What is the Cork Stoppers Market Size?

The global cork stoppers market size was estimated at USD 3.28 billion in 2025 and is predicted to increase from USD 3.51 billion in 2026 to approximately USD 6.57 billion by 2035, expanding at a CAGR of 7.21% from 2026 to 2035. The market for cork stoppers is expanding rapidly as it maintains its premium and environmental core value.

Market Highlights

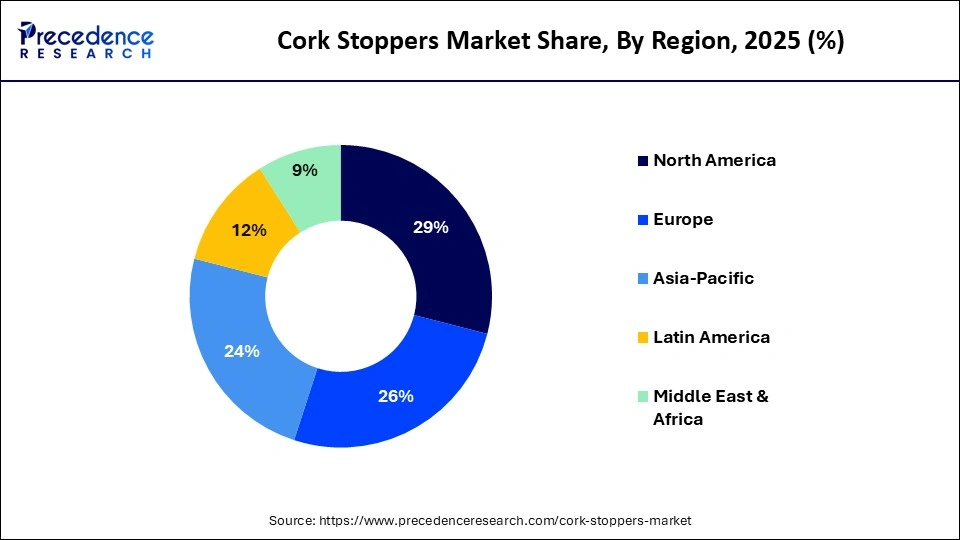

- North America dominated the market, holding a share of approximately 29% in 2025.

- Asia Pacific is expected to be the fastest-growing region during the forecast period.

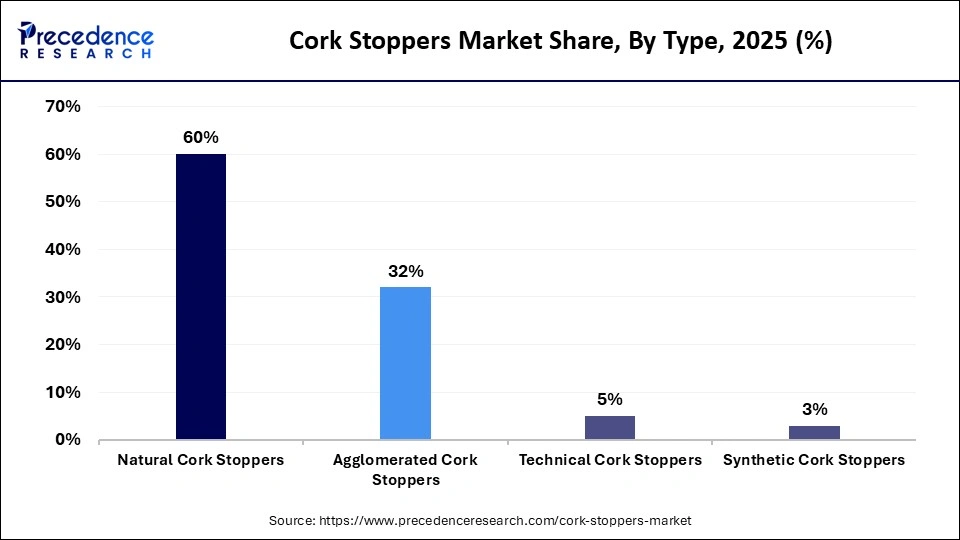

- By type, the natural cork stoppers segment held the largest revenue share of approximately 58% in 2025.

- By type, the synthetic cork stoppers segment is expected to grow at a remarkable CAGR of 6.1% between 2026 and 2035.

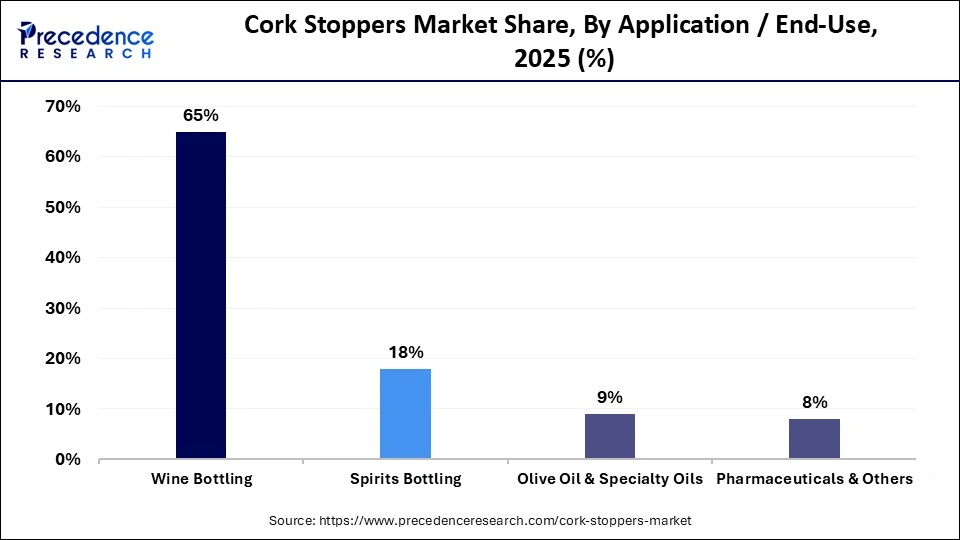

- By application/end use, the wine bottling segment held a major market share of approximately 65% in 2025.

- By application/end use, the spirits/specialty oils segment is expected to grow with the highest CAGR of 6.2% in the market during the studied years.

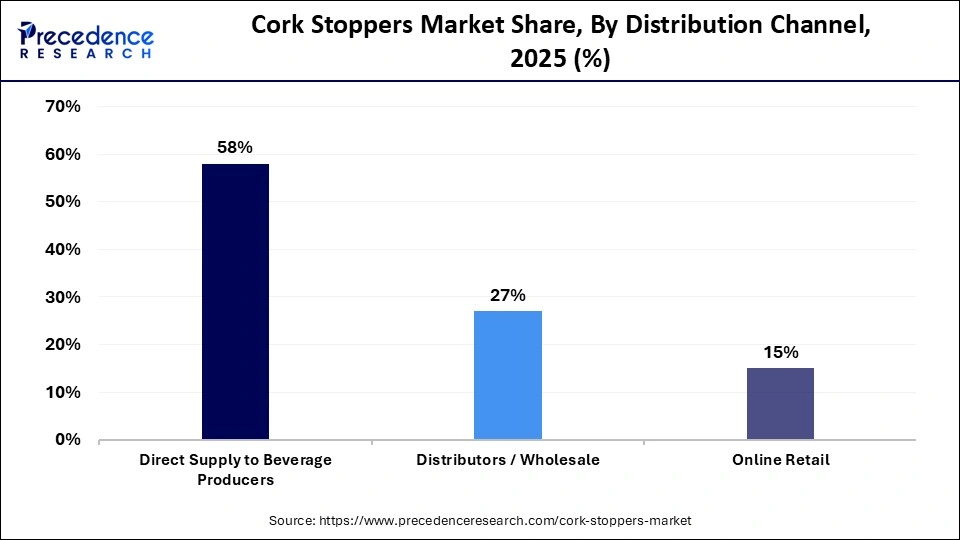

- By distribution channel, the direct supply to beverage producers segment dominated the market with a share of approximately 58% in 2025.

- By distribution channel, the online retail segment is expected to grow at the highest CAGR of 6.6% between 2026 and 2035.

What is Cork Stopper?

The cork stoppers market comprises natural and engineered cork closures used to seal bottles across beverage (especially wine and spirits), food, and specialty industries. The market is rapidly growing due to an increase in the consumption of drinks such as wine/spirits, as well as a growing preference for sustainable and eco-friendly materials, along with premium packaging. As today's consumers and governments are more aware of non sustainable materials like plastic's disastrous impact on the environment, they are taking a self-conscious approach towards biodegradable and reusable materials.

The current beverage industry wants to be associated with premium and luxury brands, so they are selecting a sealing material for their beverage that corresponds to luxury, quality, and heritage. A cork stopper is preferred for aging wine due to its unique capabilities, such as high elasticity, compressibility, and micro-oxygenation. Today, technological advances have reduced the risk of cork taint, further improving the market for cork stoppers.

What is the Role of AI in the Cork Stoppers Market?

Artificial intelligence (AI) plays a vital role in the market by transforming the way cork stoppers are designed or manufactured. It can enable manufacturers to develop customized corks based on clients' requirements. AI-based precision engineering uses ultra-sensitive imaging with AI to inspect every cork and find defective corks from the bulk. Automation and robotics aim to enhance efficiency, safety, and quality control across production facilities. AI and machine learning (ML) algorithms analyze vast amounts of data and assist manufacturers in predicting manufacturing challenges, allowing them to make proactive decisions.

Cork Stoppers Market Trends

- Sustainability Focus: As cork is natural, sustainable, and recyclable, it perfectly aligns with the global shift to eco-friendly packaging. As cork is obtained from oak tree bark without cutting the tree itself, it is a long-term, sustainable material for packaging. As global industries reduce their carbon footprint, they are hence prioritizing cork stoppers as their packaging material due to their unique abilities, such as carbon sequestration and non-destructive harvesting, making them a more sustainable alternative to plastics & metals.

- Technological Integration: With advancements in AI, automation, and material science, they have solved a major challenge for cork stopper packaging, that is, cork taint. It is done by scanning the cork batch and removing those contaminated by trichloroanisole. These technologies ensure consistent, reliable, and standardized performance from a large batch. Cork incorporated with digital tags allows traceability, which improves consumer trust.

- Premiumization: Various premium wine brands choose the cork stopper as packaging material over synthetic alternatives due to its quality of providing an ideal, traditional, and superior aging process. Many consumers often refer to cork stopper packaging material as a status symbol, as it is often associated with luxury. Cork stoppers, as a packaging material, are not only used in wine but also in spirits, craft distilleries, and microbreweries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.28 Billion |

| Market Size in 2026 | USD 3.51 Billion |

| Market Size by 2035 | USD 6.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.21% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Which Type Segment Dominated The Cork Stoppers Market?

The natural cork stoppers segment held a dominant position in the market with a share of approximately 58% in 2025, due to their unique ability to undergo micro-oxygenation, which is very significant in wine aging. The perception of natural cork stoppers as top-tier is due to traditional and ideal qualities, making it a high-end packaging material. They are harvested from the bark of oak trees without harming the trees, making them more eco-friendly and aligning with the green packaging demand from consumers.

The synthetic cork stoppers segment is expected to show the fastest growth with a CAGR of 6.1% over the forecast period, as synthetic stoppers resolve the issues of natural cork stoppers' defects, such as high cost and supply inconsistency. A synthetic cork stopper is more economical than a natural cork stopper due to its low cost, mass production, and convenience, as it can be stored easily, unlike a natural cork stopper, which has to be stored horizontally.

Application Insights

How the Wine Bottling Segment Dominated the Cork Stoppers Market?

The wine bottling segment registered its dominance over the global market with a share of approximately 65% in 2025, because of consumers' demand for top-tier, customary, and natural packaging. Almost 65% of cork stopper consumption is for wine bottling applications. Despite competition from other packaging options, cork accounts for a significant share of wine seals, as it provides proper aging and maturation of wine through controlled micro-oxygenation.

Newer generations, especially millennials, prefer that wine with a natural cork is of superior quality and are likely to pay more for such wine. The “pop” of cork is considered a pivotal part of the consumer experience. The wine bottle sector is highly versatile, so the cork stopper packaging industry has also improved, providing various options based on demand.

The spirits/specialty oil segment is expected to expand rapidly in the market with a CAGR of 6.2% in the coming years, as a cork stopper can provide an airtight seal, preventing oil from undergoing rancidity, enclosing aroma and freshness, and preserving its delicate flavor. Cork stoppers are also preferred due to their high-end trends, sustainability demands, and functional superiority in preserving high-end products.

In gourmet foods, such as top-tier olive oil and premium beverages, cork enhances the packaging appeal, and it seems more like a handcrafted product. Various luxury brands require a product that is artisanal and high-end, making cork stoppers a suitable choice for spirits/speciality oils.

Distribution Channel Insights

Which Distribution Channel Segment Led the Cork Stoppers Market?

The direct supply to beverage producers segment contributed the biggest revenue share of approximately 58% in the market in 2025, due to high quality control and reducing cork taint. Direct supply provides customized designs to premium brands, facilitating long-term relations between producers and wineries & distilleries. Advances in sterilization and testing technologies enhance the quality of packaging and reduce contamination. Direct supply offers better security for high-volume producers and reduces logistical disruption. It helps maintain trust, integrity, and transparency, hence establishing good and long-term relationships.

The online retail segment is expected to witness the fastest growth in the market with a CAGR of 6.6% over the forecast period, due to a current transformative shift from traditional deliveries to e-commerce. E-commerce platforms are more convenient, offer doorstep delivery, and increase access to small- to medium-sized enterprises.

Small-scale wineries, distilleries, and specialty oil manufacturers often source packaging from online platforms, as they demand a small, flexible, and customized order. The post-pandemic era has witnessed a surge in home consumption of wine, which accelerated the adoption of online shopping. Easier access to high-end products has also improved the use of this distribution channel.

Regional Insights

How Big is the North America Cork Stoppers Market Size?

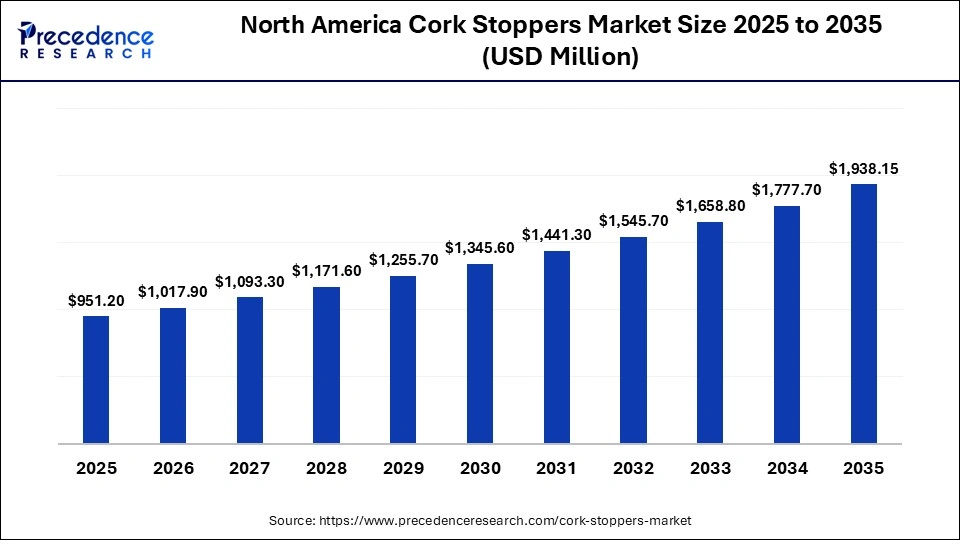

The North America cork stoppers market size is estimated at USD 951.20 million in 2025 and is projected to reach approximately USD 1,938.15 million by 2035, with a 7.38% CAGR from 2026 to 2035.

Why North America Dominated the Cork Stoppers Market?

North America held the largest revenue share of the market with a share of approximately 29% in 2025, due to high consumption of high-end wine & spirits, customers' preference for eco-friendly cork, growth in craft beverages, and demand for classic closures that signify quality and authenticity. The US is driving the economy toward premium and story-rich packaging, owing to the booming wine and craft spirit industries. As governments and consumers shift towards green packaging and make self-conscious decisions about using sustainable packaging, the demand for cork stoppers has increased.

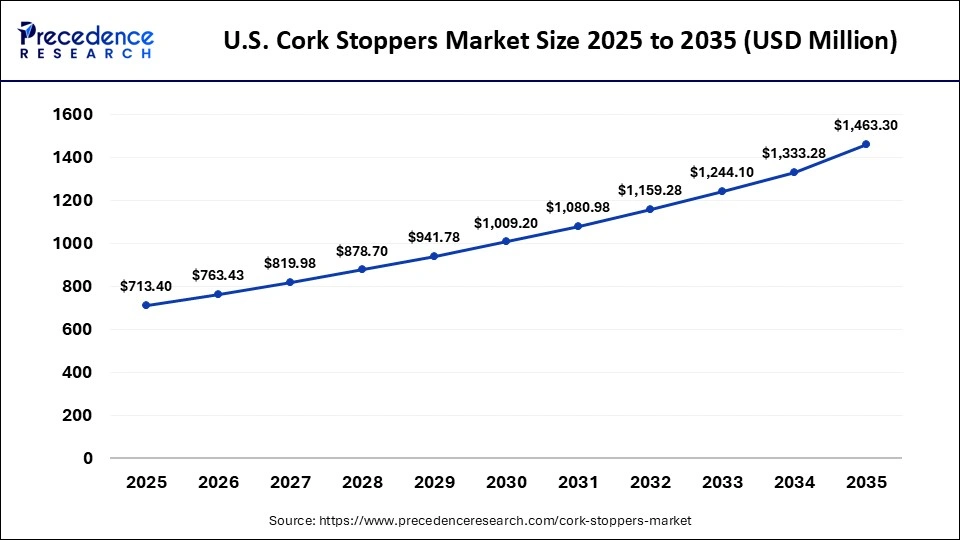

What is the Size of the U.S. Cork Stoppers Market?

The U.S. cork stoppers market size is calculated at USD 713.40 billion in 2025 and is expected to reach nearly USD 1,463.30 million in 2035, accelerating at a strong CAGR of 7.45% between 2026 and 2035.

The U.S. Cork Stoppers Market Trends

The U.S. led the market due to its massive consumption of beverages, resulting in high demand, well-established industry infrastructure, and rapid adoption of technology like B2B/B2C digitalization. The U.S. is the largest importer of natural cork, importing mostly from Portugal. Major cork companies like Amorim Cork America, Cork Supply USA, and Portocork America are situated in the U.S., further enforcing the U.S. as the logistical and sales hub in the region. The growing preferences for high-quality and eco-friendly materials also augment market growth.

How Will Asia-Pacific Grow in the Cork Stoppers Market?

The Asia-Pacific region is expected to witness the fastest growth with a CAGR of 7.5% during the predicted timeframe, due to rapid urbanization, economic stability, and a surge in wine consumption. In recent years, a drinking culture has grown significantly, leading to a significant increase in wine consumption, particularly in countries such as China, India, and Japan, thereby boosting the cork stopper market.

Economic growth and stability have led to an increase in disposable income, leading to a rise in wine consumption. Today, social media has helped people explore each other's culture, tradition, and trends, leading to exposure to Western culture and wine appreciation. The region also has a suitable manufacturing infrastructure and an affordable workforce, encouraging foreign companies to set up their facilities.

China Cork Stoppers Market Trends

China holds a major share of the Asia-Pacific region, due to a surge in consumption, demand driven by the massive wine-growing industry, and its luxury gifting culture. Due to the influence of Westernized culture, their huge demand for both local and imported wine is creating a huge domestic market for the wine industry. The luxury gifting culture strongly aligns with cork stoppers, exuding a high-end product image. China produces & supplies cork stoppers for domestic as well as export purposes, and is a major consumer and producer of cork stoppers.

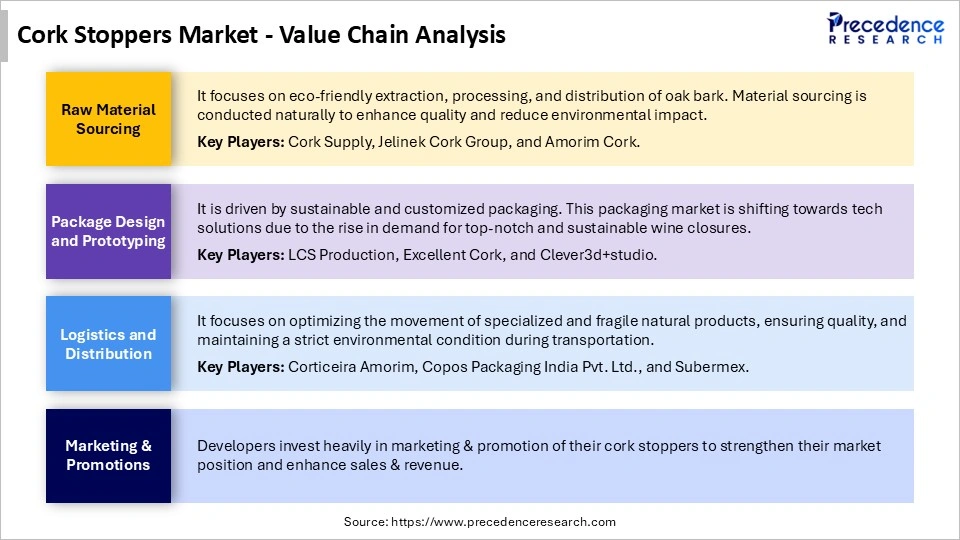

Cork Stoppers MarketValue Chain Analysis

Who are the Major Players in the Global Cork Stoppers Market?

The major players in the cork stoppers market include Corticeira Amorim SGPS, Cork Supply Group, Nomacorc, Vinventions, Diam Bouchage, Périgord, SÜDDEUTSCHE KORKENFABRIK, M.A. Silva Corks, Advance Cork International, Portocork America, Jelinek Cork Group, Lafitte Cork and Capsule, Rich Xiberta Corks, WidgetCo Inc., and CorkLink Group.

Recent Developments

- In September 2025, Antero, a West Lothian-based start-up, announced that it received a £15,000 loan to use its CorkEco Solutions in the construction and textile industries to reduce carbon emissions, while using CorkStyle to deliver planet-friendly jewellery, apparel, and corporate gifting products.(Source: https://projectscot.com)

- In May 2025, the Cork Collective announced the launch of its cork collection and recycling program to advance eco-conscious practices in California. The initiative helps transform used cork into valuable, eco-friendly products, that showcase the material's versatility and circular potential. (Source: https://www.prnewswire.com)

- In November 2024, MA Silva, a Portuguese bottle cork closure manufacturer, announced the launch of Nobeltech and Nobel Corkstoppers with the help of AI technology. The new product line provides stakeholders with a superior option combining tradition, innovation, and environmental stewardship.(Source: https://www.thedrinksbusiness.com)

Segments Covered in the Report

By Type

- Natural Cork Stoppers

- Agglomerated Cork Stoppers

- Technical Cork Stoppers

- Synthetic Cork Stoppers

By Application

- Wine Bottling

- Spirits Bottling

- Olive Oil & Specialty Oils

- Pharmaceuticals & Others

By Distribution Channel

- Direct Supply to Beverage Producers

- Distributors/Wholesale

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content