What is the Curved Display Devices Market Size?

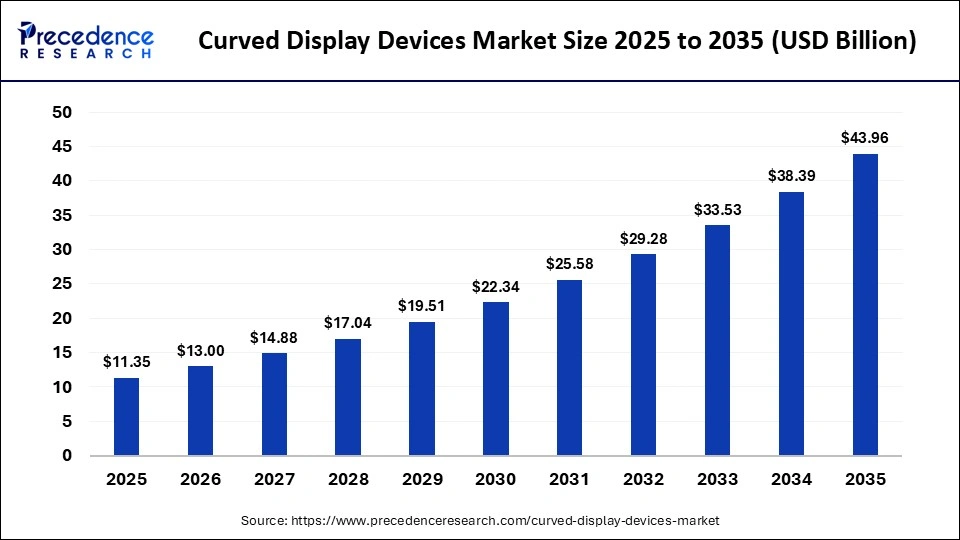

The global curved display devices market size was calculated at USD 11.35 billion in 2025 and is predicted to increase from USD 13.00 billion in 2026 to approximately USD 43.96 billion by 2035, expanding at a CAGR of 14.50% from 2026 to 2035. The market is experiencing significant growth due to rising demand for immersive gaming experiences and luxury automotive displays. Growth is further fueled by advancements in OLED technology and increased R&D investments, which are transforming user experiences from traditional flat screens to ergonomic 3D visuals.

Market Highlights

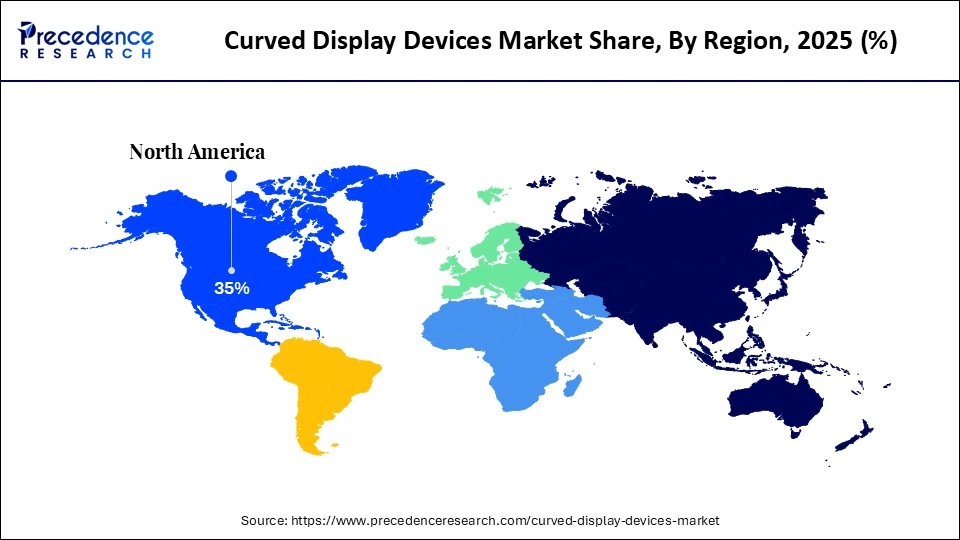

- Asia Pacific dominated the market with a major share of around 35% in 2025 and is expected to grow at 14.5% CAGR in the coming years.

- North America is expected to grow at a significant CAGR between 2026 and 2035.

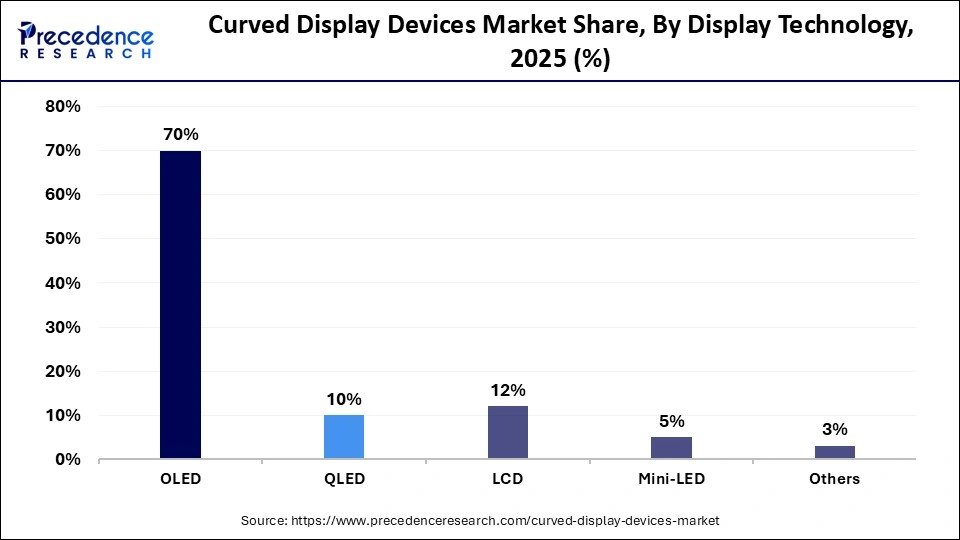

- By display technology, the OLED segment generated the biggest market share of around 70% in 2025.

- By display technology, the QLED segment is expanding at the fastest CAGR of 12.4% between 2026 and 2035.

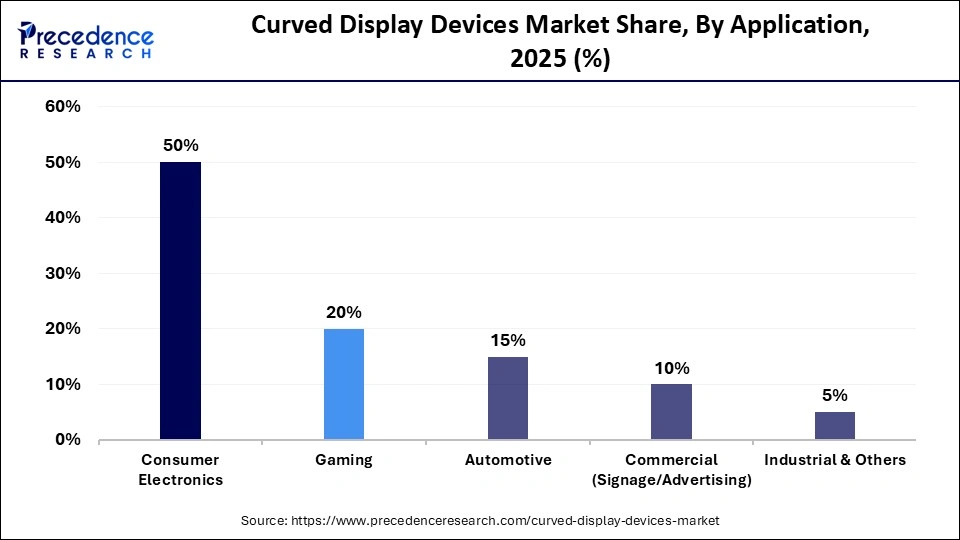

- By application, the consumer electronics segment accounted for the largest market share of about 50% in 2025.

- By application, the gaming segment is expected to grow at a solid CAGR of 12.7% between 2026 and 2035.

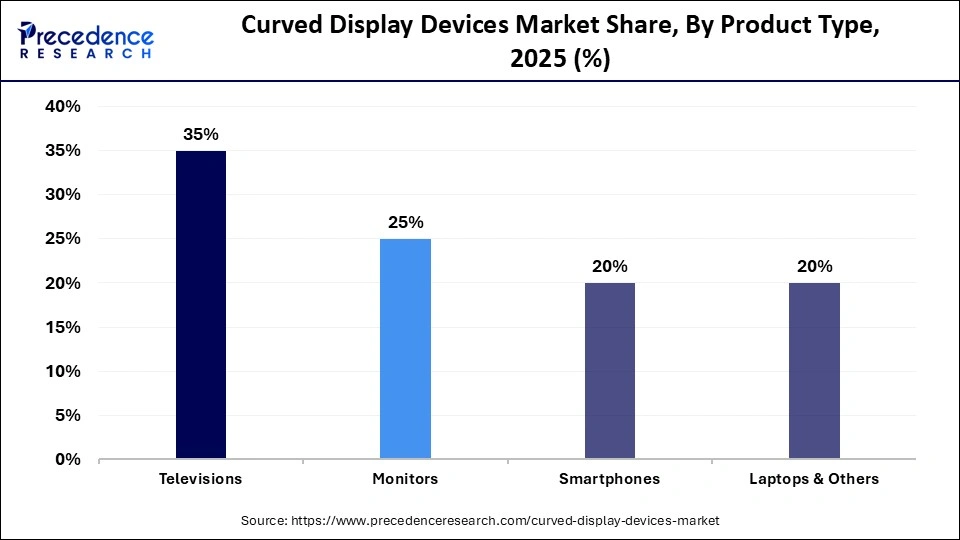

- By product type, the television segment contributed the highest market share of around 35% in 2025.

- By product type, the monitors segment is expected to grow at a strong CAGR of 12.9% between 2026 and 2035.

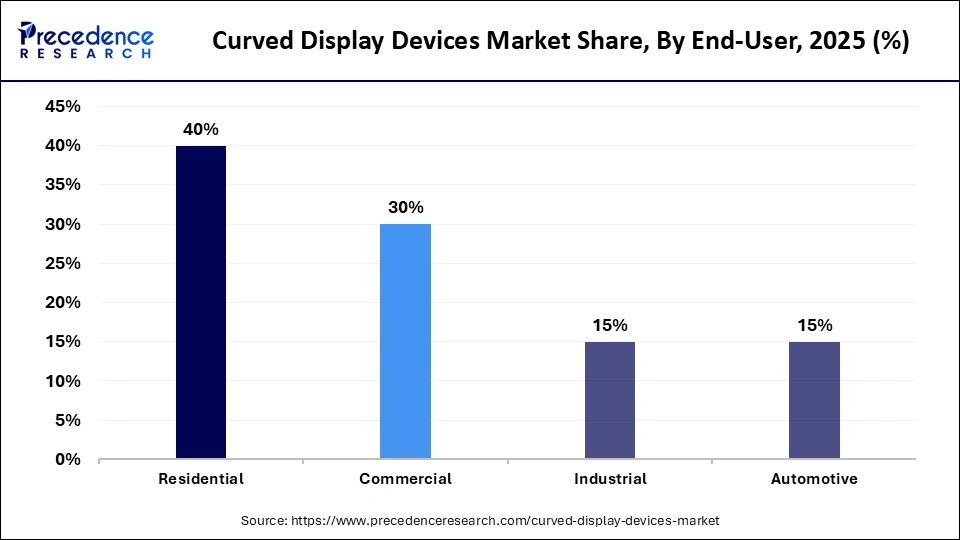

- By end-user, the residential segment held a major market share of around 40% in 2025.

- By end-user, the commercial segment is expected to expand at the highest CAGR of 13.2% from 2026 to 2035.

What are Curved Display Devices?

Curved display devices are electronic screens with a concave form factor designed to enhance immersion, viewing comfort, and visual depth in applications such as TVs, monitors, smartphones, wearables, and automotive dashboards. These displays use advanced panel technologies like OLED, QLED, and LCD to deliver wider fields of view, reduced glare, and improved aesthetics, driving adoption across consumer electronics, gaming, automotive, and commercial signage markets. Growth is fueled by advances in flexible/OLED technology and rising demand for immersive user experiences.

How is AI Transforming the Curved Display Devices Market?

Artificial intelligence (AI) is transforming the curved display devices market by automating image optimization based on ambient light and user behavior, enhancing viewing experiences in TVs, monitors, and automotive displays. In curved gaming monitors, AI enables higher refresh rates and smoother visuals, increasing immersion and reducing glare. AI-powered curved displays can track user presence or adapt to viewing angles to reduce distortion. AI is also used in the production process to inspect, measure, and enhance the quality of complex curved display panels, reducing human error.

Major Trends in the Curved Display Devices Market

- Demand for Gaming and Entertainment Monitors: Curved monitors are increasingly popular for gaming as they reduce glare, minimize distortion, and provide a wider field of view.

- Automotive Dashboard Integration: Manufacturers are adopting curved, wraparound, and panoramic displays for car dashboards and infotainment systems, enhancing both aesthetic appeal and user experience.

- Flexible OLED Technology in Mobiles and Wearables: The shift toward foldable phones and curved-edge smartphones is a primary driver, with OLED technology enabling smaller form factors, better performance, and more durable screens.

- Enhanced Demand for Display Performance: High-end curved displays are integrating superior technology like 4K/8K resolution and 144Hz–240Hz refresh rates, significantly improving image quality and responsiveness.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.35 Billion |

| Market Size in 2026 | USD 13.00 Billion |

| Market Size by 2035 | USD 43.96 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.50% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Display Technology, Application, Product Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Display Technology Insights

How Did the OLED Segment Dominate the Curved Display Devices Market?

The OLED segment dominated the market with approximately 70% share in 2025, primarily due to its superior flexibility, high contrast ratios, deep blacks, and fast refresh rates. Since OLED displays are self-emissive, they do not require backlights, allowing for thinner, lighter, and more adaptable curved and bendable screens. Additionally, their ability to be manufactured on flexible substrates enables seamless, curved, and foldable designs, making them the preferred choice for immersive TVs and premium automotive applications. Continuous advancements in material science and production techniques are further strengthening their market position.

The QLED segment is expected to grow at the fastest CAGR of 12.4% during the forecast period. This growth is attributed to QLED's exceptional brightness, cost-effectiveness, and wide color gamut, which cater to high demand in the TV and gaming monitor sectors. QLED displays provide vibrant colors and remarkable brightness at more accessible price points for large curved televisions, making them increasingly popular for gaming and home theater setups. Their high refresh rates and color accuracy create a more engaging, panoramic, and cinematic experience, contributing to higher production and consumer interest.

Application Insights

What Made Consumer Electronics the Leading Segment in the Curved Display Devices Market?

The consumer electronics segment led the market with around 50% share in 2025. This segment's dominance is driven by the need for immersive, ergonomic, and premium viewing experiences across televisions, smartphones, monitors, and wearables, making them favored for home entertainment and competitive gaming. The rapid adoption of curved screens in high-end smartphones and tablets enhances aesthetics, ergonomics, and visual immersion, contributing to significant sales volume. Additionally, smartwatches and other wearables are increasingly incorporating curved displays to improve ergonomic designs that fit comfortably on the body.

The gaming segment is expected to grow at a CAGR of 12.7% in the coming years. This growth is fueled by intense demand for immersive, high-refresh-rate, and ultrawide screens, which enhance peripheral vision. Curved screens offer a panoramic effect that adds depth, making them essential for competitive gaming. The introduction of advanced, high-resolution, and rapid-response panels is boosting high-end premium sales. Moreover, the rapid growth of mobile gaming is driving the adoption of curved screens on smartphones, shifting consumer preferences from standard to premium displays.

Product Type Insights

Why did the Television Segment Dominate the Curved Display Devices Market?

The television segment dominated the market with about 35% market share in 2025. The high demand for immersive, large-screen home entertainment systems and the rapid adoption of 4K/8K technologies have contributed to this growth with enhanced picture quality. Curved TVs provide a superior, panoramic cinematic experience by matching the viewer's field of vision and minimizing peripheral distortion. The rise of e-sports and advanced home gaming has also increased demand for curved screens, alongside the integration of AI for automatic brightness, color, and contrast adjustments, further boosting segment expansion.

The monitors segment is expected to grow at the fastest CAGR of 12.9% over the projection period. This growth is driven by increasing demand for immersive displays and greater adoption in productivity-focused professional workstations, along with high-resolution gaming experiences. The distinctive design of curved monitors appeals to users seeking a modern and aesthetically pleasing setup while also encouraging manufacturers to innovate. The integration of OLED technology enhances color contrast and speeds up response rates, making curved monitors more attractive to consumers and accelerating market growth.

End-User Insights

What Made Residential the Dominant Segment in the Curved Display Devices Market?

The residential segment accounted for about 40% market share in 2025. This dominance is a consequence of higher demand for immersive home entertainment, the rise of high-end gaming, and increased adoption of advanced technologies. The growth in remote work has led to an increased use of curved monitors in home offices, as they provide improved ergonomics and elevate productivity for tasks involving multiple side-by-side window displays. The expansion of OLED, QLED, and MicroLED technologies is also lowering production costs, making curved displays more accessible to the average household consumer.

The commercial segment is expected to experience the fastest growth, growing at a CAGR of 13.2% in the upcoming period. This growth is driven by the rising demand for immersive, large-format screens in retail, corporate environments, and advertising. Curved screens are increasingly being used in patient monitoring, diagnostic imaging, and improved passenger information systems in transportation, along with a growing integration of interactive video walls, smart boards, and advanced conferencing displays to enhance collaboration. Improved, durable OLED and LED panels that offer better contrast and brightness are becoming essential for commercial high-traffic environments.

Regional Insights

What is the Asia Pacific Curved Display Devices Market Size?

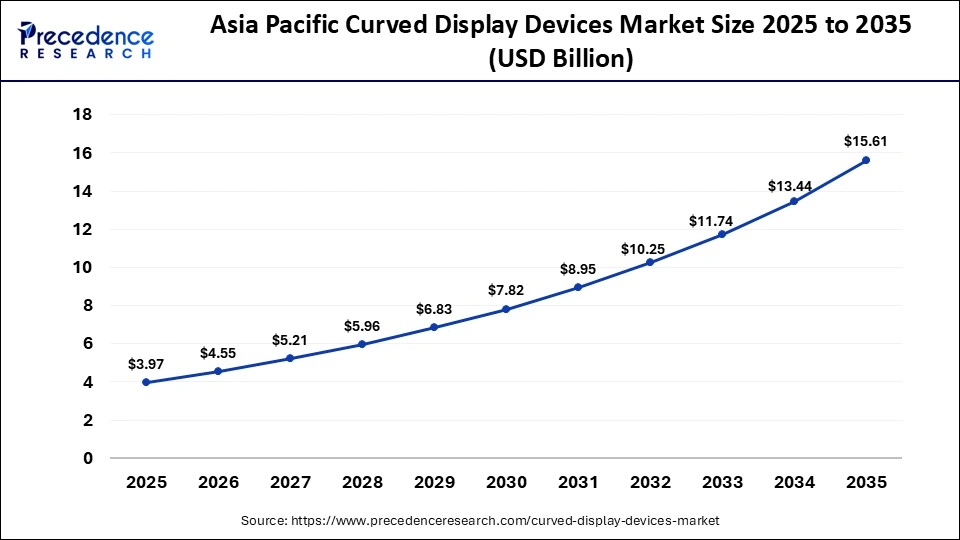

The Asia Pacific curved display devices market size is expected to be worth USD 15.61 billion by 2035, increasing from USD 3.97 billion by 2025, growing at a CAGR of 14.67% from 2026 to 2035.

How Did Asia Pacific Dominate the Curved Display Devices Market?

Asia Pacific dominated the curved display devices market with about 35% in 2025 and is expected to grow at the fastest CAGR of 14.5% throughout the forecast period. This is mainly due to its strong position as a global manufacturing hub for electronics, high consumer demand for premium devices, and rapid, tech-driven urbanization. South Korea, China, and Japan are central to display manufacturing and innovation, enabling lower production costs and high-volume output.

There is increasing demand for immersive gaming monitors, premium curved TVs, and smartphones in emerging economies like India and China. Significant government-supported initiatives utilize smart, curved displays, along with massive investments in OLED production by companies like Samsung and BOE in South Korea and China, which contribute to market growth.

India Curved Display Devices Market Trends

India is an emerging market within the region, as it is a major and competitive hub for the manufacturing of electronic devices, including curved displays. Additionally, increasing disposable income and urbanization are driving demand for advanced, curved-screen consumer electronics, including premium smartphones, wearables, and televisions. India is aiming to reduce its reliance on imports by investing in and building up its local, indigenous display manufacturing capabilities, with higher adoption.

How is the Opportunistic Rise of North America in the Curved Display Devices Market?

North America is experiencing significant growth in the market. This growth is mainly driven by a high consumer disposable income, a strong appetite for premium technology, and rapid adoption in gaming and professional sectors. Curved displays are increasingly used in B2B applications, such as professional visualization, command centers, and corporate boardrooms, due to improved ergonomics and reduced eye strain. North American consumers are considered early adopters, facilitating the rapid market entry of new display technologies like flexible OLED and MicroLED for their immersive experience.

U.S. Curved Display Devices Market Trends

The U.S. is a major contributor to the market within North America, as it is a hub for R&D in display technologies, focusing on flexible and foldable screens for consumer electronics and automotive applications. The market growth is further fostered by high consumer purchasing power and a preference for high-end home entertainment systems. The country is home to major players such as Dell Technologies, HP Inc., and ViewSonic Corporation, contributing to market growth.

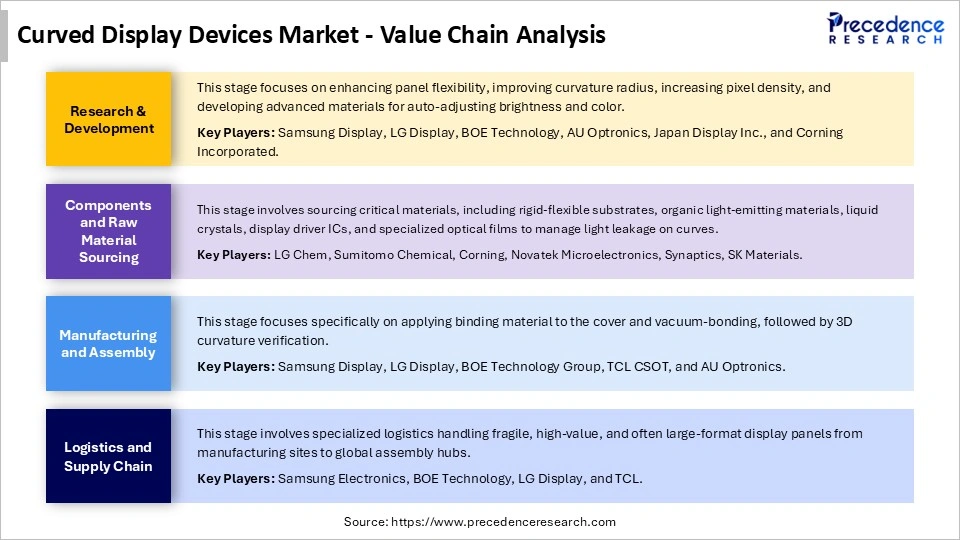

Curved Display Devices Market Value Chain Analysis

Who are the Major Players in the Global Curved Display Devices Market?

The major players in the curved display devices market include Samsung Electronics Co., Ltd., LG Display Co., Ltd., Sony Corporation, Dell Technologies Inc., HP Inc., Lenovo Group Limited, ASUS Tek Computer Inc., Acer Inc., MSI (Micro-Star International), ViewSonic Corporation, BenQ Corporation, AOC International, Philips Electronics N.V., TCL Technology Group Corporation, and Hisense Group.

Recent Developments

- In July 2025, Samsung introduced its Smart Monitor family, featuring the luxury M9 (M90SF) alongside upgraded editions of the M8 (M80SF) and M7 (M70F). The M9, with advanced AI features and QD-OLED technology, offers a stunning visual experience with real-time optimization for work and entertainment. Its sleek design and 32-inch display make it ideal for chic environments.(Source: https://news.samsung.com)

- In August 2025, vivo launched the T4 Pro, a smartphone emphasizing premium durability and performance, powered by the Snapdragon 7 Gen 4 processor. It boasts flagship-level imaging with 10x telephoto and 3x periscope zoom capabilities. With a slim profile and vibrant color options, the device allows for 4K video recording and is priced starting at INR 27,999.(Source: https://vivonewsroom.in)

- In September 2025, Tecno unveiled the Pova Slim, claiming it as the world's slimmest 5G smartphone with a curved display at 5.95 mm thick. It features a 6.78-inch 3D curved AMOLED screen, a MediaTek Dimensity 6400 chipset, and a distinctive rear camera setup. With an IP64 rating and a 5,160mAh battery supporting 45W fast charging, the Pova Slim combines style with functionality.(Source https://thepatriot.in)

Segments Covered in the Report

By Display Technology

- OLED

- QLED

- LCD

- Mini-LED

- Others

By Application

- Consumer Electronics

- Gaming

- Automotive

- Commercial (Signage/Advertising)

- Industrial & Others

By Product Type

- Televisions

- Monitors

- Smartphones

- Laptops & Others

By End-User

- Residential

- Commercial

- Industrial

- Automotive

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting