Critical Limb Ischemia Treatment Market Size and Forecast 2025 to 2034

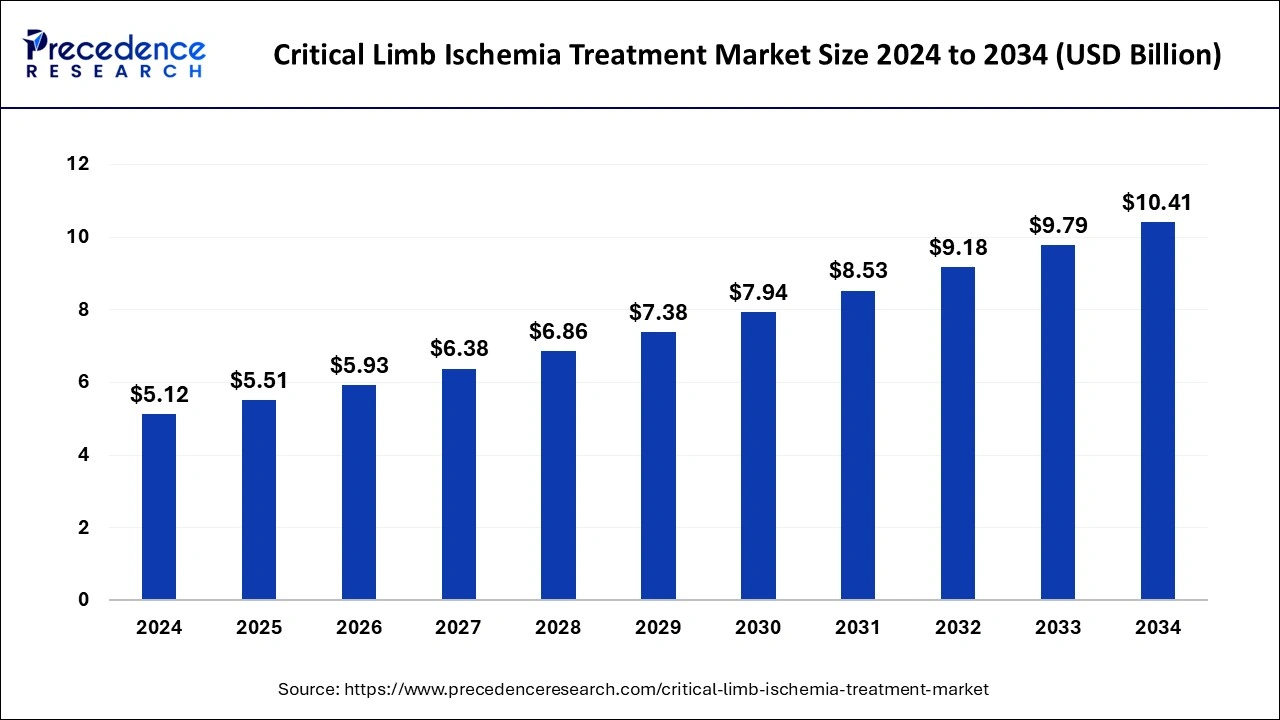

The global critical limb ischemia treatment market size was estimated at USD 5.12 billion in 2024 and is anticipated to reach around USD 10.41 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034. The growth of the critical limb ischemia treatment market is driven by the rising technological advancements in therapeutic approaches.

Critical Limb Ischemia Treatment Market Key Takeaways

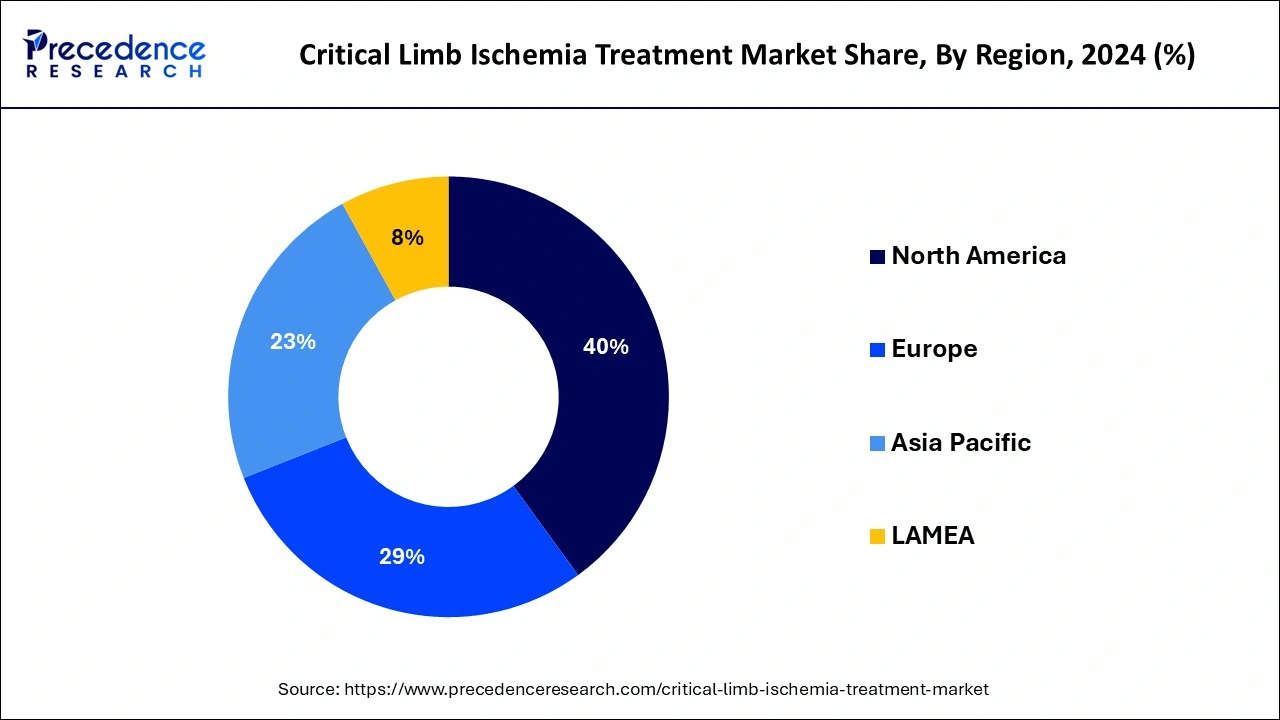

- North America dominated the global critical limb ischemia treatment market with the largest market share of 40% in 2024.

- Asia Pacific is projected to expand at a solid CAGR during the forecast period.

- By treatment, the devices segment has held the significant market share in 2024.

Role of AI in Critical Limb Ischemia Treatment

AI is revolutionizing the treatment of critical limb ischemia. AI algorithms quickly analyze medical imaging, thereby accelerating the diagnostic process and helping in early detection. AI can be used to determine the revascularization of vessels to heal wounds in specific patients, enhancing the overall treatment process. Furthermore, AI's predictive analytics capability predicts patient outcomes, which helps physicians to customize treatment plans.

U.S. Critical Limb Ischemia Treatment Market Size and Growth 2025 to 2034

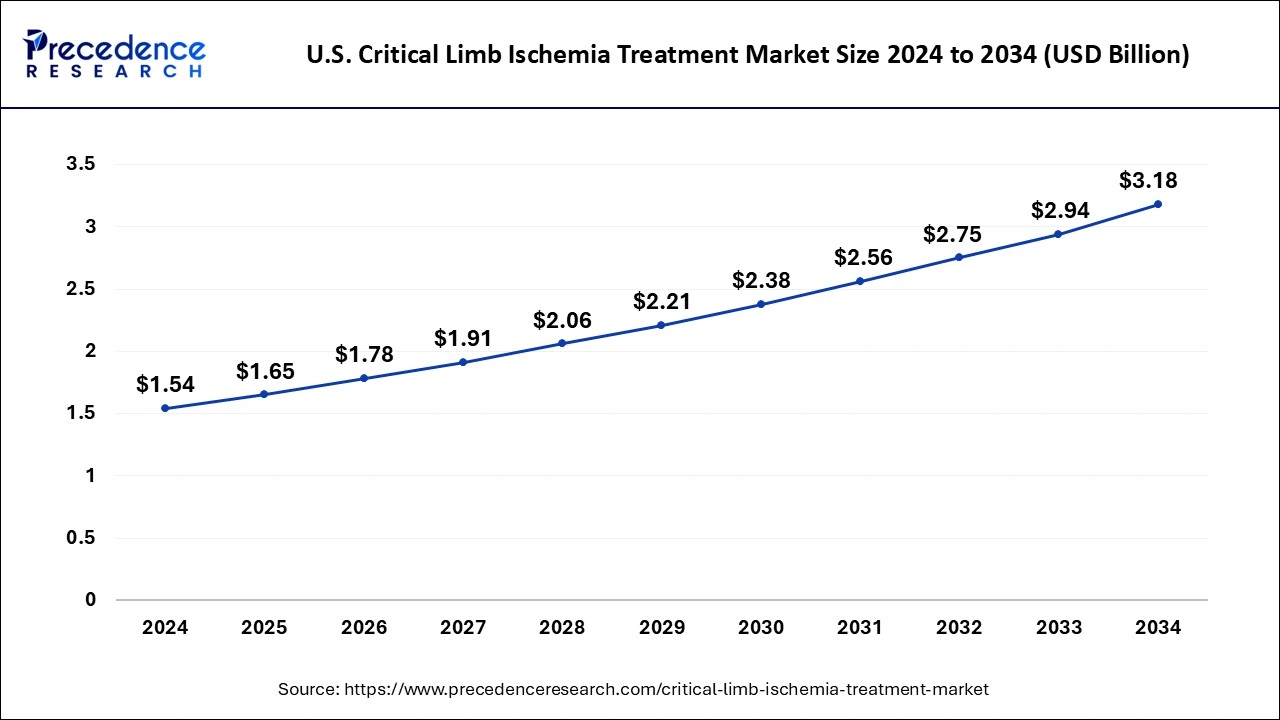

The U.S. critical limb ischemia treatment market size was evaluated at USD 1.54 billion in 2024 and is predicted to be worth around USD 3.18 billion by 2034, rising at a CAGR of 7.52% from 2025 to 2034.

North America dominated the global critical limb ischemia treatment market with the largest market share of 40% in 2024.During the forecast period, the market in the area is anticipated to expand at a moderate CAGR. The growth can be attributed to the rise in government activities and awareness about CLI and other risk-associated conditions, as well as to increases in healthcare spending, disposable income, and the accessibility to cutting-edge technology in the area. A new study estimates 2 million and 3 million Americans have significant limb ischemia.

From 2025 to 2034, the market in Asia Pacific is projected to expand at a rapid CAGR. The growth in the prevalence of CLI in nations like China and India, the expansion in the senior population, and the explosion in government initiatives and healthcare spending are driving the market for critical limb ischemia treatment in the area. The region's market is expected to grow due to the area's large population, unmet medical requirements, and rising patient awareness. Because of the rise in disposable income brought on by economic growth in emerging economies like China and India, consumers' purchasing power is improving. In the foreseeable future, this is anticipated to increase the market in these nations.

Market Overview

Some significant market developments for treating critical limb ischemia are improved endovascular procedures and the best revascularization approaches. Players in the market have the potential to profit from the need to enhance revascularization results with a focus on lowering ischemia-related cardiovascular risk factors.

In terms of treatment, dilation devices and stents dominate the critical limb ischemia market. As a result, businesses are focused on developing stents and dilation devices for revascularization. When these are used, clinical outcomes improve, ultimately improving patient quality of life. Since the FDA approved technologically improved peripheral dilatation systems a few years ago, this market segment has seen lucrative opportunities, enhancing the value chain of the manufacturers in the market for acute limb ischemia treatment.

The product pipeline will be enriched, and the need for critical limb ischemia therapies will increase as more clinical trials are conducted to address the drawbacks of current peripheral dilatation devices and endovascular treatments. The critical limb ischemia treatment market will grow due to the demand for cutting-edge tools and balloon dilators for critical limb ischemia (CLI) vascular surgery.

Growth Factors

- The growing prevalence of diabetes across the globe is a major factor boosting the growth of the market since diabetic patients are more prone to critical limb ischemia (CLI).

- Market players are focusing on developing innovative stents and dilation devices for revascularization, which fuels the growth of the market.

- Rising government initiatives to spread awareness of CLI further contribute to market expansion.

- Ongoing research & developments focusing on the development of effective therapeutics for CLI propels the market's growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.51 Billion |

| Market Size by 2034 | USD 10.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.35% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Segments Covered | By Treatment, By Devices |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Diabetes

The rising prevalence of diabetes is expected to drive market growth since diabetic patients are more prone to CLI. Moreover, as the global population ages, there is a heightened vulnerability to age-related vascular diseases, such as peripheral arterial disease (PAD), which is a key cause of CLI. This, in turn, boosts the demand for CLI treatment. The rising need for effective management and treatment strategies to address the complexities associated with these interconnected health issues further fuels the market's growth.

Rising Demand for Dilation Devices

Increasing demand for stents and dilation devices fuels the growth of the market. These devices successfully dilate the artery while safeguarding the arterial wall. These devices are frequently used to treat critical limb ischemia. Moreover, the rising approvals for these devices contribute to market expansion.

Restraint

High Cost

High costs associated with advanced therapies limit the market's growth to a certain extent. This financial barrier can limit access to effective treatments for many patients who are in need. Additionally, certain treatments can cause severe bleeding and infection, which deter patients from seeking necessary care, thereby exacerbating their health conditions.

Opportunity

Rising R&D

Rising investments in research and development activities to develop innovative therapies for treating CLI create immense opportunities in the market. Approaches such as gene therapy and tissue engineering hold great promise, potentially revolutionizing the way this condition is addressed. Investing in public health initiatives focused on the prevention and management of diseases can lead to a substantial reduction in the incidence and burden of CLI. Moreover, the increasing demand for innovative technologies, such as endovascular procedures, stents, and drug-coated balloons, will boost the market during the forecast period.

Treatment Insights

Based on treatment, during the forecast period, the devices segment is anticipated to hold a significant share of the worldwide critical limb ischemia therapy market. Stents and dilation devices successfully dilate the artery while safeguarding the arterial wall. These are the tools that are frequently used to treat critical limb ischemia. Patients experience a higher quality of life thanks to the low complication rates and the tremendous technical success of dilation devices and stents.

During the forecast period, the devices segment is likely to be driven by these benefits. Another reason for the segment's dominance is the rise in FDA approvals and patient preference for revascularization as the initial course of treatment. The Tack Endovascular System in Below the Knee Arteries (TOBA II BTK) optimized balloon angioplasty study has recently produced promising outcomes in clinical trials.

Devices Insights

The devices segment has been divided into peripheral dilatation systems and embolic protection devices. The peripheral dilatation system is expected to make up a sizable portion of the devices segment during the forecast period, which is explained by the rise in balloon dilatation procedures and CLI vascular surgery. Leading companies in the critical limb ischemia market are concentrating on creating and introducing cutting-edge peripheral dilatation devices.

The Peripheral System by Radianz Radial will be used by people, according to a June 2022 announcement from Cordis, a world authority on cardiovascular technologies. The Peripheral System solution Radianz Radial consists of the PTA Catheter by SABER X RADIANZTM to facilitate treatment, the Guiding Sheath by BRITE TIP RADIANZTM to maximize lesion access of the lower extremity and the Vascular Stent System, SMART RADIANZTM, to help sustain patency for long-lasting positive outcomes.

Critical Limb Ischemia Treatment Market Companies

- Boston Scientific Corporation

- Pluristem Therapeutics Inc.

- Micro Medical Solutions

- Cesca Therapeutics Inc.

- Cardiovascular Systems, Inc.

- Abbott Laboratories

- LimFlow SA

- Rexgenero Ltd.

Recent Developments

- In April 2024, Abbott received approval from the U.S. Food and Drug Administration (FDA) for its Esprit BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System), a breakthrough innovation for people with chronic limb-threatening ischemia (CLTI) below-the-knee (BTK). This system is designed to keep arteries open and deliver drugs to support vessel healing prior to completely dissolving.

- In March 2024, Elixir Medical announced that it has received approval from the U.S. FDA for its DynamX BTK System, a novel, adaptive implant for use in the treatment of narrowed or blocked vessels below-the-knee (BTK) in patients with CLI.

Segment Covered in the Report

By Treatment

- Medication

- Antihypertensive Agents

- Antiplatelet Drugs

- Antithrombotic Agents

- Lipid-lowering Agents

- Others

By Devices

- Embolic Protection Devices

- Peripheral Dilatation System

- Balloon Dilators

- Vascular Stents

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting