What is the Companion Diagnostics Market Size?

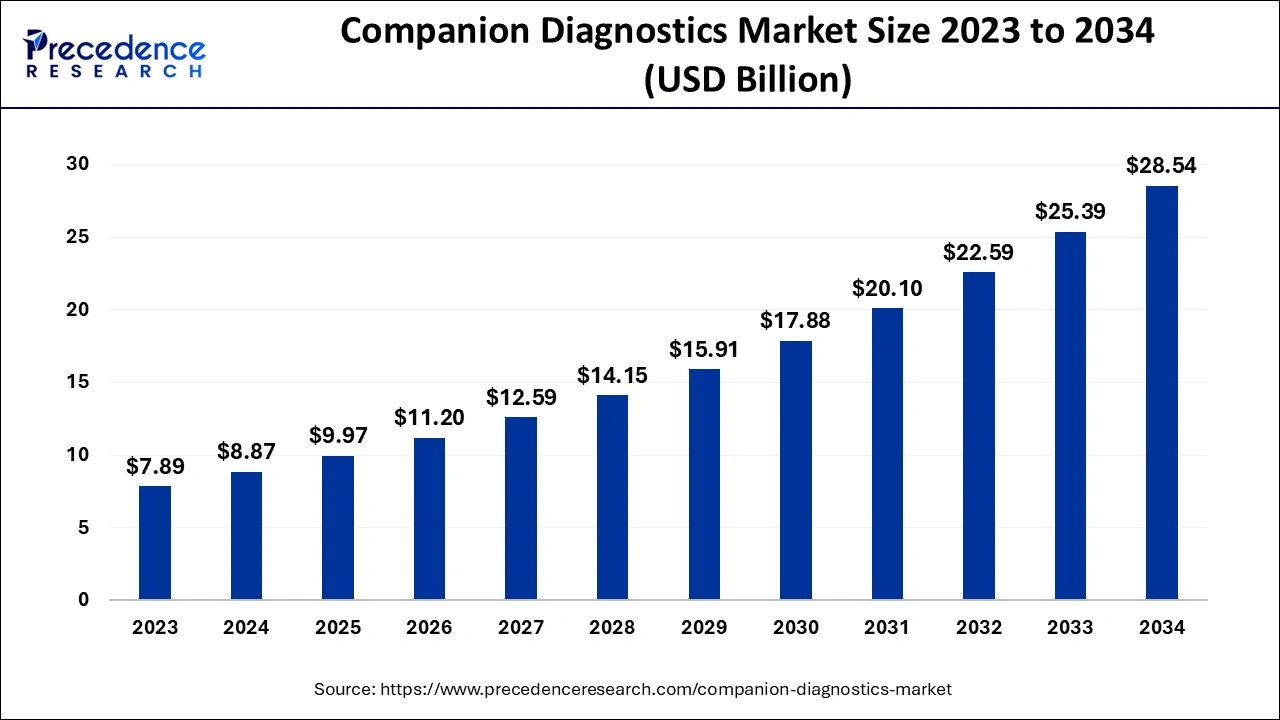

The global companion diagnostics market size is calculated at USD 9.97 billion in 2025 and is predicted to increase from USD 11.20 billion in 2026 to approximately USD 31.46 billion by 2035, expanding at a CAGR of 12.18% from 2026 to 2035.

Companion Diagnostics Market Key Takeaways

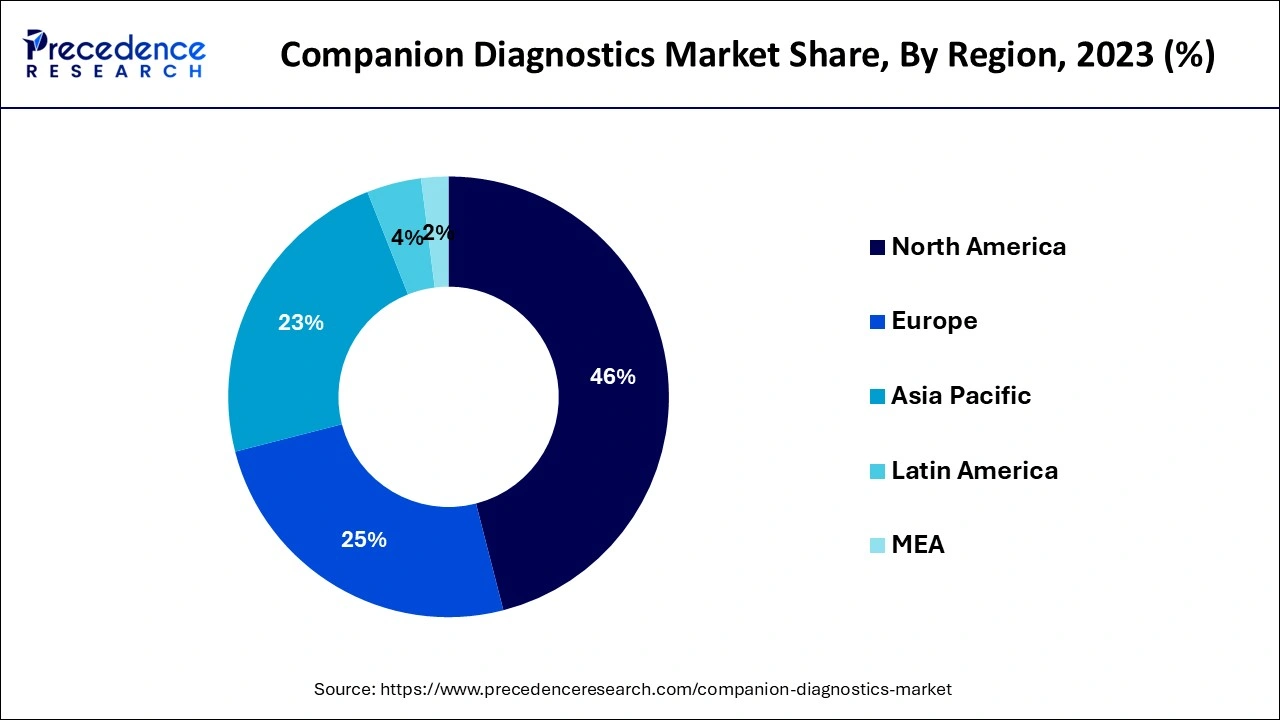

- North America dominated the market with the largest share in 2025

- Asia Pacific is the fastest-growing region in 2025

Companion Diagnostics Market Growth Factors

With signs of progress in hereditary sequencing and genomics, it is currently generally accepted that medications can show shifting results in various people. A superior comprehension of the hereditary attributes or biomarkers of an individual can advance the act of overseeing 'the right medication, with impeccable timing, at the right portion, for the perfect individual'. Drug and biopharmaceutical organizations are ceaselessly endeavoring to execute patient-choice analytic systems in the previous phases of medication improvement to give designated treatments to the right competitor. These further backings the development of the companion diagnostics market.

NGS-based friend symptomatic tests intend to open atomic data from every patient's growth genome to direct therapy choices for disease treatments. Cutting-edge sequencing recognizes numerous biomarkers for various medication treatments in a more limited time when contrasted with other sequencing procedures. The utilization of NGS boards for biomarker estimation in one test can help in the therapy of a wide range of kinds of diseases. The different innovative headways in NGS likewise give market players a quick upper hand over players giving different advancements like PCR, ICH, and ISH. Subsequently, significant market players are zeroing in on creating companion demonstrative items in light of NGS.

Market Outlook

- Market Growth Overview: The companion diagnostics market is growing rapidly, driven by the rising adoption of personalized medicine, targeted therapies, and precision oncology. Increasing prevalence of chronic diseases and technological advancements in molecular diagnostics are further fueling market growth.

- Major Investors: Key investors include pharmaceutical companies, biotechnology firms, and diagnostic solution providers, such as Roche, Thermo Fisher Scientific, and Qiagen, who fund R&D for novel biomarkers and diagnostic assays. Their investments help accelerate the development and commercialization of companion diagnostics that guide targeted therapy selection and improve patient outcomes.

- Global Expansion: The market is expanding worldwide due to increasing collaborations between diagnostic companies and pharmaceutical firms, along with rising awareness of precision medicine in developed regions. Emerging regions like Asia Pacific and Latin America offer growth opportunities driven by improving healthcare infrastructure, expanding oncology care, and government support for molecular diagnostics.

- Advances in Technology: Ongoing advances in technologies, including next-generation sequencing (NGS), liquid biopsies, and artificial intelligence in genomic profiling, are leading to improved diagnostic accuracy and expanding applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.97 Billion |

| Market Size in 2026 | USD 11.20 Billion |

| Market Size by 2035 | USD 31.46 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.18% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

By Indication,By Product & Service,By Technology,By Indication,By End-User |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

Market Dynamics

Drivers

Advancements in the latest technologies

The next-generation sequencing based companion indicative tests mean to open nuclear information from each persistent development genome to coordinate treatment decisions for illness medicines. Forefront sequencing perceives various biomarkers for different medicines in a more restricted time when stood out from other sequencing strategies. The use of NGS sheets for biomarker assessment in one test might perhaps help in the treatment of a wide scope of sorts of illnesses. The different creative degrees of progress in NGS moreover give market players a speedy advantage over players giving various headways like PCR, ICH, and ISH. Thusly, critical market players are focusing on making amigo illustrative things considering NGS.

Restraints

Lack of awareness and high cost of companion diagnostics techniques

While immunotherapy has shown a critical guarantee in malignant growth treatment, its significant expense has restricted generally persistent access. Doctors could rather find it best to join treatments; this, thusly, could broaden the length of the treatment from five months to the north of three years. For this situation, the more extended the term, the more prominent the cost. Also, the expense of customized immunotherapies is high. The expense of disease immunotherapies can far surpass the expense expected for other treatment choices, like chemotherapy or radiation treatment. In this way, the significant expense of immuno-oncology treatments is supposed to hamper the development of the companion diagnostics market.

Opportunities: Growing advancements in biologics

The companion diagnostics market is exceptionally solidified. The top players are F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (the US), Qiagen N.V. (Germany), Thermo Fisher Scientific, Inc. (the US), Abbott Laboratories, Inc. (the US) - in the companion diagnostics market represented a joined larger part portion of the overall industry in 2020. There is a serious level of rivalry among the market players. Just significant organizations can bear the cost of high-capital ventures as well as the significant expense of R&D and production. This will keep new contestants from entering this market.

Challenges

Lack of resources in underdeveloped nations

It is essential to assemble mindfulness among patients, clinicians, and the general population concerning the significance of clinical preliminaries. To further develop mindfulness among clinicians, giving extraordinary admittance to legitimate, proof put together most recent data concerning these new malignant growth medications can be useful. To work on open mindfulness, expanding admittance to a typical and believed wellspring of truth is vital. A few distributing houses and industry players give month-to-month diaries and data handouts. Partners have likewise centered around mindfulness drives to guarantee patients and suppliers can get to and figure out the advantages of friend diagnostics.

Segment Insights

Indication Insights

The companion diagnostics market is portioned into malignant growth, cardiovascular illnesses (CVDs), neurological sicknesses, irresistible infections, and different signs (provocative and acquired infections, among others). In 2022, the malignant growth section represented the biggest portion of the companion diagnostics market. Factors like developing job of friend diagnostics in the customized medication therapy for malignant growth, and expanding the utility of biomarkers in the analysis of disease.

End-User Insights

The drug and biotechnology organizations and reference research facilities fragment represented the biggest offer on the lookout, by the end client. The companion diagnostics market is fragmented into drug and biotechnology organizations, reference labs, CROs, and opposite-end clients (counting doctor and clinic labs, and scholastic clinical focuses). In 2025, drug and biotechnology organizations represented a bigger portion of the companion diagnostics market. The developing utilization of companion diagnostics is inferable from their rising conspicuousness in drug improvement and the rising significance of companion analytic biomarkers.

Regional Insights

Companion Diagnostics Market Size and Forecast 2026 to 2035

The U.S. companion diagnostics market size is estimated at USD 4.59 billion in 2025 and is anticipated to reach around USD 14.66 billion by 2035, expanding at a CAGR of 12.31% between 2026 and 2035.

North America represented the biggest portion of the friend diagnostics market. The North American friend diagnostics market development can be ascribed to the presence of many driving companion diagnostics sellers and public clinical research centers, the simple availability of innovatively progressed gadgets and instruments, and the profoundly evolved medical services framework in the US and Canada.

The utilization of companion diagnostics is viewed as a significant treatment choice device for differentoncologydrugs, which is likewise reflected in how the FDA orders these examinations concerning risk.

The companion diagnostics clinical preliminaries have come to the cutting edge in the drug business, regardless of the COVID-19 flare-up, as it helps support the possibilities of clinical achievement. The testing unit has been seeing popularity for distinguishing those contaminated with SARS-CoV-2. The novel Covid stayed the primary concentration for symptomatic test producers regarding innovative work.

The rising weight of disease in the United States is additionally expected to drive market development. As indicated by the information distributed by American Cancer Society Inc., in January 2020, in the United States, there were around 1.8 million new disease cases analyzed and 606,520 malignant growth passings.

Moreover, the great repayment situation for bosom disease symptomatic arrangements in the United States is expected to work with their reception. For example, in January 2020, the Centers for Medicare and Medicaid Services (CMS) extended its inclusion of cutting-edge sequencing as an asymptomatic device for patients with germline (acquired) bosom malignant growth.

Additionally, in October 2021, the United States Food and Drug Administration endorsed Agilent's Ki-67 IHC MIB-1 pharmDx (Dako Omnis) that guides in recognizing patients with early bosom malignant growth (EBC) at high gamble of infection repeat. This will additionally prompt drive the market development over the conjecture period around here.

Inferable from the above factors, the North American portion is supposed to hold a significant offer in the worldwide companion diagnostics market.

Why is Asia-Pacific Emerging as a High-Growth Market for Companion Diagnostics?

Asia-Pacific presents rewarding open doors for the central members working in the companion diagnostics market, attributable to high populace base, development in mindfulness about companion diagnostics, improvement in medical care foundation, and expansion popular for advanced treatments. organizations are zeroing in on consolidations and acquisitions to reinforce the improvement in indicative methods, as would be considered normal to drive the market development around here. Nonetheless, greater expenses caused in R&D to create friend diagnostics can hamper the companion diagnostics market development in Asia-Pacific.

India Companion Diagnostics Market Analysis

India's market is expanding due to the rising burden of cancer and chronic diseases, growing adoption of precision medicine, and increased use of targeted therapies. Improved diagnostic infrastructure, expanding molecular testing capabilities, supportive government initiatives, and higher clinician awareness of personalized treatment approaches are further driving demand. Additionally, increasing collaboration between pharmaceutical and diagnostic companies and rising healthcare investments are accelerating market growth nationwide.

Why is Europe Considered a Notably Growing Region in the Companion Diagnostics Market?

Europe is expected to grow at a notable rate during the forecast period due to the rapid adoption of precision medicine, a strong focus on early disease detection, and the rising prevalence of chronic and oncological disorders. Supportive regulatory frameworks, well-established healthcare infrastructure, increasing investments in advanced diagnostics, and strong collaboration between pharmaceutical, biotechnology, and diagnostic companies are accelerating innovation and market expansion. Additionally, favorable reimbursement policies and growing awareness of personalized therapies are boosting demand across key European countries.

UK Companion Diagnostics Market Analysis

The market in the UK is expanding due to the growing adoption of precision medicine and targeted therapies, particularly in oncology. Strong support from the NHS, rising use of biomarker-based testing, and active clinical research are driving demand. Government funding for genomics, growing collaboration between diagnostic companies and pharma firms, and improved regulatory pathways are further accelerating market growth across the country.

How is the Opportunistic Rise of the Middle East & Africa in the Companion Diagnostics Market?

The Middle East & Africa companion diagnostics market is gradually developing as healthcare systems modernize and investments in advanced diagnostic technologies increase. Oncology hospitals and specialized facilities are adopting these products faster, supported by government healthcare reforms, early disease detection initiatives, and partnerships with global diagnostic companies. Saudi Arabia leads the region due to healthcare modernization and significant government investments in precision medicine and personalized healthcare.

What Opportunities Exist in Latin America for the Market?

Latin America presents significant opportunities in the companion diagnostics market. These opportunities arise from the increasing awareness and adoption of personalized medicine and targeted therapies. Expanding oncology care and investments in advanced diagnostic infrastructure are driving demand for accurate and timely disease detection. Additionally, collaborations between local healthcare providers and global diagnostic companies are facilitating technology transfer and market growth across countries like Brazil and Mexico.

Value Chain Analysis

Regulatory Approvals: Regulatory approval for companion diagnostics (CDx) typically involves simultaneous evaluation with the associated therapeutic drug, requiring submissions such as a PMA in the U.S. (FDA) or CE marking in Europe (EMA).

- Key players: Roche and Abbott Laboratories.

Patient Support and Services:Patient support and services for companion diagnostics (CDx) help guide patients and healthcare providers through personalized treatment plans.

- Key players: Roche, Abbott Laboratories, Thermo Fisher Scientific, Qiagen, Agilent Technologies.

Companion Diagnostics Market Top Companies & Their Offerings

- F. Hoffmann-La Roche Ltd. (Switzerland): Offers companion diagnostics, molecular testing, and personalized medicine solutions, primarily for oncology, enabling targeted therapies and improved patient outcomes.

- Agilent Technologies, Inc. (US): Provides diagnostic instruments, reagents, and laboratory solutions, including molecular and genomic testing tools for companion diagnostics and precision medicine applications.

- Qiagen N.V. (Germany): Develops sample and assay technologies, molecular diagnostics kits, and companion diagnostic solutions for oncology and personalized treatment decisions.

- Thermo Fisher Scientific, Inc. (US): Supplies laboratory instruments, reagents, and diagnostic platforms, supporting companion diagnostics, genomic testing, and precision healthcare solutions.

- Abbott Laboratories, Inc. (US): Offers molecular and immunoassay-based companion diagnostic tests that support targeted therapies and disease-specific patient management.

Recent Developments

- In May 2021, Qiagen N.V. (Germany) extended the Thera screen KRAS Kit.

- In April 2019, Roche Diagnostics (Switzerland) obtained TIB Molbiol Group (Germany). This securing will improve Roche's expansive arrangement of sub-atomic diagnostics arrangements with a wide scope of examines for irresistible infections, for example, distinguishing SARS-CoV-2 variations.

Segments Covered in the Report

By Indication

- Cancer

- Lung Cancer

- Breast Cancer

- Blood Cancer

- Colorectal Cancer

- Other Cancer Types

- Neurological Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Other Indications

By Product & Service

- Assays, Kits & Reagents

- Software & Services

By Technology

- Polymerase Chain Reaction

- Next-generation Sequencing

- In Situ Hybridization

- Immunohistochemistry

- Other

By Indication

- Oncology

- Neurology

- Infectious Diseases

- Others

By End-User

- Pharmaceutical & Biopharmaceutical Companies

- Reference Laboratories

- Contract Research Organizations

- Other End Users

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting