Power Inverter Market Size and Forecast 2025 to 2034

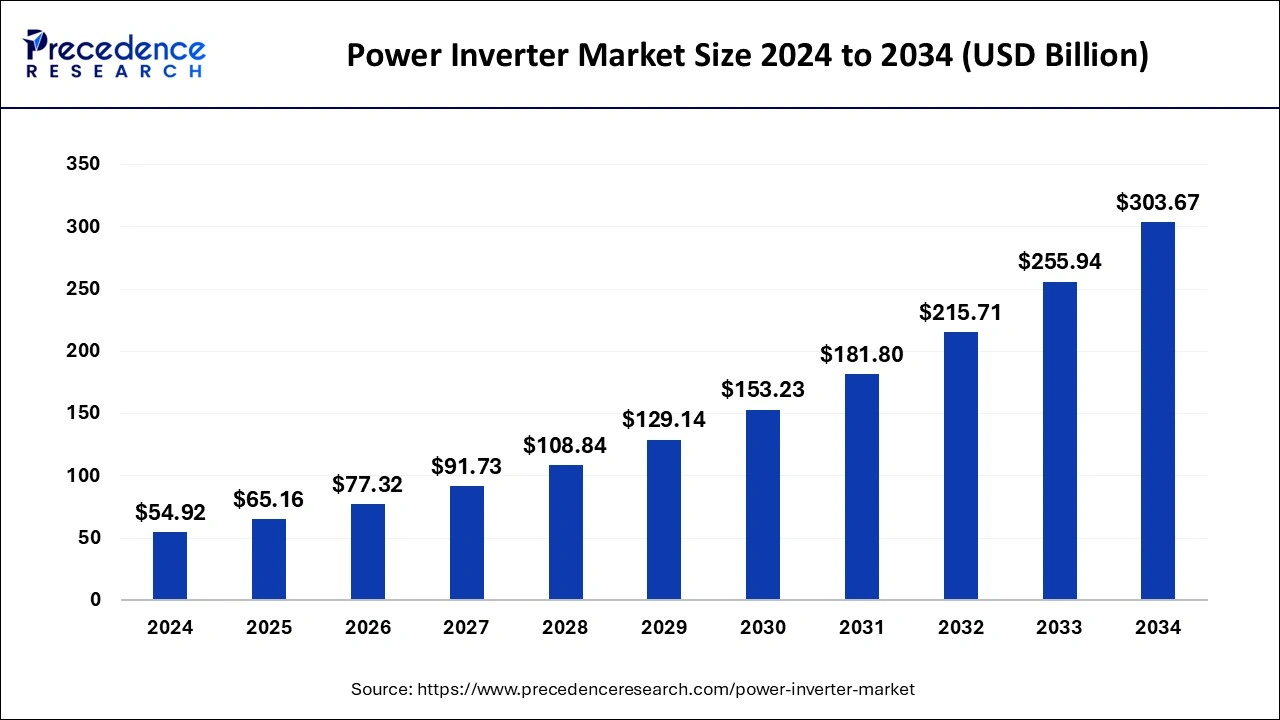

The global power inverter market size was estimated at USD 54.92 billion in 2024 and is anticipated to reach around USD 303.67 billion by 2034, expanding at a CAGR of 18.65% from 2025 to 2034. from 2025 to 2034. The integration of renewable energy, portability, energy efficiency, and continuous power supply are the major rationales behind the success of the power inverter market.

Power Inverter Market Key Takeaways

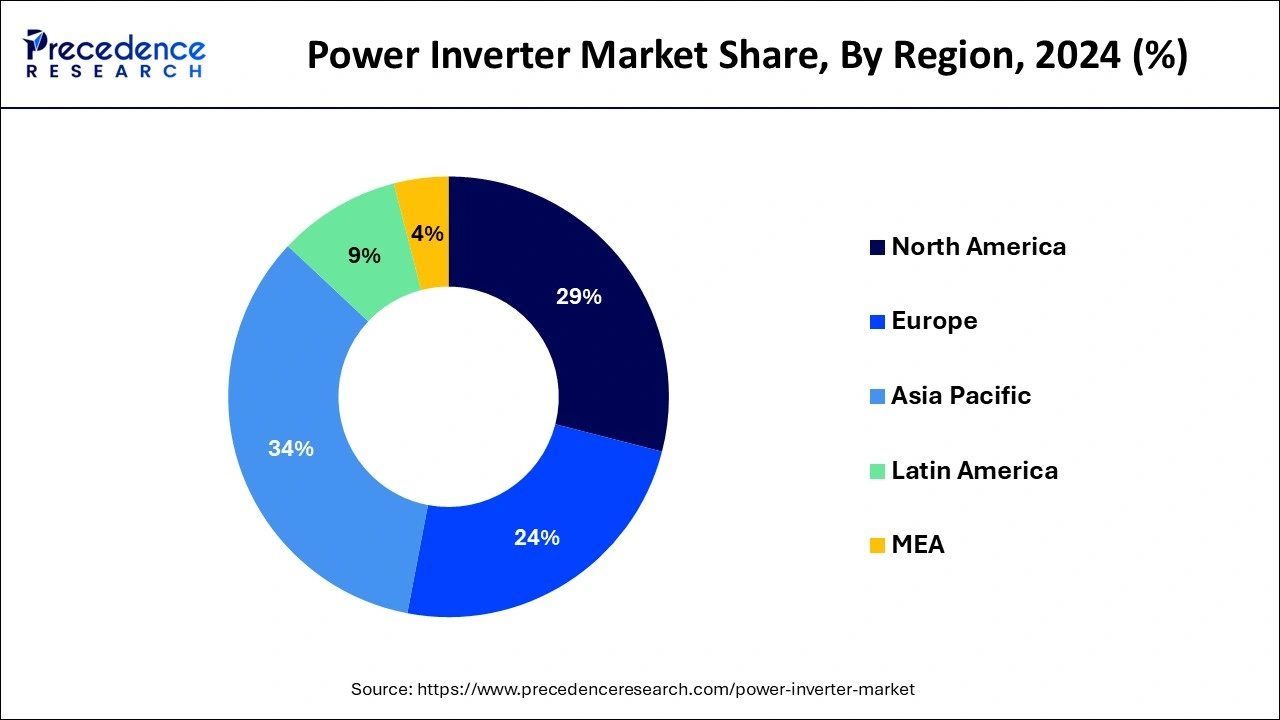

- Asia Pacific led the global power inverter market with the largest market share of 34% in 2024.

- North America is projected to grow at a significant CAGR during the forecast period.

- By type, the 5-95 KW segment dominated the power inverter market in 2024.

- By type, the 100-495 KW segment is expected to be the fastest-growing in the power inverter market during the forecast period.

- By end use, the residential segment dominated the market in 2024.

- By end use, the commercial segment is expanding at a notable CAGR during the forecast period.

- By application, the motor drive segment contributed the highest market share in 2024.

- By application, the EVs/HEVs segment is growing at a solid CAGR during the forecast period.

Advantages of AI-integration in Power Inverters

Artificial intelligence is transforming power systems with technological changes. AI helps to reduce computational time, decrease utility and consumer costs, and ensure the reliable operation of an electrical power system. AI techniques can automate and improve the performance of power systems. AI techniques are integrated into power system operations, control and planning, and various applications.

AI can resolve system frequency changes and maintain the voltage profile that minimizes transmission losses and reactive current in distributed systems and reduces the fault rate. AI helps to increase the power factor and improve the voltage profile. AI can improve the efficiency of electrical automation management, address the risk of accidents, and ensure the smooth operation of the power system for a long period.

Asia Pacific Power Inverter Market Size and Growth 2025 to 2034

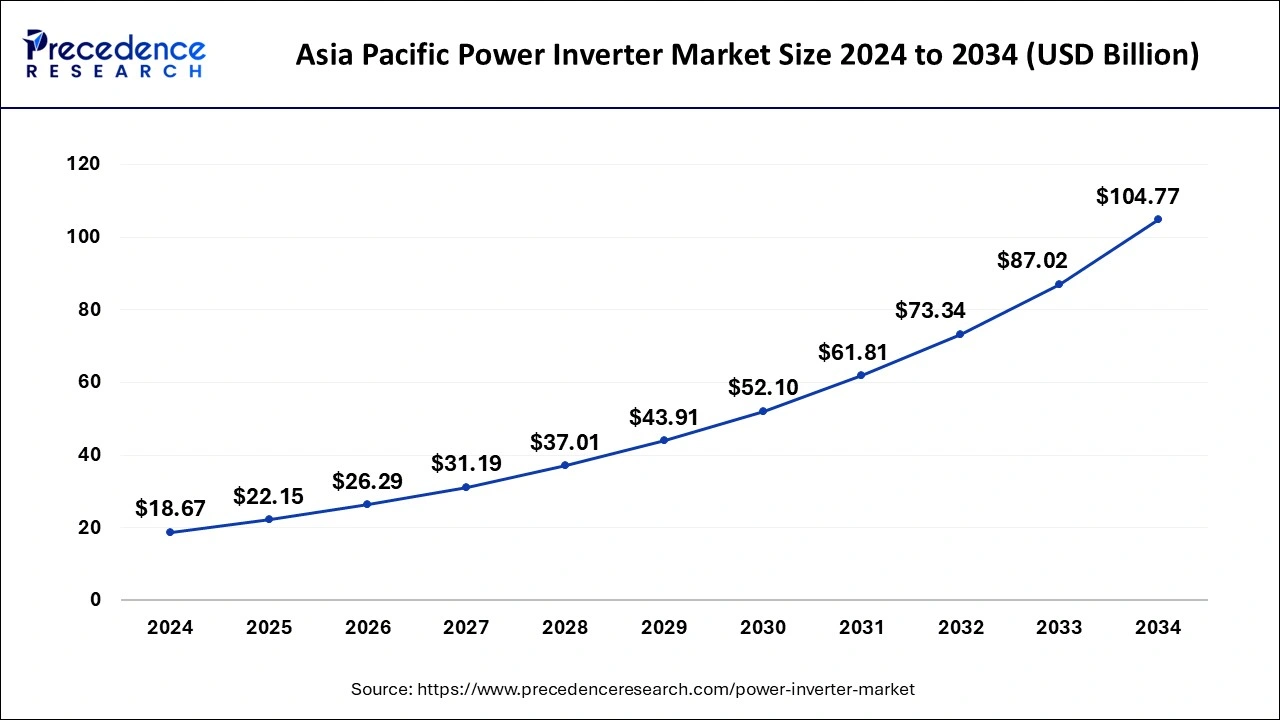

The Asia Pacific power inverter market size was evaluated at USD 18.67 billion in 2024 and is predicted to be worth around USD 104.77 billion by 2034, rising at a CAGR of 18.82% from 2025 to 2034.

Asia Pacific led the global power inverter market with the largest market share of 34% in 2024 and is estimated to be the most opportunistic market during the forecast period. The rapid industrialization, rapid urbanization, rising disposable income, improving lifestyle, and rising standards of living in the region are some of the major factors that drives the growth of the Asia Pacific power inverter market. The rising government initiatives and investments in the development of the rural regions and electrification is positively impacting the market.

The growing number of real estate projects in the rural areas is expected to boost the demand for the power inverters owing to the fluctuating power supply in the rural areas. Moreover, the rising awareness regarding the power inverters along with the easy availability of the power inverters in the sub-urban and rural areas of the Asia Pacific is expected to contribute significantly towards the market growth. Hence, the Asia Pacific power inverter market is expected to witness a considerable growth rate during the forecast period.

North America is anticipated to be the fastest-growing region in the power inverter market during the forecast period with the U.S. as the major contributing country to the regional market's growth. The U.S. leads as the prominent market due to the presence of several power inverters. The dominance of 60 KW plus capacity-three phase string inverters and 1.5 MW plus capacity central inverters is contributing to the success of the U.S. country. The Solar Energy Industries Association states that the U.S. showcases a cumulative installation of 153 GWdc solar capacity during the first quarter of the year 2023 and is expected to reach around 375 GWdc by 2028. The photovoltaic solar installations with new electricity generating capacity additions were remarkably grown in the first quarter of the year 2023. The rising adoption of solar power inverters is expected to be the prominent growth factor for the regional market's growth in the coming years.

- During the period from September 2023 to August 2024, the world received 110 shipments of Solar Inverters from the United States. These imports were provided by 29 U.S. exporters to 69 global buyers, indicating a growth rate of 116% compared to the prior twelve months. During this time, in August 2024 specifically, World received 6 shipments of Solar Inverters from the United States. This indicates a year-on-year increase of 20% relative to August 2023.

- Worldwide, the leading three importers of Solar Inverter are India, the United States, and Vietnam. India tops the global list for Solar Inverter imports with 46,451 shipments, while the United States follows with 17,548 shipments, and Vietnam ranks third with 14,077 shipments.

Europe is expected to grow significantly in the power inverter market during the forecast period. The growing demand for renewable energy is increasing the use of power inverters in Europe. At the same time, the use of advanced technologies and new developments is also being encouraged. Furthermore, the increasing use of electric vehicles is also increasing the demand for the use of power inverters. This, in turn, increases the government investments as well as polices to encourage its use. Thus, all these factors promote the market growth.

The industries in the UK are using advanced technologies to improve the development process of the power inverters. At the same time, they are also being used for enhancing various features of these inverters, enhancing their performance. Thus, this innovation is further supported by the investments provided by the government.

The growing use of electric vehicles is increasing the demand for power inverters in Germany. Furthermore, this demand is also driven by the policies laid down by the government as well as the increasing demand for renewable energies.

Market Overview

A power inverter refers to an electronic device upon which several factors depend which includes input voltage, output voltage, frequency, and overall power handling. It can be a combination of mechanical effects and electronic circuitry. Moreover, solar power inverters are an integral part of large solar systems. They have the potential to convert direct current electricity into alternate current and can determine the efficiency of the whole solar system. The focus on minimizing the power generation costs propels the market's expansion. According to the International Renewable Energy Agency (IRENA), power inverters will expand significantly over the next 30 years. Several government policies supported the adoption of clean energy and helped to decline renewable energy prices. The reduced installation costs of inverters, cells, solar modules, and related equipment boost the demand and need for the power inverter market.

Market trends

- In May 2025, Hybrid Inverters and Lithium-Ion Batteries were launched by the collaboration between Exide Pakistan and SRNE Solar Technology Co. Ltd, at The Nishat Hotel, Lahore, for the Pakistani market. With the launch of innovative energy solutions for a sustainable future, a milestone was achieved in the renewable energy sector.

- In May 2025, central inverters of the new range of 4500 kW, along with PCS for large solar farms, were announced and launched by the ZGR Corporación, which is a Spanish manufacturer. To operate under the future 2000 V regulations, this range was prepared, which will allow them to be adopted in different international markets, such as Latin America and Europe. Source: Exide Pakistan, SRNE launch hybrid inverters, lithium-ion batteries ZGR presents new range of 4500 kW central inverters and PCS at Intersolar – pv magazine International

Power Inverter Market Growth Factors

- The major factors that boost the adoption of power inverters across the residential and commercial sectors are the low cost of operation and the elimination of the

- Inconveniences associated with the change-over switches, unlike the power generators.

- Power inverters are utilized for operating various household appliances and electrical products.

- The availability of power inverters in various sizes and power ranges helps to cater to the different needs of household and commercial units across the globe.

- The strong economic growth coupled with the rising disposable income of consumers is boosting the growth of the global power inverter market.

- Moreover, with the rising demand for uninterrupted power supply and protection the electric appliances from the damages caused by power fluctuations, the demand for power inverters is surging across the globe. Rapid urbanization along with the rising electrification in the developing and underdeveloped regions is fostering the adoption of the power inverters.

- The reliance on electronic appliances has significantly increased due to the rising technological advancements in the consumer electronics industry and the rising affordability of consumers across the globe. This has significantly boosted the demand for power inverters owing to the need for an uninterrupted power supply.

- The rising awareness regarding the availability of various types of power inverters at various power ranges has fueled the sales of the power inverters.

- Moreover, the power inverters are eco-friendly and free from noise and carbon emissions and also eliminate the usage of gasoline.

- Furthermore, the rising investments by the market players in the research & development activities to enhance the operational efficiency of the power inverters and introduce the latest technologies are expected to drive the growth of the global power inverter market.

- The indirect sales channels in the power inverters market play a crucial role in the distribution.

- The rising popularity of solar inverters among commercial and residential users is significantly expected to drive the growth of the global power inverters market during the forecast period. Moreover, the rising demand for electric vehicles among global consumers is expected to drive the growth of the EVs/HEVs power inverters market.

- The rising awareness among consumers regarding the deteriorating environmental conditions owing to vehicle emissions is surging the demand for electric vehicles.

- The rise in the adoption of EVs will significantly drive the demand for power inverters across the globe.

- Furthermore, the growing government initiatives to promote eco-friendly power sources are significantly impacting the adoption of solar PVs and the EVs/HEVs power inverters across the globe, thereby contributing significantly towards the growth of the global power inverter market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 303.67 Billion |

| Market Size in 2025 | USD 65.16 Billion |

| Market Size in 2024 | USD 54.92 Billion |

| Growth Rate from 2025 to 2034 | 18.65% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

Type, Application, End User |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rising awareness of people regarding environmental issues and efforts to reduce carbon emissions are driving the demand for clean energy solutions in the form of power inverters. Countries like the U.S. and China are leading in constant economic growth and development in the supply chain. The favorable government policies support the production of power inverters in the U.S. and China which drives their adoption and solar power inverters as well.

Restraint

There can arise issues regarding elevated DC voltages and high voltages can present risks to installers, firefighters, and maintenance personnel. The costs of installation, maintenance, and

marketing can be financially tough for some people dealing with this. The short-circuit situations can be problematic presenting health risks to the workforce.

Opportunity

The power inverters have wide applications in the automotive field. They are in high demand for electric vehicle powertrains. Vehicle inverters have the potential to power the onboard electric systems and motors of vehicles. There are leading and noticeable manufacturers and providers of vehicle inverters including Toyota Industries (Japan), Sensata Technologies (U.S.), Delphi Technologies (UK), etc. which contribute to the expansion of the power inverter market.

Type Insights

The 5-95 KW segment dominated the power inverter market in 2024 due to its great utilization in rail traction and electric vehicles. An electric car has the potential to go around 100 miles on 30 KW of energy and hence electric vehicles launched in 2022 can travel about 400 miles on 100 KW of power. With the increased use of 100 KW of power by electric vehicles, demand for power inverters will also increase.

The 100-495 KW segment is expected to grow at the fastest rate in the power inverter market over the forecast period. This segmental growth will be due to the huge adoption of electric vehicles capable of traveling on 100-495 KW of energy in the coming years. This power energy serves as a traction inverter in rail traction that can convert AC power into DC power for the DC motors used in locomotives. The increased awareness of consumers regarding the benefits of using electric vehicles for environmental sustainability will accelerate the growth of this segment. The rise in petroleum fuel prices and government initiatives and policies encourage the purchase of electric vehicles driving the demand and need for this power energy segment.

End Use Insights

The residential segment dominated the market in 2024. The rising government expenditure on the development of infrastructure and electrification has fueled the adoption of the power inverters among the residential users. The rising number of residential structures and rising urbanization is a major factor that fuels the deployment of the power inverters in the residential units across the globe. Moreover, the increasing demand for the various consumer electronics among the household consumers will foster the demand for the power inverters in the residential segment.

The commercial segment is expanding at a notable CAGR during the forecast period. This can be attributed to the increased demand for the uninterrupted power supply in the commercial units like malls, gyms, and other commercial spaces. The regular power supply is essential for the smooth operation of the commercial activities and any interruption in the power supply may result in huge financial loses to the commercial units. Hence, the adoption of power inverters in the commercial units is expected to grow rapidly during the forecast period.

Application Insights

The motor drive segment contributed the highest market share in 2024. This is attributed to the increased popularity and increased adoption of the motor drives across the globe. The motor drives accounts for around 45% of the electric energy consumption across all the electric appliances. The increased efficiency of the motor drives has boosted the growth of this segment in the global power inverters market.

The EVs/HEVs segment is growing at a solid CAGR during the forecast period. This is simply attributed to the increased adoption of the electric vehicles across the globe. The rising concerns regarding the vehicle emissions has forced the government to develop policies that encourages the adoption of the EVs and HEVs. The rising government initiatives to restrict the carbon emission from vehicles is significantly boosting the growth of this segment. Moreover, the surging popularity of the autonomous vehicles among the consumers is further expected to fuel the growth of this segment in the forthcoming years.

Power Inverter Market Companies

- SMA Solar Technology AG

- ABB Ltd.

- Huawei Technologies Co., Ltd.

- Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC)

- Omron Corporation

- Advanced Energy Industries, Inc.

- SolarEdge Technologies Inc.

- Enphase Energy, Inc.

- Tabuchi Electric Co., Ltd.

- Schneider Electric SE

Key Market Developments

- In April 2025, the Chinese company Solis has launched a new three-phase high-voltage inverter intended for commercial use. The firm announced that its S6-EH3P(80-125)K10-NV-YD-H model is now the largest wall-mounted hybrid inverter in the world. It comes in three variants offering AC outputs of 80 kW, 100 kW, or 125 kW.

- In April 2025, Austrian inverter producer Fronius introduced a new hybrid inverter solution designed for small residential and commercial uses. The inverters, rated at IP-66, have a DC voltage range of 150-1,000 V and a maximum power point tracking usable voltage range of 150-807 V. The nominal input voltage stands at 600 V, with a feed-in start-up input voltage of 150 V. Additionally, these systems can function in temperatures ranging from -25 C to 60 C and feature regulated air cooling alongside automatic arc detection.

- In March 2025, INVERGY, synonymous with renewable energy solutions, has expanded its range of hybrid inverters to address rising energy needs. The company has recently introduced its new line of hybrid inverters. The new 60kW and 80kW units enhance the current 30kW and 50kW options, providing greater power, flexibility, and improved reliability for commercial and industrial uses.

- In May 2024, ABB Ltd. announced the launch of an innovative new package of motors and inverters including the AMXE250 motor and HES580 inverter designed for electric buses which is an energy-efficient, readily available, and reliable solution for industries.

- In December 2024, Omron Corporation announced the launch of its latest edition of the G5Q-HR Power relay to enhance performance and extend operational life. It exhibits wide applications like home appliances, lighting equipment, and FA equipment.

Segments Covered in the Report

By Type

- Less than 5KW

- 5-95 KW

- 100-495 KW

- More than 500 KW

By End Use

- Utility

- Commercial

- Residential

By Application

- Motor Drives

- Rail Traction

- Uninterruptible Power Supply

- EVs/HEVs

- Wind Turbines

- Solar PVs

- Others

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content