufacturers and craft breweries to launch innovative beverages. Alcoholic cannabis beverages are served as a mix of classic alcoholic products like beers, wines, and cocktails, with cannabis compounds including THC or CBD, delivering distinctive flavor profiles and functional experiences. Moreover, targeted marketing campaigns emphasizing relaxation, social enjoyment, and mild intoxication are resonating with younger consumers seeking differentiated and novel beverage experiences.

Component/Cannabinoid Insights

What Made CBD-Infused Beverages the Dominant Segment in the Market?

In 2025, the CBD-infused beverages segment dominated the cannabis beverages market while holding the largest share of 58%. This is because consumers are increasingly inclined toward non-psychoactive cannabis products that offer wellness benefits. CBD, or cannabidiol, offers anti-anxiety, anti-inflammatory, and calming effects without intoxication, making it ideal for functional beverages. Thus, manufacturers began incorporating CBD into waters, teas, energy drinks, and sodas to allow precise dosing and easy absorption, supported by the global rise of the wellness trend, growing awareness of alternative therapies, and favorable regulatory conditions in North America and Europe.

The THC-infused beverages segment is expected to grow at a CAGR of 13.7% in the upcoming period, as tetrahydrocannabinol-based drinks have a recreational and psychoactive value. THC drinks, such as sparkling water, tea, and cocktails, are intended mainly to relax, be euphoric, and recreational in nature. There is a high adoption of THC-infused drinks in North America, especially in those states that have legalized recreational cannabis, contributing to segmental growth.

THC-infused beverages offer regulated dosing, addressing concerns about overconsumption and promoting responsible use. Innovative packaging, diverse flavors, and marketing focused on social experiences and premium positioning are appealing to urban millennials and young adults. While regulatory restrictions in some regions limit distribution, licensed dispensaries and select hospitality venues provide controlled access, supporting the growth and adoption of THC beverages.

Distribution Channel Insights

How Does the Licensed Dispensaries Segment Lead the Cannabis Beverages Market?

The licensed dispensaries segment led the market, accounting for 55% share in 2025 because of their compliance with regulations. Licensed dispensaries provide controlled and secure environments to purchase cannabis- and hemp-infused beverages with the confidence of quality, proper dosage, and legality. These are typically learning facilities where the consumers are informed of the impact of a product, consumption methods, and the value of wellness, resulting in a feeling of trust and confidence. Licensed dispensaries also support sampling programs, loyalty programs, and promotion programs, which raise brand awareness and uptake. Moreover, they serve as the primary distribution channel because they maintain strict regulatory control and are equipped to safely handle psychoactive cannabis products.

The online platforms segment is expected to expand at the fastest CAGR of 13.8% throughout the forecast period due to their unmatched convenience, product variety, and home delivery, allowing consumers to easily access CBD- and THC-infused beverages without geographic restrictions. E-commerce enables shoppers to explore diverse flavors, dosages, and formulations that may not be available in brick-and-mortar stores, while also catering to privacy-conscious and tech-savvy consumers. Additionally, the rise of digital literacy, mobile commerce, and robust logistical networks in regions like North America, Europe, and Asia-Pacific is accelerating adoption, making online platforms a growing distribution channel in the market.

Product Format Insights

Why Did the Sparkling Water & Sodas Segment Dominate the Market?

The sparkling water & sodas segment dominated the cannabis beverages market with a major revenue share of 55% in 2025. This is mainly due to their popularity, refreshing flavor, and the possibility of being enriched with both CBD and THC. The low-calorie and low-sugar formulations are favored by health-conscious users, and carbonation improves the sensory experience. Sparkling cannabis drinks are also used as alternatives to social and recreational use of cannabis in public and at home.

The convenience of the beverage format, combined with its availability through dispensaries and online platforms, and the ability to provide precise dosing, has boosted its adoption. Consumer demand for refreshing, flavorful, and functional beverages is driving the popularity of sparkling waters and sodas, positioning them as the most favored types of cannabis-infused drinks.

The juices & functional drinks segment is expected to grow at the highest CAGR of 14.1% during the projection period. This is primarily due to the increasing demand for wellness-focused and nutrient-enhanced cannabis beverages. These drinks combine fruit or vegetable extracts with CBD or THC, providing both flavor and functional benefits such as stress relief, relaxation, or energy. Innovative formulations, including adaptogen blends, herbal infusions, and low-calorie recipes, further enhance their appeal.

Widely available through e-commerce platforms, specialty wellness stores, and licensed dispensaries, this segment is expanding rapidly. The growing popularity of cannabis for medicinal purposes, alongside interest in functional beverages, is boosting the demand for juices and health-focused cannabis drinks, contributing to segmental growth.

Region Insights

How Big is the North America Cannabis Beverages Market Size?

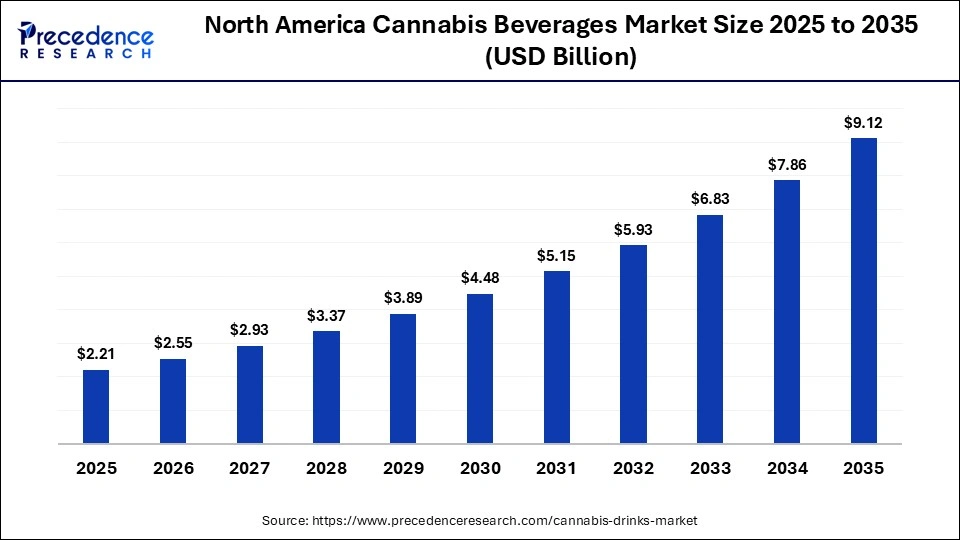

The North America cannabis beverages market size is estimated at USD 2.21 billion in 2025 and is projected to reach approximately USD 9.12 billion by 2035, with a 15.32% CAGR from 2026 to 2035.

What Made North America a Leader in the Cannabis Beverages Market?

North America led the market by capturing a 62% share in 2025. This is mainly due to favorable regulations commercializing cannabis products and increased consumer awareness about health & wellness. Some countries like the U.S, Canada, and Mexico have established legal frameworks for the production, distribution, and sale of cannabis-based beverages, providing a stable environment for both local and international players. The presence of well-established dispensary networks, online platforms, extensive distribution channels, and diverse product offerings, including both CBD- and THC-infused beverages, further reinforces North America's dominance in the market.

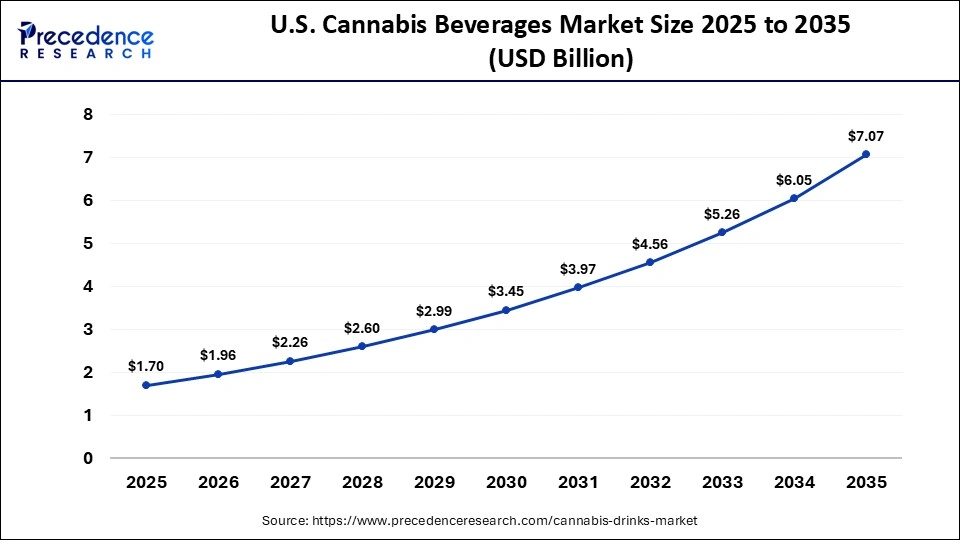

What is the Size of the U.S. Cannabis Beverages Market?

The U.S. cannabis beverages market size is calculated at USD 1.70 billion in 2025 and is expected to reach nearly USD 7.07 billion in 2035, accelerating at a strong CAGR of 15.23% between 2026 and 2035.

U.S. Market Analysis

The U.S. is the major contributor to the North American cannabis beverages market due to increasing legalization and regulatory acceptance of cannabis products across multiple states, making them more accessible to consumers. Rising consumer interest in alternative wellness and recreational products, including low-calorie, non-alcoholic, and functional beverages, is driving demand. Additionally, innovation in flavors, formulations, and delivery methods is attracting a wider audience, further fueling market expansion.

Why is Asia Pacific Considered the Fastest-Growing Region in the Cannabis Beverages Market?

Asia Pacific is expected to grow at the fastest CAGR of 15.4% during the forecast period. This is because of the growing demand for medicinal cannabis and increasing interest of consumers in functional drinks. Some countries are exploring the medicinal potential of cannabis for chronic pain management, stress relief, and overall wellness, which is fueling adoption, while the expansion of e-commerce and online platforms is improving product accessibility. Additionally, rising disposable incomes, urbanization, and increasing health-conscious lifestyles are boosting demand, and as more governments adopt favorable policies and consumer awareness increases, the Asia Pacific is expected to remain the fastest-growing market for cannabis beverages.

How is the Opportunistic Rise of Europe in the Cannabis Beverages Market?

Europe is expected to grow at a significant rate in the coming years. CBD-infused drinks have gained popularity among health-conscious and wellness-oriented consumers, supported by renowned brands, strong distribution networks, and accessible retail channels such as licensed dispensaries, specialty stores, and e-commerce platforms. The growing appeal of functional, low-sugar, and flavorful beverages among Europe's largely urban and youthful adult population, combined with the expansion of the wellness market, favorable regulations, and high disposable incomes, is driving long-term growth in the region.

Recent Developments

- In November 2025, Nine Dot Cannabis Beverages announced the release of two new flavors, Berry Punch and Peach Punch, in the cannabis beverages market, as an extension of its product line. The new products will target health-conscious and flavor-conscious consumers who want to enjoy functional cannabis drinks.(Source: https://www.bevnet.com)

- In May 2024, Tilray Brands, Inc. launched new cannabis-infused beverages in the XMG brand, introducing two sub-brands, XMG Plus (XMG+) and XMG Zero. The program is aimed at offering high-quality and various types of drinks to transform the market of cannabis drinks and satisfy the increasing demand of consumers to have functional and wellness-oriented drinks.(Source: https://ir.tilray.com)

- In January 2024, the Elevate product line is a new cannabis beverage product that was released by Texas Original, one of the largest medical cannabis providers. The beverage is a combination of CBG and THC in equal amounts with other functional compounds, such as ginger juice and turmeric, which are aimed at a medical and wellness-oriented audience.(Source: https://www.businesswire.com)

Who are the Major Players in the Global Cannabis Beverages Market?

The major players in the cannabis beverages market include Canopy Growth Corporation, Tilray Brands, Inc., Keef Brands, CANN Social Tonic, VCC Brands (VCC Brands In.), Phivida Holdings Inc., The Alkaline Water Company, Hexo Corp, Dixie Brands Inc., Koios Beverage Corporation, Mirth Provisions (Legal Beverages), Constellation Brands, Heineken (incl. Lagunitas infused), Coca-Cola (cannabis beverage partnerships), and Aurora Cannabis Inc.

Segments Covered in the Report

By Type

- Non-Alcoholic Cannabis Beverages

- Alcoholic Cannabis Beverages

By Component/Cannabinoid

- CBD-Infused Beverages

- THC-Infused Beverages

By Distribution Channel

- Licensed Dispensaries

- Online Platforms

- Retail Stores

- Other Channels

By Product Format

- Sparkling Water & Sodas

- Coffee & Tea

- Juices & Functional Drinks

- Sports/Other Beverages

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting