Companion Animal Health Market Size and Forecast 2025 to 2034

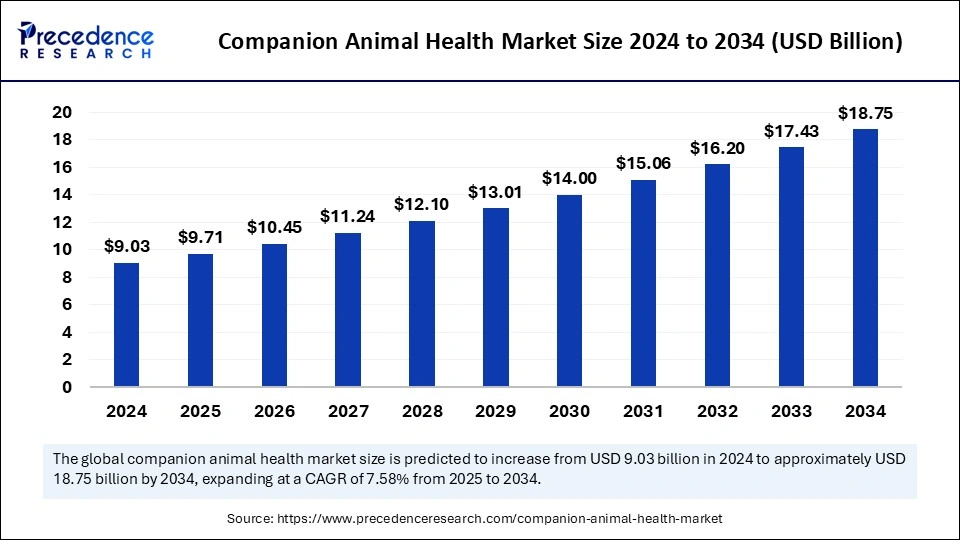

The global companion animal health market size accounted for USD 9.03 billion in 2024 and is predicted to increase from USD 9.71 billion in 2025 to approximately USD 18.75 billion by 2034, expanding at a CAGR of 7.58% from 2025 to 2034. The global market growth is attributed to the growing spending and pet population, increasing pet humanization, and the increasing rate of medical care for pets.

Companion Animal Health Market Key Takeaways

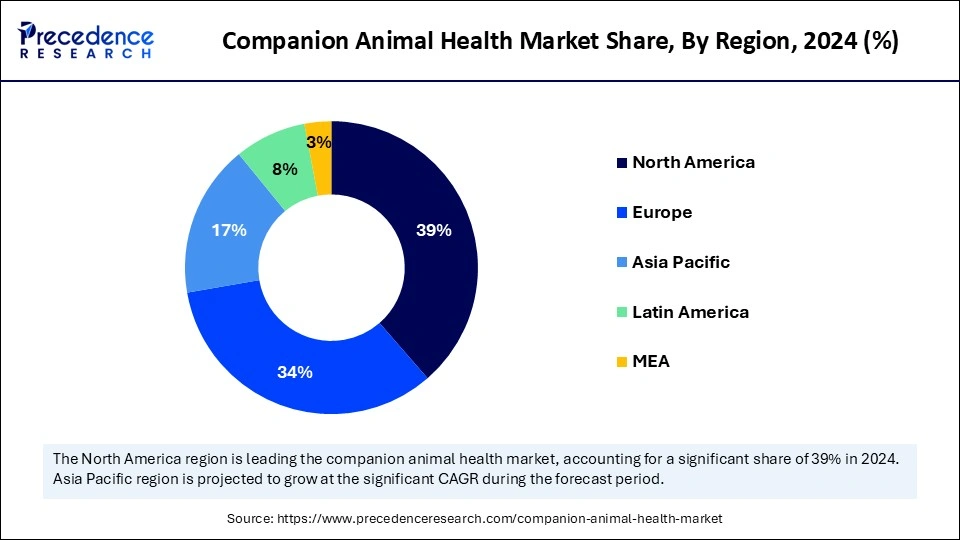

- North America dominated the market by holding more than 39% of market share in 2024.

- Asia Pacific is expected to grow at the fastest rate in the market during the forecast period.

- By animal, the dogs segment held the biggest market share of 42% in 2024.

- By animal, the cats segment is expected to grow rapidly during the forecast period.

- By product, the pharmaceuticals segment held the major market share of 45% in 2024.

- By product, the diagnostics segment is expected to grow rapidly during the forecast period.

- By distribution channel, the hospital pharmacies segment contributed the largest market share of 81% 2024.

- By distribution channel, the e-commerce segment is expected to grow at the fastest rate during the forecast period.

- By end-use, the hospitals and clinics segment recorded more than 81% of market share in 2024.

- By end-use, the point-of-care/in-house testing segment is anticipated to grow at a significant CAGR during the forecast period.

How Artificial Intelligence (AI) is Changing the Companion Animal Health Market?

Artificial intelligence is revolutionizing companion animal healthcare within the fast-changing realm of veterinary medicine. AI-driven tools and technologies assist veterinarians in optimizing clinic operations, tailoring treatment strategies, and boosting diagnostic precision. The integration of AI in Veterinary Clinic Software significantly enhances numerous clinic functions, enabling the swift and accurate analysis of vast data sets.

To identify patterns and early signs of diseases, AI-powered systems can sift through medical records, laboratory results, and clinical notes. AI allows veterinarians to enhance personalized treatment plans. AI technologies, like Veterinary Clinic Management Software, can improve clinic efficiency and streamline various administrative tasks. Various veterinary clinics have successfully implemented AI technology to improve clinic efficiency and patient care, which is further expected to revolutionize the growth of the companion animal health market in the coming years.

U.S. Companion Animal Health Market Size and Growth 2025 to 2034

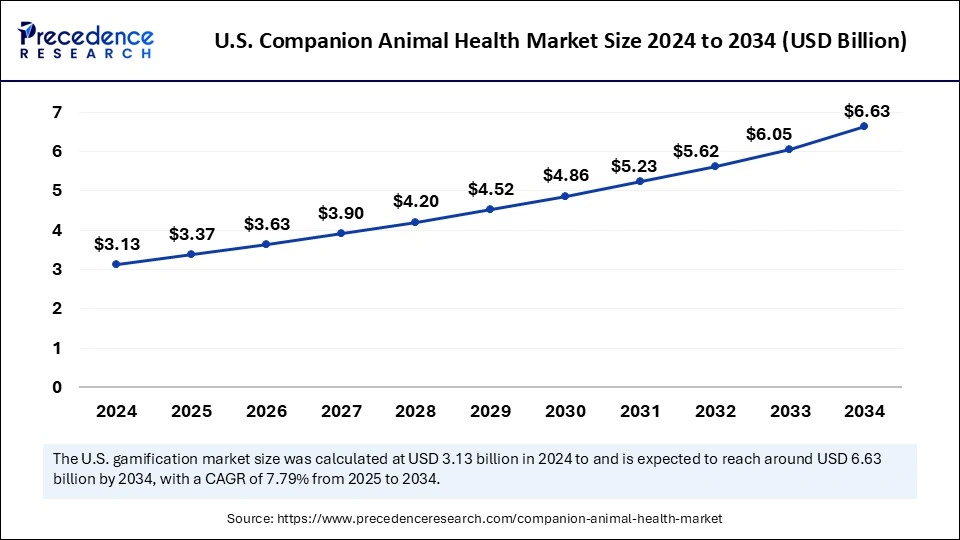

The U.S. companion animal health market size was exhibited at USD 3.13 billion in 2024 and is projected to be worth around USD 6.63 billion by 2034, growing at a CAGR of 7.79% from 2025 to 2034.

North America dominated the companion animal health market in 2024. The market growth is attributed to factors such as the expansion of pet insurance coverage, advances in veterinary medicine, and the increasing existence of various well-developed pharmaceutical companies that are significantly increasing their commercialization of their products and rising pet ownership. The U.S. and Canada are the dominant countries driving the market growth.

The U.S. has dominated the market growth in 2024, driven by factors such as the increasing concerns among pet owners regarding their animals' health, growing pet ownership of cats and dogs, and increasing pet ownership rates in the U.S.

- In September 2023, global animal health company Ceva Santé Animale (Ceva) announced the launch of its highly anticipated 2024 “Call for Projects.” The aim behind this launch was to support and discover new innovative solutions for the well-being and care of companion animals and their pet parents.

Asia Pacific is expected to grow fastest during the forecast period. The companion animal health market growth in the region is attributed to the increasing shift in pet adoption practices, rising adoption of the Western lifestyle, and growing pet humanization. In addition, the increasing urgent need to reduce the frequency of zoonotic illnesses, ongoing initiatives to commercialize veterinary vaccines and medicines, and rising significant research and development investments made by international firms. China, India, Japan, and South Korea are the fastest-growing countries in the region.

China is the fastest-growing country in the market, and the Chinese market is experiencing robust growth propelled by the increasing demand for preventive treatments such as pharmaceuticals and vaccines and rising pet health awareness. In addition, the increasing prevalence of diseases in animals and the growing companion animal population are further expected to enhance the growth of the companion animal health market in China.

Europe holds a considerable share of the global market. The market growth in Europe is attributed to the increasingly robust focus on research and development on animal welfare and rising technological advancements. Various companies are developing diagnostic tools, treatments, and new vaccines to improve the quality of care provided to pets. For instance, Germany had 34.7 million pets and 83 million of the world's wealthiest consumers.

Market Overview

The companion animal health market revolves around the distribution and production of medications designed especially for pets, such as birds, dogs, cats, and other domesticated animals, kept primarily for companionship instead of commercial objectives. Companion animal drug development has enhanced in tandem with advancements in human medicine, allowing pets to obtain therapies and prescriptions that can efficiently increase their longevity, enhance their well-being, and treat medical issues.

In addition, drug companion animals can enhance the geriatric dog's comfort and quality of life and deal with these problems. The companion animal health market is also driven by various factors such as changing lifestyles, rising disposable income, increasing preference towards veterinary vaccinations, increasing activities by various governments, increasing number of animals, and the increasing focus on animal health monitoring solutions.

Companion Animal Health Market growth factors

- The increasing rates of pet ownership, increasing focus on zoonotic diseases, and rising advancements in veterinary healthcare are expected to drive the market growth during the forecast period.

- The increasing number of veterinary practitioners and their growing income level in developing nations are anticipated to enhance market growth.

- The increasing pet ownership among people about the significance of regular pet care is further driving the growth of the companion animal health market.

- The increasing prevalence of infectious diseases among cats, such as feline panleukopenia, has also contributed to the market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.75 Billion |

| Market Size by 2025 | USD 9.71 Billion |

| Market Size in 2024 | USD 9.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.58% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal, Product, Distribution Channel, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Animal Type Insights

The dogs segment accounted for the dominating share of 48.60% in 2024. The growth of the segment in the global companion animal health market, driven by rising pet ownership, increasing humanization of pets, growing popularity of advanced therapeutics, and surging investment in preventive care, nutrition. Dog owners treat dogs as family members and spend a higher amount on premium healthcare and wellness products. Moreover, the growing number of households with dogs, particularly in urban areas, has led to increasing demand for companion animal health products and services.

The cats segment is expected to grow fastest during the forecast period. The segment growth in the market is attributed to the growing trend of pet humanization, the increasing prevalence of feline-specific diseases, and the increasing adoption of cats as companion animals in emerging countries. Cats are considered low maintenance because they do not need special training for basic hygiene and self-cleaning. In addition, the increasing cat adoption rate with rising demand for feline-specific drugs is driving the major players to make research and development investments.

Product Insights

The pharmaceuticals segment held a dominant presence in the market in 2024, with 39.20%. The growth of the segment is mainly driven by the ongoing efforts for the development and innovation of veterinary drugs and medicines. The introduction of new and advanced anti-inflammatory drugs, parasiticides, antibiotics, and other specialized pharmaceutical medications to address numerous health conditions in companion animals. Anti-inflammatory drugs and analgesics are vital for managing chronic pain, a common issue in aging companion animals.

The diagnostics segment is expected to grow fastest during the forecast period. The segment growth in the market is driven by the increasing prevalence of various health conditions and diseases in companion animals, such as infectious diseases, cardiovascular diseases, and cancer. These advanced factors significantly increased the demand for advanced diagnostic technologies and tools. In addition, pet owners are willing to invest in comprehensive diagnostic services to provide appropriate treatment, detect issues early, and become more proactive in monitoring their pets' health.

Distribution Channel Insights

The retail pharmacies segment dominated the global companion animal health market with a 57.30% share in 2024. Retail pharmacies offer a wide range of pharmaceutical products for companion animals, ensuring convenient and easy access to necessary medications for pet owners. Retail pharmacy staff are specialized in veterinary medicine, providing valuable guidance to pet owners regarding the best health needs of their pets. This enhances customer trust and loyalty towards retail pharmacies as reliable and convenient sources for companion animal health products.

End-Use Insights

The veterinary clinics contributed the biggest market share of 36.50% in 2024. The segment's growth is attributed to the rising expansion of veterinary clinics with innovative infrastructure around the world. Veterinary clinics are dedicated to enhancing the quality of animal healthcare with their innovative rehabilitation solutions, laser therapies, and diagnostic services. Such factors are contributing to the overall growth of the segment.

Route of Administration Insights

The oral segment held the major market share of 44.70% in 2024. Oral drug administration in animals is more convenient, safer, and efficient, offering convenience for both pet owners and animals, ultimately improving treatment outcomes. Drugs administered orally to animals come in numerous forms, including liquids. semisolids, and solids like tablets, capsules, powders, and granules.

Companion Animal Health Market Companies

- Mars Inc.

- Embark Veterinary, Inc.

- SYNLAB

- NationWide Laboratories

- IVC Evidensia

- CVS Group Plc

- Greencross Vets

- Zoetis Services LLC

- IDEXX Laboratories, Inc.

- The Animal Medical Center

Recent Developments

- In May 2024, Dr. Clauder joined forces with protein pioneer Calysta to launch the world's first dog treats made with FeedKind Pet protein, a revolutionary new pet food ingredient.

- In October 2024, a Canadian diversified animal health company, Grey Wolf Animal Health Corp., announced the Canadian commercial launch of SILEO to veterinary clinics throughout Canada.

- In November 2024, a global leader in animal health, Boehringer Ingelheim, launched VETMEDIN Solution, the first oral solution approved by the U.S. Food and Drug Administration (FDA) for the management of congestive heart failure (CHF) in dogs due to MMVD or DCM.

- In April 2024, a leading companion animal cancer therapeutics company, ELIAS, announced the appointment of Brian Segebrecht as Chief Revenue Officer in anticipation of the impending product approval of the ELIAS Cancer Immunotherapy (ECI) in Q4.

Segments Covered in the Report

By Animal Type

- Dogs

- Cats

- Horses

- Others

By Product

- Vaccines

- Pharmaceuticals

- OTC

- Prescription

- Feed Additives

- Diagnostics

- Medicated Feed

- Others Therapeutics

By Distribution Channel

- Retail

- Online Pharmacies

By Route of Administration (For Pharmaceuticals)

- Oral

- Injectable

- Topical

- Others (e.g., intranasal, transdermal)

By End-use

- Veterinary Clinics

- Animal Hospitals

- Pet Owners

- Veterinary Research Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting