What is the Colorado Legal Cannabis Market Size?

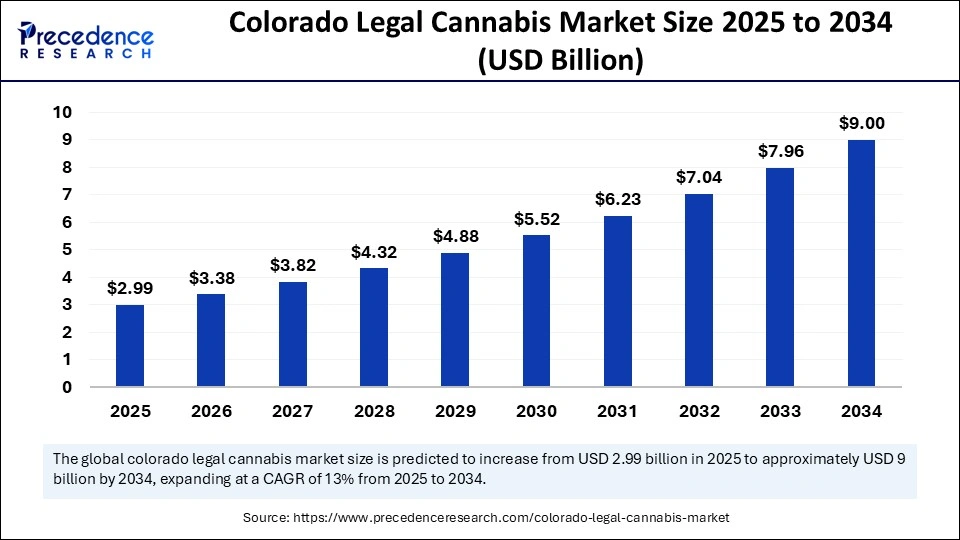

The global colorado legal cannabis market size is valued at USD 2.99 billion in 2025 and is predicted to increase from USD 3.38 billion in 2026 to approximately USD 9.00 billion by 2034, expanding at a CAGR of 13.00% from 2025 to 2034. The growth of the market is driven by increased acceptance of cannabis in the medical field.

Colorado Legal Cannabis Market Key Takeaways

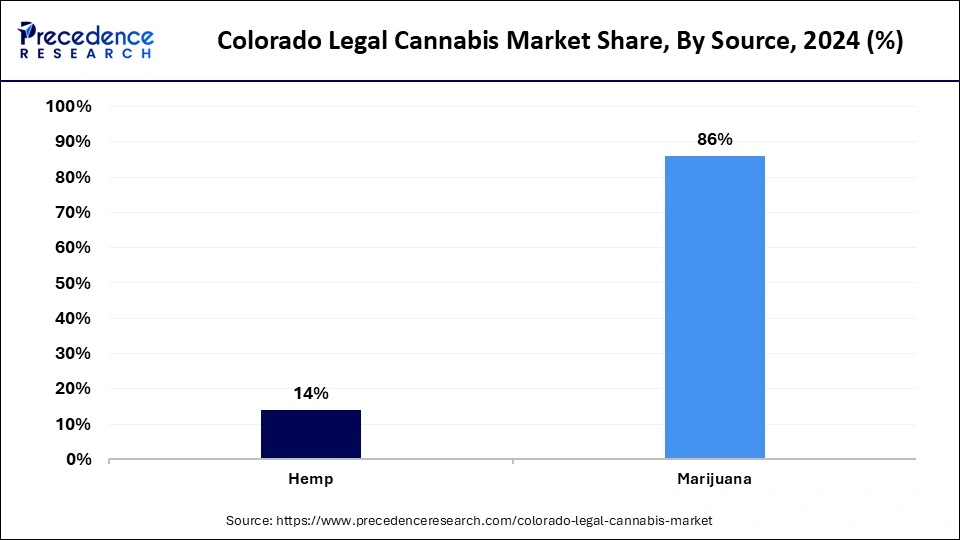

- By source, the marijuana segment held the largest market share of 86% in 2024.

- By derivatives, the CBD segment accounted for the major market share of 66% in 2024.

- By cultivation, the indoor cultivation segment contributed more than 57% of market share in 2024.

- By cultivation, the greenhouse cultivation segment is expected to expand at the fastest rate in the coming years.

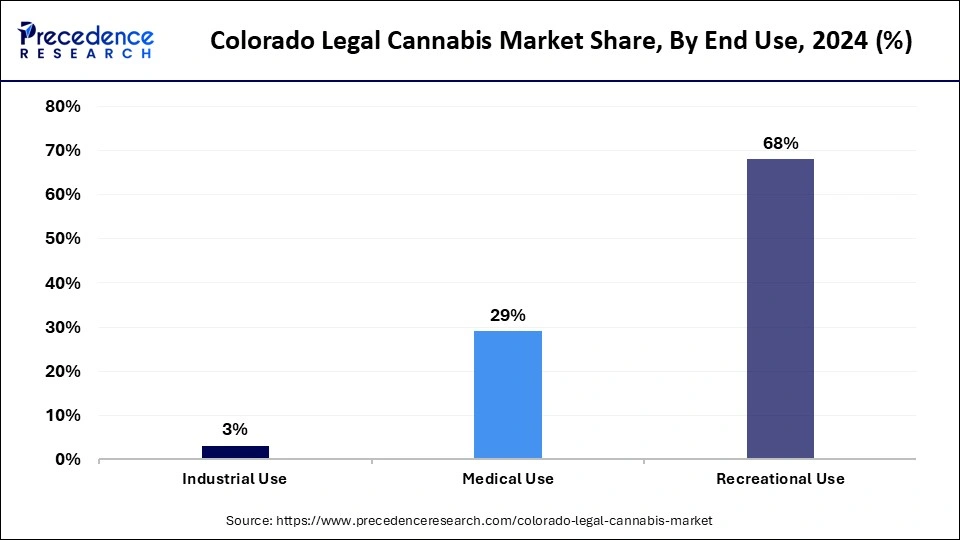

- By end use, the recreational use segment generated the biggest market share of 68% in 2024.

Artificial Intelligence: The Next Growth Catalyst in Colorado Legal Cannabis

Artificial Intelligence (AI) can be beneficial in cannabis cultivation. Cannabis farms often cover large acres that need regular surveillance to ensure the security of the farm. AI-driven tools offer real-time monitoring through different video feeds. The combination of AI and machine learning (ML) monitoring systems sends an alert signal by identifying the security breach in real-time. Many cannabis growers are using AI and Machine Leaning algorithms to protect their crops. AI technology helps in improving the testing methods for cannabis. The contamination can be identified quickly through AI tools, helping farmers ensure that it is removed. This can help improve the consistency and quality of the cannabis.

AI-driven tools can analyze large datasets to identify patterns or trends to detect any contaminants or unwanted substances in cannabis. With AI technology, the genetic composition can be analyzed to identify different strains of cannabis and its applications. This can help accelerate research and development activities to find different therapeutic uses for cannabis.

Strategic Overview of the Global Colorado Legal Cannabis Industry

Cannabis is a genus of flowering plants that has been historically utilized for various purposes throughout human history. The legalization of cannabis in the state of Colorado happened back in 2012. The Colorado legal cannabis market has been witnessing steady growth due to the rise in awareness among the population regarding the benefits of cannabis in medical use. A growing demand from consumers for cannabis for recreational as well as medicinal purposes is boosting the growth of the market. According to the Colorado Department of Revenue, in 2024, the revenue earned through marijuana sales was estimated to be USD 1.39 billion. Such a rise in sales of marijuana for medicinal and recreational purposes supports market growth.

Favorable support from the government and regulatory frameworks are important factors for the growth of this market. The Colorado State Government has been regularly funding research and development activities related to cannabis and its medicinal use. People have become more aware of the therapeutic properties of cannabis, especially for chronic health issues like cancer, neurological treatments, and anxiety & depression. Moreover, advancements in farming methods boosted the production and quality of cannabis. Key players operating in the market are focusing on diversifying their product portfolios, which sustain the market's long-term growth.

Colorado Legal Cannabis Market Growth Factors

- The rising awareness about the therapeutic benefits of cannabis, especially for chronic issues, is boosting the growth of the market.

- The legalization of cannabis for recreational purposes is propelling the market's growth.

- Rising research and development activities to explore the applications of cannabis drive the growth of this market.

- The increasing use of cannabis for medical purposes further supports market growth.

Market Outlook:

- Market Growth Overview: The colorado legal cannabis market is expected to grow significantly between 2025 and 2034, driven by pioneering legal status, creating a first-mover advantage, and attracting significant tourism or early adopters. This early growth can be further fueled by an influx of capital and the establishment of a robust regulatory framework and infrastructure that attracts professional investment and facilitates the creation of scalable businesses.

- Sustainability Trends: Sustainability trends involve energy efficiency & reduction of carbon footprint, water conservation and management, waste management, and the circular economy.

- Major Investors: Major investors in the market include Canopy Growth, CanopBoulder, and First Capital Ventures.

- Startup Economy: The startup economy is focused on high costs and capital requirements, market saturation and consolidation, and tax burdens.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.00 Billion |

| Market Size in 2025 | USD 2.99 Billion |

| Market Size in 2026 | USD 3.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.00% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Derivatives, Cultivation, End Use |

Market Dynamics

Drivers

Increased Application in Medical Field

The increased application of cannabis in the medical field is a major factor driving the growth of the Colorado legal cannabis market. The legalization of marijuana in Colorado has boosted its adoption in the medical field for various purposes, such as in the management of chronic pain and in the development of medicines. With the legalization of marijuana in Colorado since 2000, access to medical cannabis has increased all over the state. A rise in the number of cases of chronic diseases across the state further boosts the demand for medical cannabis.

The growing awareness among people regarding the benefits and therapeutic properties of cannabis for different conditions like multiple sclerosis, chronic pain, cancer, and arthritis is boosting the market's growth. A survey revealed that the majority of patients in Colorado reported using it for severe pain, which accounts for 78.3% of patients in 2022. The increasing awareness of the benefits of cannabis for neurological disorders is further driving the market growth. With the growing utilization of cannabis for medical purposes across the state, the market continues to sustain its growth trajectory in the coming years.

Restraint

Availability of Unregulated Cannabis

The Colorado legal cannabis market faces limitations because of the availability of unregulated cannabis. These cannabises are not compliant with regulatory frameworks and do not adhere to the rules of legalized cannabis in Colorado State. These products are available widely at cheaper prices with inferior quality. Some consumers often prefer unregulated cannabis products for the more affordable price. The heightened competition from unregulated cannabis limits the growth of this market.

Opportunity

Demand for Cannabis Edibles and Rising R&D

The rise in the demand for cannabis edibles, like gummies, presents new opportunities in the Colorado legal cannabis market. Many key players are focusing on research and development activities in areas such as cultivation, extraction, and quality control. With the growing awareness among people about the therapeutic benefits of cannabis, consumption of cannabis edibles is rising. This creates opportunities for key players to innovate in product development. They can create low-dose cannabis edibles that fulfill consumer's medical needs without any side effects.

Source Insights

The marijuana segment led the Colorado legal cannabis market with the largest share in 2024. This is mainly due to the legalization of recreational and medicinal marijuana. Technological advancements in cannabis cultivation methods further propelled the segment growth. With the increased burden of chronic diseases, there is a significant increase in the adoption rate of medicinal marijuana, which bolstered the segment.

Meanwhile, the hemp segment is expected to grow at a significant rate in the upcoming period. The growth of the segment is attributed to regulatory support for agricultural practices along with the growing demand for various hemp products. The rising awareness of the benefits of hemp further supports segmental growth. Hemp has proven effective in improving heart health and digestive health. Moreover, it is a good source of healthy fats, protein, and fiber.

Derivatives Insights

The CBD segment dominated the Colorado legal cannabis market in 2024. This is mainly due to the noticeable increase in consumer awareness about the therapeutic benefits of CBD. Regulatory guidelines that support the production and sales of CBD products further bolstered the growth of this segment. A significant rise in the consumption of CBD products, like CBD oil, for medical purposes propelled the segment's growth. CBD oil is used in various therapies for pain relief. It is also useful for relief from inflammation, depression, and anxiety.

On the other hand, the THC segment is projected to witness significant growth during the forecast period. The growth of the segment can be attributed to the rising consumer demand for THC for recreational purposes. The rise in research and development activities aimed at exploring the potential of THC for medical use further contributes to segmental growth.

Cultivation Insights

The indoor cultivation segment led the Colorado legal cannabis market with the largest share in 2024. This is mainly due to the high-quality cannabis. Many growers prefer the indoor cultivation method, as it allows them to control environmental conditions. This leads to the cultivation of high-quality cannabis with improved properties. Moreover, indoor cultivation methods can lead to higher yields. Meanwhile, the greenhouse cultivation segment is expected to grow at the fastest rate during the projection period. The rapid shift toward sustainable cultivation practices is a key factor driving the growth of the segment. In addition, greenhouse cultivation methods require less energy, making it cost-effective.

End Use Insights

The recreational use segment dominated the Colorado legal cannabis market in 2024. This is mainly due to the legalization of cannabis for recreational purposes. There has been a significant rise in the acceptance of marijuana for recreational purposes in the last few years. A regulatory framework set by regulatory agencies in the state of Colorado for recreational marijuana further bolstered the segment's growth.

On the other hand, the medical use segment is expected to grow at a significant rate in the coming years. The growth of the segment can be attributed to the rising awareness regarding the therapeutic benefits of cannabis. Cannabis helps in chronic pain management, decreases anxiety, and reduces inflammation. Thus, it is used in therapeutics. The rising research and development activities focusing on expanding therapeutic uses of cannabis further contribute to the segment's growth.

Regional Insights

North America's Cannabis Capital: How Colorado Became the Region's Dominant Market Hub

North America's dominance in the market is reflected in the state's role as the region's most mature, regulated, and innovation-driven cannabis ecosystem. Colorado pioneered recreational legalization in 2014, setting standards for compliance, testing, retail models, and product innovation that many other North American jurisdictions later adopted. The state attracts major North American cannabis brands, investors, and researchers due to its advanced regulatory framework and strong consumer demand.

U.S. Colorado Legal Cannabis Market Trends

The U.S. market is expanding steadily as consumer demand for both recreational and medical products rises, supported by a mature regulatory framework and broader acceptance of cannabis use. Product diversification continues to be a defining trend, with strong growth in edibles, concentrates, vapes, and wellness-oriented CBD items alongside traditional flower sales. Cultivators are increasingly shifting from energy-intensive indoor grows towards more cost-efficient and sustainable greenhouse operations, reflecting pressure to improve margins and environmental performance.

Asia Pacific's Emerging Surge: The Region Showing the Fastest Growing Interest in Colorado's Legal Cannabis Market

Asia Pacific is showing the fastest growth in engagement with market as countries and companies across the region look to Colorado for regulatory models, cultivation technologies, and product-innovation strategies. Growing investment interest from APAC biotech and wellness firms is driving collaborations with Colorado-based companies, particularly in areas like cannabinoid research, extraction technologies, and medical-grade product development. With rising demand for alternative wellness solutions in markets such as Australia, Thailand, and South Korea, APAC stakeholders increasingly view Colorado as the blueprint for safe, scalable cannabis commercialization.

Value Chain Analysis of the Colorado Legal Cannabis Market

- Inbound Logistics

This stage includes sourcing all necessary materials for growing and processing cannabis. - Operations

This stage covers all activities that transform raw materials into finished cannabis products. - Outbound Logistics

Outbound logistics involves storing, fulfilling orders for, and transporting finished cannabis products to licensed dispensaries or retail partners. - Marketing and Sales

This stage focuses on promoting cannabis products and completing sales within the legal restrictions placed on advertising and sales channels. - Service

The service stage involves providing support and information to consumers after a purchase.

Recent Developments

- In April 2025, recreational marijuana sales began in Colorado Springs. City Records Friday showed 22 storefronts had secured active recreational licenses for opening day.

- In December 2024, The Cannabist Co. Holdings Inc., a leading experienced cultivator, manufacturer, and retailer of cannabis products in the U.S., partnered with Flower by Edie Parker, the leading female-founded and operated cannabis lifestyle brand, in Virginia and Colorado. The Cannabist Co. launched Flower by Edie Parker's premium products in the markets with the brand's best-selling “Petal Puffer” all-in-one vape and vape cartridges. The company announced the launch of Flower by Edie Parker's cannabis-infused edibles line, ‘Seedies,' in Colorado and New York, with additional markets launching in Q1 2025.

Colorado Legal Cannabis Market Companies

- Northwest Cannabis Solutions

- The Hollingsworth Cannabis Company, LLC

- Alkaloid Cannabis Company

- Herbs House

- Nirvana Cannabis

- Edgemont Group (Leafwerx )

- Olympia Weed Company

- Canna West Seattle

- Grow Op Farms (Phat Panda)

- Forbidden Farms, LLC

Segments Covered in the Market

By Source

- Hemp

- Marijuana

By Derivatives

- CBD

- THC

- Others

By Cultivation

- Indoor Cultivation

- Greenhouse Cultivation

- Outdoor Cultivation

By End Use

- Industrial Use

- Medical Use

- Recreational Use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting