What is the Companion Animal Diagnostics Market Size?

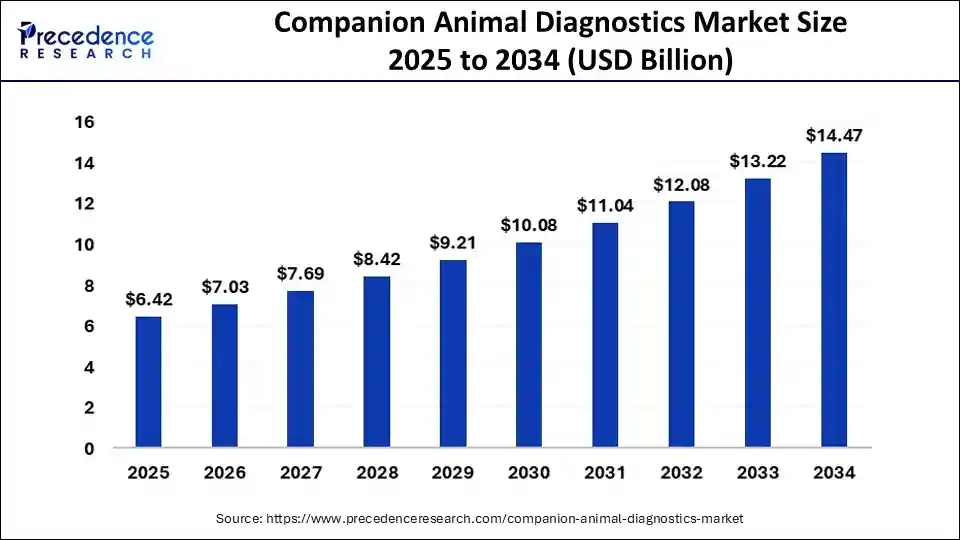

The global companion animal diagnostics market size is calculated at USD 6.42 billion in 2025 and is predicted to increase from USD 7.03 billion in 2026 to approximately USD 14.47 billion by 2034, expanding at a CAGR of 9.45% from 2025 to 2034.

Companion Animal Diagnostics Market Key Takeaways

- In terms of revenue, the global companion animal diagnostics market was valued at USD 5.87 billion in 2024.

- It is projected to reach USD 14.47 billion by 2034.

- The market is expected to grow at a CAGR of 9.45% from 2025 to 2034

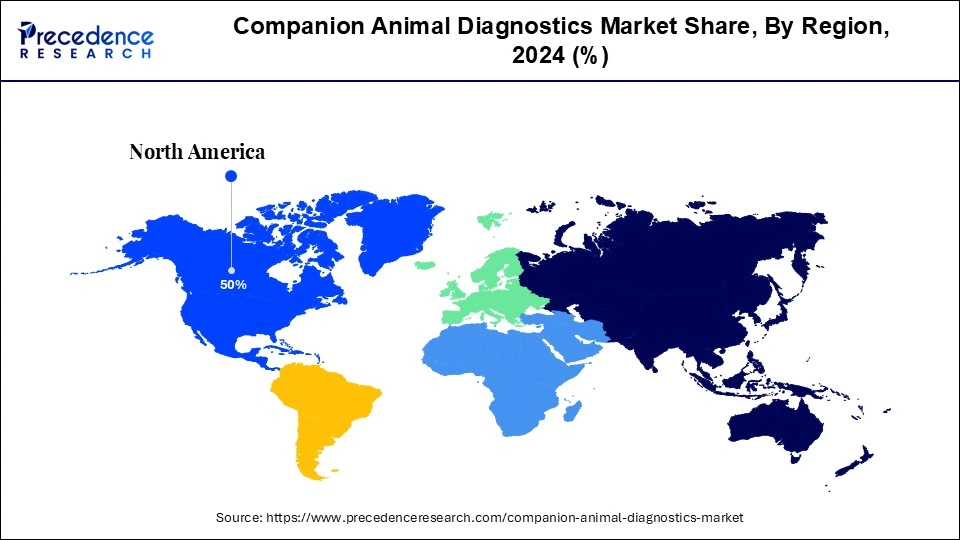

- North American region dominated the companion animal diagnostics market in 2024.

- Asia Pacific is predicted to host the fastest-growing market during the forecast period.

- By animal type, the dogs segment dominated the market in 2023.

- By animal type, the equine segment is expected to show the fastest growth over the projected period.

- By application, in 2023, the clinical pathology segment dominated the market.

- By technology, the clinical biochemistry segment dominated the market in 2023.

- By technology, the molecular diagnostics segment will experience rapid growth over the projected period.

- By end-use, the laboratories segment dominated the market in 2023.

- By end-use, the veterinary hospitals & clinics segment is projected to expand significantly over the forecast period.

Market Overview

A companion diagnostic, often an in vitro device, provides the essential information for the safe and effective use of a corresponding medicine or biological product. This test assists medical professionals in assessing whether the benefits of a specific medicinal product to patients outweigh any potential serious risks or side effects. The companion animal diagnostics market expansion is primarily driven by the rising demand for pet insurance, an increasing number of companion animals, and a growing number of veterinarians in developed countries. In recent years, the cost of pet healthcare, including pet food, supplies, over-the-counter medications, veterinary services, pet insurance, and other services like companion animal diagnostics, has significantly increased. Due to the substantial rise in pet care expenses, many pet owners, particularly in major markets across North America and Europe, are investing in pet insurance.

Companion Animal Diagnostics Market Growth Factors

- Increasing demand for complete and semi-automated diagnostic testing can fuel the growth of the companion animal diagnostics market.

- The rising use of glucose monitoring equipment for the detection of diabetes is expected to drive market growth.

- The development of in vitro diagnostic tools along with imaging systems can boost market growth further.

- The growing demand for point-of-care diagnostics (POCD) tools is likely to help in the companion animal diagnostics market expansion.

Companion Animal Diagnostics Market Outlook

- Industry Growth Overview:

The companion animal diagnostics market is expected to grow significantly from 2025 to 2034, fueled by the rising number of pets worldwide and increased awareness of preventive pet healthcare. Advanced diagnostic products, including in-clinic analyzers, molecular assays, immunoassays, and point-of-care tests, are becoming more widely used, accelerating market growth. Additionally, the growing incidence of infectious and chronic diseases in pets, such as heart disease, diabetes, and parvovirus, is creating a greater demand for effective diagnostics. - Technological & Innovation Trends:

The market is undergoing rapid technological changes involving digital diagnostic and cloud-based veterinary laboratory solutions to streamline reporting and improve clinical decision-making. Portable blood analyzers and lateral flow assays are examples of in-clinic rapid testing devices that are becoming more popular due to their convenience and real-time results. Additionally, companies such as IDEXX Laboratories, Heska, and Thermo Fisher Scientific are heavily investing in R&D of next-generation diagnostics, which integrate wearable devices and remote monitoring technologies. - Global Expansion:

Major market players are strategically expanding their global footprint to target emerging veterinary markets, improve service delivery, and meet regional regulatory standards. This growth helps increase supply chain efficiency and improves access to new diagnostics in areas where the pet population is growing and veterinary facilities are limited. The companies are collaborating with local veterinary chains and universities, among others, to accelerate market adoption and reach. - Major Investors:

The companion animal diagnostics market is attracting both strategic and private equity investors, drawn by high-margin consumables, recurring revenues, and strong growth potential in preventive pet care. The companies that have recently been acquired by firms like KKR, TPG Capital, and Bain Capital, which provide veterinary diagnostics and pet health technology startups, include such companies. Additionally, ESG-compatible investments are becoming more popular, with funds being invested in companies that promote sustainable production processes, bio-based reagents, and energy-efficient laboratory systems. - Startup Ecosystem:

The startup ecosystem is rapidly evolving. New companies such as AniCell Biotech (US), IDVet (France), and VetCell Diagnostics are drawing significant venture capital to develop innovative diagnostic assays, quick test kits, and smart monitoring platforms. Moreover, partnerships with established veterinary chains, laboratories, and research centers are helping these startups grow quickly and expand into global markets.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.47 Billion |

| Market Size in 2025 | USD 6.42 Billion |

| Market Size by 2026 | USD 7.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.45% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Animal Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rising popularity of rapid tests

Rapid tests are gaining popularity among end users due to their ease of use, specificity, repeatability, and low cost. Companies are increasingly focusing on introducing rapid tests that can provide definitive results in less than 24 hours or even during the initial examination of the animal. Moreover, the growing demand for innovative technologies that offer quick results and real-time diagnostic convenience is expected to create significant opportunities for market participants. Spending on pet healthcare has surged dramatically in recent years, including the purchase of pet food, supplies, over-the-counter medications, veterinary treatment, pet insurance, and other services such as companion animal diagnostic services.

- In April 2024, Charles River Laboratories International, Inc. announced that it is launching its Alternative Methods Advancement Project (AMAP), an initiative dedicated to developing alternatives to reduce animal testing. The initiative aims to drive the new standard for drug discovery and development.

Restraint

Lack of infrastructure

Companion animal diagnostic products can be costly, varying significantly depending on the pet. The primary expenses include initial costs and healthcare costs, with diagnostic fees being especially high for exotic breeds and severe injuries. Diagnostic costs are often the most significant financial burden for pet owners. Various studies indicate that the average veterinary visit can range from $50 to $400. Therefore, these expenses can limit pet adoption among middle-income consumers.

Opportunity

AI-powered urinalysis

Integrating artificial intelligence (AI) into diagnostic platforms marks a transformative opportunity for the companion animal diagnostics market. Vetscan Imagyst is the first AI-driven technology to offer five applications on a single platform, including AI urine sediment analysis. This innovation streamlines diagnostic workflows and enables timely and accurate pet treatment decisions.

The expansion of diagnostic capabilities to point-of-care settings, as demonstrated by Vetscan Imagyst, presents a unique growth avenue. Point-of-care diagnostics allow veterinarians to conduct in-clinic sediment analysis of fresh urine, significantly reducing the time required to obtain results. This approach aligns with the need for rapid diagnostics, contributing to better patient outcomes. The application of AI in urine sediment analysis covers elements such as red and white blood cells, epithelial cells, casts, crystals, and bacteria and offers a comprehensive solution for urinalysis.

- In January 2024, Zoetis, Inc. announced the expansion of its multi-application diagnostics platform, Vetscan Imagyst, to include AI Urine Sediment analysis. The new application will enable accurate, in-clinic sediment analysis of fresh urine, allowing clinicians to make treatment decisions quickly.

Animal Type Insights

The dogs segment dominated the companion animal diagnostics market in 2023. The growth of the segment is attributed to the rising incidence of obesity, diabetes, cancer, and other major diseases among dogs has significantly driven segment growth. Obesity increases the risk of joint problems, cancer, diabetes mellitus, and other chronic conditions. The surge in animal healthcare spending, especially in developed regions, further propels this growth. Additionally, rising awareness among pet owners has led to more frequent glucose level diagnoses by increasing the demand for glucose monitors.

The equine segment is expected to show the fastest growth over the projected period. The declining preference for horses as companion animals due to their higher maintenance needs and associated expenditures has influenced market trends. Despite this, many advanced diagnostic tests are available for equine diseases such as West Nile Virus (WNV), influenza, and anemia. Companies like IDEXX and Heska offer in-house analyzers for various tests, including hematology, immunology, chemistry, and blood gas, applicable to multiple species. This availability of sophisticated diagnostic tools supports ongoing healthcare for a range of animals despite shifts in companion animal preferences.

Application Insights

The clinical pathology segment dominated the companion animal diagnostics market in 2023. The rising number of pathology tests conducted on pets is a significant factor driving market growth. The clinical pathology sector encompasses various fields, including hematology, clinical chemistry, immunohematology, cytopathology, urinalysis, coagulation, endocrinology, and general pathology. Increasing pet owners' concern about their pets' health has led to heightened demand for innovative diagnostic devices. This growing focus on comprehensive pet healthcare underscores the need for advanced diagnostic solutions.

- In May 2024, the American Institute of Pathology & Laboratory Sciences (Ampath) opened its first reference laboratory in Gurugram as part of its expansion plans in North India. This marks the company's second reference lab in India.

Technology Insights

The clinical biochemistry segment dominated the companion animal diagnostics market in 2023. Clinical biochemistry plays a crucial role in diagnosing and tracking the progression of zoological diseases by analyzing blood plasma for various chemicals, including substrates, hormones, and enzymes. The rising demand for advanced veterinary care, coupled with the introduction of micro methods, is expected to drive further growth in this field. Additionally, the increasing incidence of chronic diseases in pets, such as diabetes and liver diseases, is anticipated to boost the demand for advanced clinical biochemistry solutions.

The molecular diagnostics segment will experience rapid growth in the companion animal diagnostics market over the projected period. Molecular diagnostics is emerging as a transformative force that contributes to comprehensive diagnostic solutions. Its integration into platforms like Zoetis signifies a shift towards more efficient and rapid diagnostic procedures.

End-use Insights

The laboratories segment dominated the companion animal diagnostics market in 2023. Diagnostic facilities conduct various tests to identify the sources of companion animals. These specialized centers, known as animal diagnostics laboratories, offer effective diagnostic procedures for multiple species. They provide veterinary diagnostics to pet owners and support government-related programs or research collaborations.

The veterinary hospitals & clinics segment is projected to expand significantly in the companion animal diagnostics market over the forecast period. Hospitals and clinics specializing in veterinary health offer a wide array of diagnostic services to pet owners. These services include advanced diagnostic imaging systems like 4D imaging and related software. They ensure effective therapeutics through innovative diagnostic imaging, novel therapies, nuclear and regenerative medicines, laser diagnosis, and specialized surgeries.

Regional Insights

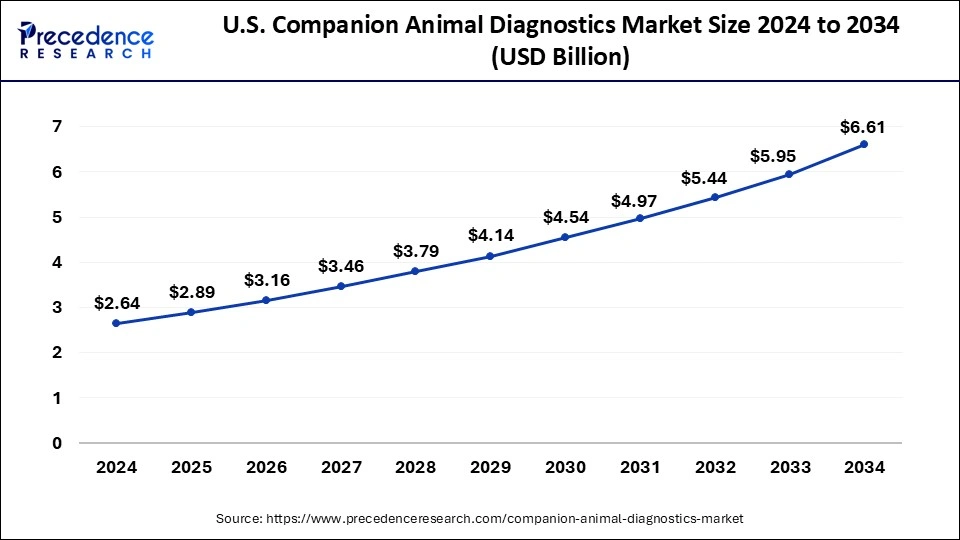

U.S. Companion Animal Diagnostics Market Size and Growth 2025 to 2034

The U.S. companion animal diagnostics market size is evaluated at USD 2.89 billion in 2025 and is projected to be worth around USD 6.61 billion by 2034, growing at a CAGR of 9.61% from 2025 to 2034.

North America

North America dominated the companion animal diagnostics market in 2023. The region's advantageous healthcare structure and expanding government efforts have driven an increase in veterinary healthcare expenditure, establishing it as the top revenue stakeholder in the global veterinary diagnostic market. Rapid advancements in bioreactors, reagents, supplies, and other biocatalytic equipment are expected to further drive regional growth. Furthermore, increased R&D spending on technologies such as cultured cell engineering for companion animal diagnostics is anticipated to significantly boost the regional market.

- In January 2023, a new U.S. law eliminated the requirement that drugs in development must undergo testing in animals before being given to participants in human trials. Animal rights advocates have long pushed for such a move, and some in the pharmaceutical industry have argued that animal testing can be ineffective and expensive.

U.S. Companion Animal Diagnostics Market Analysis

The U.S. is a major contributor to the North American companion animal diagnostics market. In-clinic analyzers, molecular diagnostics, and AI-enabled services are deeply integrated into U.S. veterinary clinics and reference labs, increasing demand for reagents and diagnostic equipment. Additionally, the animal health research ecosystem and favorable regulatory environment, which is well-funded in the country, further boost innovation and commercialization.

What Makes Asia Pacific the Fastest-Growing Region?

Asia Pacific is expected to host the fastest-growing companion animal diagnostics market in the coming years. This is due to the increasing middle-class population, urbanization, and growing awareness of pet health in countries like China and India. The market for companion animal diagnostics is changing, with more emphasis on preventative care practices. As a result, this region is projected to see significant growth in companion animal diagnostics, driven by a growing pet population and a shift towards more responsible and informed pet healthcare.

- In April 2024, HDFC ERGO General Insurance introduced Paws n Claws, an extensive insurance policy designed for pet dogs and cats. India's pet care industry is experiencing a consistent annual growth rate of approximately 13% and is projected to reach $800 million by 2025.

China Companion Animal Diagnostics Market Analysis

China is considered a major player in the market in Asia Pacific and is expected to lead regional market growth in the upcoming period. This is mainly due to the rising pet ownership driven by rapid urbanization, higher disposable incomes, and a growing middle class. Additionally, governments across the country are investing in veterinary facilities, including diagnostic laboratories, molecular testing, and point-of-care services. The growing awareness about pet health & wellness also contributes to market growth.

What Makes Europe a Notably Growing Area in the Market?

Europe is expected to grow at a notable rate in the companion animal diagnostics market over the forecast period, supported by its well-developed veterinary infrastructure and strong regulatory frameworks. The European Union's animal health programs and standardized veterinary regulations drive demand for high-quality, rigorous diagnostic solutions. Leading markets such as Germany, the UK, and France invest heavily in molecular assays, preventive testing, and the expansion of reference laboratories to support advanced veterinary care.

Germany Companion Animal Diagnostics Market Analysis

Germany is leading the market in Europe due to its well-established veterinary infrastructure and high standards for animal healthcare. German pet owners are now fond of preventive healthcare, which results in the consistent demand for in-clinic rapid tests and lab-based diagnostics. The presence of a well-developed network of veterinary laboratories and research organizations is likely to support market growth.

What Opportunities Exist in Latin America?

Latin America offers immense opportunities for the companion animal diagnostics market. This is mainly due to increased demand for preventive care, driven by rising awareness among pet owners about their pets' health. Higher disposable income among pet owners and greater availability of diagnostic reagents also drive market growth. Several diagnostic companies are reinforcing their distribution networks in Latin America to enter the new market.

Brazil Companion Animal Diagnostics Market Analysis

Brazil is a leading country in Latin America, thanks to its large and growing population of pet owners and a rising middle class that increasingly spends on pet health. Major diagnostics companies are expanding their distribution networks in Brazil to capitalize on this emerging opportunity. Growth is likely to be driven by improving access to veterinary care and fostering a more tolerant attitude toward preventive diagnostic testing.

What Potentiates the Growth of the Market in the Middle East & Africa (MEA)?

The companion animal diagnostics market in the Middle East & Africa is potentiated by the rising pet ownership in urbanized areas and the GCC. This, in turn, boosts the demand for veterinary diagnostic services. Furthermore, governments across the region are investing in animal health programs to support animal welfare. The rising demand for mobile testing services also contributes to regional market growth. Saudi Arabia is a key player in the market in the Middle East & Africa. The market in Saudi Arabia is expected to grow significantly as more people own pets, disposable incomes increase, and investments in veterinary facilities rise.

Companion Animal Diagnostics Market – Value Chain Analysis

Raw Material & Reagent Sourcing

- The foundation of companion animal diagnostics lies in procuring high-quality reagents, chemicals, and consumables such as antibodies, antigens, culture media, and molecular biology kits. These materials are essential for accurate testing in laboratories and clinics.

Key Players: Thermo Fisher Scientific, Merck KGaA, Sigma-Aldrich (part of Merck), Lonza Group

Diagnostic Component & Kit Fabrication

- Raw reagents and materials are processed into diagnostic components, including ELISA kits, PCR kits, lateral flow assays, and in-clinic rapid test strips. Precision and quality control at this stage are critical for reliable results.

Key Players: IDEXX Laboratories, Zoetis, Abaxis, Virbac

Diagnostic Instrument & Analyzer Manufacturing

- Components are integrated into diagnostic instruments, including hematology analyzers, biochemistry analyzers, immunoassay systems, and point-of-care devices. This stage ensures ease of use, speed, and accuracy for veterinary practices.

Key Players:Heska Corporation, IDEXX Laboratories, Thermo Fisher Scientific, NEOGEN Corporation

Testing & Laboratory Services

- Veterinary laboratories conduct clinical pathology, microbiology, molecular, and serology testing for companion animals. Reference labs play a key role in providing specialized testing and advanced diagnostics beyond the in-clinic capabilities.

Key Players:VCA Inc., IDEXX Reference Laboratories, AniCell Biotec

Distribution & Veterinary Clinic Integratio

- Diagnostic kits, instruments, and services are supplied to veterinary hospitals, clinics, and diagnostic centers. Integration with clinic workflows, digital reporting, and telemedicine platforms enhances adoption and diagnostic efficiency.

Key Players:IDEXX Laboratories, Zoetis, Heska Corporation, IDVet

Post-Diagnostic Support & Data Services

- Manufacturers provide after-sales service, software updates, and data analytics solutions, including disease trend monitoring, client management, and veterinary decision support systems, which help improve diagnostic outcomes and animal health management.

Key Players:IDEXX Laboratories, Zoetis, Thermo Fisher Scientific

Top Companies in the Companion Animal Diagnostics Market & Their Offerings

- IDEXX Laboratories, Inc. (U.S.): A global leader in veterinary diagnostics, IDEXX offers advanced in-clinic analyzers, reference laboratory services, and digital imaging solutions for rapid and accurate companion animal testing.

- Zoetis Inc. (U.S.): Zoetis provides a strong portfolio of veterinary diagnostic instruments, point-of-care tests, and disease-specific kits supporting clinical decision-making in companion animal healthcare.

- Heska Corporation (U.S.): Heska specializes in point-of-care blood diagnostics, allergy testing, and imaging systems designed for high-efficiency veterinary practices.

- Thermo Fisher Scientific, Inc. (U.S.): Thermo Fisher supplies high-precision diagnostic reagents, molecular testing tools, and lab equipment widely used in advanced veterinary diagnostic labs.

- Abaxis, Inc. (U.S.): Known for its compact VetS analyzers, Abaxis offers portable blood chemistry and hematology testing systems used for quick in-clinic diagnostics.

- Virbac SA (France): Virbac provides diagnostic kits and veterinary tools focused on infectious disease detection and routine clinical screening for companion animals.

- VCA, Inc. (U.S.): As a major veterinary hospital network, VCA operates extensive diagnostic laboratories offering comprehensive pathology, microbiology, and clinical chemistry services.

- IDVet (France): IDVet develops high-quality PCR and ELISA kits for infectious disease detection in companion animals, supporting veterinary labs worldwide.

- NEOGEN Corporation (U.S.): NEOGEN delivers veterinary diagnostic assays, rapid test kits, and molecular solutions for pathogen detection in companion animals.

- bioMérieux SA (France): A leading diagnostics company, bioMérieux offers advanced microbiology and molecular systems used for detecting infectious diseases in pets.

- Randox Laboratories Ltd. (UK): Randox provides veterinary diagnostic analyzers, quality-control systems, and multiplex testing solutions for companion animal clinics and labs.

- AniCell Biotech (U.S.): AniCell focuses on regenerative and biologic diagnostic solutions, producing advanced cellular products that support veterinary therapeutic assessment.

Recent Developments

- In April 2023, Mars Incorporated successfully acquired Heska Corporation, a global leader in advanced veterinary diagnostic and specialty products.

- In June 2022, Mars Petcare introduced a groundbreaking initiative, the MARS PETCARE BIOBANKTM. This 10-year endeavor aims to revolutionize pet health by uniting clinical, genetic, and lifestyle data from 20,000 cats and dogs across the United States.

- In September 2022, Zoetis Inc. acquired Jurox, a privately held animal health firm that develops, produces, and markets a wide variety of veterinary pharmaceuticals for treating livestock and companion animals. Jurox's headquarters are in Australia, with regional offices in New Zealand, the United States, Canada, and the United Kingdom.

Segments Covered in the Report

By Technology

- Clinical Biochemistry

- Clinical Chemistry Analyzers

- Glucose Monitoring

- Immunodiagnostics

- Hematology

- Molecular Diagnostics

- Urinalysis

- Others

By Animal Type

- Dogs

- Cats

- Equine

By Application

- Clinical Pathology

- Bacteriology

- Parasitology

- Others

By End-use

- Laboratories

- Veterinary Hospitals & Clinics

- Point-of-Care/in-House Testing

- Research Institutes and Universities

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting