Condensing Unit Market Size and Forecast 2025 to 2034

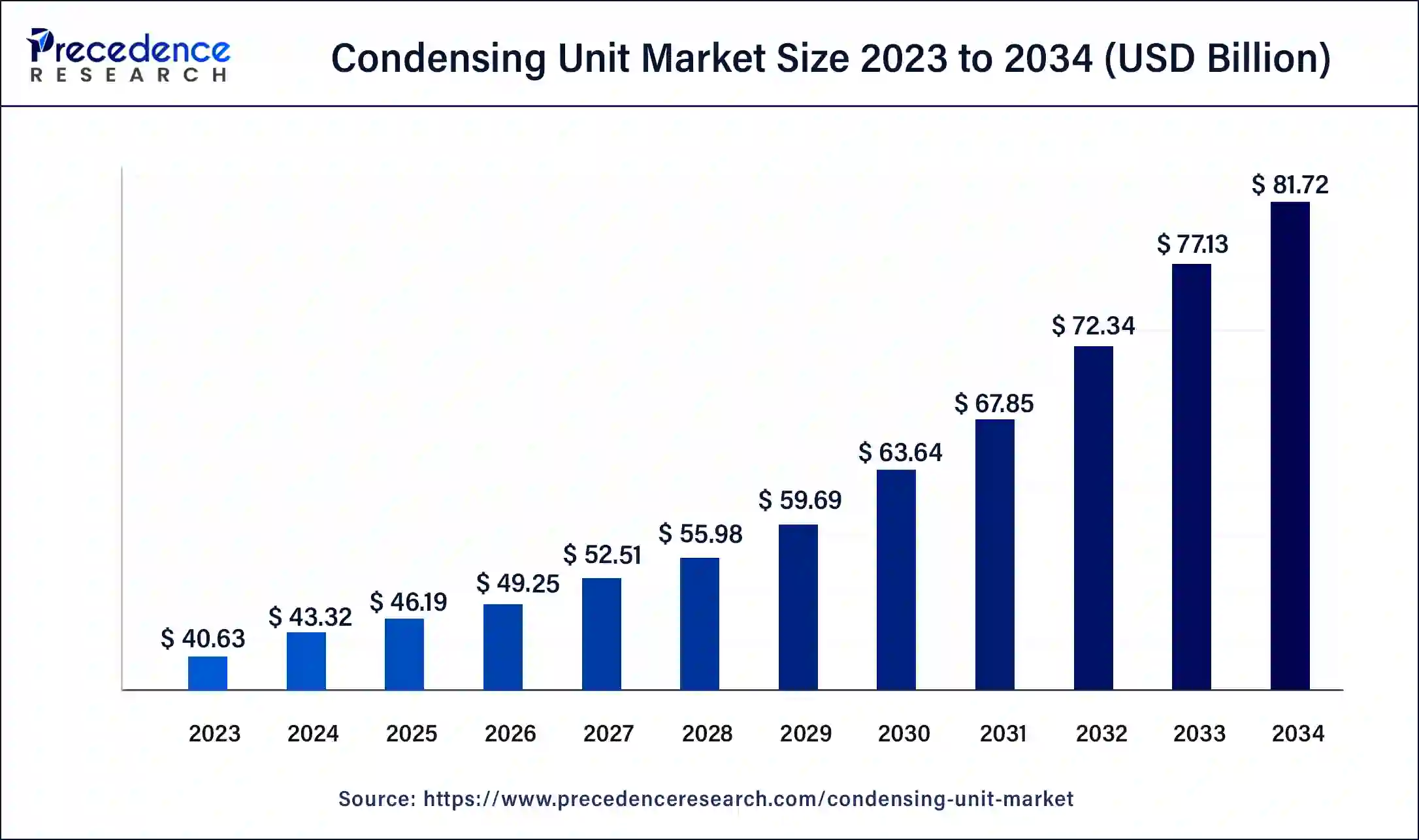

The global condensing unit market size is valued at USD 46.19 billion in 2025 and is predicted to increase from USD 49.25 billion in 2026 to approximately USD 81.72 billion by 2034, growing at a CAGR of 6.55% from 2025 to 2034. In a number of industries, including food and beverage, pharmaceuticals, healthcare, and retail, there is an increasing demand for refrigeration and air conditioning systems due to urbanization, industrialization, and commercialization.

Condensing Unit Market Key Takeaway

- The global condensing unit market was valued at USD 43.32 billion in 2024.

- It is projected to reach USD 81.72billion by 2034.

- The condensing unit market is expected to grow at a CAGR of 6.55% from 2025 to 2034

- Asia Pacific is expected to be the market leader during the forecast period.

- By application, the industrial segment held the largest share of the market in 2024.

- By application, the commercial segment is expected to gain a considerable share during the forecast period.

- By type, the air-cooled segment held the largest share of the market.

- By type, the evaporative condensing unit is expected to grow rapidly during the forecast period.

- By function, the air conditioning segment held the dominant share of the market and is expected to grow further during the forecast period.

- By function, the heat pump segment is expected to grow rapidly during the forecast period.

Market Overview

Global rules pertaining to energy efficiency have been pushing up demand for condensing units, especially those with high-efficiency ratings. Condensing units are essential components of air conditioning and refrigeration systems, and as energy efficiency rises in importance, both consumers and companies are looking for more effective solutions. More ecologically friendly and energy-efficient choices are now available because of technological developments in condensing unit design and components. Producers are always coming up with new ideas to create devices that work better, use less energy, and have a smaller environmental effect. One of the main industries driving the condensing unit market is the heating, ventilation, air conditioning, and refrigeration (HVACR) sector. Condensing unit demand rises in tandem with the expansion of the construction industry and the rising need for HVACR systems in the residential, commercial, and industrial domains.

The food service sector greatly depends on refrigeration to maintain the freshness and quality of its food. The need for refrigeration equipment, particularly condensing units used in commercial refrigeration systems, is rising in tandem with the worldwide food service industry's rise. The need for refrigeration equipment, including condensing units, is being driven by the growth of cold chain logistics, especially in the food and pharmaceutical industries. Condensing unit sales are expected to rise significantly as cold chain logistics protect temperature-sensitive goods during storage and transit. The need for replacements of older condensing units is rising as they approach the end of their useful lives or become out of compliance with new regulations.

Condensing Unit Market Growth Factors

- The need for air conditioning and refrigeration systems is directly correlated with the need for condensing units. The need for condensing units rises as a result of rising global temperatures and a growth in urbanization, which increases the need for air conditioning and refrigeration in the residential, commercial, and industrial sectors.

- Growth in the condensing unit market is mostly driven by technological advancements, including the creation of more energy-efficient units, intelligent control systems, and environmentally friendly refrigerants. Manufacturers draw in customers and companies who want to modernize their systems with their continuous innovation efforts to increase efficiency, dependability, and environmental sustainability.

- Energy-efficient condensing unit adoption is being driven by government legislation and programs aiming at decreasing greenhouse gas emissions and boosting energy efficiency. The adoption of high-efficiency units is encouraged by compliance with standards like Energy Star in the United States and comparable legislation elsewhere, driving market expansion.

- The need for trustworthy refrigeration systems is fueled by strict food safety laws, particularly in the food and beverage sector. Condensing units are essential parts of refrigeration systems used to store and preserve food, and as rules tighten, there is a growing need for units that are both efficient and compliant.

- The cold chain logistics sector is growing quickly due to the increased demand for perishable commodities and the globalization of food supply chains. The need for refrigeration equipment in this industry is driven by the necessity of condensing units to maintain proper temperature conditions throughout the transportation and storage of perishable goods.

- Condensing units are in more demand as a result of rising disposable incomes and rising living standards in emerging nations, which raise consumer expenditure on appliances like refrigerators and air conditioners.

Condensing unit market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the increasing sales of air-cooled refrigeration solutions coupled with rise in number of residential constructions across the world.

- Major Investors: Several market players and strategic investors are actively entering this market, drawn by joint ventures, R&D and business expansion. Numerous condensing unit brands such as Heatcraft Refrigeration Products LLC, BITZER SE, SCM Frigo S.p.A. and some others have started investing rapidly for manufacturing high-quality cooling systems for numerous industries.

- Startup Ecosystem: Numerous startup brands are engaged in developing condensing units for end-user industries. The prominent startup companies dealing in condensing unit comprises of Phononic, SkyCool, BrainBox AI and some others.

Condensing Unit Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.55% |

| Market Size in 2026 | USD 49.25 Billion |

| Market Size in 2025 | USD 46.19 Billion |

| Market Size by 2034 | USD 81.72 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Function, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

HVAC system upgrades and retrofits

In the condensing unit market, energy-efficient components are frequently given priority in HVAC system renovations due to the growing emphasis on sustainability and energy conservation. There is a demand for condensing units with high Energy Efficiency Ratio (EER) and Seasonal Energy Efficiency Ratio (SEER) ratings. Condensing unit replacement may be necessary when retrofitting conventional HVAC systems with VRF technology in order to make room for the new system architecture. Condensing units that have been upgraded with quieter fan and compressor technologies can enhance occupant comfort, particularly in homes and businesses where noise pollution is an issue. Modular and scalable condensing unit designs allow flexibility for system extension or change. Modular condensing units can be retrofitted into existing HVAC systems to simplify upgrades and future-proof installations.

Restraint

Fluctuating raw material prices

The condensing unit market the heat pump segment is expected to grow rapidly during the forecast period. may be significantly impacted by changes in the price of raw materials. Condensing units usually consist of a number of different parts composed of steel, aluminum, copper, and plastics. Price fluctuations for these raw materials have the potential to have a direct impact on condensing unit production costs, which could then have an impact on pricing, profit margins, and market competitiveness as a whole.

The condensing unit market may see price volatility as a result of fluctuating raw material prices. Manufacturers may periodically modify their prices to account for variations in the cost of materials, which may have an effect on consumer demand and purchase decisions. The procurement of materials at stable costs can provide difficulties for manufacturers, and price changes can cause delays that affect production schedules and delivery timeframes.

Opportunity

HVACR industry growth

Condensing units with better energy efficiency ratings are in high demand as sustainability and energy efficiency become more and more important. In order to increase efficiency in the condensing unit market, manufacturers are coming up with innovative ways to create units with better controls, better heat exchangers, and more sophisticated compressor technology. The integration of smart controls and Internet of Things (IoT) technologies into condensing units enables performance optimization, predictive maintenance, and remote monitoring. Replacement HVACR systems are becoming more and more popular as older models approach the end of their useful lives. In order to save running expenses and improve performance, many businesses are updating to newer, more efficient condensing units.

Application Insights

The industrial segment held the largest share of the condensing unit market in 2024. The need for condensing units rises as industrial operations spread throughout the world, and the requirement for refrigeration rises in a number of industries, including chemicals, food and beverage, and pharmaceuticals. Effective and dependable refrigeration systems are required in industrial settings due to regulatory requirements for food safety, product quality, and environmental standards, which drive the development of modern condensing units. Energy efficiency is becoming a top priority for industrial buildings in an effort to cut expenses and lessen their environmental effect. In this market, energy-efficient condensing units with features like sophisticated controls and variable-speed compressors are preferred. Industrial condensing units usually have features like robust construction to endure hard operating conditions and easy access for maintenance.

The commercial segment is expected to gain a considerable share during the forecast period. Condensing units are used in a variety of commercial applications, including cold storage warehouses, restaurants, grocery stores, convenience stores, and other commercial enterprises. This is known as the commercial portion of the condensing unit market. By compressing and condensing refrigerant vapor into liquid form, condensing units play a critical part in the refrigeration process. This liquid is then circulated throughout the refrigeration system to remove heat from the enclosed space. Condensing units are found in many types of refrigeration equipment, such as beverage coolers, ice makers, walk-in coolers, display cases, and chilled transport trucks. These units are made to offer dependable and effective cooling solutions to protect perishables, keep food safe at the right temperature, and guarantee the quality of the product.

Type Insights

The air-cooled segment holds the largest share of the condensing unit market. In the market for condensing units, the term "air-cooled" refers to a particular kind of unit that employs air as a cooling medium to extract heat from the refrigerant. The refrigerant in these units changes phases from gas to liquid, releasing heat throughout the process. A fan or fans are then used to release this heat into the surrounding air. Commercial, industrial, and residential air conditioning systems, as well as refrigeration systems, frequently employ air-cooled condensing units. They do not need a water source for cooling, which makes them popular in applications where water quality or availability is an issue.

The evaporative condensing unit is expected to grow rapidly during the forecast period. In the market for condensing units, evaporative condensing units play a big role, particularly in sectors where effective cooling is crucial. These units are especially well-suited for usage in high-temperature situations or in systems where water conservation is a concern since they take advantage of the principle of evaporative cooling to increase the condensation process' efficiency. Compared to conventional air-cooled systems, evaporative condensing units provide a number of benefits. They often run at lower condensing temperatures, which lowers running costs and increases energy efficiency. They can assist companies in meeting regulatory standards and reducing their carbon footprint without sacrificing efficiency.

Function Insights

The air conditioning segment held the dominant share of the condensing unit market and is expected to grow further during the forecast period. Condensing units made especially for air conditioning systems are usually referred to as belonging to the air conditioning category. These units, which remove heat from the refrigerant gas and return it to a liquid state, are an essential part of air conditioning systems. Numerous condensing units in the air conditioning category may be labeled with their energy efficiency ratings, such as SEER (Seasonal Energy Efficiency Ratio) in the United States or EER (Energy Efficiency Ratio) in other regions, due to the growing emphasis on energy efficiency and environmental concerns. Condensing systems designed for particular uses, like server room cooling or precision cooling for lab or medical settings, may occasionally be found.

The heat pump segment is expected to grow rapidly during the forecast period. Due to its adaptability and energy efficiency, heat pumps are becoming more and more popular in the condensing unit industry. Because they may be used for both heating and cooling purposes, condensing units with integrated heat pumps are appropriate for a variety of situations, including commercial, industrial, and residential ones. These units function by employing a refrigerant to transport heat from one location to another. They can be used for cooling purposes by taking heat from inside air or heating purposes by taking heat from outside air, even in cold weather. Heat pump condensing units are becoming more and more popular in a variety of sectors due to improvements in heat pump technology that have raised efficiency and performance.

Regional Analysis

Asia Pacific is expected to be the market leader in the condensing unit market during the forecast period. Numerous factors, including accelerating urbanization and industrialization, as well as the rise of the cold chain logistics industry, are responsible for this growth. The need for efficient condensing units has increased due to the growing need for refrigeration and air conditioning systems across a variety of industries, including food and beverage, pharmaceuticals, and healthcare. Due to their sizable populations and developing economies, nations like China, India, Japan, and South Korea are the main drivers of the market's expansion in the area.

North America is observed to grow at a notable rate in the condensing unit market. This is mostly due to factors including the rising demand for air conditioning and refrigeration systems in the residential, commercial, and industrial sectors. The market is defined by the existence of major businesses that provide a broad array of goods suitable for different uses. The use of low-GWP (Global Warming Potential) and sustainable refrigerants is being driven by consumer preferences and environmental restrictions, which is forcing manufacturers to create eco-friendly substitutes and enhance their product lines. Condensing units are becoming more and more in demand as the food retail industry grows and the necessity for cold chain logistics services and dependable refrigeration solutions increases.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The increasing demand for high-quality air-conditioners in numerous countries such as Germany, France, Italy, UK and some others has boosted the market expansion. Additionally, rapid investment by market players for opening up new HVAC manufacturing centers is expected to propel the growth of the condensing unit market in this region.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The growing adoption of heat pumps and refrigeration systems by the healthcare companies in Argentina and Brazil has boosted the market expansion. Also, partnerships among electric brands and heavy industries for developing a wide range of condensing units is expected to drive the growth of the condensing unit market in this region.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The rising sales of advanced HVAC systems in numerous countries such as UAE, Saudi Arabia, South Africa and some others has driven the market growth. Additionally, numerous government initiatives aimed at deploy high-quality air-conditioning systems in the commercial sector is expected to boost the growth of the condensing unit market in this region.

Value-Chain Analysis

- Raw Material Procurement

The raw materials for a condensing unit primarily include metals such as copper, aluminum, and stainless steel for the condensing units (coils, fins, and tubes), as well as plastics and other materials for the casing and fan.

Key Companies: BHP Group, Freeport-McMoRan, Rio Tinto and others. - Testing and Quality Control

The testing and Quality Control (QC) of a condensing unit involves rigorous procedures throughout the manufacturing process and post-installation, focused on safety, performance, efficiency, and structural integrity.

Key Companies: Qualitest,Intertek, Bureau veritas and others. - Distribution Channel

The distribution channel for a condensing unit is a multi-step process that primarily uses an indirect distribution model due to the technical nature of the product, the need for specialized installation, and after-sales service.

Key Companies: BITZER SE, SCM Frigo S.p.A, Carrier Global Corporation and others.

Key Players: Developing condensing units for end-users

- Emerson Electric Co.: Emerson Electric Co. is a global technology and software company headquartered in St. Louis, Missouri, that provides advanced automation solutions for industrial, commercial, and residential sector.

- Carrier Global Corporation: Carrier Global Corporation is an American multinational company headquartered in Palm Beach Gardens, Florida, that provides intelligent climate and energy solutions. This company is a global leader in heating, ventilation, air conditioning (HVAC), refrigeration, and fire & security equipment.

- Danfoss: Danfoss is a global engineering company that provides a wide range of technologies for refrigeration, air conditioning, heating, motor control, and mobile machinery. The company's solutions are designed to increase machine productivity, lower energy consumption, and reduce emissions, helping to meet growing needs for infrastructure, food supply, and climate-friendly solutions.

- GEA Group Aktiengesellschaft: GEA Group Aktiengesellschaft is a German-based global technology company that provides systems and components for the food, beverage, and pharmaceutical industries. The company offers a wide range of products such as machinery and advanced process technology.

- Heatcraft Refrigeration Products LLC: Heatcraft Refrigeration Products LLC is a major North American manufacturer of commercial refrigeration equipment such as evaporators, condensing units, and walk-in coolers.

- BITZER SE: BITZER SE is a German manufacturer of refrigeration and air conditioning technology, headquartered in Sindelfingen. The company provides a wide range of products, including various compressors, heat exchangers, and pressure vessels in different parts of the world.

Recent Developments

- In February 2024, Panasonic Europe introduced a new 20HP CO2 (R744) outdoor condensing unit designed for supermarkets and industrial process cooling to the European market. The 20 HP unit adds to the company's current line of 2 HP, 4 HP, and 10 HP CO2 outdoor systems and provides support for applications involving process cooling and food retail, such as blast chillers, walk-in cold rooms, freezers, and chilled and low-temperature display cases.

- In April 2024, Blue Star, a manufacturer of cooling goods, stated that it wants to reach 15% of the home air conditioner market by FY25. At the moment, the corporation has about 14% market share. According to Blue Star's MD, B Thiagarajan, the company witnessed record air conditioner sales in March and plans to surpass 1.1 million units sold in FY24. He stated that he anticipates the market will expand by at least 20%, sharing summer demand.

- In June 2025, Panasonic Corporation announced to open a condensing business unit in Europe. This new manufacturing center is inaugurated to develop a wide range of condensing units for the consumers of this region.

(Source: https://news.panasonic.com ) - In July 2025, Embraco partnered with FIR. This partnership is done for launching a condensing unit named ‘Bioma+'.

(Source: https://www.embraco.com ) - In February 2025, Daikin launched ERA condensing units. ERA Condensing Units is designed to provide energy-efficient climate control by using the lower Global Warming Potential (GWP) refrigerant R-32.

(Source: https://refindustry.com )

Segment Covered in the Report

By Type

- Air-cooled

- Water-cooled

- Evaporative condensing unit

By Application

- Industrial

- Commercial

- Transportation

By Function

- Air-Conditioning

- Refrigeration

- Heat Pumps

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting