What is the Coal Power Generation Market Size?

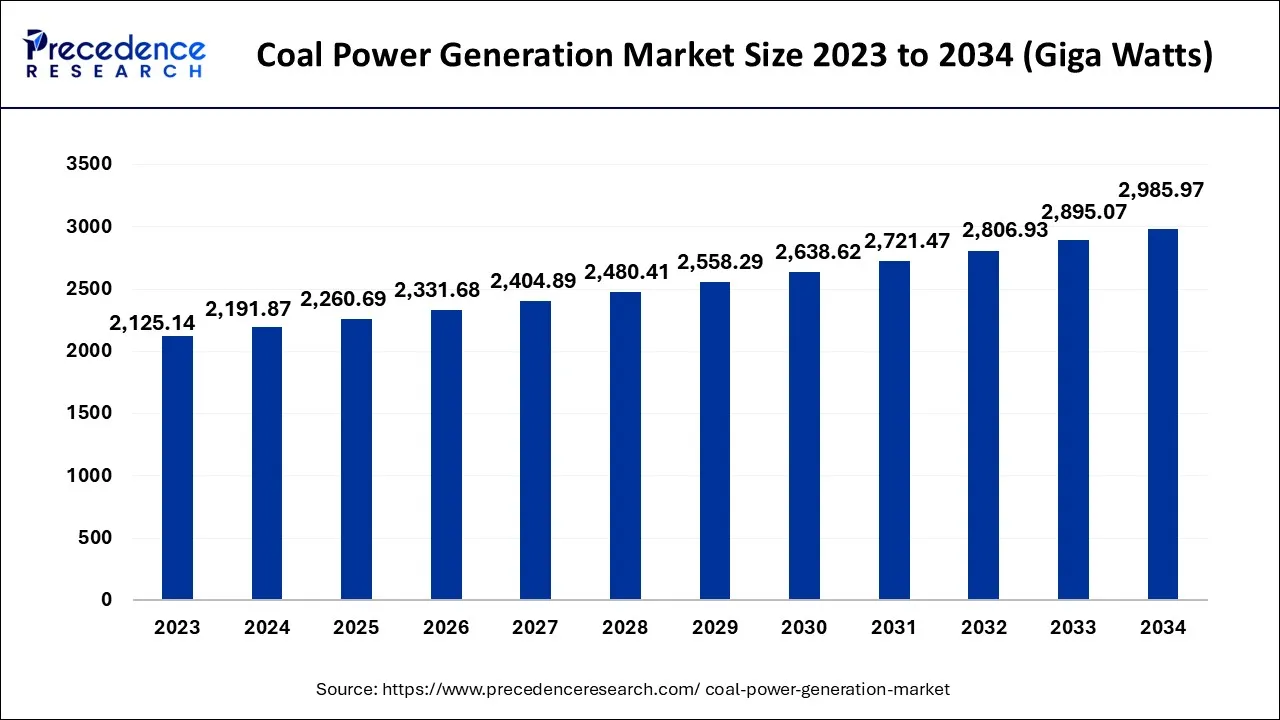

The global coal power generation demand is worth around USD 2,260.69 giga watts in 2025 and is anticipated to reach around USD 3,076.87 giga watts by 2035, growing at a CAGR of 3.14% over the forecast period 2026 to 2035. The presence of low-cost electricity generation technologies in the coal power industry will continue to contribute to the growth of the global coal power generation market.

Coal Power Generation Market Key Takeaways

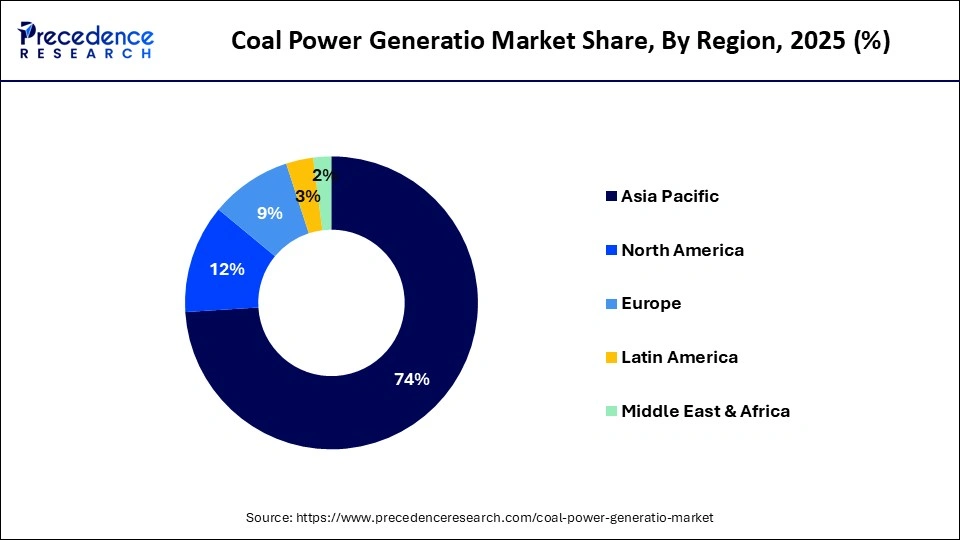

- Asia Pacific held the dominating volume share of 74% in 2025 and is predicted to maintain its dominance between 2026 and 2035.

- Middle East and Africa is expected to grow significantly between 2026 and 2035.

- By Technology, the pulverized coal system segment generated the dominating share of the market, In terms of volume.

- By Technology, the cyclone furnaces segment is expected to record the fastest CAGR between 2026 and 2035.

- By Application, the residential segment captured the highest share of around 57% in terms of volume, In 2025.

- By Application, the commercial and industrial is the fastest-growing segment of the global market.

Market Overview

Coal power generation is a standard method of producing electricity, as coal is abundant and relatively cheap compared to other sources of energy. The coal power generation market refers to the global market for the production of electricity from coal. It includes the various companies, organizations, and industries involved in mining, transporting, processing, and burning coal to generate electricity.

Increasing government focus on supporting coal power generation, along with effective policies and regulations, is considered to drive the growth of the global coal generation market. Governments around the world are offering subsidies to coal power generation companies; with this, tax incentives by governments help to reduce the cost of producing electricity from coal.

Governments are investing in research and development of new technologies that can improve the efficiency and environmental performance of coal power plants, such as carbon capture and storage technologies. Moreover, governments are significantly promoting the building of coal power plants to support electricity generation by coal power plants in order to boost financial health along with cost-effective electricity production.

The US government has invested in research and development of new technologies that can improve the efficiency and environmental performance of coal power plants. For example, the Department of Energy's Office of Fossil Energy has supported research on carbon capture and storage (CCS) technologies, which can capture carbon dioxide emissions from coal-fired power plants and store them underground.

Along with this, several governmental bodies or departments are also investing in the development of infrastructure, such as ports and railways, that can make it easier and more cost-effective to transport coal to power plants.

Indian railway ports handle significant quantities of imported coal. India is the world's second-largest coal importer, after China, and imports a substantial portion of its coal from countries such as Australia and Indonesia. The ports of Mundra, Krishnapatnam, and Kandla are some of the major ports in India that handle imported coal. The government significantly focuses on developing infrastructure to ease coal transportation in larger quantities with the deployment of advanced technology to induce productivity.

IIT's Technological Advancement: Supplement for Coal Power Generation

Researchers are consistently seeking for ways to make coal power generation more efficient and cleaner. Several Innovative experiments were conducted on a new kind of nickel alloy that showed promising resistance to oxidation in extreme temperature and pressure conditions. These findings can be instrumental in reducing the environmental impacts of using fossil fuel-based sources like coal for power generation while boosting efficiency levels in the power sector.

- A team of researchers at the Indian Institute of Technology Bombay (IIT Bombay) have reported promising results in a steam oxidation test conducted on Ni-base superalloy 617, or Alloy 617, which is expected to transform the functionality of coal-based power plants. The tests were performed in a simulated Advanced Ultra Supercritical (AUSC) environment, specifically designed to replicate the extreme temperature and pressure conditions that exist in a coal-fired power plant.

5g Chipset Market Growth Factors

- The easy availability of domestic coal reserves in coal-rich countries is expected to boost the growth of the coal power generation market in the coming years.

- The significant rise is Government investment in coal power plants are anticipated to drive the expansion of the coal power generation market during the forecast period.

- The rapid urbanization and industrialization are likely to accelerates the demand for electricity in the various region around the over the forecast period.

- The significant rise in population along with increasing disposable income is expected to propel the growth of the market during the forecast period.

- The less upfront capital costs of coal power plants are anticipated to contribute to the overall market's revenue.

- The less cost required for electricity generation than other sources such as natural is projected to create significant growth opportunities for market's growth during the forecast period.

- The significant increase in construction spending for residential and commercial project development is expected to contribute the overall the growth of the coal power generation market during the forecast period.

Market Outlook

- Industry Growth Overview: The global coal power generation market is experiencing modest growth driven by increasing energy demand in emerging economies.

- Major investors: Major corporate and institutional investors in the market include state-owned enterprises like China Energy Investment Corporation, China Huaneng Group, and NTPC Limited (India), as well as private companies such as Adani Power, Tata Power, and JSW Energy.

- Global Expansion: The market stands at a complex intersection of aggressive decarbonization efforts in Western economies and an unyielding demand for energy security and industrial growth in developing Asia.

- Startup Ecosystem: The startup ecosystem within the broader coal power generation market primarily focuses on developing "clean coal" technologies and enhancing operational efficiency through digital solutions.

Market Scope

| Report Coverage | Details |

| Market Demand in 2025 | 2,260.69 Giga Watts |

| Market Demand by 2035 | 3,076.87 Giga Watts |

| Growth Rate from 2026 to 2035 | CAGR of 3.14% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Cost-competitiveness of coal power generation plants

Coal is often a cost-competitive source of electricity generation, particularly in regions where other energy sources, such as renewables, are not yet widely available or cost-effective. Coal power generation is often more affordable than other sources of energy, such as natural gas or renewables, especially in regions where coal is abundant and easily accessible. This can help to ensure that electricity remains affordable and accessible for households and businesses.

Coal power generation can provide reliable and affordable electricity access for regions with limited access to other energy sources. This can be particularly important for developing countries, where access to electricity is still limited. Thus, the cost-competitiveness of coal power generation plants is observed as a critical driver of the growth of the coal power generation market.

Rising demand of electricity

Coal is the prime source of document for electricity generation in several countries around the world. Coal-fired plants produce electricity by burning coal in a boiler to produce steam. In coal-fired power plants, subbituminous coal, bituminous coal, or lignite is burned. Coal power generation is often more affordable than other sources of energy, such as natural gas especially in regions where coal is abundant and easily accessible. Additionally, the cost-competitiveness of coal power generation plants is expected to be the major driving factor for the growth of the coal power generation market. This can help to ensure that electricity remains affordable and accessible for businesses and households. Thus, rising consumption of electricity around the world is likely to propel the growth of the market during the forecast period.

- According to the IEA, Global coal demand reached a record high in 2022 amid the global energy crisis, rising by 4% year-on-year to 8.42 billion tonnes (Bt). In China, demand rose by 4.6%, or 200 million tonnes (Mt). In India, it increased by 9%, or 97 Mt.

- According to the International Energy Agency (IEA), coal-fired generation set a new global record high of 10,440 TWh. In 2022, representing about 36% of global electricity production. Worldwide, more than 107 countries and 2,000 entities are using coal across roughly 13,800 coal units.

Restraint

Environmental regulations

Environmental regulations can significantly restrain the growth of the coal power generation market by increasing costs and creating additional regulatory hurdles. Many countries and regions have implemented emissions reduction requirements for coal power plants in an effort to reduce greenhouse gas emissions and combat climate change.

Compliance with these regulations can require significant investments in emissions-reduction technologies, which can increase costs and reduce profitability. Environmental regulations can create additional permitting and approval requirements for coal power plants. These requirements can increase the time and cost of developing new coal power projects, making them less attractive to investors and power generators.

Opportunity

Deployment of carbon capture and storage technology

Carbon capture and storage (CCS) technology creates an opportunity for the coal power generation market to grow by reducing the environmental impact of coal-fired power plants. CCS technology captures carbon dioxide (CO2) emissions from coal-fired power plants and stores them underground, preventing them from entering the atmosphere and contributing to climate change.

With increasing global pressure to reduce greenhouse gas emissions, regulations are being implemented to limit CO2 emissions from power plants. CCS technology can help power plants comply with these regulations, allowing them to continue operating and avoiding potential penalties or shutdowns. With CCS technology, coal-fired power plants can be more competitive with other forms of energy generation that emit fewer greenhouse gases.

Technology Insights

The pulverized coal system segment holds the dominating share of the market, In terms of volume. The pulverized coal system is the most commonly used technology in coal power generation plants. The pulverized coal system offers a combination of efficiency, flexibility, reliability, low emissions, and ease of maintenance that makes it a popular choice for coal power generation.

Moreover, the advancements in the pulverized coal system technology are subjected to maintain the segment's growth during the forecast period. Modern and advanced pulverized coal systems are equipped with advanced pollution control technologies, such as flue gas desulfurization (FGD) and selective catalytic reduction (SCR), which can significantly reduce emissions of sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter.

The cyclone furnaces segment is expected to register the fastest growth in the market during the forecast period. The advantages offered by cyclone furnaces over traditional coal-fired power plants are supplementing the segment's growth. Cyclone furnaces are better able to handle a broader range of coal types, including lower-quality coals that are typically more difficult to burn. This makes them more flexible and adaptable to different coal sources, which can help to reduce costs and increase efficiency.

Application Insights

The residential segment held a significant volume share of the market, and the affordability and reliability of coal power generation for residential consumers have supported the segment's growth. Coal power generation can be a cost-competitive source of electricity, which can help to keep electricity prices affordable for residential consumers. The enormous demand for household electricity is the primary factor in supplementing the segment's growth throughout the forecast period.

The commercial and industrial segment is the fastest-growing segment of the coal power generator market; the segment is predicted to hold the largest revenue share during the forecast period. Manufacturing industries and commercial areas require a continuous supply of electricity. The ability of coal power generation plants to produce a large and sufficient amount of electricity constantly has highlighted their industrial use.

Additionally, industries implementing advanced technologies to reduce the CO2 emissions from coal power generation plants are expected to fuel the segment's growth during the forecast period.

Regional Insights

Asia Pacific Coal Power Generation Market Demand and Growth 2026 to 2035

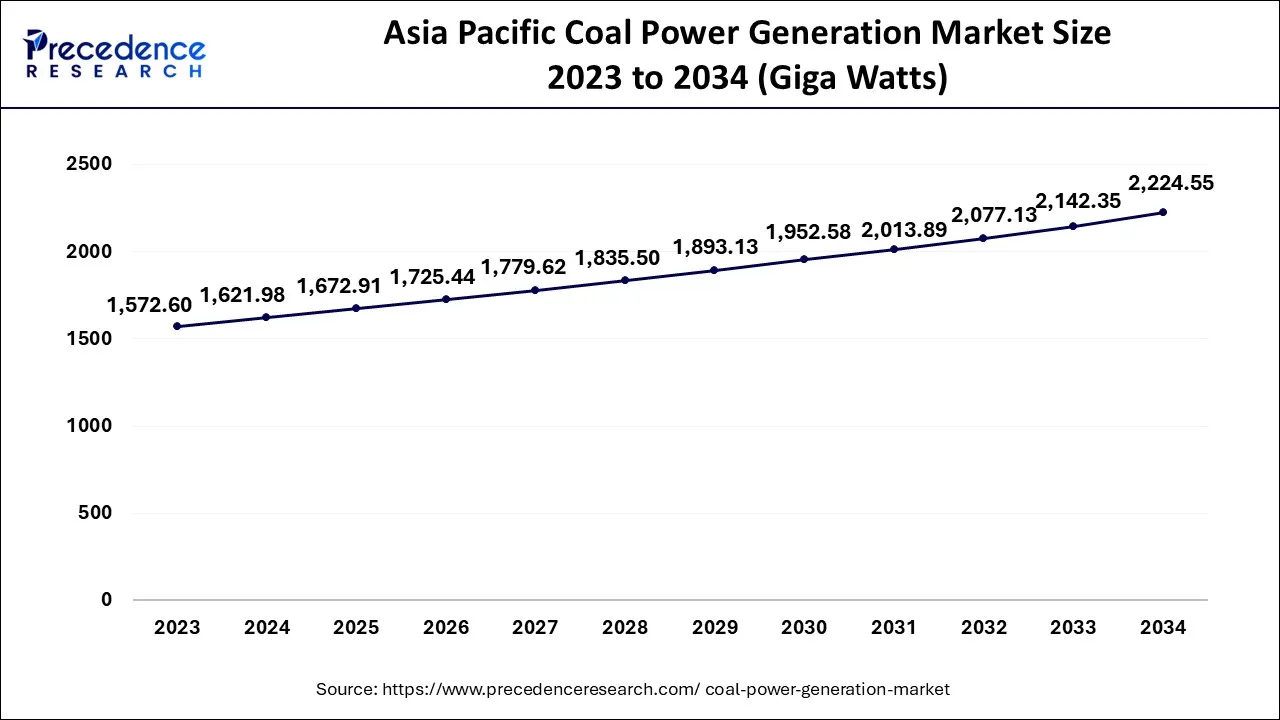

The Asia Pacific coal power generation demand is exhibited at USD 1,672.91 giga watts in 2025 and is projected to be worth around USD 2,306.75 giga watts by 2035, growing at a CAGR of 3.26% from 2026 to 2035.

Asia Pacific held the dominating volume share of the global coal power generation market in 2025

Asia Pacific region is expected to maintain its dominance throughout the analyzed period. Countries such as Japan, India, China, and Indonesia are major coal consumers as a fuel source for electricity generation due to their large populations and growing economies.

China's coal power generation industry is one of the strongest and most established in the world. China is the world's largest producer and consumer of coal, accounting for around 60% of the country's total primary energy consumption. In China, the coal power generation market is dominated by state-owned enterprises that control the majority of coal production, transportation, and power generation facilities. The large size of China's coal power generation industry has allowed for economies of scale in both coal mining and power generation, resulting in lower costs and higher efficiency.

Several governments and private bodies are shifting towards cost-effective measures to produce electricity; South Korea is intended to be one of such countries that is currently focusing on electricity production while improving the infrastructure of coal power plants.

In October 2022, South Korea's power utility stated that it is focused on increasing the coal power electricity generation this year to boost the country's financial health. Under this plan, the Korea Electric Power Corporation (KEPCO) will produce 12.8 terawatt hours with coal instead of using liquified natural gas.

- India's total installed power generation capacity has grown around 80 % over the last 10 years. The installed capacity which was 2,48,554 MW in March 2014 has been increased to 4,46,190 MW in June 2024. Installed capacity of Coal based power has increased from 1,39,663 MW in March 2014 to 2,10,969 MW in June 2024.

- SHAKTI policy for transparent allocation of coal to Thermal Power plant was introduced, which enabled efficient domestic coal allocation to Thermal power plants and also ensured revival of various stressed Thermal Power projects.

- According to the Centre for Research on Energy and Clean Air (CREA), 50 GW of coal power capacity started construction in China in 2022, a more than 50% increase from 2021, with many projects newly permitted in 2022 and fast-tracked to construction. A total of 106 GW of new coal power projects were permitted, more than quadrupling from 23 GW in 2021.

- According to the Global Energy Monitor, China accounted for 95% of the world's new coal power construction activity in 2023.

- The Government of India has also implemented the Pradhan Mantri Sahaj Bijli Har Ghar Yojana- (SAUBHAGYA) with the

- objective to achieve universal household electrification for providing electricity connection to all willing un-electrified household in rural area and all willing poor household in urban areas in the country. Under these schemes, 18,374 villages have been electrified and 2.86 crore household were provided electricity connection.

The coal power generation market in the Middle East and Africa is expected to grow significantly during the forecast period. There are multiple opportunities for the coal power generation market in the MEA region, particularly in countries with substantial coal reserves or limited alternative energy sources. There have been some recent developments that suggest that coal power generation may be gaining some traction in the region.

For instance, in 2021, Saudi Arabia announced plans to build a new coal-fired power plant with a capacity of 1.5 gigawatts, which would be the largest coal-fired power plant in the Middle East if completed. The plant is intended to provide a source of baseload power to support the growth of renewable energy sources in the country.

North America is another considerable marketplace for coal power generation. The US government has provided tax incentives to support investment in coal power plant technology. For instance, the federal government has provided tax credits for carbon capture and storage projects, which can help to make these projects more financially viable.

Moreover, the US government has provided loan guarantees to support the construction of new coal-fired power plants. For example, the Department of Energy's Loan Programs Office provided a $1.3 billion loan guarantee to support the construction of the Prairie State Energy Campus, a 1,600-megawatt coal-fired power plant in Illinois.

However, the long-term outlook for the North American coal power generation market is likely to be constrained by a combination of economic and environmental factors, as well as increasing competition from natural gas and renewable energy sources.

- In 2024, electricity use increases the most in the residential and commercial sectors. It expected 3% more electricity consumption in the U.S. residential sector than 2023, which mostly reflects the hot summer this year.

- According to the U.S. Energy Information Administration, In U.S. electricity generation, from 4,230 to 4,350 billion kilowatthours.

Europe's Coal Comeback: Powering Notable Growth Amid Energy Generation

Europe held a notable market share in 2025. The growth of the region can be attributed to the increasing adoption of supercritical and ultra-supercritical boilers, which reduce the overall operational costs and carbon emissions. In addition, coal offers a cheaper and domestically available substitute to volatile gas prices, particularly for Eastern Europe.

Germany Coal Power Generation Market Trends

The growth of the market in the country can be driven by ongoing integration with renewable energy sources and growing emphasis on AI-powered emissions control. Carbon pricing makes coal generation more cost-effective, boosting its replacement by gas and battery storage.

Coal Power Generation Market-Value Chain Analysis

- Upstream Coal Exploration and Mining

The value chain begins with the identification of coal reserves and the physical extraction of various coal types, including Anthracite, Bituminous, and Lignite.

Major Players: China Shenhua Energy, Glencore. - Midstream Processing, Logistics, and Supply Chain

Once extracted, coal must be prepared and transported to power stations. Advanced technologies like heavy media cyclones and teeter bed separators are used to improve coal quality and reduce ash content.

Major Players: Mahanadi Coalfields Limited (MCL), BHP Group & Rio Tinto. - Downstream Power Generation and Technology

This stage involves the conversion of thermal energy from coal into electrical energy.

Major Players: NTPC Limited, Duke Energy. - Equipment Manufacturers and Service Providers

The value chain is supported by specialized engineering firms that provide the core hardware (boilers, turbines, generators) and digital optimization tools.

Major Players: Siemens Energy, General Electric.

Top Companies in the Coal Power Generation Market & Their Offerings:

- Tata Power Company Limited (India): Has developed advanced Combined Heat and Power (CHP) plants for simultaneous electricity and steam production.

- Mitsubishi Power (Japan): A technology provider focusing on upgrading existing thermal plants with high-efficiency boilers and advanced emission controls.

Coal Power Generation Market Companies

- China Huaneng Group

- China Datang Corporation

- NTPC Limited

- Korea Electric Power Corporation (KEPCO)

- American Electric Power (AEP)

- Duke Energy Corporation

- E. ON SE

- RWE AG

- Southern Company

- Eskom Holdings SOC Ltd.

Recent Developments

- In June 2024,Adani Power Ltd (APL) announced that its arm Mahan Energen Ltd has approved a proposal to merge coal mining firm Stratatech Mineral Resources with itself which will help improve fuel security.

- In February 2023, Indonesia announced the launch of the first mandatory carbon trading for coal power plants. This step is a part of Southeast Asia's biggest economy to boost renewable energy and achieve net zero emissions by 2060. The first phase of carbon trading will cover 99 power plants with a capacity of at least 100 MW.

- In February 2023,JERA, Japan's largest power generator and steelmaker, Kobe Steel, announced the launch of two power units, a natural gas-fired and a coal-fired, respectively. Japan is currently facing tight power capacity; this launch aims at the nation's carbon neutrality goal by 2050. Both companies have already planned to launch two new power units in April and August.

- In November 2022,The Asian Development Bank, Indonesia, and a private power firm announced to team up to launch the first coal fired power plant under a groundbreaking carbon emission reduction program. The new project is aimed to be a 660-megawatt Cirebon 1 power plant with a $250-300 million deal.

- In July 2022,Bangladesh-India Friendship Power Company Ltd (BIFPCL) announced to start the implementation of a 1,320-megawatt Rampal coal fired power plant 14 kilometers away area from the Sunderbans. The company aims to begin the trial process in the coal plant by September. According to the officials, the electricity generated in the coal fired power plant of Rampal will be supplied to Khulna and later on to Dhaka across the Padma River.

- In June 2022, Georgia Power announced to launch of a beneficial coal ash project at Plant Bowen near Carterville. The ash will be excavated to construct buildings, roads, and bridges in Georgia. Georgia Power already recycles 85% ash and gypsum from the coal power plant, which has helped as an offset financial tool.

- In January 2022,Bryden Wood announced the creation of a new digital platform for making the replacement of coal-fired boilers at existing coal power plants with advanced modular nuclear reactors possible at scale and speed; this aims to allow the use of existing infrastructure for clean electricity generation and offer a low-risk path to decarbonizing global power generation.

Segments Covered in the Report

By Technology

- Pulverized Coal Systems

- Cyclone Furnaces

- Others

By Application

- Residential

- Commercial and Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content