Cloud FinOps Market Size and Forecast 2025 to 2034

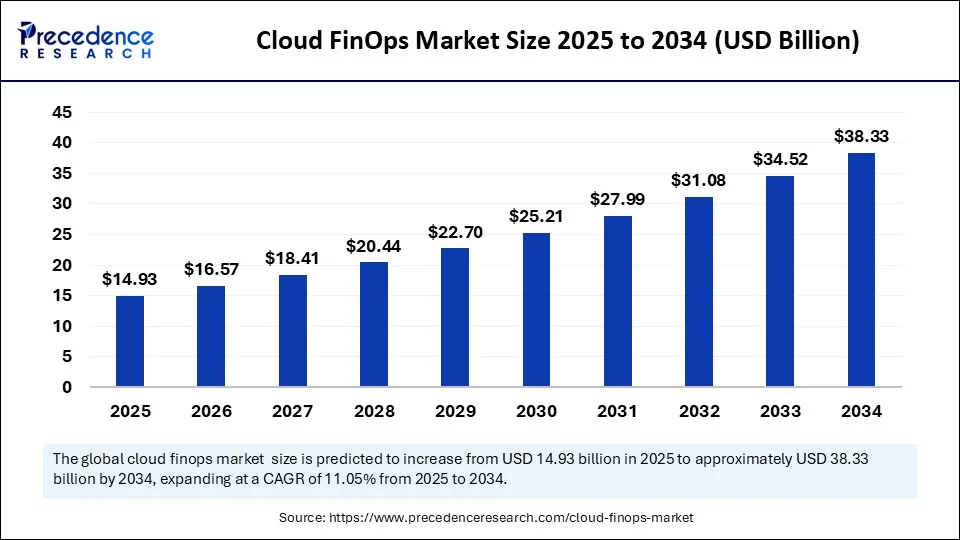

The global cloud FinOps market size accounted for USD 13.44 billion in 2024 and is predicted to increase from USD 14.93 billion in 2025 to approximately USD 38.33 billion by 2034, expanding at a CAGR of 11.05% from 2025 to 2034. The growth of the market is attributed to the rising adoption of cloud across various industries and high demand for better cost transparency and financial accountability.

Cloud FinOps MarketKey Takeaways

- The global cloud FinOps market was valued at USD 13.44 billion in 2024.

- It is projected to reach USD 38.33 billion by 2034.

- The market is expected to grow at a CAGR of 11.05% from 2025 to 2034.

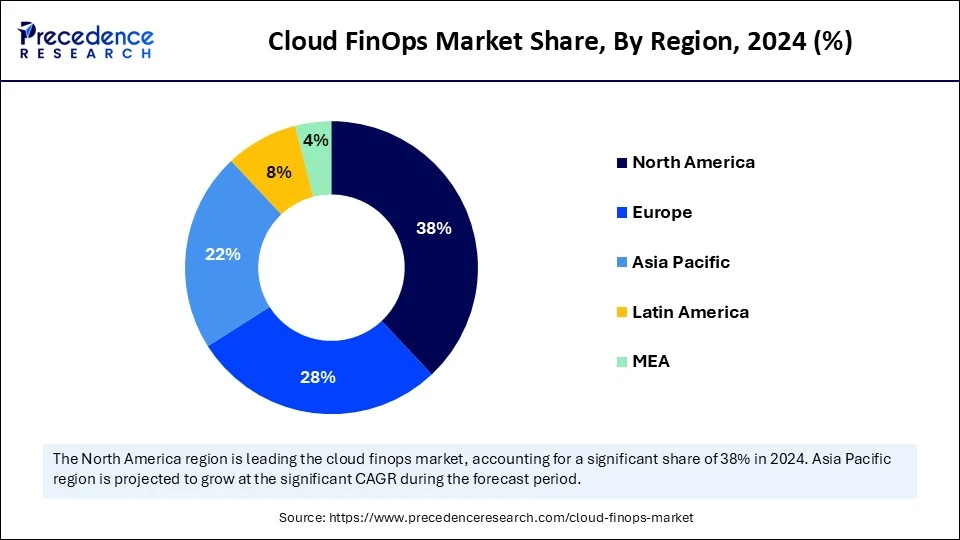

- North America dominated the cloud FinOps market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 12.45% in the upcoming years.

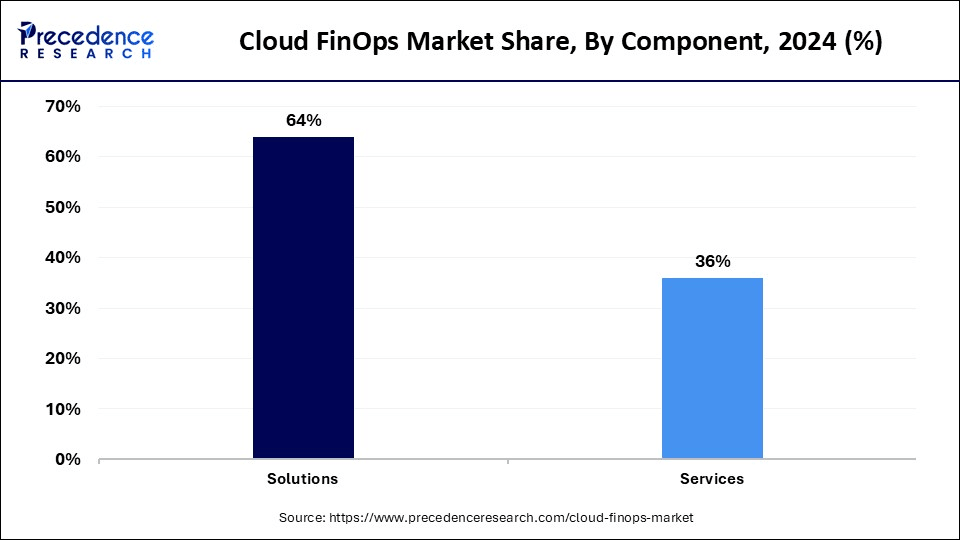

- By component, the solutions segment held the biggest market share of 64% in 2024.

- By component, the service segment is expected to grow at the fastest CAGR of 13.05% during the forecast period.

- By application, the cost management and optimization segment contributed the highest market share in 2024.

- By application, the budgeting & forecasting segment is expected to grow at the fastest CAGR in the coming years.

- By deployment mode, the public cloud segment held the major market share in 2024.

- By deployment mode, the hybrid cloud segment is emerging as the fastest growing.

- By organization size, the large enterprises segment led market in 2024.

- By organization size, the SMEs segment is expected to grow at the fastest CAGR during the projection period.

By end-user, the IT & telecom segment generated the highest market share in 2024. - By end-user, the BFSI segment is expected to grow at the fastest CAGR during the forecast period.

Impact of AI on the Cloud FinOps Market

Artificial intelligence is revolutionizing the Cloud FinOps market by improving cloud cost management, automation, accuracy, and predictive capabilities. Massive amounts of billing and usage data can be analyzed in real time by AI-driven tools to identify irregularities, recommend rightsizing, and, more precisely, predict future expenses. The use of machine learning models to automate tagging compliance suggests the best instance types and forecast budget overruns to minimize human error and manual labor. Additionally, AI helps non-technical stakeholders better understand cost analysis. With the increasing complexity of cloud environments due to multi-cloud and AI/ML workloads, FinOps tools must incorporate AI for proactive governance, quicker decision-making, and increased return on investment.

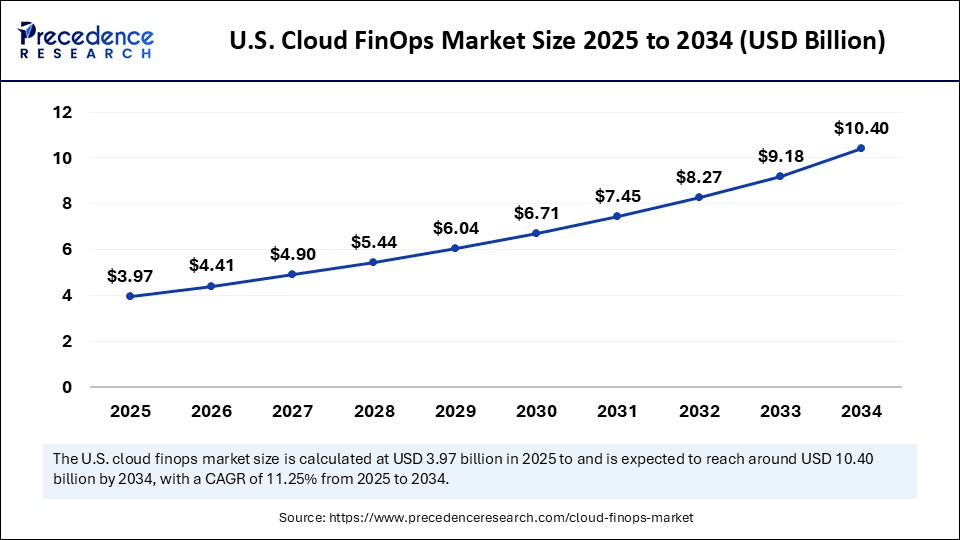

U.S. Cloud FinOps Market Size and Growth 2025 to 2034

The U.S. cloud FinOps market size was exhibited at USD 3.58 billion in 2024 and is projected to be worth around USD 10.40 billion by 2034, growing at a CAGR of 11.05% from 2025 to 2034.

Why did North America dominate the market in 2024?

North America dominated the cloud FinOps market with the largest revenue share in 2024. This is mainly due to its vast cloud ecosystem. The region is recognized as an early adopter of cloud solutions. FinOps has been integrated into cloud strategies by businesses in a variety of industries to control growing costs and promote departmental accountability. A well-organized FinOps culture is supported by the region's strong collaboration between the engineering, IT, and finance teams. The demand for real-time cost tracking and optimization tools has increased due to the sophisticated deployment of multi-cloud and GenAI workloads. The strong presence of leading tech companies, high cloud usage, and the availability of qualified FinOps specialists further solidify North America's leadership.

Asia is expected to grow at the fastest rate in the upcoming years as more companies in the region are moving their operation to cloud platforms. The need for FinOps solutions is increasing as a result of a rise in digitalization in both large corporations and SMEs. AI-based apps and cloud-native architectures are being adopted by organizations, necessitating careful resource cost monitoring. Automation and real-time budget alerts are becoming more and more popular as ways to manage cloud usage and prevent cost overruns. The region's FinOps footprint is growing quickly as a result of growing awareness of cloud financial governance.

Europe is considered to be a significantly growing area. A strong emphasis on financial transparency, data privacy, and sustainability in cloud operations drives the cloud FinOps market in the region. Enterprises are implementing FinOps practices to streamline cloud usage, align budgets, and meet regulatory standards. The integration of cost allocations, forecasting, and emissions tracking solutions into FinOps is rising. Organizations in the region are also focusing on improving cross-functional visibility into cloud expenses, particularly in complex hybrid and multi-cloud setups. The push for ESG accountability further supports the adoption of FinOps tools.

Market Overview

The cloud FinOps market is experiencing significant growth as organizations increasingly adopt multi-cloud environments and seek greater financial accountability in their cloud operations. Complex billing structures and frequent overspending have resulted from the increase in cloud usage, necessitating real-time cost optimization and resource allocation tolls. Effective cloud expense control is made possible by cross-functional cooperation between finance engineering and cloud computing operations more quickly, thanks to government policies and programs that encourage cost transparency. The industry is anticipated to grow rapidly over the next several years as automation, artificial intelligence, and predictive analytics become increasingly integrated into FinOps platforms.

How are organizations addressing rising cloud costs and financial inefficiencies?

Real-time cost optimization and resource allocation tools are required because the increase in cloud usage has resulted in complicated billing structures frequently overspending. To effectively control cloud expenses, finance engineering and operations teams can collaborate across functional boundaries thanks to FinOps practices. Additionally, the public and private sectors are adopting cloud computation more quickly thanks to government policies encouraging cost transparency. The market is anticipated to grow significantly over the next few years and more integrated into FinaOps platforms.

Cloud FinOps MarketGrowth Factors

- Multi-Cloud and Hybrid Cloud Adoption: As businesses shift to multi-cloud and hybrid models, managing and optimizing cloud costs across platforms becomes complex. FinOps helps unify billing and improve cost visibility across AWS, Azure, GCP, and private clouds.

- Focus on Cloud Cost Optimization: Rising cloud bills are pushing CFOs and CIOs to demand better financial control. FinOps enables cost accountability, forecasting, and efficient budget management to support lean operations.

- Growth of AI and GenAI Workloads: AI/ML and GenAI workloads require high-cost GPU instances. FinOps supports real-time tracking and optimization of these resources, reducing waste and managing growing cloud expenses effectively.

- Cross-functional Collaboration: FinOps encourages collaboration between finance, engineering, and operations, making cloud spending a shared responsibility and improving overall efficiency.

- Rising Regulatory and compliance pressures: Regulatory demand for cost transparency and sustainability in cloud usage is increasing. FinOps tools support detailed reporting, audit trails, and emissions tracking to meet compliance needs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 38.33 Billion |

| Market Size in 2025 | USD 14.93 Billion |

| Market Size in 2024 | USD 13.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, Deployment Mode, Organization Size, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Cloud Adoption Across Enterprises

The trend toward digital transformation has sped up cloud adoption in various industries, including IT, BFSI, healthcare, and retail. Managing cloud expenses has become a strategic priority as businesses shift their core workloads to cloud platforms. When more departments use cloud services, their visibility and governance become more difficult. Cloud FinCloud helps businesses handle this expanding scale by enabling distributed accountability and centralized monitoring. FinOps is becoming crucial to ensuring both business agility and finances as cloud-native adoption rises.

Moreover, organizations are now embracing DevOps and agile methodologies which lead to decentralized cloud usage and frequent provisioning of resources often without financial oversight. This trend increases the risk of overspending, making FinOps a necessary framework to enforce cost owner shifts across engineering and finance teams. Additionally, subscription-based cloud pricing and fluctuating usage patterns demand ongoing monitoring and forecasting. FinOps helps businesses gain granule control over cloud expenditure and ties cloud investments back to business value. As cloud consumption grows, FinOps ensures that scalability doesn't come at the cost of inefficiency.

Need for Real-Time Cost Optimization

The rising need for real-time cost optimization drives the growth of the cloud FinOps market. Traditional cost-tracking methods are retrospective, often identifying inefficiencies after damage is done. Modern enterprises require real-time insights into cloud spending to act proactively. FinOps tools deliver dashboards, alerts, and trend analyses that help teams optimize costs instantly, whether by rightsizing resources, shutting down idle workloads, or modifying usage plans. Real-time optimizes financial surprises and improves forecasting accuracy. This agility supports the DevOps cycle and accelerates cloud ROI.

Restraints

Lack of Standardization in Cloud Cost Models

Each cloud providers, such as AWS, Azure, and GCP, have a unique billing format structure and jargon for use. Organizations find it challenging to implement a uniform FinOps strategy across providers due to a lack of standardization. A lot of companies find it difficult to convert complicated cloud bills into useful information which frequently require custom integrations to normalize disparate cost data, which increases implementation delays and operational burdens. This fragmentation also limits the ability to compare or migrate workloads effectively by making benchmarking and cross-provider optimization challenges. When working with cloud environments that have inconsistent cost metrics, financial teams face a much steeper learning curve. Smaller teams consequently frequently give up deep optimization completely.

Limited FinOps Expertise and Talent

Professionals with the ability to bridge the gap between finance engineering and cloud operations are in short supply, and FinOps is still a relatively new field. Adoption is slowed by the lack of internal teams in many organizations that are capable of successfully implementing or running FinOps procedures. It is still very difficult to upskill current staff members or find talent with a technical or financial background. Furthermore, it is more difficult for SMBs to develop capabilities internally because the majority of training programs are still in their infancy and are geared toward large corporations. Dependence on outside consultants is increased by this talent shortage, which can be expensive and unsustainable in the long term. Monitor KPIs or analyze optimization recommendations in the absence of experienced practitioners. Because of this, the program is either poorly implemented or fails completely.

Opportunities

Integration of FinOps with DevOps & CI/CD Pipelines

The rising integration of FinOps with DevOps creates immense opportunities in the cloud FinOps market. There is a high demand for incorporating FinOps into infrastructure as code procedures, CI/CD pipelines, and DevOps workflows are growing. Deployment pipelines that incorporate real-time cost feedback enable developers to make informed choices that strike a balance between budget and performance. FinOps tools now have the chance to bridge the gap between cost consciousness and code by providing API plugins and automation triggers that complement developer environments. Furthermore, rather than being a post-deployment activity, this assists businesses in putting in place cost controls that grow with the lifecycle of their applications.

AI-Powered Predictive Forecasting and Anomaly Detection

FinOps platforms that integrate AI and machine learning to predict cloud costs, identify anomalies in real time, and suggest optimization tactics create immense growth opportunities. Businesses use predictive analytics to minimize financial surprises and match budgets with future consumption trends. Suppliers who create self-learning cost engines will provide benefits beyond simple tracking. Furthermore, AI can save engineering and finance teams hours of manual analysis by automation across shared services. These features are especially appealing to rapidly expanding companies with dynamic infrastructure.

Component Insights

Why did the solutions segment dominate the market in 2024?

The solutions segment dominated the cloud FinOps market with the largest share in 2024 due to the increased adoption of platforms that provide automation, cost transparency, and unified dashboards across multi-cloud environments. These solutions assist in forecasting usage patterns, automating rightsizing, and identifying underutilized resources. Well-known FinOps platforms with innovative integrations with AWS Azure and GCP include Apptio CloudHealth and Spot. Additionally, supported by these solutions are sophisticated chargeback systems targeting compliance and real-time anomaly detection. From the beginning, organizations use these tools to establish a disciplined FinOps practice. They are essential to cloud cost governance because of their scalable architecture and automation features.

The services segment is expected to grow at the fastest rate in the coming years as enterprises often lack the in-house expertise to set up and operate FinOps solutions. Managed services and consulting firms assist businesses in implementing best practices, customizing dashboards, and enabling stakeholder training. Many organizations prefer outsourcing. FinOps operations ensure quick results and avoid misconfigurations. Services are particularly valuable in complex environments with hybrid deployments, multiple business units, or strict compliance needs. The growing ecosystem of certified FinOps consultants and vendors is accelerating segmental growth. This also helps bridge communication gaps between engineering, finance, and operations teams.

Application Insights

What made cost management & optimization the dominant segment in the market?

The cost management & optimization segment dominated the cloud FinOps market in 2024 as businesses look to identify and cut out unnecessary cloud spending to achieve an instant return on investment. This includes idle workloads, oversized instances, and unused resources, particularly in dynamic environments. Actionable insights are offered by FinOps platforms including scheduling unused instances, automating cost-saving measures, and suggesting appropriate sizes. Employing these tools helps businesses better use their resources and reach budget goals set by the CFO. DevOps teams must have constant cost visibility to make wise decisions. The need for strong cost management capabilities is further supported by the expanding usage of autoscaling services and containerized workloads.

The budgeting & forecasting segment is expected to grow at the fastest CAGR during the forecast period as finance teams demand predictive insights to plan multi-month cloud budgets and avoid overspending. FinOps tools offer scenario planning, variance analysis, and forecasting models using AI/ML. This helps organizations allocate cloud costs more accurately and align them with future business goals. As cloud adoption becomes more central to business strategy, long-term planning gains importance. Budgets must account for growing AI workloads, SaaS tools, and seasonal trends. The integration of FinOps with ERP and financial planning tools is also driving rapid growth in this application segment.

Deployment Mode Insights

Why does the public cloud segment dominate the cloud FinOps market in 2024?

The public cloud segment dominated the market with a major revenue share in 2024 as businesses are increasingly seeking solutions to cut out unnecessary cloud spending to achieve an instant return on investment. This includes idle workloads, excessive instances, and unused resources, particularly in dynamic environments. Actionable insights are offered by FinOps platforms including scheduling unused instances, automating cost-saving measures, and suggesting appropriate sizes. These tools are used by businesses to increase resource utilization and reach budget goals set by the CFO. To make wise decisions, DevOps teams need to have constant cost visibility. The growing use of containerized workloads and autoscaling services further supports the demand for robust cost management capabilities.

The hybrid cloud segment is expected to grow at the fastest CAGR in the upcoming period as companies are seeking ways to balance cloud innovation with legacy infrastructure investments. FinOps in hybrid environments must track clouds, on-premises, and private workloads across disparate billing and usage systems. Enterprises with regulatory or data residency requirements are more likely to use hybrid models. This increases the complexity of cost allocation, forecasting, and chargeback. FinOps platforms are evolving to provide centralized dashboards that consolidate hybrid spending. The need for end-to-end visibility and governance is fueling strong demand in this segment. Hybrid cloud FinOps also supports transition planning and cost modeling during migration.

Organization Size Insights

How does large enterprises segment dominate the market in 2024?

The large enterprises segment dominated the cloud FinOps market with a significant share in 2024 due to their vast infrastructure, multi-departmental use, and sizable cloud footprints. These businesses need complex cost management because they frequently use several public cloud providers and operate a large business. They can establish cost allocation guidelines by team department or business unit with the aid of FinOps tools. To avoid budget overruns and preserve financial compliance, they also employ real-time analytics. For governance management, large organizations frequently have specialized FinOps teams or cloud centers of excellence. Their dependence on FinOps solutions is strengthened by their requirement for compliance through audit trials and role-based dashboards.

The SME segment is expected to expand at the highest CAGR during the projection period as smaller businesses are accelerating their digital transformation using affordable cloud infrastructure. Unlike large enterprises, they increasingly adopt lightweight FinOps tools or cloud-native billing dashboards to control spending. SMEs seek simplicity and fast deployment. Many use FinOps to identify savings, optimize SaaS usage, and avoid bill shock. Vendor partnerships offering bundled FinOps features (e.g. in GCP or AWS billing) are also driving adoptions. With tighter budgets, SMEs rely on FinOps to prioritize cost-effective scaling and sustainable growth. As FinOps becomes more accessible, more SMEs are embedding it into their operations.

End-User Insights

What made IT & telecom the dominant segment in the market?

The IT & telecom segment dominated the cloud FinOps market in 2024 due to its constant cloud innovation and high infrastructure demands. IT and telecommunications businesses depend on cloud computing for DevOps automation, analytics, storage, and computation. Cost management thus becomes essential for both financial planning and effective delivery. Telecom and IT firms can optimize thousands of cloud projects and assets with FinOps. Additionally, they gain from ongoing monitoring of real-time services. CDNs and AI workloads. Their large engineering teams make collaborative FinOps practices helpful in coordinating cloud usage with business and technical objectives.

The BFSI segment is expected to grow at the fastest rate during the forecast period as banks, insurers, and fintech firms move legacy systems to the cloud while complying with strict regulatory frameworks. These institutions use FinOps to monitor the cloud across sensitive data environments, ensure cost transparency, and stay audit-ready. They are investing in real-time budget alerts, chargeback systems, and secure cost allocation models. With clouds becoming central to digital banking, transaction processing, and fraud detection, optimizing spend is now a strategic need. As FinOps also supports carbon tracking and ESG reporting, it aligns well with BFSIs' long-term compliance goals.

Cloud FinOps Market Companies

- Amazon Web Services (AWS)

- Flexera

- HCL Technologies

- IBM Corporation

- Microsoft Corporation

- Oracle

- SAP

- ServiceNow

- VMware

- CloudBolt Software, Inc.

Recent Developments

- On 4 June 2025, Amazon Web Services (AWS) announced multiple FinOps enhancements at FinOps X 2025, including Q for Cost Optimization, an AI-powered assistant offering tailored saving insights, enhanced Aurora I/O Optimization features, a redesigned AWS Pricing Calculator, and CUDOS Dashboard v5.6 with taxonomy tools and multi timeframe views.

(Source: https://www.finops.org) - In June 2025, Microsoft Azure launched FOCUS native exports within Azure Cost Management, enabling standardized, cross-cloud cost tracking aligned with FOCUS 1.2. The advancements support better interoperability between SaaS/PaaS services and broader FinOps data aggregation for enterprise clients.

(Source: https://connectcx.ai)

Segments Covered in the Report

By Component

- Solutions

- Native Solutions

- Third-Party Solutions

- Services

- Professional Services

- Managed Services

By Application

- Cost Management & Optimization

- Resource Allocation & Planning

- Budgeting & Forecasting

- Billing & Chargeback

- Others

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- SMEs

- Large enterprises

By End-User

- Government

- Consumer Goods and Retail

- Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting