Canned Alcoholic Beverages Market Size and Forecast 2025 to 2034

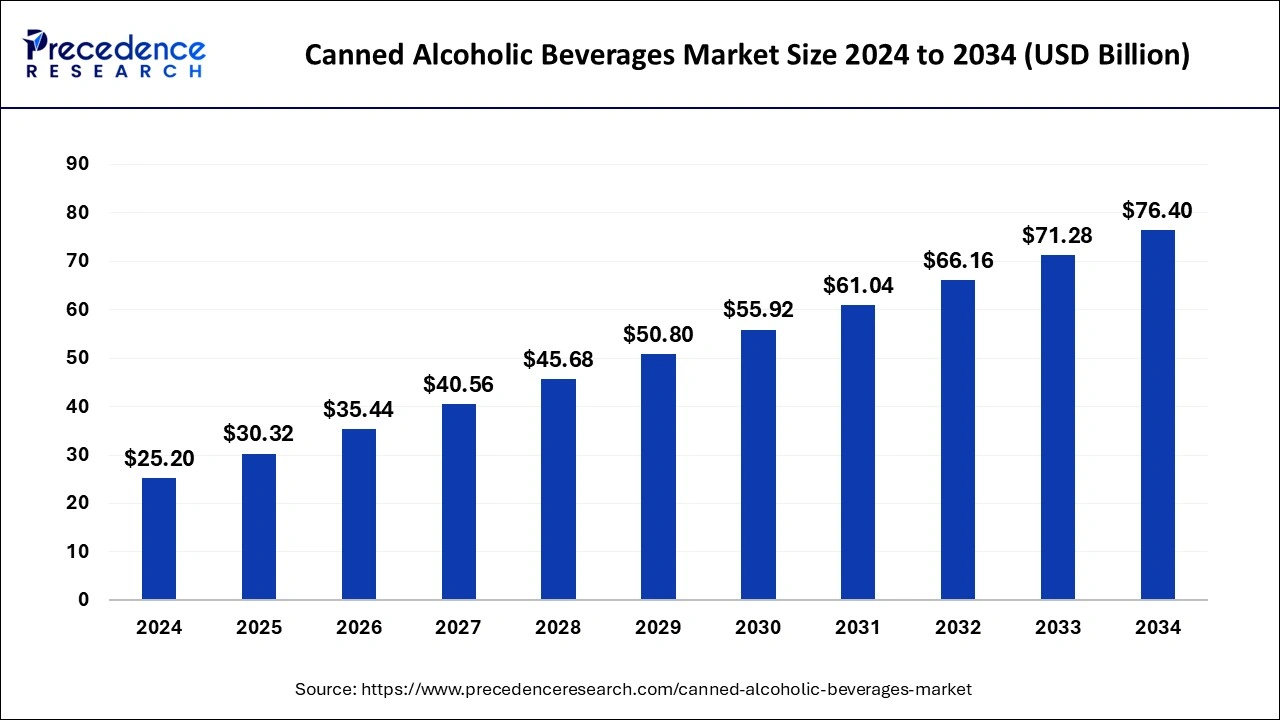

The global canned alcoholic beverages market size was estimated at USD 25.20 billion in 2024 and is predicted to increase from USD 30.32 billion in 2025 to approximately USD 76.40 billion by 2034, expanding at a CAGR of 11.73% from 2025 to 2034. The rising demand for convenient alcoholic beverages is expected to boost the growth of the global canned alcoholic beverages market.

Canned Alcoholic Beverages MarketKey Takeaways

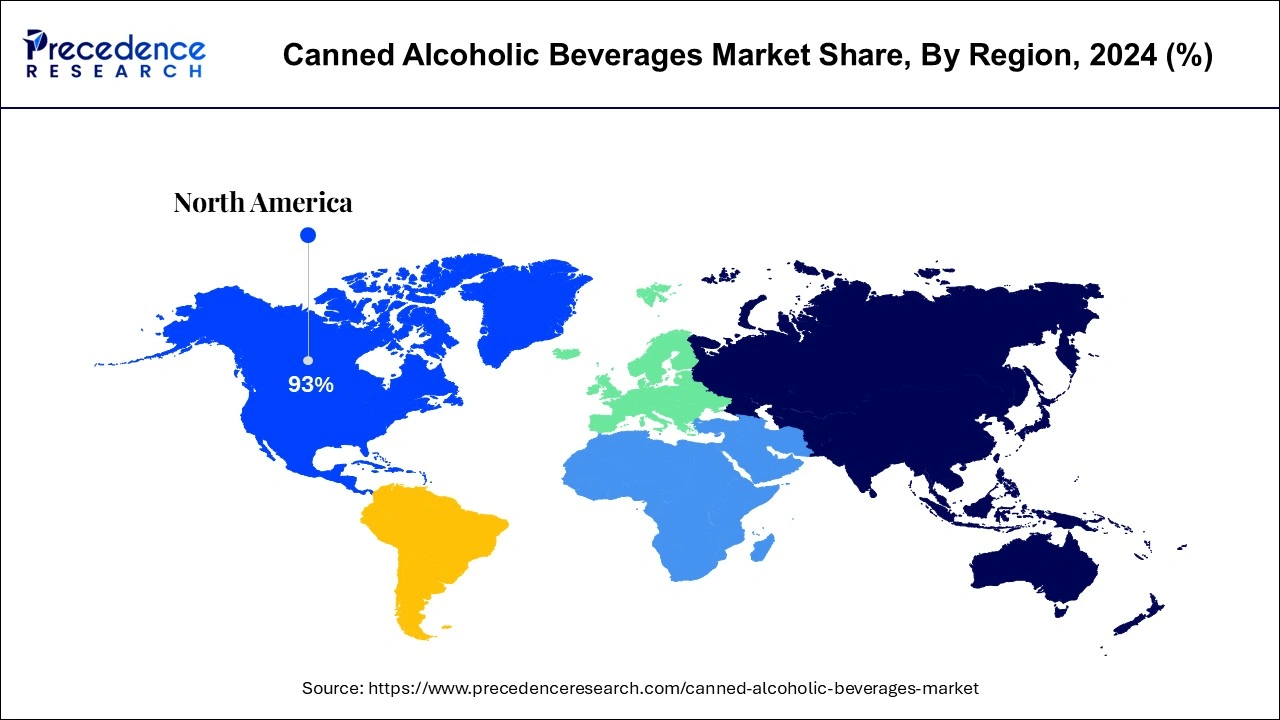

- North America generated more than 93% of revenue share in 2024.

- Asia Pacific is predicted to grow at a remarkable CAGR of 29.34% from 2025 to 2034.

- By product, the hard seltzers segment led the global market in 2024.

- By product, the wine segment is expected to expand at a CAGR of 14.30% from 2025 to 2034.

- By alcoholic content, the medium segment led the global market between 2025 to 2034.

- By distribution channel, the liquor stores segment captured more than 55% of revenue share in 2024.

- By distribution channel, the online segment is predicted to witness remarkable growth from 2025 to 2034.

U.S. Canned Alcoholic Beverages Market Size and Growth 2025 to 2034

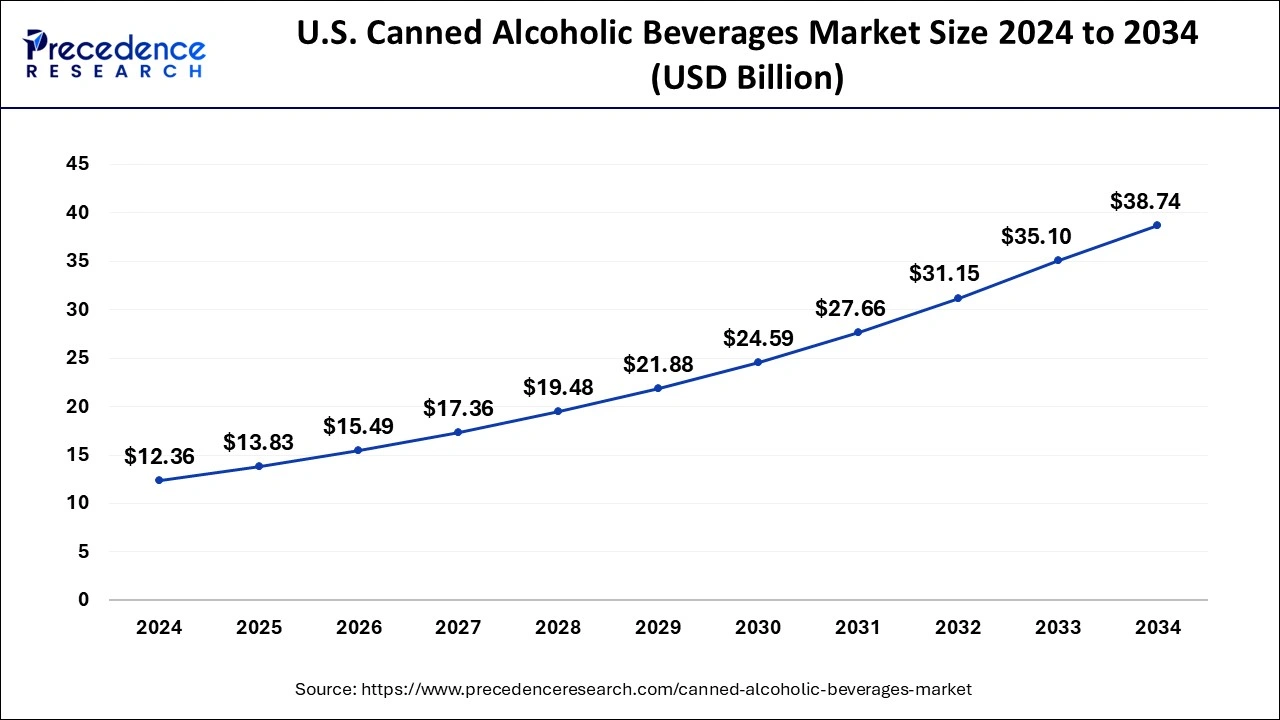

The U.S. canned alcoholic beverages market size was valued at USD 12.36 billion in 2024 and is expected to reach USD 38.74 billion by 2034, growing at a CAGR of 12.10% from 2025 to 2034.

North America holds the largest share of around 93% in 2024. The availability of a wide range of alcoholic beverages in the region has supplemented the growth of the canned alcoholic beverages market. Along with this, the rising spending on alcoholic drinks in the region is expected to maintain North America's growth. Moreover, the increasing demands for premium and super-premium alcoholic beverages, especially beer and vodka, are fueling the development of the canned alcoholic beverages market in North America.

- In January 2025, T�ST Beverages, known for its nonalcoholic sparkling drinks, launched a new 250ml can format in the US market. This launch expands the brand's packaging options, which already include 750ml and 250ml bottles in other markets. The introduction of the can format is strategically timed to coincide with Dry January, providing a convenient alternative for American consumers in various outdoor and casual settings.

Asia Pacific is expected to grow at a noticeable CAGR of 29.34% during the forecast period.The growth of the canned alcoholic beverages market in Asia Pacific is attributed to the availability of affordable alcoholic beverages. The shifting interest towards canned beverages in Asia Pacific is expected to boost the growth of the market. Asahi Group Holdings, Sula Vineyards and Suntory Holdings Limited are a few prominent manufacturers of canned alcoholic beverages in Asia Pacific.

Europe is another largest marketplace for the canned alcoholic beverages market.The sudden shift of consumers towards premium and convenient alcoholic drinks has fueled the growth of the canned alcoholic beverages market in Europe. The enormous demand for functional alcoholic beverages in the region is predicted to boost the market's growth during the projected timeframe.

At the same time, emerging economies and rising disposable income are observed as significant factors in boosting the market's growth in Latin America, the Middle East and Africa. However, the ban on alcohol production in a few Middle Eastern countries hampers the market's growth.

Market Overview

Canned alcoholic beverages are premixed cocktails packed in a metal container. The cans used for holding alcoholic beverages are made up of either aluminum or steel. The utilization of cans for alcoholic beverages has increased in recent years with growing demand for premiumization of packaging for alcoholic beverages. Moreover, the preference for canned alcoholic beverages is rising across the globe as can preserve the taste of beverages and they are capable of serving the beverages fresh.

Canned alcoholic beverages are comparatively stable, as aluminum or steel can reduce oxidation. The cans used for alcoholic beverages also offer prolonged shelf life and preserve the beverages even in adverse weather conditions. Generally, vodka, beer, and other cocktails are packaged in cans to protect the inner product from intense heat.

Canned Alcoholic Beverages MarketGrowth Factors

The global canned alcoholic beverages market is expected to witness noticeable growth during the forecast period. The rising demand for convenient alcoholic beverages is one of the most significant factors to drive the growth of the canned alcoholic beverages market. Canned beverages are travel friendly and portable; the convenience offered by canned alcoholic beverages is fueling the growth of the market.

In recent years, many governments have approved the sales of canned alcoholic beverages in supermarkets, this factor is driving the market's growth. However, the rising environmental concerns are likely to hinder the growth of canned alcoholic beverages market.

Other factors such as rising disposable incomes, emerging economies and rapidly rising interest in alcoholic beverages across the globe are expected to boost the growth of canned alcoholic beverages market. Moreover, the rising demand for ready-to-drink beverages worldwide is fueling the growth of canned alcoholic beverages market.

The rising focus on business strategies to expand the product line in the alcoholic beverages industry is supplementing the market's growth. Additionally, companies involved in the global canned alcoholic beverages market are turning their sales of alcohol beverages online, the convenient availability of beverages online is highlighting the growth of the market. 5Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.73% |

| Market Size in 2025 | USD 30.32 Billion |

| Market Size by 2034 | USD 76.40 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Alcoholic Content and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increased demand for convenient alcoholic beverages

Canned alcoholic beverages are portable and lightweight. Cans used for alcoholic drinks hardly weigh up to 15 grams. Cans are unbreakable, which makes them travel-friendly and easy to dispose of. Canned alcoholic beverages are stackable and also provide an easy storage option as the material used for packaging protects the inner liquid from light or excess oxygen.

Aluminum or steel cans are a durable and accessible form of drinking. Canned alcoholic beverages offer convenience to drinkers and can be immediately consumed. The rising demand for convenient alcoholic drinks across the globe is observed as a significant driving factor for the market's growth.

- In February 2025, Hailee Steinfeld launched the Angel Margarita canned cocktail. The canned cocktail, which is sourced and manufactured in Jalisco, Mexico, with 100-percent Agave tequila blanco, will come in four flavors: lime, grapefruit paloma, ranch water, and wild berry.

Restraint

Expensive and complicated production of cans

Economically, aluminum and steel are costly as compared to plastic materials. The high production costs of cans for alcoholic beverages limit the involvement of small-scale alcoholic beverage manufacturers. The raw materials required to produce cans are 20-25% more expensive than plastic bottles. Apart from this, the initial investment in the machinery needed for the manufacturing process is hefty.

Additionally, the production of aluminum or steel cans for beverages is complex and consumes more electricity. Considering these limitations, the complicated and expensive production of cans required for packaging alcoholic beverages is prone to hamper the market's growth.

Opportunity

The rising popularity of ready-to-drink alcohols

The rising trend of ready-to-drink alcoholic beverages promises a plethora of opportunities for the global canned alcoholic beverages market to grow. The market is witnessing an enormous demand for ready-to-drink canned alcoholic beverages as they offer convenience and a premium experience for drinkers. According to the distilled spirits council, the global consumption of ready-to-drink cocktails rose by 42.3% in 2021.

Moreover, prominent companies in the market are focused on the production of ready�to�drink alcoholic beverages. For instance, in October 2022, IMFL manufacturers Radico Khaitan Limited launched its ready-to-drink Magic Mix Vodka Cocktail with 4.8% alcohol; this beverage will be sold in the can packaging. The company has announced the launch of three variants, mojito, cosmopolitan and cola.

- In February 2025, Allied Blenders and Distillers Limited (ABD), India's third-largest spirits company, completed the acquisition of all brands and intellectual property rights from Fullarton Distilleries Private Limited. This move strengthens ABD's position in the super-premium spirits segment and aligns with its emphasis on product innovation in India's craft spirits industry.

Product Insights

The hard seltzers segment dominated the global canned alcoholic beverages market in 2024. The hard seltzers alcoholic beverages are generally made of malted barley or grain-neutral spirits. The low-calorie content in the hard seltzers canned alcoholic beverages has fueled the growth of the hard seltzers segment. New product launches, increasing demand for gluten-free alcoholic drinks and rising health concerns are a few factors to maintain the development of the hard seltzers segment during the forecast period.

The wine segment is expected to grow at a CAGR of 14.30% during the forecast period. The growth of the wine segment is attributed to the rising premiumization of aluminum cans to offer a high-class drinking experience to consumers. The preference for white wine in canned packaging is rising as aluminum cans chill the white wine much faster than traditional bottles. The improving quality of packaging for canned wine will drive the growth of the wine product segment during the forecast period.

The ready-to-drink (RTD) segment is the fastest-growing segment of the global canned alcoholic beverages market, owing to the growing popularity of convenient at-home alcoholic beverages that can be consumed immediately after purchase. RTD canned alcoholic beverages are proven to keep the ingredients fresh for a long time. Moreover, the rising preference for travel-friendly canned beverages is observed to propel the growth of the RTD segment. Key players are focused on launching new attractive flavors in RTD canned alcoholic beverages; this promises a bright future for the segment's development.

Alcoholic Content Insights

The medium alcohol content segment dominates the global canned alcoholic beverages market. The medium alcohol content can vary from 5% to 8% typically. These alcoholic beverages have a moderate number of calories and act as a regular brew. At the same time, the increasing production of light alcoholic beverages with refreshing flavors and tastes will serve as a driving factor for the growth of the light alcohol content segment.

Distribution Channel Insights

The liquor stores segment accounts for over 55% of the total share of the global canned alcoholic beverages market. The liquor stores are generally located all over with the availability of a wide range of premium and private brands of alcoholic beverages. According to the survey by Chase Design, a New York-based human behavior strategy and design firm, 40% of people prefer choosing their favorite labels from liquor stores directly. Walmart and Costco are a few of the leading prominent in-store distributors of canned alcoholic beverages.

The online distribution channel segment is expected to witness a significant increase during the forecast period. Key players in the global canned alcoholic beverages market are focused on launching their websites to reach out to a wide range of consumers across the globe. In addition to this, consumers are inclined towards buying alcoholic beverages online due to the availability of multiple options, hassle-free doorstep delivery and easy payment options.

Canned Alcoholic Beverages Market Companies

- Bacardi Limited

- Union Wine Company

- Sula Vineyards

- Brown-Forman

- Kona Brewing Co.

- Asahi Group Holdings

- Barefoot Cellars

- Integrated Beverage Group LLC

Recent Developments

- In December 2024, Coca-Cola expanded its portfolio and launched Schweppes Mix canned alcoholic cocktails. The launch of "Schweppes" Mix is a major step for "Coca-Cola" Thailand in expanding its portfolio into the alcoholic beverage market.

- In February 2024, Malibu launched a new line of ready-to-serve (RTS) cocktails in Tetra Pack formats, including Strawberry Daiquiri, Pineapple Bay Breeze, and Rum Punch. These convenient, shareable cocktails cater to on-the-go consumption and highlight the brand's commitment to meeting consumer preferences for easy and enjoyable beverages.

- In March 2023, Jack Daniel's and Coca‑Cola RTD launched in the United States. The highly anticipated ready-to-drink (RTD) take on one of the world's most requested �bar calls� cocktails ordered by brand name balances the smooth character of Jack Daniel's Tennessee Whiskey with the refreshing taste of Coca‑Cola. Jack Daniel's & Coca‑Cola RTD makes its U.S. debut.

- In February 2023,Vita Coco, a leading coconut water brand, and Captain Margo, a rum brand, launched the RTD alcohol drink Vita Coco Spiked with Captain Morgan. The new product offers three rum-based cocktails, pina colada, strawberry and lime mojito. The newly launched �Vita Coco Spiked with Captain Morgan is commercially available across the United States.

- In February 2023, the fastest growing beer company, Bira 91, announced its entry into the hard seltzers category by launching the �Grizly' hard seltzers ale. The Grizly by Bira 91 brings cocktails, wine and beer in one can. The canned alcoholic beverage by Bira 91 contains all-natural ingredients with low-sugar content.

- In January 2023, Chicago-based Molson Coors Beverage Company launched �Roxie', a zero-proof canned cocktail. Roxie comes in three flavors in canned packaging, Ripe with Passionfruit, Lost in Mango and Forbidden Pineapple. The company has made canned alcohol available in its online store.

- In September 2022, a prominent mixed line of canned cocktails, FRESCA, debuted in the United States with a canned alcohol cocktail option. The premixed and ready-to-drink alcoholic beverages by FRECA are crafted with real spirits. The zero-sugar drink is available in four packs of 12-oz cans.

- In August 2022, headquartered in the United States, Tito's announced the launch of its new ready to drink vodka in canned packaging. The 16-oz and double insulated can offer high-quality, smooth vodka cocktails at a reasonable price.

- In August 2022, Canvus Cocktails, a newly launched local Cincinnati brand, announced its commitment to become the official canned cocktail of Cincinnati Bengals. With the announcement, the brand has promised to bring a new range of bourbon and vodka-based canned cocktails in the upcoming year.

- In August 2022, globally leading alcohol beverage brand Monster planned to launch its first flavored malt beverage, RTD alcohol, in canned packaging. This launch by Monster promises a long-term strategy for the company to sustain itself in the alcohol industry.

- In August 2022, a leading company in developing canned cocktails, Monaco Cocktails, launched a new canned cocktail category by entering into the hard lemonade category. Monaco Hard Lemonades are specially made for summer with original peach flavors. The latest launched cocktail by Monaco offers two shots of vodka and 9% ABV in every can. The Monaco Hard Lemonades feature a selection of vodka, gin and rum.

Segments Covered in the Report

By Product

- Hard Seltzers

- Wine

- RTD Cocktails

By Alcoholic Content

- High

- Medium

- Low

By Distribution Channel

- Liquor Stores

- On-trade

- Online

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content