Chondroitin Sulfate Market Size and Forecast 2025 to 2034

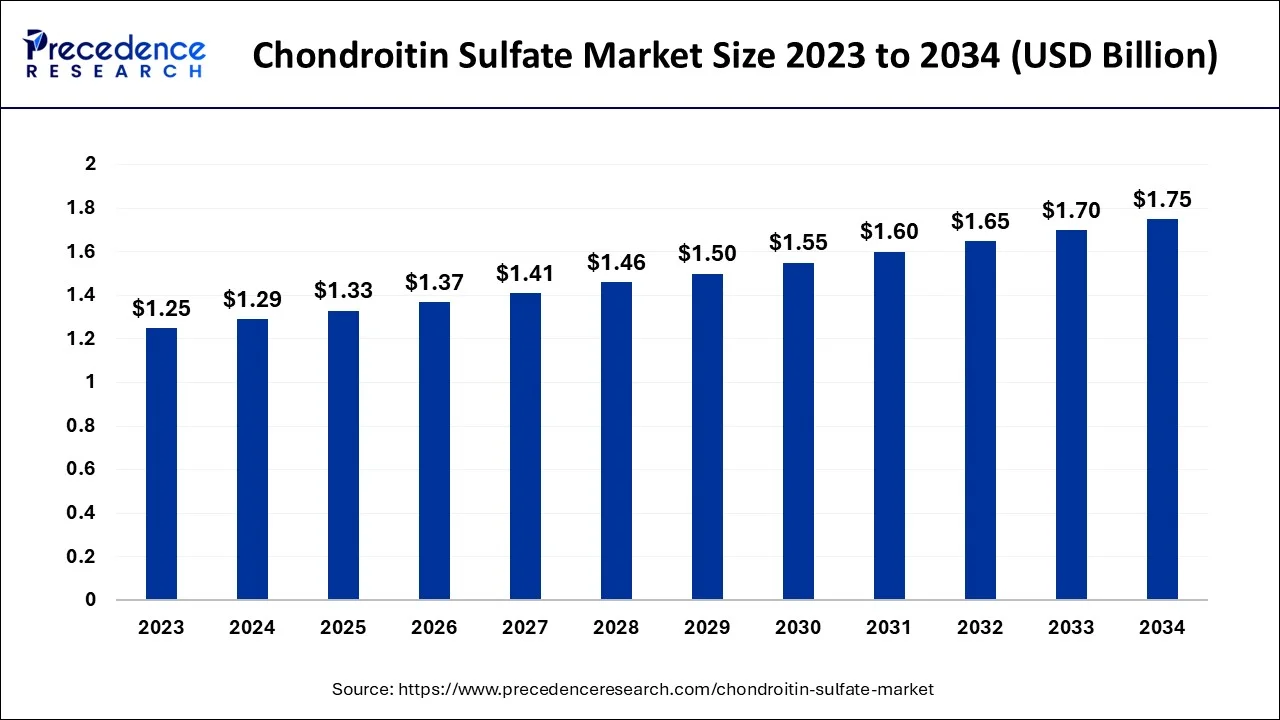

The global chondroitin sulfate market size was estimated at USD 1.29 billion in 2024 and is anticipated to reach around USD 1.75 billion by 2034, expanding at a CAGR of 3.10% from 2025 and 2034.

Chondroitin Sulfate Market Key Takeaways

- In terms of revenue, the chondroitin sulfate market is valued at USD 1.33 billion in 2025.

- It is projected to reach USD 1.75 billion by 2034.

- The chondroitin sulfate market is expected to grow at a CAGR of 3.10% from 2025 to 2034.

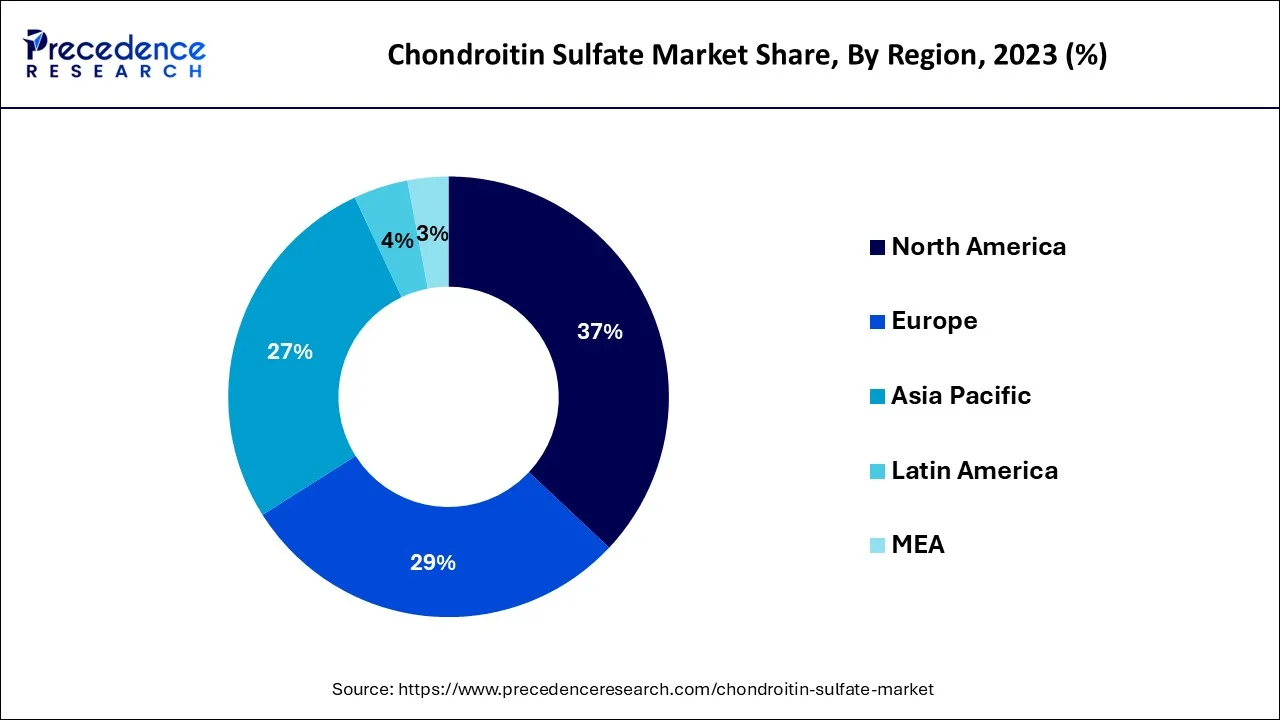

- North America led the market and generated more than 37% of revenue share in 2024.

- The Asia-Pacific region is expected to expand at a CAGR of 9% from 2025 to 2034.

- By source, the bovine segment dominated the global market in 2024.

- By application, the nutraceuticals segment dominated by global market in 2024.

U.S. Chondroitin Sulfate Market Size and Growth 2025 to 2034

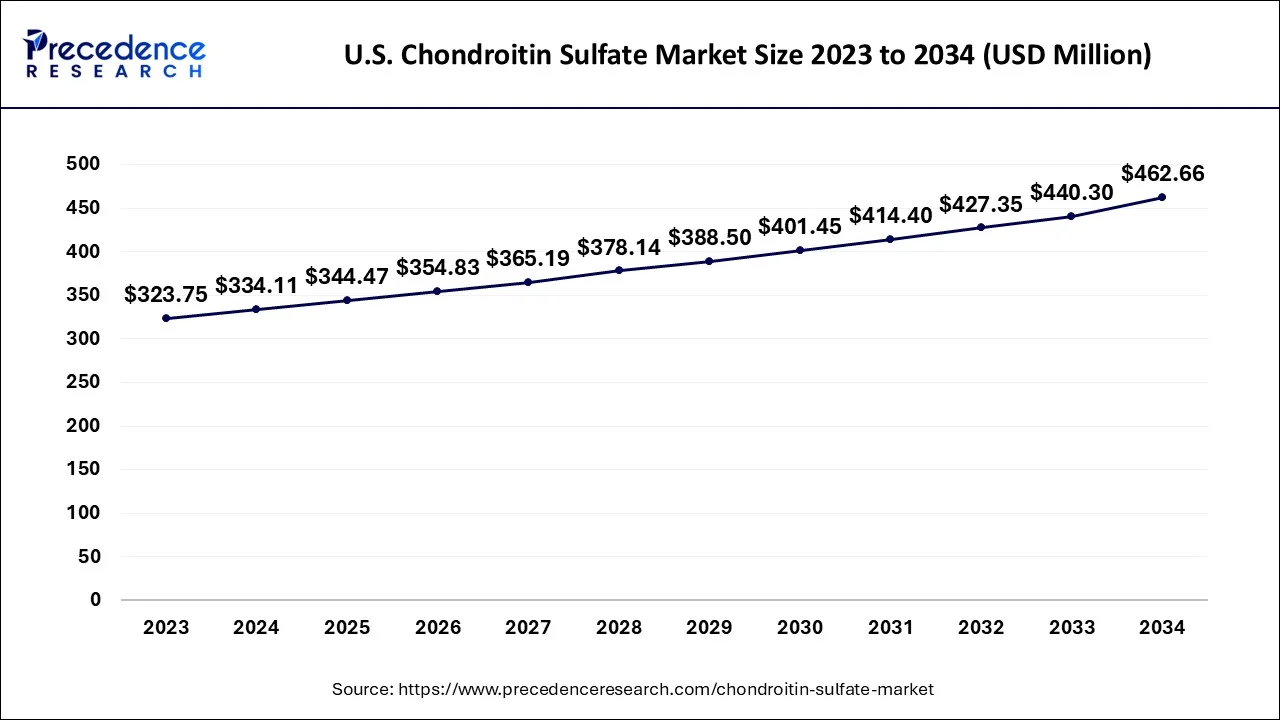

The U.S. chondroitin sulfate market size accounted for USD 334.11 million in 2024 and is expected to be worth around USD 462.66 million by 2034, growing at a CAGR of 3.35% from 2025 and 2034.

North America dominated the market in 2024. The dominance of the region can be attributed to the increasing pharmaceutical sector in the region along with the FDA approvals for using products containing sodium chondroitin sulfate. Moreover, in North America, the US led the market owing to the increasing prevalence of osteoarthritis in the nation. Also, the increasing geriatric population and need for dietary supplements are expected to fuel market growth soon.

- In May 2025, IQI Trusted Petfood Ingredients and Spanish biotech company Eggnovo entered a collaboration to distribute Ovopet, a functional eggshell membrane (ESM) ingredient, to the North American pet food market. The ingredient, made from upcycled eggshells, is promoted as a science-backed solution supporting joint, skin, coat, and gut health in pets.

(Source: https://www.petfoodindustry.com/ )

During the forecast period, the chondroitin sulfate market in the Asia-Pacific region is anticipated to expand at a CAGR of roughly 9%. The market is primarily driven by the expanding demand for supplements made with chondroitin sulfate from the healthcare and food & beverage industries. Furthermore, the region's market is anticipated to grow as more people become conscious of the health benefits of chondroitin sulfate.

Chondroitin sulfate market share in the Asia-Pacific region is divided into application, source, and country segments. The market is divided into three groups based on the source: bovine, marine, and porcine. Due to the expanding demand for supplements containing chondroitin sulfate obtained from bovines in the healthcare industry, the bovine segment is anticipated to maintain the highest share of the market among these.

The market is divided into three categories based on application: functional foods & beverages, pharmaceuticals, and dietary supplements. The dietary supplements market is further divided into segments for joint health, skincare, and other products.

Due to the expanding demand for dietary supplements containing chondroitin sulfate from the healthcare industry, China is predicted to be the largest market for chondroitin sulfate among the nation's major countries. Moreover, the country's chondroitin sulfate market will continue to expand as more people become aware of its beneficial health effects. Due to the rising demand for dietary supplements containing chondroitin sulfate from the healthcare industry, India is another significant market for chondroitin sulfate in the county.

In 2024, the chondroitin sulfate market in North America captured the largest share. This increase is mainly due to the expanding pharmaceutical industry in the U.S. along with FDA endorsements for the use of products containing sodium chondroitin sulfate. Moreover, demand is heightened by elements like increasing pharmaceutical applications, notably the occurrence of osteoarthritis, cataract operations, growing use of cholesterol therapies, and eye drop formulations. This is propelled by a sophisticated healthcare infrastructure, elevated consumer awareness regarding joint health, and strong R&D funding in nutraceuticals. The U.S., characterized by an older population and extensive consumption of joint health supplements, played a major role in this supremacy.

Europe ranks as the second top region in the global chondroitin sulfate market. This is due to the increasing demand from the cosmetics, pharmaceutical, food, pet food, and veterinary sectors. In addition, Chondroitin sulfate is authorized and controlled as a symptomatic slow-acting agent for osteoarthritis (SYSADOA) in Europe, and its consumption is recommended alongside glucosamine. Moreover, Europe is demonstrating a consistent increase, harmonizing conventional bovine-based products with new synthetic options. Spain plays a significant role in R&D for nutraceutical products, especially in innovations like supplements infused with chondroitin sulfate, fueling market expansion. Spanish manufacturers invest significantly in R&D to maintain leadership in product innovation within the nutraceutical sector.

Market Overview

The expansion of the chondroitin sulfate market is related to rising healthcare costs and consumer demand for pharmaceuticals and personal care products. The solution is also used to protect the cornea during cataract surgery, and it is used in medications to treat inflammation, joint pain, and eye dryness. The chemical formula of chondroitin sulfate and the glucuronic acid typically found in cartilage around joints is similar.

Chondroitin sulfate is also consumed and is accessible as capsules and tablets. The tablets are frequently used as food additives for animals as well. Additionally, the substance increases joint lubrication to support healthy cartilage function.

The market is expanding due to the growing use of chondroitin sulfate for the treatment of joint pain, acidity, heart disease, anaemia, and HIV. Chondroitin sulfate is increasingly used in personal care products, and its inclusion in cosmetics and hair care products, along with rising customer expenses, has caused the market for the substance to expand quickly over the foreseeable future.

For instance, animal glands and organs are used medically in several nations, including Japan, China, and India. Tallow, fertilizer, meat meal, and pet food are all products made from animal intestines. As a dietary supplement and a supplier of vitamin B12 for the prevention and treatment of different kinds of anemia, liver extract from pigs and cows are also used.

Fish waste with excessive bones or high oil content is converted into industrial sources and feed. Additionally, collagen and chondroitin sulfate, which are components used in pharmaceutical, cosmetic, nutraceutical, and food products, are derived from cartilage.

More animals are being killed due to increased demand for meat and meat-based products. The fact that the source of chondroitin is cartilage obtained after slaughter has been highly advantageous to the substance's producers. Osteoarthritis occurs as one of the musculoskeletal conditions that affect the elderly most frequently.

The joints are affected, motion is limited, and pain is experienced. Chondroitin sulfate is used to cure osteoarthritis to reduce pain, stop the disease's progression, and cure its symptoms. As osteoarthritis grows increasingly widespread in developed countries like the U.S. and the U.K., among many others, it is likely to gain popularity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.33 Billion |

| Market Size in 2024 | USD 1.29 Billion |

| Market Size by 2034 | USD 1.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.1% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Market growth for nutraceutical products is expected to drive expansion over the forecast period

Sodium chondroitin sulfate is used as a thickener in health food, forming agents, additives, preservatives, and in animal feed. It is also used in dietary supplements and food products. Because it is effective in treating canine arthritis and joint pain, including conditions like osteoarthritis, hip dysplasia, and elbow dysplasia, it is widely used. Applications for food- and feed-grade materials are anticipated to drive market expansion during the projection period.

Additionally, it is used to enhance liver function, improve digestion, lower blood sugar, and prevent tumour metastasis. Its use in the treatment of osteoarthritis and several other conditions is becoming more and more popular, which is anticipated to help the market expand overall.

Increasing efforts of major market participants to create chondroitin sulfate

Chondroitin sulfate development efforts by major pharmaceutical market players are projected to drive market growth. For example, in July 2021, Bioiberica introduced a new brand image for its investment in healthcare-branded ingredients. The patented CS Bioactive chondroitin sulfate and hyaluronic acid matrix ingredient Mobilee was part of this investment. Such actions will help the market expansion during the anticipated period.

Market Restraint

Product reactions may affect growth

There is some concern about the health of chondroitin sulfate since it comes from animal sources, even though clinical examinations have not revealed any clinical symptoms or overdoses of the substance. Some chondroitin tablets may contain excessive amounts of manganese, which could be harmful when used over an extended period.

Alternative reactions include loose stools, male pattern baldness, blockage and stomach pain, swelling, clogging, cerebral pain, leg swelling, swollen eyelids, skin rash, and unpredictable pulse. These reactions can vary from person to person. These factors will likely constrain the expansion of the worldwide chondroitin sulfate market. Additionally, social and religious restrictions in some developing nations may threaten the global chondroitin sulfate market.

Market Opportunity

Increasing pharmaceutical necessities are generating numerous opportunities for the global chondroitin sulfate industry growth

Firms that manufacture pharmaceutical-grade chondroitin sulfate should have a lot of business opportunities due to the expanding pharmaceutical industry worldwide. The market for dietary supplements is anticipated to be driven by osteoarthritis and an expanding population of older people worldwide, which will probably drive chondroitin sulfate demand. The United States now allows chondroitin sulfate in food and nutritional supplements. The nutraceutical market is likely to expand as more people become aware of how chondroitin in sulfate can aid in joint health issues.

Additionally, the rising demand for dietary supplements containing chondroitin sulfate in the country may present opportunities for vendors and manufacturers in the market. Synthetic chondroitin sulfate will be produced by Gnosis S.p.A. in Italy, which should reduce the product's operating costs and enable it to avoid complicated manufacturing procedures. This should also help the market dispute. Credit goes to these kinds of product innovations, and producers should have many opportunities to produce synthetic goods that are both high quality and affordable.

Directly ingestible chondroitin B Sulfate-containing nutraceuticals are exempt from veterinary inspection. To ensure the quality of the product and adhere to the standard production processes, they must be manufactured in accordance with United States and GMP standards. A trend of opportunities is coming to the chondroitin sulfate market due to all these factors.

-

In January 2025, GC Green Cross recently announced on the 10th the launch of its anti-inflammatory pain reliever "Teksan RAY" in a large 30-capsule product. Teksan RAY is the first compound soft capsule anti-inflammatory pain reliever in South Korea, effective in alleviating various pains, including menstrual pain, and lowering fever.

(Source: https://biz.chosun.com )

Source Insight

- Bovine

- Swine

- Shark

The global market was dominated by the bovine source segment in 2024. This results from the source being used more frequently across a wide range of application companies, personal care, and cosmetics, including pharmaceutical and nutraceuticals, on a global scale. Several industries that use shark-derived chondroitin sulfate are in the nutraceutical, pharmaceutical, and animal feed industries. Sharks are currently thought to be an extinct species, which might prevent the sector from growing.

The shark-derived product is the predominant form due to its ability to treat people with rheumatoid arthritis, HIV, and gut inflammation; during the forecast timeline, demand is expected to increase due to this preference. Production of synthetic sodium chondroitin sulfate involves a two-stage fermentation-based process. There is little chance of contamination or adulteration because animal cartilage is not used in the procedure. The straightforwardness of the extraction procedure also contributes to low sourcing costs. It can also be used as a substitute by vegetarians and others who have dietary or religious restrictions, so its demand is expected to rise in Asian and Middle Eastern countries.

Application Insights

- Nutraceuticals

- Pharmaceuticals

The industry was dominated by the nutraceuticals sector in 2024. Its high market share is credited to the sector's increasing investments due to the requirement to create new and more potent dietary supplements. It is commonly used as a dietary supplement to cure osteoarthritis and joint discomfort in the nutraceutical industry. They are consumed to reduce the pain of arthritis and to strengthen the bones, joints, and cartilage. The source is categorized, considering each country's national laws.

To treat arthritis pain, it is recommended as a dietary supplement along with glucosamine in the US. The market is expected to grow as dietary supplement intake rises in countries like the United States. Moreover, chondroitin sulfate and glucosamine hydrochloride are frequently found in animal feed additives. Pet diets, especially those for cats and dogs, comprise chondroitin sulfate from bovine sources to enhance joint health and mobility. The medication is also used to treat chronic pain brought on by patellar luxation and intervertebral disc disease, osteoarthritis, hip dysplasia, and intervertebral disc disease.

Chondroitin Sulfate Market Companies

- Solabia Group

- Knowde

- JIAXING HENGJIE BIOPHARMACEUTICAL CO., LTD.

- SEIKAGAKU CORPORATION

- Stanford Chemicals

- Qingdao Wantuming Biological Products Co, Ltd.

- ZPD A/S (Denmark)

- Sioux Pharm, Inc.

- Sino Siam Bio technique Co., Ltd.

- Summit Nutritionals International

- William Reed Ltd.

- Bioiberica S.A.U.

- Yantai Ruikangda Biochemical Products Co., Ltd

Recent Development

- In April 2, 2025, Gnosis by Lesaffre revealed a rebranding of its chondroitin sulfate product. The updated name, MyCondro, formerly Mythocondro, introduced in 2016, aims to enhance its effectiveness recognition among consumers and features a new logo.

-

In June 2024, Vegetarian glucosamine enters the joint health drink Opening in new window. The development of a new joint health drink made with glucosamine for the US market highlights how the popular joint health ingredient is spreading from the supplement arena to the food and beverage category. It is then used in conjunction with chondroitin.

(Source: https://www.nutraingredients.com) -

In May 2024, BRF SA, a biopharmaceuticals and nutraceuticals company known to produce chondroitin sulfate, and SALIC signed a strategic agreement for product supply under which SALIC can acquire up to 200,000 pounds of products per year in case of food emergency in Saudi Arabia.

-

In April 2024, Borsch Med Pte Ltd, a health and nutrition company, announced the partnership with Zeria Pharmaceutical Co. Ltd as its distributor for chondroitin-based products in the Singapore market.

- In November 2024, Borsch Med Pte Ltd, a prominent health and nutrition firm, announced the availability of Zaria chrondroitin-based joint health supplements at select Unity pharmacies across Singapore. The improved distribution network of the Japanese-produced supplements highlights Borsch Med's dedication to assist Singapore's citizens in their pursuit of healthy and active ageing.

- March 2022 -A new product for its market-dominating joint health brand, Highflex, was created by Bioiberica, a multinational life science company, in collaboration with ByHealth, a major Chinese dietary and vitamin supplement supplier. In China, unmet customer demand for novel, low-dose joint health solutions are satisfied by Highflex type II collagen tablets.

- July 2022 -With the slogan "Making Bones Stronger for Joint Health," Chinese herbal health services and product supplier Infinitus debuted a new line of Li Mai Jian supplements.

Segments Covered in the Report

By Source

- Bovine

- Poultry

- Synthetic

- Swine

- Shark

By Application

- Nutraceuticals

- Personal Care & Cosmetics

- Animal Feed

- Pharmaceuticals

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting