What is the 3D Printed Surgical Models Market Size?

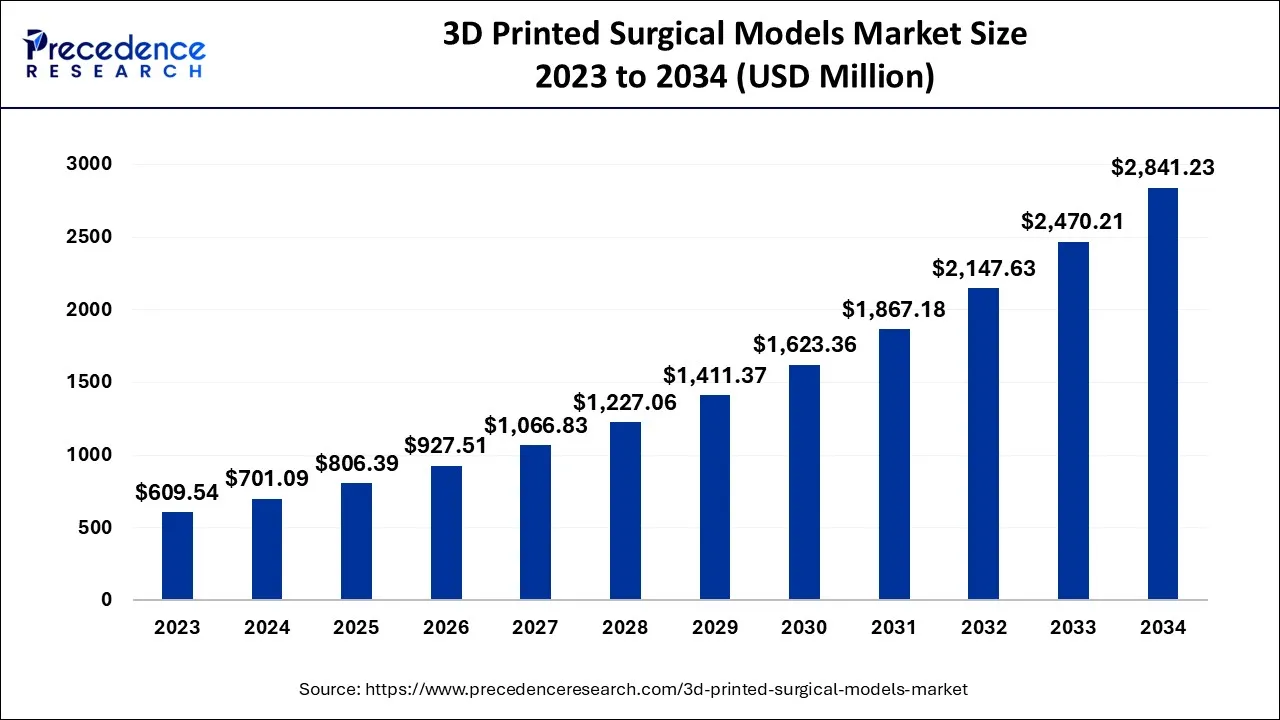

The global 3D printed surgical models market size is calculated at USD 806.39 million in 2025 and is predicted to increase from USD 927.51 million in 2026 to approximately USD 3,179.96 million by 2035, expanding at a CAGR of 14.71% from 2026 to 2035.

3D Printed Surgical Models Market Key Takeaways

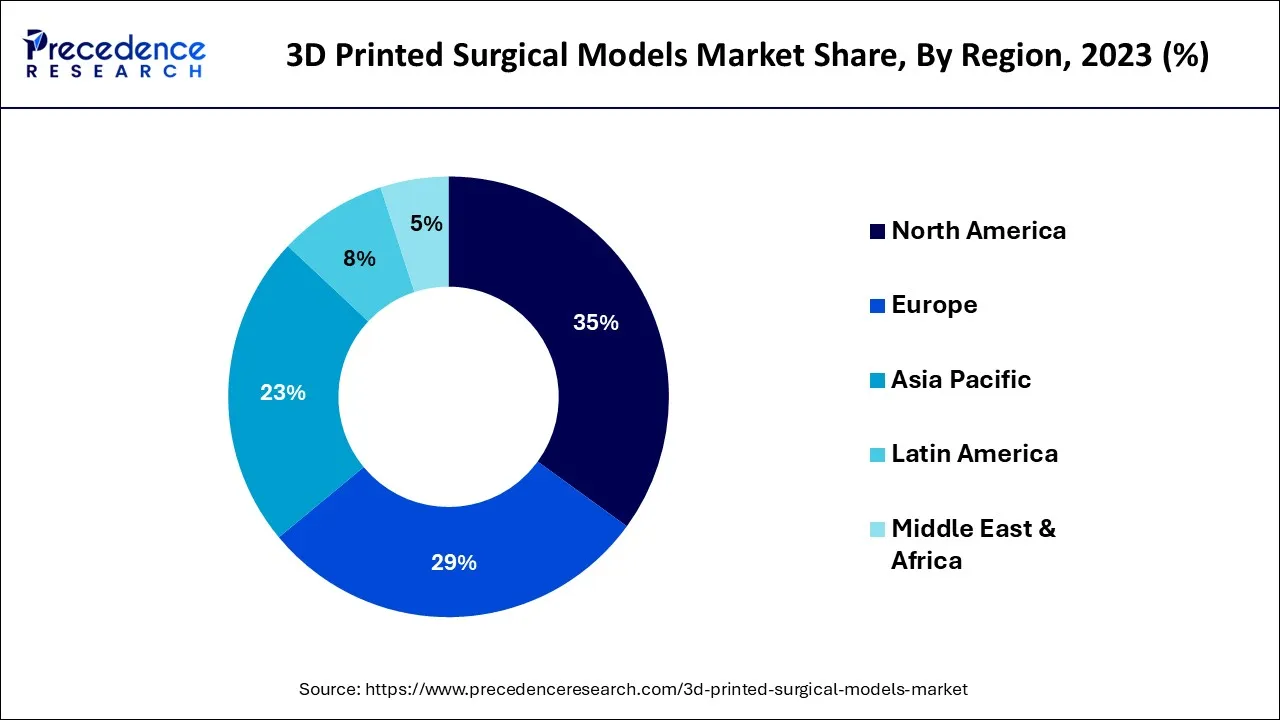

- North America dominated the market and generated more than 35% of the revenue share in 2025.

- By Specialty, the orthopedic surgery segment captured more than 33% of the revenue share in 2025.

- By Technology, The fused deposition modeling (FDM) segment is expected to expand at a remarkable CAGR between 2026 and 2035.

- By Material, the plastics material segment generated more than 34% of total revenue in 2025.

3D Printed Surgical Models Market Growth Factors

As a result of increased demand for high-tech advancements in surgical instruments, techniques, 3D printed resources, and individualized healthcare, the market for 3D printed surgical models has grown. The medical industry's use of 3D-printed surgical models for the preparation of endovascular aneurysm restoration, tumor excision, and the treatment of trauma damages in orthopedic operations has improved market statistics for 3D-printed surgical models.

The market is expanding due to technological advancements and advances in medical sciences. An aging population and a global demand for nominally invasive surgery drive the industry share. On the other hand, the high rate of technology is expected to limit demand. Increased use of refurbished and recycled equipment will likely constrain industry growth during the forecast period. The pandemic has reduced demand for goods and equipment, affecting innovative investments in the healthcare area.

Market Outlook

- Market Growth Overview: The 3D printed surgical models market is growing rapidly due to increasing demand for personalized surgical planning, complex procedure simulation, and enhanced medical training. Advancements in 3D printing technology, improved imaging techniques, and rising adoption in hospitals and medical institutions are also driving the market.

- Global Expansion: The market is growing worldwide, driven by the need for precise pre-surgical planning, reduced operation times, and improved patient outcomes. Emerging regions such as Asia-Pacific, Latin America, and the Middle East offer opportunities due to expanding healthcare infrastructure, rising investments in medical technology, and increasing adoption of advanced surgical solutions.

- Major Investors: Major investors include medical device manufacturers, 3D printing technology companies, and venture capital firms specializing in healthcare innovation. They contribute by funding R&D, developing anatomically accurate surgical models, advancing printing materials and techniques, and supporting adoption in hospitals and training institutions globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 806.39Million |

| Market Size in 2026 | USD 927.51 Million |

| Market Size by 2035 | USD 3,179.96Million |

| Growth Rate from 2026 to 2035 | CAGR of 14.71% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Specialty, Technology, Materials, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increased prevalence of osteoarthritis and other musculoskeletal conditions driving the market growth

One of the major factors driving the growth of the 3D printed surgical models market is the increasing prevalence of osteoarthritis and other musculoskeletal conditions. Osteoarthritis is a condition that causes pain, stiffness, and loss of joint function by damaging the joint cartilage and surrounding tissues. 3D printing medical devices enable the creation of a replica of a patient's joint, which can provide surgeons with critical information that a 2-dimensional scan may not reveal.

The probability of developing osteoarthritis rises with age. According to the US National Library of Medicine, by 2040, it is expected that approximately 78 million (26%) US adults aged 18 and above will have doctor-diagnosed arthritis. As a result, the adoption of 3D-printed medical devices is increasing, positively impacting market growth.

Restrains

Regulatory challenges restrain the market growth

The regulation on 3D Printed surgical model products hinders the industry growth. Bioprinter tissue is a "custom-made device" due to the high degree of personalization in construct shape and genetic material. The addition of biological material complicates matters, and regulatory bodies worldwide, such as the FDA, need to catch up with the rapidly evolving field of bioprinting, with currently unclear guidance and regulations for such technology.

The classification and ultimate regulation of regenerative medicine and tissue-engineered technologies and their components is challenging in all design, production, and handling aspects. These technologies' seemingly never-ending innovation and advancement exemplify the convergence of several different pathways covering a broad taxonomy of perceived utility, cost-effectiveness, and biography.

Opportunities

Increase the use of patient-specific implants future for 3D-printed surgical models

Patient-specific Implant is the most recent and progressive application of 3D printing in the surgical field. Based on accurate 3D imaging, patient-specific implants are planned, resulting in perfectly fitting implants that restore appropriate anatomy, relation, and function. In craniomaxillofacial surgery, PSI is becoming increasingly popular, with many companies offering various implants made of multiple materials for operation and restoring anatomy and symmetry.

Titanium implants combined with autogenous bone grafts for load-bearing reconstruction following mandibular resections and avulsion injuries and personalized PSI integrated with dental implants for future dental arch and occlusion restoration.

In orthopedics, patient-specific implants were used for bony reconstruction following tumor resections, the production of customized external fixators used in fracture treatment, and cervical spine renovation. To repair skull defects, PSI technology is also used in neurosurgery, primarily in cranioplasty. PSI results in a more precise and long-lasting reconstruction method, with less morbidity and a shorter operation time.

Segment Insighst

Specialty Insights

The orthopedic surgery segment dominated the global industry, accounting for more than 33% of the total revenue share in 2023. The growing elderly population and the rising prevalence and incidence of orthopedic ailments are the primary factors influencing the market growth of orthopedic surgery.

According to the WHO, around 1.71 billion people worldwide suffer from musculoskeletal disorders. Lower back pain is the foremost cause of disability in 160 countries, and musculoskeletal diseases are the leading cause of disability globally. The neurosurgery segment is expected to grow rapidly during the forecast period. This is due to technical advancements in 3D printing methods and materials, the increasing incidence of neurological diseases, and the delicate architecture of the brain's vasculature, which requires high degrees of accuracy in neurosurgery.

Technology Insights

The FDM segment is expected to grow significantly in the coming years due to the printers' widespread use and low cost. FDM technology, which belongs to the material extrusion technology class, is ideal for physicians interested in 3D printing because it is office-friendly, simple to use, fast, and allows for low-cost prototype creation. Others include powder bed fusion technologies, directed energy deposition technologies, and other related technologies. The other segment is expected to grow rapidly due to the increasing popularity of HP's MultiJet fusion technology, which belongs to the powder bed fusion class of technologies.

Materials Insights

In 2025, the plastics material segment dominated the global market, accounting for more than 34% of total revenue. The segment is expected to grow fastest, retaining its leading position throughout the forecast period. Plastics have the highest revenue share due to the availability of improved thermoplastic resin and biodegradable plastics, the material's low cost, reusability, and compatibility with a variety of 3D printing technologies.

Plastics have remained used in a diverse and ever-increasing variety of goods due to their small cost, easiness of manufacture, versatility, and water resistance. The polymers category is expected to grow significantly during the forecast period due to the introduction of desktop resin-based 3D printers and the versatility of these materials. The polymers are also expected to grow at the -fastest rate during the forecast period, while the metals segment will have the second-highest revenue share by 2032.

Regional Insights

U.S. 3D Printed Surgical Models Market Size and Growth 2026 to 2035

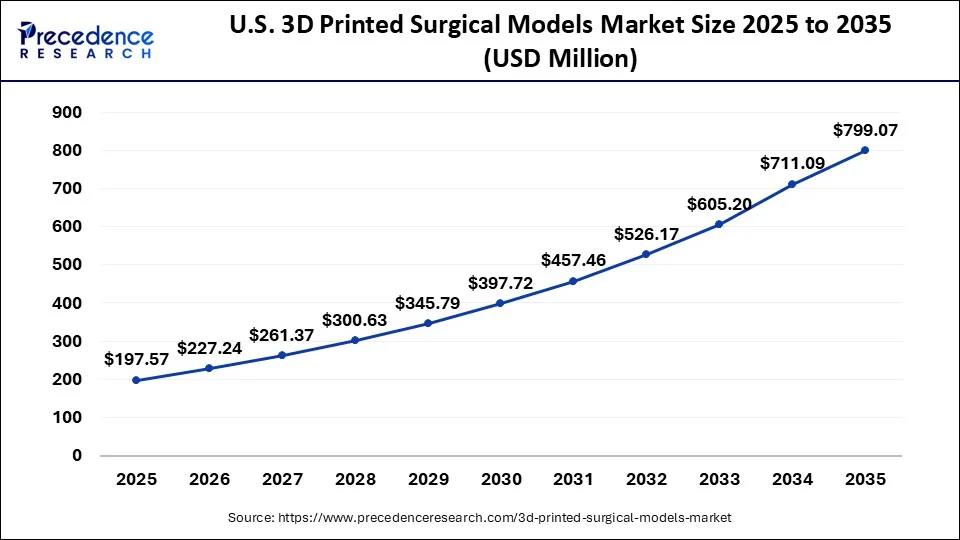

The U.S. 3D printed surgical models market size is exhibited at USD 197.57 million in 2025 and is projected to be worth around USD 799.07 million by 2035, growing at a CAGR of 15.00% from 2026 to 2035.

In 2025, North America dominated the global industry, accounting for more than 35% of overall revenue. According to forecasts, the local market will grow due to a rising geriatric population and the high frequency of illnesses associated with sedentary living. The region's growth will be driven by the most progressive healthcare set-up, including clinics and clinics, and extensive use of cutting-edge medical amenities and products such as 3D printing.

U.S. 3D Printed Surgical Models Market Analysis

The 3D printed surgical models market in the U.S. is expanding due to a strong emphasis on point-of-care manufacturing, widespread adoption of precision medicine, and supportive regulatory frameworks. The U.S. FDA, through the Center for Devices and Radiological Health (CDRH), oversees the regulation of 3D printed medical devices, biologics, and drugs, ensuring safety and compliance.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is the fastest-growing region in the 3D printed surgical models market due to increasing investments in healthcare infrastructure and the adoption of advanced medical technologies. Rapid growth in surgical procedures, rising demand for personalized patient care, and the expansion of hospitals and medical training centers are driving market adoption. Additionally, supportive government initiatives and the presence of key 3D printing technology providers are accelerating the region's market growth.

India 3D Printed Surgical Models Market Analysis

The Indian market is growing due to advancements in material science and technology, which include biocompatible materials, AI integration, and cost-effective hardware. In December 2025, Medi-Mold announced the investment of INR 100 Cr for the first 3D printed ortho-implant facility in India. Additionally, rising demand for personalized and complex surgical planning, especially in orthopedics, cardiology, and neurosurgery, drives the market

- In May 2025, AIIMS Bhopal launched 3D printing through research and innovative projects to transform kidney stone surgeries.

Why is Europe Considered a Significant Region in the 3D Printed Surgical Models Market?

Europe is a significant region due to strong funding and investments by government and private entities for healthcare innovation. The region's advanced healthcare infrastructure, widespread adoption of innovative medical technologies, and a strong focus on precision medicine also contribute to market growth. The presence of key 3D printing companies, supportive government regulations, and growing investment in medical research and surgical training further strengthen the region's market position.

- 3D Systems Inc. reported that its EXT 220 MED printing system enabled the production of 40 cranial implants throughout Europe.

What are the Major Factors Contributing to the 3D Printed Surgical Models Market within Latin America?

The market in Latin America is driven by several factors. Firstly, strong government support and strategic acquisitions and partnerships are boosting the development of 3D printed surgical equipment. Secondly, there is a growing medical tourism and a rapid shift toward advanced 3D printed tools to improve patient outcomes. Additionally, the rising demand for personalized surgical planning, complex procedure simulations, and improved training for medical professionals is boosting market growth.

What Opportunities Exist in the Middle East & Africa (MEA)?

The Middle East & Africa (MEA) offers significant opportunities in the 3D printed surgical models market, driven by the rising establishment of surgical centers and strategic collaborations between global players like Stratasys, Medtronic, and 3D Systems Inc. Hospitals and surgical centers are adopting 3D printed models for preoperative planning, complex surgeries, and medical training. Additionally, government initiatives, rising medical tourism, and partnerships with global 3D printing technology providers are further driving market growth in the region.

- In October 2024, the Saudi Food and Drug Authority (SFDA) announced the launch of a new initiative to boost the development of diagnostic laboratory equipment and 3D printing in hospitals.

3D Printed Surgical Models Market Companies

- 3D Systems, Inc.

- Lazarus 3D, LLC

- Osteo3D

- Axial3D

- Onkos Surgical

- Formlabs

- Materialise NV

- 3D LifePrints U.K. Ltd.

- WhiteClouds Inc.

Recent Development

- In April 2024, 3D Systems, Inc. announced the U.S. FDA clearance for the world's first 3D printed PEEK cranial implants.

(Source: 3dsystems.com ) - In December 2024, Axial3D announced the collaboration to expand access to patient-specific 3D models for MRI-based imaging.

(Source: axial3d.com ) - In 2022, Axial 3D collaborated with Radius, NC. a digital manufacturing and supply chain company, helping physicians visualize patient anatomy to produce intricate surgical models. Axials 3D is creating customized 3D-printed models to improve surgical planning and patient outcomes.

- In 2022, Albany New York-based startup Lazarus 3D raised USD 6 million. Lazarus 3D creates realistic-looking organs to enable surgeons to practice surgery.

- In 2020, Medtronic, an American Irish-domiciled medical device company, paid an undisclosed sum to Medicare International. The acquisition of Medicare expands Medtronic's already extensive portfolio by adding to its spinal solution profile as new digital technology allows for the customization of spinal implants. Medicare International is a spinal surgery company that has 30+ FDA-approved spinal implant technologies in use in over 150,000 spinal surgeries to date.

Segments Covered in the Report

By Specialty

- Cardiac Surgery/Interventional Cardiology

- Annuloplasty (mitral valve repair)

- Repair Coronary Aneurysm

- Replacement of Aortic Valve

- Stent Insertion

- Repair Congenital Heart Defects

- Gastroenterology Endoscopy of Esophageal

- Endoscopy of Esophageal lesion

- Splenectomy

- Neurosurgery

- Repair Aneurysm

- Transsphenoidal Excision of Pituitary Gland

- Remove Brain Tumor

- Orthopedic Surgery

- Repair Scoliosis

- Repair Clavicle Fracture

- Hip Repair

- Repair Intervertebral Disc

- Hip Replacement Revision

- Repair Leg Fracture

- Osteotomy

- Reconstructive Surgery

- Facial Reconstruction

- Hand Reconstruction

- Breast Reconstruction

- Mastoidectomy

- Cleft Palate Correction

- Surgical oncology

- Removal of Adrenal Tumor

- Removal of Liver Tumor

- Endoscopic Removal of Cardiac Lesion

- Thoracic Removal of Lung Tumor

- Removal of Renal Tumor

- Transplant Surgery

- Cardiac Surgery/ Interventional Cardiology

- Heart Transplant

- Liver Transplant

- Lung Transplant

- Kidney Transplant

By Technology

- Stereolithography (SLA)

- ColorJet Printing (CJP)

- MultiJet/PolyJet Printing

- Fused Deposition Modeling (FDM)

By Material

- Metal

- Polymer

- Plastic

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting