What is the Compound Feed Market Size?

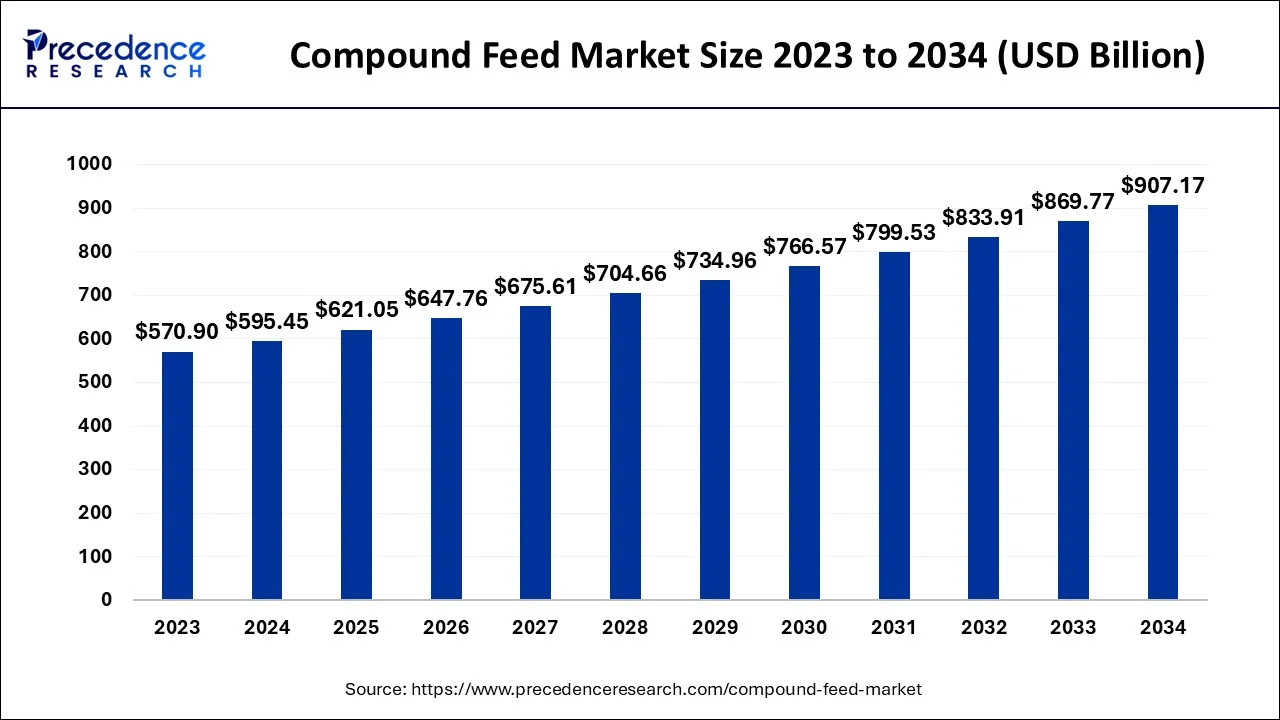

The global compound feed market size is accounted at USD 621.05 billion in 2025 and predicted to increase from USD 647.76 billion in 2026 to approximately USD 907.17 billion by 2034, expanding at a CAGR of 4.30% from 2025 to 2034.

Compound Feed Market Key Takeaways

- In terms of revenue, the market is valued at $621.05 billion in 2025.

- It is projected to reach $907.17 billion by 2034.

- The market is expected to grow at a CAGR of 4.30% from 2025 to 2034.

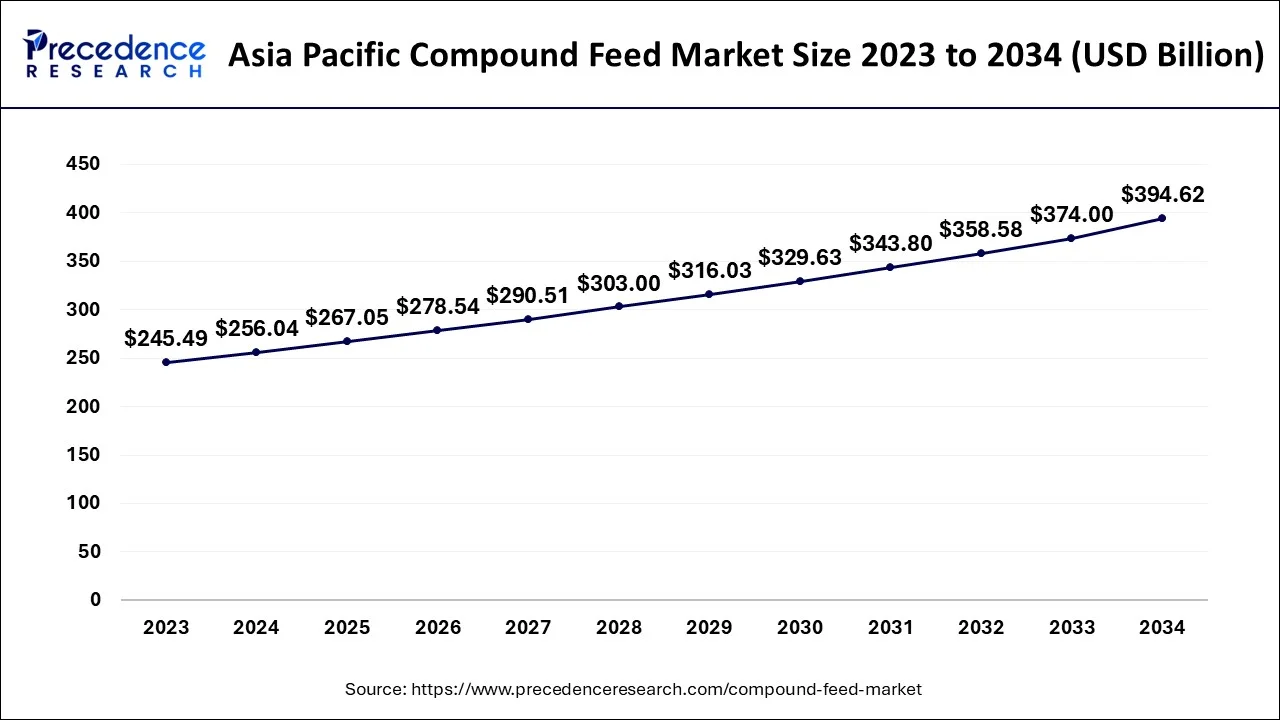

- Asia Pacific compound feed market was valued at USD 245.49 billion in 2024.

- Cattle livestock segment accounted market share of around 27% in 2024.

- By livestock, swine segment dominated the market and garnered largest revenue share 33% in 2024, while poultry segment accounted 30%.

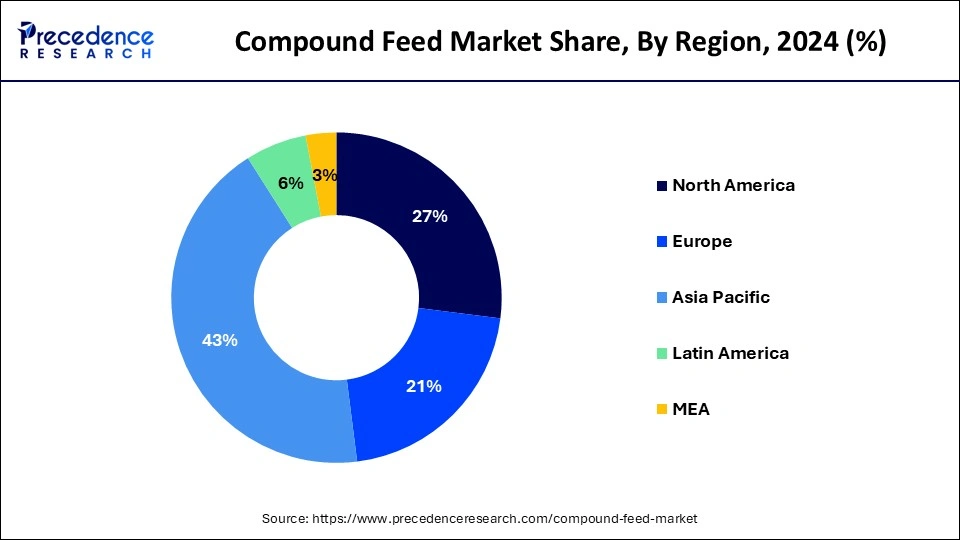

- By region, Asia Pacific region accounted largest revenue share 43% in 2024 while Europe region hit 30% revenue share.

Market Overview

In order to obtain meat, poultry, animals are being reared on a larger scale across many countries. Compound feed it's a product which is used for feeding the farm animals which happens to be a mix of animal products and plant products. The compound feed has all the essential nutrients for the healthy growth of these animals. In order to have healthy animals for deriving various products there is a growing focus of manufacturers in providing a better feed to these farm animals. Due to these improved efforts there shall be an increased production through livestock which would also be economical. In many nations across the globe there is a growing demand for dairy products as well as meat and in order to meet the growing demand of the market the manufacturers are focusing on providing a nutritious compound feed to the animals. There are many stringent government policies in most of the developed nations which hampers the growth of the compound feed market.

Apart from the policies there is also an increase in the cost of raw material used in the production of this feed which shall also be one factor that will hamper the growth of the market in the coming years period there are many other natural changes in the weather which may have a larger effect all these animals and the production of the food. As there is a growing focus on providing nutritive food at affordable costs major manufacturers are working in order to provide both. When there is a demand for animal products the prices of the byproducts also grows during that phase. There are many rules associated with the field which make it mandatory to have at least a few raw materials.

During the pandemic the livestock market was affected to a great extent. The compound feed market was also affected. As there was a complete shutdown of various industries the manufacturing units of the compound feed were also closed. As there were restrictions on movement and also the supply chain there was a shortage of raw material. The supply of compound feed to different nations had also stopped due to restrictions on import and export activities. As the demand for poultry and meat had dropped during the pandemic the market saw a negative phase.

Compound Feed Market Growth Factors

Compound feed market affects the environment there's a growing focus on reducing the cost associated with this feed. The manufacturers are adopting ways that will be helpful in reducing the impact on the environment. The production of raw material also affects the final product. There is a growing concern among the consumers regarding the production of raw materials as it affects the market. As there is a growing demand for high protein diets in many nations across the globe the market is expected to grow well during the forecast period. Consumers across the developed as well as the developing economies seek animal based proteins as compared to the plant based proteins which will drive the market growth in the coming years.

In order to meet the demand of the livestock products there is a growing demand for the production of livestock. In many nations livestock business happens to be a livelihood for the farmers. There is a growth in the demand for animal based products due to a major shift in the food eating habits add increased purchasing power. In the developed nations the consumption of milk is high as compared to the developing nations. There is a growth in the consumption of dairy products in the United States as compared to the recent years. The market for meat, poultry and dairy products is expected to have a good growth in the coming years. The demand for these products in the Asia Pacific region is less as compared to the other developed nations. In order to have healthy animals farmers are adopting ways that will help in improving the quality of compound feed. This market is also expected to grow as it happens to be the only source of income for many farmers in rural areas.

Growing awareness among the consumers regarding the good quality of food products and safer food products derived from the animal origin will create a demand for a quality feed. As the amount of land used for the livestock production is less the market will grow well during the forecast period. There is a growth in animal husbandry due to a growing demand for animal products. As there's an increase in the number of restaurants and food chains across the globe which happens to be an organized sector there shall be a growing demand for this product in the coming years. There's an increased adoption of technology in order to overcome the issue of the quantity of land available for animal husbandry. There is an increase in the industrialization there has been a development in the management of livestock.

Growing awareness regarding the use of technologies and modern ways of fielding the market is expected to grow well in the coming years. The growing demand for better quality of compound feed as it is extremely useful in meeting the daily requirements of the animals in terms of the correct nutrients required.

Recent Trends in the Compound Feed Market:

Rising Demand for Animal Protein

- Global consumption of meat, dairy, and eggs is rising as a result of expanding urban populations and rising incomes. Compound feed becomes more necessary as a result of livestock farmers expanding their businesses. There is a greater need for specialty feeds designed for cattle, pigs, and poultry in order to enhance animal health, growth, and efficiency.

Ingredient Innovation & Precision Nutrition

- Feed manufacturers are adding probiotics, enzymes, vitamins, and amino acids to improve animal performance and health. Precision-feeding tools allow farms to match feed to the animal's species, age, and growth stage. Alternative proteins like insect meal, algae, and by-products are gaining attention for sustainability and cost-effectiveness

Market Outlook

- Industry Growth Overview: Development in automated production technologies and feed formulation is driving industry growth. To improve animal performance and health, manufacturers are adding balanced nutrients, enzymes, and additives. Global meat consumption is rising, and government initiatives that promote the growth of livestock are bolstering market expansion overall.

- Sustainability Trends: Sustainability has become a key focus in the compound feed industry as producers aim to reduce waste and minimize the carbon footprint of livestock production. The use of plant-based proteins, locally sourced grains, and eco-friendly feed additives is gaining traction. Companies are also investing in precision feeding technologies to optimize resource use and reduce environmental impact.

- Startup Ecosystem: Alternative protein sources like algae, insects, and single-cell proteins are being developed by startups in the compound feed industry. For farm management quality monitoring and feed formulation, many are concentrating on digital solutions. These startups are expanding rapidly and promoting sustainable innovation in the industry with the help of agrotech investors and partnerships with feed producers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 907.17 Billion |

| Market Size by 2026 | USD 647.76 Billion |

| Market Size by 2025 | USD 621.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Asia Pacific Market Share in 2024 | 43% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

|

Segments Covered |

Ingredients, Source, Form, Livestock, Supplement, Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Ingredients Insights

Depending upon the ingredients, the cereals segment is expected to have a larger market share and the cakes and the meals segment will have the second place in the market during the forecast period. This segment has had the second largest market share in the recent years. Cakes are made by using the residues which are left from the oil seeds during the process of oil extraction. This compound feed market segment is expected to have the largest market share due to its nutrient content.

Cakes and meals produced from the residues of the oilseeds have the largest amount of nitrogen which accounts to 95% add since the cakes are made from oil seeds they happen to be rich in the protein content. These cakes are also high in vitamin B. Compared to all the other segments this segment will have a good market share due to its nutritive value and its ease of storage. The serial segment is expected to grow in the coming years as it has a good nutritional value and it is also available easily throughout the globe. The sources of cereal feed are corn rice and wheat. Barley oats as well as Millet are the other forms of cereal which are also used in the feed.

Form Insights

By form, the pellet form is expected to have the largest market share. The pellet segment has dominated the market in the past. Pellet which is derived from many different plants sources or animal sources as are largely used.

Followed by the pallet segment the crumble segment is also expected to have a good compound annual growth rate during the forecast period. By crushing the pellet the obtained consistency is fed to animals in order to increase the production. Many different types of ingredients are used in order to make this type of feed.

Livestock Insights

By livestock, the poultry segment is expected to have a largest revenue share in 2024. If there is an increase in the rearing of poultry animals across many nations the market is expected to grow in the coming year period growing demand for Turkey as well as chicken will drive the growth of this segment. As poultry happens to be a great source of protein available at an affordable cost the market is expected to grow in the coming years. Due to the health benefits associated with the consumption of white meat as compared to the red meat there is a greater demand for the poultry segment.

Followed by the poultry segment, the swine segment is also expected to grow well in many nations across the globe. There has been an increase in the export of pork products to many Asia Pacific regions due to a growing demand for these products.

Source Insights

By source, the plant based segment is expected to have a larger market share in the coming years. This segment happens to be an affordable option and the nutrient content of the feed derived from the use of plant based sources is at par the animal sources. Easy availability of these products and increasing environmental concerns will drive the market growth during the forecast period. In the European region there is a growing demand for compound feed and the crop production is used in the manufacturing.

Regional Insights

Asia Pacific Compound Feed Market Size and Growth 2025 to 2034

The Asia Pacific compound feed market size is evaluated at USD 267.05 billion in 2025 and is predicted to be worth around USD 394.62 billion by 2034, rising at a CAGR of 4.42% from 2025 to 2034.

The Asia Pacific region is expected to be the largest market during the forecast period. As there is a growth in the income of the people and an increased demand for meat consumption the market in this region is expected to grow well. Many countries belonging to the Asia Pacific region have a maximum consumption of compound feed.

The APAC region is experiencing accelerated growth in compound feed production secondary to increased meat consumption, urbanization, and dietary habits. Governments are seeking to sustain the demand for animal protein in a cost-effective manner, and encouraging feed producers to seek sustainable approaches, including reducing reliance on imported products such as soymeal. China has also introduced measures to drive new legislative and regulatory solutions to better include insect protein and amino-acid based feed in their sub-markets.

China is at the forefront of APAC due to the country with the most livestock and with formal feed reforms in place. During 2023, the push to lower soymeal utilization below ten percent of total compound feed utilization which is fueling innovation. New Hope Liuhe are primed to develop solutions to grow in scale.

The North American region and the European region are also expected to grow well during the forecast period. As the demand for poultry as well as cattle is growing in the North American region the market will grow well during the forecast period. As there is a growth in the production of meat due to an increase in the demand for these products the compound feed market in the developed nations is also expected to grow well in the coming years. In Africa and the Middle East region the demand for compound feed will continue to grow due to a growing demand for animal products.

Why is North America Dominates the compound feed market?

North America is the largest compound feed market in the world, primarily because of its sophisticated livestock industry along with feed production capabilities and regulatory framework, as well as having incorporated precision nutrition and antibiotic-free feed formulations.

The United States is the primary force behind the North American presence, largely due to the volume of poultry and swine production. In 2022, The U.S. poultry sector produced more than 24 billion pounds of poultry, thus creating a sizeable demand for feed. Leading food companies, such as Cargill and Tyson Foods, have made significant investments and infrastructure in feed, and the USDA's support in funding livestock nutrition programs range from the fundamental to leading industry into the future's feed, thus expanding the U.S. role in global feed markets.

The European market for compound feed is growing steadily for a few reasons, including strict environmental regulations and a switch to sustainable and antibiotic-free formulations. For example, the EU's "Farm to Fork" plan, which allows EU member countries to be innovative in clean and traceable animal nutrition. With the continued rise of demand for high-quality and organic meat and dairy, compound feed development will only continue across the region.

Germany is the leader in the European compound feed market due to its robust dairy and pork production, the nation emphasizes strict standards regarding feed formulations and is more supportive towards enzyme-rich and eco-friendly formulations. Local producers are investing in alternative proteins and traceability technology to meet the EU's sustainability guidelines.

Value Chain Analysis

- Raw Material Procurement: Cereals, oilseed meals, vitamins, minerals, and other supplements are essential raw materials in the compound feed industry. Since price changes can have a direct impact on production costs, maintaining a consistent and reasonably priced supply is essential. To guarantee consistent quality and lessen reliance on imports, manufacturers are increasingly collaborating with regional suppliers.

- Retail Sales and Marketing: Feed is processed and formulated into different forms, like pellets or mash, to meet the nutritional needs of poultry, cattle, swine, and fish. Advanced technologies such as automated mixing and precision nutrition are improving product consistency and efficiency.

- Waste Management and Recycling: Reusing milling and processing byproducts as feed ingredients lowers waste and boosts cost effectiveness. To reduce its impact on the environment, the industry is progressively implementing sustainable production methods. For businesses looking to align with global sustainability goals, recycling and resource optimization have emerged as critical priorities.

Compound Feed Market Companies

- Cargill, Inc (US)

- ADM (US)

- ForFarmers (the Netherlands)

- Godrej Agrovet, Ltd (India)

- Hueber Feeds, LLC (US)

- Nor Feed (France)

- ARASCO (Saudi Arabia)

- JAPFA (Indonesia)

- Charoen Pokphand Foods (Thailand)

- New Hope Group (US)

- Land O' Lakes (US)

- Nutreco N.V (the Netherlands)

- Weston Milling Animal Group (Australia)

- Feed One Co. (Japan)

- Kent Nutrition Group (US)

- Elanco Animal Health (US)

- De Hues Animal Nutrition (the Netherlands)

- Muyuan Foodstuff Co., Ltd (China)

- Alltech, Inc (US)

- Guangdong Haid Group (China)

Recent Developments

- 11 March 2025, Kemin Industries introduced PROSIDIUM, a novel feed pathogen‑control solution for animal feed (poultry & swine) at VIV Asia 2025 in Bangkok, aimed at enhancing bio‑security in feed production. https://www.prnewswire.com

- 19 June 2025, ADM opened a new R&D centre in Lausanne, Switzerland, focusing on animal microbiome research for farm and companion animals, to support the development of tailored feed solutions.

https://www.adm-asia.com

Segments covered in the report

By Ingredients

- Feed Cereals

- Cakes & Meals

- Animal By-Products

- Supplements

- Others

By Source

- Plant-based

- Animal-based

By Form

- Mash

- Pellet

- Crumble

- Other

By Livestock

- Cattle

- Poultry

- Ruminants

- Swine

- Aquaculture

- Other

By Supplement

- Vitamins

- Antibiotics

- Antioxidants

- Amino Acids

- Enzymes

- Acidifiers

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting