U.S. Canned Tuna Market Size and Forecast 2025 to 2034

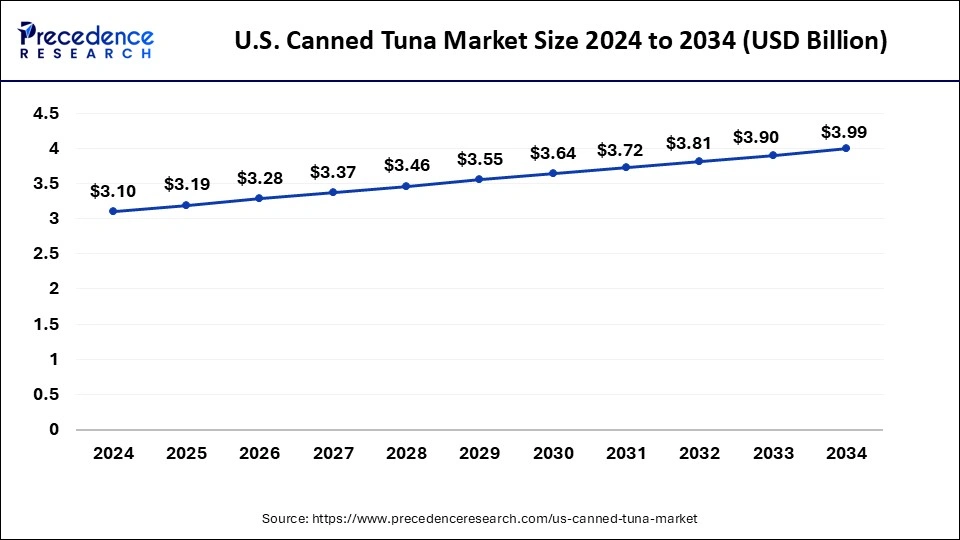

The U.S. canned tuna market size was estimated at USD 3.10 billion in 2024 and is predicted to increase from USD 3.19 billion in 2025 to approximately USD 3.99 billion by 2034, expanding at a CAGR of 2.50% from 2025 to 2034.

U.S. Canned Tuna Market Key Takeaways

- By product type, the flavored segment held the dominating share of the market in 2024.

- By end-use, the B2C segment dominated the U.S. canned tuna market in 2024.

- By sales channel, the direct sales segment held the dominating share of the market in 2024.

- By tuna species, the skip jack segment held the largest share of the U.S. canned tuna market in 2024.

Market Overview

Canned tuna has emerged as a staple pantry item during the pandemic, owing to its nutritional benefits and versatility. However, its popularity has led to concerns regarding the sustainability of tuna stocks. Data indicates that a significant portion of tuna species are being fished at biologically unsustainable levels, posing a threat to long-term viability.

The United States heavily relies on tuna resources for various aspects including food security, economic development, and cultural significance. Despite the high market demand, there remains an overcapacity of tuna fishing fleets, as highlighted by the food and Agriculture Organization of the United Nations.

In the United States, canned tuna ranks third in popularity among seafood choices, trailing behind shrimp and salmon. However, it's important to note that the term "tuna" encompasses a wide range of species, with only a subset considered true tuna. Among commercially sold varieties, albacore, skipjack, and yellowfin are the primary options. Albacore commands a premium due to its pale tint, firm texture, and light flavor, with consumers typically paying more for it compared to skipjack.

Skipjack, being smaller, faster-growing, and more abundant, presents a more sustainable option. Understanding the distinctions between these species is crucial for both sustainability and consumer health considerations.

U.S. Canned Tuna Market Growth Factors

- Canned tuna's nutritional profile, boasting lean protein, vitamin B12, vitamin D, and omega-3 fatty acids, positions it as a compelling choice for health-conscious consumers. With 6.5 grams of protein per ounce, comparable to beef and surpassing pork, it drives the U.S. canned tuna market's growth.

- Canned tuna's abundance as a protein source, coupled with heart-healthy unsaturated fatty acids and omega-3 content, underscores its value in reducing cardiovascular risks, fueling further market expansion.

- The convenience and affordability of canned tuna make it an indispensable pantry staple, appealing to a wide consumer base. Its shelf-stable nature and cost-effectiveness compared to other protein sources contribute to market growth.

- Additionally, canned tuna's importance for pregnant women, providing essential long-chain omega-3 fatty acids crucial for infant brain development, further bolsters the U.S. canned tuna market's growth.

- The prevalence of skipjack tuna, marketed as "chunk light" or "light" tuna, dominates the North American canned tuna market. Despite varying income levels, consumers appreciate the accessibility and affordability of canned tuna, driving sustained market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.19 Billion |

| Market Size by 2034 | USD 3.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-use, Sales Channel, Tuna Species, and Type |

Market Dynamics

Drivers

Economic benefits offered by canned tuna

Canned tuna offers not only metabolic benefits but also significant economic advantages as a protein source. The cost per gram of protein from canned tuna rivals that of beef and is notably lower than pork. Substituting canned tuna for pork at recommended consumption levels could save roughly $100 annually for an average adult, representing 4.5% of at-home food expenses. These savings become even more substantial for larger households and lower-income brackets.

For instance, replacing fresh salmon with canned tuna for cognitive benefits could save a family of four approximately 7.6% of its annual food budget, while substituting pork with canned tuna based on protein content could result in savings of about 5.8% per year. Such economic benefits offered by canned tuna act as a major driving factor for the U.S. canned tuna market.

Rising demand for convenient and nutritious edible options

Canned fish, notably canned tuna, emerges as a convenient and nutritious meal solution, offering the catch of the day packed with essential nutrients in a compact can. With easy-open lids and hermetic metal packaging preserving natural goodness, canned tuna epitomizes simplicity and healthiness. The increasing demand for canned tuna, particularly in the United States, underscores consumers' preference for a convenient yet nourishing seafood choice, driving the growth of the U.S. canned tuna market.

Restraint

Concerns associated with seafood consumption

Amidst the allure of seafood, tuna emerges as a complex player in the narrative of dietary health, particularly concerning mercury exposure in the United States. Despite the widespread presence of mercury emissions from various sources, such as coal-burning power plants, tuna shoulders a disproportionate burden, contributing nearly 40% of the nation's dietary mercury intake. This reality raises significant concerns, especially for vulnerable demographics like pregnant women and young children, who are encouraged to incorporate omega 3 rich seafood into their diets for optimal health.

The nuanced nature of the issue becomes apparent when considering different tuna species; for instance, albacore can contain up to three times more mercury than skipjack, often marketed as "light" tuna. Such disparities underscore the importance of informed consumer choices to navigate the potential health risks associated with mercury exposure in seafood consumption. Thereby, concerns associated with the consumption of seafood products are observed to create a restraint for U.S. canned tuna market.

Opportunities

Reduction in raw material prices

Reducing raw material prices in the United States are observed to spur increased demand for canned tuna across the nation, both large and small, resulting in moderate import growth in top markets. In the United States, the positive trend towards higher value processed tuna persists also present opportunities for the U.S. canned tuna market.

Emergence of technology in seafood trade

- NOAA Fisheries launched online tool to simplify seafood trade, boosting opportunities for the U.S. canned tuna market.

NOAA Fisheries has introduced an online tool to streamline trade monitoring requirements for seafood traders. The Seafood Import and Export Tool simplifies the process of identifying relevant NOAA trade monitoring programs for specific products, facilitating smoother transactions. This innovation and emergence of advanced technological solutions offer lucrative opportunities for the growth of U.S. canned tuna market by enhancing efficiency and compliance in the seafood trade.

Product Type Insights

The flavored segment held the dominating share of the U.S. canned tuna market in 2024, with offerings such as spicy thai chili, lemon pepper, sundried tomato & basil, and more. These flavor-infused options cater to consumer preferences for convenient meal solutions, easily complementing crackers, salads, sandwiches, or wraps in mere minutes. Spicy thai chili, in particular, elevates the tuna experience with its bold and spicy flavor profile, accentuated by a hint of sweetness. Featuring a tantalizing blend of chili, onion, and tomato combined with high-quality tuna, it appeals to aficionados of zesty cuisine. Moreover, Spicy Thai Chili boasts nutritional merits, being low in saturated fat, devoid of trans fat, and an exemplary source of protein.

End Use Insights

The B2C segment dominated the U.S. canned tuna market in 2024. B2C companies invest in marketing and branding efforts to promote their canned tuna products and differentiate themselves in the market. Strong branding, advertising campaigns, and product innovations can help B2C brands capture consumer attention and loyalty. Canned tuna is a nutritious food choice, rich in protein, omega-3 fatty acids, vitamins, and minerals. Health-conscious consumers are drawn to canned tuna for its nutritional benefits, including support for heart health, brain function, and overall well-being.

Sales Channel Insights

The direct segment held the dominating share of the U.S. canned tuna market in 2024. Direct sales channels, such as online platforms and subscription services, offer unparalleled convenience and accessibility to consumers. Individuals can easily purchase canned tuna products from the comfort of their homes, eliminating the need to visit physical stores. Direct sales platforms typically offer a wide selection of canned tuna products, including various flavors, sizes, and packaging options. This diverse product range caters to different consumer preferences and dietary needs, allowing individuals to find products that suit their tastes.

Tuna Insights

The skipjack segment led the U.S. canned tuna market, representing the most prevalent species utilized in canned tuna production. Widely recognized as "canned light" or "chunk light" tuna, skipjack is also available in fresh and frozen forms. Renowned for its distinct flavor profile, good-quality skipjack meat boasts a deep red hue when raw, while smaller specimens exhibit a lighter red coloration. Once cooked, skipjack takes on a light gray appearance. Occasionally, canned skipjack includes a blend with yellowfin tuna if species separation isn't carried out during harvesting.

Skipjack chunks are rich in various B-complex vitamins such as niacin and pyridoxine (B-6), alongside being abundant sources of vitamin E, vitamin B12, thiamin, and riboflavin. Moreover, skipjack tuna serves as a natural reservoir for essential minerals, including iodine, selenium, calcium, zinc, potassium, phosphorus, and magnesium. Notably, iodine plays a crucial role in human nutrition, particularly in thyroid hormone synthesis.

With a Nutrivore Score of 645, skipjack tuna emerges as a highly nutrient-dense food, offering a concentrated array of essential nutrients such as EPA+DHA, B vitamins, taurine, selenium, protein, phosphorus, and vitamin D, among others. This nutritional profile underscores skipjack tuna's value as a premium dietary component.

Recent Developments

- In January 2023, FoodTech Start-up Vgarden recreated the famous canned tuna with plant protein.

- In July 2023, Wild Planet Foods launched five new sustainably caught seafood items in Whole Foods Market stores nationwide.

- In February 2023, Conservation International (CI) and several tuna industry groups formally launched a new collaboration focused on strengthening the environmental, social, and economic performance of the domestic longline tuna fisheries in Fiji and New Caledonia.

- In May 2023, TNC announced expansion of partnership to drive conservation and Pacific Island food security.

U.S. Canned Tuna Market Companies

- AMERICAN TUNA

- Conservation International

- FoodTech

- Walmart

- Wild Planet Foods

- Wild Selections

- SAFE CATCH

- NATURAL SEA

- The Tuna Store

- Crown Prince

- Bumble Bee Seafoods

- Wild Planet

- StartKist

- TNC

Segments Covered in the Report

By Product Type

- Flavored

- Unflavoured

By End-use

- B2C

- B2B

By Sales Channel

- Direct

- Indirect

By Tuna Species

- Albacore

- Skip Jack

- Yellowfin

- Others

By Type

- Ready-To-Eat

- Ready-To-Cook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting