What is the Power Rental Market Size?

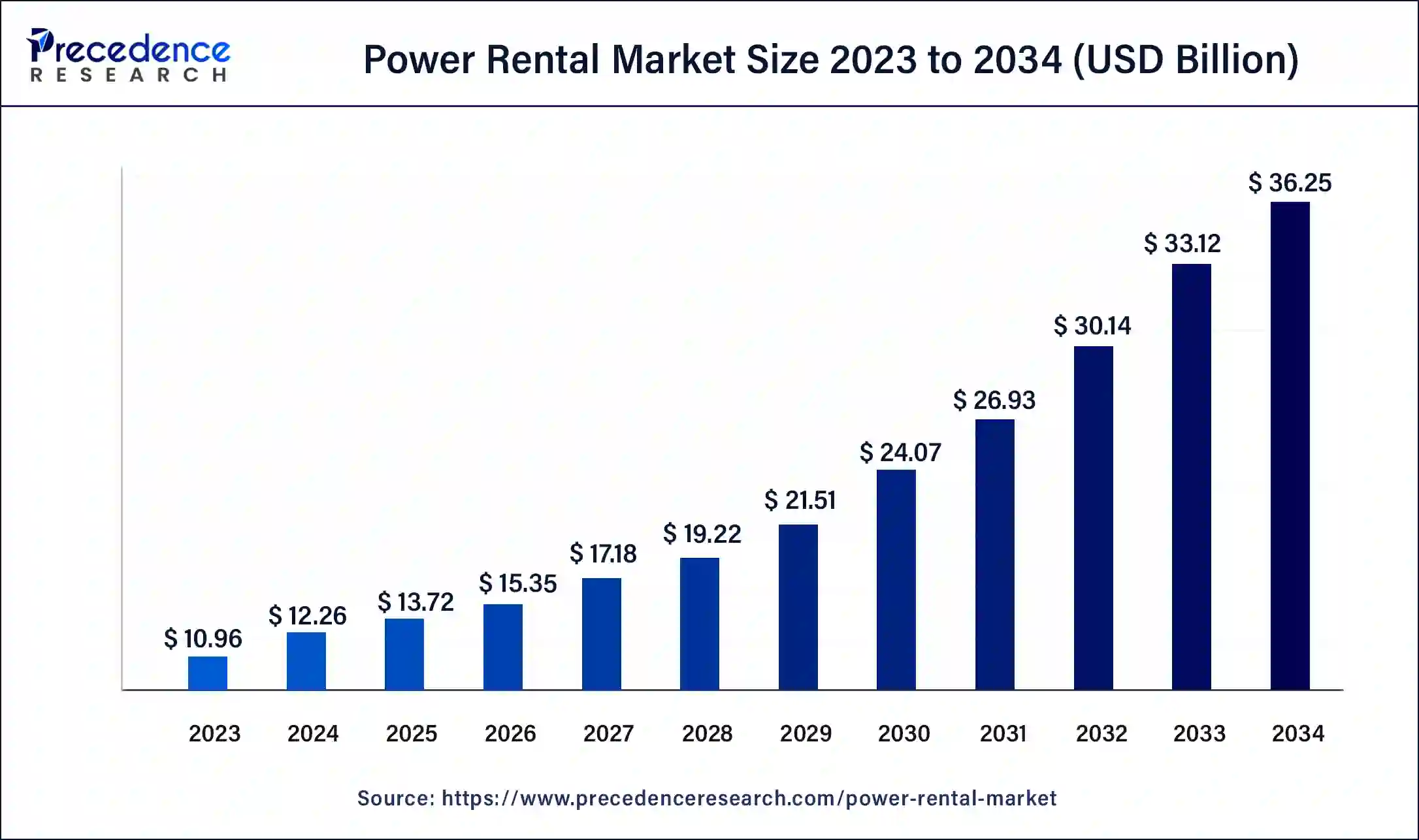

The global power rental market size is calculated at USD 13.72billion in 2025 and is predicted to increase from USD 15.35 billion in 2026 to approximately USD 39.28 billion by 2035, expanding at a CAGR of 11.09% from 2026 to 2035.

Power Rental Market Key Takeaways

- North America dominated the power rental market.

- By application , the continuous load segment dominated the market in 2025.

- By fuel,the diesel management segment contributed more than 81%f market share in 2025.

- By fuel, the gas segment is estimated to grow rapidly in the market during the fastest period.

- By end user, the mining segment dominated the market in 2025.

What is the Power Rental Market?

The power rental is a renting of generator, whether they operate on diesel or gas. It provides fully functional power equipment as well as a variety of components for use in power plants. Furthermore, it provides organizations with flexibility, speed, and cost-effectiveness while dealing with power outages. The purpose of rental power services is to help stabilize utility power networks while also providing additional energy to industry and communities. As a result, it has a wide range of applications in the mining, building and construction, oil and gas industries.

In the event of a power outage, the use of power leasing equipment is predicted to expand, propelling the global power rental market growth. During periods of power outage, power rental systems meet the needs of a wide range of industries by providing backup power to keep operations running. The factors fueling the demand for continuous power supply in the gas and oil and mining industries, as well as the growing need for electrification and rural power delivery. The grid stabilization is required due to ageing electricity infrastructure.

The mining industry is major use of rental power. Due to mining sites are not connected to the grid, they rely on generator sets that have been hired on a temporary basis. The rental generators are in modest demand in manufacturing businesses when the existing power supply system, such as purchased generator sets, has to be maintained, or when there is a need for extra power during peak load demand, or when there is a brief outage. As a result, sectors with poor grid power supplies are heavily reliant on the power rental market's expansion.

Most firms prefer to rent rather than buy a new generator to save money. Furthermore, projects from diverse sectors range from one site to the next and are spread across different regions. Rather of hauling one's generator between locations, renting for different locations appears to be more convenient and cost-effective. The high cost of purchasing new generators, as well as huge growth in numerous industries such as construction, oil and gas are driving the power rental market. However, the power rental market growth is likely to be constrained by the expansion of power distribution networks and the increased development of renewable energy projects.

How is AI contributing to the Power Rental Market?

The application of AI in the power rental industry allows for the improvement of asset usage, maintenance, and operational efficiency via real-time analytics. The predictive maintenance avoids equipment failure, while the energy demand forecasting aids the allocation of the assets. AI assists in the performance of the engine, participates in the management of the microgrid, and takes care of the customers through automation. The smart safety alerts will minimize the risks.

Market Trends

- Growing consumer awareness and rising demand for enhanced reliability and zero downtime are driving the need for power rental equipment.

- Population growth and a higher standard of living, along with a thriving manufacturing sector, are positively influencing the market.

- Increasing investments in infrastructure development and rapid expansion of manufacturing facilities are propelling the market.

- Government initiatives and funding for industrial development also support the growth of the market.

Power Rental Market Outlook

Global dependence on temporary power makes industrial, commercial, and infrastructure activities critical areas for acceptance into the power sector.

The rental segments switch to greener hybrid systems, contributing to carbon footprint reduction along with windmill-like operational efficiencies.

Industrialized countries spur power rentals, thus spotting new demand areas that were previously hidden behind the traditional power sector.

The likes of General Electric, Caterpillar, United Rentals, Ashtead Group, and Aggreko are fueling the power rental tech enhancements with their capital.

Smart tracking and on-demand service models, along with efficient generators, are the main features of the digital platforms that are modernizing the rental sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 39.28Billion |

| Market Size in 2026 | USD 15.35 Billion |

| Market Size in 2025 | USD 13.72 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.09% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fuel, Application, End Use, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Power Rental Market Segment Insights

Application Insights

The continuous load segment dominated the global power rental market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. Due to expanding advancements throughout the world that are inaccessible to the grid and require steady power for an endless number of hours, the continuous load segment is expected to account the largest proportion of the market. The continuous load generators are utilized not just as a backup power source, but also as a primary power source.

The peak load is estimated to be the most opportunistic segment during the forecast period. This is attributed to the constantly changing infrastructures in several verticals, particularly to promote tourism activities, which require 24/7 power access.

Fuel Insights

The diesel segment accounted for 81% revenue share in 2025. The key market players in the oil and gas, mining, and other manufacturing industries all favor the growth of the segment. The increasing demand for diesel generators sets to supply temporary power requirements is due to the adequate availability and low cost of diesel fuel.

The gas segment is estimated to be the most opportunistic segment during the forecast period. Due to increasingly severe regulations and environmental policies in various locations, the market potential of gas generators is likely to expand moderately over the forecast period.

End User Insights

The mining segment dominated the global power rental market in 2025, in terms of revenue. The mining industry is quickly expanding around the world as a result of increased production and export of various minerals and metals to support the manufacturing of various goods.

The construction is estimated to be the most opportunistic segment during the forecast period. The rental power is preferred by construction industry players in order to save generator installation and transportation costs. The commercial spaces, residential buildings, and roadways are examples of construction projects.

Power Rental Market Regional Insights

The North America segment dominated the global power rental market in 2025, in terms of revenue, and is estimated to sustain its dominance during the forecast period. The rapid expansion of commercial venues such as hotels, malls, and retail stores has led to a significant increase in the demand for reliable power, resulting in higher power rental consumption.

The North American continent dominates in terms of revenue generation, primarily owing to the upsurge in the construction sector and infrastructure projects. Rental power is widely used during natural calamities that occur frequently, and the turning down of grid power is still a factor, causing temporary power demand in industrial and commercial areas.

United States Power Rental Market Trends

The U.S. is steadily moving forward as more and more data centers are established and cloud infrastructure is used on a large scale. Disasters occurring frequently lead to the need for emergency rentals, and the use of clean hybrid systems is an indication of the market being changed by environmental regulations. The government-financed construction activities are a factor that is contributing to the growing demand for the deployment of equipment.

The Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. The countries such as Thailand and Indonesia are seeing massive commercial infrastructure development. Furthermore, growing digitalization, combined with the prevailing industrial revolution 4.0 across the region, would provide a significant boost to the industry's growth.

Asia-Pacific is taking a giant leap ahead in the field of urbanization and the development of the manufacturing industry. The enormous infrastructure rollout, coupled with the increasing power demand, is driving the use of generator rentals; the most favorable conditions for this trend are in commercial, industrial, and project-based applications.

India Power Rental Market Trends

India has the advantage of the large-scale development programs that need temporary power during the construction period. During peak hours, power shortages cause rental activity to continue, while hybrid solar-integrated systems are getting tied up with sustainability and emission-controlled operational models.

Europe continues to have a stable growth path due to the incorporation of renewables and stringent emission standards. The rental market facilitates clean power deployment, so hybrid and low-emission power are deemed suitable for regulated industrial and public energy environments.

Germany Power Rental Market Trends

Germany is the one that pulls the demand with its highly industrialized production, which needs a backup supply during maintenance. The renewable energy transition is giving rise to the use of flexible rentals that help stabilize the grid, which is backed by the use of alternative fuels and the preference for low-emission generators.

The power rental market in Latin America is driven by ongoing advancements in infrastructure development, which is also helping in addressing structural power deficiencies. The region is witnessing a growing demand for flexible, on-demand power solutions, driven by expanding industrialization and urbanization. The increasing adoption of smart and eco-friendly power generation technologies, such as hybrid and renewable-based systems, is further driving the market. Regulatory shifts in the region are also moving toward cleaner energy sources and focusing on emissions reduction, thus encouraging utilities and industries to seek reliable rental equipment.

The Middle East & Africa (MEA) offers significant opportunities in the power rental market. These opportunities arise from rapid urbanization, industrialization, and infrastructure development efforts in the region. Countries in the Middle East are leading the regional market. This is because they are investing heavily in mega-projects, including construction, real estate, and industrial developments. Similarly, emerging economies in Africa are focusing on infrastructure to support urbanization and industrialization. These projects are leading to increased demand for power rental services, thus leading to market expansion.

Power Rental Market Value Chain

Searching and taking out of raw materials of fossil fuels for power generation.

Key players: BHP and Rio Tinto, ExxonMobil

1. Turning the sources of energy that have been extracted into electric power.

Key players: Tata Power and Torrent Power

Running the infrastructure and doing the management that transfers electric power to the consumers.

Key Players: Austin Energy, ABB

Store the extra power generated for later balancing and controlling the supply.

Key players: Fluence and Pumped Hydro Storage

1. Keeping an eye on and doing maintenance to make sure temporary systems are reliable.

Key Players: ABB and Eaton

Power Rental Market Key Players Offering

Supplies multiple kinds of equipment for diverse industrial scenarios, such as pumps, generators, compressors, and lighting, along with flexible deployment solutions.

Power generation equipment and services, along with the Co., are delivered internationally and customized to meet the needs of industrial and commercial operations.

The Oil & Gas sector-restricted diesel generators are provided by the company and are renowned for their high reliability and power performance during rental use.

Other Major Key Players

- Newburn Power Rental Ltd.

- ProPower Rental

- Shenton Group

- Modern Hiring Service

- United Rentals

- FG Wilson

- APR Energy

Recent Developments

- In June 2025, Aggreko expanded its Greener Upgrades portfolio by introducing three new gas generators with power ratings of 350 kW, 1500 kW, and a 1500 kW Rapid Deploy model. These additions enhance Aggreko's lineup of efficient and lower-emission modular power solutions, designed to help customers achieve performance goals while reducing energy costs and emissions. The new models are suited for various applications from urban developments to remote operations and are part of Aggreko's Greener Power Packages, which include expert services and remote monitoring capabilities to ensure operational efficiency and reliability.

(Source: globenewswire.com ) - In October 2025, Aggreko launched a rental scheme for 1MW solar PV and battery storage systems, featuring tracking systems and containerised controls for improved energy delivery and resilience.

(Source: solarpowerportal.co.uk) - In June 2025, MyCharge Technology PLC in Ethiopia launched a power bank rental service in Addis Ababa. Users can rent from over 60 stations via an app, returning within 72 hours after a refundable 2,000 Birr deposit.

(Source: theouut.com)

Segments Covered in the Report

By Fuel

- Diesel

- Natural Gas

By Application

- Continuous Load

- Standby Load

- Peak Load

By End User

- Mining

- Construction

- Utility

- Events

- Manufacturing

- Oil & Gas

- Others

By Region

- North America

- Europe

- Asia-pacific

- Latin America

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting