Immunohematology Market Size and Forecast 2025 to 2034

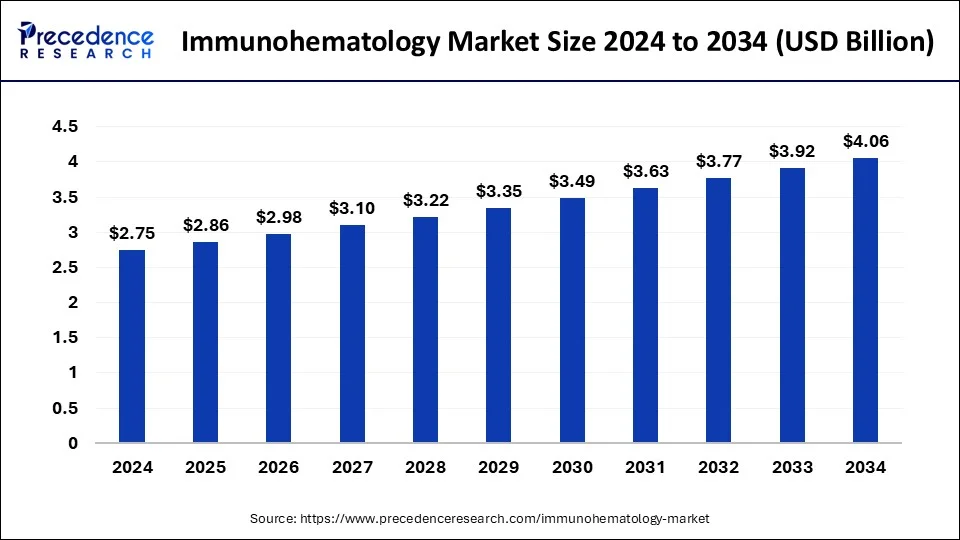

The global immunohematology market size was exhibited at USD 2.75 billion in 2024 and is predicted to increase from USD 2.86 billion in 2025 to approximately USD 4.06 billion by 2034, expanding at a CAGR of 3.97% from 2025 to 2034.

Immunohematology Market Key Takeaways

- In terms of revenue, the global immunohematology market was valued at USD 2.75 billion in 2024.

- It is projected to reach USD 4.06 billion by 2034.

- The market is expected to grow at a CAGR of 3.97% from 2025 to 2034.

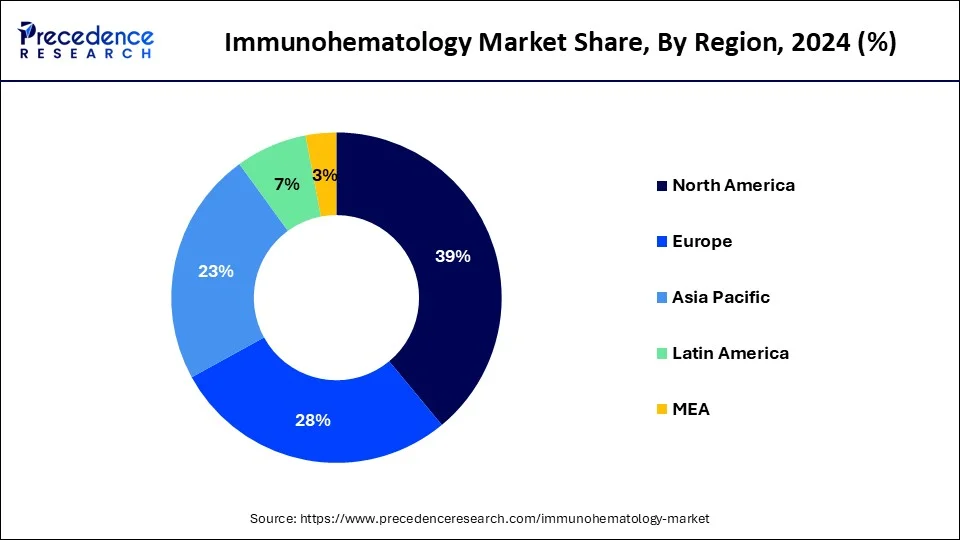

- North America dominated the market with the largest revenue share of 39% in 2024.

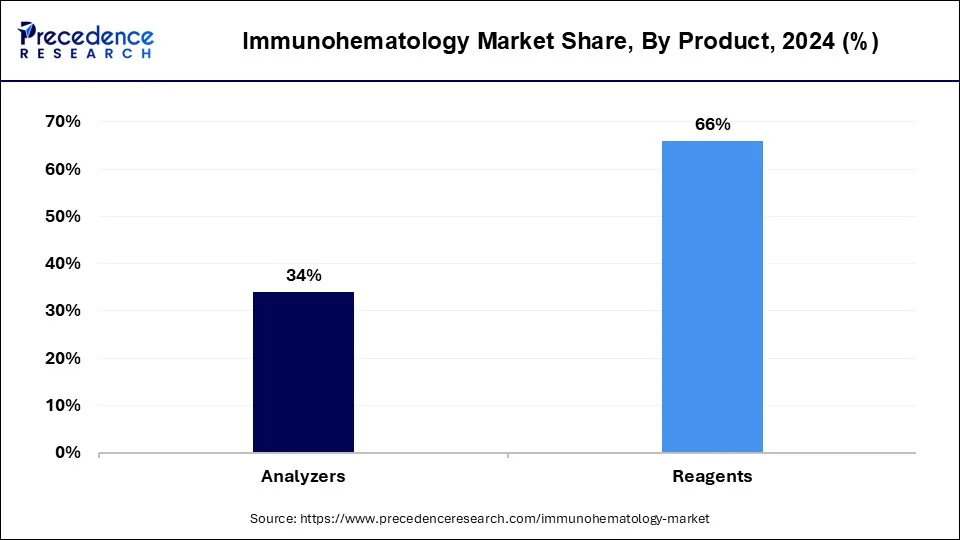

- By product, the reagents segment has contributed more than 66% of revenue share in 2024.

- By technology, the PCR segment has held the largest revenue share of 39% in 2024.

- By end use, the diagnostic laboratories segment has captured the biggest revenue share of 25% in 2024.

U.S. Immunohematology Market Size and Growth 2025 to 2034

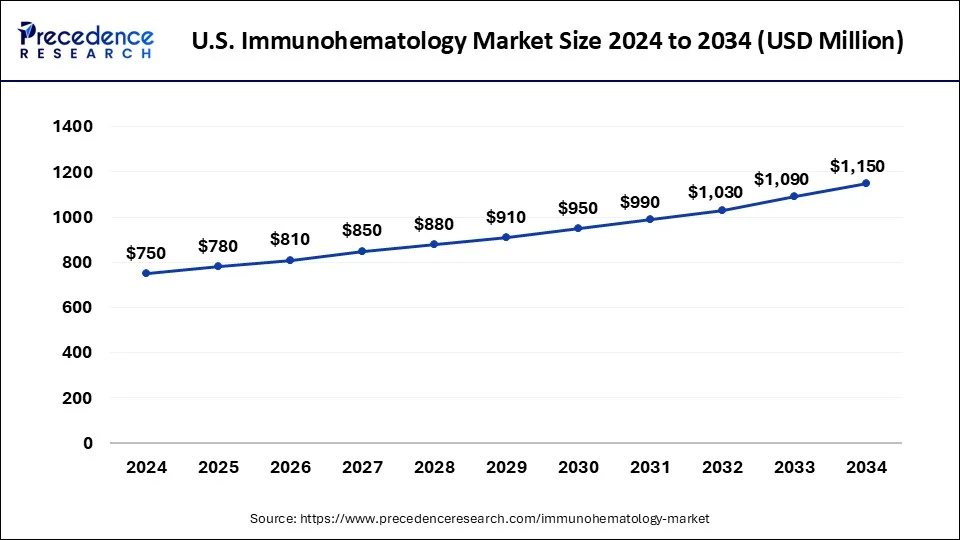

The U.S. immunohematology market size was estimated at USD 750 million in 2024 and is predicted to be worth around USD 1,150 million by 2034, with a CAGR of 4.37% from 2025 to 2034.

North America held the dominating share in 2024 and stands out as the fastest-growing region in the immunohematology market for the forecast period, driven by robust blood transfusion practices and a well-established infrastructure. Annually, over 15 million units of whole blood are collected in the United States alone, with 5 million patients receiving blood components. A significant proportion of the US population, approximately 60%, is eligible to donate blood, and volunteer donors contribute over 98% of the blood supply. The region boasts a network of 600 blood centers across 45 states, supplying half of the blood in the US and a quarter in Canada.

Regulatory agencies like the American Red Cross play a pivotal role, mobilizing donors, volunteers, and resources to provide disaster relief, blood products, and services, as well as education and training. The demand for blood in North America is substantial, with someone in the US needing a blood transfusion every two seconds. Daily, blood is required for various critical medical procedures, including cancer treatment, organ transplants, cardiothoracic surgeries, anemias, and trauma care.

With its robust infrastructure, stringent regulatory oversight, and high demand for blood products, North America presents significant opportunities for growth and innovation within the immunohematology market. By leveraging its well-established blood collection and distribution network and advancing technologies, the region can further enhance patient care and transfusion outcomes, driving continued expansion in the immunohematology sector.

- In January 2024, the United States market witnessed the launch of the HemoFlow 500 Series, heralding the arrival of the Next Generation Blood Scale/Mixer Devices.

Market Overview

Immunohematology, a specialized field within medical science, focuses on the analysis of red blood cell antigens and antibodies relevant to blood transfusions. It encompasses the conceptual framework and clinical methodologies essential for contemporary transfusion therapy. Throughout history, endeavors to preserve human life through blood transfusions have been documented, underscoring its critical role in healthcare.

Globally, of the 118.5 million blood donations collected, 40% originate from high-income countries, despite comprising only 16% of the world's population. Notably, in low-income nations, over half of blood transfusions are administered to children under five years old, while in high-income counterparts, individuals aged over 60 receive the majority (up to 76%) of transfusions.

In the area of laboratory medicine, immunohematology entails the preparation of blood and its components for transfusion, alongside the meticulous selection and monitoring of these components post-transfusion. This entails detailing the preparation, adaptation, and indications of both conventional and contemporary blood products.

- In January 2022, Healthcare and Life Sciences Investment witnessed the initiative to invest in a future transformed by the pandemic.

- In May 2022, Quidel and Ortho Clinical Diagnostics merged to establish an in vitro diagnostics company.

Immunohematology Market Growth Factors

- The continuous need for blood transfusions, particularly for patients with blood cancers, drives the market growth. With thousands of blood components being transfused daily, the reliance on volunteer blood donors becomes crucial for ensuring a steady supply, thus contributing to market expansion.

- As the population ages and medical practices become more sophisticated, the demand for blood component therapy is expected to increase. This demographic trend, coupled with advancements in medical treatments, acts as a growth factor for the market.

- Extensive awareness programs aimed at educating, motivating, and recruiting blood donors play a pivotal role in ensuring an adequate supply of safe blood. Launching such initiatives leads to market growth by fostering a culture of regular blood donation.

- Recognizing the importance of safe and adequate blood supply, countries are increasingly integrating blood transfusion services into their national healthcare policies and infrastructure. This strategic approach contributes to market growth by prioritizing the availability of blood as an essential healthcare component.

- Emphasizing the collection of blood, plasma, and other components from low-risk, voluntary unpaid donors through strengthened donation systems and effective donor management fosters market growth by ensuring a sustainable and reliable blood supply chain.

- Promoting the rational use of blood and blood products, along with implementing safe and good clinical transfusion practices, including patient blood management, reduces unnecessary transfusions and associated risks. This focus on efficiency and safety drives market growth by instilling confidence in blood transfusion services.

- Addressing concerns about transfusion-transmitted diseases requires the adoption of advanced technology for blood screening, voluntary donations, donor selection, and maintaining aseptic conditions during transfusion. Investing in these technological advancements is essential for market growth as it enhances safety and reduces transmission risks.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.75 Billion |

| Market Size in 2025 | USD 2.86 Billion |

| Market Size by 2034 | USD 4.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.97% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Immunohematology Market Dynamics

Drivers

Meeting clinical demand through enhanced safety and efficiency

The immunohematology market experiences growth as the demand for blood transfusion, though showing a decreasing trend due to heightened awareness and adherence to patient blood management principles, underscores the need for timely access to safe blood in healthcare facilities. This shift in demand highlights the importance of efficient blood transfusion services, driving the necessity for advanced immunohematology solutions that ensure safe preparation, selection, and monitoring of blood components, ultimately aligning with evolving clinical needs and fostering market expansion through innovation and enhanced patient outcomes.

Advancements in transfusion medicine and quality assurance

The evolution of the blood transfusion system, propelled by advancements in Transfusion Medicine and Technology, underscores its pivotal role within healthcare services. Measures to ensure the quality of blood and its products have become imperative, driving the need for enhanced standards in blood banks and transfusion services. The National AIDS Control Organization, through the Technical Resource Group on Blood Safety, has played a significant role in formulating comprehensive standards to elevate the quality control system encompassing collection, storage, testing, and distribution of blood and its components. These efforts not only enhance patient safety but also contribute to the growth of the immunohematology market by fostering a culture of excellence and innovation within the field.

Restraint

High Initial Investment

The adoption of automation in immunohematology poses a significant financial barrier due to its expensive nature, typically requiring substantial initial investments. While some facilities may opt for a 'reagent rental agreement' to mitigate costs, this model still entails ongoing expenses for reagents and maintenance. Moreover, the initial costing includes not only the equipment but also expenses for room restructuring, reagent storage facilities, and interfacing hardware and software with the hospital information system (HIS). Additionally, the variability in testing costs, influenced by the type of testing and individual center protocols, makes cost comparison challenging. Despite the potential efficiency gains, the high upfront and operational costs associated with automation limit the growth of the immunohematology market.

Opportunities

Advancements in Testing Technologies

The introduction of advanced testing technologies, such as microcolumns and polystyrene microplates, presents significant opportunities for growth within the immunohematology market. These innovations offer distinct advantages, including the ability to conduct antiglobulin tests without washing steps and enhanced visualization of reactions. Moreover, the development of more recent systems utilizing microplates sensitized by human antiglobulin allows for visualizing reactions through magnetized red cells, further streamlining testing processes. By combining these techniques with the latest generation of automated instruments, healthcare facilities can achieve greater efficiency and accuracy in immunohematology testing. These advancements not only enable the resolution of complex cases but also open doors for expanding the scope of immunohematology services. With the potential to enhance patient care and diagnostic capabilities, the adoption of these sophisticated technologies represents a promising opportunity for growth within the immunohematology market.

Advancements in Diagnostic Methods

The continuous evolution of diagnostic methods for in vitro measurements of the antigen-antibody reaction presents significant opportunities within the immunohematology market. Important innovations have led to substantial improvements in blood compatibility between donors and recipients, enhancing patient safety and transfusion outcomes. The utilization of completely automated systems, coupled with information technology integration, emerges as a highly efficient strategy. By automating various stages, including sample identification, reagent selection, result interpretation, and data transfer to laboratory information management systems, these systems significantly reduce transfusion risks associated with human errors. This integration not only enhances workflow efficiency but also improves overall laboratory performance, creating promising opportunities for growth and advancement within the immunohematology market.

Product Insights

Within the immunohematology market, the reagents segment dominated in 2024, offering unique specialty reagents essential for laboratory procedures. These reagents empower laboratories to conduct a wide range of tests, from basic to complex antibody workups, ensuring the selection of the most compatible blood components.

A key distinction within this segment lies in the types of anti-globulin reagents available for use in laboratory procedures: broad spectrum (polyspecific sera) and monospecific sera. These reagents are integral to the process of identifying and characterizing antibodies in blood samples, facilitating precise compatibility testing. By leveraging these specialized reagents, healthcare professionals can enhance patient safety and improve outcomes by selecting blood components that minimize the risk of adverse reactions. As such, the reagents segment serves as a cornerstone of immunohematology practices, driving advancements in transfusion medicine and contributing to better patient care.

Technology Insights

The PCR segment held the largest share of the immunohematology market, particularly in enhancing blood typing methods. DNA-based techniques, facilitated by PCR, offer valuable tools for improving immunohematology typing. Specifically, ready-to-use Conformité Européenne (CE)-marked test kits utilizing PCR-SSP (Polymerase Chain Reaction with Sequence-Specific Priming) have been developed. These kits enable the molecular determination of blood group antigens, complementing traditional serology methods. PCR-SSP technology plays a crucial role in resolving discrepancies or doubts arising from serologic test results, offering a robust and easy-to-handle solution.

End Use Insights

The diagnostic laboratories segment led the immunohematology market in 2024. Diagnostic laboratories are often equipped with the latest technologies and automated systems for conducting immunohematology tests. The adoption of advanced immunohematology analyzers and reagents enhances the efficiency and accuracy of testing, making these laboratories crucial players in the immunohematology market. Many healthcare facilities outsource their immunohematology testing to centralized diagnostic laboratories. This centralization allows for more standardized and reliable testing processes, contributing to the dominance of diagnostic laboratories in this market.

The hospitals segment is observed to grow at a notable rate in the immunohematology market. Hospitals adhere to stringent regulatory standards and quality control measures in their laboratories. This ensures that immunohematology practices meet high standards of accuracy and reliability, which is essential for patient safety and effective treatment outcomes. Hospitals are the primary responders to emergencies and trauma cases where immediate blood transfusions are often necessary. The critical nature of these situations requires reliable immunohematology support to ensure timely and safe transfusions.

Immunohematology Market Companies

- Grifols S.A.

- Immucor Inc.

- Thermo Fisher Scientific

- Merck KGaA

- Abbott Laboratories

Recent Developments

- In November 2023, QuidelOrtho reportedly considered selling its Transfusion Medicine Unit, as per sources.

- In November 2023, Versiti finalized the acquisition of Pearl Pathways, an Indianapolis-based company.

- In July 2023, QuidelOrtho collaborated with BYG4lab to bolster its Informatics Offerings.

Segments Covered in the Report

By Product

- Analyzers

- Reagents

By Technology

- Biochips

- Gel Cards

- Microplates

- PCR

- Erythrocyte-Magnetized Technology

By End-User

- Hospitals

- Diagnostic Laboratories

- Blood banks

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting