Genetically Modified Feed Market Size and Forecast 2025 to 2034

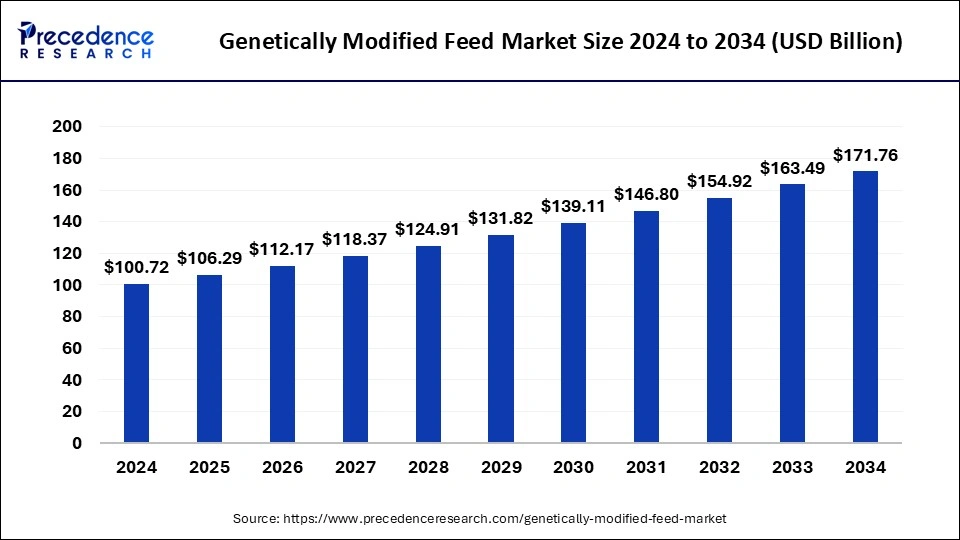

The global genetically modified feed market size was calculated at USD 100.72 billion in 2024 and is predicted to increase from USD 106.29 billion in 2025 to approximately USD 171.76 billion by 2034, expanding at a CAGR of 5.48% from 2025 to 2034. The rising demand for nutrient-rich food across the world is driving the growth of the genetically modified feed market.

Genetically Modified Feed Market Key Takeaways

- he global genetically modified feed market was valued at USD 100.72 billion in 2024.

- It is projected to reach USD 171.76 billion by 2034.

- The market is expected to grow at a CAGR of 5.48% from 2025 to 2034.

- North America led the market with the largest share in 2024.

- Asia-Pacific is expected to attain the fastest rate of growth during the forecast period.

- By source, the crops segment led the genetically modified feed market in 2024 and is expected to grow at the fastest rate.

- By form, the pellets segment dominated the market in 2024.

- By form, the meal/cake segment is expected to grow with the highest CAGR during the forecast period.

- By feed type, the concentrates segment held the largest share of the market in 2024.

- By feed type, the roughages segment is expected to grow with the fastest CAGR during the forecast period.

- By application, the poultry segment dominated the market in 2024.

Market Overview

The genetically modified feed market is one of the most important industries of the biotechnology industry. This industry mainly deals with developing hybrid crops to sustain the increasing demand for food across the world. There are several types of sources that mainly include crops such as corn, soybean, cottonseed, canola, alfalfa, and some others. The forms of genetically modified feed mainly include pellets, crumbles, mash, and meal/cake. There are two feed types: roughages and concentrates. Genetically modified feed has several applications, including poultry, swine, dairy, cattle, pet foods, and others. This industry is expected to grow exponentially with the growth in the genetic engineering sector.

- In March 2023, the English government passed the Genetic Technology (Precision Breeding) Act, which allows genetically modified food to be developed commercially in England.

Genetically Modified Feed Market Growth Factors

- The growing developments in the biotechnology sector are expected to drive the growth of the genetically modified feed market.

- The rising government initiatives for strengthening the genetic engineering industry have driven the market growth.

- The increasing number of patients suffering from chronic kidney disorders across the world fosters market growth.

- The increase in funding from public and private sector entities for developing hybrid crops propels the market growth.

- The rising demand for genetically modified crops across the world boosts the genetically modified feed market growth to some extent.

- Increasing demand for poultry-based products is expected to boost the market growth.

- The rising advancements in genome editing technologies across the world boost the market growth.

- The ongoing research and development activities related to genetically modified organisms (GMOs) have impacted the market growth positively.

- The rising application of genetically modified seeds for biofuel production across the world is driving genetically modified feed market growth.

- The growing advancements in agricultural biotechnology have boosted the market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 171.76 Billion |

| Market Size in 2025 | USD 106.29 Billion |

| Market Size in 2024 | USD 100.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.48% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Form, Feed Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for GM feed for additional nutrient value

Food habits around the world have changed rapidly with the advancements in the biotechnology sector and its related fields. Nowadays, the demand for multi-nutrient-based food products is increasing. The developments in genetically modified crops have allowed the development of food products with numerous benefits that provide several advantages for people. For instance, the demand for genetically modified soybeans and corn has increased as they provide added benefits that are not found in conventional soybeans or corn.

Moreover, several companies are engaged in research and development of genetically modified crops with added nutritional value to grab maximum customer attention. Thus, the growing demand for GM feed due to its added value is expected to drive the growth of the genetically modified feed market.

- In June 2023, Bayer AG announced that its genetically modified corn had received approval from the USDA's Animal and Plant Health Inspection Service (APHIS) across the North American region.

Restraint

Side effects and testing methodologies

The application of genetically modified feed has gained traction in recent times. Although there are several advantages to genetically modified crops, there are also several problems associated with them. Firstly, the testing methodologies of some genetically modified crops are not conducted at various levels of testing that make them suitable for commercial use. Secondly, there are several side effects associated with genetically modified food products, including allergic reactions, antibiotic resistance, immune suppression, and others. Thus, the absence of proper testing methodologies, along with side effects associated with the consumption of genetically modified food, is likely to restrain the growth of the genetically modified feed market during the forecast period.

Opportunity

Integration of AI in genetic engineering

The applications of AI have increased rapidly in the fields of genetic engineering due to its ability to provide accurate results and processing methodologies associated with it. Recently, the integration of AI has been done in genetic engineering to get superior outcomes and the development of protein-based crops. Thus, the growing integration of AI technology in bioinformatics research activities is expected to create ample growth opportunities for genetically modified feed market players in the future.

- In February 2024, the researchers of KAUST Bio-Ontology Research Group launched an innovative AI tool. This innovative AI tool is named as ‘DeepGO-SE'. DeepGO-SE helps in the prediction of the functions of unknown proteins, which further helps in protein engineering for developing high-grade genetically modified foods.

Source Insights

The crops segment held the largest market share in 2024 and is expected to continue its dominance during the forecast period. The crops segment is divided into several types, including corn, soybean, cottonseed, canola, alfalfa, and others. The demand for genetically modified crops has increased due to the increase in population across the world, boosting market growth. Also, genetically modified crops come with several benefits, including high nutrition, less pesticide use, disease and drought resistance, faster growing of crops, and some others, which are likely to drive the growth of the genetically modified feed market.

- In May 2024, the government of China approved the use of genetically modified wheat due to its superior features, such as resistance to pests and herbicides.

The fruits and vegetables segment is expected to grow at a significant rate during the forecast period. This segment mainly consists of genetically modified papaya, potato, eggplant, and some others. The growing advancements in gene cloning technologies and the rising demand for nutrient-rich vegetables are driving the market growth. Moreover, the rising emphasis of government organizations on developing genetically modified vegetables and fruits with added benefits is likely to drive the growth of the genetically modified feed market.

- In March 2023, the Genetic Engineering Appraisal Committee (GEAC) of India announced the beginning of the trials of two more genetically modified (GM) food crops, including potato and banana.

Form Insights

The pellets segment dominated the market in 2024. The growing developments in the palletization processes, along with the rising focus on sustainability, are driving the market growth. Moreover, the rising application of pellets in power generation, industrial heating, commercial and domestic heating, and some others has driven the market growth. Also, the growing demand for wood pellets for clean energy generation is likely to boost the growth of the genetically modified feed market.

- In April 2024, Japan Petroleum Expansion Co. Ltd. (JAPEX) announced that it would deliver 25,000 metric tons of wood pellets to the Ozu Biomass Power Plant at the Nagahama Port in Japan.

The meal/cake segment is expected to grow with the highest CAGR during the forecast period. The growing demand for soya de-oiled cake as an organic supplement, along with its usage in the poultry industry as a protein and micronutrient, is driving the market growth. Moreover, the shortage of soy feed across several countries such as India, Canada, the U.S., and some others has increased the import activities for genetically modified soy meal/cake, thereby driving the growth of the genetically modified feed market.

- In May 2022, the government of India announced the import of around 550,000 metric tons of genetically modified (GM) soymeal to develop the poultry industry in India.

Feed Insights

The concentrates segment held the largest share of the market in 2024. The growing demand for genetically modified concentrates due to their high protein content and less fiber is driving the market growth. Moreover, the rising application of concentrates such as genetically modified oil cakes, cereal grains, and cotton seeds for cattle feeds has driven the growth of the genetically modified feed market. Also, the ongoing research and developmental activities related to the research and development of genetically modified feeds are boosting the market growth to some extent.

The roughages segment is expected to grow at the fastest rate during the forecast period. The demand for cattle rearing as a primary occupation across the world has increased the demand for genetically modified roughages, thereby driving the market growth. Moreover, the rising application of roughages in animal feed ingredients, along with the increasing demand for genetically modified roughages as they improve the rumen function in cattle, is boosting the growth of the genetically modified feed market.

Application Insights

The poultry segment dominated the market in 2024 and is expected to continue its dominance during the forecast period. The growing demand for broiler chicken as a meat product across the world has driven market growth. Moreover, the rising application for egg-related items has increased the demand for genetically modified eggs, thereby driving market growth. Also, the rising demand for genetically modified ducks, turkeys, and geese due to their additional nutritional values has boosted the growth of the genetically modified feed market.

- In May 2023, scientists at Hiroshima University in Japan developed genetically modified allergen-free eggs that can be consumed by people suffering from egg white allergies.

The cattle segment is expected to grow in the market during the forecast period. The growing demand for dairy products such as milk, ghee, and paneer across the world has increased the demand for genetically modified cattle, thereby driving the market growth. Moreover, the growing trend of precision livestock farming, along with rising demand for cattle meat in Western countries, has driven the market growth. Also, rising advancements in genetic engineering, along with developments of transgenic cattle with superior qualities, are likely to drive the growth of the genetically modified feed market.

- In March 2024, various scientists from several institutions in Brazil and the U.S. developed a transgenic cow that delivers milk with proinsulin and insulin, which is highly valuable for patients suffering from diabetes.

Regional Insights

North America held the largest genetically modified feed market share in 2024. The market's growth in the North American region is mainly driven by rising government investment in developing the biotechnology sector in countries such as the U.S., Canada, Mexico, and others. The rising developments in genetic engineering, along with advancements in technologies related to biotechnology, are driving the market growth in this region. Also, there are several research institutes related to the research and development of genetically modified feed, which in turn has driven the market growth. Moreover, the rising awareness of people regarding genetically modified crops increases the demand for genetically modified feeds, thereby driving market growth.

Moreover, the presence of several local market players such as Monsanto, Stine Seed, Corteva, and some others are constantly engaged in developing genetically modified feeds and adopting several strategies such as launches, joint ventures, and business expansions, which in turn drives the growth of the genetically modified feeds market in this region.

- In September 2022, the U.S. government announced that it would invest around US$ 2 billion to strengthen the biotechnology sector across the U.S. region.

- In September 2022, Norfolk Plant Sciences announced that the U.S. Department of Agriculture (USDA) and Plant Health Inspection Service (APHIS) had approved the genetically modified tomato of Norfolk Plant Sciences for commercial use in the U.S.

- In July 2023, Stine Seed Company announced to expand its retail outlet in Canada. This new retail outlet will be opened in Ontario, Canada and will deal in genetically manufactured soybean and corn across the North American region.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growing demand for dairy products and broiler chicken has boosted the market growth. Also, rising investments by new startup companies for developing genetically modified crops along with growing interest of people towards genetically modified brinjal, banana, tomato, and maize in India, Japan, China, Singapore, Australia, Thailand, and others is driving the market growth.

Also, the government of several countries such as India, China, Japan, and others have increased their emphasis on developing genetically modified crops with added nutritional value, which in turn drives the market growth. For instance, in December 2022, the government of India urged several biotech research institutions to develop genetically modified seeds for 13 important crops, including rice, wheat, and sugarcane, with improved yield and quality.

Moreover, there are several local companies such as Maharashtra Hybrid Seed Company (MAHYCO), JK Agri Genetics, Origin Agritech Ltd, Kanematsu Corporation, and some others are constantly engaged in developing home dialysis systems and adopting several strategies such as launches, joint ventures, and acquisitions, which in turn drives the growth of the genetically modified feeds market in this region.

- In April 2024, the Queensland University of Technology (QUT) of Australia approved QCAV-4 for commercial use. QCAV-4 is a genetically modified (GM) variety of Cavendish bananas that is resistant to fungal disease.

- In June 2024, Origin Agritech Ltd. announced the launch of a new gene-editing technology for producing high-grade varieties of genetically modified maize, corn, soybeans, and wheat in China.

Recent Developments

- In October 2023, the government of China approved several crop varieties. The crop varieties include genetically modified varieties of soybean and corn for commercial use after numerous years of trials.

- In October 2023, Syngenta Seedcare announced it would expand its operation in Maintal, Germany. This service center will focus on providing biological seed treatment solutions across the EU region.

- In September 2023, BASF launched a new tomato hybrid in Brazil. This new variety is named Nunhems, which is resistant to the Tomato Brown Rough Virus (ToBRFV).

- In March 2023, Corteva Agriscience announced the launch of a new gene-editing technology for developing corn hybrids in North America.

- In July 2022, AgbioInvestor launched a new tool for developing genetically modified crops. This new tool allows researchers to access information regarding the current GM crop situation, recognize trends, and make productive decisions for the future while developing genetically modified crops.

Genetically Modified Feed Market Companies

- DuPont

- Dow

- BASF

- Bayer

- Syngenta

- Monsanto

- Corteva Agriscience

- R.Simplot Company

- Okanagan Specialty Fruits Inc

- J.R. Simplot Company

Segments Covered in the Report

By Source

- Crops

- Corn

- Soybean

- Cottonseed

- Canola

- Alfalfa

- Others

- Fruits & Vegetables

- Papaya

- Potato

- Eggplant

- Others

By Form

- Pellets

- Crumbles

- Mash

- Meal/Cake

By Feed Type

- Roughages

- Concentrates

By Application

- Poultry

- Layer

- Broiler

- Turkey

- Others

- Swine

- Grower

- Starter

- Sow

- Cattle

- Dairy

- Calf

- Others

- Aquaculture

- Carp

- Trout

- Salmon

- Shrimp

- Others

- Pet Food

- Dogs

- Birds

- Cats

- Fish

- Equine

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting