Clinical Trial Supply And Logistics Market Size and Forecast 2025 to 2034

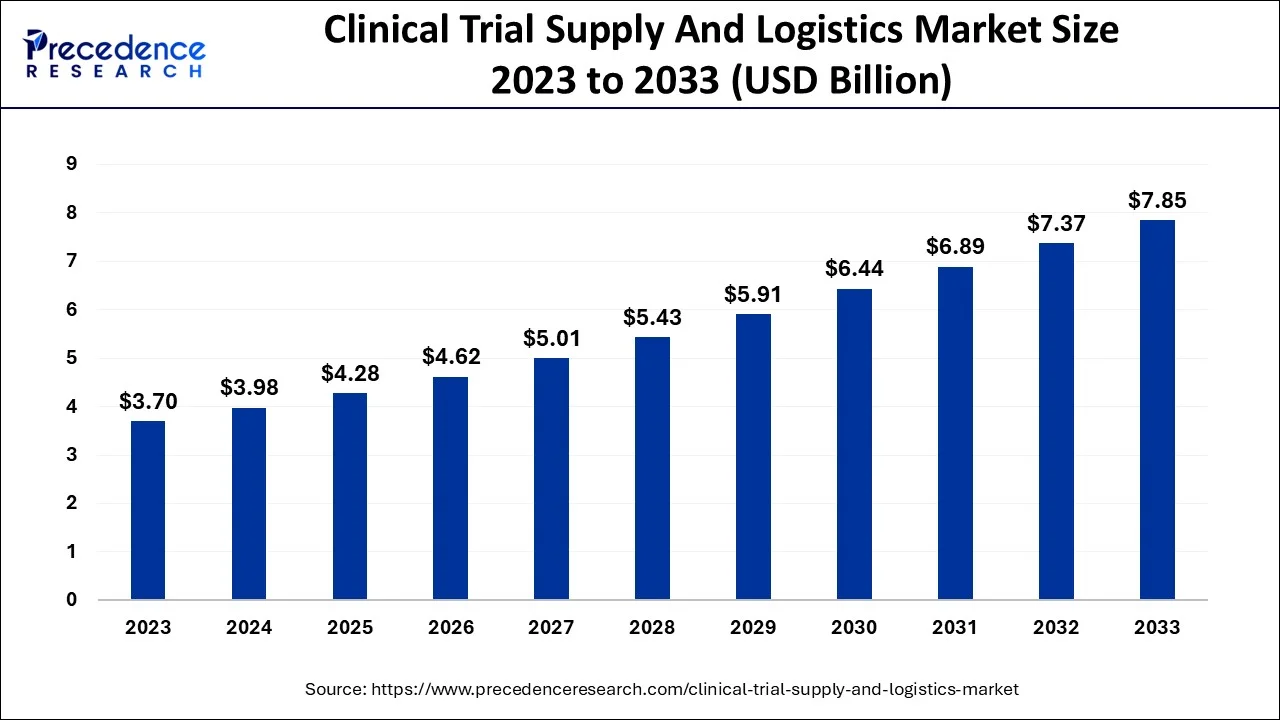

The global clinical trial supply and logistics market size was estimated at USD 3.98 billion in 2024 and is predicted to increase from USD 4.29 billion in 2025 to approximately USD 8.45 billion by 2034, expanding at a CAGR of 7.84% from 2025 to 2034.

Clinical Trial Supply and Logistics Market Key Takeaways

- In terms of revenue, the global clinical trial supply and logistics market was valued at USD3.98 billion in 2024.

- It is projected to reach USD 8.45 billion by 2034.

- The market is expected to grow at a CAGR of 7.84% from 2025 to 2034.

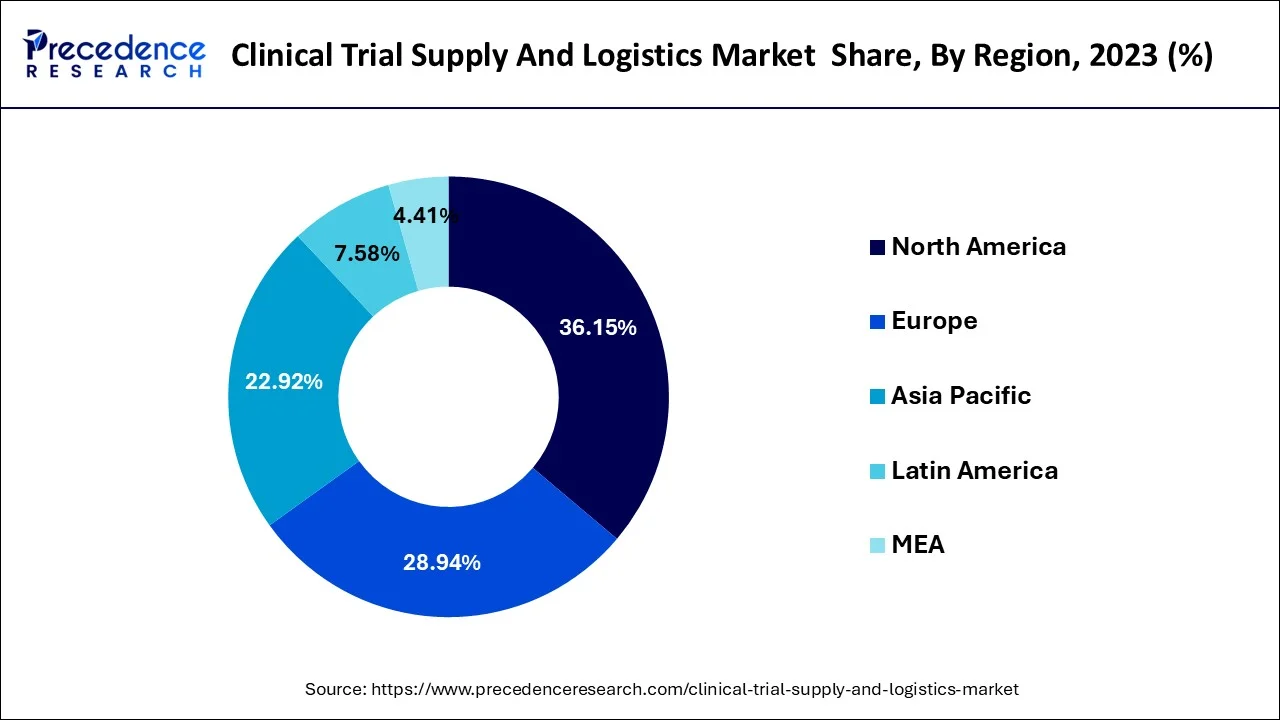

- North America dominated the global market with the largest market share of 36% in 2024.

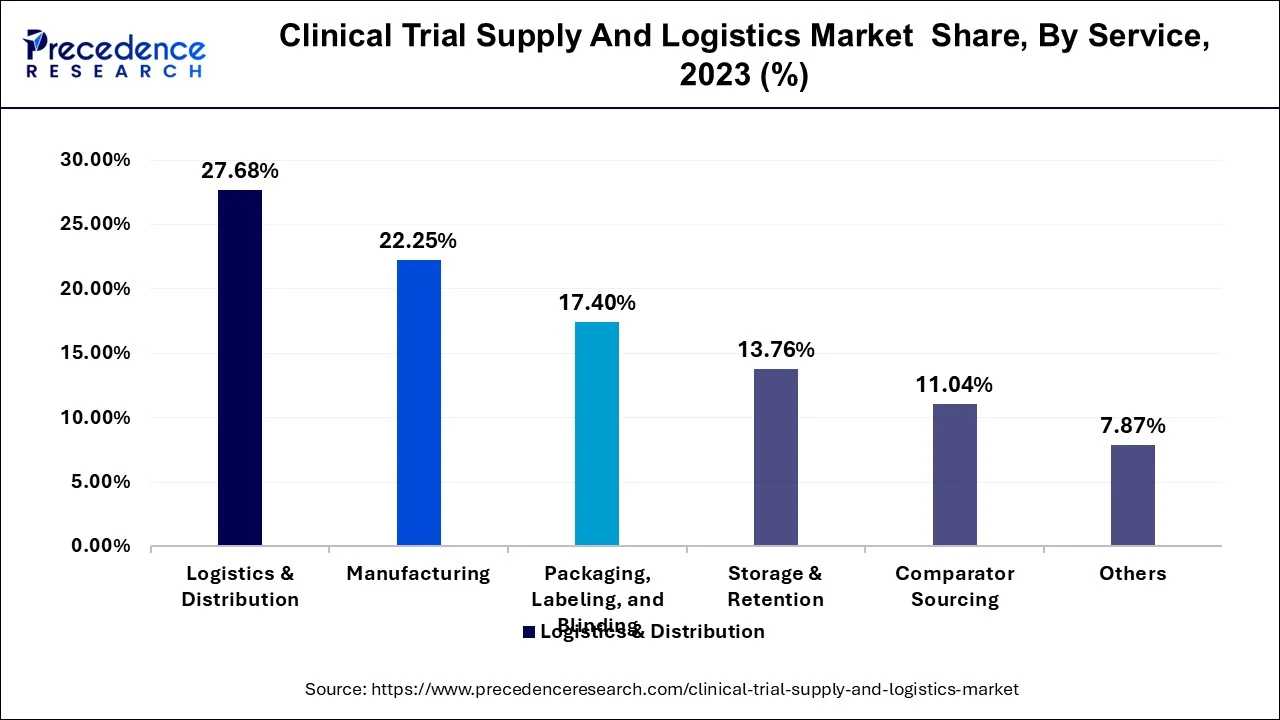

- By service, the logistics & distribution segment captured the biggest market share of 27.85% in 2024.

- By service, the manufacturing segment is projected to grow at a significant CAGR from 2025 through 2034.

- By phase, Phase 3 contributed the highest market share of 40.41% in 2024.

- By phase, Phase 2 is expected to experience the fastest CAGR between 2025 and 2034.

- By therapeutic area, the cardiovascular diseases segment held the largest market share of 32.33% in 2024

- By therapeutic area, the rare diseases and orphan indications segment is expected to witness significant growth from 2025 to 2034.

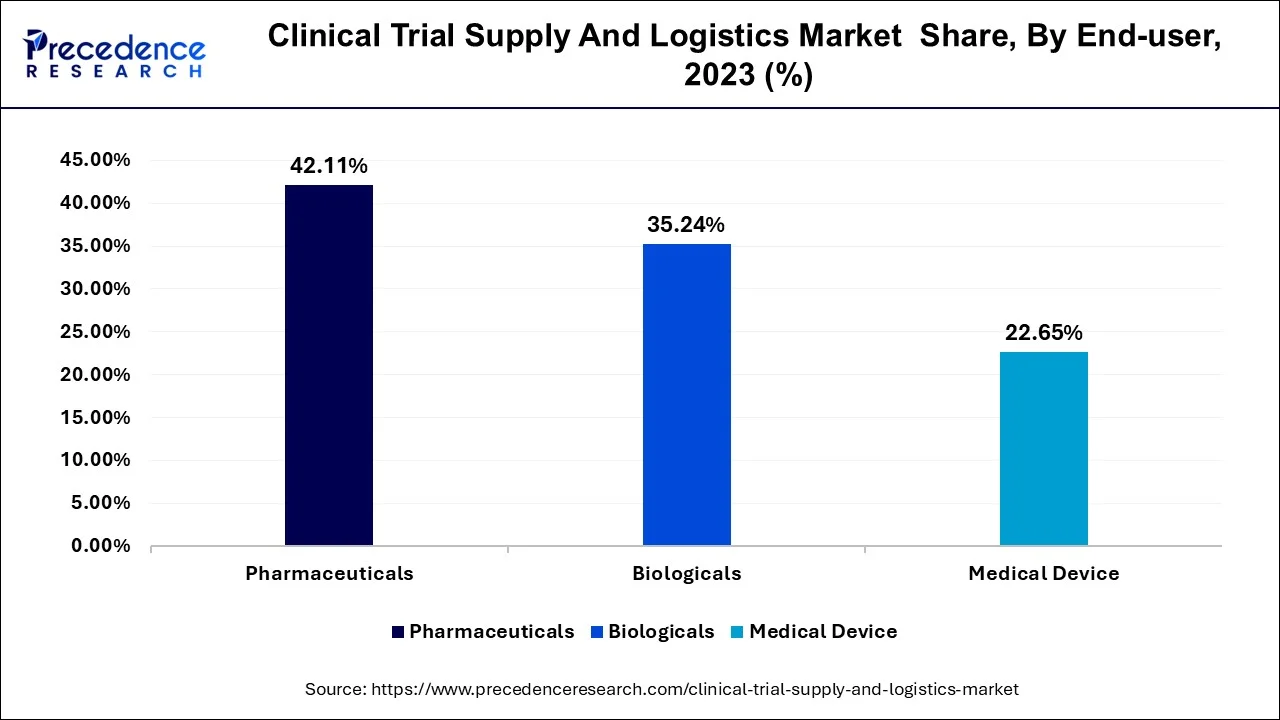

- By end user, the pharmaceuticals segment generated the major market share of 42.22% in 2024

U.S. Clinical Trial Supply and Logistics Market Size from 2025 to 2034

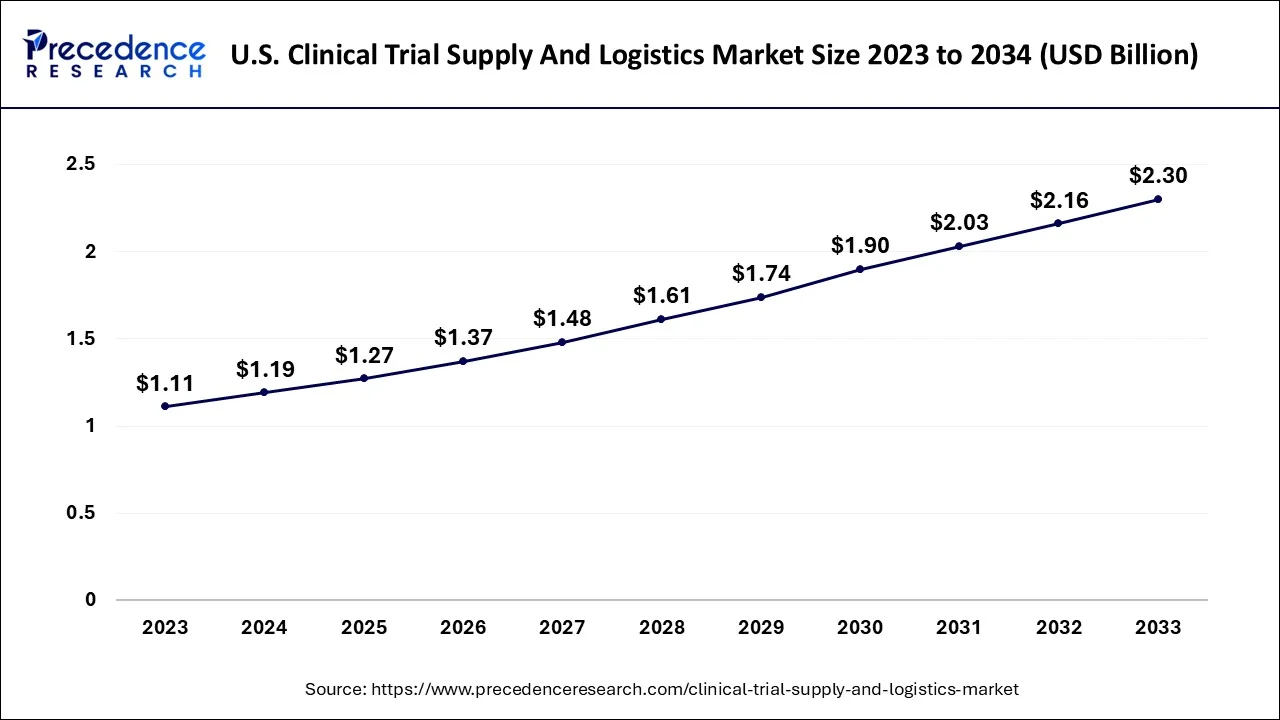

The U.S. clinical trial supply and logistics market size was valued at USD 1.44 billion in 2024 and is projected to surpass around USD 2.96 billion by 2034, expanding at a CAGR of 7.53% between 2025 and 2034.

North America is expected to dominate the market over the forecast period due to the pharmaceutical hub. North America, particularly the United States, is a global hub for pharmaceutical and biotechnology research and development. The region is home to numerous pharmaceutical companies, contract research organizations (CROs), and academic institutions conducting clinical trials. These entities rely on clinical trial supply & logistics providers to support their trials. Moreover, the stringent regulatory environment is another important factor that propels the market growth in the area.

North America, particularly the United States, is a global hub for pharmaceutical and biotechnology research and development. The region is home to numerous pharmaceutical companies, contract research organizations (CROs), and academic institutions conducting clinical trials. These entities rely on clinical trial supply & logistics providers to support their trials. Moreover, the stringent regulatory environment is another important factor that propels the market growth in the area.

The United States Food and Drug Administration (FDA) and Health Canada are stringent regulatory authorities overseeing clinical trials and drug approvals in the region. Compliance with their regulations is essential. Clinical trial supply & logistics providers in the area have expertise in navigating these regulatory frameworks and ensuring that trial materials meet compliance requirements. Thus, this is expected to drive the market growth in the region.

The United States Food and Drug Administration (FDA) and Health Canada are stringent regulatory authorities overseeing clinical trials and drug approvals in the region. Compliance with their regulations is essential. Clinical trial supply & logistics providers in the area have expertise in navigating these regulatory frameworks and ensuring that trial materials meet compliance requirements. Thus, this is expected to drive the market growth in the region.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The region has witnessed a surge in clinical trial activity, driven by factors such as large patient populations, diverse disease demographics, and cost advantages. Pharmaceutical companies and CROs are conducting an increasing number of trials in the region, leading to greater demand for clinical trial supply & logistics services. Thus, the aforementioned stats are expected to drive the market growth during the forecast period.

The region has witnessed a surge in clinical trial activity, driven by factors such as large patient populations, diverse disease demographics, and cost advantages. Pharmaceutical companies and CROs are conducting an increasing number of trials in the region, leading to greater demand for clinical trial supply & logistics services. Thus, the aforementioned stats are expected to drive the market growth during the forecast period.

Market Overview

Clinical trial supply & logistics refers to the planning, management, and execution of the procurement, storage, distribution, and tracking of pharmaceutical products, medical devices, and other materials needed for clinical trials. Clinical trials are essential for evaluating the safety and efficacy of new drugs, therapies, and medical interventions before they can be approved for widespread use. Managing the supply chain and logistics for clinical trials is a critical aspect of ensuring that these trials are conducted efficiently and effectively.

Clinical Trial Supply and Logistics Market Growth Factors

The global clinical trial supply and logistics market involves sourcing and acquiring the necessary investigational products, placebos, comparators, and other materials required for the clinical trial. These materials are often provided by pharmaceutical companies or contract research organizations.

The clinical trial supply & logistics market is being driven by several factors, including a growing number of clinical trials, stringent regulatory requirements, advancements in technology, a rise in rare disease research, and growing mergers and acquisitions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.45 Billion |

| Market Size in 2025 | USD 4.29 Billion |

| Market Size in 2024 | USD 3.98 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Phase, End-user, and Therapeutic Area |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

One of the strongest drivers to the market is the increasing complexity of clinical trials. Modern drug development often involves biologics, advanced therapies such as CAR-T, and precision medicines tailored to narrow patient populations. These therapies require strict temperature control, specialized packaging, and real time monitoring throughout distribution. As trials expand across multiple geographies to reach rare disease patients or diverse cohorts, supply chains must become more adaptive and resilient. This complexity is fuelling demand for logistics partners with advanced cold chain capabilities, digital tracking solutions, and global distribution networks that can ensure regulatory compliance and product integrity.

Another key driver is the globalization of clinical research. Pharmaceutical and biotechnology companies are increasingly conducting trials in emerging markets to access larger patient pools, speed up recruitment, and reduce overall development costs. This geographic spread creates challenges in coordinating shipments, adhering to varied regulatory frameworks, and maintaining quality standards across continents. To meet these needs, specialized logistics providers are investing in regional hubs, digital coordination platforms, and standardized operating procedures. The expansion of trials into Asia Pacific, Latin America, and Eastern Europe is therefore creating sustained demand for efficient and scalable supply solutions, significantly boosting market growth.

Restraint

A significant restraint for the market is the high cost of building and maintaining advanced cold chain logistics systems. Many investigational drugs, specially biologics and cell based therapies, require storage at ultra-low or cryogenic temperatures throughout transportation and storage. Establishing this infrastructure involves investment in specialized freezers, insulated packaging, backup power systems, and monitoring technologies, all of which significantly increase operational expenses. Smaller logistics providers and trial sponsors often struggle to meet these requirements, creating barriers to entry and slowing broader market participation.

Another major obstacle is the complex and fragmented regulatory environment across different countries and regions. Clinical trial supplies must comply with strict standards for labelling, documentation, import/export clearances, and handling procedures. Inconsistent regulations and lengthy approval timelines can delay shipments and disrupt trial schedules, particularly in global, multi-site studies. Non-compliance risks not only financial penalties but also jeopardise the validity of trial results. Navigating this regulatory patchwork requires significant expertise and resources, making it a persistent challenge for both sponsors and logistics providers.

Opportunity

Increasing collaborations

The increasing collaboration among the key market players is expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in April 2022, Thermo Fisher Scientific Inc and Matrix clinical trials, a service of Matrix medical network, announced that they are working together to develop an innovative decentralized clinical trial (DCT) solution to deliver clinical trials to patients. To help in detecting, retaining, and attracting trial participants while guaranteeing a favorable patient experience, the company is deploying cutting-edge Matrix mobile research sites around the United States. The two businesses are simultaneously looking for ways to extend their partnership to new regions.

Service Insights

Within the service category, the manufacturing segment is emerging as the fastest-growing area of the clinical trial supply and logistics market. As clinical research becomes more complex and therapies increasingly shift toward personalized medicine, advanced biologics, and cell and gene therapies, the demand for specialized manufacturing capabilities is rising.

This includes not only the production of investigational drugs but also the preparation of highly sensitive formulations that require strict handling and quality control. The manufacturing segment is benefiting from growing outsourcing by pharmaceutical and biotechnology companies. Who rely on specialized partners to ensure efficiency, compliance, and scalability. This is creating sustained momentum positioning manufacturing as a critical growth driver in the years ahead.

Clinical Trial Supply And Logistics Market Revenue, By Service, 2022-2024 (USD Million)

| Service | 2022 | 2023 | 2024 |

| Logistics & Distribution | 952.1 | 1,026.0 | 1,108.5 |

| Storage & Retention | 476.6 | 510.3 | 547.7 |

| Packaging, Labeling, and Blinding | 605.9 | 645.2 | 688.6 |

| Manufacturing | 767.8 | 824.6 | 887.9 |

| Comparator Sourcing | 383.4 | 409.4 | 438.1 |

| Others | 273.4 | 290.6 | 309.6 |

Phase Insights

Among clinical trial phases, Phase 2 is expected to register the fastest growth over the forecast period. Early stage trails are expanding due to the surge in novel therapies, rare disease treatments, and targeted drug candidates entering the development pipeline. Sponsors are prioritizing rapid proof of concept studies to evaluate safety and tolerability before moving to later phases. With the global push to accelerate drug discovery, Phase 2 trials are seeing increased demand for agile and adaptive supply chains that can quickly respond to evolving trial designs. The need for specialized packaging, precise dosing, and smaller but highly customized supply volumes further strengthens the role of logistics partners in this segment, making Phase 2 a hotbed for growth within the market.

Clinical Trial Supply And Logistics Market Revenue, By Phase, 2022-2024 (USD Million)

| Phase | 2022 | 2023 | 2024 |

| Phase I | 440.7 | 475.9 | 515.1 |

| Phase II | 726.0 | 776.7 | 832.9 |

| Phase III | 1,396.1 | 1,496.6 | 1,608.5 |

| Phase IV | 896.3 | 956.8 | 1,023.9 |

End User Insights

In terms of end users, the biologicals segment is projected to experience the fastest expansion. The growing pipeline of biologics, including monoclonal antibodies, vaccines, and cell and gene therapies is driving demand for highly specialized clinical trial supply and logistics solutions. Unlike conventional pharmaceuticals, biologics often require ultra-low temperature storage, secure distribution channels, and advanced tracking technologies to maintain product integrity.

As investment in biologics intensifies across both established and emerging markets, clinical trial supply chains are adapting to manage the complexity and sensitivity of these products. This shift is pushing the biologicals segment to the forefront of market growth, as sponsors increasingly rely on logistics partners with deep expertise in biologic handling.

Clinical Trial Supply And Logistics Market Revenue, By End User, 2022-2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Pharmaceuticals | 1,453.3 | 1,560.9 | 1,680.7 |

| Biologicals | 1,218.3 | 1,306.1 | 1,403.7 |

| Medical Device | 787.5 | 839.0 | 896.0 |

Therapeutic Area Insights

From a therapeutic standpoint, rare diseases and orphan indications are positioned as the fastest growing area in clinical trial supply and logistics. Advances in genomics and precision medicine have spurred development of highly targeted therapies for conditions with limited or no existing treatment options. These trials often involve smaller patient populations spread across multiple geographies, making the supply chain highly complex and logistically demanding.

Tailored solutions are required to ensure timely and secure delivery of investigational products to dispread trial sites. Additionally, strong regulatory incentives and rising investment in orphan drug research are accelerating activity in this space. As a result, the rare disease segment is gaining prominence, fuelling rapid growth in the demand for specialized trial supply and logistics support.

Clinical Trial Supply And Logistics Market Revenue, By Therapeutic Area, 2022-2024 (USD Million)

| Therapeutic Area | 2022 | 2023 | 2024 |

| Oncology | 919.1 | 987.2 | 1,063.0 |

| Cardiovascular Diseases | 1,119.4 | 1,198.7 | 1,286.8 |

| Respiratory Diseases | 773.5 | 829.9 | 892.6 |

| CNS and Mental Disorders | 647.1 | 690.2 | 738.0 |

Recent Development

- In August 2025, THL Partners is acquiring a leading U.S. network of clinical trial sites, demonstrating growing investor interest in trial infrastructure. This follows previous divestments by major firms, underscoring the rising strategic value placed on streamlined trial execution and site networks.

(Source: THL Partners to acquire clinical trial firm Headlands from KKR | Reuters) - In August 2025, to boost life sciences competitiveness, the UK is rolling out a reform to slash clinical trial set up durations from months to just a few weeks. Standardized contracting and streamlined bureaucratic processes underpin this initiative to attract more trials to the region.

(Source: https://healthindustryleaders.com)

Segments Covered in the Report

- Almac Group

- DHL

- Parexel

- Thermo Fisher Scientific (Patheon)

- Marken

- Piramal Pharma Solutions

- UDG Healthcare

- Catalent, Inc.

- FedEx

- Movianto

- Packaging Coordinators Inc.

Segments Covered in the Report

By Service

- Logistics & Distribution

- Storage & Retention

- Packaging, Labeling, and Blinding

- Manufacturing

- Comparator Sourcing

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By End-user

- Pharmaceuticals

- Biologicals

- Medical Device

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Respiratory Diseases

- CNS and Mental Disorders

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting