What is the 3D Printed Prosthetics Market Size?

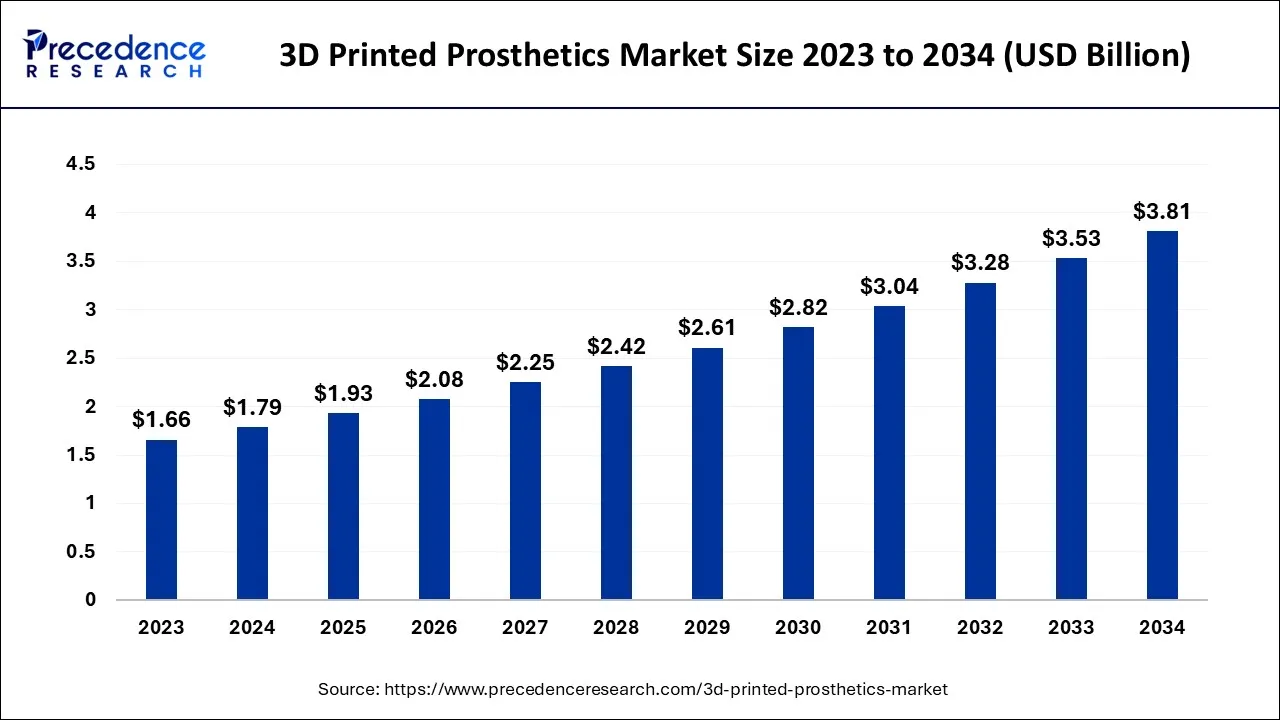

The global 3D printed prosthetics market size is calculated at USD 1.93 billion in 2025 and is predicted to increase from USD 2.08 billion in 2026 to approximately USD 4.07 billion by 2035, expanding at a CAGR of 7.75% from 2026 to 2035.

3D Printed Prosthetics Market Key Takeaways

- In terms of revenue, the market is valued at $1.93 billion in 2025.

- It is projected to reach $4.07billion by 2035.

- The market is expected to grow at a CAGR of 2% from 2026 to 2035.

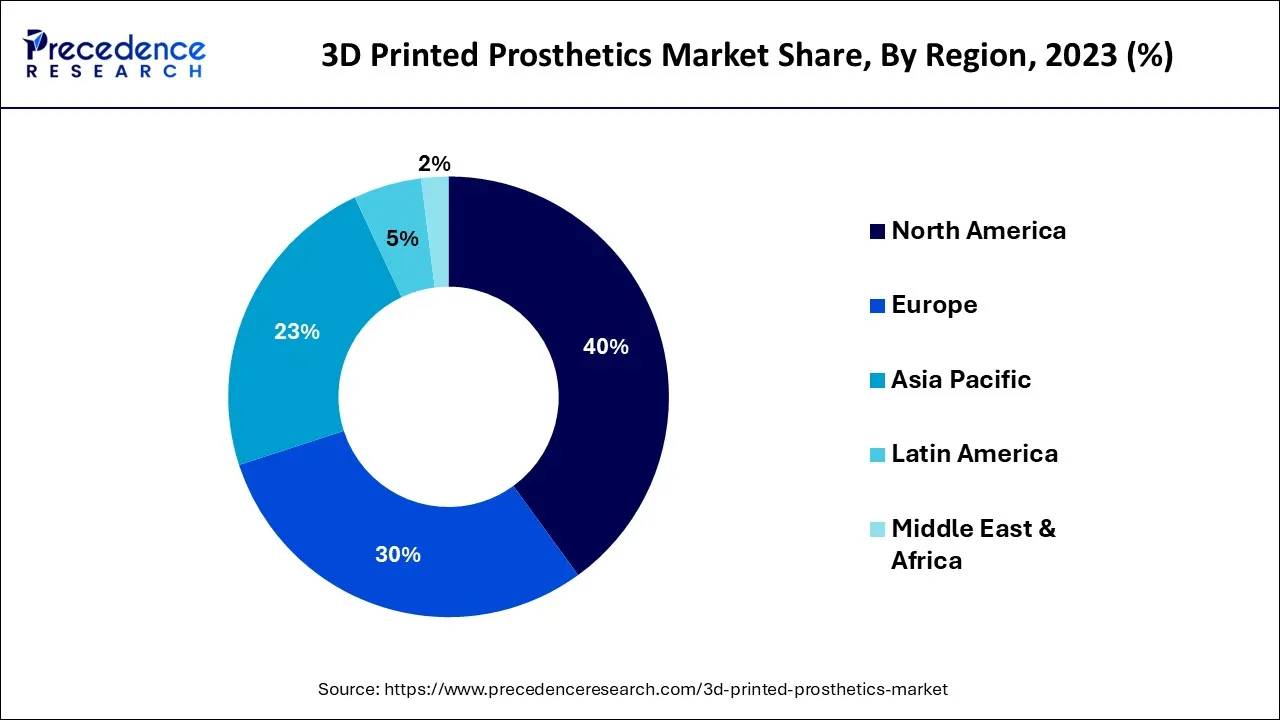

- North America region generated more than 40% of the revenue share in 2025.

- By Type, the limbs segment captured more than 34% of revenue share in 2025.

- By Material, the polypropylene segment contributed more than 33% of revenue share in 2025.

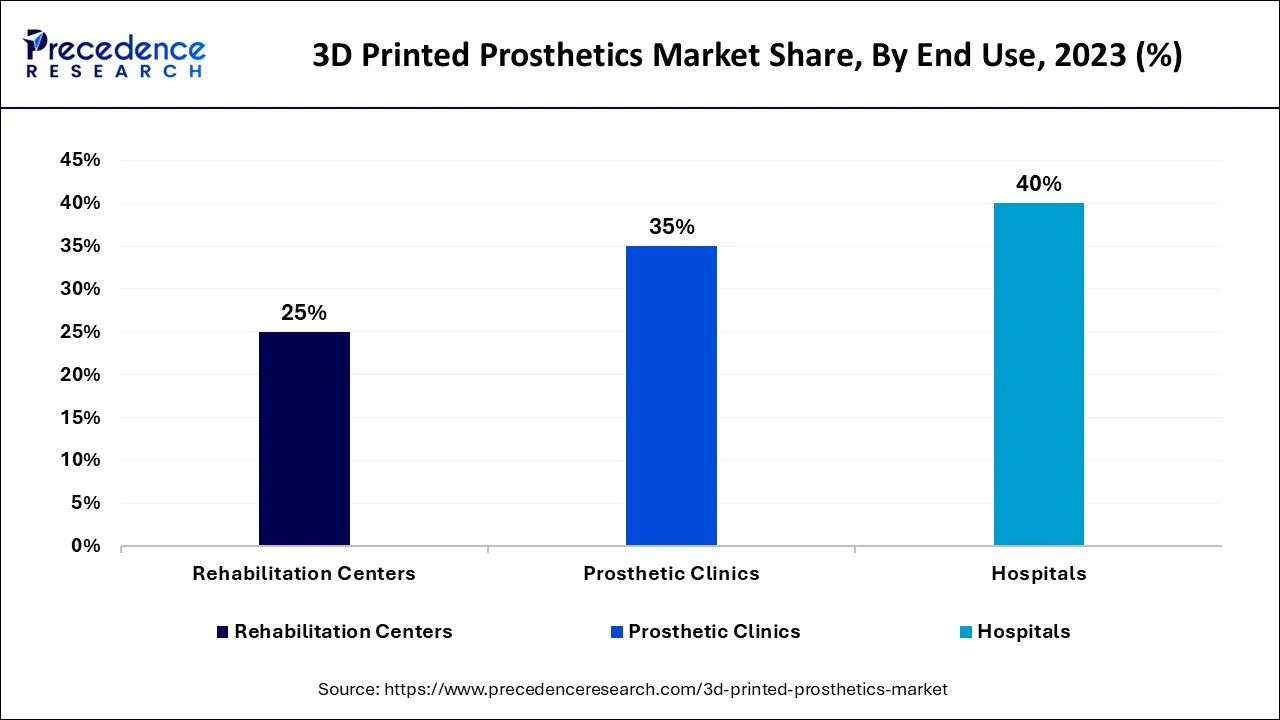

- By End-use, the hospitals segment recorded more than 40% of revenue share in 2025.

3D Printed Prosthetics Market Growth Factor

The rising incidence of limb loss due to accidents, injuries, and medical conditions such as diabetes and peripheral arterial disease is a significant factor driving the demand for 3D-printed prosthetics. The focus of market players on producing 3D-printed prosthetics is expected to propel the market's growth. It has been acknowledged that 3D-printed prosthetics are likely to overcome the limitations of traditional products, which is why their sales are anticipated to increase in the near future.

The production and shipping of raw materials for 3D printed prosthetics goods had been significantly affected by the COVID-19 epidemic. During the COVID-19 pandemic shutdown in several nations, the supply network was disrupted. Market participants noticed a decline in the sales of 3D-printed prostheses goods. However, sales of 3D printed prosthetics increased following the COVID-19 pandemic as the need and desire for the devices increased along with customer knowledge of prosthetics. Additionally, the market experienced rapid development after the epidemic as many producers stated that the need for 3D printing grew significantly as a result of the ability to create components on demand in a quicker amount of time and the ability to reduce waste and overstock.

The market for 3D printed prosthetics is expected to grow significantly as a result of factors including rising demand for specially designed prosthetic products, an increase in sports injuries and auto accidents, and rising private and public spending leading to improved R&D. Additionally, advantageous reimbursement policies, government efforts, and a preference for cutting-edge innovative goods along with increased R&D spending for the creation of highly sophisticated prosthetics all contribute to the market's expansion. Many businesses are developing a novel approach to prosthetics that is useful and aesthetically pleasing by combining the benefits of additive manufacturing and generative design. Prosthetics can be 3D made from materials like acrylic, polyurethane, polyethylene, and polypropylene.

The market for 3D-printed prosthetic products is expanding due to the increase in unintentional accidents. Accidental wounds can be very damaging to a person, and they occasionally result in amputation. The number of fatalities from automobile accidents in the US rose to 42915 in 2021, the greatest number in 16 years. Amputation instances increase by about 50,000 per year in the US, according to a study from the National Centre for Health Statistics. Sales of 3D-printed prostheses are increasing as a result of an increase in amputation instances caused by other medical conditions like diabetes and vascular illnesses. For instance, a study that appeared in the American Journal of Managed Care estimated that 85% of patient limb amputations resulted from diabetic foot ulcers, with one patient leg being removed worldwide every 30 seconds.

- Increased instruction and practice using 3D-made surgical models for doctors

- The high prevalence of surgical treatments and the desire for individualized healthcare

- Widespread use of fused deposition modeling technique

- A prominent provider of 3D-printed prosthetic devices is increasingly focusing on working with hospitals and rehabilitation facilities.

- Using 3D printing to create novel goods that encourage bone ingrowth and enhance implant fixation to spinal bone

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.07 Billion |

| Market Size in 2025 | USD 1.93 Billion |

| Market Size in 2026 | USD 2.08 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.85% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Material, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Constant Research And Development

A prosthetic process will soon be accessible to the average individual due to the increasing use of 3D printing in prostheses. People who need prosthesis operations would be happy with the price because the conventional approach has been very pricey. The price has dropped considerably thanks to 3D printing. With CAD, it is very simple to change the designs, and manufacturing costs are also very cheap. Due to this, it provides a more believable option for bionic limbs. Speed is a crucial factor when it comes to 3D printing and prosthesis uses. prostheses can be produced more quickly than conventional prostheses when using 3D printing. Making a single prosthesis requires weeks or even months for conventional prosthetic manufacturers. With the advent of 3D printers, this is altering. According to the Amputee Coalition, there are almost 2 million individuals living without a leg in the United States alone. In the United States, there are roughly 185,000 amputations carried out annually due to a range of reasons.

Many businesses are now making investments in 3D-printed prostheses and expanding their availability. Scientists at the Israel Institute of Technology plan to create an automatic manufacturing line for low-cost, customized prosthetic arms in March 2021. At CES 2020, prosthetic limb manufacturer Unlimited Tomorrow unveiled TrueLimb, a completely remote 3D mechanical arm that amputees can purchase by entering into their online accounts. Additionally, in August 2021, a group of scientists from Shanghai Jiao Tong University and MIT developed an inflatable artificial hand that is much less expensive than similar prostheses. However, the inflatable hand costs $500 instead of US$10,000 for metal limb neuroprosthetics and is composed of a light, pliable substance. Companies are continuously introducing new technologies and creating new goods as a result of the rising demand for 3D prosthetics, which is fueling the market's expansion.

- In March 2024, NIPPON EXPRESS HOLDINGS, INC. acquired a stake in Instalimb, Inc., which is expanding its 3D-printed prosthetics business overseas in the Philippines, India, and elsewhere. Instalimb is a Japanese start-up whose vision is to "Create a world where everyone in need can access high-quality prosthetic & orthotic devices."

Key Market Challenges

Durability

The longevity of artificial appendages is still a worry despite their relatively cheap cost. The prosthetic arms created by hobbyist printers fail more frequently than conventional ones do. A 3D-printed limb's longevity is tested, but the FDA does not accept it.

Regulatory Challenges

One of the major challenges facing the 3D-printed prosthetics market is the lack of regulatory guidelines and standards. The production of 3D-printed prosthetics involves several complex processes, including design, printing, and assembly. However, there are currently no standardized guidelines or regulations for these processes, leading to variations in quality and safety across different products. This lack of regulation can create challenges for patients and healthcare providers who are trying to determine the safety and effectiveness of 3D-printed prosthetics.

Lack Of Widespread Acceptance

Another challenge facing the 3D-printed prosthetics market is the lack of widespread acceptance and awareness among healthcare providers and insurance companies. Traditional prosthetics have been in use for decades and are widely accepted by the medical community, with established reimbursement policies by insurance companies. On the other hand, 3D-printed prosthetics are relatively new, and there may be skepticism or reluctance among healthcare providers to adopt them. Additionally, insurance companies may not have established policies for reimbursement of 3D-printed prosthetics, which can make it difficult for patients to access these devices.

Key Market Opportunities

Rising demand for customization and personalization

One of the biggest advantages of 3D printing technology is the ability to customize and personalize prosthetics according to the individual needs of the patient. Traditional prosthetics are often expensive and may not fit perfectly, leading to discomfort and limitations in movement. With 3D printing, prosthetics can be designed and manufactured to fit the exact specifications of the patient, allowing for greater comfort and mobility. This presents an opportunity for 3D printing companies to focus on providing customized and personalized prosthetics for individuals with specific needs, such as amputees or those with disabilities.

Rising customer preference toward affordable prosthetics

Another opportunity in the 3D-printed prosthetics market is the ability to provide affordable prosthetics to those who may not have access to traditional prosthetics due to cost constraints. 3D printing technology has significantly lowered the cost of producing prosthetics, making them more accessible to a wider range of individuals. This presents an opportunity for 3D printing companies to focus on providing affordable prosthetics to individuals in developing countries or those without insurance coverage. Additionally, 3D printing technology allows for the production of prosthetics on demand, reducing the need for large inventories and lowering the overall cost of production.

- In June 2023, to enhance spinal procedures using 3D printing with HP's Jet Fusion 5200 3D printers, Mighty Oak Medical and HP embarked on a technological collaboration. Installing Jet Fusion 5200 3D printers has resulted in 99.7% accurate screw replacement and increased reproducibility and consistency.

Segment Insights

Type Insights

The driving factors for the growth of the 3D printed prosthetics market include the increasing demand for personalized and affordable prosthetics, advancements in 3D printing technology, and the ability to produce prosthetics with complex geometries and internal structures. As 3D printing technology continues to improve and become more accessible, it is likely that the market for 3D-printed prosthetics will continue to grow, with a focus on providing customized, personalized, and affordable solutions to individuals with specific needs.

The limbs sector led the international market in 2024 and accounted for 34% of total revenue and the segment is anticipated to maintain its leadership position throughout the forecast period. The driving factors for the growth of this segment include the increasing demand for personalized and affordable prosthetics, advancements in 3D printing technology, and the ability to produce prosthetics on demand.

Additionally, industry participants in 3D-printed prostheses are focusing on the creation of waterproof prosthetic appendages. The purpose of the innovation is to give users greater mobility, particularly in sports. The prosthetic appendages made using 3D printing have benefits like not hurting the user, being comfier, and being very adjustable.

Material Insights

With a 33% revenue share, the polypropylene sector commanded the majority of the worldwide market in 2025. Over the forecast period, it is expected that the sector will experience profitable development. The main drivers of the market's growth during the forecast period are the rising demand for polypropylene material in the production of 3D printed prosthetics, low manufacturing costs, the material's superior durability, rising R&D investment, and an increase in preference for polypropylene globally.

The advantages of polypropylene include its lightweight, which allows for greater weight reduction than other materials, and its ability to be sterilized without losing its qualities. It also has superb mechanical qualities, which makes it a wonderful substance for 3D printing prostheses. Therefore, the aforementioned elements fuel the market's expansion.

End Use Insights

In 2025, hospitals held the largest portion of the worldwide industry, accounting for 40% of total revenue. This is brought on by the sharp rise in patient admissions, the rise in accident reports, and the growing expenditure in 3D R&D. Additionally, the market is being driven by an increase in the use of 3D printed prosthetics by both small and big institutions as well as an increase in hospital availability, particularly in industrialized nations.

Over the course of the forecast period, prosthetic clinics are anticipated to experience the highest growth due to the rising demand for 3D printed prosthetics in these facilities, an increase in the number of patients in need of affordable prosthetics, an increase in cases of amputation, and an increase in the prevalence of chronic diseases globally.

Regional Insights

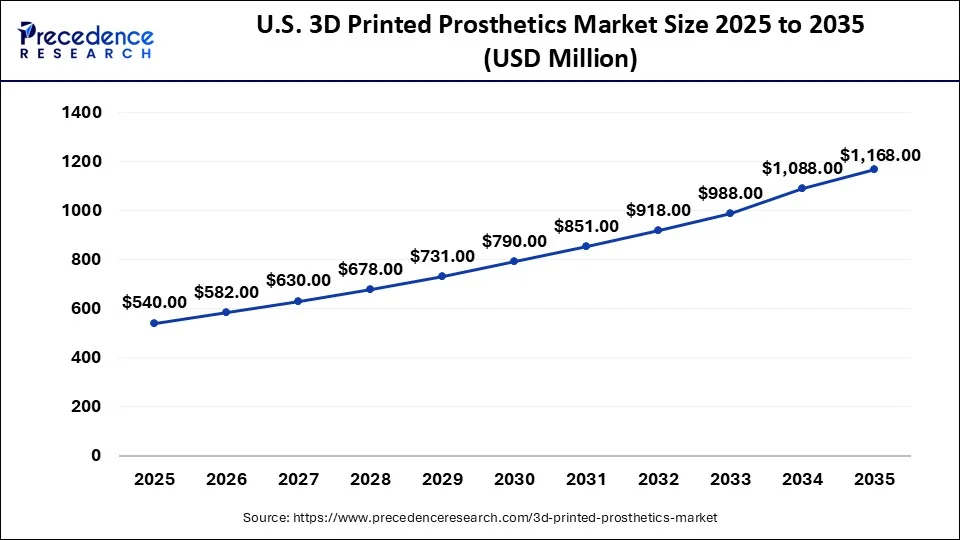

What is the U.S. 3D Printed Prosthetics Market Size?

The U.S. 3D printed prosthetics market size is exhibited at USD 540 million in 2025 and is projected to be worth around USD 1,168 million by 2035, growing at a CAGR of 8.02% from 2026 to 2035.

How did North America dominate the 3D Printed Prosthetics Market in 2025?

In 2025, North America held a commanding position in the world market and contributed more than 40% of global income. The rise in sports injuries, the rising need for high-quality healthcare services, the existence of several major market participants in this area, and the well-established healthcare infrastructure all contribute to the market's expansion. Additionally, encouraging government programs to support R&D activities and incentives to increase the uptake of 3D-printed prosthetics are probably going to drive market expansion in the area.

- In March 2025, Cybermed Inc., a global innovator in digital dental technology, announced the launch of REON Ceramic C&V (Crown and Veneer), an innovative ceramic 3D printing material. This advanced material is specifically designed for final permanent prostheses, offering exceptional strength, biocompatibility, and aesthetic precision.

U.S. 3D Printed Prosthetics Market Analysis

The U.S. is modernizing due to a rapid industrial shift beyond basic polymers to high-performance biocompatible materials and regulatory support for additive manufacturing. Medicare, the federal health program for older Americans and people with disabilities, has planned to cover affordable 3D printed prosthetics.

How is the Asia Pacific expected to be the Rapidly Growing Region in the 3D Printed Prosthetics Market?

During the projection era, a rapid rate of growth is anticipated for the Asia Pacific region. The primary driver of the market's expansion has been identified as an increase in the number of significant key players investing in R&D in this area. Additionally, the rise in accidental instances and the existence of a sizable portion of the population that belongs to the middle-income group significantly increase the demand for affordable and cutting-edge 3D-printed prosthetics in order to draw important medical device businesses to the area. Countries such as China, Japan, and India are expected to be major contributors to this growth. The European market for 3D-printed prosthetics is also experiencing significant growth, with a focus on providing personalized and customized solutions for patients. Countries such as Germany, France, and the UK are leading the way in this market, with increasing investments in research and development.

India 3D Printed Prosthetics Market Trends

The Indian market is growing and expanding due to cost efficiency, customization, expansion of healthcare infrastructure, the national strategy for additive manufacturing, and policy support. India is embracing wide applications of 3D printing across jewellery, automotive, aerospace, healthcare, construction, and more sectors.

- In October 2025, Motorica, a global MedTech company, announced the launch of its Digital Prosthetics Program in India. This launch aims to transform access to advanced assistive care.

Latin America

What Opportunities Exist in the 3D Printed Prosthetics Industry in Latin America?

Latin America is expected to grow at a significant rate in the market, owing to the continuous innovations in additive manufacturing, including AI-driven design automation, new biocompatible materials, and the integration of smart sensors. There is a remarkable growth of specialized startups and new regulatory frameworks, which are expanding 3D printed healthcare.

MEA

What makes Revolution in the 3D Printed Prosthetics Industry in the Middle East and Africa?

The Middle East and Africa are expected to grow at a lucrative rate in the market, driven by the adoption of localized and cost-effective manufacturing technologies, resilience in localized production and supply chain, and demand for high-quality and customized medical solutions. The major Middle East initiatives are Saudi Arabia's Vision 2030, the UAE goals, UNICEF projects, and Egypt's localization efforts.

3D Printed Prosthetics Market-Value Chain Analysis

- R&D:This stage includes data acquisition, patient mapping, iterative digital design, advanced material research, integration of smart systems, regulatory and clinical validation, and decentralized production.

Key Players: Stratasys Ltd., 3D Systems Corporation, HP Inc., Materialise NV, Open Bionics, UNYQ Inc. - Distribution to Hospitals, Pharmacies:This stage is driven by the rise of point-of-care, personalized dosages and tablets, medicare reimbursement, and digital inventory and logistics.

Key Players: 3D Systems Corporation, Stratasys Ltd, Materialise NV, Formlabs Inc., Open Bionics, UNYQ. - Patient Support & Services:This stage encompasses initial assessment, digital onboarding, personalized design, and rapid fabrication, fitting & post-processing services, and long-term maintenance.

Key Players: Ottobock, Ossur, Protosthetics, Open Bionics, Limbitless Solutions, Unlimited Tomorrow, Materialise.

3D Printed Prosthetics Market Companies

- 3D Systems Corporation

- EnvisionTEC

- Stratasys Ltd.

- Bionicohand

- YouBionic

- UNYQ

- Mecuris

- LimbForge, Inc.

- Open Bionics

- Create Prosthetics

- Bio3D Technologies

- Laser GmbH

- Prodways Group

- Protosthetics

- 3T RPD Ltd.

- Formlabs

Recent Developments

- In October 2024, Qwadra, the digital division of Eqwal and a global provider of digital solutions in the orthotics and prosthetics (O&P) sector, formed a strategic partnership with Denmark-based Create it REAL, known for its advanced 3D printing technologies. The collaboration involves incorporating Create it REAL's multi-patented Programmable Foam technology into Qwadra's Sona Flex.

- In February 2024, UK-based robotics company Open Bionics announced that its 3D-printed finger device had been adopted for the first time by a hand amputee from London. The new 3D printed prosthesis, called the Hero Gauntlet, was made for 50-year-old Londoner Suleman Chohan using Open Bionics' 3D scanning and additive manufacturing technology.

- In February 2023, a contract was struck between Ricoh USA, Inc. and Stratasys Ltd. to supply 3D-printed anatomic models for clinical settings on demand. The new service builds on an existing relationship between Ricoh 3D for Healthcare and Stratasys to increase access to 3D-printed medical models.

- In order to be used in orthotics and prosthetics (O&P) operations, Protosthetics, a maker of 3D printed prosthetics, started its internal 3D printing program in 2022.

- A major competitor in 3D printed prostheses, YouBionic, is concentrating on making their 3D printed prosthetic hand strong, flexible, and mobile. In order to improve its usability, the business is incorporating artificial intelligence.

- Prodways Group, another significant participant in the market for 3D printed prosthetics, provides patients of all ages with technologically cutting-edge limbs. The business is concentrating on providing the same to a larger customer group by expanding into various regional areas.

Segments Covered in the Report

By Type

- Sockets

- Limbs

- Joints

- Others

By Material

- Polyethylene

- Polypropylene

- Acrylics

- Polyurethane

By End-use

- Hospitals

- Rehabilitation Centers

- Prosthetic Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content