What is the Cell Cycle Inhibitors Market Size?

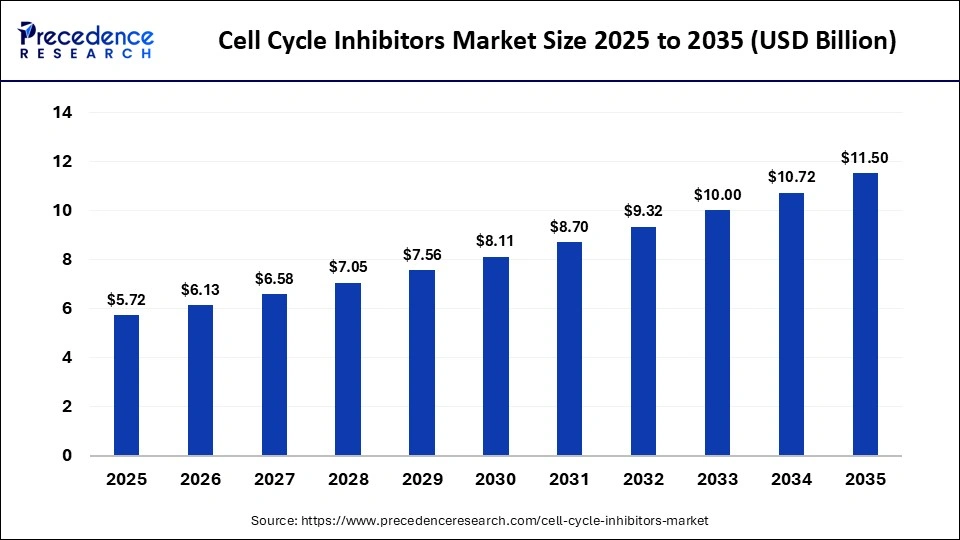

The global cell cycle inhibitors market size was calculated at USD 5.72 billion in 2025 and is predicted to increase from USD 6.13 billion in 2026 to approximately USD 11.50 billion by 2035, expanding at a CAGR of 7.23% from 2026 to 2035.This expansion in the market is driven by the rise in the incidence of breast, lung, and colorectal cancer and the success of targeted therapies like CDK4/6 inhibitors, which are less toxic and more effective treatment options.

Market Highlights

- North America dominated the cell cycle inhibitors market in 2025.

- Asia-Pacific is expected to expand with the highest CAGR during the forecast period.

- By drug class, the CDK4/6 inhibitors segment held the largest market share in 2025.

- By drug class, the multi-target inhibitors segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By cancer type, the breast cancer segment dominated the market in 2025.

- By cancer type, the lung cancer segment is expected to rise with the highest CAGR during the forecast period.

- By route of administration, the oral segment held the largest revenue share of the market in 2025.

- By route of administration, the intravenous segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By end-user, the private cancer hospitals and specialty clinics segment accounted for the highest revenue share of the market in 2025.

- By end-user, the academic medical centers segment is expected to grow with the highest CAGR between 2026 and 2035.

What is the Landscape of the Cell Cycle Inhibitors Market?

The market is experiencing immense growth due to a rise in R&D investments, the pivot towards personalized medicine, and a surge in uptake of the emergency. This market focuses on the development, clinical application, and commercialization of therapeutic agents that target and inhibit cyclin-dependent kinase (CDK). The market is also expanding with growing interest in novel targets and with many clinical trials addressing resistance to existing treatment. With the target on oncology, this market is burgeoning due to a rise in cancer prevalence, particularly breast cancer, and rapid growth in targeted therapies.

What is the Role of AI in the Cell Cycle Inhibitors Market?

AI is revolutionizing the market by accelerating drug discovery, enhancing trial efficiency, and facilitating precision therapeutics. It is changing the market by overcoming high costs, prolonged timelines, and high failure rates associated with oncology drug production. AI accelerates cancer treatment by streamlining molecular design, forecasting efficacy, and identifying drug targets.

It analyzes patient data and identifies high-benefit subgroups to optimize personalized treatment. It also facilitates drug repurposing by discovering new applications of the existing compound. Despite its potential, the integration of AI with cell cycle inhibitors faces challenges like inferior data quality, the need for an enhanced link between physical experiments and computational modeling, and regulatory barriers.

Cell Cycle Inhibitors Market Trends

- Dominance of CDK4/6 Inhibitors: The CDK4/6 is rapidly growing in the market due to their significant potency in treating HR+/HER2- breast cancer, making up most of the cases. This class of drugs has become standard care in advanced diseases, and they are increasingly applied to early, high-risk adjuvant situations.

- Shift to Combination Therapies: The market is transitioning from stand-alone therapies to combination therapies to overcome challenges like acquired resistance and limited effectiveness. Combination therapies have enhanced patients' survival rate, delayed treatment resistance, and increased the therapeutic application.

- Precision Medicine Focus: It is shifting from the conventional chemotherapy approach to highly data-driven, biomarker-specific treatment strategies. These therapies are customized to an individual's genetic makeup, leading to enhanced potency and fewer side effects.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.72Billion |

| Market Size in 2026 | USD 6.13 Billion |

| Market Size by 2035 | USD 11.50Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Class, Cancer Type, Route of Administration, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Drug Class Insights

Which Drug Class Segment Led the Cell Cycle Inhibitors Market?

The CDK4/6 inhibitors segment led the market in 2025 due to their enhanced efficacy and safety. These therapies have had a revolutionary impact on treating hormone receptor-positive or -negative metastatic breast cancer. These are oral therapies that are relatively well tolerated and precisely target cancer cells, hence enhancing patient experience and adherence. CDK4/6 inhibitors are expanding in these markets, as they are also indicated in early-stage breast cancer and have potential use in other malignancies.

The multi-target inhibitors segment is expected to rise rapidly between 2026 and 2035 due to its unique ability to overcome the limitations of resistance and reduced potency associated with single-target therapies. It provides a more extensive treatment approach, especially in complex aggressive cancer. Multi-target inhibitors act through multiple targets, enhancing treatment efficacy and enabling a synergistic effect. This helps patients recover faster than conventional, single-target therapies.

Cancer Type Insights

Why the Breast Cancer Segment Dominated the Cell Cycle Inhibitors Market?

The breast cancer segment held a major revenue share of the market in 2025 due to the high incidence of HR+ and HER2 subtypes, which rely exclusively on the CDK4/6 pathway for cell cycle progression. These are the first line of treatment in breast cancer, and in combination with hormone therapies, they have driven the dominance of this widespread cancer treatment. The segment's dominance is further reinforced by the expansion of these drugs in the post-surgical management of high-risk early-stage breast cancer.

The lung cancer segment is expected to show the fastest growth over the forecast period due to high molecular dysregulation, which fuels aggressive proliferation in over 80% of cases. These targeted agents are increasingly adopted to fight treatment resistance in both small-cell and non-small-cell lung cancers. Clinical trials are rapidly growing in lung cancer that focuses on unmet medical needs.

Route of Administration Insights

How Did the Oral Segment Dominate the Cell Cycle Inhibitors Market?

The oral segment accounted for the highest revenue share of the market in 2025, as it offers high patient convenience, enhanced quality of life, and better tolerability with extended chronic cancer treatment regimens. Oral therapies are cost-efficient as they minimize hospital workload, resource utilization, and trained nurse staff, decreasing overall treatment costs. Advancements in drug formulation have enhanced the bioavailability and stability of oral agents, making them highly effective. The market is further boosted by a surge in cancer incidence and the expansion of these drugs in earlier treatment stages.

The intravenous segment is expected to expand rapidly in the market in the coming years, driven by demand for accurate dosage in acute oncology, enhanced bioavailability, and a surge in combination therapies. IV formulations are preferred in aggressive cancer for their high potency and targeted cancer treatment. The rapid expansion of IV in oncology is driven by complex treatment management and improved patient comfort by reducing needlesticks.

End-User Insights

Which End-User Segment Dominated the Cell Cycle Inhibitors Market?

The private cancer hospitals and specialty clinics segment contributed the biggest market share in 2025 due to their ability to offer premium, top-tier cancer care, fast adoption of advanced treatment, and superior patient support service. These are the main centers for treating complex, high-risk, and HR+ metastatic breast cancer.

Hospitals and specialty clinics rapidly adopt new and more convenient treatment protocols, which increase patients' cooperation and minimize patient visits to hospitals. Private cancer hospitals' and specialty clinics' adaptability, advanced technology, and end-to-end care system capture the majority of the market for high-cost specialized cancer treatment.

The academic medical centers segment is expected to witness the fastest growth in the market over the forecast period due to their role in transforming complex high-risk research into clinical practice. It is a primary center of precision medicine, integrating advanced research capability, patient access, and proactive toxicity management for targeted cancer therapies. Academic centers receive research grants from several government and private bodies, enabling them to conduct advanced research.

Regional Insights

Which Factors Drive the Cell Cycle Inhibitors Market in North America?

North America held a major revenue share of the market in 2025 due to the rise in the prevalence of cancer, mature healthcare infrastructure, rapid adoption of precision medicine, and massive R&D investments. Proactive regulatory approval allows faster market penetration, further boosting this market. In the U.S., high insurance coverage and reimbursement facilitate patients' expensive cancer treatment. Its dominance is further driven by an established innovation-led infrastructure.

U.S Market Trends

The U.S. leads the market in North America due to the rise in the incidence of cancer, the advanced healthcare ecosystem, and early regulatory approval. A rise in patient awareness regarding novel oral targeted therapies for cancer further expands market growth. The presence of a robust R&D and clinical trial infrastructure and a strong presence of pharmaceutical companies propel the market.As of 9th February 2026, there were 125 clinical trials registered in the U.S. related to cell cycle inhibitors as an intervention, of which 12 were active.

How Will Asia-Pacific Grow in the Cell Cycle Inhibitors Market?

Asia-Pacific is expected to be the fastest-growing region in the foreseen period due to a surge in the prevalence of cancer, enhanced healthcare access, and an increase in cost-effective generic drugs, particularly for CDK4/6 inhibitors. This market is propelled by notable investments in pharmaceutical R&D, upgrading clinical infrastructure, and government support for oncology. R&D initiatives are focused on third-generation CDK4/6 inhibitors and novel combination therapies to overcome treatment resistance. Substantial clinical research advancements are contributing to market growth.

China Market Trends

China is governing the Asia-Pacific region in this market due to an increase in cancer prevalence, enhanced healthcare infrastructure, the availability of low-cost drugs, and a robust government. This market is further expanded by rapid clinical trials, ease in regulatory approvals, and a surge in the number of biopharma firms, enabling fast, high-volume production of drugs. Government initiatives like the Full-Chain Support Plan and Real-World Data (RWD) in Pilot Zones further boost the market. A massive investment in AI-driven drug discovery has made China a leading player in this sector.

Will Europe Grow in the Cell Cycle Inhibitors Market?

Europe is expected to grow at a notable CAGR in the foreseeable future. It is witnessing a rapid growth due to high cancer incidence, strong adoption of advanced targeted therapies, and massive investments in R&D. It is a major center for cancer innovation, with strengthened regulation and joint research improving market access. R&D initiatives like MESI-STRAT, ONCODISTINCT, and EORTC Collaboration are further accelerating market growth.

Germany Market Trends

Germany is leading the market in Europe due to its well-established healthcare ecosystem, high adoption of novel drugs, and strong clinical research initiatives. The market is driven by robust government support and significant investment in biotechnology and R&D. Government initiatives like German Cancer Aid (Deutsche Krebshilfe) funding and DFG-funded Collaborative Research Centers (CRC) are further boosting the market.

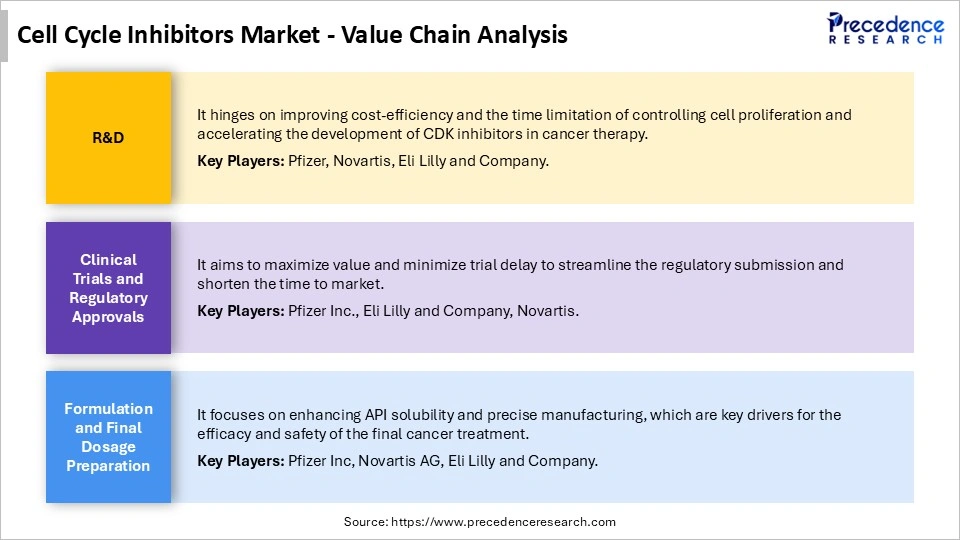

Cell Cycle Inhibitors Market Value Chain Analysis

Who are the Major Players in the Global Cell Cycle Inhibitors Market?

The major players in the cell cycle inhibitors market include Pfizer Inc., Novartis AG, Eli Lilly and Company, AstraZeneca, Roche (F. Hoffmann-La Roche Ltd.), G1 Therapeutics, Inc., Syros Pharmaceuticals, Inc., Merck & Co. / Merck Sharp & Dohme, Bristol Myers Squibb, Astex Pharmaceuticals, Prelude Therapeutics, Jiangsu Hengrui Pharmaceuticals, Sanofi, Onconova Therapeutics, Gilead Sciences

Recent Developments

- In August 2025, Incyclix Bio announced that it raised $11.25 million as part of its Series B financing round for developing INX-315-01, a novel, potent, and selective CDK2 inhibitor for the treatment of advanced and resistant cancer. The company aims to advance its Phase 1/2 clinical trial to address the unmet needs of patients with advanced, treatment-resistant breast and ovarian cancers. (Source: https://www.globenewswire.com)

- In August 2025, Boehringer Ingelheim Pharmaceuticals, Inc., received an FDA approval for zongertinib (Hernexeos), an oral tyrosine kinase inhibitor used for the treatment of adults previously treated for non-small cell lung cancer. The drug is effective in patients with tumors having HER2 tyrosine kinase domain-activating mutations.(Source: https://www.oncologynewscentral.com)

- In June 2025, Gilead Sciences, Inc. and Kymera Therapeutics, Inc. partnered together to develop and commercialize a novel molecular glue degrader (MGD) program targeting CDK2 with broad oncology treatment potential, including in breast cancer. MGDs can eliminate disease-driving proteins rather than just blocking them. (Source: https://www.businesswire.com)

Segments Covered in the Report

By Drug Class

- CDK4/6 Inhibitors

- Multi-Target Inhibitors

- Aurora Kinase Inhibitors

- WEE1 Inhibitors

- Checkpoint Kinase (CHK1/2) Inhibitors

By Cancer Type

- Breast cancer

- Lung cancer

- Ovarian cancer

- Glioblastoma

- Hematologic Malignancies

- Others

By Route of Administration

- Oral

- Intravenous

By End User

- Private Cancer Hospitals and Specialty Clinics

- Academic Medical Centers

- Community Oncology Clinics

- Tertiary and Quaternary Care Hospitals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting