What is AI Data Center HVDC Power Supply System Market Size?

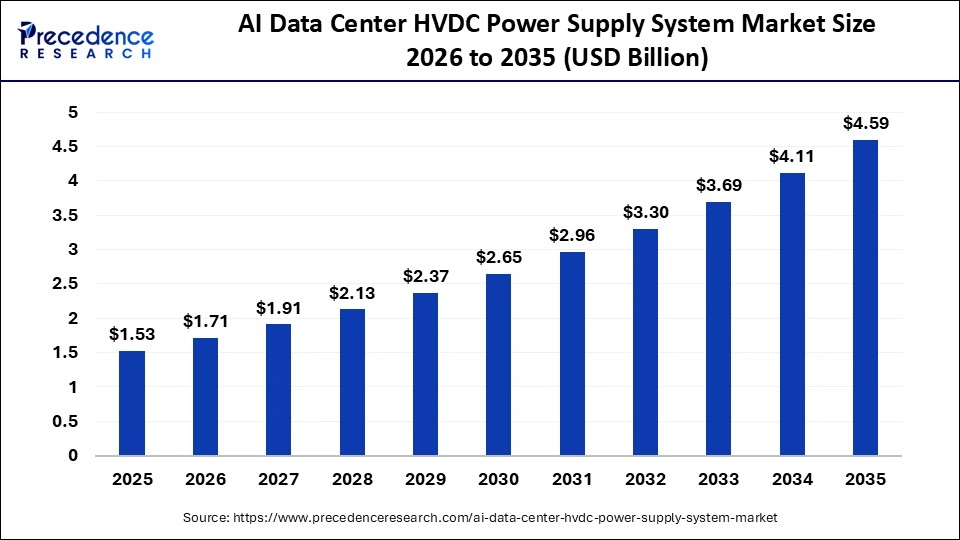

The global AI data center HVDC power supply system market size is calculated at USD 1.53 billion in 2025 and is predicted to increase from USD 1.71 billion in 2026 to approximately USD 4.59 billion by 2035, expanding at a CAGR of 11.62% from 2026 to 2035. The market is significantly expanding due to the development of hyperscale AI data centers by leading players, government support for technological evolution across many sectors, and the growing demand for uninterrupted power supply for data center development worldwide.

Market Highlights

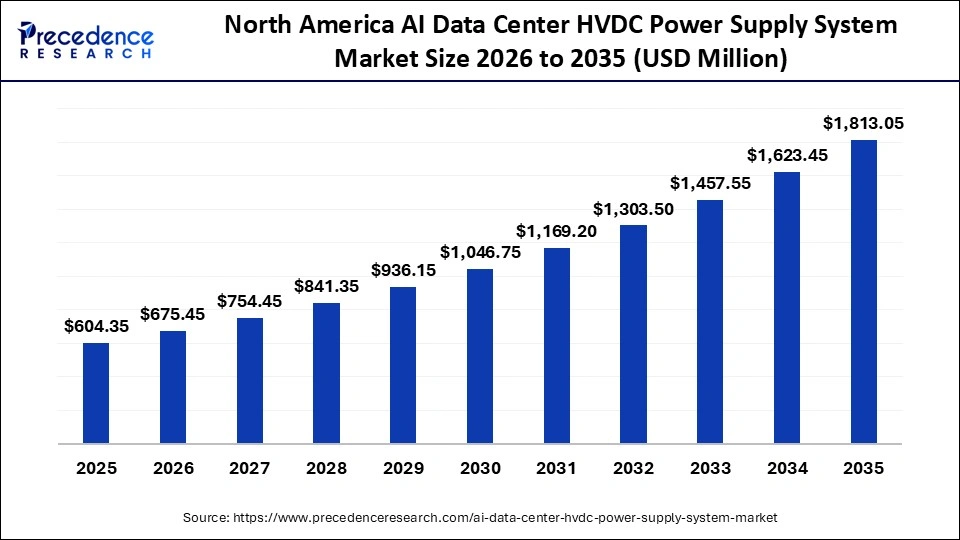

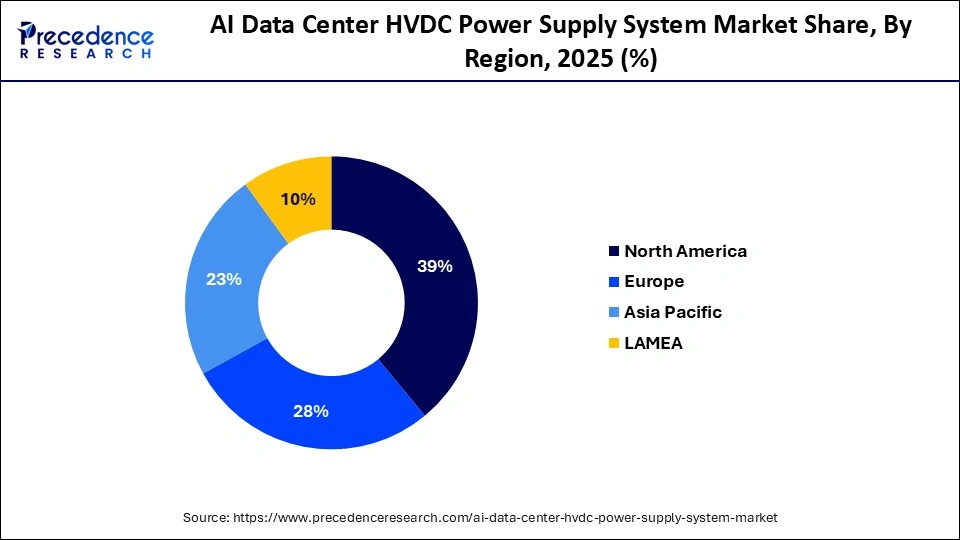

- North America dominated the market by holding more than 39% of market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By type, the output voltage: 336V segment held the major market share in 2025.

- By type, the output voltage: 240V segment is growing at the fastest CAGR from 2026 to 2035.

- By application, the internet segment contributed the highest market share in 2025.

- By application, the smart manufacturing segment is expected to grow at a strong CAGR from 2026 to 2035.

AI Data Center HVDC Power Supply System Market: Developments and Insights

The market focuses on the development, manufacturing, and deployment of power delivery infrastructure designed specifically for artificial intelligence data centers that require highly stable and efficient energy systems. These facilities increasingly rely on high-voltage direct current systems, which are better suited to meet the massive, continuous power demands of GPU clusters, large language model training environments, and high-density server racks. The market is experiencing exponential growth due to the sharp rise in electricity consumption associated with AI workloads, which has surpassed the operational limits of many conventional data center designs.

HVDC infrastructure reduces energy losses during transmission, minimizes cooling requirements, and allows for compact electrical room layouts that are easier to scale for multi-megawatt AI campuses. Compared with traditional AC systems, HVDC provides higher distribution efficiency, improved fault isolation, and superior compatibility with renewable energy sources and battery energy storage systems. These benefits make HVDC a foundational technology for next-generation AI facilities, especially hyperscale and edge-AI deployments where power density and system reliability are critical performance drivers.

AI Data Center HVDC Power Supply System Market Outlook

The market is growing due to a combination of factors, including the increasing power demands of AI workloads, improved energy efficiency, and reduced infrastructure costs and complexity. The AI model's complexity requires power-intensive GPUs to meetdata center power demands at scale. HVDC architecture reduces the need for AC/DC conversions, thereby reducing energy losses and heat dissipation.

Sustainability is a major focus in the AI data center. The HVDC supply system market encompasses the deployment of direct-current architecture, renewable energy integration, PPAs, and water efficiency. The market is further shifting towards advanced liquid cooling systems aiming to enhance thermal efficiency and minimize water consumption.

Major investors in the market include well-developed power management companies and leading tech giants collaborating with other enterprises to develop AI-integrated solutions. It includes companies like Google, Microsoft, AWS, and Meta, the tech giants that are heavily investing in AI data centers by securing power through strategic partnerships and power purchase agreements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.53 Billion |

| Market Size in 2026 | USD 1.71 Billion |

| Market Size by 2035 | USD 4.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.62% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI Data Center HVDC Power Supply System MarketSegmental Insights

Type Insights

Output Voltage 336V: This segment held the largest share in the AI data center HVDC power supply system market during 2025, driven by its ability to support highly efficient, fully integrated power architectures for AI data centers, often referred to in the industry as the Panama solution. This configuration reduces capital expenditure by simplifying the electrical distribution path and lowering the need for multiple power conversions. With fewer components, reduced cabling complexity, and minimal transformation stages, 336V systems deliver higher reliability, lower points of failure, and improved operational continuity for large GPU clusters. The architecture is widely adopted in hyperscale and cloud data centers that require dense power distribution with consistent performance.

Output Voltage 240V: The 240V output voltage segment is expected to witness the fastest CAGR over the foreseeable period due to the escalating power needs of AI-driven compute environments. As training clusters increase in size and inference workloads scale toward edge and on-premise facilities, operators are choosing 240V HVDC systems to eliminate redundant AC-DC conversions present in conventional setups. This reduction in conversion steps enables power savings of 10 to 15% while lowering heat output and improving overall thermal stability. The 240V architecture is also easier to integrate into modular data centers and emerging micro-grid systems, making it an attractive option for operators building smaller but high-density AI facilities.

Application Insights

Internet: The internet segment held the largest share in the AI data center HVDC power supply system market in 2025, driven by substantial financial investment capacity, extremely high power-density requirements, and a strong focus on energy-efficient operations that can scale rapidly with user demand. Hyperscale data centers owned by major internet and cloud companies require multi-megawatt HVDC distribution systems to support GPU clusters used for AI training, content delivery, large-scale search engines, and global cloud services. As a result, leading internet companies continue to invest hundreds of millions of dollars in new hyperscale campuses and AI-optimized facilities, increasing the adoption of 336V and 240V HVDC architectures to reduce losses and improve operational efficiency.

Smart Manufacturing: The smart manufacturing segment is expected to experience the highest CAGR over the foreseeable period. This surge is driven by the integration ofIndustry 4.0 technologies, including AI-powered robotics, machine-vision inspection, and digital twins, which require significant on-site computing capacity and stable high-density power distribution. HVDC systems are increasingly preferred because smart factories cannot tolerate downtime and require continuous, uninterrupted operations to maintain production quality and equipment coordination. The expansion of autonomous production lines, predictive-maintenance platforms, and sensor-heavy environments further boosts demand for reliable HVDC infrastructure, reinforcing strong growth in this segment.

AI Data Center HVDC Power Supply System Market Regional Insights

The North America AI data center HVDC power supply system market size is estimated at USD 604.35 million in 2025 and is projected to reach approximately USD 1813.05 million by 2035, with a 11.61% CAGR from 2026 to 2035

What Factors Made North America a Dominant Force in the AI Data Center HVDC Power Supply System Market?

North America held the largest share of the AI data center HVDC power supply system market in 2025, driven by the rapid expansion of hyperscale data centers, a strong innovation culture, and the region's ability to adopt emerging technologies at scale. The region continues to attract significant capital investment as major data center developers, utilities, and technology companies take advantage of favorable federal and state regulatory frameworks, tax incentives, and grid-modernization initiatives. This environment supports the deployment of next-generation power architectures, including high-voltage direct current systems designed for AI workloads.

North America is home to the world's leading cloud service providers, including Google, Amazon Web Services, and Microsoft, each investing heavily in building multi-gigawatt AI campuses optimized for GPU clusters and large-scale model training. These facilities require high-density, low-loss, and thermally efficient power delivery, accelerating the shift from legacy AC infrastructure to advanced HVDC systems. The region also benefits from a mature supply chain of power-electronics manufacturers, engineering firms, and utility partners capable of supporting large deployments with high reliability. Additionally, increasing adoption of renewable energy and the rising need to synchronize AI data centers with clean power sources further strengthen North America's leadership in the HVDC power supply system market.

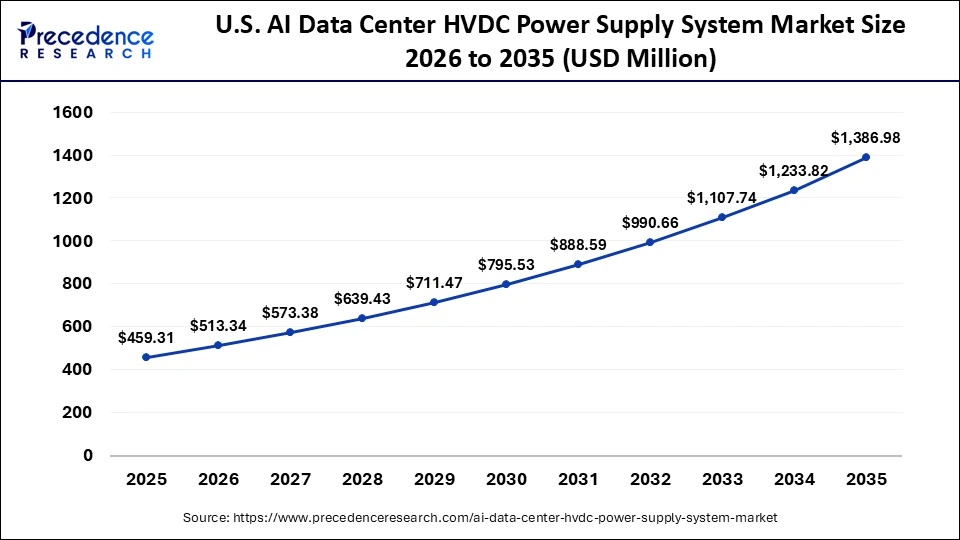

The U.S. AI data center HVDC power supply system market size is calculated at USD 459.31 million in 2025 and is expected to reach nearly USD 1,386.98 million in 2035, accelerating at a strong CAGR of 11.69% between 2026 and 2035.

U.S. AI Data Center HVDC Power Supply System Market Trends

The United States is a leading contributor to the market's growth due to the rapid shift toward higher-voltage architectures, including emerging 800V DC and multi-hundred-volt distribution systems designed to support the extreme power density of GPU-based AI clusters. U.S. data center operators are increasingly prioritizing HVDC infrastructure to improve electrical efficiency, reduce conversion losses, and stabilize power delivery for hyperscale AI campuses that often exceed 100 MW of connected load.

Key trends shaping the U.S. AI data center HVDC market include the rise of gigawatt-scale development plans across states such as Virginia, Ohio, Texas, and Arizona, reflecting the massive infrastructure expansion required for AI training and inference. There is also an accelerating adoption of variable-speed converter technology that enhances real-time load matching, reduces harmonic distortion, and improves overall grid compatibility for large AI facilities.

Asia Pacific is expected to witness the fastest CAGR over the foreseeable period of 2026 to 2035, driven by rapidly accelerating energy demand, fueled by large-scale digital transformation, the expansion of hyperscale cloud zones, and the deployment of AI-optimized data centers across China, India, Japan, South Korea, and Southeast Asia. The region's rapid industrialization and adoption of AI, 5G, automation, and high-performance computing have created unprecedented pressure on regional power infrastructure, driving a strong shift toward HVDC systems that offer higher efficiency and lower transmission losses.

Growth is also fueled by ambitious renewable-energy commitments across the region, including large national programs to integrate multi-gigawatt solar, wind, and hydro capacity into national grids. HVDC systems are increasingly preferred because they can transmit renewable power over long distances with high stability, making them essential for AI campuses that require consistent, high-density power delivery. Governments in countries such as China and India are also investing in green data center policies, grid modernization, cross-border power corridors, and energy-storage-backed AI facilities, all of which strengthen demand for advanced HVDC power architectures. These combined structural drivers firmly position Asia Pacific as the fastest-growing market for AI data center HVDC power supply systems.

China AI Data Center HVDC Power Supply System Market Trends

The region is expanding largely due to leading players collaborating to build a robust, uninterrupted power supply for AI data centers. For example, NVIDIA is partnering with other local enterprises in power supply and component offerings, resulting in the development of 800V HVDC power solutions, power distribution units, power shelf devices, and supercapacitors. Also, the extended development cycles require advanced power electronics technology, which has tempted enterprises to seek support from Chinese manufacturers.

Europe is expected to see significant growth in the AI data center HVDC power supply system market due to the European Union's strategic goal of expanding regional data center capacity to nearly three times current levels, a target that directly increases demand for high-efficiency power-delivery architectures. As AI workloads accelerate and power density requirements exceed the capabilities of legacy AC systems, operators across Germany, the Netherlands, France, Ireland, and the Nordic countries are turning to HVDC solutions to achieve higher electrical efficiency, lower conversion losses, and more predictable thermal performance.

The region's strict energy-efficiency regulations and sustainability mandates are also driving adoption, since HVDC systems align with the EU's climate targets, green-data-center taxonomy, and national carbon-reduction frameworks. Europe's growing reliance on renewable energy sources such as offshore wind and large-scale solar requires long-distance, low-loss transmission, making HVDC an essential component of next-generation AI infrastructure. Additionally, many European data center operators are integrating heat-reuse networks, battery-energy-storage systems, and grid-interactive technologies that function more efficiently with HVDC. These combined policy, infrastructure, and technological drivers position Europe as a significant growth region for AI data center HVDC power supply deployments over the coming decade.

Germany AI Data Center HVDC Power Supply System Market Analysis

The region is substantially growing due to the increasing focus on energy efficiency and sustainable power solutions across several industrial processes and Data center needs, which are paramount to Germany's Energy transition target. Leading marketers are further contributing to the country's growth by collaborating and launching innovative technologies to support AI data centers.

For instance, in October 2025, a leading marketer from Germany, Infineon Technologies AG supports the power architecture with 800V DC capacity, which was introduced by NVIDIA for AI infrastructure, at Computex 2025.

The Middle East and Africa AI data center HVDC power supply system market is notably expanding due to large-scale national initiatives focused on smart city development, economic diversification, and long-term digital transformation. Countries such as the UAE, Saudi Arabia, and Qatar are accelerating investment in next-generation digital infrastructure to support AI-driven government services, autonomous transportation, fintech platforms, and large public-sector data ecosystems. These projects require high-density, energy-efficient data centers that rely on HVDC power architectures to meet strict performance and reliability standards.

rowth is further supported by rapid grid modernization efforts across the region, including the deployment of renewable-energy megaprojects and long-distance transmission systems that align naturally with HVDC technology. The demand for high-performance computing, GPU clusters, and AI-enabled analytics platforms is increasing across oil and gas operations, logistics hubs, national security, and smart-infrastructure monitoring. As a result, MEA is becoming a global hub for AI-optimized data centers, supported by government policies that encourage cloud expansion, attract hyperscalers, and promote early adoption of cutting-edge power and cooling technologies. These structural advantages are expected to sustain strong growth in HVDC system deployment throughout the region.

Saudi Arabia AI Data Center HVDC Power Supply System Market Analysis

The country is a leading contributor to the market's growth in the MEA region, owing to smart city projects like NEOM, which has deployed over 840 HVDC modules in the area, highlighting its significant influence. Major data center projects, such as the framework agreement by xAI and a whopping investment by AWS and Human, further drive market growth in the Middle East and Africa.

AI Data Center HVDC Power Supply System Market Value Chain

The stage involves the production of specialized power semiconductors and crucial components required for HVDC systems. Key Players: Infineon Technologies, Analog Devices, Renesas, Rohm, STMicroelectronics, Navitas and Texas Instruments.

The stage involves developing power racks, battery backup units, and power distribution units for power delivery in data centers. Key Players: Flex Power, Delta Electronics, LiteOn, LeadWealth.

The stage involves constructing data centers and installing power infrastructure, along with integrating HVDC systems. Key Players: STT Global Data Centers, CtrIS Datacenters, and Yotta Data Services

This stage involves the stable operation of data centers with efficient management of HVDC power infrastructure for AI data centers. Key Players: Equinix, Applied Digital and Vertiv.

AI Data Center HVDC Power Supply System Market Companies

the company offers a range of intelligent power distribution systems, backup power solutions, and solid-state circuit breakers to enable scalable, energy-efficient HVDC infrastructure.

the company, offers industrial power supplies, such as modular solutions.

Delivers integrated management and automation solutions for high-density AI workloads.

the company provides a range of systems, including UPS, power distribution, and thermal management systems for AI data centers.

The company is a frontrunner in intelligent power management and collaborated with NVIDIA.

Other AI Data Center HVDC Power Supply System Market Companies

- Huawei

- Hitachi

- Mitsubishi Electric Corporation

- Sungrow Power

- Kehua Data

- Delta Electronics

- Larsen & Turbo Ltd.

Recent Developments

- In October 2025, a global leader in power management with green solutions, Delta introduces its next-gen highly integrated high-voltage DC power distribution, advanced accuracy, and networking solutions for AI data centers at the OCP Global Summit 2025. (Source:https://www.deltaww.com)

- In July 2025, a global leader in the semiconductor sector, NVIDIA partnered with Texas Instruments aiming to develop 800V HVDC power distribution systems that will facilitate next-gen AI data centers. (Source: https://www.powerelectronicsnews.com)

AI Data Center HVDC Power Supply System MarketSegments Covered in the Report

By Type

- Output Voltage: 240V

- Output Voltage: 336V

- Other

By Application

- Internet

- Smart Manufacturing

- Finance

- Communications

- Government and Military

- Other

Get a Sample

Get a Sample

Table Of Content

Table Of Content