Zero Liquid Discharge Systems Market Size and Forecast 2025 to 2034

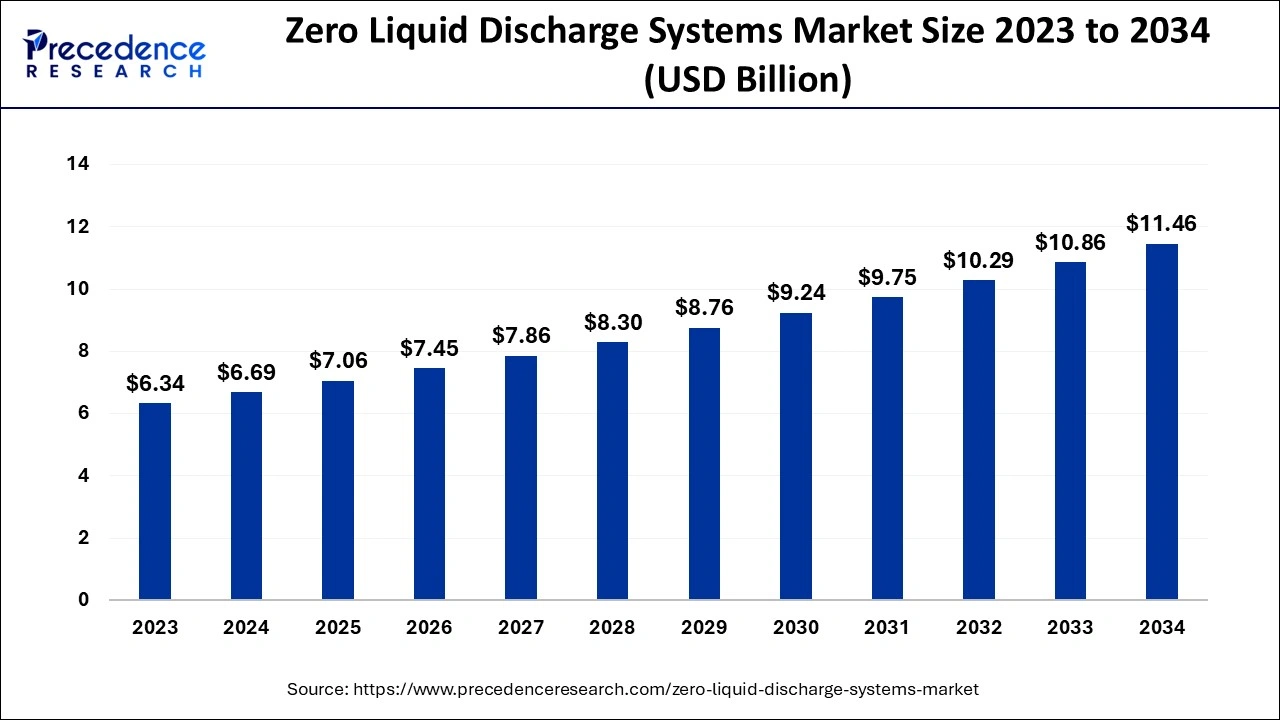

The global zero liquid discharge systems market size was calculated at 6.69 billion in 2024 and is anticipated to reach around USD 11.46 billion by 2034, growing at a CAGR of 5.53% from 2025 to 2034. The rising demand for wastewater management in industries is driving the growth of the zero liquid discharge systems market.

Zero Liquid Discharge Systems Market Key Takeaways

- Asia Pacific dominated the zero liquid discharge systems market in 2024.

- North America will witness significant growth during the forecast period.

- By system type, the conventional segment led the market in 2024.

- By system type, the smart segment is expected to witness the fastest growth during the forecast period.

- By technology, the thermal based segment contributed the highest market share in 2024.

- By technology, the membrane based segment is expected to grow at a significant CAGR during the forecast period.

- By process, the evaporation/crystallization segment held a notable market share in 2024.

- By end-use, the energy and power segment captured the biggest market share in 2024.

- By end-use, the oil & gas segment is anticipated to show the fastest growth during the anticipated period.

How Can Artificial Intelligence (AI) Impact the Zero Liquid Discharge Systems Market?

The integration of artificial intelligence into the zero liquid discharge systems market improves the operations and predicts the demand for time-to-time maintenance. AI provides the real-time parameters in waste water treatment. AI helps in increasing efficiency and reduces the downtime. Predictive analytics helps in preventing failure of equipment and minimize the cost effectiveness and enhance the reliability.

- In August 2024, Veolia is increasing its leading Hubgrade portfolio range of products with the launch of Hubgrade Water Footprint, a revolutionary digital solution made to help customers reduce their water footprint, reducing greenhouse gas emissions and water-related energy use.

Market Overview

Zero liquid discharge (ZLD) systems are innovative water treatment methods created to discard liquid waste from industrial plants. They treat wastewater by reusing and recycling as much water as possible within the facility, and convert the remaining waste into solid residue. There are two categories of ZLD systems: conventional and hybrid, each offering unique advantages and disadvantages cons. The major players in the market include SUEZ Water Technologies & Solutions, Aquatech International LLC, and GEA Group.

Zero liquid discharge systems are engineering technologies and systems for water treatment. They help recover contaminated wastewater. The increasing demand for the zero liquid discharge systems market from different end-use industries for efficient and cost-effective wastewater management.

Zero Liquid Discharge Systems Market Growth Factors

- Increasing industrialization: The rising industrialization across the world, such as the development of oil and energy, energy and power, automotive, electronic industries, chemical, pharmaceutical, and others, are driving the demand for zero liquid discharge systems for the efficient wastewater management is driving the growth of the market.

- Increasing environmental pollution: The increasing government pollution in reducing industrial pollution and promoting sustainability in industrial applications and working conditions are contributing to the expansion of the zero liquid discharge systems market.

- Increasing investment in industrial development: The ongoing investment in industrial development by the government and private players and the integration of smart technologies for increasing the efficiencies of industrial applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.46 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Market Size in 2025 | USD 7.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Technology, Process, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of the zero liquid discharge system owing to its benefits

The increasing demand for the zero liquid discharge systems market by different industries due to its several benefits, such as reduced water consumption, enhanced water recovery, water conservation, cost-effectiveness, compliance with regulations, reduced waste, flexibility for multiple water resources, compliance with the stringent environmental pollution, energy recovery, and others.

Restraint

High cost

The high initial investment for installing zero liquid discharge systems, such as engineering expertise, equipment, and infrastructure, is a major factor hampering market growth, which makes it difficult for smaller markets with limited budgets to afford it. Moreover, this system requires energy consumption, ongoing maintenance, and skilled labor to work properly, which can add to overall costs.

Opportunity

Technological advancements in discharge systems

The zero liquid discharge systems market is witnessing ongoing technological innovation, fueled by growing environmental awareness, increasing demand for sustainable water management, and stringent regulations. Major innovations include improved membrane filtration technologies, IoT integration, and automation for innovations in energy recovery and better system monitoring.

- In November 2024, Toyobo Mc Corporation, in association with Bims, launched their RO membranes in India. The launch event included a seminar that gathered industry leaders and experts from both India and across the globe.

System Type Insights

The conventional segment led the global zero liquid discharge systems market in 2024. The rising industrial development in economically developing countries is driving the demand for zero-discharge systems. The technology is deployed by several industries for the management of end-of-pipe treatment. The conventional zero liquid discharge system is effective and cost-efficient, which drives the adaptation of technology or systems by the different end-use industries.

The smart segment is expected to witness the fastest growth in the zero liquid discharge systems market during the forecast period. The rising advancement in the industries and the adaptation of smart technologies into the industries and other applications are driving the growth of the market. Smart technologies help in enhancing wastewater management in industries. The smart zero liquid discharge system is implemented by different end-use industries such as the electronics industry, chemical industry, pharmaceutical industry, and others.

Technology Insights

The thermal based segment dominated the zero liquid discharge systems market in 2024. The increasing adoption of thermal-based technology in zero liquid discharge industries is due to its association with several advantages, such as a reliable and strong working system. The thermal system is compatible with working in tough conditions, though it is widely adopted by various end-use industries. Thermal-based technology helps reduce industry waste and supports economic goals and environmental policies.

The membrane based segment will witness the fastest growth in the zero liquid discharge systems market during the predicted period. The increasing demand for the cost-effective and efficient solution of industrial wastewater is driving the demand for membrane-based technology. There are two types of membranes used in wastewater management: organic membranes and inorganic membranes.

Process Insights

The evaporation/crystallization segment held a notable share in the zero liquid discharge systems market in 2023. The evaporation and crystallization process is majorly adopted by a number of industries due to its separation and management capabilities of the wastewater. The evaporation and crystallization efficiently manage the different types of wastewater, such as high-content salt water and water with different contaminants. In the crystallization process, the soluble liquid solution is converted into a solid state using both the purification and separation models. In the evaporation state, any type of liquid or compound turns into a gas state.

End-Use Insights

The energy & power segment dominated the zero liquid discharge systems market in 2024. The rising global population and the demand for the energy and power industries for efficient working management of the residential, commercial, and industrial sectors are driving the growth of the market in the energy and power industries. The rising environmental concern, the demand for reducing the carbon footprint, and the demand for water consumption from the energy and power industries are driving the growth of the market in the energy and power industries.

The oil & gas segment is anticipated to show the fastest growth in the zero liquid discharge systems market during the anticipated period. Industries like oil and gas are driving the demand for efficient technologies to reduce the wastage of water and provide environmental benefits, which are driving the growth of the market. The zero-liquid discharge systems reduce liquid waste and increase water usage efficiency.

Regional Insights

Asia Pacific dominated the zero liquid discharge systems market in 2024. The growth of the market is attributed to the rising population across countries like China, India, and other regional countries, as well as the economic development of the countries that are driving industrialization, which drives the growth of the zero liquid discharge systems. The rising concern over environmental pollution due to industrial waste and excess use of fluid is driving the demand for technology that copes with the pollution level by the industries.

- As per the latest annual report by the Central Pollution Control Board, India generated a significant amount of wastewater, approximately 72.4 billion liters, across all provinces, including Uttar Pradesh (8.3 billion liters), Maharashtra (9.1 billion liters), Gujarat (5 billion liters), and Tamil Nadu (6.4 billion liters) which is responsible for around 40% of wastewater.

- There are 1,093 sewage treatment plants having operational capacities of 26.9 billion liters of wastewater per day. There are 400 plants that are either under construction or non-operational, as per the latest report from 2020/21.

North America will witness significant growth in the zero liquid discharge systems market during the forecast period. The growth of the market is attributed to the increased presence of different industries, such as automotive, pharmaceutical, oil and gas, energy and power, and chemical industries, which require an increased number of fluid substances or water in the manufacturing of the product drives the demand for the zero liquid discharge system for reducing fluid wastage and eliminating the excessive water wastage from the industries. The integration of the technological advance system in the different end-use industries and the government intervention in the development of industries.

- As per the 2023 Irrigation and Water Management Survey results published by the U.S. Department of Agriculture's National Agricultural Statistics Service (NASS), there are 212,714 farms with 53.1 million irrigated acres, consisting of 81 million acre-feet of water applied in the United States.

Zero Liquid Discharge Systems Market Companies

- Alfa Laval

- Aquarion

- Aquatech International

- Evoqua Water Technologies

- Mitsubishi Power

- Petro Sep Corporation

- Praj Industries

- SafBon Water Technologies

- Saltworks Technologies

- Thermax

- Toshiba

- Veolia Water Technologies

- GEA Group

- H2O

Latest Announcement by Industry Leaders

- In December 2024, Aquarion Water Company completed the purchase of the City of Ansonia's municipal wastewater system. The announcement of the purchase was the municipal wastewater system's largest privatization in New England.

- In September 2024, Thermax came into its global expansion efforts by doubling its existing presence across Africa, Southeast Asia, and Middle East.

Recent Developments

- In April 2024, Thermax established a new water and wastewater treatment system manufacturing plant in Pune. The facility, which covers two acres, is a testament to the company's dedication to sustainability and resource conservation. Additionally, it emphasizes zero liquid discharge solutions, sewage treatment plants (STP), reverse osmosis (RO), and effluent recycling systems (ERS).

- In July 2024, UCC Environmental (UCC), a leading player in sustainable engineered solutions for water and wastewater treatment, air pollution control, and solids handling a wastewater treatment technology provider, comes into the strategic partnership with the Vacom System, a leading wastewater treatment technology provider to jointly offer advanced wastewater treatment solutions customized for the site-specific Zero Liquid Discharge (ZLD) demand from the in coal-fired power plants across North America.

- In September 2024, Gradiant, a leading solution provider for advanced water and wastewater treatment, launched ProtiumSource, an end-to-end solution for electrolyzer-ready water.

- In May 2024, ARA Petroleum and HELIOVIS signed the commercial contract for providing the first solar-thermally powered zero-emission desalination plant for produced water treatment. The plant is made in the oilfield of Qarat al Milh, the largest exploration site in the Sultanate of Oman.

Segments Covered in the Report

By System Type

- Conventional

- Smart

By Technology

- Thermal Based

- Membrane Based

By Process

- Pre-Treatment

- Filtration

- Evaporation/Crystallization

By End-Use

- Oil and Gas

- Pharmaceutical

- Energy and Power

- Chemical and Petrochemicals

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting