What Factors Are Fueling the Green Energy Certification Services Market Surge?

The global green energy certification services market expands with increasing investments in renewable energy, corporate ESG goals, and regulatory mandates for clean power sourcing.The market for green energy certification services is witnessing robust growth, driven by rising consumer demand for environmentally friendly products, the expansion of renewable energy sources, and increasing consumer awareness of climate change.

Market Highlights

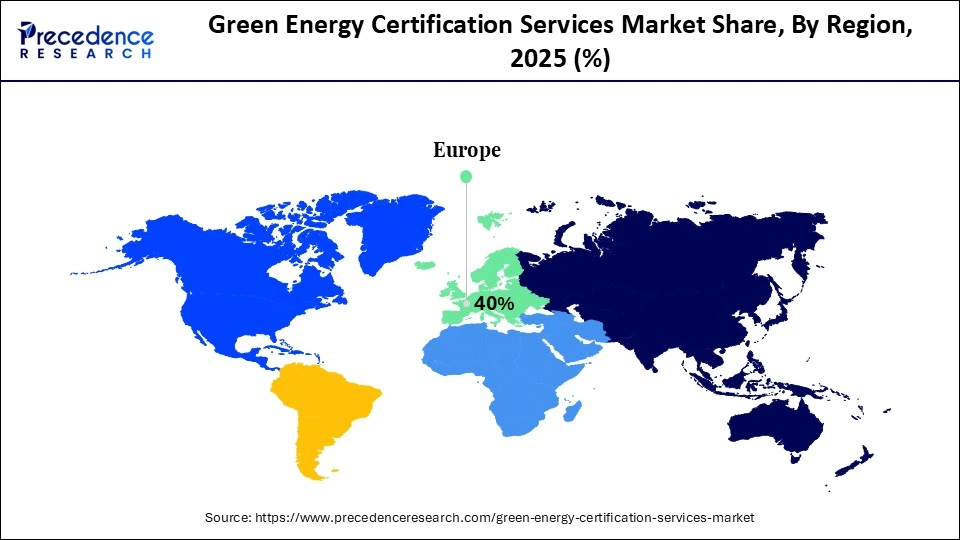

- Europe dominated the market, holding the largest market share of 40% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 20.50% between 2026 and 2035.

- By energy source certified, the solar segment held the largest market share of 25% in 2025.

- By energy source certified, the wind segment is growing at a strong CAGR of 17.20% between 2026 and 2034.

- By end-user, the corporations & industrial enterprises segment contributed the highest market share of 45% in 2025.

- By end-user, the utilities & power producers segment is expanding at a significant CAGR of 16% between 2026 and 2034.

- By purpose/use case, the voluntary renewable procurement segment accounted for the biggest market share of 50% in 2025.

- By purpose/use case, the carbon neutrality & net-zero claims segment growing at a solid CAGR of 18% between 2026 and 2034.

- By distribution channel, the direct certification bodies segment held the largest share of 42% in 2025.

- By distribution channel, the online certificate marketplaces segment is set to grow at a remarkable 20% CAGR between 2026 and 2034.

2026 Renewable Energy Industry Outlook: Renewables Recalibrate for Resilience Amid Policy Shifts

The global green energy certification services market includes services that verify, certify, track, and validate the renewable origin of electricity and energy consumed by end users. These services functions are crucial for environmental disclosure frameworks that allow utilities, corporations, and industrial buyers to demonstrate that their consumed energy is sourced from qualified renewable generation assets. The market covers Renewable Energy Certificates (RECs) widely used in the United States under programs formalized in the early 2000s, Guarantees of Origin (GOs) introduced under the EU Renewable Energy Directive in 2009, and the International REC (I-REC) Standard adopted across more than 40 countries since 2015. Each system establishes traceable documentation of renewable electricity attributes from generation to end-use, which ensures that energy claims meet regulatory and voluntary reporting requirements.

Green tariff certifications and carbon neutral energy validation services extend this framework by confirming that utility-provided tariffs or supplier-specific contracts align with renewable procurement commitments. These offerings often integrate metering verification, lifecycle emission calculations, and attestations aligned with global standards such as the GHG Protocol Scope 2 Guidance updated as far back as 2015. Renewable attribute tracking platforms support real time or near-real-time monitoring of certificate issuance, transfer, retirement, and compliance. Markets such as the EU use electronic registries like the European Energy Certificate System (EECS), while emerging economies adopt I-REC tracking infrastructures to support corporate procurement under the RE100 initiative.

Renewables Recalibrate for Resilience Amid Policy Shifts

As AI technology continues to evolve, the integration of artificial intelligence is significantly accelerating growth in the green energy certification services market by improving efficiency, reliability, and transparency across the renewable energy value chain. The shift toward digital verification aligns with global regulatory trends, including the EU's updated Renewable Energy Directive (RED II), implemented in 2021, and the U.S. Federal Energy Regulatory Commission's modernization of grid data requirements since 2020. These policies encourage the adoption of automated systems capable of validating renewable attributes with greater precision.

AI applications now span predictive analytics, automated certification workflows, smart grid forecasting, emissions accounting, and real-time compliance monitoring. In predictive analytics, machine learning models ingest long-term weather data, satellite irradiance measurements, turbine performance logs, and hydrological flow records to forecast renewable output with higher resolution. These models support solar, wind, hydropower, biomass, and geothermal projects by providing generation estimates that energy registries use to validate certificate issuance.

Automated verification processes are another major advancement. AI systems detect anomalies in metering data, compare them against baseline generation profiles, and flag discrepancies before certificates such as RECs, GOs, or I-RECs are issued. For example, wind fleet operators feeding into the European Energy Certificate System rely on AI enhanced production forecasts to support Guarantee of Origin allocations and ensure consistency with registered output.

Green Energy Certification Services Market Outlook

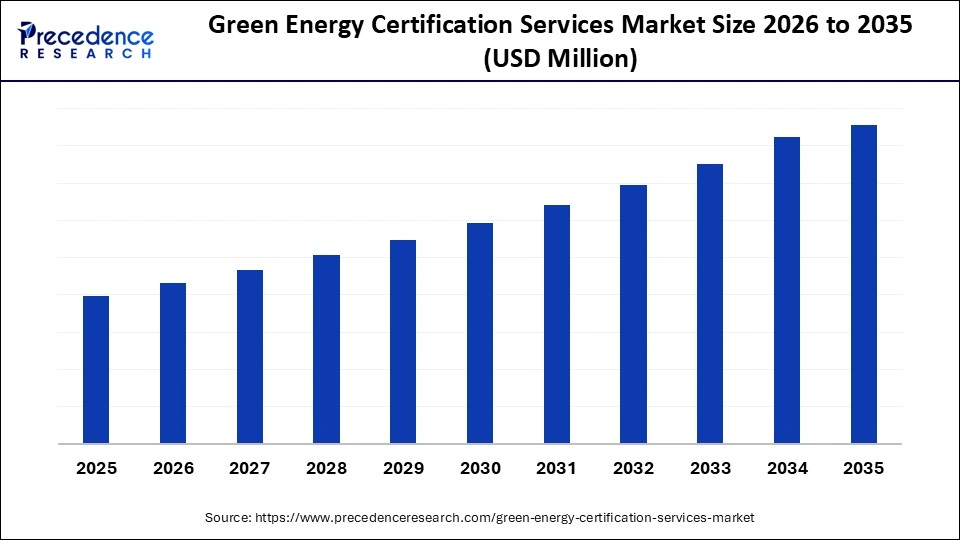

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to grow at an accelerated pace. Corporate sustainability commitments, net-zero targets, renewable energy mandates, the expansion of voluntary REC markets, cross-border renewable energy trade, and the increasing digitalization of certificate issuance and tracking platforms drive the market's growth.

- Global Expansion: Several key players in the green energy certification services market are expanding their geographic presence through strategic initiatives, including acquisitions, collaborations, and new service launches. Companies are increasingly focusing on expanding their reach to meet the global demand for verifiable renewable energy use.

- Sustainability Trends: The surge of corporate sustainability goals and net-zero ambitions, creating more opportunities for the growth of the market. Green certificates attract sustainability-linked investments and financing for new renewable energy projects. Companies are actively purchasing green energy certificates to offset emissions and align with global frameworks such as the Science Based Targets initiative (SBTi).

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Energy Source Certified, End-User, Purpose, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Green Energy Certification Services Market Segmental Insights

Energy Source Certified Insights

Solar Energy: The solar energy segment held the largest market share in 2025 at 25%. Solar energy remains the dominant source in the green energy certification services market because of its rapid global deployment, falling technology costs, and strong alignment with certification frameworks such as RECs in the United States, GOs in the European Union, and I-RECs across Asia, the Middle East, and Africa. The declining levelized cost of solar electricity, which dropped by more than 80% between 2010 and 2022 according to the International Renewable Energy Agency, has accelerated adoption across utility-scale parks and distributed rooftop systems. This expansion increases the volume of certified renewable attributes entering global registries.

Wind Energy: On the other hand, the wind energy segment is expected to grow at a remarkable CAGR between 2026 and 2034. Wind energy is a rapidly growing segment in the services market. The growth is supported by the installation of new capacity and a strong pipeline for future expansion, particularly in offshore wind. Corporations are increasingly focusing on wind power to align with carbon neutrality and sustainability strategies, owing to its large-scale availability.

Biomass & Biogas: The biomass & biogas segment is anticipated to grow at a notable rate. Biomass and biogas represent a stable, growing segment of the green energy certification services sector. The segment focuses on waste management solutions, baseload power generation, and government policy support for transportation fuels. The adoption of biomass and biogas helps countries meet their national climate goals and international commitments.

End-User Insights

Corporations & Industrial Enterprises: The corporations & industrial enterprises segment dominates the green energy certification services market, accounting for 45% of the market share. The increasing number of corporations & industrial enterprises with net-zero and ESG targets is driving the primary demand for green energy certificates, with a strong preference for solar and wind power to meet their sustainability goals.

Utilities & Power Producers: The utilities & power producers segment is the fastest-growing in the green energy certification services industry, with a 16% CAGR. The existence of government-mandated requirements that obligate utilities and power producers to source a certain percentage of their total power from renewable energy. The green energy certification allows utilities to manage financial risks associated with volatile energy prices and non-compliance penalties.

Government & Public Institutions: The government & public institutions segment is anticipated to expand at a considerable rate during the forecasted period. Government and public institutions are significant end-users of green energy certification services. Their participation is driven by mandates to achieve specific clean energy targets and their own public sustainability commitments. Several government bodies often set sustainable procurement policies. They commit to powering their own facilities with renewable energy to demonstrate leadership in climate action and align their own sustainability goals.

Purpose/Use Case Insights

Voluntary Renewable Energy Procurement: The voluntary renewable procurement segment dominates the green energy certification services market, accounting for 50% of the market share. The segment's growth is driven by the rising number of corporations voluntarily committing to ambitious net-zero emissions targets and 100% renewable electricity goals. Purchasing certified renewable energy enhances a company's brand value and aligns with Environmental, Social, and Governance (ESG) objectives.

Carbon Neutrality & Net-Zero Claims: The carbon neutrality and net-zero claims segment is set to be the fastest-growing in the green energy certification services market, with a CAGR of 18%. This acceleration is closely tied to the surge in corporate commitments following updates to major global climate frameworks, including the Paris Agreement's 1.5°C guidance reinforced in 2021 and the UN Race to Zero campaign, which saw a sharp increase in corporate signatories between 2020 and 2023. Companies must now verify that their electricity use, procurement strategies, and emission reductions align with science-based pathways. This requirement pushes organisations to adopt certified renewable energy instruments, carbon accounting verification, and third-party attestation for net zero claims.

Compliance with National/Regional Regulations: The compliance with national/regional regulations segment is expected to grow at a considerable rate due to mandatory requirements. The existence of government-mandated requirements, such as Renewable Purchase Obligations (RPO), Renewable Portfolio Standards (RPS), and others. These regulations legally require specified entities to source a specified percentage of their electricity from renewable energy sources.

Distribution Channel Insights

Direct Certification Bodies: The direct certification bodies segment dominates the green energy certification services market, accounting for 42% of the total market share. These organizations function as the primary distribution channel because they administer the issuance, tracking, transfer, and retirement of all legitimate green energy certificates. Their authority is grounded in national and regional regulatory frameworks that define how renewable attributes must be verified. In the United States, this responsibility is carried out by entities such as APX's North American Renewables Registry and the regional tracking systems underpinning Renewable Energy Certificates established in the early 2000s.

In Europe, direct certification is governed through systems such as the European Energy Certificate System (EECS), which manages Guarantees of Origin under the Renewable Energy Directive first adopted in 2009 and updated under RED II in 2021. In more than 40 emerging markets, the I-REC Standard introduced in 2015 serves as the designated certification body for international renewable attributes.

Online Renewable Certificate Marketplaces: The online certificate marketplaces segment is the fastest-growing in the green energy certification services space, with a 20% growth rate. Online certificate marketplaces are a significant distribution channel, acting as digital platforms that connect a wide range of sellers and buyers to trade certificates efficiently and transparently. Several Government policies encourage the development of transparent, organized trading platforms such as the Indian Energy Exchange (IEX).

Energy Service Companies (ESCOs): The ESCO segment is expected to see notable growth in the coming years as these firms strengthen their role as integrators and facilitators in the green energy certification services market. ESCOs operate as end-to-end providers that manage installation, energy audits, system design, financing structures, and long-term maintenance for renewable and energy efficiency projects. Their involvement is expanding because certification frameworks increasingly require verified metering, documented performance baselines, and continuous tracking of renewable attributes, all of which align directly with ESCO service models. Growth is supported by the presence of established ESCO mechanisms in major markets.

Green Energy Certification Services MarketRegional Insights

Europe dominates the green energy certification services market, accounting for 40% of the global share, due to its highly structured regulatory environment and long-standing leadership in renewable energy tracking. The region operates one of the most mature and integrated certification architectures in the world through Guarantees of Origin (GOs), which were formalized under the EU Renewable Energy Directive (RED I) in 2009 and strengthened under RED II in 2021. These directives require that every megawatt-hour of renewable electricity carry a verifiable digital certificate. This framework ensures uniform rules for generator eligibility, data verification, and certificate issuance across the continent.

Central to Europes dominance is the Association of Issuing Bodies (AIB), which manages the European Energy Certificate System (EECS). The EECS provides a harmonized registry used by more than 25 member countries. It enables seamless cross-border trade of renewable attributes between Spain, Germany, the Netherlands, France, the Nordics, and other participating markets. Because AIB members use standardized data validation rules and metering requirements, corporations can purchase GOs with full traceability and consistent verification standards across the entire region.

How Is Germany Transforming the Green Energy Certification Services Industry?

Germany leads the green energy certification services industry. A strong regulatory push, an increasing number of corporates, and growing consumer demand for certified green power primarily drive the country's growth. Government-led policy aiming for 80 percent renewable electricity by 2030 and net-zero emissions by 2045. The market uses Guarantees of Origin (GOs), the European standard for tracking renewable electricity.

Asia Pacific is the fastest-growing region in the green energy certification services market, with a CAGR of 20.50%, driven by rapid industrialization, strong policy initiatives, increasing sustainability commitments, and growing corporate demand. The Asia Pacific region is a significant leader in new renewable energy installations and accounts for more than half of the world's installed clean energy capacity. This rising physical expansion supports a high supply of certificates, driving the growth of the green energy certification services sector in the region during the forecast period. Several countries across the region have set ambitious net-zero pledges and introduced supportive policies, such as RPOs in India and GEC programs in China.

In October 2025, Singapore, along with an international standard-setting body for energy attributes, developed a draft framework to facilitate the cross-border trading of renewable energy certificates (RECs) within Southeast Asia. This means that corporates in Singapore will be able to buy RECs originating from renewable energy sources in neighbouring countries and make exclusive claims on the emissions arising from their purchase of electricity, known as Scope 2 emissions. It assists countries in standardising their approaches for tracking and accounting of RECs.

China's Green Energy Certification Services Market Analysis

China has set ambitious net-zero targets and introduced policies like Green Electricity Certificate (GEC) programs, which create a strong compliance market for certified energy.

China's decarbonisation strategy relies on rapidly expanding renewable power. A crucial part of this strategy is the Green Electricity Certificate (GEC) system. It was declared that a GEC represents the only proof of the environmental attributes of renewable electricity. 4.734 billion GECs were issued in 2024, a 28.4 fold increase from 2023. Wind power accounted for 194 million ten thousand certificates (41 % of issuance), hydropower 157 million (33 %), solar 82.7 million (17 %), and biomass 38 million (8 %).

The North America region is experiencing significant growth and holds a substantial share of the green energy certification services market. This expansion is strongly supported by well-established regulatory frameworks and aggressive corporate sustainability targets that shape procurement behaviour across utilities, technology firms, manufacturing companies, and large commercial buyers. The United States and Canada together account for the majority of regional demand because both countries operate long-standing renewable-tracking systems that support the large-scale issuance and retirement of Renewable Energy Certificates (RECs).

In the United States, REC markets are anchored in state-level Renewable Portfolio Standards introduced beginning in 1999, which require utilities to procure a defined percentage of electricity from renewable sources. These standards are monitored through regional registries such as the Western Renewable Energy Generation Information System (WREGIS), the Midwest Renewable Energy Tracking System (M-RETS), and the North American Renewables Registry (NAR). These registries provide digital verification, hourly or sub-hourly tracking in emerging markets, and documented retirement pathways for corporate Scope 2 reporting.

The United States is a major contributor to the market for green energy certification services. A combination of well-established state-level regulatory mandates and strong corporate sustainability commitments drives the country's growth. Several corporations, particularly tech giants such as Microsoft, Google, and Amazon, have strongly committed to net-zero goals and to 100% renewable energy. The country has widespread state-level Renewable Portfolio Standards (RPS) that require utilities and other energy providers to source a specified percentage of their electricity from renewable sources, thereby creating demand for compliance with Renewable Energy Certificates (RECs).

Key Players in the Green Energy Certification Services Market

- Green-e Energy

- Ecohz

- The Green Certificate Company

- RECS International

- U.S. Environmental Protection Agency (for regulation/recognition)

- Central Electricity Regulatory Commission (CERC), India

Recent Developments

- In October 2025, Constellation, the nation's largest producer of emissions-free, reliable energy and a leading energy supplier to businesses, homes, and public sector customers, and Xpansiv, a leading infrastructure provider for the global energy transition markets, announced plans to launch clean energy-based annual emission-free energy certificates (EFECs) on an online trading platform.

- In November 2025, Xpansiv Limited and Evident Group Limited announced an agreement uniting their complementary registry and infrastructure capabilities to support the continued growth of the global renewable energy markets. The agreement, in which Xpansiv has wholly acquired Evident, follows an earlier, minority investment by Xpansiv in the registry operator and certification body. The global REC network with over 300 GW of capacity and more than 4,000 participating companies.

Green Energy Certification Services MarketSegments Covered in the Report

By Energy Source Certified

- Solar Energy

- Wind Energy

- Hydropower

- Biomass & Biogas

- Geothermal

- Hybrid Renewable Sources

By End-User

- Corporations & Industrial Enterprises

- Utilities & Power Producers

- Commercial Buildings

- Government & Public Institutions

- Residential Consumers

- Renewable Energy Investors & Traders

By Purpose

- Voluntary Renewable Energy Procurement

- Compliance with National/Regional Regulations

- Carbon Neutrality & Net-Zero Claims

- Green Branding & Consumer Transparency

- Energy Trading & Attribute Market Participation

By Distribution Channel

- Direct Certification Bodies

- Energy Service Companies (ESCOs)

- Utilities & Power Retailers

- Consulting Firms & Sustainability Advisors

- Online Renewable Certificate Marketplaces

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content