What is the Continence Care Market Size?

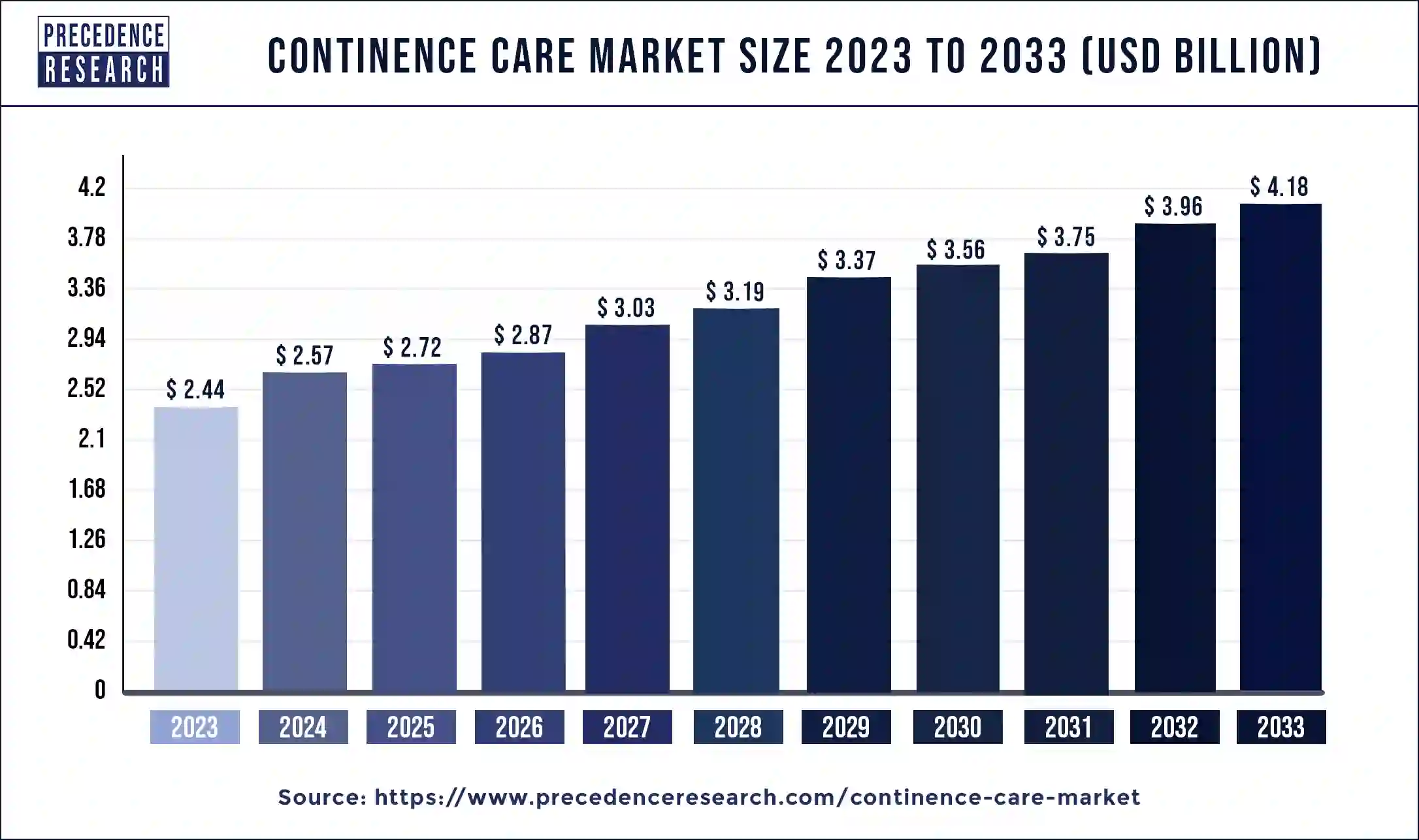

The global continence care market size is valued at USD 2.72 billion in 2025 and is predicted to increase from USD 2.87 billion in 2026 to approximately USD 4.39 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034. Urinary incontinence and other bladder-related problems are becoming more common as the world's population ages, this factor is observed to drive the growth of the market.

Continence Care Market Key Takeaways

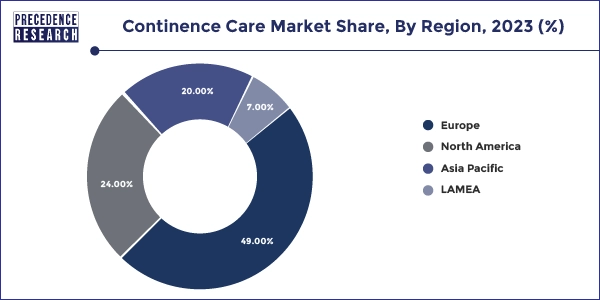

- Europe led the market with the largest revenue share of 49% in 2024.

- Asia Pacific is observed to grow at a notable rate during the forecast period.

- By product, the urinary catheters segment has captured the biggest revenue share of 54% in 2024.

- By application, the diabetes segment has held the major revenue share of 27% in 2024.

- By application, the spinal cord injury segment is expected to grow at a significant rate during the forecast period.

- By bag usage, the sterile segment accounted for the revenue share more than 66% in 2024.

- By end-use, the home care settings segmen held the largest share of the market in 2024.

Market Overview

The continence care market is growing steadily, and projections for the upcoming years predict this growth will continue with the rising demand especially for home-health care settings. Catheters (such as intermittent, indwelling, and external catheters), absorbent products (like adult diapers, pads, and liners), and other products (like pelvic floor stimulators, disposable underwear, and drainage bags) make up the market for continence care products. Geographical analysis of the market revealed that the central regions driving continence care market's expansion were North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Manufacturers in the market are concentrating on creating more sustainable and ecologically friendly products to satisfy the rising demand for eco-friendly solutions. Initiatives to raise consumer and healthcare professional awareness and educate caregivers about the value of continence management, available treatments, and appropriate product selection and use have become increasingly important.

Continence Care Market Growth Factors

- The older population is more prone to incontinence, which increases the demand for continence care goods and services. The continence care market is growing due to patients' and healthcare professionals' increased knowledge of incontinence and the available management choices.

- Increased diagnosis rates and practical continence management strategies result from this awareness. Technological developments have produced novel items for continence care that are more effective, discrete, and comfortable.

- The continence care market is expanding because of increased healthcare spending, especially in areas with aging populations and developing healthcare infrastructure. The rise of the industry is further facilitated by investments made by public and private payers in healthcare facilities and payment schemes for continence management.

- Urinary and fecal incontinence can be caused by long-term medical illnesses such as diabetes, obesity, and neurological abnormalities. The increasing global prevalence of these disorders further drives the need for products and services related to continence care.

- Products that help people manage their conditions in the comfort of their homes, such as continence care kits, are in greater demand as people choose home-based treatment over institutional settings. The need for home-based continence management systems is growing due to this trend.

Continence care market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the increasing prevalence of urine infections among the people coupled with technological advancements in the healthcare sector.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and business expansions. Various continence care brands such as B. Braun SE, Hollister Incorporated, Convetec Group PLC and some others have started investing rapidly for developing high-quality products to enhance urine treatment sector.

- Startup Ecosystem: Numerous startup companies are engaged in manufacturing advanced products for the medical sector. The crucial startup brands dealing in continence care includes Axonics, NeuSpera Medical, Amber Therapeutics and some others.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.5% |

| Market Size in 2025 | USD 2.72 Billion |

| Market Size in 2026 | USD 2.87 Billion |

| Market Size by 2034 | USD 4.39 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, By Bag Usage, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver: Rising emphasis on healthcare standards

Innovations in continence care have been made possible by the ongoing technological progress. This covers, among other things, enhanced absorbent materials, wearable monitoring devices, and sophisticated catheters. The importance of teaching patients and caregivers about difficulties related to continence, accessible therapies, and preventive measures has increased. This raised awareness aids in the early diagnosis and treatment of disorders about continence. Creating and applying clinical guidelines and quality standards guarantee that medical professionals provide evidence-based therapy for continence management. Thereby, the rising emphasis on healthcare standards creates a significant driver for the continence care market.

Restraint: Stigma and societal taboos

Because incontinence is such a delicate condition, discretion and dignity are frequently highlighted in creating and promoting continence care products. To reduce customer shame or discomfort, companies in this industry heavily spend on making discrete, comfortable, and effective devices. The views of healthcare professionals may also influence the stigma associated with incontinence in the continence care market. Underdiagnosis and undertreatment may result from people who do not prioritize the issue during medical consultations or who do not take it seriously. Social taboos and stigmas can impact how innovatively continuous care items are developed. Businesses may be reluctant to spend money on R&D in this field because they believe there is little market potential or worry about how well-received by consumers.

Opportunity: Telemedicine and digital health solutions

Telemedicine dispenses with the requirement for in-person consultations by enabling patients to consult with medical professionals remotely. Patients can use video conferencing or messaging services to discuss their continence problems, get advice, and even have virtual examinations. All-inclusive digital health platforms provide options for managing continence. These platforms might include telemedicine consultations, tailored care plans, instructional materials, and symptom tracking.

To receive ongoing support and have their treatment plans modified, patients can keep track of their progress over time and connect with medical specialists. Advanced analytics methods used for this data analysis can assist in spotting trends, forecasting exacerbations or consequences, and customizing interventions to meet the needs of specific patients. The administration of continence care is made more effective by this data-driven strategy.

Product Insights

The urinary catheters segment held the largest share in the continence care market. The market for urinary catheters makes up a sizeable portion of the continence care sector, which also includes goods and services for treating disorders such as urine incontinence. Medical devices called urinary catheters are used to remove urine from the bladder when a patient cannot do it on their own because of various illnesses or surgeries. Numerous kinds of urinary catheters can be used, such as suprapubic, indwelling (Foley), external (condom), and intermittent catheters. Every kind is made to fit a particular patient's demands and circumstances. Due to several causes, including an aging population, an increase in the prevalence of urine incontinence, technological breakthroughs in catheter design, and increased awareness of continence management, the continence care market, including urinary catheters, has grown significantly.

Urinary catheter technology has advanced, creating more user-friendly, cozy, and infection-resistant devices. Hydrophilic-coated catheters, for instance, lessen friction during insertion and withdrawal, improving patient comfort. Urinary catheters that are simple to use and maintain at home are in greater demand as home healthcare services become more prevalent. For example, individuals who support their bladder function at home frequently utilize intermittent catheters. Catheter use is connected with a substantial risk of urinary tract infections (UTIs). To lower the risk of infections, there is a rising focus on designing catheters with antimicrobial coatings or materials.

Application Insights

The diabetes segment led the continence care market in 2024. Diabetes is a widespread chronic condition affecting millions globally. As the number of individuals with diabetes increases, the prevalence of associated complications, such as urinary incontinence and neuropathy, also rises. These complications often necessitate the use of continence care products. One common complication of diabetes is diabetic neuropathy, which can lead to bladder dysfunction. This condition often results in urinary incontinence, making continence care products essential for many diabetic patients. Modern lifestyles, characterized by poor diet and lack of exercise, contribute to the rising incidence of diabetes. This, in turn, boosts the need for continence care as complications arise from poorly managed diabetes.

The spinal cord injury segment is expected to grow at a notable rate in the continence care market during the forecast period. Technological advancements and improvements in the design and functionality of continence care products have made it easier for SCI patients to manage their condition. Innovations such as intermittent catheters, hydrophilic catheters, and advanced drainage systems enhance the quality of life for these individuals, driving market growth. A significant proportion of individuals with spinal cord injuries experience bladder dysfunction. Neurogenic bladder, a common condition following SCI, leads to issues such as urinary incontinence, retention, and frequent urinary tract infections, necessitating the use of continence care products like catheters, drainage bags, and other related devices.

Bag-usage Insights

The sterile bag-usage segment dominated the continence care market in 2024. Sterile bags are crucial in preventing infections, a significant concern for individuals requiring continence care. These bags are designed to maintain a sterile environment, reducing the risk of urinary tract infections (UTIs) and other complications, which is a major priority in healthcare settings.

Sterile bags are typically user-friendly, making them a convenient option for both healthcare providers and patients. Their design often includes features that facilitate easy and hygienic handling, reducing the complexity of continence care.

End-use Insights

The home care settings segment led the continence care market in 2024. Many individuals with incontinence issues prefer the privacy and comfort of their homes for managing their condition. Home care settings offer a more dignified and personalized approach to continence care, which is a significant factor driving this market segment.

There has been an expansion of home healthcare services that provide support for individuals with incontinence. These services include nurse visits, telemedicine consultations, and the delivery of continence care products, making home care a viable and attractive option.

Regional Insights

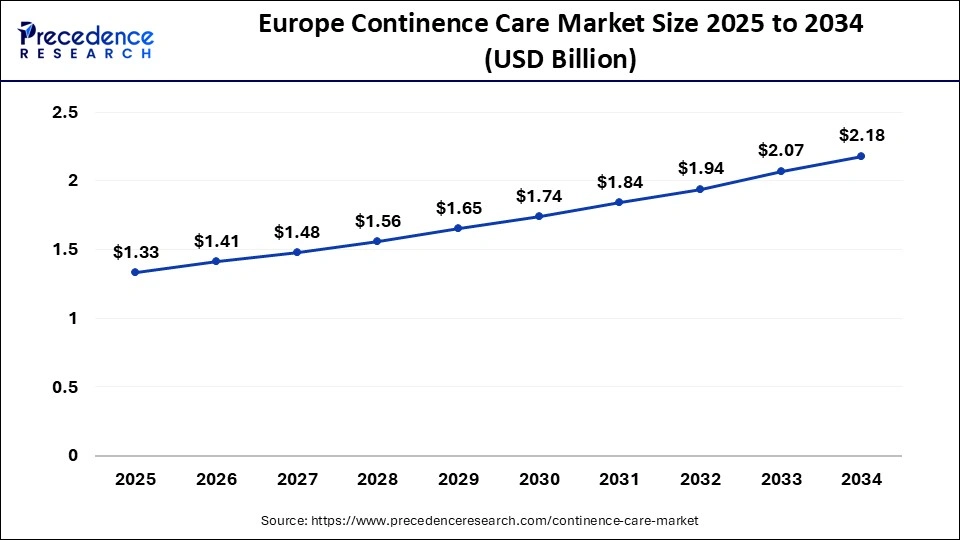

Europe Continence Care Market Size and Growth 2025 to 2034

The Europe continence care market size is estimated at USD 1.33 billion in 2025 and is predicted to be worth around USD 2.18 billion by 2034, at a CAGR of 5.60% from 2025 to 2034.

Europe held the largest share of the continence care market in 2024. The region is observed to sustain as a significant shareholder during the forecast period. Europe's population is aging, and a sizable section of older people have problems with their ability to regulate their bowels or bladder. This demographic shift fuels the demand for services and goods related to continence care. Awareness of incontinence problems and the range of goods and therapies available to address them has grown. This awareness results from higher diagnostic rates and greater acceptance of continence care treatments. With its advanced healthcare system, Europe offers access to medicines and goods for continuous care throughout the continent. Furthermore, government initiatives and reimbursement rules help to make continence management systems accessible and affordable.

Asia Pacific is expected to grow at a notable rate during the forecast period in the continence care market. Due to the rising prevalence of urine incontinence, growing consumer knowledge of the availability of continence care products, and improvements in healthcare infrastructure, the continence care market in the Asia Pacific region was witnessing substantial expansion. Products like drainage bags, catheters, and adult diapers are among those sold on the market. The aging population, shifting lifestyles, and improved access to healthcare in emerging nations drive the need for continuous care products in Asia Pacific. Furthermore, governments and healthcare institutions are increasingly stressing how crucial it is to successfully manage incontinence to enhance the quality of life for those affected and lower medical expenses related to difficulties.

Why North America held a significant share of the industry?

North America held a significant share of the market. The increasing prevalence of type 2 diabetes in several countries such as Canada, the U.S., Mexico and some others has boosted the market expansion. Additionally, the presence of various market players such as Hollister Incorporated, Procter & Gamble, Cardinal Health and some others is expected to drive the growth of the continence care market in this region.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The growing incidences of bladder cancer in numerous nations such as Argentina, Brazil, Peru, Venezuela and some others has boosted the market growth. Also, rapid investment by government to construct various cancer hospitals is expected to propel the growth of the continence care market in this region.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The rising cases of prostate cancer in several nations such as UAE, Saudi Arabia, South Africa and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the healthcare sector is expected to boost the growth of the continence care market in this region.

Key Players: Providing continence care solutions across the world

- Coloplast group: Coloplast is a global medical technology company founded in Denmark that develops and sells products for individuals with intimate healthcare needs. Its business areas include Ostomy Care, Continence Care, Interventional Urology, Advanced Wound Care, and Voice & Respiratory Care.

- B. Braun SE: B. Braun SE is a global medical technology company founded in 1839 in Germany that manufactures and supplies a wide range of healthcare products and services. It operates in various fields, including infusion therapy, anesthesia, surgery, and wound management.

- Hollister Incorporated: Hollister Incorporated is an independent, employee-owned global healthcare company headquartered in Libertyville, Illinois, that develops, manufactures, and markets a wide range of healthcare products for ostomy, continence, and critical care needs.

- Convetec Group PLC: Convatec Group PLC is a global medical products and technologies company headquartered in London, UK, focused on solutions for chronic conditions. This company operates in four main segments such as advanced wound care, ostomy care, continence and critical care, and infusion care.

- BD: Becton, Dickinson and Company (BD) is a global medical technology company that manufactures and sells numerous products including medical devices, instrument systems, and diagnostic products.

- Welland Medical: Welland Medical is a British manufacturer established in 1988 that specializes in innovative ostomy (stoma care) products for people with a stoma. Based in Crawley, West Sussex, the company works with healthcare professionals and patients to develop and produce a range of stoma care devices and accessories such as colostomy, ileostomy, and urostomy products.

Continence Care Market Companies

- Coloplast group

- B. Braun SE

- Hollister Incorporated

- Convetec Group PLC

- BD

- Welland Medical Ltd.

Recent Developments

- In April 2022, a Japanese market player, Unicharm announced the launch of world's first recycled nappies in stores of South Japan. The new product launch aims to address resource scarcity and environmental concerns.

- In September 2025, Medtronic plc announced that FDA approved Altaviva device. Altaviva device is designed for treating urge urinary incontinence.

(Source: https://news.medtronic.com ) - In June 2025, Ontex launched iD Discreet. iD Discreet is aimed at expanding access to effective and dignified continence care across Europe.

(Source: https://tissueonlinenorthamerica.com ) - In March 2025, Medline Canada launched Fitright extended wear stretch briefs. Fitright extended wear stretch briefs are designed to enhance continence care across this nation.

(Source: https://www.newswire.ca )

Segment Covered in the Report

By Product

- Urinary Catheters

- Intermittent Catheters

- Female

- Male

- Intermittent Catheter Sets

- Female

- Male

- Intermittent Catheters Dry

- Indwelling Foley Catheters Silicone

- 2W

- 3W

- Intermittent Catheters

- Catheter Maintenance/Care

- Urinary Bags

- Pediatric Urine Bags

- Night Bags > 1,5L

- Sterile

- Non-sterile

- Bag Accessories

- Leg Urine Bags < 1,5L

- Sterile

- Non-sterile

- Incontinence And Bowel Management

- Male External Catheters Silicone

- Female Incontinence Device

- Irrigation Pump/Transanal Irrigation

By Application

- Diabetes

- Strokes

- BPH

- Alzheimer

- Cerebral Palsy

- Parkinson

- Prostate Cancer

- Spinal Cord Injury

- Bladder Cancer

- Multiple Sclerosis

- Spina Bifida

- Others

By Bag Usage

- Sterile Bags

- Non-sterile Bags

By End-use

- Home Care Settings

- Hospitals

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting