What is the Cannabis Pharmaceuticals Market Size?

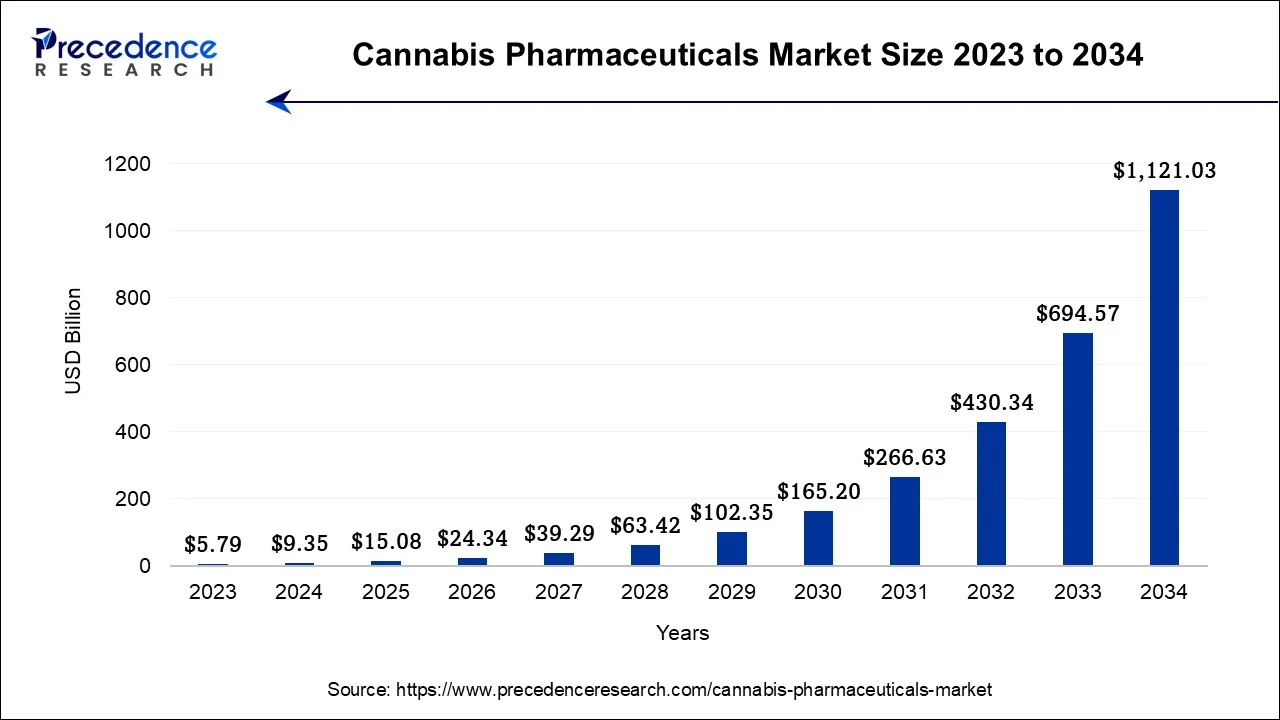

The global cannabis pharmaceuticals market size accounted for USD 15.08 billion in 2025 and is predicted to increase from USD 24.34 billion in 2026 to approximately USD 1,439.34 billion by 2035, expanding at a CAGR of 57.75% between 2026 to 2035.

Cannabis Pharmaceuticals Market Key Takeaways

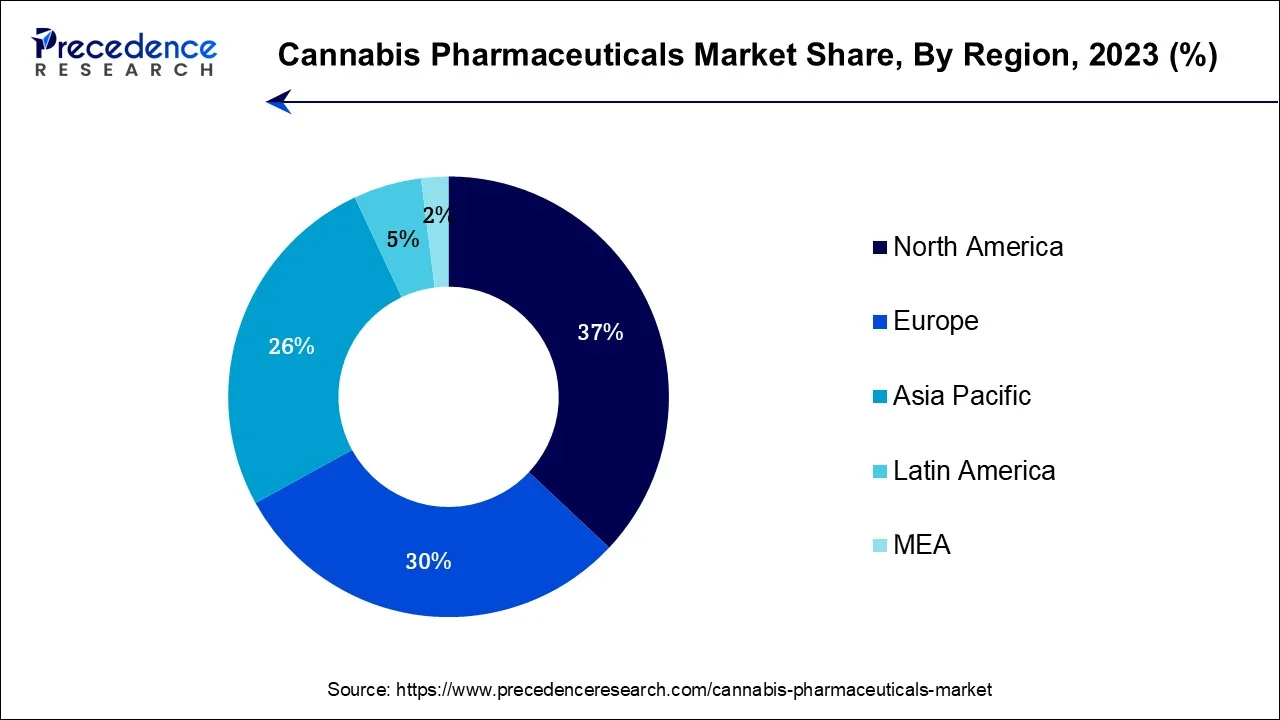

- North America contributed more than 37% of revenue share in 2025.

- Asia-Pacific is estimated to observe the fastest expansion during the forecast period.

- By Product, the sativex segment has held the largest revenue share in 2025.

- By Product, the epidiolex segment is anticipated to grow at the fastest CAGR during the projected period.

- By Distribution Channel, the hospitals segment led the global market in 2025.

- By Distribution Channel, the retail sales segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The cannabis pharmaceutical market is a sector of the pharmaceutical industry focused on the development, manufacture and distribution of medicinal products derived from the cannabis plant. Cannabis consists various active compounds such as cannabinoids that received significant attention due to their therapeutic potential in treating various medical conditions.

The market involves research institutes and pharmaceutical companies working to harness the medicinal properties of cannabinoids, such as cannabidiol (CBD) and tetrahydrocannabinol (THC), to create pharmaceutical drugs. Specific conditions such as epilepsy, multiple sclerosis, and chronic pain are the targets of these drugs. With an increasing number of countries legalizing medical cannabis and recognizing its therapeutic value cannabis pharmaceuticals market expected substantial growth during the forecast period.

In addition, the market is also seeing innovations in drug delivery methods, such as oral sprays, capsules, and transdermal patches, to optimize patient experience and outcomes. The growing landscape of cannabis pharmaceuticals holds promise for patients seeking alternative treatments and creates opportunities for companies to shape the future of cannabis-based medical therapies.

What is the Role of AI in the Cannabis Pharmaceuticals Market?

AI plays a prominent role in the cannabis pharmaceuticals market. The integration of AI in the cannabis pharma centers helps in accelerating drug discovery, enabling personalized medicine, optimizing cultivation, and enhancing the manufacturing processes. Moreover, numerous AI developers have started designing advanced platforms for testing the efficacy of medicines.

- In September 2025, Lilly launched an AI-based platform. This AI-enabled platform is designed to accelerate drug discovery in the pharma sector.

(Source: https://www.reuters.com/)

Cannabis Pharmaceuticals Market Growth Factors

The cannabis pharmaceutical market is expected to grow at a high rate during the forecast period, driven by various factors such as regulatory changes, increasing adoption, investments and changes consumer preferences, which will make it a dynamic sector in the pharmaceutical industry. The growing acceptance of medical cannabis as a sustainable treatment option for many medical conditions is one of the key factors driving demand in the medicinal cannabis market.

Clinical research and patient testimonials have demonstrated the effectiveness of cannabinoids like CBD and THC in controlling epilepsy, chronic pain, anxiety, and others. According to the report, globally around 15-40% of people with inflammatory bowel disease (IBD) rely on cannabinoids and cannabis to decrease the necessity for other medications, as well as increase appetite and relieve pain. Thus, this helps in surging number of countries and states are legalizing medical cannabis, forming a larger potential patient pool.

Moreover, changing regulatory landscapes and decreasing stigmas surrounding cannabis are encouraging pharmaceutical companies to invest heavily in research and development, leading to the creation of new cannabis-based pharmaceuticals. The development of standardized, pharmaceutical-grade products with precise dosing and delivery methods is a significant driver of growth within the industry. For instance, in August 2023, Department of Health and Human Services announced that it asked drug enforcement agency (DEA) to review of its classification under the Controlled Substances Act and consider easing restrictions on cannabis.

The DEA will may move cannabis to a Schedule III drug, alongside anabolic steroids, ketamine, and testosterone as a substance that has moderate to low potential for psychological or physical dependence. Investor interest and capital infusion are also bolstering the cannabis pharmaceuticals market. As the sector gains legitimacy, venture capital and pharmaceutical giants are entering the market, bringing substantial resources and expertise. This influx of investment is accelerating research, development, and commercialization efforts. Thus, these strategies will further drive demand across the market.

Cannabis Pharmaceuticals Market Outlook

- Market Growth Overview: The market is expected to grow significantly from 2025 to 2034, driven by the rapid investment by market players for opening new production centers, as well as technological advancements in the biopharmaceuticals industry on a global scale.

- Global Expansion: The market is expanding worldwide due to the rapid expansion of the pharmaceutical industry. Several cannabis medicine companies are strategically expanding into high-growth regions, such as the Asia-Pacific, Latin America, Eastern Europe, and the Middle East and Africa (MEA).

- Major Investors: Public companies and private manufacturers are actively investing in this industry to cater to the needs of the end-users.

- Startup Ecosystem: Numerous startups are engaged in developing high-quality cannabis products. Prominent startups dealing in cannabis pharmaceuticals include Avicanna, Boaz Pharmaceuticals, Demecan, and others.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 57.75% |

| Market Size in 2025 | USD 15.08Billion |

| Market Size 2026 | USD 24.34 Billion |

| Market Size by 2035 | USD 1,439.34Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing legalization and decriminalization of cannabis

As more countries and states legalize medical cannabis, a broader and more accessible patient base emerges. Patients who were previously unable to access cannabis-based therapies legally now have the opportunity to explore these treatments under the guidance of healthcare professionals. This expanded patient pool drives up demand for pharmaceutical-grade cannabis products designed to address specific medical conditions, from chronic pain and epilepsy to nausea associated with chemotherapy. Furthermore, the relaxation of legal restrictions fosters an environment conducive to robust research and development that further drive demand for the market.

For instance, in August 2023, Germany's government approved a proposal to ease its rules on cannabis. Also, Switzerland announced that it is allowing some people to buy recreational cannabis from pharmacies and the Czech government expected to propose a similar proposal to the one Germany has just approved. Moreover, pharmaceutical companies are gradually investing in cannabis-related research to create innovative, scientifically validated medications. This investment includes the development of precise dosing methods, standardized formulations, and novel delivery systems, enhancing the overall quality and safety of cannabis pharmaceuticals.

In addition, more healthcare providers are open to integrating cannabis-based treatments into their practice which further boosts demand for the cannabis pharmaceutical. Pharmaceutical companies and researchers are working closely with medical professionals to ensure that cannabis pharmaceuticals are prescribed and administered effectively and responsibly. Thus, the increasing legalization and decriminalization of cannabis are driving demand for the cannabis pharmaceuticals market by expanding the patient base, encouraging research and development, and fostering greater acceptance within the medical community.

Restraints

Quality control and standardization

The legalization of cannabis for medical purposes has opened up new opportunities, ensuring consistent quality and safety poses a significant challenge. Regulatory bodies are imposing stringent requirements on cannabis products, demanding rigorous testing and standardization protocols to guarantee the absence of contaminants and consistent dosages. This level of oversight can be expensive and time-consuming for companies operating in the cannabis pharmaceuticals sector, potentially driving up production costs.

Moreover, standardization may limit product variety and innovation. Cannabis is a complex plant with numerous chemical compounds, each potentially offering different therapeutic benefits. Strict standardization could stifle the exploration of novel cannabinoid combinations and formulations.

In addition, stringent quality control measures may deter potential investors and manufacturers, particularly smaller players, due to the high cost of compliance and fear of regulatory uncertainties. Thus, while quality control and standardization are essential for ensuring patient safety and product efficacy in the cannabis pharmaceuticals market, excessive regulatory burden and uniformity requirements may hamper market growth by increasing costs and limiting product diversity and innovation.

Opportunities

Investment in research and development

Cannabis pharmaceutical sector is distinctively placed to benefit from substantial research and development (R&D) investments due to the complex nature of the cannabis plant and its probable to transform medical treatments. R&D enables in-depth examination of the various cannabinoids, terpenes, and other compounds found in cannabis. This scientific understanding is expected to lead to the growth of extremely effective and targeted pharmaceuticals.

Furthermore, demanding clinical trials funded by R&D efforts offer empirical evidence of the efficacy and safety of cannabis pharmaceuticals. This data is vital for gaining regulatory approvals, which can lead to broader market access. Moreover, the investments may be directed towards keeping stringent quality control processes, guaranteeing consistent product quality, and compliance with developing regulatory standards, which is crucial for consumer trust. Thus, companies that invest significantly in R&D may establish themselves as industry leaders, gaining a competitive edge in a rapidly evolving market.

Impact of COVID-19

The COVID-19 pandemic has had a mixed impact on the Cannabis Pharmaceuticals Market. Initially, there was a surge in demand for cannabis products, including pharmaceuticals, as people sought relief from anxiety and stress during lockdowns. However, many cannabis pharmaceutical companies faced disruptions in their supply chains due to lockdowns and restrictions. This impacted the production and distribution of cannabis-based medications. The pandemic delayed regulatory processes, including clinical trials and approvals, making it harder for companies to bring new cannabis pharmaceuticals to market.

Furthermore, the pandemic accelerated the adoption of telemedicine, which provided a new channel for patients to access medical cannabis prescriptions and consultations. Moreover, some regions relaxed regulations on cannabis access during the pandemic, potentially expanding the market. Thus, COVID-19 initially boosted demand for cannabis pharmaceuticals but introduced challenges related to supply chain disruptions, regulatory delays, economic uncertainty, and shifting regulations.

Segment Insights

Product Insights

According to the product, the sativex product has held highest revenue share in 2025. Sativex is an oromucosal spray that comprises a balanced grouping of THC and CBD. It is prescribed in several regions for managing spasticity in multiple sclerosis (MS) and is under analysis for other conditions, including cancer pain and neuropathic pain. It offers a consistent and controlled delivery system, enabling patients to titrate their dosage.

The epidiolex product is anticipated to expand at a significantly CAGR during the projected period. Epidiolex is an FDA-approved pharmaceutical formulation of cannabidiol (CBD) used mainly to cure rare forms of epilepsy, such as lennox-gastaut syndrome and dravet syndrome. It has extended recognition for its efficiency in dropping the severity and frequency of epileptic seizures in patients who do not respond well to other treatments. It is an important breakthrough in the medical cannabis field, indicating the potential for cannabinoids in treating specific neurological conditions.

Distribution Channel Insights

Based on the distribution channel, the hospitals segment held the largest market share in 2025. Hospitals assist as a significant distribution channel for cannabis pharmaceuticals, particularly for patients with critical medical conditions. Healthcare professionals in hospitals may prescribe cannabis-based medications like Epidiolex or Marinol to manage specific ailments such as epilepsy or chemotherapy-induced nausea. These pharmaceuticals are typically dispensed and administered within the hospital setting under strict medical supervision.

On the other hand, the retail sales is projected to grow at the fastest rate over the projected period. Some regions with legalized medical cannabis allow the sale of cannabis pharmaceuticals through retail dispensaries. These dispensaries are often regulated by state or local authorities to ensure product quality, safety, and proper labeling. Patients can visit these retail outlets with a prescription to purchase cannabis-based medications like Sativex or Cesamet.

Regional Insights

What is the U.S. Cannabis Pharmaceuticals Market Size?

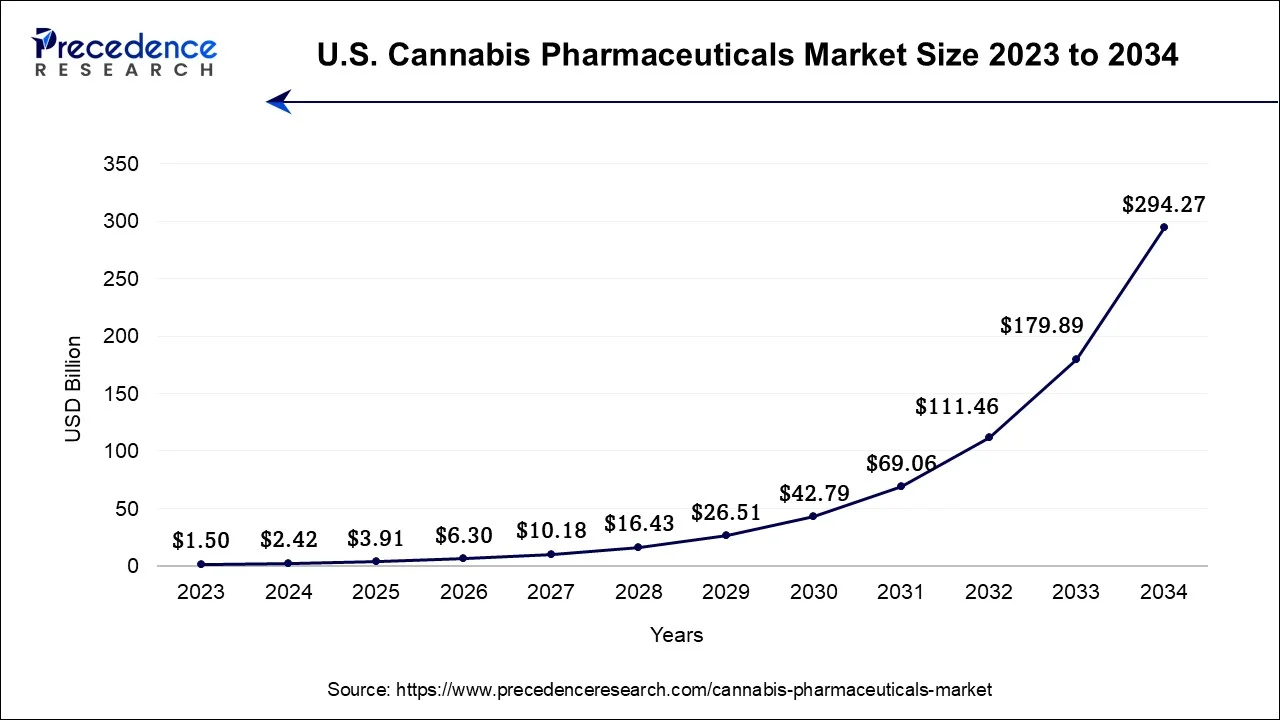

The U.S. cannabis pharmaceuticals market size is valued at USD 3.91 billion in 2025 and is expected to be worth around USD 378.02 billion by 2035, growing at a CAGR of 57.96% from 2026 to 2035.

Why Did North America Hold the Largest Share of the Cannabis Pharmaceuticals Market?

North America held the largest revenue share in cannabis pharmaceuticals in 2023. This is due to the increasing acceptance of medical cannabis. Legalization for medical use in various U.S. states and canadian provinces has spurred research and development. Epidiolex, Marinol, Sativex, and Cesamet are notable products. The region's robust healthcare infrastructure, rising patient awareness, and evolving regulatory frameworks contribute to market expansion.

U.S. Cannabis Pharmaceuticals Market Trends

The U.S. market is driven by rapidly rising state-level legalization, remarkable investments in clinical research, and even a strong pivot towards non-psychoactive, FDA-accepted, or scientifically thus, backed cannabinoid therapies. As of 2023, 38 states have legalized medical cannabis. This eventually widespread, localized legalization permits for a massive, legal, and regulated patient base, fueling the need for legitimate medical products.

What Makes Asia Pacific the Fastest-Growing Region in the Cannabis Pharmaceuticals Market?

Asia-Pacific is estimated to observe the fastest expansion in the cannabis pharmaceuticals market in 2023. This is because countries such as Australia, Thailand, and South Korea have legalized or initiated medical cannabis programs. The market is characterized by increasing patient demand, regulatory developments, and research initiatives. Epidiolex, Marinol, and Sativex are some of the products gaining attention. However, challenges include varying degrees of acceptance, regulatory hurdles, and the need for further clinical research to unlock the full medical potential of cannabis-derived medicines.

China Cannabis Pharmaceuticals Market Trends

China's market is mainly driven by rising acceptance of medical cannabis, supportive regulatory developments, and growing research investments. As awareness of therapeutic benefits grows, the need for cannabinoid-based treatments is expanding. Government initiatives targeted at modernizing drug regulations and also easing restrictions on cannabis research, thus facilitating market development.

How is the Opportunistic Rise of Europe in the Cannabis Pharmaceuticals Market?

The European cannabis pharmaceuticals market is anticipated to grow at a high rate during the forecast period. This is due to the several European countries have adopted medical cannabis programs, facilitating the development and distribution of pharmaceutical products such as Epidiolex, Sativex, and Marinol. The region's mature healthcare infrastructure, increasing patient awareness, and evolving regulatory frameworks contribute to market expansion.

Germany Cannabis Pharmaceuticals Market Trends

Germany demands high-quality, EU-GMP (European Union Good Manufacturing Practice) compliant products, provoking premium suppliers, along with strengthening the reputation of the market. There is a high, growing need for CBD-infused products, which include oils, capsules, and topicals, together with high-THC flower and extract formulations.

Why is Latin America Considered a Notably Growing Region in the Market?

Latin America is expected to expand with a notable CAGR during the forecast period. The increasing sales of CesaMet and Sativex in numerous nations, including Brazil, Argentina, and Venezuela, are boosting the market expansion. Moreover, the increasing preference of doctors to prescribe cannabis medications for treating epilepsy and other brain disorders is expected to boost the growth of the cannabis pharmaceuticals market in this region.

Brazil Cannabis Pharmaceuticals Market Trends

Brazil has unique geographical conditions along with a favorable climate for cannabis cultivation, offering an opportunity for low-cost outdoor production. Various non-profit associations have accepted legal, judicial authorization to cultivate and distribute products, which has accelerated user awareness and acceptance.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) offers significant opportunities for the cannabis pharmaceuticals market. These opportunities arise from the surging demand for Epidiolex across various countries, such as Saudi Arabia, the UAE, and South Africa. Moreover, the availability of cannabis-based medicines on e-commerce platforms is expected to propel the growth of the market in this region.

South Africa Cannabis Pharmaceuticals Market Trends

South Africa is a prominent, emerging centre for the cannabis pharmaceuticals market because of its rich biodiversity, allowing the cultivation of unique, indigenous landrace genetics. The country is thus actively transitioning towards a regulated, legal market for medicinal and industrial cannabis, opening opportunities for international collaborations and investment.

Value Chain Analysis

- Raw Materials Sourcing

Raw materials used in the production of cannabis pharmaceuticals comprise terpenes, cannabidiol, olive oil, and others.

Key Companies: Canopy Growth, Tilray, and Aurora Cannabis. - Research & Development

Cannabis pharmaceutical R&D involves several processes. The process starts with understanding the endocannabinoid system, identifying promising cannabinoids, and developing either plant-derived or synthesized single-molecule drugs according to regulatory compliance.

Key Companies: Insys Therapeutics, Inc., Corbus Pharmaceuticals, Teva Pharmaceutical, and Johnson & Johnson. - Distribution Channel

Cannabis pharmaceuticals are distributed through a definite supply channel that connects manufacturers to healthcare providers and patients, such as online pharmacies, hospitals, and retail pharmacies/stores.

Key Companies: Alibaba, Netmeds, and Amazon Pharmacy.

Cannabis Pharmaceuticals Market Companies

- Johnson & Johnson: It functions in this sector via strategic, indirect involvement aimed on research, mentorship, and allowing biotechnology startups within the cannabis space.

- Avicanna, Solvay Pharmaceuticals: Avicanna is a commercial-stage, vertically integrated biopharmaceutical firm aimed on the research, development, along with commercialization of plant-based cannabinoid-based products.

- Cannabics Pharmaceuticals: Cannabics Pharmaceuticals is a U.S.-driven clinical-stage biopharmaceutical firm focusing on developing cannabinoid-driven therapies for cancer and personalized medicine. Its core providings in the cannabis pharmaceuticals market include utilizing High Throughput Screening (HTS) technology along with AI to create tailored, evidence-driven treatments for cancer patients, with a specific aim on palliative care and tumor reduction.

Other Major Key Players

- GW Pharmaceuticals, AbbVie Inc.

- Valeant Pharmaceuticals

- Insys Therapeutics, Inc.

- Corbus Pharmaceuticals

- Teva Pharmaceutical

- Portola Pharmaceuticals

- Kao Corporation

- Ogeda S.A.

- Pfizer

- Bristol-Myers Squibb

Recent Developments

- In December 2025, Aurora Cannabis Inc. launched Daily Special. Daily Special is a new medical cannabis brand designed for the consumers of Germany.(Source: https://www.prnewswire.com/)

- In November 2025, Boheco partnered with Soulgoal Artisa. This partnership is aimed at opening a cannabis-based wellness clinic in Bangalore, India.

(Source: https://www.pharmabiz.com/) - In May 2025, Medipharm launched a new range of cannabis inhalers in the EU and UK. These inhalers are designed for asthma patients in these regions.(Source: https://www.tipranks.com/)

- January 2023: Celadon Pharmaceuticals Plc announced that UK Medicines and Healthcare products Regulatory Agency (MRHA) for the Good Manufacturing Practiced (GMP) has registered its cannabis active pharmaceutical ingredient in Midlands's facility, UK.

- February 2023: Aurora Cannabis Inc. partnered with MedReleaf Australia to launch a new medical cannabis brand for patients in the Australia, CraftPlant. It includes 3 new products available Greendale, Navana and HiVolt for doctors to prescribe. All 3 are produced from cultivars and are THC-dominant with high percentages of terpenes.

- June 2023: Avicanna Inc., a Cannabinoid-based pharmaceutical company partnered with the Canadian consortium for the Investigation of Cannabinoids to create an education course available to the medical community in Canada.

- August 2023:Avicanna Inc acquired Medical Cannabis by Shopper's Business from Shoppers Drug Mart and pleased to announce the launch of an all-new medical cannabis care platform, MyMedi.ca.

- September 2023: SOMAÍ Pharmaceuticals received authorization to manufacture, import, and export medicinal cannabis products to numerous global markets from the Portuguese Health Authority INFRAMED for its facility located in Lisbon, Portugal.

Segments Covered in the Report

By Product

- Epidiolex

- Marinol

- Cesamet

- Sativex

By Distribution Channel

- Hospitals

- Online pharmacies

- Retail

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting