Corrugated Fiberboard Market Size and Forecast 2025 to 2034

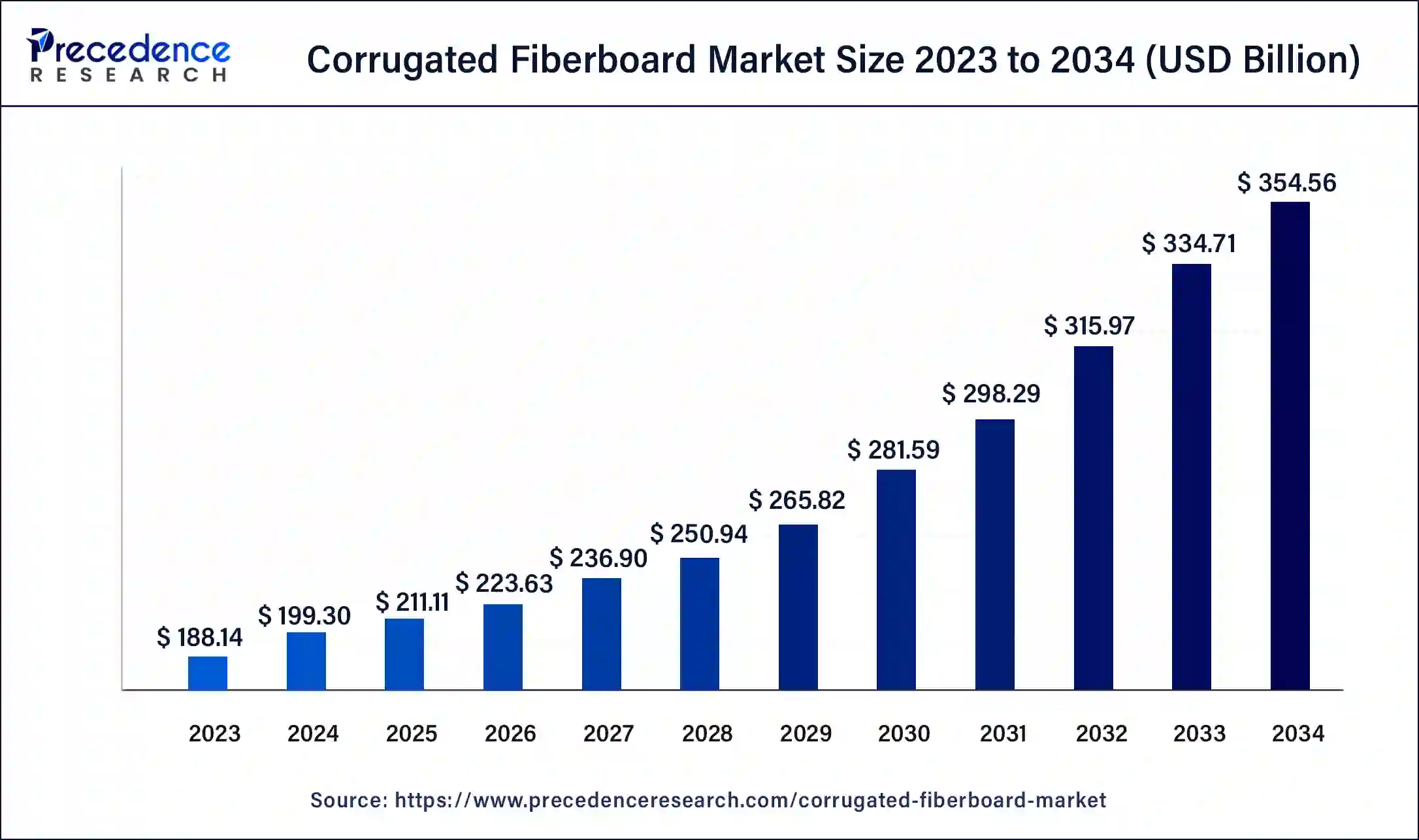

The global corrugated fiberboard market size surpassed USD 199.30 billion in 2024 and is anticipated to reach around USD 354.56 billion by 2034, growing at a solid CAGR of 5.93% over the forecast period 2025 to 2034. The market is proliferating due to the increasing retail display and packaging business, food and beverages, electronics, and several e-commerce companies that require corrugated fiberboard for packaging. The growing trend of online ordering systems is boosting the corrugated fiberboard market.

Corrugated Fiberboard Market Key Takeaways

- The global corrugated fiberboard market was valued at USD 199.30 billion in 2024.

- It is projected to reach USD 354.56 billion by 2034.

- The corrugated fiberboard market is expected to grow at a CAGR of 5.93% from 2025 to 2034.

- Asia Pacific dominated the corrugated fiberboard market in 2024.

- Europe is expected to grow at a significant rate in the market during the forecast period.

- By flute type, the flute A segment dominated the market in 2024.

- By board type, the single wall segment is expected to grow at a significant rate in the market during the forecast period.

- By end type, the food & beverage segment dominated the global market in 2024.

How Can AI Improve the Corrugated Fiberboard Market?

Artificial Intelligence is expanding to change the corrugated fiberboard market significantly by manufacturing efficient and innovative fiberboards. It helps to bring unique designs and patterns in the fiberboard industry by analyzing the data of customers and demand for the type of product that is in demand. AI also influences the market by analyzing the potential of the equipment used to manufacture fiberboards and predicting the failure of the equipment. With the potential of market demand for fiberboard in the future, artificial intelligence is beneficial in maintaining the supply chain in the market.

Due to the algorithms of machine learning, it is easy to predict the demand as per the trend and prepare orders to prevent any of the conditions, such as stockouts or overproduction. It helps to analyze the quality of the products, which is beneficial to eliminating defective pieces while producing in bulk. Customization in this industry has boosted the market exponentially, and AI has driven this process to meet the exact demands of customers. The incorporation of AI in the corrugated fiberboard market impacts its growth by analyzing demand to satisfy the requirement.

Corrugated Fiberboard Market: Reliable Packaging

Corrugated fiberboard market companies play a significant role in the packaging market as it is the most affordable, sustainable, and reliable. These fiberboard boxes are preferred for their versatility and durability, which is the best option for storage and delivery of products of a wide range. This is manufactured by keeping a layer of flute paper in the middle of two liner boards to provide a cushioning effect. This is done to provide extra safety to the fragile products while shifting from one place to another. Its manufacturing quality with an extra cushiony effect makes it the most reliable product in the packaging industry.

Major Driving Factors for the Corrugated Fiberboard Market

- Rising demand for sustainable products significantly influences the packaging market. The high manufacturing quality provides safety to goods at delivery and ensures the safe delivery of products.

- Manufacturing eco-friendly products attracts a huge number of businesses to use such corrugated fiberboard market. Customers prefer more such products which are environment friendly in comparison to others.

- The customization facility of this industry provides convenience to various businesses for the promotion of the brand and the requirement of different shapes and sizes of the product.

- Good quality protection for products ensures safe delivery of the product. This helps e-commerce businesses to grow by delivering delicate products safely.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 354.56 Billion |

| Market Size in 2025 | USD 211.11 Billion |

| Market Size in 2024 | USD 199.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Flute Type, Board Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising acceptance for sustainable fiberboards

Sustainability is a major concern among people when purchasing anything. Corrugated fiberboards are the sustainable option available in the market for shipping products and manufacturing packaging boxes. These are cost-effective and reliable packaging solutions that can be customized easily. Fiberboards are recyclable and versatile and can be used for several purposes. These advantages of such boxes enhance the market demand. The major corrugated fiberboard market player in the Trident paper box industry, Canpac Trends Pvt. Ltd, TGI Packaging Pvt. Ltd, Deluxe Packaging, and many others are constantly working on developing environmentally friendly fiberboard boxes for packaging usage.

With the growing trend to use sustainable products, the demand for these types of boxes is increasing. Technological advancement in the packaging solutions sector enhances the manufacturing quality of corrugated fiberboards, which boosts the market's growth. Various factors are driving the corrugated fiberboard market, such as the growing e-commerce market, expansion of the global market, and advanced technology. For shipping purposes, lightweight, high-strength, and customized fiberboard boxes are preferred, with better-quality flutes inserted for a cushion effect. The introduction of environment-friendly products drives this market as such packages are recyclable and biodegradable.

- In January 2023, Cascades announced the launch of a new closed basket that is made up of recyclable and recycled corrugated cardboard. It is developed as an alternative to food packages that are not suitable for recycling.

Restrain

Limited capacity to bear load and environmental factors

The corrugated fiberboards are used mainly for packaging and shipping purposes, but they can support up to a certain weight; these boxes are not suitable for transferring very heavy-weighted things. This less weight-carrying capacity restricts it to certain industries and hinders the growth of the corrugated fiberboard market. Strict guidelines for waste disposal and recycling create a challenge for the market players to develop such boxes.

Opportunity

Collaboration among major market players

Planned partnerships with several e-commerce businesses enlarge the potential of the corrugated fiberboard market. It expands the reach of manufacturing companies and updates the rising demand for it. The major reason for the continuously rising demand is the production of sustainable boxes, which most packaging companies prefer. Some of the major market players are Multipack Industries, Aaradhya Enterprise, and TGI Packaging Pvt. Ltd, and many others collaborating to bring innovative manufacturing methods for corrugated fiberboards and different raw materials that can enhance the quality of the packaging boxes.

A wide range of businesses such as electronics, food & beverages, e-commerce, pharmaceuticals, automotive, textile, cosmetics, and many others are progressively investing in this market to grow and develop innovative packaging solutions. The rising e-commerce industry increases the demand for packaging with more durability and flexibility. Product sustainability is trending, and the corrugated fiberboard market is being boosted to enhance its potential.

- In February 2023, Tesco announced the launch of recyclable cardboard packaging by replacing its plastic detergent tubs. They have come up with a new 4Rs packaging strategy to reduce plastic waste.

Flute Type Insights

The flute A segment dominated the corrugated fiberboard market in 2024. Flute A is considered the most-demand box used in the packaging and delivery sector. It is considered to be the original and thickest corrugated flute design, which provides a cushiony effect to the products. Its double-wall combination can carry heavy loads and deliver safely to fragile objects.

It is preferred by a wider range of businesses as it provides resistance against jerk due to its thickness. This is one of the best packaging options as it is an affordable solution for the storage and transport of goods from retailers. It is majorly driven by producing environmentally friendly boxes and recyclable and sustainable products.

| Flute | Flute Height* mm | Number of Flutes per m Length of the Corrugated Board |

| A | 4.8 | 150 |

| B | 2.4 | 150 |

| C | 3.6 | 130 |

| E | 1.2 | 290 |

| F, G, N | 0.5-0.8 | 400-550 |

Board Type Insights

The single wall segment is expected to grow at a significant rate in the corrugated fiberboard market during the forecast period. Such types of corrugated fiberboards are available in a single layer of corrugated medium inserted between two liners. This pattern provides a balance between flexibility and strength. These single-wall fiberboard boxes are extensively used for retail packaging and shipping as they allow cushion-type protection by absorbing shock developed and giving the boxes a proper structure. This market is majorly driven by the e-commerce industry, as the demand for packaging materials is high.

End-use Insights

The food & beverage segment dominated the corrugated fiberboard market in 2024. With the expansion of online shopping among people, these businesses require more high-quality packaging boxes for the safe delivery of products. Corrugated fiberboards are well-known for their protection and durability due to the raw materials and manufacturing process of such boxes. As e-commerce services are growing, the demand for cost-effective packaging materials is also rising. Due to various advancements in the quality of corrugated fiberboard, such as cushioning effect, easy customization facility, rough handling capacity, and many others, the packaging industry prefers these boxes over any other.

Regional Insights

Asia Pacific dominated the corrugated fibreboard market in 2024. The rising packaged food culture in food and beverage companies plays a significant role in the growth of the market. With the evolution of this food and beverage market the demand for corrugated fiberboard boxes increases. The surge in consumption of packaged food has ultimately raised the demand for good quality fiberboard boxes for packaging purposes. The food and beverages sector always prefers the usage of eco-friendly sustainable packaging products for safe and secure packaging.

- In October 2023, Tetra Pak announced the launch of Tetra Recart, which is an innovative packaging method that is sustainable and environmentally friendly. This is an alternative to traditional cans and glass jars for food and beverage packaging.

- In October 2023, the Ministry of Agriculture and Rural Affairs (MARA) of China came up with strict food packaging rules. It is to reduce excessive packaging issues in China.

- In October 2023, according to the China Paper Association, nearly 2,500 paper and cardboard production players and approximately 4,727 paper product producers who have an annual income of more than RMB 20 million, which is around USD 2.77 million, are existing in China in 2022.

Europe is expected to grow at a significant rate in the corrugated fiberboard market during the forecast period. Sustainable fiberboards are attracting massive attention from people worldwide as consciousness among all is rising towards using eco-friendly. Commercial leaders and customers are looking for eco-friendly goods, so there is a massive demand for such packaging products. Ecological and decomposable corrugated fiberboards are extremely in demand for sustainable packaging purposes.

Some of the main strategies related to packaging industries in this area increase the manufacture of sustainable corrugated fiberboard packaging. Some major corrugated fiberboard market players, such as MM PACKAGING GmbH, DS Smith Packaging France, LACAUX Freres, Gascogne Papier, and many others, are continuously developing enhanced quality corrugated fiberboards.

- In June 2024, Saica Group, which is one of the leading companies in the packaging sector, announced its collaboration with Mondelēz. This collaboration is to develop paper paper-based product.

- In October 2023, SIG announced the launch of SIG DomeMini, which is a carton bottle. It is developed to find a sustainable option in place of plastic bottles for sustainability.

Corrugated Fiberboard Market Companies

- Trident paper box industries

- TGI Packaging Pvt. Ltd

- HARIWANSH PACKAGING PVT LTD

- Canpac Trends Pvt. Ltd

- Sara Enterprise

- Smurfit Kappa Group

- REID PACKAGING

- Bravura Packers Private Limited

- Western Container Corp.

- Texas Corrugated Box & Packaging, LLC

- R&R Corrugated Packaging Group

- Shanthi Packaging

Recent Developments

- In November 2023, Bacardi announced reducing the number of cardboard gifts. The company has reduced its cardboard usage by 100 tons and promoted environmental sustainability.

- In July 2022, Unilever announced the launch of its sustainable laundry capsule, which is packed in a plastic-free cardboard container. This single step prevented 6,000 tonnes of plastic waste.

- In July 2023, Mondi announced its collaboration with Aromsa. This collaboration is to develop TankerBox, which is an alternative to stainless steel containers. It is a corrugated cardboard that is designed to replace metal barrels and intermediate bulk containers (IBCs).

- In October 2023, Lantmännen Unibake collaborated with Adara to develop fiber-based packaging products for frozen baked goods. This step is to reduce the usage of fossil-based products and eliminate plastic bags.

- In April 2022, DS Smith announced the launch of a corrugated cardboard box for the delivery of medical devices. It has opened the fiber and paper development laboratory for sustainable packaging.

- In June 2022, Verlasso announced the launch of salmon packaged in cardboard. It has replaced polystyrene with pure recyclable cardboard boxes.

- In August 2023, PepsiCo Beverages North America (PBNA) announced the removal of plastic rings kept in bottles or cans. The motive is to replace it with a paper-based solution.

- In September 2023, Sree Laxmi Printing and Packaging announced the launch of KongsbergX24. The major focus is to provide customized and personalized packaging solutions.

Corrugated Fiberboard Market Segments

By Flute Type

- Flute A

- Flute B

- Flute C

- Combination Flutes

- Micro Flutes

By Board Type

- Single Wall

- Double Wall

- Triple Wall

By End-use

- Food & Beverages

- E-Commerce

- Pharmaceuticals

- Cosmetics & Personal Care

- Electrical & Electronics

- Automotive

- Transportation & Logistics

- Textile

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting