Cannabis Cultivation Market Size and Forecast 2025 to 2034

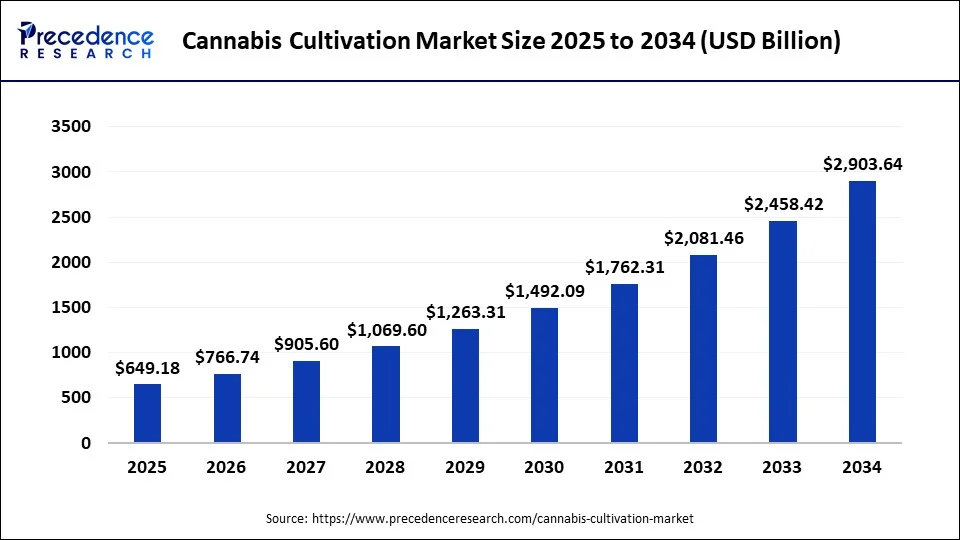

The global cannabis cultivation market size is estimated at USD 549.64 billion in 2024 and is anticipated to reach around USD 2,903.64 billion by 2034, expanding at a CAGR of 18.11% between 2025 and 2034. The rising adoption of cannabis in medical sectors is expected to boost the growth of global cannabis cultivation market.

Cannabis Cultivation Market Key Takeaways

- In terms of revenue, the market is valued at $649.18 billion in 2025.

- It is projected to reach $2,903.64 billion by 2034.

- The market is expected to grow at a CAGR of 18.11% from 2025 to 2034.

- North America generated for the maximum revenue share in the global market.

- Asia Pacific is the fastest-growing region of the global market.

- By type, the cannabis indica segment dominance the global market.

- By type, the cannabis sativa segment is the fastest-growing segment of the global market.

- By biomass, the hemp segment generated more than 78% of the revenue share in 2024.

- By biomass, marijuana is the fastest-growing segment of the global market.

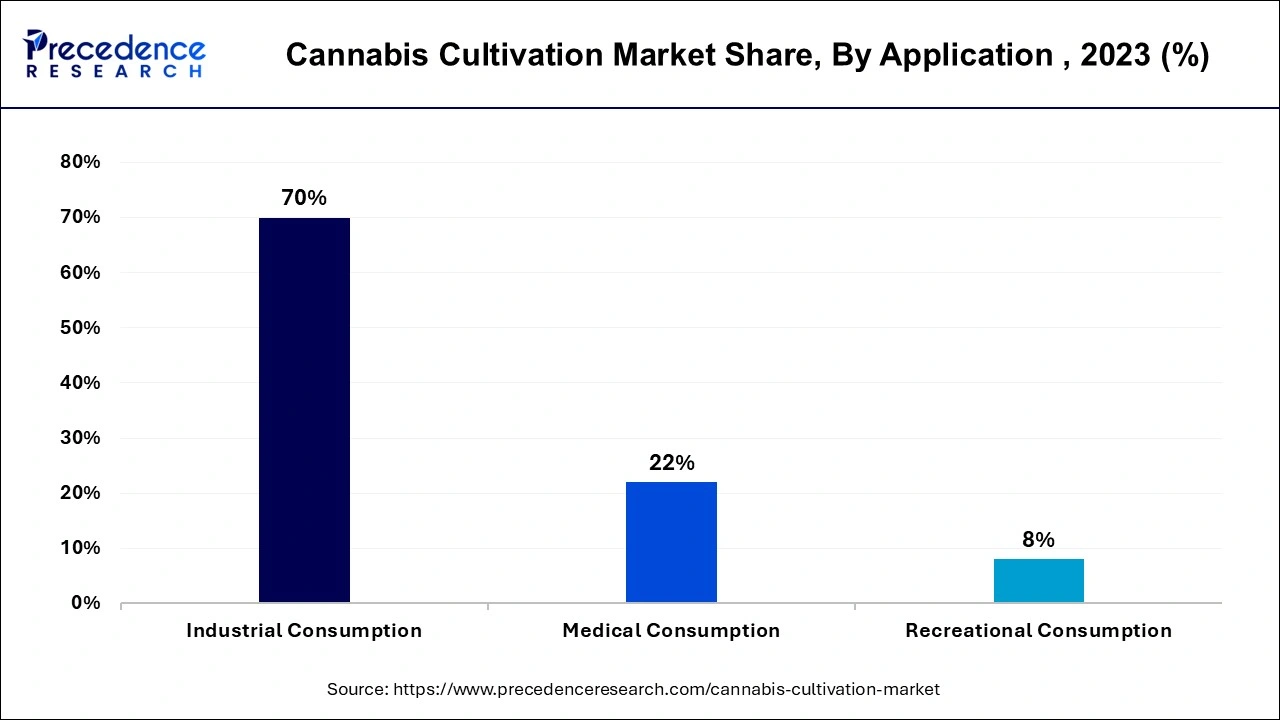

- By application, the industrial consumption segment captured more than 70% of the revenue share in 2024.

- By application, the medical consumption segment is predicted to be the most attractive segment from 2025 to 2034.

Market Overview

Native to South Asia, the cannabis plant is utilized in various industries, including medicinal and recreational purposes. Cannabis cultivation includes the process of preparing, producing, and harvesting the cannabis required for multiple purposes. Different parts of cannabis plants, such as roots, flowers, stems, sugar leaves and seeds, have received significant attention from medical and recreational industries.

Mentioned parts of the cannabis plant carry long and short cellulose fibers, herbal properties, proteins, and essential fatty acids. Cultivators are focusing on distillation and processing during cannabis cultivation to boost production. With the increasing demand for cannabis and improving technology for cultivation, the global cannabis cultivation market is projected to accelerate in the upcoming years.

Cannabis Cultivation Market Growth Factors

- The global cannabis cultivation market is expected to witness a significant shift during the analyzed period owing to the increased medical importance of cannabis in recent years. Many geographical areas have recently started legalizing the cultivation, production, and distribution of cannabis with stricter laws and regulations.

- The rising legalization of cannabis cultivation is another primary driver for the market's growth. The increasing prevalence of chronic disease and neurological disorders is observed to fuel the growth of medical cannabis during the forecast period.

- Moreover, the growing requirements for hemp cannabis from the nutraceutical and food industries, along with the adoption of cannabis in the cosmetic industry, are considered to fuel the growth of the global cannabis cultivation market.

- At the same time, the rising investments in the cultivation sector, availability of capital for cannabis cultivation facilities, the addition of key players, and growing focus on business activities such as mergers, acquisitions and partnerships are accelerating the growth of the cannabis cultivation market globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 649.18 Billion |

| Market Size in 2024 | USD 549.64 Billion |

| Market Size by 2034 | USD 2,903.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.11% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Biomass, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The rising demand of medical marijuana

Medical marijuana is typically cannabis used in the medical sector to treat various diseases. In recent years, many countries and states have legalized medical marijuana by considering its health benefits. Netherlands, Georgia, France, Portugal and Canada have stepped into the legalization of medical cannabis or marijuana. Rapid legalization has boosted the demand for medical marijuana in the global market, which drives the growth of the cannabis cultivation market. Medical marijuana is widely used to ease symptoms, including nausea and vomiting.

Moreover, medical marijuana qualifies for the treatment of HIV/AIDS, glaucoma and muscle spasms. The increasing prevalence of chronic diseases has highlighted the importance of cannabis in the medical sector.

The THC content in marijuana helps in treating/managing neurological disorders. With the rising cases of depression, anxiety, Alzheimer's and other neurological issues, the demand for medical marijuana is considered to boost rapidly. Considering the need for medical marijuana, prominent pharmaceutical companies have entered the market by producing cannabis-derived pills, powders and oil for medical purposes.

Restraint

Difficulties in cannabis shipping and distribution

As the laws regarding cannabis cultivation, production, and distribution become stricter, the shipping of cannabis-derived products has become more complex. Every country/state has set different guidelines and rules for collecting and distributing cannabis. For example, it is legal to ship cannabis with up to 0.2% THC concentration in European Union. In contrast, Australia allows cannabis with 0.005% or less THC concentration.

On the other hand, the U.S. has allowed the shipping of cannabis or marijuana with up to 0.3% THC. Considering such different regulations in shipping cannabis, it becomes difficult for cultivators to expand their business internationally. However, small-scale cultivators are not involved in the distribution phase, and the difficulties in cannabis shipping may be problematic for large-scale cultivators engaged in production and distribution.

Opportunity

Deployment of genetic engineering in cannabis cultivation to boost the production

The technological innovations in cannabis cultivation procedures highlight the bright future of the global market. Genetic engineering allows the modification of the characteristics. With the invention in the agricultural sector, cannabis cultivators have started deploying genetic engineering to enhance production; genetic engineering in cannabis cultivation allows the crossing of cannabis strains in order to achieve a desirable trait.

Technological advancements have allowed cultivators to achieve the desired product in a matter of weeks. Cultivators are capable of resisting the effects of climate change on cannabis crops, and the deployment of genetic engineering is observed to offer to strengthen the production of cannabis without failure.

Type Insights

Cannabis indica and cannabis sativa are two major competitive types of the cannabis cultivation market. Both cannabis indica and cannabis sativa have plenty of medical uses, which have highlighted their importance in the medical field.

The cannabis indica segment holds a dominating share of the global cannabis cultivation market. Cannabis indica has a higher concentration of cannabidiol, which is believed to offer more calming and relaxing effects. Cannabis indica is widely used for managing poor appetite, insomnia and anxiety.

The cannabis sativa is another fastest-growing segment of the global cannabis cultivation market. Due to the typical amount of tetrahydrocannabinol in cannabis sativa, it is believed to cause uplifting and offer pain management. Cannabis sativa is widely used in the production of fiber and oil, and another proven use of sativa is it can be used as an additive in food products. Commercially, cannabis sativa seeds are used in the production of edible/cooking oil.

Biomass Insights

The hemp segment dominates the global cannabis cultivation market; the hemp segment accounted for a revenue share of 78% in 2023. Hemp is commercially legal biomass owing to its low THC content, and it is utilized in the production of commercial products such as food, ropes, paper and even clothing. Along with this, hemp is also used in treating multiple skin infections, and the rising demand for hemp-based products from various industries will maintain the segment's dominance.

Moreover, the increasing adoption of hemp cultivation is expected to boost the growth of the hemp segment during the forecast period. For instance, in June 2022, the Tamil Nadu government in India expressed that it is actively considering legalizing hemp cultivation for industrial and medical purposes.

Marijuana is the fastest-growing segment of the global cannabis cultivation market. Many states have recently started allowing the use of medical marijuana in treating multiple diseases and managing pain. The changing perception towards marijuana will fuel the segment's growth.

Application Insights

The industrial consumption segment dominates the market by acquiring more than 70% of the total revenue share of the global cannabis cultivation market. The hydrating, anti-aging, anti-sebum and antioxidant properties have reserved a significant position for cannabis in the global cosmetic industry.

The rising demand from the cosmetic industry for cannabis has boosted the growth of the industrial consumption segment. Moreover, cannabis continues to play a vital role in the pharmaceutical industry owing to its soothing and stimulating properties. The expansion of cosmetics, personal care and pharmaceutical products will maintain the growth of the industrial consumption segment.

At the same time, the medical consumption segment is expected to be the most attractive segment during the forecast period. The rising demand for sativa cannabis from the medical sector as medical marijuana is uplifting the segment's growth. Cannabis or medical marijuana are widely utilized to manage and control symptoms such as nausea and vomiting and lessen pain post-surgery. Moreover, the development of the segment is attributed to the rising legalization of cannabis cultivation, specifically for medical use in many countries.

Regional Insights

North America accounted for the largest revenue share in the global cannabis cultivation market. The rising prevalence of neurological disorders has increased the demand for cannabis from the medical industry in North America. The availability of production lands, large consumption volume, new product launches and the presence of major key players in the region are a few other factors to fuel the cannabis cultivation market in North America. The State of California is expected to dominate the cannabis cultivation market in North America.

U.S.

The cultivation of cannabis in the U.S. is increasing for medicinal purposes. At the same time, advanced technologies for its cultivation are also being developed. Moreover, the growing licensed cultivators are also contributing to the same.

Canada

The use of cannabis in the industries for the development of various products is increasing. This, in turn, is increasing the investment for their cultivation as well as development. Various new farming techniques are also being used to enhance their production.

Asia Pacific is the fastest-growing region of the global cannabis market, and the medical application of cannabis will maintain its dominance throughout the analyzed period in Asia Pacific. To highlight the importance of cannabis, India has been utilizing cannabis in various traditional remedies. On the other hand, the complicated regulations on cannabis in Japan and China will hamper the growth of the cannabis cultivation market in Asia Pacific.

Europe is another significant marketplace for cannabis cultivation. The legalization of cultivation, utilization and consumption of cannabis in various countries of Europe is supplementing the growth of the cannabis cultivation market in Europe. For instance, in October 2022, the German government planned to legalize the home cultivation of cannabis while allowing three plants per adult. Moreover, France has legalized the use of cannabis in various industries. Also, medical cannabis is legal in France and Portugal.

The cannabis cultivation market in Latin America shows steady growth as the region is still dependent on exporting cannabis for specific medical purposes. The reformed drug laws in 2021 UAE made the regulations on the use of cannabis stricter; this is observed to limit the growth of cannabis cultivation in the Middle East.

On the other hand, in 2023, the president of South Africa addressed improving the cultivation of hemp cannabis to recover the economy post Covid pandemic; this is expected to boost the market's growth in Africa during the forecast period. Along with South Africa, many other African countries are keen to embrace the production of cannabis to boost their economies.

Cannabis Cultivation Market Companies

In recent years, the increased demand for cannabis cultivation has welcomed multiple new players in the market, a few of the prominent companies involved in the global cannabis cultivation market are-

- Aurora Cannabis

- Canopy Growth Corporation

- Orgnigram Holdings Inc

- Better Holdings

- Maricann Group

- The Cronos Group

- ABcann Medicinals Inc

- G W Pharmaceuticals Inc

Recent Developments

- In July 2025, as per the announcement of Jagat Singh Negi, the horticulture and tribal development minister, a set of rules will soon be imposed by the Himachal government for legal cultivation of cannabis (hemp) for medicinal and industrial purposes, as well as in phases the process of granting the licenses for medicinal and industrial hemp farming will also be initiated. Moreover, a variety of products developed from cannabis, which were pharmaceutical extracts and food items, were presented in the seminar on the medicinal and industrial use of hemp by the Himachal and other states stakeholders. (Source: https://www.msn.com)

- In July 2025, to receive the medical marijuana for Kentucky dispensaries, a step forward was announced by Gov. Andy Beshear. The first medical cannabis inventory was launched by Armory Kentucky, which is a Tier II cultivator based in Mayfield, making it the first inventory of the state's history. After a successful inspection by the Kentucky Office of Medical Cannabis, the facility was approved for cultivation, which began at the Graves County site. As per the announcement of Beshear, which stated that a major milestone was achieved to deliver affordable and safe access to medical cannabis, with the initiation of this cultivation at the Mayfield facility. Moreover, it was also mentioned that the operations of the licensed testing labs and processors will be initiated in the upcoming weeks. (Source:https://www.wdrb.com)

- In March 2023, Riverside City, California, approved cannabis cultivation as an allowed business. The approval for cannabis cultivation sets a framework for permitting licensing, taxation and legal operation of commercial cannabis with proper measures. Moreover, the approval permitted businesses, including storefront retailing, delivery businesses, testing laboratories and manufacturing businesses.

- In March 2023, The California Department of Fish and Wildlife (CDFW) announced grant funding of over $20 million for small-scale cannabis cultivators under its now Cannabis Restoration Grant Program. The funding aims to support conservation projects and habitat enhancement and enable cannabis cultivators to become fully licensed. Moreover, this funding covers a wide range of activities, including assisting cultivators and remediation of illegal grow sites.

- In March 2023, a globally leading cannabis lifestyle brand based in Canada, Tilray Brands Inc, announced the launch of the latest innovations Burst and Darts by its quintessential brand CANACA, based in Canada. Newly added Burts and Darts are made up of coarse ground whole flowers.

- In February 2023, the city council of Cathedral City, California, adopted a resolution to reduce the taxes on cannabis to 5% of gross proceeds. The reduction of taxes by the council aims to boost the cultivation of cannabis along with the manufacturing of cannabis goods. According to the council, the reduction in taxes on cannabis may result in revenue loss in the beginning but will attract new businesses into Cathedral City.

- In February 2023, 22Red partnered with Lonestar Select for cannabis cultivation in Arizona. 22Red is a lifestyle brand with cannabis on the menu, whereas Lonestar Select has been cultivating cannabis since 2011. The partnership aims to offer lucrative opportunities for 22Red to launch new products in the upcoming years.

- In February 2023, New Britain proposed a new site for cannabis cultivation and distribution. The latest approved center for cannabis cultivation is being built at an old Webster Bank on Slater Road. The officials have stated that this new center of cannabis cultivation will supplement the local economy and will offer employment for over 100 people.

Segments Covered in the Report

By Type

- Cannabis Indica

- Cannabis Sativa

By Biomass

- Hemp

- Marijuana

By Application

- Medical Consumption

- Recreational Consumption

- Industrial Consumption

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting