What is Canned Tuna Market Size?

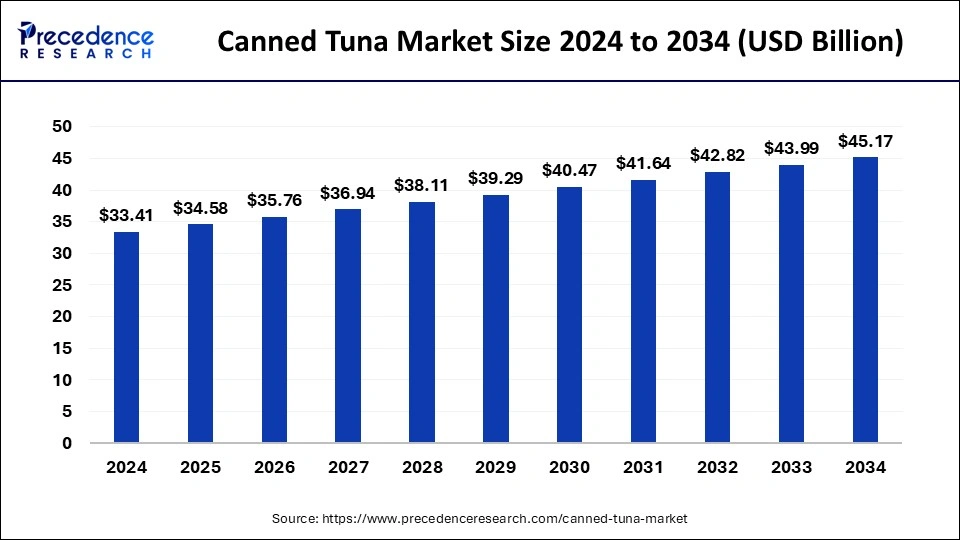

The global canned tuna market revenue is calculated at USD 34.58 billion in 2025 and is predicted to increase from USD 35.76 billion in 2026 to approximately USD 46.34 billion by 2035, expanding at a CAGR of 2.97% from 2026 to 2035.

Market Highlights

- By type, the ready-to-cook segment is anticipated to show considerable growth in the market over the forecast period.

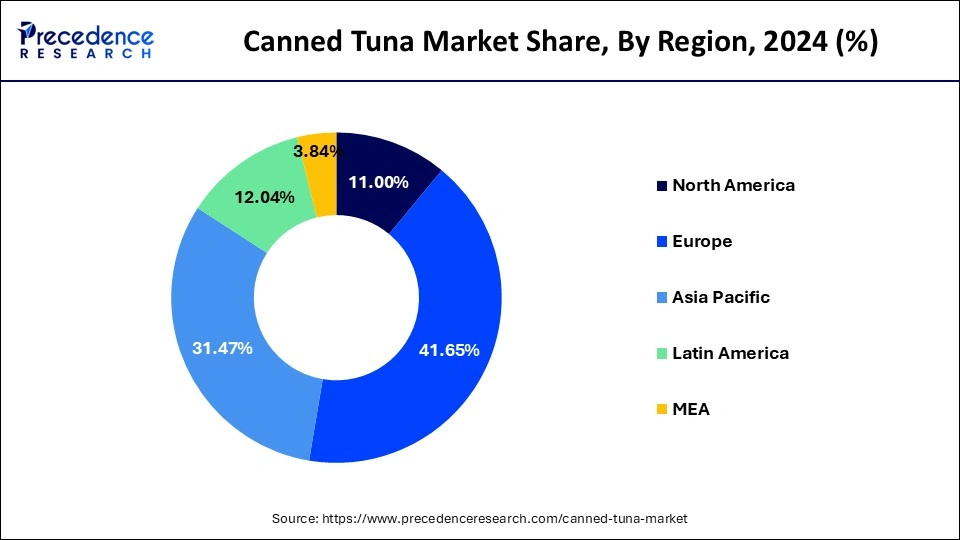

- Europe led the global market with the highest market share of 41.65% in 2025.

- Middle East & Africa expected to grow at the fastest CAGR over the studied period.

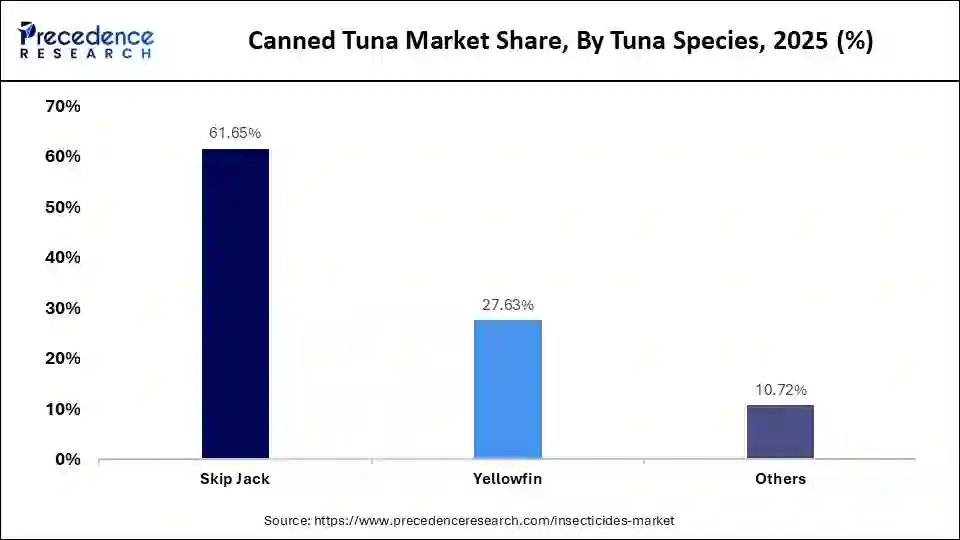

- By Tuna Species, the skip jack segment captured the biggest revenue share of 61.65% in 2025.

AI integration in the Canned Tuna Market

Artificial intelligence is helping companies to improve efficiency in their supply chain, become more sustainable, and satisfy consumer needs. The use of AI-based tracking technologies allows monitoring fishing vessels and confirming that the tuna is harvested legally and sustainably, allowing brands to adhere to environmental regulations and increase transparency. AI can be used to draw faster and smarter decisions about pricing trends, consumer preferences, and global market dynamics.

Market Overview

The market for tuna in cans is enormous and has grown steadily over time. The nutritional advantages, lengthy shelf life, and ease of use of tuna in a can are some of the factors driving this expansion. Consumer preferences for ready-to-eat and convenient seafood items have driven the demand for canned tuna. Because canned tuna has a high protein level and omega-3 fatty acids. Health-conscious consumers frequently choose it. Various canned tuna varieties, such as skipjack, yellowfin light tuna, and albacore white tuna, are usually available in the market. Because light tuna contains less mercury, it is frequently selected.

Canned Tuna Market Growth Factors

- The need for quick-to-eat food products is rising as the world's population increases, particularly in metropolitan areas. Because canned tuna is an easily accessible and shelf-stable protein source, it is ideally positioned to meet this need. In many areas, individuals with more disposable income can choose more upscale and practical food options, such as tuna in a can. Many consumers favor canned tuna due to its accessibility and price.

- Changes in eating habits, such as emphasizing wholesome and environmentally friendly foods, may be a factor in the market expansion for canned tuna. Tuna is frequently regarded as a sustainable seafood choice compared to certain other fish kinds.

- Advancements in packaging technology, like easily opened lids, eco-friendly materials, and portion-controlled packaging, can increase canned tuna's market appeal and convenience.

- The globalization of food trade gives customers access to a wide range of goods from many geographical areas. This makes canned tuna varieties easier to get, satisfying a wide range of palates.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 34.58 Billion |

| Market Size in 2026 | USD 35.76 Billion |

| Market Size by 2035 | USD 46.34 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.97% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Tuna Species, Type, and Regions |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Rising Consumer Dependency on Ready-to-Cook and Ready-to-Eat Foods

There is a vast scope of consumers who need ready-to-cook/ready-to-eat food products, leading to the high growth of the processed food market. The main reason attributed to this trend is the high-paced lifestyle, which is mostly in the urban settings of the working segment of the population. The increasing population of working women and two-earner families has added more to the demand for food items that should be ready with minimum preparation, as convenience food items.

However, it is especially millennials who push this trend forward since they pay more attention to food products that can be prepared rather quickly, and are well-balanced in their nutritional intake. These convenient foods consist of canned foods, frozen foods, instant beverages, and instant mixes, which are capable of satisfying their tight schedules. The manufacturers are more willing to invest in innovative packaging, portion control, and product certifications in accordance with changing consumer trends and to assure quality.

Expanding E-Commerce Channels

The fast growth of e-commerce websites and in the supply chain of the food industry is also contributing highly to the increased growth of the market of processed food market. This convenience and the possibility to choose an individual delivery, as well as online-only deals, have led to a considerable increase in online shopping for food. The tech-savvy millennial generation is more willing to embrace the ease of transacting their daily food services in an e-commerce environment. The online platforms also give consumers information about products, reviews, and nutritional information, and further improve the aspect of informed decision-making and consumer trust. With the increase in the penetration of the internet and the usage of smartphones, the e-commerce channel is the main channel that is likely to be used to further widen the market for processed food products.

Restraint

Environmental Concerns Hinder Growth

One of the current constraints of the canned tuna industry is an increasing number of concerns about environmental and sustainability problems related to fishing. Consumer pressure has been growing overfishing and fishing practices that have led to degradation of marine ecosystems, especially the consideration of the environmental effects of non-sustainable fishing processes. It changes the consumer expectations that pressure companies to receive certifications given by reputable sustainability agencies and pursue traceable methods of responsible sourcing.

Opportunity

Growing Incorporation of High-Nutrition Foods

The growing attention to health and wellness has created a good market potential in the canned tuna product, as more people have become interested in using high-nutrition food in their everyday menu. Tuna is a lean protein, omega-3 fatty acids, vitamins, and mineral-rich food that is a favorite food among health-conscious consumers. To meet the time-saving requirements of modern life, such convenient and simple-in-preparation food as canned tuna offers a set of advantages as a component of a nutritionally balanced diet.

Increasing awareness of the need for diets rich in protein is also contributing to the demand. Besides the enhanced shelf life, the wide supply in the supermarket industry, and online facilities, as well as the diverse flavor and packaging capabilities, increase the attractiveness of tuna. With the increasing consumer preference for long-term wellness-promoting foods, the position of tuna as one of the functional, high-nutrition staples is likely to play an important role in market growth.

Segment Insights

Tuna Species Insights

The skip jack segment holds the largest share of the canned tuna market. Katsuwonus pelamis, often known as skipjack tuna, is one of the species most frequently used to make tuna sauce. It is valued for its tasty and dark-colored meat and is noted for being comparatively tiny compared to other tuna species like albacore or yellowfin. Products from canned tuna frequently come in various cuts, like pieces or flakes.

One type of tuna commonly found in the market is a skipjack chunk. Because skipjack has a gentler flavor and a lighter color than other tuna species, it is frequently called "light tuna." The sustainability of tuna products could pique the curiosity of specific customers. There may be a niche for skipjack tuna sourced sustainably and with certifications from groups such as the Marine Stewardship Council (MSC). Different market sectors may target customers seeking particular flavor profiles, such as smoked or sauce-based skipjack tuna. Tuna can be processed in a variety of ways.

Yellowfin segment is expected to grow at the fastest rate during the forecast period. One of the main kinds of tuna frequently captured and prepared for the canned market is yellowfin tuna (Thunnus albacores). Because of its reputation for having delicate and tasty flesh, yellowfin is commonly used in canned tuna products. This highly migratory species can be found worldwide in tropical and subtropical waters. Different tuna species, such as skipjack, and yellowfin, are used in the canned tuna industry. Because of its flavor and texture, yellowfin tuna is frequently used for more expensive and superior canned tuna products. A substantial portion of the world's seafood market comprises canned tuna, which comes in various varieties, from plain to flavored and sauce-mixed.

Canned Tuna Market Revenue, By Tuna Species, 2022-2024 (USD Billion)

| Tuna Species | 2022 | 2023 | 2024 |

| Skipjack | 19.12 | 19.86 | 20.60 |

| Yellowfin | 8.61 | 8.93 | 9.25 |

| Others | 3.33 | 3.45 | 3.56 |

Type Insights

The ready-to-cook segment is expected to grow at a significant CAGR over the forecast period, fuelled by an increase in consumer demand for convenient and time-efficient meal solutions. This is the portion of products that have short preparation and cooking time, like marinated seafood, ready-seasoned meat, and half-done meal kits. In a busy modern lifestyle, particularly among working men and women. These products are also captured by health-conscious consumers since most of them provide transparent labelling, nutritional facts, and some are without preservatives or fake additives. Moreover, with the development of the latest forms of retailing and online selling, there is an increased visibility of products and their accessibility, which has contributed to the evolution of the ready-to-cook segment both in the developed and emerging economies.

Regional Insights

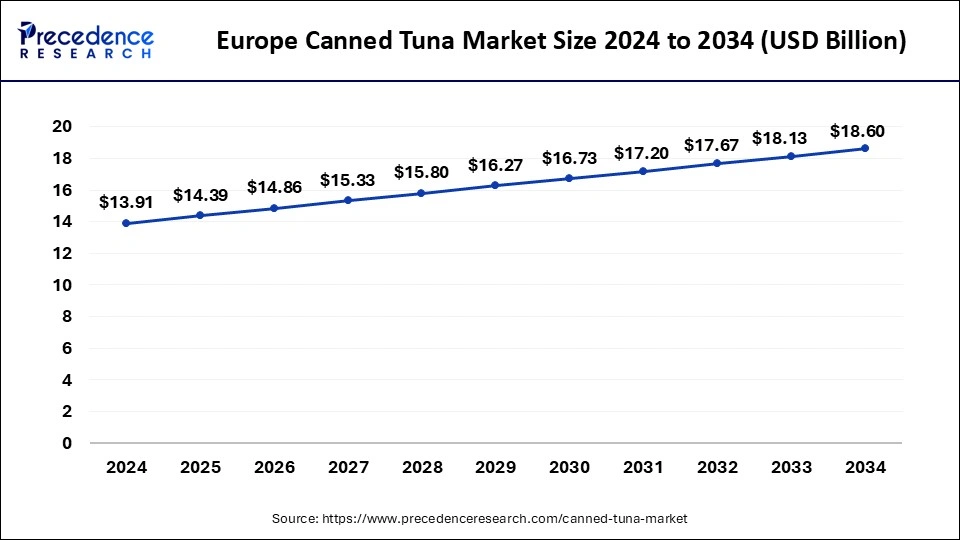

Europe Canned Tuna Market Size and Growth 2026 to 2035

The Europe canned tuna market size is exhibited at USD 14.39 billion in 2025 and is projected to be worth around USD 19.06 billion by 2035, growing at a CAGR of 2.85% from 2026 to 2035.

Europe led the canned tune market in 2024. Canned tuna has long been a well-liked and practical fish option in Europe. Because of its high protein and omega-3 fatty acid content, health-conscious consumers frequently prefer tuna. Several factors, including customer tastes, the state of the economy, and sustainability concerns, affect the market. A growing consciousness of sustainability and ethical fishing methods has affected consumer choices.

The European canned tuna market has competition from major food corporations and seafood brands. Specific consumers have a preference for brands that emphasize environmental responsibility and sustainability. European consumers are becoming more interested in seafood supplied sustainably, especially tuna in cans. Several certification schemes, like the Marine Stewardship Council (MSC), have become more significant.

What Are the Key Trends Driving the North America Canned Tuna Market?

The North American canned tuna market accounted for a substantial share due to the presence of a strong retailing network in the region, with supermarket chains and the high growth of online grocery stores, is essential in promoting sales and availability. The habitat of the consumers in North America, especially the United States and Canada, is shifting toward sustainably sourced seafood, and the brands are transforming toward caring for fish stocks and environmentally friendly packaging. Further, the number of different people in North America has also led to the increasing popularity of international foods, whereby canned tuna is incorporated in many different kinds of foods in the world, such as sushi, curry, and Mediterranean salads.

The U.S. will see a tremendous growth in terms of the segment of canned tuna during the forecast period. The increasing consumer awareness of high-protein and low-fat foods has made the tuna a favorite food item among busy professionals and health-conscious consumers. Market acceleration is also being caused by the e-commerce and direct-to-consumer surge, as they provide a greater variety of products to consumers and give them home delivery choices and discounts. The well-developed retail channels, the change of diet norms, and the rise of online trading will push the North American canned tuna market.

- In May 2025, Chicken of the Sea introduced its Wild Caught Light Tuna Packet with Ghost pepper, a new bold taste that will satisfy spice lovers. The product is characterized by 15 grams of protein in a 2.5-ounce package. It can be used in a balanced form or directly by consumers in food.

Why Is Asia-Pacific Growing Region in Canned Tuna Market?

Asia-Pacific is the fastest growing canned tuna market. The market is attracting attention for several reasons, including urbanizing populations and increasing disposable incomes. Consumer awareness regarding the safety of packaged seafood is promoting growth along with more westernized eating habits. Retail modernization through supermarkets and online grocery platforms is also making the product more accessible. Countries that have significant fishing industries will also have an abundance of local raw materials, thereby enhancing the supply chain. There is increasing interest among young consumers for flavored and prepared canned tuna food products. The rising focus on protein consumption and affordable nutritional options is adding momentum to the growth of the market, especially in the rapidly developing economies throughout Asia-Pacific.

Japan

Japan has established itself as the leader in canned tuna consumption in Asia-Pacific due to a strong seafood culture and a very well developed processed seafood industry. Extensive consumer preference for quality, freshness, and traceability of production are major factors driving the demand for quality canned tuna. Domestic manufacturers are committed to developing innovative flavours and packaging formats that appeal to local preferences. There is an increasing inclination among Japanese consumers towards healthful eating and there is a high demand for ready-to-eat canned seafood. Japan's long-standing import and distribution networks contribute a continuous flow of both imported and domestically sourced products, which has reinforced Japan's leadership position in regard to the total canned tuna market in the region.

How Is Middle East & Africa Growing in Canned Tuna Market?

The canned tuna market in the Middle East & Africa is experiencing significant growth. This is driven by factors such as increasing urbanization, greater demand for protein-rich foods that require no preparation, new supermarkets benefiting from poor transport networks. Canned products are popular with consumers because of their longevity due to weather extremes, convenience and the growing number of expatriate residents in Gulf countries, and therefore have a direct impact on how people buy and consume seafood. There are opportunities for affordable canned proteins to enter more price-sensitive markets. Investment in food distribution infrastructure and retail outlets will enhance future growth in the region for canned tuna.

Saudi Arabia

Saudi Arabia is the top country for canned tuna in the Middle East & Africa, due to its level of demand for both convenient food and imported food. The number of retailers in the Kingdom has expanded, with hypermarket chains, online grocery sites and other online retailers, which means that consumers have a lot of options to find canned tuna; consumers are buying canned tuna faster than ever thanks to the high number of people who buy product with a quick prep time and long shelf life, and there is a growing consumer focus on health and protein in their diet, which is driving demand for canned tuna. Additionally, the increased volume of imports into the country and established logistics network of Saudi Arabia support the continued supply of canned tuna products. The increasing number of households and the average age of the consumers in Saudi Arabia will help continue to solidify Saudi Arabia's leadership position and growth in the region's canned tuna market.

Value Chain Analysis for Canned Tuna Market

Drug Discovery & Clinical Development: This stage focuses on molecular discovery, validation of targets for therapy, preclinical assessments to test the substance's safety and efficacy, various phases of clinical studies to establish safe and effective doses for patients, and regulatory submissions (documentation).

- Key Companies: BeiGene, Novartis, Johnson & Johnson, AstraZeneca, Roche

API Manufacturing & Formulation Phase: This stage entails producing active ingredient (API) for use in drugs and manufacturing or synthesizing it with chemicals, followed by testing for quality and developing oral dosage forms according to acceptable stability and quality standards, as well as complying with the regulations of pharmaceutical and chemical manufacturers worldwide.

- Key Companies: Lonza, WuXi AppTec, Samsung Biologics, Catalent, Recipharm

Regulatory Approval & Commercialization: This phase focuses on submission of regulatory applications to the regulator for approval to market and sell drugs, establishing price structure for drugs within specified regulations, planning how to access the on-market, and branding drugs for clients in oncology, and educating healthcare providers in on-market use of these drugs.

- Key Companies – BeiGene, FDA, EMA, Takeda Pharmaceuticals, Pfizer

Distribution, Hospitals & Post-Marketing Surveillance Phase:This phase encompasses distribution of drugs from specialty pharmacy to hospitals through oncologists' prescribing, use by patients via patient assistance programs (PAPs), and continued monitoring for long-term side effects or risks.

- Key Companies: McKesson Corporation, AmerisourceBergen, Cardinal Health, Mayo Clinic, Cleveland Clinic

Canned Tuna MarketCompanies

- Thai Union Group PCL

- Frinsa del Noroeste SA

- Jealsa Rianxeira SA

- Centuary Pacific Food, Inc.

- Golden Prize Canning Co. Ltd.

- Albacora S.A.

- American Tuna, Inc.

- Wild Planet Foods, Inc.

- Ocean Brands GP (The Jim Pattison Group)

- C.F. Fishery Co., Ltd (Bumble Bee Foods, LLC)

Recent Developments

- In April 2025, BlueNalu, a US-based seafood cultivation company, is planning to start with bluefin tuna in California and has already locked in deals to achieve its eventual goals to distribute the product worldwide.

- In December 2024, Subsidiary of Fisheries Development Oman, SIMAK, officially launched its first consumer canned tuna products in the domestic market. The focus of the new line is to make the accessed seafood more easily available and represent high-quality, sustainably caught fish.

- In August 2024, Wild Planet, the first and only company to ever offer sustainably caught canned seafood, announced a new Limited Edition Wild Tuna Snack Pack in collaboration with two of the most popular better-for-you product brands, Simple Mills and Chosen Foods.

Segments Covered in the Report

By Tuna Species

- Skip Jack

- Yellowfin

- Others

By Type

- Ready-To-Eat

- Ready-To-Cook

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting