What is the Coal to Liquid Market Size?

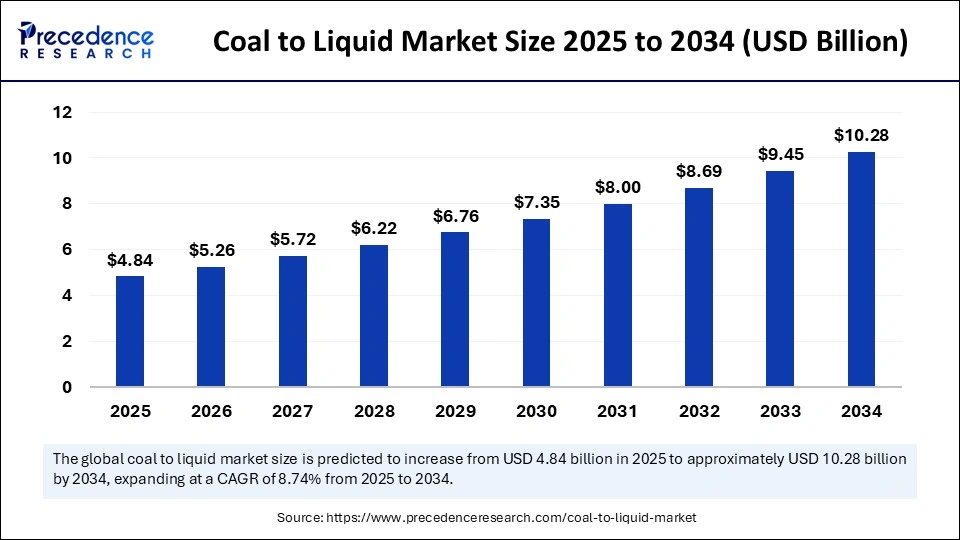

The global coal to liquid market size is calculated at USD 4.84 billion in 2025 and is predicted to increase from USD 5.26 billion in 2026 to approximately USD 10.28 billion by 2034, expanding at a CAGR of 8.74% from 2025 to 2034. The market growth is attributed to increasing energy security concerns and rising demand for alternative fuels in industrial and transportation sectors.

Coal to Liquid Market Key Takeaways

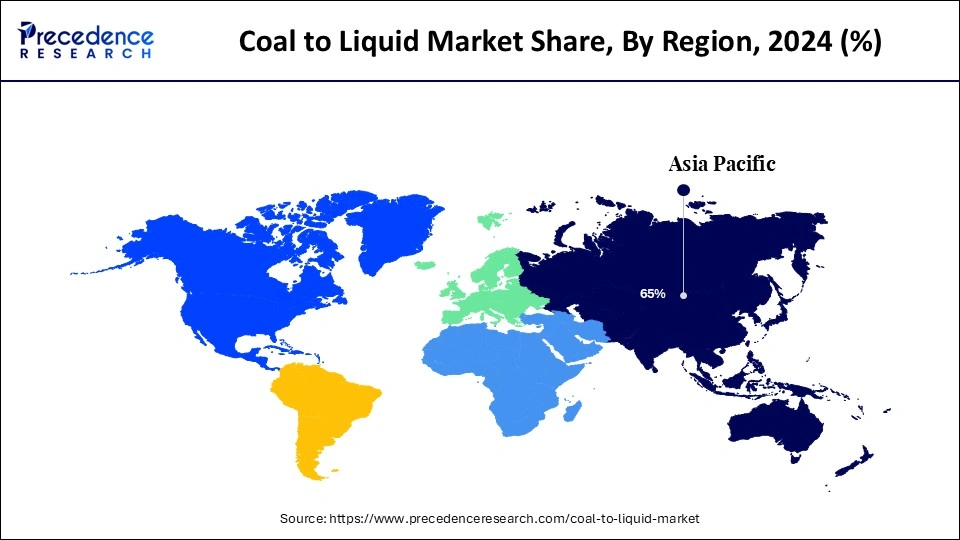

- Asia Pacific dominated the global market with the largest market share of in 65% 2024.

- North America is expected to grow at the fastest CAGR of 18.04% during the period.

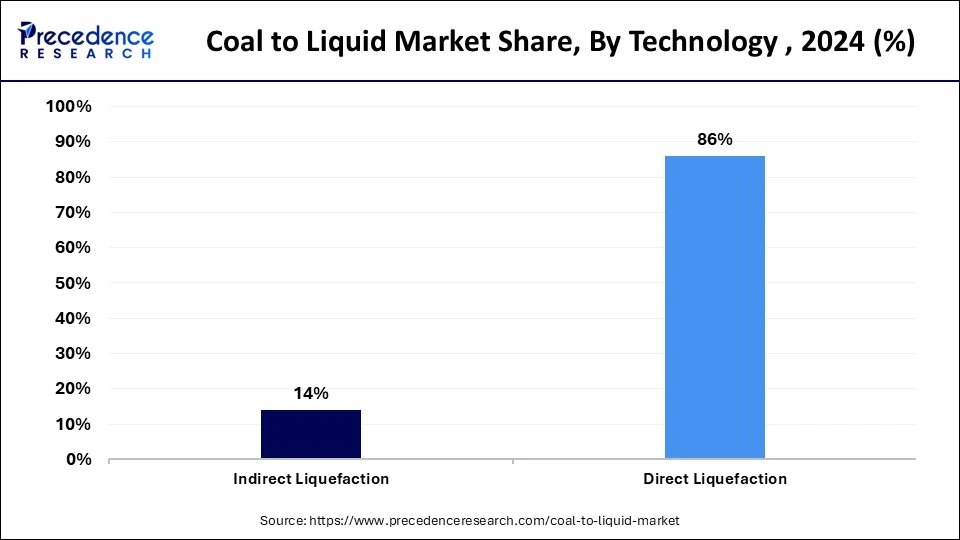

- By technology, the direct liquefaction segment contributed the biggest market share of 86% in 2024.

- By technology, the indirect liquefaction segment is expected to grow at the fastest CAGR of 9.32% between 2025 and 2034.

- By product material, the diesel segment accounted for the largest share of 67% in 2024.

- By product material, the gasoline segment is anticipated to grow at the highest CAGR of 9.22% during the years studied.

- By application, the transportation fuel segment generated the major market share of 90% in 2024.

- By application, the cooking fuel segment is expected to grow at a solid CAGR of 4.53% during the forecast period.

Impact of Artificial Intelligence on the Coal to Liquid Market

Organizations now adopt Artificial Intelligence for strategic business development while optimizing operational framework. The coal-to-liquid industry uses AI-powered tools to both increase production efficiency and achieve better equipment maintenance predictions. AI significantly impacts the market. AI can optimize process parameters, improving efficiency and maximizing yield. Furthermore, the manufacturers utilize AI to enhance both supply chain forecasting precision and distribution coordination systems.

What are the Revolutionary Approaches in the Coal to Liquid?

The rising need for secure energy and fuel diversity is expected to boost the implementation of coal-to-liquid (CTL) technologies. Transforming coal through direct and indirect liquefaction routes results in fuel products. South Africa and China along with other coal-rich nations benefit from this technology to decrease their dependence on imported oil. The U.S. Department of Energy (DOE) documented CTL technology progress in 2024, which resulted in better fuel performance and better emission regulation capabilities. Furthermore, CTL is the backbone for fuel security. The rising demand for transportation fuel is expected to drive the market growth in the coming years.

Coal to Liquid Market Growth Factors

- Rising geopolitical tensions are likely to drive domestic fuel production through coal-to-liquid technologies.

- Advancements in carbon capture and storage (CCS) technologies are expected to enhance the environmental sustainability of coal-to-liquid processes.

- Increasing industrialization in emerging economies is anticipated to boost the demand for coal-derived liquid fuels for heavy-duty transport and manufacturing.

- Energy diversification policies are likely to encourage investments in coal-to-liquid projects as countries seek to reduce dependency on imported oil.

- Technological improvements in liquefaction processes are projected to reduce production costs and increase fuel efficiency, driving adoption.

- Government support and subsidies for synthetic fuel production are expected to stimulate growth in the coal-to-liquid sector, especially in developing regions.

- Expanding aviation and defense sectors are anticipated to demand more sustainable and secure fuel sources, further driving coal-to-liquid fuel production.

Coal to Liquid Market Outlook:

- Global Expansion: The market is fostered by the huge availability of coal, the increasing demand for transportation fuels and chemical feedstocks, and CTL's role as a substitute for volatile crude oil prices.

- Major Investor: Firms, like Sasol, Royal Dutch Shell, and ExxonMobil, are widely investing through technology development, project investment, and large-scale CTL plant operation.

- Startup Ecosystem: Arq, a UK-based startup that refurbishes mining waste into a pure micro-fine hydrocarbon powder.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.28 Billion |

| Market Size in 2025 | USD 4.84 Billion |

| Market Size in 2026 | USD 5.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.74% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa |

Market Dynamics

Drivers

Increasing Energy Demand in Emerging Economies

The increasing energy demand across emerging economies is expected to drive the growth of the coal to liquid market. There is a rising adoption of coal-to-liquid technology in emerging economies because of rising energy requirements. China, India, and South Africa are using their available coal to meet needs due to increasing international pressure. These nations are adopting different fuel production techniques as a way to decrease their dependence on crude oil imports. With the rising energy demand, concerns regarding energy security are increasing. However, CTL technology reduces reliance on imported oil, which is beneficial for countries with limited domestic oil production. The International Energy Agency (IEA) reveals that Asia's energy demand grew by 4% in 2023 and persist in its upward trajectory toward 2024 with industrial growth. Furthermore, the sustained energy independence through coal processing and the facilitation of domestic economic growth fuels the market.

Restraint

Environmental Impact and Concerns Regarding Emissions

Environmental concerns surrounding carbon emissions are expected to hinder the growth of the coal to liquid market. Coal liquefaction production generates huge amounts of carbon dioxide. This, in turn, raises concerns about environmental impact. Increased global pressure from regulatory bodies encourages countries to adopt renewable energy sources. Moreover, stringent regulations to reduce carbon emissions limit the adoption of CTL technology.

Opportunity

Advancements in Indirect Liquefaction Technologies

Ongoing advancements in indirect liquefaction technologies are projected to create significant opportunities in the coal to liquid market. Technological advances lead to improved process efficiency and enhanced quality of coal-derived fuels. Fischer-Tropsch synthesis leads to indirect liquefaction by producing synthetic fuels that meet global emission standards. With its ability to make fuels with low sulfur and aromatic content. The government funds research through development programs to establish pilot initiatives for coal conversion processes. Over the past decade National Energy Technology Laboratory (NETL) which falls under the U.S. Department of Energy has shown that indirect liquefaction progressed to reach 30% better thermal efficiency. Additionally, such advancements enable wider manufacturing applications mainly involving aviation and defense sectors which further boosts the market in the coming year.

Technology Insight

The direct liquefaction segment dominated the coal to liquid market with the largest share in 2024. This technology possesses better thermal efficiency with minimal processing requirements. Under high heat and pressing conditions, coal flows to liquid hydrocarbon products without needing gasification at any point. The simplified procedure delivers financial advantages for particular uses. Moreover, the ongoing research focuses on stopping catalyst degradation to enhance the scale-up possibilities of this technique bolster the segment's growth.

The indirect liquefaction segment is expected to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to its operational adaptability and superior fuel clarity. Manufacturers obtain clean liquid fuels with minimal sulfur and aromatic composition through this technique. This technology ensures environmental compliance by letting facilities implement carbon capture and storage (CCS) technology systems.

Product Material Insights

The diesel segment held the largest share of the coal to liquid market in 2024. This is mainly due to the increased demand for diesel across various sectors, including shipping, production, and military operations. Diesel is widely preferred due to its low costs compared to other fuels. Countries such as China and South Africa focused on producing diesel from coal. The World Bank reported that diesel-driven freight activities throughout Sub-Saharan Africa increased by 7% in 2024, demonstrating a need for reliable national fuel reserves.

The gasoline segment is anticipated to grow at the highest CAGR in the market during the studied years, owing to the rising demand for gasoline-based transportation fuel. This fuel is widely used in passenger vehicles. In 2024 the International Council on Clean Transportation (ICCT) asserted that cities require improved urban fuel standards, which created heightened need for high-quality low-emission gasoline fuel.

Application Insights

The transportation fuel segment dominated the coal to liquid market in 2024. Transportation fuel made from coal, such as diesel and jet fuel, offer excellent energy density for demanding applications. The rising fuel prices across the globe prompted various nations to establish coal-to-liquid projects, which accelerate the production of transportation fuel. The International Energy Agency (IEA) reports that transportation fuel was responsible for exceeding 60% of synthetic fuel demand in coal-rich economies throughout 2024. Their usage in long-haul freight operations and heavy-duty vehicles is growing, further boosting the segment's growth.

The cooking fuel segment is projected to expand rapidly in the coming years. People living in rural areas of Sub-Saharan Africa with parts of South Asia currently lack clean cooking solutions. This drives the adoption of using coal-based alternatives because their dependence on biomass continues to be widespread. Furthermore, CTL-based cooking fuel is safer and environmentally friendly.

Regional Insights

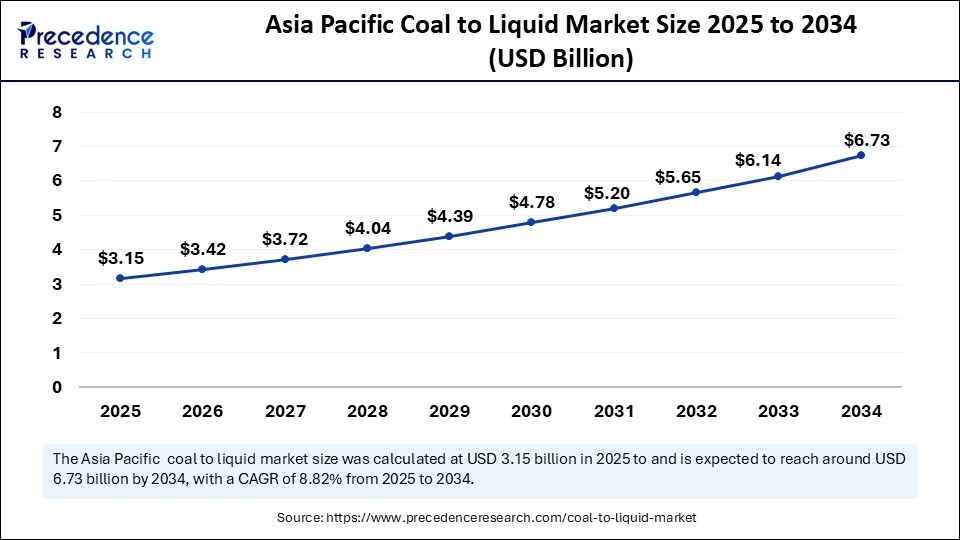

Asia Pacific Coal to Liquid Market Size and Growth 2025 to 2034

The Asia pacific coal to liquid market size is exhibited at USD 3.15 billion in 2025 and is projected to be worth around USD 6.73 billion by 2034, growing at a CAGR of 8.82% from 2025 to 2034.

What Made the Asia Pacific Dominant in the Market in 2024?

Asia Pacific dominated the coal to liquid market with the largest share in 2024. This is mainly due to the vast coal resources and major investments in synthetic fuel systems. China served as the leading force in regional market growth by building additional plants for indirect liquefaction to decrease its reliance on imported crude oil and ensure fuelsecurity. The International Energy Agency (IEA) reported that China maintains operation of the biggest coal liquefaction facilities in the world by 2024. The increased energy demand further bolstered the regional market growth.

Putting Efforts to Raise Effectiveness & CL-based Solutions is Assisting North America

North America is projected to witness significant growth in the market during the forecast period. With the increasing concerns regarding energy security, the demad for CTL technology is increasing. U.S. developed coal-to-liquid pilot installations, specifically for defense operations and aviation, as they need clean synthetic fuels. The rising research efforts for enhancing the efficiency and production of CTL-based fuel is likely to boost the growth of the market. Moreover, stringent regulations regarding environmental sustainability are encouraging consumers to shift toward renewable power sources, supporting regional market growth.

Immersive Technological Advancement: Accelerates the China Market

A major share of the Chinese market is driven by persistent investment in innovative, robust CTL techniques, such as the "second-generation CTL technology," a development of early processes, which is being assigned in new projects to boost effectiveness and lower environmental impact.

Exploration of Integrated Carbon Capture (CCUS): Impacts the US Market

One of the prominent developments in the US market is the integration of CCS technologies into CTL processes to achieve carbon dioxide emissions. This approach makes CTL more environmentally friendly and a commercially viable, large-scale plant with fully united CCS. The US scientists are implementing hybrid solutions that comprise co-process coal with biomass to reduce the overall carbon footprint of the produced fuel.

Emergence of Regulatory Landscape & Projects is Fueling MEA

The prospective notable growth of the market will be propelled by the well-developed "Coal to Liquid Technology Regulation, 2023" to facilitate a legal and regulatory framework for CTL operations, such as licensing and emission standards, focusing on attracting investment and R&D. Alongside, supportive government with CTL-related investments and pilot projects in industrial hubs, including Riyadh and Jeddah, aiming at technological breakthroughs to optimize effectiveness and integrate carbon capture technologies.

Possession of Operational Plants: Bolsters the African Market

Such as Sasol executes the Secunda CTL plant complex, which comprises two production units (Sasol II and Sasol III, now termed as Synfuels West and East). This mainly explores the indirect conversion process (Fischer-Tropsch synthesis) to produce about 160,000 barrels of synthetic crude oil per day, meeting nearly 30% of the country's transport fuel needs.

Coal to Liquid Market: Value Chain Analysis

- Resource Extraction

Steps include mining coal and then converting it into liquid fuels through complex processes, such as gasification, direct liquefaction, or indirect liquefaction.

Key Players: INNER MONGOLIA YITAI COAL Co. Ltd., Envidity Energy Inc., etc. - Power Generation

Specifically, it generates power indirectly through a process known as Integrated Gasification Combined Cycle (IGCC), where coal is first converted into a synthetic gas (syngas).

Key Players: Envidity Energy Inc., Bumi plc, DKRW Energy Partners LLC, etc. - Regulatory Compliance and Energy Trading

The countries implement stricter environmental regulations concerning high carbon emissions and water consumption.

Key Players: China Shenhua Energy Co., Ltd., Shanxi Lu'an Co., Ltd., Altona Energy Plc, etc.

Coal to Liquid Market Companies

- Yankuang Group

- TransGas Development Systems

- Shell plc

- Sasol Ltd.

- Regius Synfuels Ltd

- Qatargas Operating Co. Ltd.

- PT. Bakrie Global Ventura

- Pall Corp.

- Linc Energy Systems

- Inner Mongolia Yitai Investment Co. Ltd.

- Envidity Energy Inc.

- DKRW Energy Partners LLC

- China Shenhua Energy Co. Ltd.

- Chevron Corp.

- Altona Rare Earths Plc

- Air Products and Chemicals Inc.

Recent Developments

- In October 2024, China officially commenced operations of its most advanced and largest-scale direct coal liquefaction project in Hami, Xinjiang Uyghur Autonomous Region, according to the State Energy Group. The initiative marks the application of China' independently developed second-generation direct liquefaction CLT technology. Once fully operational, the project is expected to produce 4 million metric tons of liquefied coal products annually, 3,2 million tons via direct liquefaction and 800,000 tons through indirect methods, supporting the country's strategic energy diversification and domestic fuel production goals.

- In June 2024, India's Ministry of Coal, under its strategic development initiatives, announced a pioneering underground coal gasification pilot project through Eastern Coalfields Limited at the Kasta coal block in Jamtara District, Jharkhand. The initiatives mark the country's first attempt at in-situ gasification, converting underground coal into useful gases such as methane, hydrogen, carbon monoxide, and carbon dioxide. These gases serve as feedstock for the production of synthetic natural gas, fertilizers, fuels, explosives, and other industrial chemicals, highlighting the Ministry's strong push to promote coal-based chemical transformation in India's energy mix

- In May 2022, the Republic of Botswana announced plans to construct a USD 2.5 billion coal-to-liquid fuel plant under a public-private partnership framework. The facility aims to reduce dependence on fuel imports by producing an estimated 12,000 barrels of diesel and gasoline per day over a 30-year lifespan, targeting primarily local consumption. According to Botswana Oil, the country currently imports 21000 barrels of liquid fuel daily, facing periodic supply disruptions due to logistical issues in South Africa. Leveraging its vast 212 billion ton coal reserves, Botswana seeks to enhance fuel security by tapping into domestic resources and transitioning into synthetic fuel production.

Segments Covered in the Report

By Technology

- Indirect Liquefaction

- Direct Liquefaction

By Product Material

- Gasoline

- Diesel

- Other Fuels

By Application

- Cooking Fuel

- Transportation Fuel

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting