What is the Coagulation Analyzers Market Size?

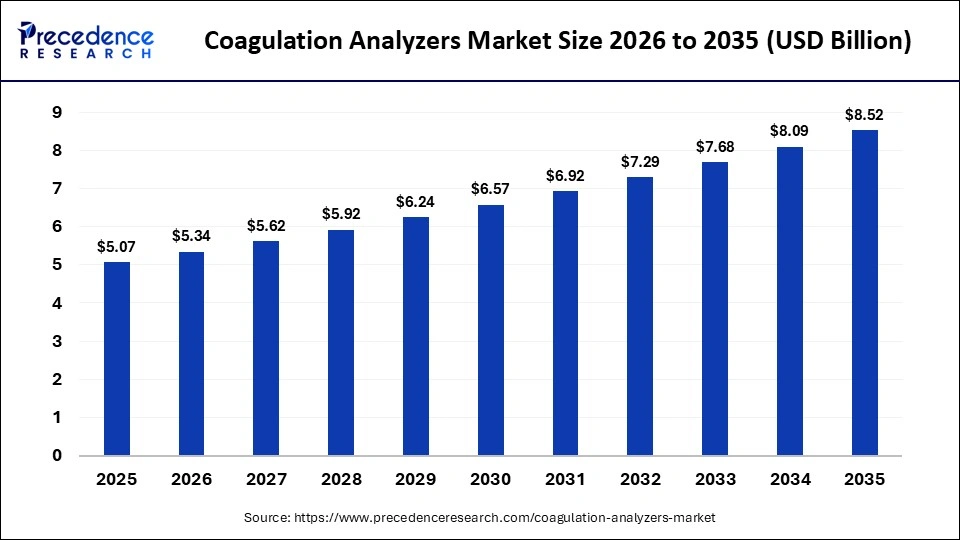

The global coagulation analyzers market size accounted for USD 5.07 billion in 2025 and is predicted to increase from USD 5.34 billion in 2026 to approximately USD 8.52 billion by 2035, expanding at a CAGR of 5.33% from 2026 to 2035. The coagulation analyzers market is poised for significant growth, with projections indicating a robust increase.

Market Highlights

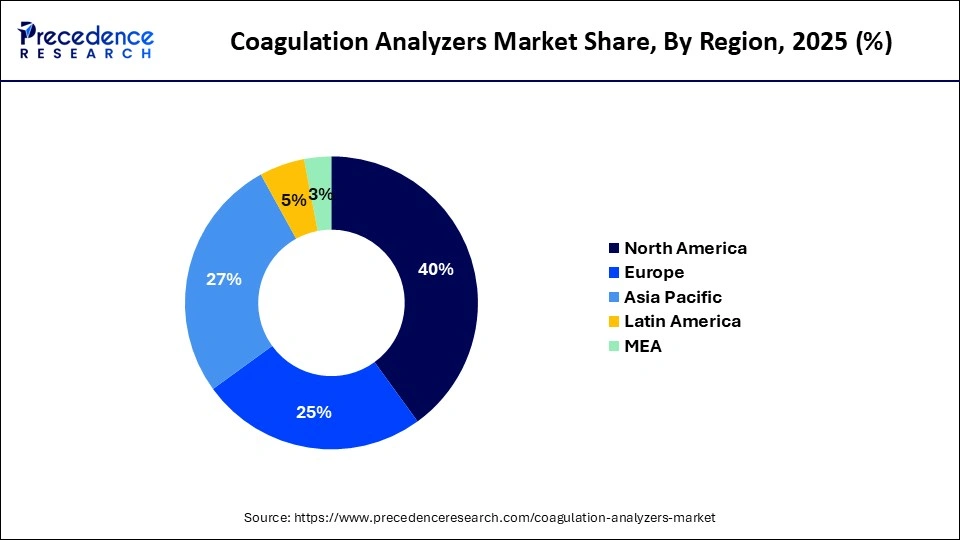

- North America dominates the market, accounting for more than 40% of market share in 2025.

- Asia Pacific is expected to grow at a significant CAGR from 2026 to 2035.

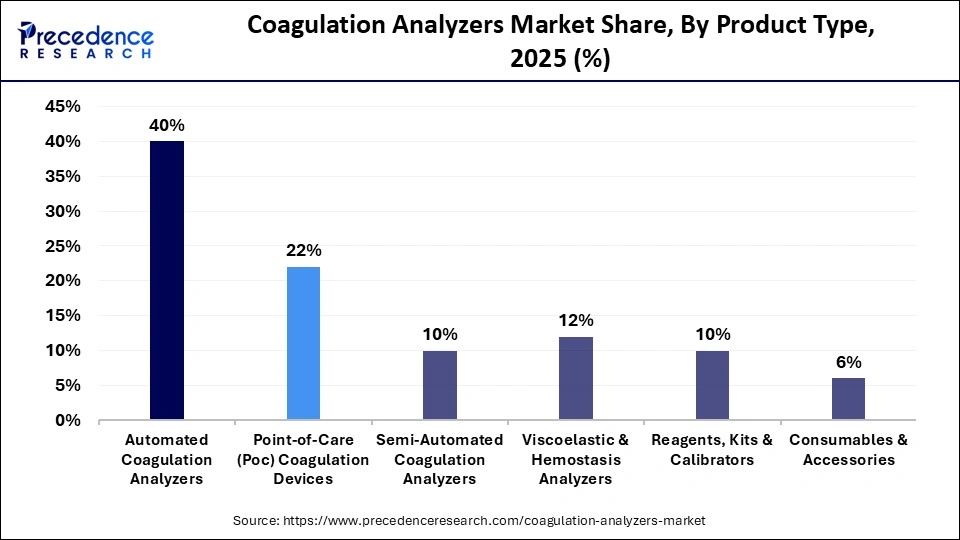

- By product type, the automated coagulation analyzers segment contributed the largest share of 40% in 2025.

- By product type, the point-of-care (POC) coagulation devices segment is expanding at a strong CAGR between 2026 to 2035.

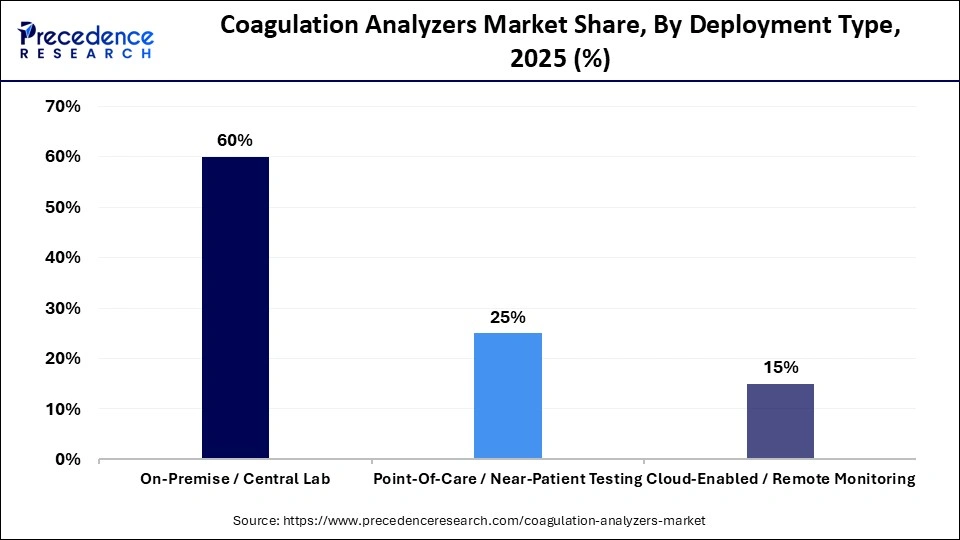

- By deployment type, the on-premises segment accounted for the biggest market share of 60% in 2025.

- By deployment type, the point-of-care segment is growing at a significant CAGR from 2026 to 2035.

- By application, the diagnostic testing segment captured the highest market share of 35% in 2025.

- By application, the anticoagulant therapy monitoring segment is expanding at a notable CAGR from 2026 to 2035.

- By technology/mode of action, the photo-optical/ optical clot detection segment contributed the highest market share of 30% in 2025.

- By technology/mode of action, the viscoelastic testing segment is expected to grow at a significant CAGR from 2026 to 2035.

- By end-user type, the hospitals & clinical diagnostic laboratories segment held the major market share of 55% in 2025.

- By end-user type, the point-of-care clinics & ambulatory centers segment is growing at a significant CAGR from 2026 to 2035.

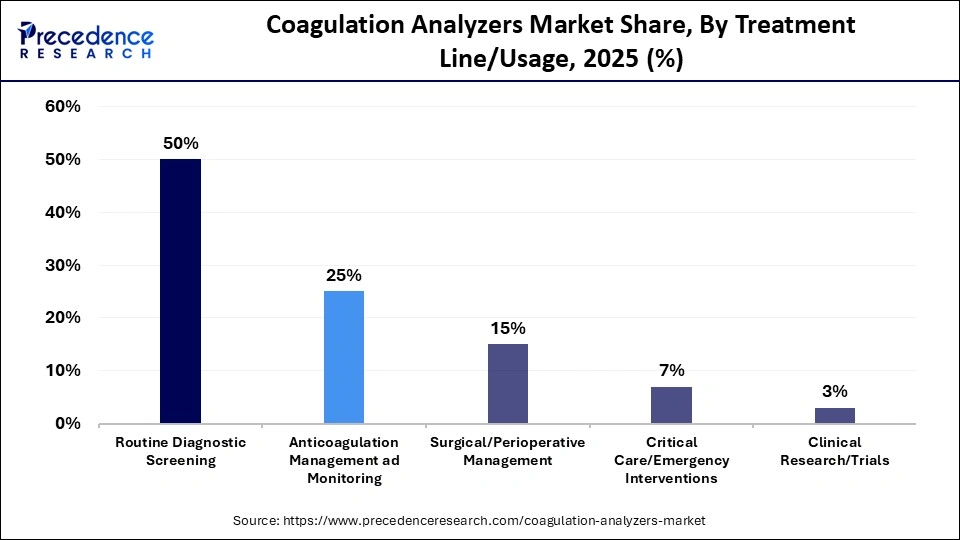

- By treatment line/usage, the routine diagnostic screening segment contributed the largest market share of 50% in 2025.

- By treatment line/usage, the anticoagulation management & monitoring segment is poised to grow at a significant CAGR from 2026 to 2035.

- By distribution channel, the direct sales segment accounted for the largest market share of 50% in 2025.

- By distribution channel, the online/e-procurement & consumables marketplaces segment is projected to grow at a high CAGR from 2026 to 2035.

What Is the Coagulation Analyzers Market? Applications, Clinical Use Cases

The coagulation analyzers market encompasses automated and semi-automated diagnostic instruments used to evaluate blood clotting mechanisms by measuring parameters such as prothrombin time (PT), activated partial thromboplastin time (aPTT), D-dimer levels, fibrinogen concentration, and coagulation factor activity. These parameters help clinicians assess the intrinsic, extrinsic, and common pathways of coagulation. Coagulation analyzers are essential in diagnosing bleeding disorders, thrombophilia, liver dysfunction, and for monitoring anticoagulant therapies, including warfarin, unfractionated heparin, and direct oral anticoagulants.

Epidemiological trends strongly support growing clinical demand. According to the World Health Organization's 2023 cardiovascular report, cardiovascular diseases remain the leading global cause of death, responsible for approximately 17.9 million deaths annually, which increases the need for coagulation monitoring before and after interventional cardiology procedures.

The Centers for Disease Control and Prevention (CDC) reported in 2022 that nearly 900,000 people in the United States experience venous thromboembolism each year, creating sustained clinical demand for rapid PT, aPTT, and D-dimer testing. Similarly, the National Hemophilia Foundation estimates that around 1 in 5,000 male births in the United States results in hemophilia A, highlighting the ongoing need for routine factor activity testing.

Surgical volume is another major driver. Data from the Organisation for Economic Co-operation and Development (OECD) show that countries such as Germany, France, and Japan collectively perform more than 20 million inpatient surgical procedures annually, each of which requires preoperative coagulation screening to minimize hemorrhagic complications. Trauma cases also elevate demand, as rapid point-of-care coagulation assessment is incorporated into modern trauma protocols such as the European Trauma Course framework (updated 2023) to guide transfusion decisions and reversal of anticoagulation.

Technological Advancements in Coagulation Analyzers: Faster Assays, Integrated Sensors

The coagulation analyzers industry is gradually and noticeably evolving in response to rising demand for rapid diagnostics and enhanced analytical precision. There is a shift from manual or semi-automated systems to fully automated, high-throughput analyzers that lessen operator dependence and reduce human error. Similarly, the adoption of microfluidics allows laboratories to perform detailed coagulation tests with smaller blood volumes, making the process faster and less invasive. Additionally, connectivity is transforming the testing environment through easy LIS/HIS integration, enabling real-time data sharing and remote monitoring. Furthermore, advanced optical and electrochemical detection techniques are increasing the sensitivity of clot detection, setting a new benchmark for accuracy and reproducibility in coagulation testing.

Key Market Trends in the Coagulation Analyzers Market

- Point-of-care coagulation devices that have gained large user acceptance in the emergency departments, ICUs, and rural care settings, where the rapid turnaround time determines the most important decisions.

- The move towards personalized medicine is also a factor influencing this market, as clinicians are increasingly using precise coagulation profiles for tailoring anticoagulant therapies. Besides that, hospitals and diagnostic labs are taking the initiative to use multi-parameter systems, which are cost-effective, to consolidate testing platforms and reduce operational burden.

- The demand for modern analyzers to replace the outdated manual systems is driven by emerging economies, as healthcare infrastructure investments in these countries are picking up pace.

Coagulation AnalyzersMarket Outlook

The two primary drivers propelling the industry forward are government initiatives and the ramping up of drug production on a global scale. Worldwide, numerous governmental programs are enhancing awareness about blood-clotting disorders and their potential severe consequences if left unaddressed. This increased awareness, particularly in rural areas, has facilitated the establishment of numerous healthcare facilities dedicated to treating affected patients. Additionally, the significant acceleration in drug manufacturing ensures that medications are readily accessible through local pharmacies, thereby enabling prompt treatment and recovery for individuals in need.

The global expansion is, nonetheless, whether it be developing countries like India or developed nations like the U.S., a definite surge in the treatments related to cardiovascular diseases is increasing its reach worldwide. If we see that the concept of Ventricular defibrillation is rapidly increasing, it is often colloquially referred to as jump-starting. In layman's terms, it is a critical intervention in cardiac arrhythmias. This technique involves delivering an electrical shock to the myocardium to depolarize the cardiac cells, thereby restoring normal sinus rhythm. It is used to manage life-threatening ventricular tachyarrhythmias and ventricular fibrillation, especially during acute myocardial infarction, to re-establish effective cardiac function and improve perfusion.

There are numerous investors in the market, but the two primary leading investors are Werfen and Sysmex Corporation. They have made significant investments in the market to raise public awareness and support technological advancements.

The startup ecosystem is like a living organism with a network of ideas, aspirations, and traits that eventually lead to the birth of completely new industries. Essentially, it is the community that solves problems, with entrepreneurs questioning existing assumptions and coming up with solutions that change how society functions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.07 Billion |

| Market Size in 2026 | USD 5.34 Billion |

| Market Size by 2035 | USD 8.52 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Deployment Type, Application, Technology/Mode of Action, End-User, Treatment Line/Usage, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Coagulation Analyzers Market Segmental Insights

Product Type Insights

Automated Coagulation Analyzers: Automated coagulation analyzers dominate the coagulation analyzers market, holding a 40% share, due to their accuracy, speed, and ability to handle many tests; thus, these systems remain the market leaders. They reduce the need for manual interaction and thus decrease the risk of human error, contributing to a more efficient workflow. Also, their capability to link with laboratory information systems makes them the most modern and advanced choice in diagnostics. Laboratories, as patient influx continues to increase, opt for devices that deliver stable, reproducible results even under pressure. The movement towards uniform, high-throughput testing further explains why these instruments have such a firm grasp on the market. In general, automated analyzers remain the unquestioned main instruments for coagulation diagnostics.

Point-of-Care (POC) Coagulation Devices: The point-of-care (POC) coagulation devices are the fastest growing in the coagulation analyzers market by holding a share 22%, because they meet the healthcare sector's demand for rapid and decentralized testing. These portable devices are a favorite among the medical staff because they deliver results almost instantly; thus, they are the main tool for treatment decision-making in emergency or intensive care situations. What is more, their simplicity of use makes them great for ambulances, small clinics, and surgical departments as well. As patients' expectations for fast care increase, demand for compact, easy-to-use analyzers also grows. Apart from that, they also serve as helpers in remote and rural healthcare facilities where access to the lab is limited.

Deployment Type Insights

On-Premise / Central Lab: On-premise is dominating the coagulation analyzers market, holding a 60% share, driven by equipment, workflows, and data. In these systems, there is stable performance and high processing capacity, which is, of course, very important for heavy daily test loads. So, institutions with strict IT and compliance requirements opt for in-house deployment to retain oversight. On-premise configurations also enable a deeper integration with existing laboratory networks. Their reliability and tradition make them a trusted option for well-established healthcare facilities. Therefore, on-premises remains the default deployment model for centralized diagnostics.

Point-of-Care / Near-Patient Testing: The near-patient testing segment is the fastest-growing in the coagulation analyzers market, with a 25% growth rate. It looks to eliminate dependence on laboratory logistics and accelerate medical decision-making. Health care organizations eager to implement patient-centered, streamlined workflows are the biggest adopters of POC arrangements. The convenience and flexibility of placing analyzers directly in care sites are among the main factors contributing to changes in diagnostic flow.

Application Insights

Diagnostic Testing (Bleeding / Clotting Disorders): Diagnostic testing is dominating the coagulation analyzers market, holding a 35% share, and is the most important, as coagulation assays are instrumental in evaluating bleeding disorders, readiness for surgery, and overall clotting function. Hospitals and labs constantly perform these tests as part of their routine; thus, the demand for them is substantial and steady. Automation in diagnostic systems, on the one hand, ensures precision; on the other hand, it provides clinicians with quick assistance via the interpretation of patient conditions. Given the trend toward lifestyle and chronic diseases, routine coagulation testing is becoming an even more critical part of the healthcare process. Diagnostic workflows cannot do without these assays if they are to serve as safe guides for clinicians' next moves. This continual clinical relevance is what keeps diagnostic testing at the very top.

Anticoagulant Therapy Monitoring (Warfarin/DOACs): The Anticoagulant Therapy Monitoring segment is the fastest-growing in the coagulation analyzers market, with a 25% share, as the number of patients on long-term blood-thinning regimens increases. Proper management of these therapies requires frequent, accurate measurement of coagulation levels to avoid complications. The rise in the aged population and the increase in cardiovascular risks are driving the demand for continuous monitoring at a rapid pace. Point-of-care devices make such monitoring even more convenient, as they give clinicians the freedom to adjust dosages on the spot. In addition, the fashion for personalized therapy is also bearing fruit for targeted monitoring. The combination of clinical necessity and ease of use is the major driver behind the enormous growth in this sector.

Technology/Mode of Action Insights

Photo-optical/Optical Clot Detection: Photo-optical dominates the coagulation analyzers market, holding a 30% share, due to its long-term use, reliability, accuracy, and compatibility with automated platforms. Laboratories are confident in this method because it is a source of stable results and is easily performed alongside regular coagulation tests. The technology is inexpensive, making it a highly attractive method in situations with high volume and where budget constraints exist. Most of the current analyzers are built on photo-optical concepts, which further consolidates its dominant position. The technology has been continuously improved, so it remains up-to-date and efficient, although new innovations have been introduced recently. Its good performance, as well as the lab staff's familiarity with it, is what has kept photo-optical technology in the leading position for so long.

Viscoelastic Testing (TEG/ROTEM): Viscoelastic testing is the fastest-growing segment in the coagulation analyzers market, with a 15% share. This is a real-time procedure using whole blood and is very helpful in cases of trauma, surgery, and intensive care. Such detailed information allows the doctor to customize interventions for the patient, thereby improving the chances of recovery in complex cases. The more personalized medicine becomes, the more people want such advanced tests. Hospitals conducting high-risk operations are progressively installing viscoelastic instruments.

End-User Insights

Hospitals & Clinical Diagnostic Laboratories: Hospitals & clinical diagnostic laboratories dominate the coagulation analyzers market, holding a 55% share. Due to their high patient turnover, they require reliable, automated analyzers capable of handling large-volume workloads. Furthermore, it is typical of these institutions to have the budgets and technical personnel needed to work with advanced systems. The integration of laboratory workflows renders high-throughput devices indispensable for maintaining efficiency. Supported with a solid infrastructure and constant testing needs, hospitals remain the major consumers. It is their central position in patient care that firmly puts them in the lead.

Point-of-Care Clinics & Ambulatory Centers: The point-of-care clinics & ambulatory Centers are the fastest-growing segment in the coagulation analyzers market, holding a 15% share. As such, there is a gain due to the availability of compact analyzers that provide immediate results and support fast-paced clinical decision-making. The trend of patients choosing outpatient facilities for convenience has further increased demand. On top of that, ambulatory centers implement point-of-care systems to stay viable without the need to be fully equipped with labs. They are expanding into both urban and rural areas, which is accelerating the adoption of analyzers. This, in turn, makes them the fastest-progressing end-user group.

Treatment Line/Usage Insights

Routine Diagnostic Screening: Routine diagnostic screening is dominating the coagulation analyzers market, holding a 50% share, because coagulation tests are pivotal components of everyday clinical assessments, necessary instruments during pre-surgical checks, and for monitoring various disorders. Screening techniques used for diagnostic purposes serve as the main pillar of coagulation diagnostics in hospitals and labs alike. The volume of regular tests is much higher than that of specialized procedures, which is why the latter are in the shadow of the former and account for a very small share of the total market. The instruments are set up to meet the day-to-day needs, so the clinical staff cannot do without them. Clinicians turn to routine results when it comes to patient safety and when they need therapeutic guidance. This persistent request is what keeps routine screening as the dominant treatment line.

Anticoagulation Management & Monitoring: The anticoagulation management & monitoring is fastest growing in the coagulation analyzers market by holding a share 25%, is the area where the fastest growth is observed with the most significant reason behind this being the escalation of cardiovascular issues which, in turn, has led to the increase of cardiovascular disease patients, who have become the major recipients of blood-thinning treatments.

Distribution Channel Insights

Direct Sales: This segment dominates the coagulation analyzers market, accounting for 50% of the market share and playing a crucial role in reaching end users. Direct sales dominate the market, contributing the largest share due to their established relationships with hospitals and clinical laboratories. This channel allows for in-depth customer engagement and support, which is vital for high-value medical instruments.

Online / E-procurement & Consumables Marketplaces: On the other hand, online sales are emerging as the fastest-growing distribution channel. The rising trend of e-procurement and the increased reliance on online marketplaces are driving this growth. As healthcare organizations seek more convenient purchasing options and streamlined procurement processes, online sales are expected to expand significantly in the coming years.

Coagulation Analyzers MarketRegional Insights

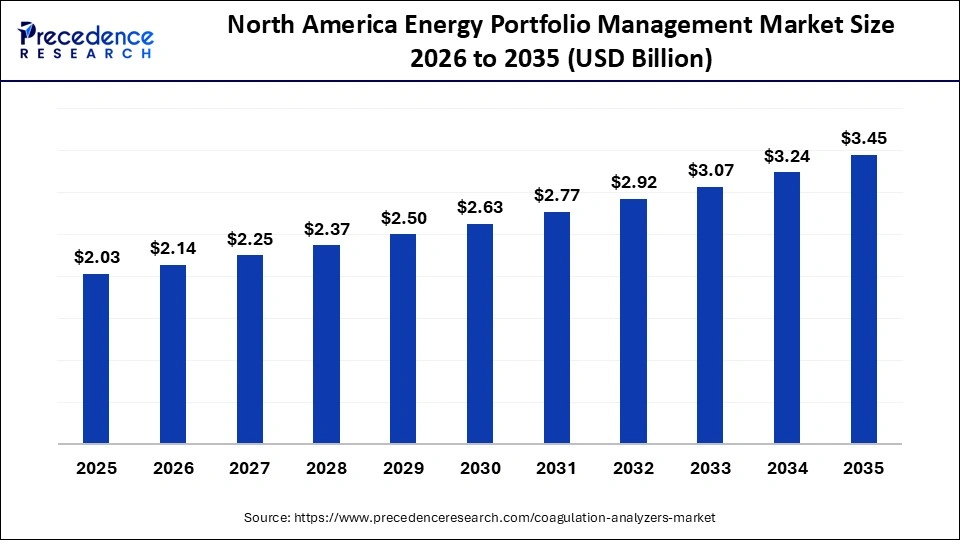

The North America coagulation analyzers market size is estimated at USD 2.03 billion in 2025 and is projected to reach approximately USD 3.45 billion by 2035, with a 5.45% CAGR from 2026 to 2035.

Why is North America Dominating the Coagulation Analyzers Market?

North America continues to dominate the coagulation analyzers market, holding a 40% share, driven by a mature diagnostic ecosystem and high clinical adoption of automated testing systems across hospitals, diagnostic centers, and emergency care settings. The region maintains a strong emphasis on early identification of coagulation disorders, supported by clinical guidelines from organizations such as the American Society of Hematology (ASH) and the American College of Cardiology (ACC), which encourage routine PT, aPTT, and D-dimer testing for patients undergoing anticoagulant therapy or cardiovascular procedures.

High awareness of coagulation abnormalities, combined with the region's growing burden of thrombotic disease, reinforces consistent demand. The Centers for Disease Control and Prevention (CDC) reported in 2022 that venous thromboembolism affects approximately 900,000 individuals annually in the United States, underscoring the need for frequent monitoring.

Advanced analyzers with high-throughput workflows, integrated quality-control features, and laboratory information system connectivity are in strong demand. Hospitals increasingly require analyzers that deliver fast turnaround times for trauma care, cardiac interventions, and perioperative management. Emergency departments also rely on point-of-care coagulation platforms aligned with national stroke protocols, including the American Heart Association's 2024 guidance, which supports rapid D-dimer assessment to differentiate thrombotic events.

The U.S. coagulation analyzers market size is calculated at USD 1.52 billion in 2025 and is expected to reach nearly USD 2.61 billion in 2035, accelerating at a strong CAGR of 5.56% between 2026 and 2035.

U.S. Coagulation Analyzers Market

The U.S. is the main contributor to demand, with factors behind this production including nationwide hospital chains, high incidence of chronic conditions, and the rapid adoption of automated analyzers in clinical workflows. Canada is next in line, with consistent uptake mainly driven by government-led diagnostics infrastructure modernization and a focus on equitable access to quality testing. These two countries create a regional market landscape characterized by high technology and high value.

The Asia Pacific coagulation analyzers market size is expected to be worth USD 2.34 billion by 2035, increasing from USD 1.37 billion by 2025, growing at a CAGR of 5.50% from 2026 to 2035.

What Made the Asia Pacific Fastest Growing Market in the Coagulation Analyzers Market During 2025?

Asia Pacific is the fastest-growing region in the coagulation analyzers market. It is expected to grow at a CAGR of 27% between 2026 and 2035, driven by worldwide awareness of coagulation-related problems, especially among the elderly population, which is encouraging increased testing requirements. Several hospitals are moving to a complete switch from manual testing to automated platforms, which are more accurate and have higher throughput. On top of that, government-led investments in laboratory infrastructure are reducing access to advanced analyzers. The region's development is also the result of the rapidly growing private healthcare networks and the increasing number of patients.

China Coagulation Analyzers Industry

China sets the example for others to follow with its fast hospital laboratory upgrades and huge investments in high-throughput analyzers. India is not very far from China, where the long-term trend of a growing patient base, together with the boom in private diagnostic chains, is driving market penetration to new levels. Moreover, Southeast Asian countries show strong momentum in uptake as they build new healthcare facilities and put diagnostic practices into operation.

The Europe coagulation analyzers market size has grown strongly in recent years. It will grow from USD 1.27 billion in 2025 to USD 2.17 billion in 2035, expanding at a compound annual growth rate (CAGR) of 5.50% between 2026 and 2035.

Why Is Europe Notably Growing in the Coagulation Analyzers Industry?

Europe is notably growing in the coagulation analyzers market, with a 25% share, supported by high clinical standards and structured diagnostic pathways established across national healthcare systems. Many European countries follow standardized coagulation testing protocols aligned with the European Haematology Association (EHA) and the European Society of Anaesthesiology and Intensive Care (ESAIC), which recommend routine PT, aPTT, fibrinogen, and D-dimer testing for patients undergoing major surgery, anticoagulant therapy, or cardiovascular management. Preventive healthcare remains a central pillar of European health policy, and this has resulted in more frequent coagulation screenings, particularly for aging populations with an elevated risk of thrombotic and bleeding disorders. According to Eurostat's 2023 demographic report, over 21% of the EU population is aged 65 or older, a group with higher diagnostic demand for coagulation evaluation.

Next-generation, high-throughput analyzers are increasingly being selected by European hospitals because they provide enhanced accuracy, automated calibration, onboard quality-control management, and faster turnaround times, all of which are essential for perioperative care and emergency departments. Many laboratories across Germany, France, the United Kingdom, and the Nordics are integrating analyzers that comply with the upgraded ISO 15189:2022 medical laboratory requirements, which emphasize traceability, precise measurement performance, and digital connectivity with national laboratory information systems.

Germany Coagulation Analyzers Industry

Germany is still leading the way in laboratory automation and remains one of Europe's earliest adopters of innovative analyzer technologies. This leadership is supported by the country's long-standing investment in high-throughput laboratory systems, strong engineering capabilities, and alignment with stringent quality frameworks such as ISO 15189:2022. German laboratories are also influenced by national initiatives such as the Medical Informatics Initiative (MII), launched in 2016, which continues to promote digital integration and standardized data exchange across diagnostic networks. These factors make Germany one of the most consistent adopters of next-generation coagulation analyzers that offer automated calibration, advanced optical detection, and integrated quality-control management.

The Middle East and Africa are notably growing in the coagulation analyzers market, holding a share of 3%, driven by the rising prevalence of lifestyle-related diseases such as diabetes, obesity, and cardiovascular disorders. These conditions significantly increase the risk of thrombotic events, which in turn fuels demand for more reliable coagulation testing across hospitals and diagnostic laboratories. According to the World Health Organization's 2023 regional update, noncommunicable diseases account for more than 75% of mortality in high-income Middle Eastern countries, a trend that has encouraged routine PT, aPTT, and D-dimer testing in both inpatient and outpatient settings.

Standardization of diagnostics and the need to improve patient outcomes are major drivers behind hospital investments in automated and semi-automated analyzers. Several national health initiatives are supporting this shift. For instance, the Saudi Ministry of Health's Health Sector Transformation Program (launched under Vision 2030) includes plans to modernize laboratory services and expand automated diagnostic platforms.

MEA Country Level Analysis

The UAE and Saudi Arabia are the most eager adopters, helped by healthy investment in healthcare technology and large-scale hospital expansions. South Africa comes next in Africa, where the most consistent demand is observed, and is the main driver of extensive diagnostic laboratory networks. The other countries are slowly but steadily raising their adoption levels as healthcare access and funding improve.

Latin America is notably growing in the coagulation analyzers market, with a 5% share, driven by the transition of hospitals and laboratories from manual to automated coagulation testing to improve reliability, reproducibility, and operational efficiency. Many facilities are shifting toward high-throughput systems with integrated quality-control functions because manual clotting assays have higher variability and longer turnaround times. This shift aligns with regional initiatives to modernize diagnostic workflows; for example, the Pan American Health Organization (PAHO) has emphasized strengthening laboratory automation and quality standards in its 2022-2030 Sustainable Health Agenda for the Americas, prompting hospitals to adopt equipment that supports standardized coagulation assessment.

Patient inflow is rising as chronic disease incidence increases across the region. According to PAHO's 2023 noncommunicable disease report, cardiovascular diseases account for roughly 34% of total deaths in Latin America, reinforcing the need for routine PT, aPTT, fibrinogen, and D-dimer testing for patients undergoing anticoagulant therapy or cardiovascular interventions.

Brazil Coagulation Analyzers Market

Brazil is the market leader, with its widespread diagnostic networks and ongoing healthcare modernization initiatives. Mexico is next, where both public and private hospitals are increasingly investing in high-performance analyzers. The rest of the countries in the region are gradually embracing advanced coagulation systems as their healthcare budgets and capacities improve.

Coagulation Analyzers Market Value Chain

- Raw Material Sourcing

Sourcing raw materials for coagulation analyzers includes essential elements such as high-quality plastics (PP, ABS) for containers and housings, metals (iron, tungsten) used in surgical coagulators, specialized reagents (chromogenic substrates, buffers) required for testing, and precise electronic components. All these materials are procured from verified vendors that prioritize quality and ensure biological safety (free from toxins and pyrogens) and instrument performance, leading to dependable hematology results.

Key players: Siemens Healthineers and Diagnostica Stago SAS.

- R&D

The research and development in the coagulation analyzers focuses on automation integration, portability, and the development of new, high-value assays to improve diagnostic and workflow accuracy.

Key players: AbbVie

Top Companies Coagulation Analyzers Market

- Sysmex Corporation

- Siemens Healthineers

- Roche Diagnostics

- Abbott Laboratories

- Instrumentation Laboratory (Werfen)

- Helena Laboratories

- Thermo Fisher Scientific

- Horiba Medical

- Nihon Kohden Corporation

- Diagnostica Stago

- Medtronic

- Mindray

- SEKISUI Diagnostics

- Beckman Coulter

- Sysmex Europe GmbH

- Erba Mannheim

- Agappe Diagnostics

- Diagon Ltd.

- Rayto Life and Analytical Sciences

- Trivitron Healthcare

Recent Developments

- In December 2025, Invicta Diagnostic, a diagnostics chain located in Mumbai, is set to launch its Rs 28 crore SME IPO for subscription today, despite low grey market activity indicated by a GMP of 0%. This three-day book-building issue will be open until December 3, with a listing anticipated on the NSE SME on December 8. The IPO consists entirely of a new issue of 33.08 lakh shares and is priced in the Rs 80-85 range.(Source: https://economictimes.indiatimes.com)

Coagulation Analyzers MakretSegment Covered in the Report

By Product Type

- Automated Coagulation Analyzers

- Fully Automated Benchtop Analyzers

- High-Throughput Systems

- Point-Of-Care (POC) Coagulation Devices

- Portable INR/PT Testers

- Handheld Coagulation Meters

- Semi-Automated Coagulation Analyzers

- Semi-Automated Photo-Optical Systems

- Semi-Automated Mechanical Systems

- Viscoelastic & Hemostasis Analyzer

- TEG (Thromboelastography) systems

- ROTEM Systems

- Reagents, Kits & Calibrator

- PT/aPTT Reagents

- Factor Assays & Controls

- Consumables & Accessories

- Cuvettes, Cartridges, QC Materials

By Deployment Type

- On-Premise/Central Lab

- Point-Of-Care/Near-Patient Testing

- Cloud-Enabled/Remote Monitoring (Connected Systems)

By Application

- Diagnostic Testing (Bleeding/Clotting Disorders)

- Anticoagulant Therapy Monitoring (Warfarin/Doacs)

- Pre-Surgical & Perioperative Screening

- Critical Care & Emergency Testing

- Research & Clinical Trials

By Technology/Mode of Action

- Photo-Optical/Optical Clot Detection

- Mechanical/Electromechanical Detection

- Chromogenic/Colorimetric Assays

- Viscoelastic Testing (Teg/Rotem)

- Immunoassay-Based Coagulation Tests

- Ai/Software-Driven Data Analytics & Connectivity

By End-User

- Hospitals & Clinical Diagnostic Laboratories

- Point-Of-Care Clinics & Ambulatory Centers

- Blood Banks & Transfusion Centers

- Specialty Hematology Centers

- Research Institutes & CROs

- Other End-Users

By Treatment Line/Usage

- Routine Diagnostic Screening

- Anticoagulation Management & Monitoring

- Surgical/Perioperative Management

- Critical Care/Emergency Interventions

- Clinical Research/Trials

By Distribution Channel

- Direct Sales (Manufacturer Hospital/Lab)

- Distributors & Channel Partners

- Service & Maintenance Contracts (Incl. Consumable Bundles)

- Online/E-Procurement & Consumables Marketplaces

- Government Tenders & Public Procurement

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting