What is Claims Processing Software Market?

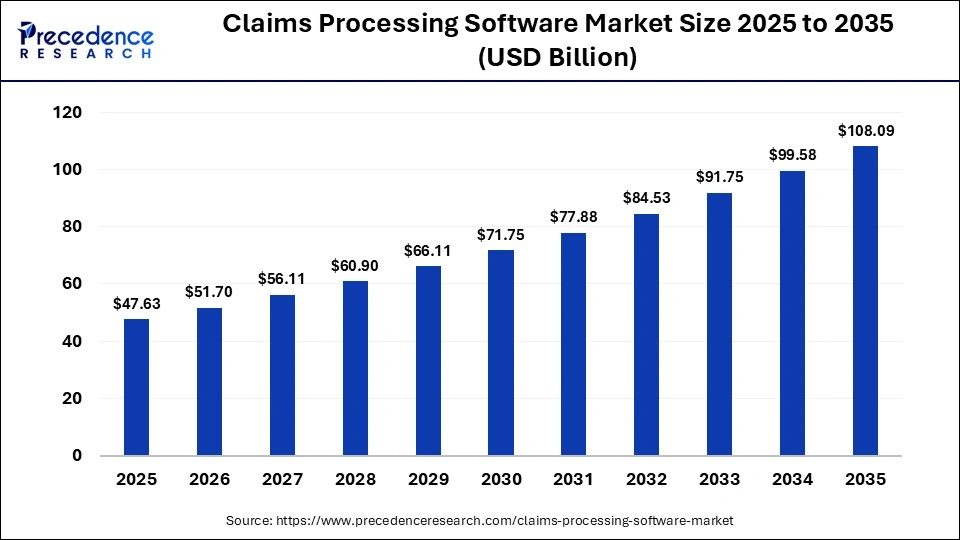

The global claims processing software market size was calculated at USD 47.63 billion in 2025 and is predicted to increase from USD 51.7 billion in 2026 to approximately USD 108.09 billion by 2035, expanding at a CAGR of 8.54% from 2026 to 2035. The market is driven by the growing adoption of claim processing software from governmental organizations, along with the rapid investment by software companies in developing advanced software solutions to enhance claim processing capabilities.

Market Highlights

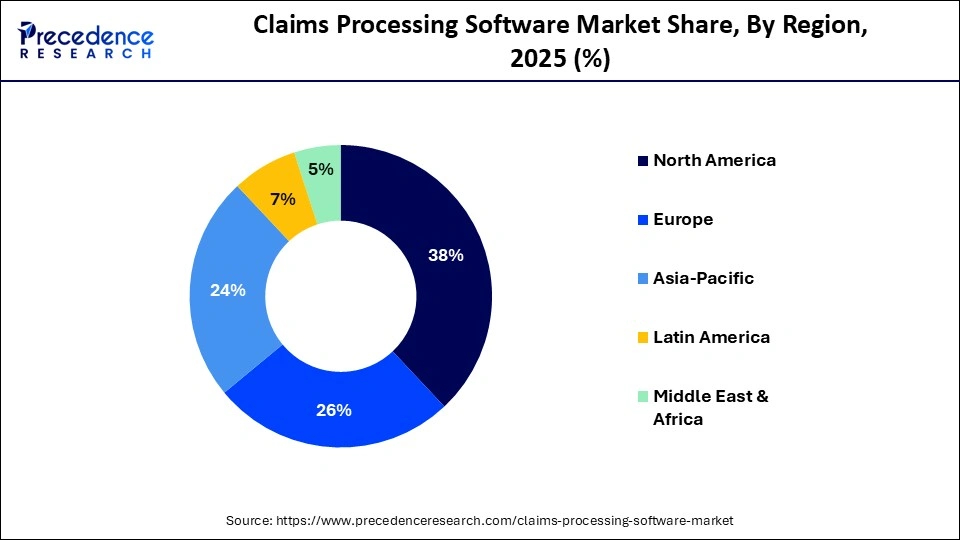

- North America led the market with a share of 38% in 2025.

- Asia Pacific is expected to grow at the highest CAGR during the forecast period.

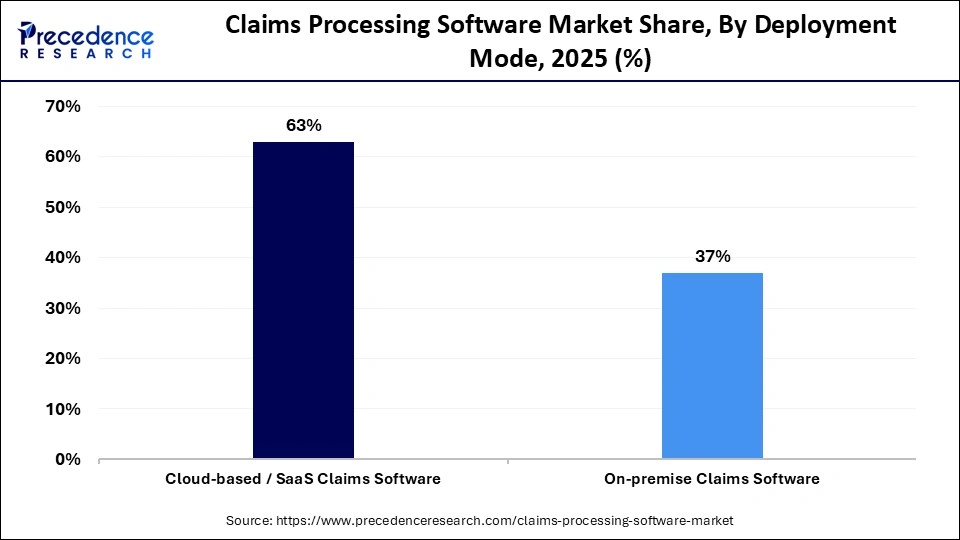

- By deployment mode, the cloud-based / SaaS claims software segment held the largest market share of 63% in 2025.

- By deployment mode, the on-premises claims software segment is expected to expand at a considerable CAGR during the forecast period.

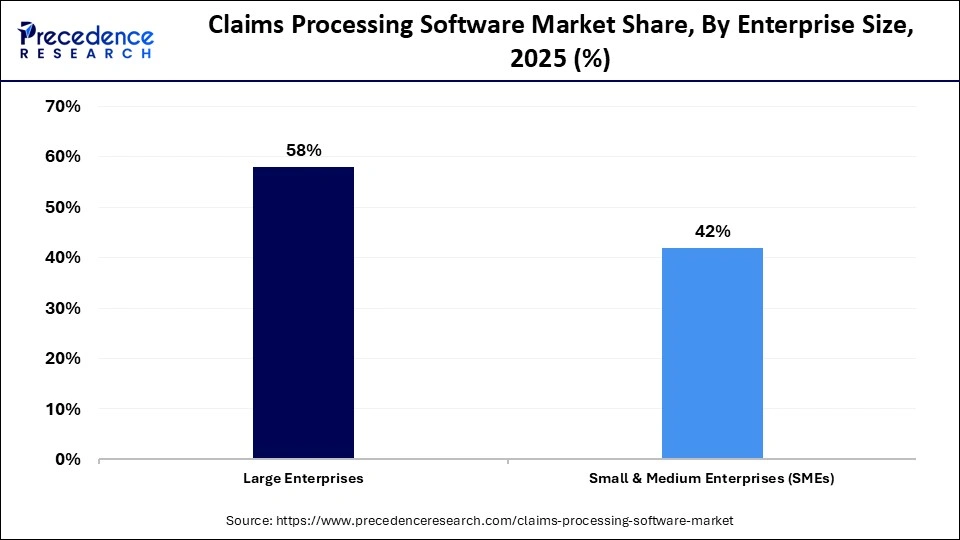

- By enterprise size, the large enterprises segment held the highest market share of 58% in 2025.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to grow at the fastest CAGR during the forecast period.

- By claims type, the health insurance claims segment dominated the market with a share of 28% in 2025.

- By claims type, the property & casualty (P&C) claims segment is expected to expand at the highest CAGR during the forecast period.

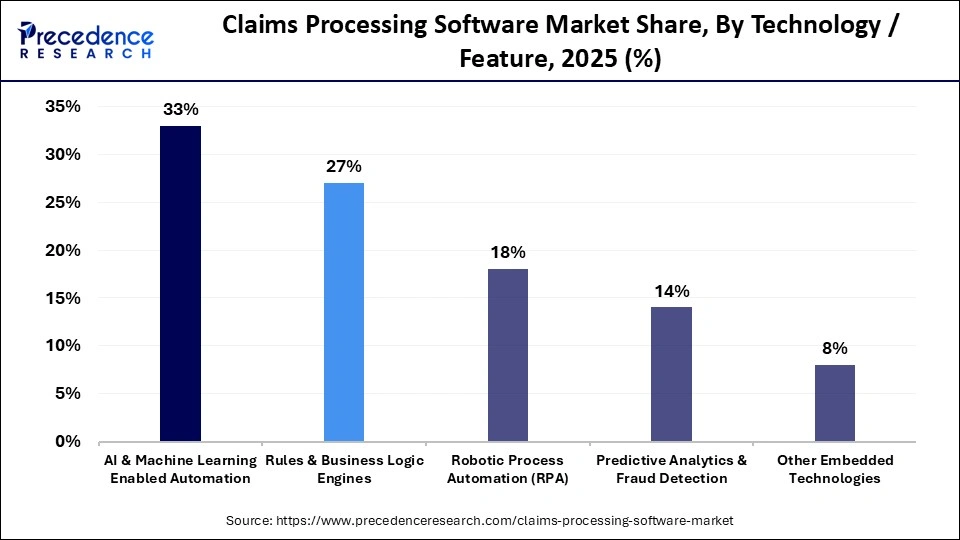

- By technology/feature, the AI & machine learning enabled automation segment held a major market share of 33% in 2025.

- By technology/feature, the predictive analytics & fraud detection segment is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the insurance carriers/insurers segment held the largest share of 62% in 2025.

- By end-user, the third-party administrators (TPAs) segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview

The claims processing software industry is a crucial branch of the ICT sector. This industry deals with the design and development of claims processing software. This software improves operational efficiency, enhances fraud detection, reduces processing errors, supports multi-line claims handling (health, auto, property, casualty), and accelerates claims turnaround time. This market is driven by the growing digital transformation in insurance, increasing demand for customer experience improvement, regulatory compliance requirements, and rapid adoption of analytics and machine learning in the healthcare sector.

Claims Processing Software Market Trends

- Automation & RPA Adoption: Robotic Process Automation (RPA) and workflow automation are increasingly used to reduce manual tasks, speed up claims adjudication, and cut operational costs.

- Collaborations: Several market players are partnering with AI developers to design advanced software for enhancing claim management capabilities.

- Rapid Adoption of Automated Solutions in Hospitals: The surging adoption of automated claims processing software in modern hospitals is an ongoing trend in the industry.

- Service Launches: The software development companies are constantly engaged in launching claim processing services for insurance companies.

- Cloud Based Solutions & SaaS Growth: Cloud deployment continues to gain traction as insurers adopt scalable, secure, and cost-efficient SaaS platforms that enable real-time collaboration, data access, and remote operations.

Why is AI integral in the Claims Processing Software Industry?

Artificial intelligence plays a prominent role in shaping the landscape of the software industry. In the software development sector, AI helps in intelligent debugging, enhancing productivity, and improving user experience. In recent times, several industries have started developing AI-based claims processing software to improve fraud detection capabilities, reduce operational costs, enhance accuracy, and deliver superior customer experience. AI automates complex tasks like claim validation, fraud detection, and risk assessment, reducing human error and speeding up processing times. It also leverages machine learning to analyze historical and real-time data, enabling predictive insights, smarter decision-making, and personalized customer experiences.

- In February 2025, Wisedoc launched an AI-based claims management platform. This platform is designed to enhance the processing of complex medical records in the healthcare sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 47.63 Billion |

| Market Size in 2026 | USD 51.7 Billion |

| Market Size by 2035 | USD 108.09 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution Type, Deployment Model, Organization Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Deployment Mode Insights

Why Did the Cloud-Based / Saas Claims Software Segment Dominate the Market?

The cloud-based / SaaS claims software segment dominated the claims processing software market with a share of 63% in 2025 and is expected to grow at the fastest rate in the coming years. This is due to the surging adoption of cloud-based software by insurance companies to enhance their operational efficiency. Cloud deployment offers insurers scalable, flexible, and cost-effective solutions that can be deployed rapidly without heavy IT infrastructure investments. These platforms enable real-time access to data, seamless collaboration across departments, and remote operations, which are essential for modern, digital-first claims management.

The on-premises claims software segment is expected to grow at a considerable CAGR during the forecast period. This is mainly due to the rapid deployment of on-premises software in manufacturing companies to improve their claim management capabilities. Moreover, numerous advantages of on-premises software, such as high security, cost-effectiveness, and enhanced flexibility, are expected to drive its adoption.

Enterprise Size Insights

How Does the Large Enterprises Segment Dominate the Claims Processing Software Market?

The large enterprises segment dominated the claims processing software market with a major share of 58% in 2025. This is because big insurers and multinational companies handle a high volume of claims, requiring robust, scalable, and integrated software solutions to manage complex workflows efficiently. These organizations have the resources to invest in advanced features like AI-driven analytics, automation, and cloud-based platforms, which optimize claim processing, reduce operational costs, and improve customer experience. Their scale and need for compliance across multiple regions further drive the adoption of sophisticated claims software, reinforcing their market dominance.

The small & medium enterprises (SMEs) segment is expected to grow with the fastest CAGR during the forecast period. This is because small and mid-sized insurers are increasingly adopting digital solutions to streamline operations, reduce manual work, and stay competitive. Additionally, the rising focus on improving customer experience and regulatory compliance is encouraging SMEs to invest in modern, scalable claims software, fueling growth in this segment.

Claims Type Insights

What Made Health Insurance Claims the Leading Segment in the Claims Processing Software Market?

The health insurance claims segment led the claims processing software market with a share of 28% in 2025. This is due to the high volume and complexity of medical claims, which require efficient verification, adjudication, and fraud detection. There is heightened demand for faster claim settlements, integration with electronic health records (EHRs), and compliance with stringent healthcare regulations. Moreover, the increasing focus of insurance companies to launch a wide range of health insurance policies is expected to drive the growth of this segment.

The property & casualty (P&C) claims segment is expected to grow with the highest CAGR during the forecast period. This is due to increasing demand for faster, more accurate handling of complex claims related to auto, home, and commercial insurance. Advanced software helps insurers automate damage assessments, fraud detection, and policy verification, reducing processing time and operational costs. Additionally, partnerships among construction companies and insurance providers to develop and deploy advanced claim processing software to gather information about property damage are expected to propel the growth of this segment.

Technology/Feature Insights

Why Did the AI & Machine Learning Enabled Automation Segment Dominate the Claims Processing Software Market?

The AI & machine learning enabled automation segment dominated the claims processing software market with a share of 33% in 2025. This is due to the increased demand for AI-enabled claims processing software from the healthcare sector. These technologies significantly enhance efficiency by automating repetitive tasks, detecting fraud, and accurately validating claims on a large scale. Furthermore, insurers increasingly rely on AI-driven automation to optimize workflows, cut processing costs, and maintain compliance, solidifying this segment's leading position.

The predictive analytics & fraud detection segment is expected to expand at the fastest CAGR during the forecast period, as insurers are increasingly leveraging data-driven tools to identify fraudulent claims early and optimize decision-making. Advanced analytics and AI help reduce financial losses, improve claim accuracy, and enhance operational efficiency, driving higher adoption of these technologies. Additionally, rising regulatory scrutiny and the need for faster, more reliable claims handling are further fueling demand for predictive and fraud detection solutions.

End-User Insights

How Does the Insurance Carriers/Insurers Segment Dominate the Claims Processing Software Market?

The insurance carriers/insurers segment dominated the claims processing software market with the largest share of 62% in 2025. This is due to the increased demand for advanced claims processing solutions from the insurance companies to enhance their operational capabilities. Large insurers handle high volumes of claims, making automation and advanced software critical for efficiency, accuracy, and compliance with regulatory standards. Their continuous investment in digital transformation and technology adoption further reinforces their dominant position in the market.

The third-party administrators (TPAs) segment is expected to grow at the highest CAGR during the forecast period because TPAs manage claims on behalf of multiple insurers and need efficient, scalable solutions to handle high volumes accurately. Advanced software helps TPAs reduce processing time, minimize errors, and improve transparency for both insurers and policyholders. Additionally, the rising outsourcing of claims operations by insurers to TPAs is boosting the demand for automated and integrated claims management systems.

Regional Insights

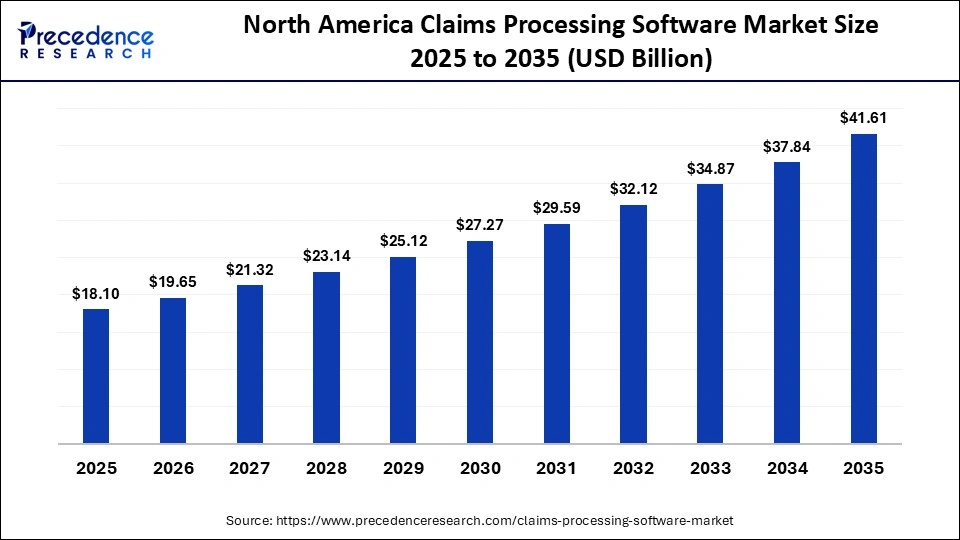

How Big is the North America Claims Processing Software Market Size?

The North America claims processing software market size is estimated at USD 18.10 billion in 2025 and is projected to reach approximately USD 41.61 billion by 2035, with a 8.68% CAGR from 2026 to 2035.

Why Did North America Dominate the Claims Processing Software Market?

North America dominated the claims processing software market, accounting for 38% share in 2025. This is due to the surging demand for workflow automation software from the public sector entities, as well as the rapid deployment of cloud-based claims processing software in the insurance sector. There is a significant rise in the number of software development companies, which positively contributed to the market. The region's early adoption of advanced technologies like AI, RPA, and cloud computing, combined with strict regulatory and compliance requirements, drove insurers to implement sophisticated software solutions. Moreover, the presence of various claims processing software companies, including Cognizant, Oracle, Guidewire, Claim Vantage, and Optum, is expected to drive the growth of the claims processing software market in this region.

- In October 2025, Optum launched Optum Real. Optum Real is an AI-based claims review software designed for the healthcare sector of the U.S. region.

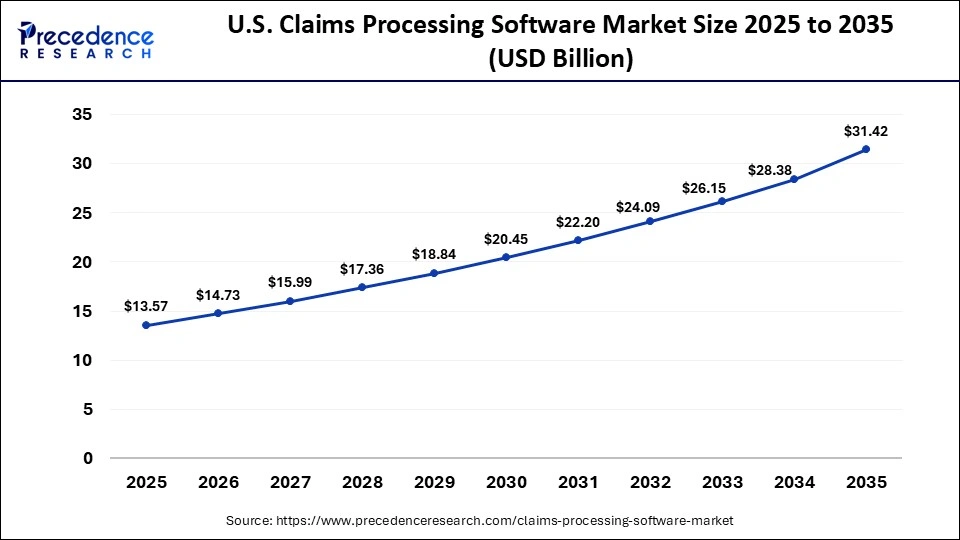

What is the Size of the U.S. Claims Processing Software Market?

The U.S. claims processing software market size is calculated at USD 13.57 billion in 2025 and is expected to reach nearly USD 31.42 billion in 2035, accelerating at a strong CAGR of 8.76% between 2026 to 2035.

U.S. Claims Processing Software Market Trends

The market in the U.S. is driven by the rapid adoption of advanced claims processing software in pharmacies and retail outlets, along with the growing emphasis of the logistics companies on deploying advanced software to enhance claim management procedures. Also, the surging focus of e-commerce brands to deploy cloud-based claim processing software in their supply chain operations is expected to accelerate market growth.

Why is Asia Pacific Expanding with the Fastest CAGR During the Forecast Period?

Asia Pacific is expected to grow with the fastest CAGR in the market during the forecast period. This is due to the rise in the number of insurance brokers in various countries, including China, India, South Korea, and Japan, which has increased the demand for advanced software. Also, the rapid investment by the government in deploying advanced software in the tax department, along with the proliferation of software startups, is positively contributing to the market. Moreover, the presence of several market players such as Seamless Insure, MotionsCloud, FPT Software, and Azentio Software is expected to foster the growth of the claims processing software market in this region.

- In May 2025, Azentio Software launched the AMLOCK anti-money laundering (AML) platform. This platform is designed for the BFSI sector of the APAC region.

China Claims Processing Software Market Analysis

China is a major contributor to the market within Asia Pacific. The rapid expansion of its insurance and healthcare sectors is driving the market. Strong government initiatives promoting digital transformation and regulatory reforms are encouraging insurers to adopt automated and AI-driven solutions. Additionally, advancements in cloud computing, mobile technology, and the focus on improving customer experience are accelerating the adoption of claims processing software across the country.

Who are the Major Players in the Global Claims Processing Software Market?

The major players in the claims processing software market include Cognizant, Oracle, SAP, Mediware Information Systems, Verisk Analytics, Xactware Solutions, Guidewire Software, and ClaimVantage

Recent Developments

- In September 2025, BriteCore launched a new range of cloud-based claim processing solutions. This claim processing software is designed for insurance companies to improve visibility across teams, streamline workflows, and save time.(Source: https://www.britecore.com)

- In September 2025, Shift Technology launched Shift Claims. Shift Claims is an AI-based software designed to transform the claims management operations in the insurance sector.(Source: https://fintech.global)

- In February 2025, Capital Rx, Inc. launched Judi Health. Judi Health is an advanced software designed to enhance claims processing in the pharmacy and medical sector.(Source: https://www.judi.health)

Segments Covered in the Report

By Deployment Mode

- Cloud-based/ SaaS claims software

- On-premise claims software

By Enterprise Size

- Large Enterprises

- Medium & Small Enterprises (SMEs)

By Claims Type

- Health Insurance Claims

- Auto Insurance Claims

- Property & Casualty (P&C) Claims

- Life Insurance Claims

- Other Claims (Travel, Specialty lines)

By Technology/Feature

- AI & Machine Learning Enabled Automation

- Rules & Business Logic Engines

- Robotic Process Automation (RPA)

- Predictive Analytics & Fraud Detection

- Other Embedded Technologies

By End-User

- Insurance Carriers / Insurers

- Third-Party Administrators (TPAs)

- Brokers & Agents

- Government & Public Sector Programs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting