Upper Limb Prosthetics Market Size and Forecast 2025 to 2034

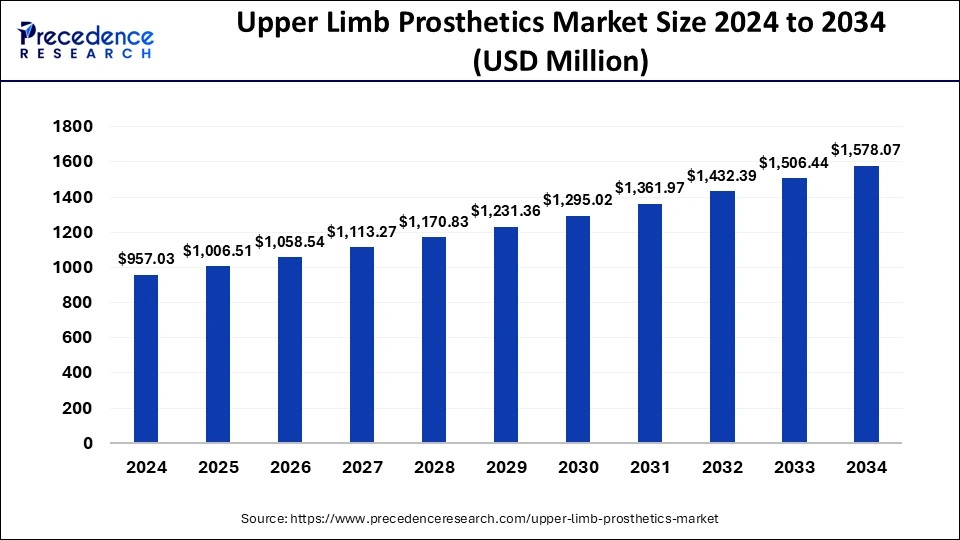

The global upper limb prosthetics market size was calculated at USD 957.03 million in 2024 and is predicted to increase from USD 1,006.51 million in 2025 to approximately USD 1,578.07 million by 2034, expanding at a CAGR of 5.13% from 2025 to 2034. The market is growing due to the increased occurrence of osteosarcoma worldwide, a rise in sports injuries, and an uptick in road accidents.

Upper Limb Prosthetics MarketKey Takeaways

- In terms of revenue, the global upper limb prosthetics market was valued at USD 957.03 million in 2024.

- It is projected to reach USD 1,578.07 million by 2034.

- The market is expected to grow at a CAGR of 5.13% from 2025 to 2034

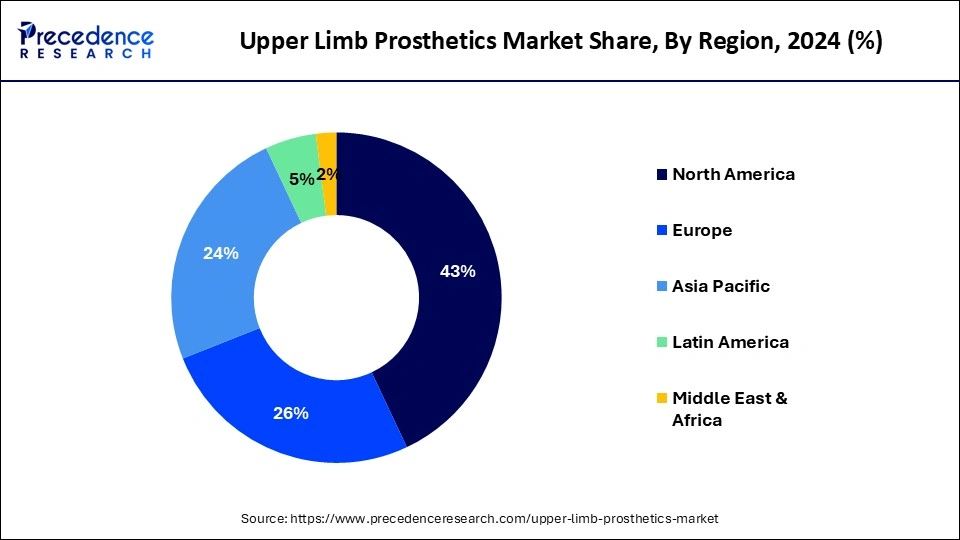

- North America dominated the market with the largest market of 43% in 2024.

- Asia Pacific is projected to experience the highest growth during the forecast period.

- By component, the prosthetic arm segment dominated the market in 2024 and is expected to experience further growth over the forecast period.

- By component, the prosthetic wrist segment is poised for significant growth in the forecast period.

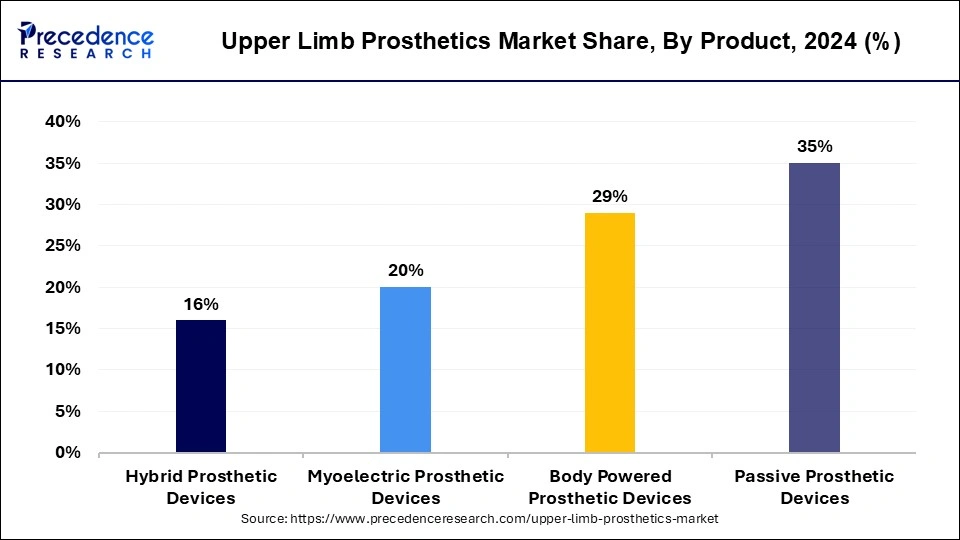

- By product, the passive prosthetic devices segment dominated the market with the largest share of 35% in 2024.

- By product, the body-powered prosthetic devices segment is expected to experience the fastest growth rate during the forecast period.

- By end-user, the prostetic clinics segment dominated the market in 2024.

- By end-user, the hospitals segment is poised for substantial growth throughout the forecast period.

Upper Limb Prosthetics Market Size and Growth 2025 to 2034

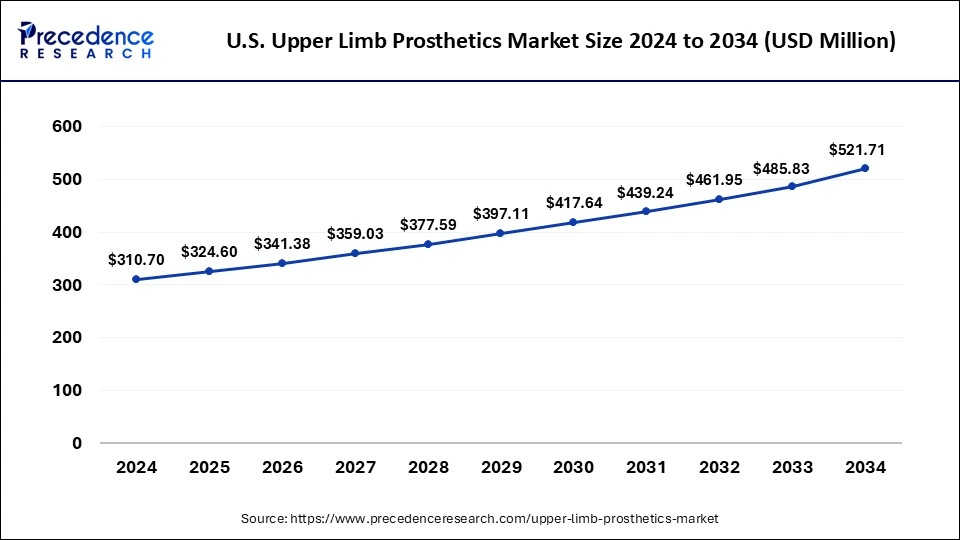

The U.S. upper limb prosthetics market size was exhibited at USD 310.70 million in 2024 and is projected to be worth around USD 521.71 million by 2034, growing at a CAGR of 5.32% from 2025 to 2034.

North America dominated the upper limb prosthetics market with a substantial share of 43% in 2024. This significant market presence is attributed to a rise in accidents and traumas, increased prosthetic surgeries, growing demand for prosthetic devices, advanced healthcare facilities with skilled professionals, and the strong presence of key industry players in the region.

- The Digital Resource Foundation for the Orthotics and Prosthetics Community reports around 31,000 prostheses sold annually in the USA, accounting for total prostheses sales amounting to approximately USD 7.75 million.

- A study revealed that over 10,000 upper limb amputations occurred in the USA, with 5.2% at the wrist disarticulation and transradial level, 6.1% transhumeral or elbow disarticulation, 2.3% at the shoulder or higher, and the majority (75.6%) involving finger amputations.

Asia Pacific is projected to experience the highest growth during the forecast period. This growth is driven by increased healthcare spending and a rising aging population facing higher instances of osteoarthritis, osteoporosis, bone injuries, and obesity. The region's significant healthcare infrastructure development, particularly in countries like India, China, and Japan, and the flourishing medical tourism industry contributes to the growing demand for these medical devices.

Market Overview

The global upper limb prosthetics market is witnessing substantial development, propelled by innovations like hybrid nanomaterials that enhance prosthetic device performance, providing significantly better and more effective prosthetic limbs. These breakthroughs are substantially improving the quality of life for individuals with disabilities. Manufacturing techniques, materials, and electronics evolve, resulting in sophisticated and functional upper limb prosthetic devices. Key factors include myoelectric developments utilizing muscle signals for hand movement control and the application of 3D printing for personalized prostheses.

Advancements in the field are driving significant growth in the upper limb prosthetics market. The yearly toll of nearly 1.3 million lives due to global traffic accidents, as reported by the World Health Organization (WHO), emphasizes the urgent need for progress. Furthermore, there is an increased occurrence of osteosarcoma worldwide, a rise in sports injuries, and an uptick in road accidents.

- According to the National Organization for Rare Disorders, there are between 750-1,000 new cases of osteosarcoma diagnosed in the United States annually, with approximately 450 cases occurring in children or teenagers under the age of 20.

- Johns Hopkins Medical Centre reports that approximately 775,000 children aged 14 and under are treated in hospital emergency departments for sports-related injuries annually.

Upper Limb Prosthetics Market Growth Factors

- The rapid advancement of technology has played a crucial role in driving the growth of the upper limb prosthetics market.

- The significant increase in road accidents is a major factor in the market's growth. These accidents result in severe injuries, including the loss or irreparable damage to upper limbs, often leading to upper limb amputations.

- The increasing incidence of osteosarcoma, a type of bone cancer, globally is driving the demand for these devices, resulting in the expansion of the upper limb prosthetics market.

- The increasing prevalence of sports injuries worldwide drives the demand for upper-limb prosthetics, positively influencing market trends. These injuries are often caused by falls, being struck by objects, collisions, and overexertion during unstructured or informal sports activities.

- The elderly population, susceptible to falls and accidents due to age-related weakness, is a crucial driver of upper limb prosthetics market. The increasing importance of independence among elderly individuals worldwide is expected to expand the market further.

- The trend of mergers and acquisitions (M&A) in the market is anticipated to persist in the coming years, propelled by factors such as increasing global demand.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.13% |

| Market Size in 2025 | USD 1,006.51 Million |

| Market Size by 2034 | USD 1,578.07 Million |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Product Type, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing geriatric population across the globe

The elderly population is more susceptible to falls and accidents due to age-related weakness. The increasing emphasis on independence among the global elderly population is expected to drive the growth of the upper limb prosthetics market. There are over 610 million individuals, accounting for approximately 8% of the world's population, aged 65 or older. In cases where limb-sparing or limb-salvage surgery is performed, such as for arm bone tumors, upper limb amputations may occur. Prosthetic equipment, like upper limb prosthetics, becomes essential to aid function after amputation.

- A report released in May 2022 by WHO and UNICEF highlights a significant issue: out of more than 2.5 billion people requiring assistive products like wheelchairs, hearing aids, or communication apps, almost one billion face restricted access. This challenge is particularly prevalent in low- and middle-income countries, where access can be as low as 3% of the actual need for these transformative products.

Leveraging machine learning

Researchers at the Florida Atlantic University College of Engineering and Computer Science are incorporating stretchable tactile sensors using liquid metal on the fingertips to develop prosthetic hands with a more natural feel. The latest technology offers significant advantages over traditional sensors, featuring high stretchability, flexibility, and conductivity. While an average human fingertip has about 3000 touch receptors, those with upper limb amputations lack this pressured sense of touch. In a recent study, researchers used individual fingertips on the prosthesis to distinguish between different speeds of sliding motions on various textured surfaces, employing only one variable parameter: the distance between ridges. This can boost the growth of the upper limb prosthetics market.

Restraint

Stringent regulatory requirements and high costs

The upper limb prosthetics market faces challenges due to the high costs associated with these prostheses, acting as a barrier for amputees. Additionally, stringent regulatory requirements, mainly overseen by the U.S. Food and Drug Administration (FDA), hinder market growth. The FDA closely monitors the development, approval, and post-approval effects of medical devices, including upper limb prosthetics, categorizing them as class II devices. These devices must undergo a complex 510(k) approval process to gain commercial approval, demonstrating both safety and efficacy.

Opportunities

Myoelectrics development

In the upper limb prosthetics market, the discovery of myoelectric has opened lucrative business opportunities for key players. Electric prostheses, or myoelectric prostheses, operate through electric signals generated by the body's muscles. These prosthetics utilize existing muscles in the residual limb, allowing users to control the device's functions. A sensor within the prosthesis captures electrical signals from the muscles, translating them into movements. This technology provides a natural-looking prosthesis that leverages existing nerves for functional use. The demand for such prosthetics is expected to rise globally, mainly due to traumatic cases resulting from accidents or injuries that lead to losing body parts, such as fingers, toes, arms, or legs.

- In February 2022, the engineering startup Esper Bionics, based in New York, introduced a prosthetic arm with advanced self-learning technology. The Esper Hand incorporates an electromyography-based brain-computer interface (BCI), a technology that captures brain activity. This BCI system enables the user to control the hand by sending impulses from the brain to specific muscles, facilitating faster and more intuitive movement prediction than similar prosthetics.

Versatile treatment and technological advancement

Upper-limb prosthetics now offer treatment for trauma, vascular complications, and bone cancer at various levels, such as trans phalangeal, transmetacarpal, transcarpal, wrist, transradial, transhumeral, interscapulothoracic. Technological advancements have driven the demand for upper-limb prosthetics, contributing to the growth of the myoelectric prosthetics market, prosthetic arm market, and upper-limb prosthetics market. Emerging innovations, including suspension systems and osseointegration, are gaining popularity. 3D printing is also becoming prevalent in upper limb prosthetics due to its cost-effectiveness and faster construction time.

- The American Cancer Society estimates around 3910 new primary bone and joint cancer cases in 2022.

- According to e-NABLE, a prosthetic limb built with 3D printing costs USD 500, significantly lower than the USD 80,000 for a conventional artificial limb. The printing extrusion for this limb took approximately 10 to 15 hours to construct.

Component Insights

The prosthetic arm segment dominated the upper limb prosthetics market in 2024 and is expected to experience further growth over the forecast period. This is attributed to the increase in road accidents, a growing elderly population, and a rise in the prevalence of joint disorders like osteoarthritis in both developed and developing countries. Moreover, ongoing innovations in materials, sensors, and design have led to prosthetic arms that closely emulate natural hand movements, providing enhanced agility and control.

The prosthetic wrist segment is poised for significant growth in the forecast period. Continuous technological advancements play a vital role in propelling the development of the prosthetic wrist segment. The segment's expansion is further fueled by the increased functionality offered by modern prosthetic wrists, enabling users to perform a broader range of daily activities with greater precision. Studies, such as one published in the Journal of Prosthetics & Orthotics, underscore significant strides in prosthetic wrist functionality, contributing to users' independence and overall improvement in quality of life.

- An article published by Watch Live in October 2024 highlights advancements in bionic technology that have aided a woman in regaining sensations in her hand. Phantom limb pain, a common post-amputation, often hinders regular prosthetic functionality. Although achieving a hand akin to Luke Skywalker's bionic one is still in the future, scientists claim progress with the latest prosthetic technique. Doctors are optimistic that more individuals will soon benefit from this innovative approach.

Product Insights

The passive prosthetic device segment dominated the largest market share of 35% in 2024. The segment is driven by critical factors such as an increase in amputees, a higher demand for upper limb prosthetic surgeries, rising patient awareness about prosthetic devices, and advancements in prosthetic technology. These factors have contributed to the notable expansion of the passive prosthetics segment.

- A study from Ohio State University estimates that there are around 3 million amputees worldwide. In the United States alone, 2.1 million individuals are living with limb loss, a number expected to double by 2050, according to another study.

The body-powered prosthetic devices segment is expected to experience the fastest growth rate during the forecast period. These devices feature simpler designs with fewer components, making them a cost-effective choice for patients. Their minimal electronic components contribute to lower maintenance requirements and reduced risk of malfunctions, ultimately enhancing patient satisfaction.

- In July 2022, researchers introduced a groundbreaking breath-driven concept that revolutionized access to hand prosthetics. This air-powered hand is designed to be lightweight, low-maintenance, and user-friendly. It is an excellent body-powered prosthetic option, especially for children and individuals in low and middle-income countries.

End User Insights

The prosthetic clinics segment dominated the market share in 2024. The rising incidence of limb amputation, attributed to factors like sports injuries, diabetes, vascular diseases, and other accidents, is boosting the demand for specialized clinic services in the field. Clinics offering customized as well as personalized prosthetic solutions via skilled experts providing expert evaluation, fitting, and continuous care for prosthetic limbs are attracting more patients and contributing to the segment's rapid growth.

Besides the dominant clinics segment in the upper limb prosthetics market, the hospital's segment has shown a significant presence. This segment is poised for substantial growth throughout the forecast period. Hospitals are at the forefront of adopting and providing cutting-edge prosthetic technologies and devices, making them appealing to patients seeking advanced and innovative solutions. This trend is expected to drive significant growth in the hospital segment.

Recent Developments

- In September 2023, Össur's upper limb research and development (R&D) facility secured funding from Scottish Enterprise to develop new solutions in upper limb prosthetics.

- In May 2022, Ottobock SE & Co. KGaA showcased its Myo Plus T.H. upper limb prosthetic device at OTWorld in Leipzig. Ottobock anticipates introducing and demonstrating the Myo Plus T.H. upper limb prosthetic device, enhancing treatment possibilities and advancing market readiness.

Upper Limb Prosthetics Market Companies

- Össur

- Ottobock

- Steeper Group.

- Fillauer LLC

- Open Bionics

- Comprehensive Prosthetics & Orthotics

- COAPT LLC.

- Mobius Bionics.

- Protonix

- Motorica

Segments Covered in the Report

By Component

- Prosthetic Arm

- Prosthetic Elbow

- Prosthetic Wrist

- Prosthetic Shoulder

- Others

By Product Type

- Passive Prosthetic Devices

- Body Powered Prosthetic Devices

- Myoelectric Prosthetic Devices

- Hybrid Prosthetic Devices

By End-user

- Hospitals

- Prosthetic Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting