What is the Green Refineries Market Size?

The global green refineries market is witnessing strong growth as energy companies shift toward renewable fuels and sustainable feedstocks to meet net-zero targets. The growth of the market is driven by increasing demand for cleaner fuels across the world. Strict environmental regulations are fueling demands for renewable energy solutions and green hydrogen, contributing to global market growth.

Green Refineries Market Key Takeaways

- Europe dominated the global green refineries market with the largest share of approximately 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By feedstock, the used cooking oil segment captured the biggest market share of 40% in 2024.

- By feedstock, the algae oil segment is expected to grow at the highest CAGR between 2025 and 2034.

- By process technology, the hydroprocessing segment contributed the maximum markets share of 50% in 2024.

- By process technology, the gasification & pyrolysis segment is likely to grow at the fastest CAGR during the forecast period.

- By product type, the renewable diesel segment held the highest market share of 45% in 2024.

- By product type, the sustainable aviation fuel (SAF) segment is expected to grow at a notable CAGR during te forecast period.

- By application, the transportation fuel segment accounted for the significant market share of 55% in 2024.

- By application, the aviation fuel segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By end-user, the oil & gas companies segment generated the major market share of 35% in 2024.

- By end-user, the aviation industry segment is expected to expand at the highest CAGR over the projection period.

Key Technological Shift in the Green Refineries Market

The green refineries market is undergoing a significant transformation due to technological shifts, such as electrification, renewable energy integration, digitalization, smart refining, hydrogen production and utilization, and advanced catalyst and process technologies, driven by increased demand for reducing carbon emissions and enhancing operational efficiency. Digitalization and technologies, such as the Internet of Things (IoT), AI, and advanced analytics, are transforming green refineries, enabling the optimization of refinery operations, enhanced safety, and reduced overall costs. These technologies are increasing the production of green hydrogen in plants due to the rapid adoption of cleaner alternatives to traditional hydrogen production methods, which is fostering the use of cutting-edge technologies in grain refineries.

Major companies, including TotalEnergies, Shell, and Reliance Industries, are offering cutting-edge technologies such as green hydrogen, carbon capture technologies, solar & wind power generation, electrification, and biofuels. Specialized green technology developers, including Aunfire and LanzaTech, are driving innovations and adoption of AI-driven process optimization for sustainable green refineries.

What are Green Refineries?

The green refineries market is experiencing rapid growth due to global decarbonization efforts and government support. The market refers to facilities that convert renewable feedstocks such as used cooking oil, vegetable oils, animal fats, and algae into sustainable fuels and chemicals. These refineries produce renewable diesel, sustainable aviation fuel (SAF), bio-naphtha, bio-propane, and other green hydrocarbons as drop-in alternatives to fossil fuels. Green refineries support decarbonization in transportation, aviation, marine, and industrial applications while enabling energy transition strategies.

Growth is driven by regulatory mandates, investments in hydrogenation, isomerization, and pyrolysis technologies, as well as partnerships between oil majors and biofuel companies. Europe leads due to its strict renewable fuel policies, while the Asia Pacific is the fastest-growing region, driven by rising fuel demand and expanding renewable energy adoption.

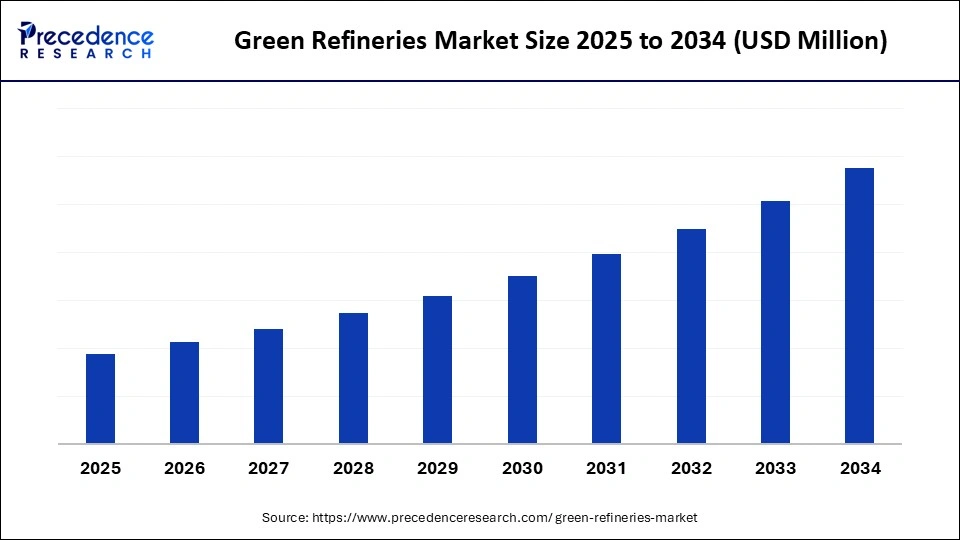

Green Refineries Market Outlook

- Industry Growth Overview: The green refineries industry is experiencing rapid growth, driven by a global shift towards reducing carbon footprints and achieving net-zero emission goals by 2030. The industry is expected to evolve with advancements in green hydrogen and biofuels by 2030, driven by strong government support and growing demand for cleaner fuels.

- Sustainability Trends: The green refineries market is increasingly incorporating sustainable practices and technologies to reduce its carbon footprint and environmental impact. The oil and gas industry is the first to witness transformation through the adoption of green refineries. The shift toward production of sustainable and low-carbon fuels, including renewable diesel, sustainable aviation fuel (SAF), and biofuels, is reducing greenhouse gas emissions.

- Global Expansion: Asian countries, including China, India, and Japan, are leading the expansion of green refinery reach worldwide. India is playing a significant role, with government approval, in the National Green Hydrogen Mission, which aims to promote domestic production of hydrogen, including electrolysers and renewable energy targets. In January 2023, India set a mission with the goal of achieving 5 million metric tons per annum of green hydrogen production by 2030.(Source: https://www.nsws.gov.in)

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock, Process Technology, Product Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Investments in Hydrogen Infrastructure

Governments worldwide are investing heavily in hydrogen infrastructure for production facilities and hydrogen plant pipelines. The increased demand for clean energy is driving the need for green hydrogen in refineries. The development of centralised hydrogen supply networks and contract-based hydrogen trading models is enabling the production of green hydrogen. Government initiatives and policies aimed at promoting green hydrogen production and use are accelerating the growth of green hydrogen production and imports worldwide. These investments further accelerate partnerships and collaborations between gas companies and refineries, shaping the competitive landscape in the market.

Restraint

Technology Integration

The integration of technology is the primary challenge for the green refineries market, driving up integration costs and complexity. The integration of cutting-edge technology requires significant investments, which hampers its adoption in medium- and small-sized refineries. The integration of novel technologies with existing systems can be complex, which causes technical and operational challenges. The regular maintenance and update requirements increase the total cost, thereby hindering the adoption of technology.

Opportunity

Growing Focus on Decarbonizing Industrial Operations

The increasing global demand for cleaner fuels, such as renewable diesel and biofuels, is driving a focus on decarbonizing industrial operations. To meet strict environmental regulations and reduce carbon emissions goals, industries are focusing on adapting green refineries. The decarbonisation strategies like electrification, green hydrogen production, and carbon capture and storage CCS are enabling the reduction of carbon footprint for industries. Additionally, government initiatives and policies promoting the production and use of green hydrogen facilitate the adoption of green refineries in the industry.

Segments Insights

Feedstock Insights

Why Did the Used Cooking Oil Segment Dominate the Green Refineries Market?

The used cooking oil segment led the market with a 40% share in 2024, driven by increased demand for sustainable energy and cost-effective alternatives. Used cooking oil is a significant source of renewable energy and a contributor to reduced greenhouse gas emissions. This feedstock is affordable, making it an ideal solution for biodiesel production. The wide availability of used cooking oil from various domestic waste sources, including the food service industry, food processing plants, and households, is contributing to the growth.

The algae oil segment is expected to grow at the fastest CAGR over the forecast period due to its high sustainability and versatility. The growing adoption of sustainable and renewable energy sources helps to reduce reliance on fossil fuels. This oil has the capacity to produce a large amount of biofuel per acre annually. The applicability of algae oil in various applications, such as dietary supplements, biofuels, cosmetics, and food products, makes it an attractive option as a green refinery.

Process Technology Insights

What Made Hydroprocessing the Dominant Segment in the Green Refineries Market?

In 2024, the hydroprocessing segment dominated the market, accounting for approximately 50% of the market share, driven by increased hydrogen demand and advancements in catalyst technology. Hydroprocessing requires green hydrogen to remove impurities, such as sulfur, nitrogen, and metals, from petroleum products, resulting in cleaner films. The increased demand for low-sulphur fuels is driving the adoption of efficient hydroprocessing technologies. The growing demand for hydroprocessing catalysts, such as hydrocracking catalysts and hydrotreating catalysts, contributes to the efficient refining process, which in turn drives the growth of the market segments.

The gasification & pyrolysis segment is expected to grow at the fastest rate over the projection period, driven by its high use in the production of sustainable chemicals and biofuels. Gasification is the process of converting organic materials into synthesis gas, which uses the introduction of chemicals, power, and biofuels. The thermal decomposition process, known as pyrolysis, helps convert biomass and waste materials into gaseous products, biochar, and bio-oils, making them ideal technologies for green refineries.

Product Type Insights

How Does the Renewable Diesel Segment Dominate the Green Refineries Market in 2024?

The renewable diesel segment dominated the market with a 45% share in 2024, owing to the Ability of renewable diesel to reduce greenhouse gas emissions. Governments worldwide have implemented strict environmental regulations, fueling an industrial shift toward innovations and the production of renewable diesel. The direction of renewable disease is high in the North America and Europe regions, with an industrial focus on production and adoption. The low-carbon fuel standards and federal incentives for low-carbon fuels are contributing to this growth.

The sustainable aviation fuel (SAF) segment is expected to expand at the fastest CAGR in the upcoming period, driven by increased demand for cleaner energy sources and stringent environmental regulations. SAF manufacturers are investing heavily to enhance production capacity and advance refining technologies, such as HEFA-SPK. The growing use of waste oils and agricultural residues as food stocks is contributing to the segment's growth. With significant investment in SAF research and development by airlines, aerospace companies, and technological advancements, the segment is expected to experience rapid expansion.

Application Insights

Why Did the Transportation Fuel Segment Dominate the Green Refineries Market?

The transportation fuel segment dominated the market, accounting for approximately 55% of the market share in 2024, due to the transportation sector's commitment to comply with strict environmental regulations. The rising vehicle ownership, urbanization, and industrialization are fueling demand for sustainable transportation fuel. Renewable fuels, including green hydrogen and biofuels, are the preferred choice for the transportation sector. With a growing global push toward decarbonization, the trend toward fuel mix, particularly in the form of electric and hybrid vehicles, is contributing to segmental growth.

The aviation fuel segment is expected to grow at a rapid pace during the forecast period, driven by increased environmental concerns, regulatory pressure, airline commitments, and a reduction in carbon emissions. The demand for sustainable aviation fuel has increased in the aviation industry. The rapid adoption of aviation fuel is driving the need for innovative refining technologies and alternative feedstocks, fueling the operational capabilities of green refineries. The technological development and commercialization, including HEFA-SPK and Fischer-Tropsch (FT), are fueling the green refineries market.

End-user Insights

Which End-user Dominates the Green Refineries Market?

The oil & gas companies segment dominated the market with the largest share of approximately 35% in 2024, driven by increased demand for cleaner energy sources. Oil and gas companies are leveraging the technical expertise, infrastructure, and capital development of nuclear technologies, including low-carbon hydrogen and biofuels, to enhance their operations. The shift toward renewable production and the creation of supply chain synergies are driving the adoption of green refineries by oil and gas companies. These companies are focusing on addressing operational emissions through CCUS technologies.

The aviation industry segment is likely to experience the fastest growth due to increased adoption of sustainable aviation fuel (SAF). The aviation industry is fueling the adoption of renewable feedstocks and influencing refinery investments. Advanced technologies, such as Hydroprocessed Esters and Fatty Acids (HEFA), Alcohol-to-Jet (AtJ), and Fischer-Tropsch synthesis, are fueling the segment's growth. Additionally, the evolution of HEFA-SAF technologies is enabling the use of renewable fuels in the aviation industry.

Regional Insights

Europe Green Refineries Market Trends

Europe dominated the market by holding approximately 40% share in 2024. This is primarily due to the region's strong climate goals and the development of its hydrogen infrastructure. Europe has set the climate goal of achieving carbon neutrality, driving demand for green hydrogen and renewable energy. Europe is investing heavily in hydrogen infrastructure with plans to build large and comprehensive hydrogen pipelines by 2030. The Regional Hydrogen Strategy and REPowerEU plan are accelerating the production, import, export, and use of green hydrogen, with the target of producing and importing renewable hydrogen.

According to the International Energy Agency's July Oil Market Report, European refinery output was projected to rise to 11.3 million barrels per day in July 2025, up from 11 million barrels per day in June and 10.9 million barrels per day in May 2025.(Source: https://www.opis.com)

Asia Pacific Green Refineries Market Trends

Asia Pacific is expected to experience rapid growth in the global market, driven by the region's increased consumption of hydrogen power. Asia Pacific is home to numerous refinery plants, particularly in countries like China, India, Japan, and South Korea. District environmental regulations are promoting the adoption of cleaner technologies, including hydrogen generation, to reduce carbon emissions. The demand for hydrogen power has increased in Asian industries, such as petroleum refining, contributing to market growth. Additionally, the strong focus on innovations and advancements in hydrogen production technologies, such as electrolysis and steam methane reforming, is fueling this growth by improving efficiency and reducing costs.

- In January 2020, the Indian Mumbai refinery was in the process of migrating to the updated ISO 50001:2018 standards for energy management systems. This process enhances energy efficiency and reduces energy costs in Mumbai. Mumbai refinery was the first refinery to receive ISO 5002 accreditation in 2014.

Country-Level Investments and Funding for the Green Refineries Industry

- U.S.: The U.S. has heavily invested in expanding production capacity, with approximately 37 SAF projects currently under development. The U.S. has set a goal of 3 billion gallons of SAF production annually by 2030.

- Canada: Canada is highly active in green refinery, aligning wth projects, including Imperial Oil's C$507 million renewable diesel facilities in Alberta.

- Germany: The Country has invested more than $339 billion in clean energy in June 2023.

- The UK: In 2023, the UK increased investments in renewable energy, particularly for offshore wind. Key players, such as BP and Shell, are investing heavily in SAF.

- China: China is the global leader for investing in clean energy, having invested around half of the global solar PV, and is a dominant player in lithium-ion batteries. In 2024, Belt and Road Initiatives (BRI) received $11.8 billion in green energy from the Chinese government.

Green Refineries Market - Value Chain Analysis

- Resource Extraction

Crops, plants, algae, and animal fats are the primary resources extracted for green refineries, enabling the development of sustainable liquid fuel solutions, such as biodiesel and ethanol.

Key Players: Reliance Industries Limited, Neste, Renewable Energy Group (REG), and Praj Industries Limited.

- Distribution Network Management

Green refineries integrate sustainable practices into logistics and operations through the use of distribution network management, with a strong focus on increasing efficiency, reducing environmental impact, and optimizing costs.

Key Players: Siemens, Linde Engineering, Thermax, and TotalEnergies.

- Regulatory Compliance and Energy Trading

Green refineries must adhere to safety and operational standards. Energy trading enables green refineries to buy and sell renewable energy credits or excess clean energy, enhancing profitability while supporting grid stability and carbon reduction goals.

Key Players: Intertek, EcoVadis, GPC Regulatory, and Wire Consultancy.

Green Refineries Market Companies

- Sinopec

- ExxonMobil

- Linde

- Air Liquide

- Siemens Energy AG

- Reliance Industries

- Larsen & Toubro (L&T)

- NTPC Ltd

- Adani Green Energy Ltd

- ONGC

Recent Developments

- In July 2025, a wholly-owned subsidiary of Larsen & Toubro (L&T), L&TEnergy GreenTech Ltd (LTEG), set up India's largest green hydrogen plant at Indian Oil Corporation Ltd's (IOCL) Panipat Refinery in Haryana. This plant will supply 10,000 tonnes of green hydrogen annually to IOCL for 25 years to support the government of India's National Green Hydrogen Mission. (Source: https://www.larsentoubro.com)

- In April 2025, BPCL virtually commissions a 5MW Green Hydrogen Plant at the Biona Refinery, inaugurated by BPCL Chairman and Managing Director Shri G. Krishnakumar. This plant demonstrates state-of-the-art advancements in Indian energy transitions that align with the National Green Hydrogen Mission.(Source: https://x.com)

Segments Covered in the Report

By Feedstock

- Used Cooking Oil (UCO)

- Domestic Waste Oil

- Industrial Waste Oil

- Animal Fats

- Beef Tallow

- Pork Lard

- Poultry Fat

- Vegetable Oils

- Rapeseed Oil

- Soybean Oil

- Palm Oil

- Others (Sunflower, Canola)

- Algae Oil

- Others

- Waste Grease

- Other Industrial Bio-Wastes

By Process Technology

- Hydroprocessing

- Hydrotreating

- Hydrocracking

- Transesterification

- Gasification & Pyrolysis

- Fermentation

- Others

By Product Type

- Renewable Diesel

- Sustainable Aviation Fuel (SAF)

- Bio-Naphtha

- Bio-Propane / Bio-LPG

- Others (Bio-Wax, Bio-Chemicals)

By Application

- Transportation Fuel

- Road Vehicles

- Buses & Trucks

- Aviation Fuel

- Marine Fuel

- Industrial Applications

- Others

By End User

- Oil & Gas Companies

- Biofuel Producers

- Aviation Industry

- Marine Industry

- Industrial Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting