What is the Canned Mushroom Market Size?

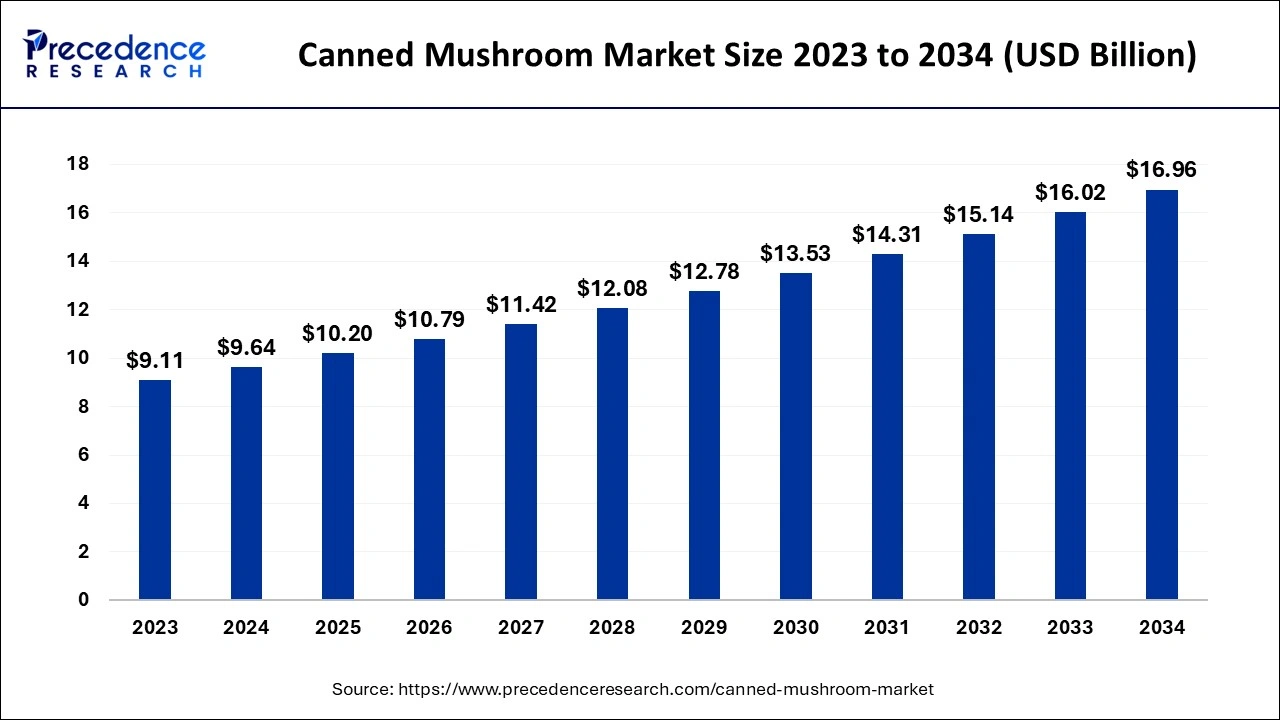

The global canned mushroom market size is calculated at USD 10.20 billion in 2025 and is predicted to increase from USD 10.79 billion in 2026 to approximately USD 16.96 billion by 2034, expanding at a CAGR of 5.81% from 2025 to 2034.

Canned Mushroom Market Key Takeaways

- In terms of revenue, the global canned mushroom market was valued at USD 10.20 billion in 2025.

- It is projected to reach USD 16.96 billion by 2034.

- The market is expected to grow at a CAGR of 5.81% from 2025 to 2034.

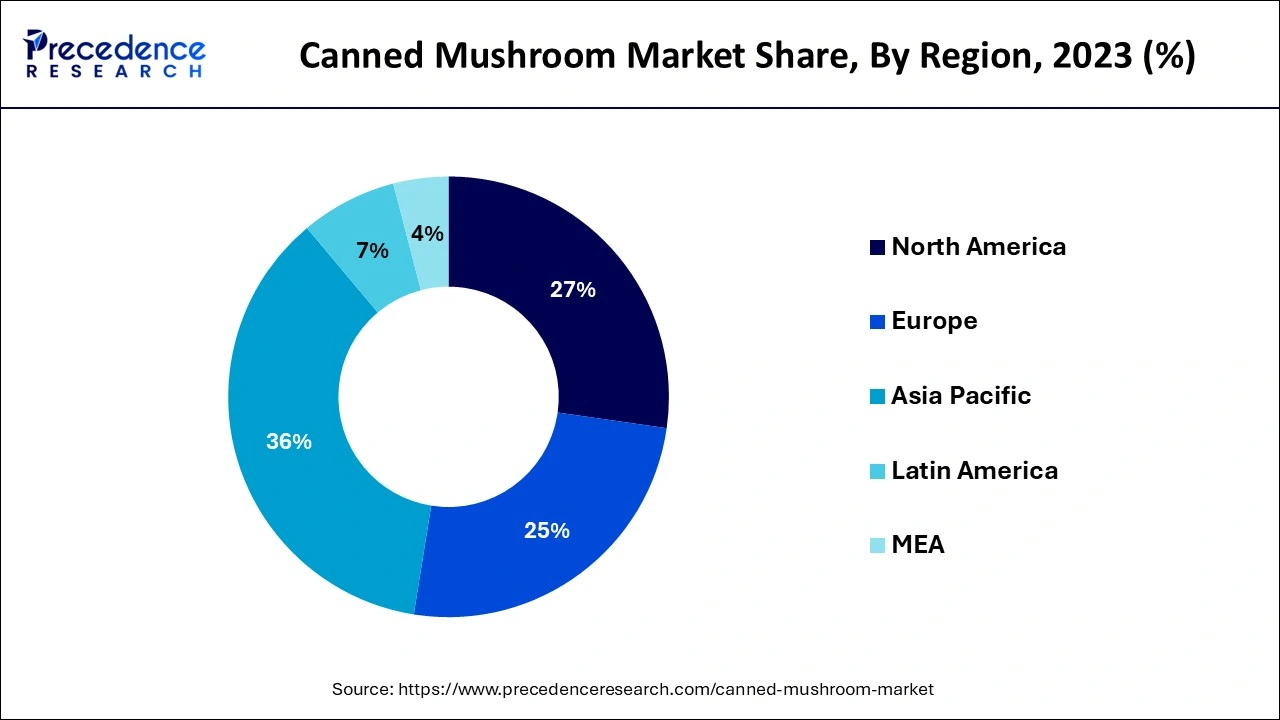

- Asia Pacific dominated the canned mushroom market with the largest market share of 36% in 2024.

- North America's canned mushroom market is expected to grow at the fastest rate during the forecast period.

- By product, the button mushroom segment contributed the biggest market share of 58% in 2024.

- By product, the shiitake mushroom segment is expected to grow at the fastest CAGR of 6.52% over the forecast period.

- By nature, the conventional segment led the market in 2024.

- By nature, the organic segment is anticipated to show the fastest growth during the projected period.

- By form, the whole segment dominated the canned mushroom market in 2024.

- By form, the sliced segment is anticipated to grow at a faster rate during the studied period.

- By application, the household segment dominated the market in 2024 with the largest market share.

- By application, the restaurant segment is projected to grow at a notable CAGR of 6.18% during the forecast period.

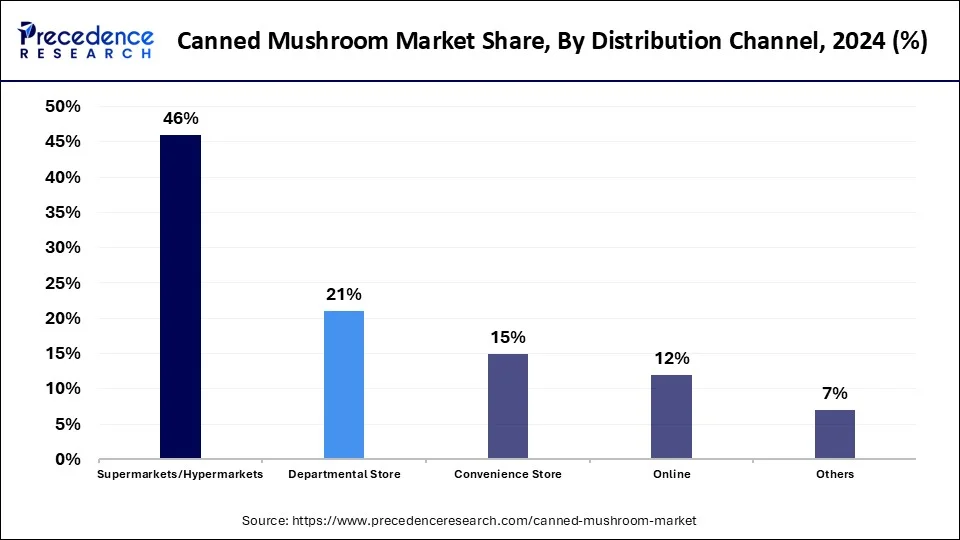

- By distribution channel, the supermarket/hypermarket segment accounted for the highest market share of 46% in 2024.

- By distribution channel, the online segment is expected to expand at a solid CAGR of 7.33% during the projected period.

What is a canned mushroom?

A mushroom is a fruiting body of a fungus that is fleshy and bears spores. It is heavy in proteins, low in calories and full of nutrients. Also works well as a healthy substitute for anemic patients and those who are concerned about their weight. There are many different varieties of canned mushrooms on the market, such as chanterelle, white button, Portobello, and Crimin mushrooms. The convenience of using canned mushrooms, which need less preparation time, has led to their increasing popularity.

How is AI impacting the food industry?

Improved productivity and safety are further benefits of using artificial intelligence in the food manufacturing process. The methods used for quality control are being revolutionized by automated AI-driven inspection systems. These technologies can enhance supply chain management and anticipate contamination hazards by utilizing predictive analytics. Artificial Intelligence machine vision systems are skilled in examining product quality, guaranteeing that only the best products make it to consumers. AI in food production can result in safer food items, a large decrease in waste, and an increase in industry profitability overall. Through using AI, the food business may progress toward a more prosperous and sustainable future.

Canned Mushroom Market Growth Factors

- The growing working population and busy lifestyle of consumers are expected to fuel market growth soon.

- These mushrooms increase satiety and reduce appetite, which further boosts the demand among consumers.

- A rising focus on product development and packaging through Product development can propel canned mushroom market growth shortly.

Market Outlook

- Industry Growth Overview:

The canned mushroom market is growing, driven by rising innovations in sustainable packaging, partnerships with health-focused brands, and improved demand from the foodservice sector. - Global Expansion:

The canned mushroom market is experiencing global expansion, as canned mushrooms are standard for their nutritional value, including vitamins, high protein, and minerals, while being low in fat, calories, and cholesterol. This perception drives demand as customers become more health-aware. Asia Pacific is dominated in the market due to increasing urbanization, suitability, and rising middle-class incomes. - Major investors:

Major investors in the canned mushroom market are usually large, recognized food processing and agricultural corporations, rather than venture capital organizations or individual investors. It includes Bonduelle Group, B&G Foods, Inc., Greenyard NV, Costa Group Holdings Ltd., and other

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 16.96 Billion |

| Market Size in 2025 | USD 10.2 Billion |

| Market Size in 2026 | USD 10.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.81% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Nature, Form, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Advancements in scanning technologies

Ongoing advancements in scanning technologies are making canned Mushrooms a more feasible option for consumers. Leading the market players utilize new technologies in canning to ensure good taste, flavor, and nutritional value in the Product. Additionally, Containers that are sustainable and foolproof are becoming popular as packaging items. This packaging can Prevent mushrooms from spoilage, which increases its shelf life.

- In September 2023, Zooz, an adult soft drink, launched with a GBP1.25 million investment. This week marks the debut of a brand-new, non-alcoholic health beverage based on mushrooms. As a trailblazer in the quickly expanding no- and low-alcohol sector, Zooz is expected to redefine and create a whole new subcategory. The opinions of bar owners and daring patrons on adult soft drinks.

Restraint

Health concerns and preference for fresh mushrooms

Increasing consumer preference for fresh and frozen mushrooms Can potentially limit the market growth. Companies often use sodium in tinned mushrooms to preserve them for a longer duration of time, which can cause health concerns among Consumers. However, this can lead consumers to seek fresh mushrooms over canned ones, hindering the consumer base for the sector.

Opportunity

Increasing convenience food demand

The need for easy and fast food items is on the rise across the globe due to hectic ways of living. Hence, the demand for this product is Meant to rise as a time-saving option for people. Tinned mushrooms are easy products that consumers prefer to utilize for making various dishes. Therefore, manufacturers can benefit from the convenience food craze. Furthermore, Canned mushrooms enable users to add flavors and nutrients to dishes without requiring much time for raw mushrooms.

Segment Insights

Product Insights

The button mushroom segment dominated the canned mushroom market in 2024. The dominance of the segment can be attributed to the widespread use of these mushrooms in the culinary world. They are also known for their smooth texture and mild flavor, which makes them a staple in numerous cuisines worldwide. Additionally, button mushrooms are low in salt and high in potassium, which helps the heart function steadily.

- In September 2024, the region of Padampur in Kalika municipality-2 began to grow mushrooms commercially. An air conditioning system has been installed in 12 tunnels so that button mushrooms (Agaricus bisporus) may be produced there. The Mayor of the Municipality, Binod Remgi, officially opened the farmland.

The shiitake mushroom segment is expected to grow at the fastest rate in the canned mushroom market over the forecast period. This is because Shiitake mushrooms are utilized in the production of pharmaceutical and healthcare products. Their application as an important al ingredient in the healthcare industry fuels the segment growth in the market. Also, people are becoming more aware of their health and fitness, which, in turn, leads them to consume nutritious food.

Nature Insights

The conventional segment led the canned mushroom market in 2024. the dominance of the segment can be linked to the rising demand for canned mushrooms in the conventional market coupled with the cost-effectiveness of conventional farming methods. Moreover, conventional canned mushrooms have a longer shelf life because of the preservatives used.

The organic segment is anticipated to show the fastest growth in the canned mushroom market during the projected period. The growth of the segment can be driven by the rising trend of plant-based food and growing concerns about environmental sustainability which encourage customers to purchase organic consumables. Furthermore, increasing consumer health awareness will propel the demand for organic mushrooms.

Form Insights

In 2024, the whole segment dominated the canned mushroom market by holding the largest market share. This is because of rising consumer inclination toward ready-to-use and convenience food products. Whole canned mushrooms provide convenience in various culinary applications, including pizzas and salads, soups, and stews for both professional chefs. And home cooks. This factor has a special relevance in today's fast-paced lifestyle, where consumers seek time-cutting options.

The sliced segment is anticipated to grow at the fastest rate in the canned mushroom market during the studied period. The growth of the segment can be linked to the increasing demand for easy-to-use food products and advantages offered by sliced mushrooms for consumers. Additionally, the reduced labor cost and preparation time associated with utilizing sliced mushrooms for various businesses further fuels the demand for this segment in the market.

Application Insights

The household segment dominated the canned mushroom market in 2024. The rising popularity of home meal preparation and cooking is the key driver of the household segment. Furthermore, the increasing of consumers in culinary exploration and health-conscious eating is helping fuel the demand for homemade dishes like Canned mushrooms.

The restaurant segment is projected to witness the fastest growth in the canned mushroom market during the forecast period. The extended shelf life of canned mushrooms and ease of storage propels the segment's growth. Moreover, then the cost-effectiveness of canned mushrooms is one of the important factors boosting their demand in the restaurant segment. Restaurants are constantly seeking ways to stimulate their food costs.

Distribution Channel Insights

The supermarket/hypermarket segment led the canned mushroom market in 2024. The dominance of the segment can be attributed to the ease of purchasing along with the bulk purchase facility offered by Supermarkets/Hypermarket to the consumers. Also, the extensive range of canned mushrooms offered by supermarkets and hypermarkets propels the growing demand for canned mushrooms.

The online segment is expected to show the fastest growth in the canned mushroom market during the projected period. Consumers can search for a wide range of canned mushroom products, read reviews, compare prices, and make purchases from their homes. Furthermore, personalized recommendations and targeted advertising offered by online channels have improved the shopping experience, which enables consumers to purchase canned mushrooms online.

Regional Insights

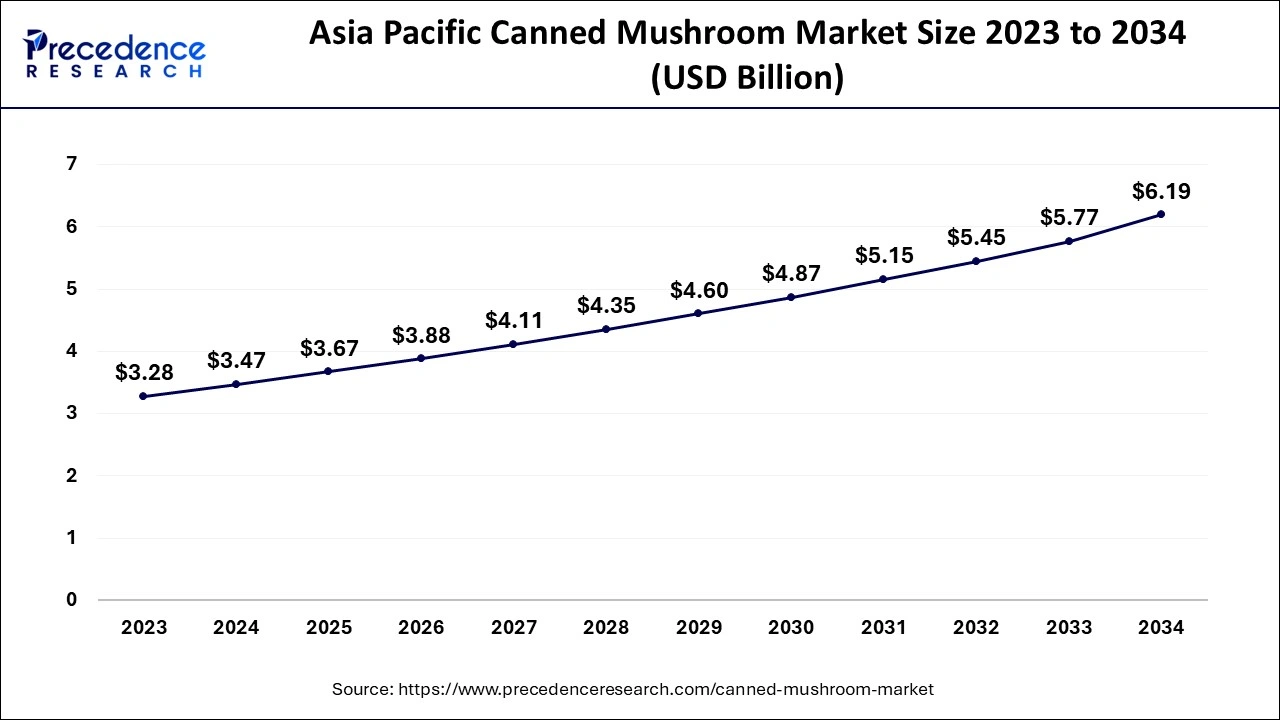

Asia Pacific Canned Mushroom Market Size and Growth 2025 to 2034

The Asia Pacific canned mushroom market size is exhibited at USD 3.67 billion in 2025 and is projected to be worth around USD 6.19 billion by 2034, growing at a CAGR of5.96% from 2025 to 2034.

Asia Pacific: Advanced farming techniques

Asia Pacific dominated the canned mushroom market in 2024. The dominance of the region can be attributed to the changing lifestyles and growing urbanization in the region which has led consumers to prefer convenient and ready-to-eat food products, such as canned mushrooms. Moreover, the rising middle class in nations like India and China fuels the demand for diverse and nutritious food options. Growing awareness of the health benefits of the consumption of mushrooms further contributes to this trend.

India: Large-scale cultivation

In India, comprehensive production capacity, high domestic consumption driven by increasing spending and busy lifestyles, and significant use in popular regional cuisines. The country benefits from progressive cultivation technology, including controlled-environment farming, which increases effectiveness and production. There is a rising customer awareness of the health advantages of mushrooms, like their high nutritional content and antioxidants

North America: Health and dietary trends

North America's canned mushroom market is expected to grow at the fastest rate during the forecast period. The growth of the segment can be linked to the convenience offered by this type of food in households and restaurants, where swift ingredient management is important. Furthermore, In the North American region, the United States shows robust growth credited to the increasing consumption of processed food products and the nutritional benefits offered by canned mushrooms.

U.S.: Consumer lifestyle and convenience

In the U.S., increasing customer demand for convenient and time-saving meal choices, the long shelf life and cost-effectiveness of canned mushrooms, and the ingredient's adaptability and health advantages. The growing popularity of plant-driven and meat-substitute diets further drives growth as mushrooms are seen as a nutritious and versatile substitute.

Europe: Demand for convenience

Europe is experiencing substantial growth in the market due to increasing urbanization and busy lifestyles are increasing demand for ready-to-eat, convenient products. Around 63% of employed Europeans prefer pre-packaged or pre-sliced ingredients, making canned mushrooms a popular choice for quick meal services. Increasing awareness of the health advantages of mushrooms, like their nutritional value and role as a source of antioxidants, is driving market growth.

UK: Innovation and Quality Improvement

In the UK, development in canning and packaging knowledge has improved the texture, taste, and nutritional value of canned mushrooms, helping to dispel previous biases against canned food. Novelties include BPA-free cans, reduced-sodium choices, and organic variants, which appeal to health-aware customers.

- In January 2024, Red Light Holland Corp., a business that grows, produces, and markets functional mushrooms, as well as mushroom home grow kits in North America and Europe, announced the opening of SR Wholesale North America, its Fresh Mushroom Sales Division. The purpose of this strategic decision is to increase Red Light Holland's market presence and product options by concentrating on selling fresh mushrooms that are obtained from its AEM Partners, which include the farms Holburne and F&R.

Value Chain Analysis – Canned Mushroom Market

Raw Material:

The raw materials for canned mushrooms are fresh mushrooms and a processing brine made of salt, water, and often citric acid.

- Key Players: B&G Foods and Giorgio Fresh Co.

Synthesis and Processing:

The synthesis and processing of canned mushrooms contribute a standard series of food preservation steps focused on microbial safety and quality retention. The white button mushroom is the type most usually used for profitable canning.

- Key Players: Okechamp SA and Bonduelle SA

Compound Formulation and Blending:

The compound formulation and blending for canned mushrooms mainly include preparing a brine solution containing salt (NaCl) and acidity regulators (citric acid) to ensure preservation and desirable color.

- Key Players: Monterey Mushrooms Inc., and Greenyard NV

Canned Mushroom Market Companies

- Bonduelle Group

- Greenyard NV

- B&G Foods Inc.

- The Mushroom Company

- Monterey Mushroom Inc.

- Dhruv Agro

- Prochamp B.V.

- Monaghan Mushroom Ltd.

- Shanghai Finc Foods Co. Ltd.

- Others

Recent Developments

- In January 2024, Giorgio Foods expanded its product line with the announcement of a new brand of stuffed mushrooms. The firm wants to provide tasty and quick meal alternatives in response to the increasing demand. To satisfy a wide range of palates, the newest product line will include a variety of filling flavors. Giorgio's foray into stuffing mushrooms is in line with the prevailing inclinations toward prepared and high-end cuisine options.

- In February 2024, from February 19 to 23, Procham, a canned mushroom expert located in the Netherlands, displayed its most recent offerings at the Gulfood Trade Show in Dubai.

Segments Covered in the Report

By Product

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Morel Mushroom

- Others

By Nature

- Organic

- Conventional

By Form

- Whole

- Sliced

- Chopped

- Others

By Application

- Household

- Restaurants

By Distribution Channel

- Supermarkets/Hypermarkets

- Departmental Store

- Convenience Store

- Online

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting