Data Processing and Hosting Services Market Size and Forecast 2025 to 2034

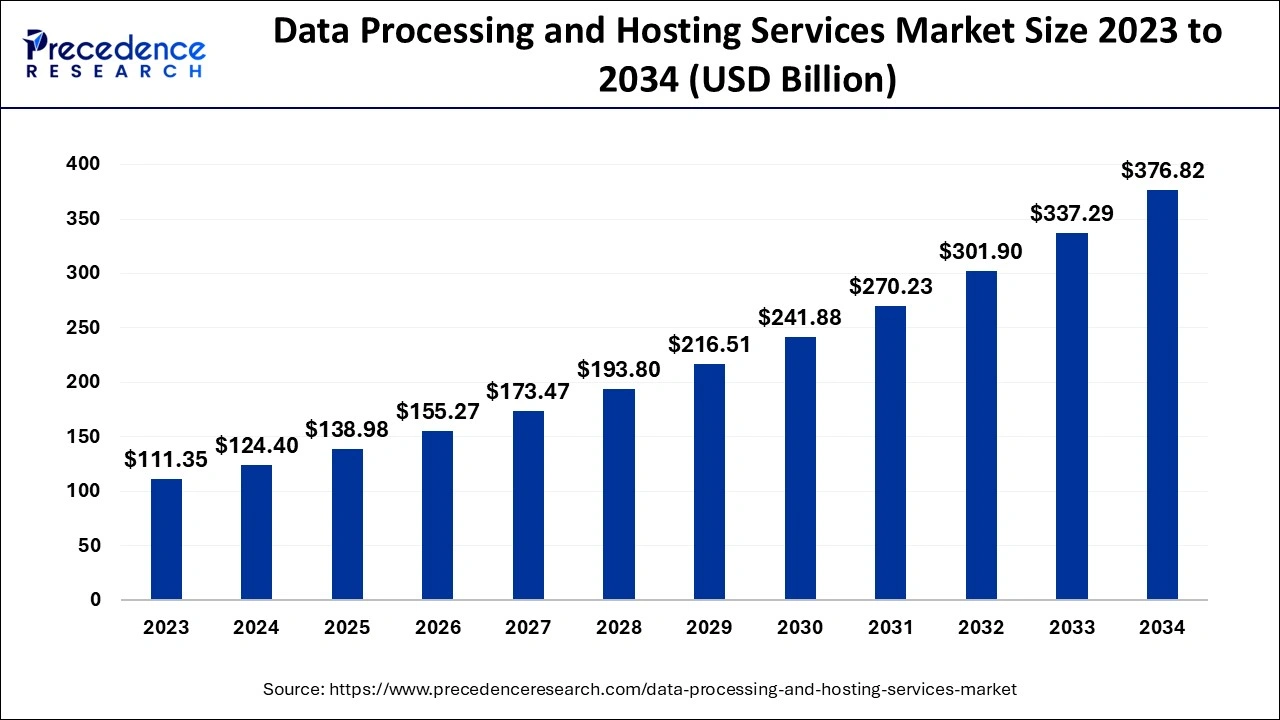

The global data processing and hosting services market size was accounted at USD 124.40 billion in 2024, and is anticipated to reach around USD 376.82 billion by 2034, expanding at a CAGR of 11.72% from 2025 to 2034. The market has witnessed rapid growth, fueled by the increasing demand for digital services among industries. Companies have turned to cloud-based data processing services, which provide cost-efficiency, flexibility, and scalability. Furthermore, adopting AI, IoT, and big data applications has further driven the data processing and hosting services market.

Data Processing and Hosting Services Market Key Takeaways

- The global data processing and hosting services market was valued at USD 124.40 billion in 2024.

- It is projected to reach USD 376.82 billion by 2034.

- The data processing and hosting services market is expected to grow at a CAGR of 11.72% from 2025 to 2034.

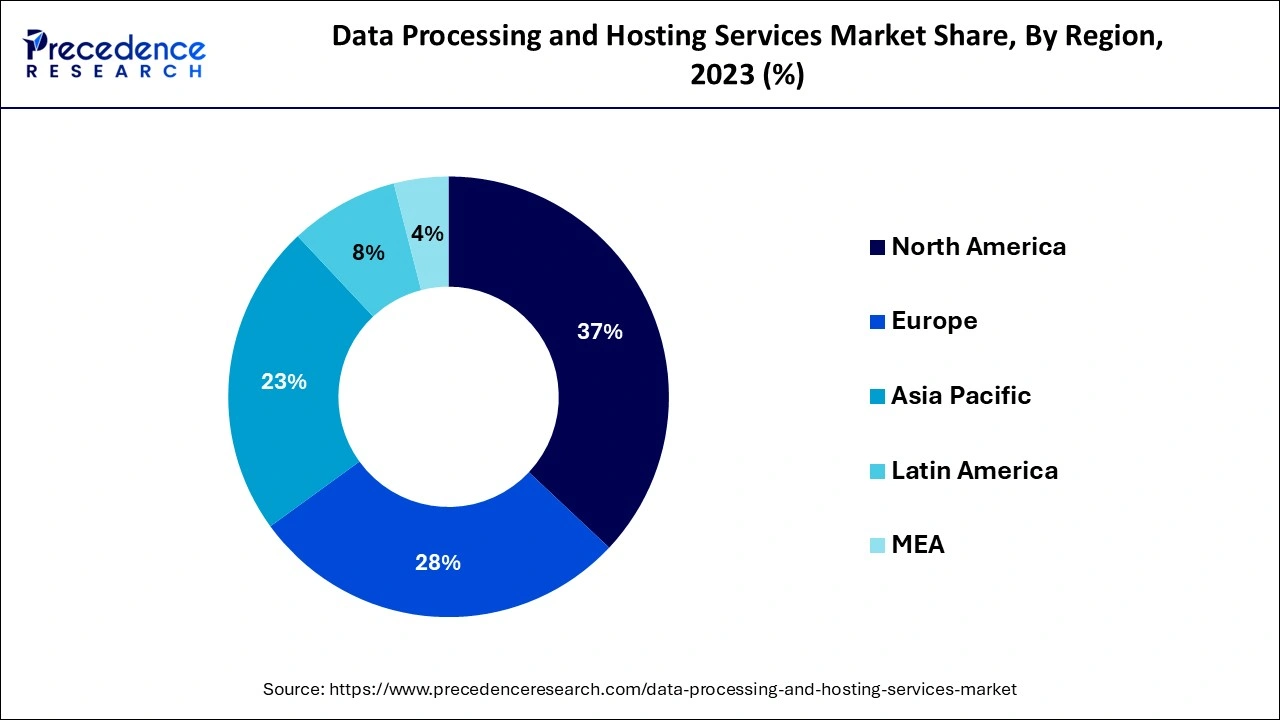

- North America led the data processing and hosting services market with the largest market share of 37% in 2024.

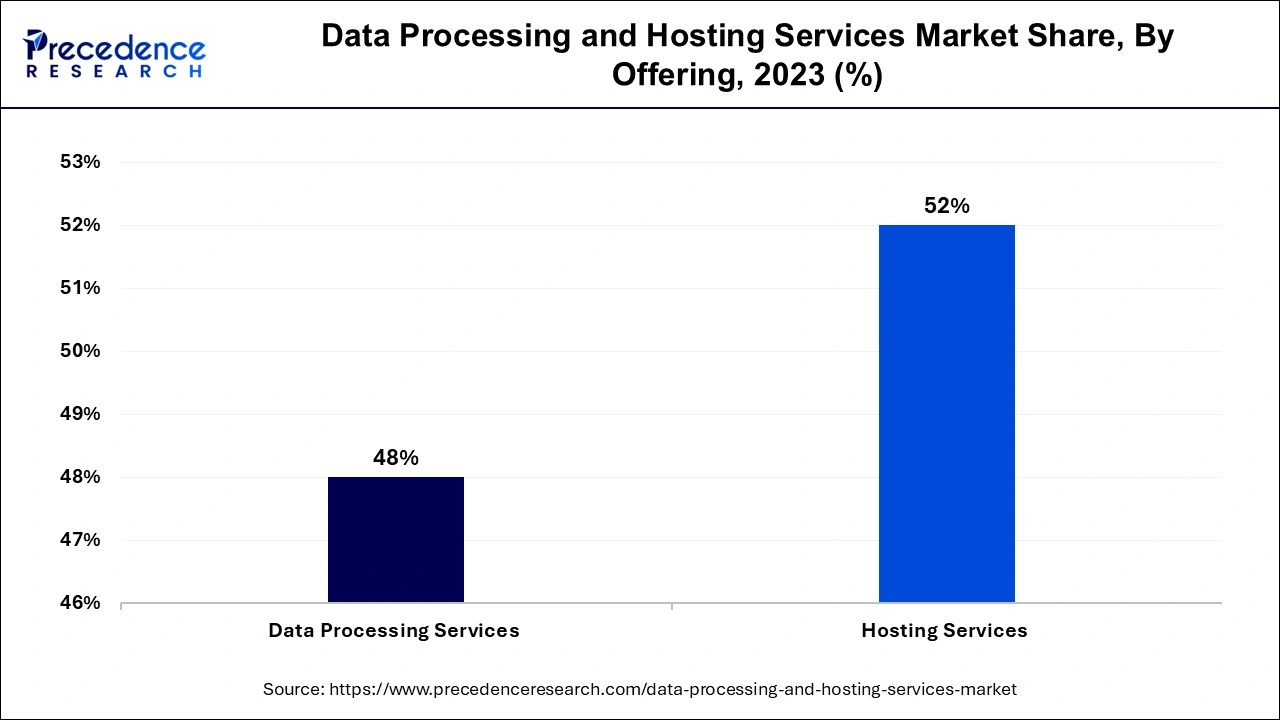

- By offering, the hosting services segment accounted for the largest market share of 52% in 2024.

- By offering, the data processing services segment is expected to grow at a notable CAGR of 12.42% market during the forecast period.

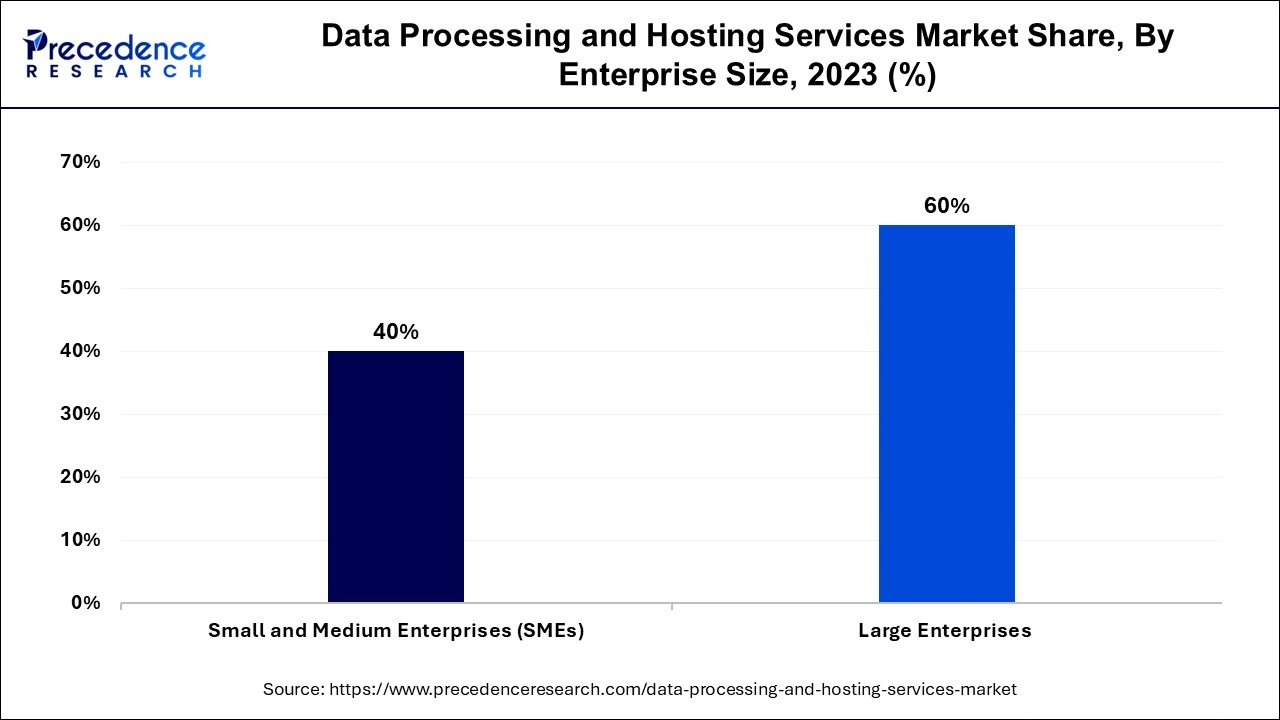

- By enterprise size, the large enterprises segment contributed the highest market share of 60% in 2024.

- By enterprise size, the SME segment is expected to grow at a solid CAGR of 13.02% during the forecast period.

- By end use, the IT and telecom segment has held the major market share of 27% in 2024.

- By end use, the manufacturing segment is expected to grow at a double-digit CAGR of 12.42% during the forecast period.

U.S. Data Processing and Hosting Services Market Size and Growth 2025 to 2034

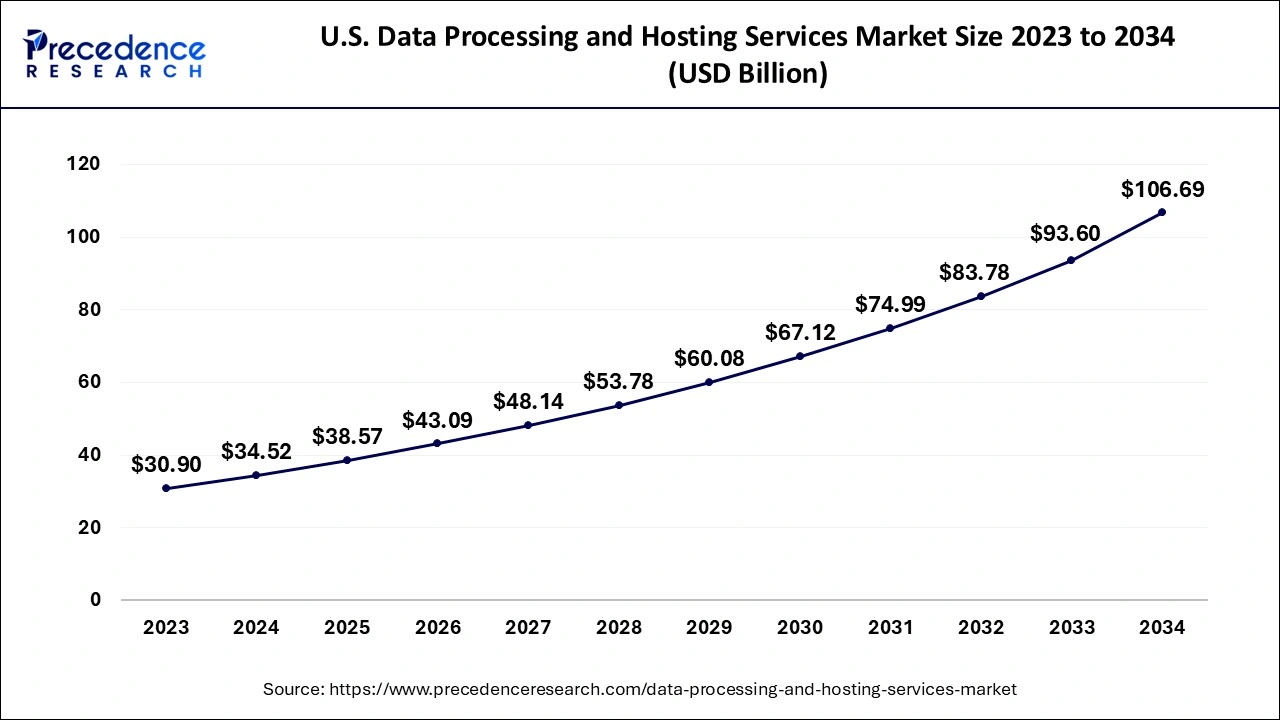

The U.S. data processing and hosting services market size was estimated at USD 34.52 billion in 2024 and is expected to be worth around USD 106.69 billion by 2034, growing at a CAGR of 11.95% from 2025 to 2034.

North America held the largest share of the data processing and hosting services market in 2024. Digital transformation efforts are boosting businesses in the region to migrate to cloud-based platforms, automate processes, and modernize their IT infrastructure. These strategies are necessary for staying up in the rapidly digital economy. The demand for advanced data hosting and processing services has surged as companies embrace digital technologies and tools. Robust infrastructure is required to store, process, and manage large volumes of data efficiently as organizations seek secure and scalable data processing services to support their transformation efforts.

The data processing and hosting services market is growing significantly in the U.S. The country leads in cloud adoption, with businesses across industries rapidly adopting hybrid, private, and public cloud data processing services for cost efficiency, flexibility, and scalability. This significant adoption has become a major driver in the region. In addition, companies in the U.S. are heavily investing in big data analytics, machine learning, and artificial intelligence. These advanced technologies need accurate data hosting and processing abilities, accelerating the demand for robust infrastructure to manage large-scale data analysis and management.

Asia Pacific is expected to grow at the fastest rate in the data processing and hosting services market during the forecast period. China, India, Japan, and South Korea are the developing countries in Asia Pacific. These countries are accelerating the demand for data hosting and processing services significantly. These countries are witnessing rapid growth in internet adoption owing to higher e-commerce growth and digital engagement. As consumers and businesses adopt online services and digital technologies in these countries, the need for efficient and scalable data processing services increases. Furthermore, infrastructure development and ongoing digital innovation are prevalent in these countries.

Market Overview

The data processing and hosting services market deals with data processing and hosting activities. Data processing services offer specialized reports from the data provided by clients. Hosting services can involve application and web hosting. Cloud adoption is a notable growth factor in this transformation as businesses rapidly leverage cloud services as a service, software as a service, and platform as a service.

Multi-cloud and hybrid strategies are also gaining traction as businesses aim to balance cost, security, and performance across various cloud environments, ensuring agility and resilience in their digital operations. In addition, integrating machine learning and AI in data hosting and processing services is expected to drive the growth of the data processing and hosting services market during the forecast period.

Data Processing and Hosting Services Market Growth Factors

- Companies can gain predictive insights, enhance data analytics, and automate workflows by leveraging AI, which is expected to drive the data processing and hosting services market growth.

- The rapid digital transformation of several end-user markets globally as customers increasingly stream content online, communicate via online-based messenger services, shop online, and play online video games. This trend is anticipated to drive the demand for the market.

- Businesses across developing markets have rapidly outsourced their IT infrastructure needs, further fueling the market's growth.

- The increasing demand from companies, including retail, for online presence is further anticipated to drive the growth of the data processing and hosting services market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 376.82 Billion |

| Market Size in 2024 | USD 124.4 Billion |

| Market Size in 2025 | USD 138.98 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.72% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Enterprise Size, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

The adoption of web and mobile applications

The explosion of web and mobile applications has significantly affected the data processing and hosting services market for backend infrastructure, particularly in data storage and processing. As customers increasingly rely on applications for entertainment, shopping, communication, and even healthcare, the volume of applications has skyrocketed. Millions of interactions and transactions are processed daily by platforms such as social media networks, messaging applications, and e-commerce sites. For instance, the demand for virtual healthcare solutions increased, pushing data hosting providers to increase their infrastructure to accommodate the increased data traffic rapidly.

Restrain

Stringent laws

The personal data of millions of individuals was exposed because of these challenges, which resulted in legal, irreversible damage to brand reputation, substantial financial losses, and irreversible consequences damage to brand reputation. Regulations govern transferring, processing, storing, and collecting personal information and ensuring that companies respect individuals' privacy rights. Strict laws such as the U.S.'s California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) impose rigorous guidelines on how companies in the data processing and hosting services market must handle data. Due to this, companies are often reluctant to embrace cloud-based hosting services and fully process data.

Opportunity

Edge computing

By bringing data processing closer to the data processing and hosting services market, edge computing changes the game for web hosting at edge nodes instead of far-off data centers. This enhances content delivery for applications that need real-time data processing, such as interactive applications and Internet of Things (IoT) devices, by handling data closer to the user. Thus, it's clear that this advanced trend is growing rapidly. To meet the needs of modern devices and applications, edge computing will be the key trend, whether it's driving localized data processing or improving the user experience.

- In 2024, 73% of businesses across various industries are planning to increase their investment in edge technology.

Offering Types Insights

The hosting services segment accounted for the largest share of the data processing and hosting services market in 2024. Businesses in all industries need reliable hosting to support their digital storefronts, applications, and websites, which has become important in the digital economy. This demand reaches companies of all sizes, from small firms to large companies. The segment growth is attributed to the need for a strong online presence and rapid growth of e-commerce. The preference for hybrid and remote work models has further escalated the prevalence of cloud-based collaboration secure hosting solutions, VPNs, and tools. Due to the employees working from several locations, Businesses turn to secure and scalable hosting services to ensure effective communication, data security, and uninterrupted operations.

The data processing services segment is expected to grow rapidly in the data processing and hosting services market during the forecast period. As businesses need instant decision-making capabilities based on live data, the demand for real-time data processing is rising. This is particularly vital in industries such as e-commerce, telecommunication, and finance, where real-time data analytics are crucial for staying responsive and competitive to market changes. Analyzing and processing data in real time allows companies to react efficiently and quickly. In addition, the exponential growth in data generation from enterprise systems, social media, and IoT devices is increasing the need for advanced data processing capacities. This advanced trend drives demand for real-time data processing and batch services and allows businesses to harness data effectively.

Enterprise Size Insights

The large enterprises segment held the largest share of the data processing and hosting services market in 2024. To modernize the IT infrastructure of large enterprises, they focus on digital transformation, driving demand for hosting services and advanced data processing. This includes automating workflows to improve efficiency, adopting AI and machine learning technologies, and migrating legacy systems to the cloud. These modernization efforts need reliable and scalable data processing solutions to manage increasing digital workloads. In addition, major enterprises manage massive volumes of data among various functions such as operational analytics, customer data, and more. They need both batch and real-time processing capabilities to derive actionable insights from this data. Processing vast datasets efficiently allows large enterprises to stay competitive in a data-driven world, optimize operations, and make informed decisions.

The SME segment is expected to grow significantly in the data processing and hosting services market during the forecast period. Due to their flexibility, scalability, and cost-effectiveness, SMEs rapidly adopt cloud-based solutions. Furthermore, the demand for robust data hosting and processing services increases as SMEs pursue digital transformation. To support their online operations, they rely on services such as customer management systems, digital marketing, and e-commerce platforms. This preference enhances the strong demand for web and cloud hosting services as SMEs expand and modernize their digital abilities.

End-use Types Insights

The IT & telecom segment held a significant share of the data processing and hosting services market in 2024. Telecom and IT companies are rapidly adopting cloud services to efficiently handle large volumes of data, deliver scalable solutions, and upgrade their infrastructure. Cloud computing provides these companies with the flexibility to estimate based on demand, which is necessary for supporting diverse applications and managing dynamic workloads. In addition, by reducing the need for maintenance and on-premises, cloud services provide cost-effective solutions. This preference enables telecom and IT providers to improve their service offerings, address the growing demands of their customers more effectively, and improve operational efficiency.

The manufacturing segment is expected to grow rapidly in the data processing and hosting services market during the forecast period. Adopting industry 4.0 technologies such as smart manufacturing, robotics, and automation boosts the need for advanced data hosting and processing solutions. To ensure efficient operations, these technologies generate vast amounts of data that must be analyzed and processed in real-time to guarantee efficient operations. Real-time data processing allows manufacturers to improve and monitor production processes, quickly respond to operational issues, and improve accuracy. As industry 4.0 includes, robust data processing infrastructure is vital for leveraging insights and managing complex data streams to enhance manufacturing effectiveness and efficiency.

Data Processing and Hosting Services Market Companies

- GoDaddy Operating Company LLC.

- Bluehost; HostGator.com LLC

- Hostinger International Ltd.

- Amazon Web Services Inc.

- SiteGround Hosting Ltd.

- A2Hosting

- DreamHost LLC.

- GreenGeeks.com

- IBM Corporation

- Teradata Corporation

- Hewlett Packard Enterprise Development LP

- SAP SE

- Oracle Corporation

- Alteryx Inc.

- Cloudera Inc.

- Salesforce.com Inc.

Recent Developments

- In October 2024, Liquid Web, a leader in managed hosting and scalable cloud solutions for small to medium-sized businesses (SMBs), announced the launch of its new GPU hosting solution. This solution is designed for developers who need robust computational power. GPU hosting is an ideal platform for rendering, machine learning (ML), and artificial intelligence.

- In August 2024, a global leader in location technology, Mapbox, introduced new abilities for Mapbox Tiling Service to efficiently serve, style, and process data from weather visualizations to custom aerial imagery and satellite.

- In February 2024, the Cabinet Office's buying arm, the Crown Commercial Service, launched a framework deal for G-Cloud 14 Lots 1-3 for cloud hosting. This hosting is available to a broad range of local public sector bodies, which could be worth up to £ 6.5 billion.

- In March 2023, an AI supercomputing service, NVIDIA DGX Cloud was announced by NVIDIA that gives enterprises immediate access to the software and infrastructure needed to train advanced models for generative AI and other advanced applications.

Segments Covered in the Report

By Offering

- Data processing services

- Batch processing

- Real-time processing

- Hosting services

- Web hosting

- Cloud hosting

- Shared (reseller) hosting

- Others

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End Use

- BFSI

- Healthcare

- Government

- Manufacturing

- IT & telecom

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content