Center Stack Display Market Size and Forecast 2025 to 2034

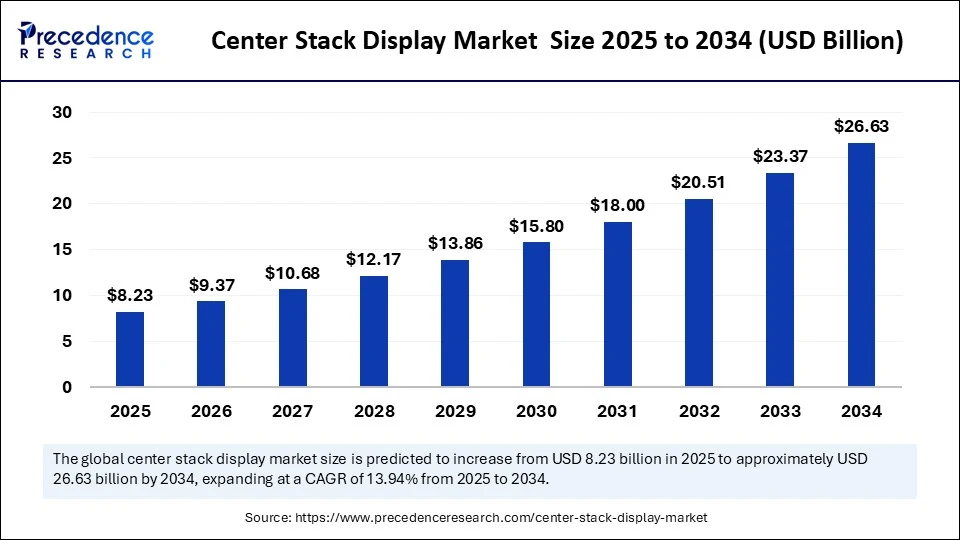

The global center stack display market size accounted for USD 7.22 billion in 2024 and is predicted to increase from USD 8.23 billion in 2025 to approximately USD 26.63 billion by 2034, expanding at a CAGR of 13.94% from 2025 to 2034. The market for center stack displays is experiencing growth due to increasing automotive advancements and the rising demand for enhanced in-car entertainment and navigation systems. Additionally, technological innovations and consumer preference for modernized vehicle interiors are fueling this expansion.

Center Stack Display Market Key Takeaways

- In terms of revenue, the globalcenter stack display market was valued at USD 7.22 billion in 2024.

- It is projected to reach USD 26.63 billion by 2034.

- The market is expected to grow at a CAGR of 13.94% from 2025 to 2034.

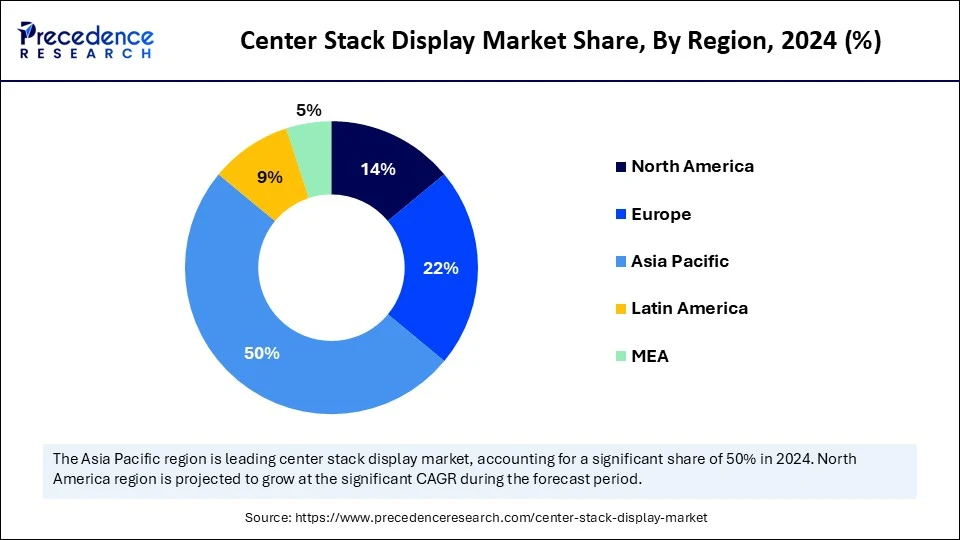

- Asia Pacific dominated the global center stack display market with the largest market share of 50% in 2024.

- By region, North America is anticipated to grow at the fastest CAGR during the forecast period.

- By display technology, the TFT-LCD / TFT-LCD with IPS segment led the market in 2024.

- By display technology, the OLED / AMOLED segment is expected to grow at the fastest CAGR during the forecast period.

- By screen size, the 7–10 inches segment accounted for a considerable share in 2024.

- By screen size, the above 10 inches (large / tablet-style) segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By resolution & image performance, the standard resolution segment led the center stack display market in 2024.

- By resolution & image performance, the high resolution segment is set to experience the fastest CAGR from 2025 to 2034.

- By touch & HMI input type, the capacitive multi-touch segment captured the biggest market share in 2024.

- By touch & HMI input type, the haptics/force feedback touch segment is anticipated to grow with the highest CAGR during the studied years.

- By user interface/software, the connected infotainment segment generated the major market share in 2024.

- By user interface/software, the voice + AI adaptive UI segment is predicted to witness significant growth over the forecast period.

- By connectivity & integration, the vehicle networks segment captured a significant revenue share in 2024.

- By connectivity & integration, the automotive ethernet segment is predicted to witness significant growth over the forecast period.

- By automotive grade/functional safety, the non-safety critical segment contributed the highest market share in 2024.

- By automotive grade/functional safety, the safety-aware segment enjoyed a prominent position during forecast period.

- By vehicle type/application, the passenger cars segment held the largest market share in 2024.

- By vehicle type/application, the electric vehicles segment is expected to grow at the fastest CAGR during the forecast period.

- By form factor & mounting, the integrated flush-mount displays segment accounted for significant market share in 2024.

- By form factor & mounting, the floating tablet segment is projected to experience the highest growth CAGR between 2025 and 2034.

How is AI Shaping the Future of the Center Stack Display Market?

Artificial Intelligence is revolutionizing the center stack display market by enabling personalized, intuitive, and predictive user experiences. AI-powered voice assistants allow drivers to interact with information systems hands-free, improving safety and convenience. Machine Learning algorithms are being deployed to predict the driver's preferences, from navigation routes to entertainment choices. AI also plays a critical role in integrating displays with advanced driver assistance systems, enhancing situational awareness. Furthermore, AI-driven natural language processing is making human vehicle communication more seamless and accurate. As vehicles become increasingly autonomous, AI-powered center stack displays are poised to act as central hubs for both in-car control and entertainment.

Asia Pacific Center Stack Display Market Size and Growth 2025 to 2034

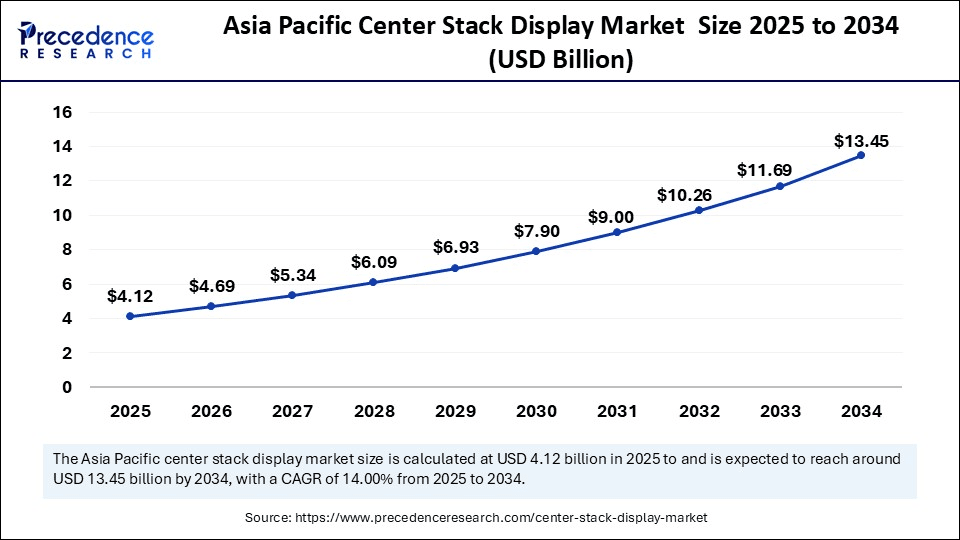

The Asia Pacific center stack display market size is exhibited at USD 4.12 billion in 2025 and is projected to be worth around USD 13.45 billion by 2034, growing at a CAGR of 14.00% from 2025 to 2034.

Why Is Asia Pacific the Dominant Player in the Market for Center Stack Displays?

Asia Pacific continues to dominate the market for center stack displays, driven by booming vehicle sales and rising consumer demand for in-car connectivity. Countries like China, Japan, and South Korea are at the forefront of automotive innovation, adopting advanced cockpit technologies rapidly. The growing middle class and increasing disposable income in emerging markets also drive the adoption of feature-rich vehicles. Local automakers are partnering with technology providers to introduce affordable yet advanced display solutions. The rise of EVs, particularly in China, further accelerates the integration of digital cockpits. Favorable government policies supporting smart mobility and connected infrastructures add to market momentum.

In addition, Asia Pacific's strong electronics manufacturing ecosystem provides a competitive advantage in scaling display production. Companies in the region are leading in OLED, AMOLED, and flexible display technologies, making advanced systems more accessible. Automakers are increasingly differentiating vehicles through infotainment and connectivity, with centre stack displays serving as a focal point. The growing adoption of shared mobility and ride-hailing services also creates demand for passenger-centric display experiences. As consumers prioritize digital interaction, the Asia Pacific will remain the engine of growth for the global centre stack displays market.

Why Is North America the Rising Star in the Center Stack Display Market?

North America is the fastest-growing region in the market, driven by high adoption of advanced infotainment systems in vehicles. Automakers in the U.S. and Canada are early adopters of connected and smart display technologies, integrating them into both luxury and mainstream vehicles. Strong consumer demand for advanced safety and convenience features fuels steady market penetration. The presence of key automotive manufacturers and tech companies accelerates innovation in display solutions. Additionally, regulatory support for vehicle connectivity and safety strengthens market adoption. The region's mature automotive ecosystem ensures consistent demand for center stack display upgrades.

North America also benefits from high consumer spending power and strong demand for premium vehicles. Leading automakers and tier-1 suppliers are investing in R&D to deliver innovative cockpit experiences. Collaborations with tech companies for high-tech advanced use of modules and voice-control integration further boost adoption. The expansion of electric vehicles in the region also contributes to demand, as EVs often feature advanced digital cockpits. Growing emphasis on personalized driving experiences is reinforcing the role of center stack displays as essential vehicle components. As the automotive digital revolution advances, North America will continue to set the pace for adoption and way further.

Market Overview

Center stack displays (CSDs) are the primary in-vehicle display units installed on the center stack of an automobile dashboard that provide infotainment, vehicle controls (HVAC, seat, vehicle settings), navigation, connectivity readouts, and HMI (human-machine interface) functions. CSDs combine display hardware (LCD/TFT, OLED/AMOLED, projection, or bonded touch panels), touch/gesture/haptic input, dedicated display controllers, embedded software, and connectivity to vehicle networks (CAN, MOST, Automotive Ethernet) and external networks (Wi-Fi, Bluetooth, cellular). Tier-1 suppliers deliver them, as do display manufacturers and semiconductor/software providers, and are core to modern cockpit architectures for ICE, hybrid, and electric vehicles.

The center stack display market is rapidly evolving as automotive manufacturers integrate advanced information and control systems into vehicles. These displays, located at the center of the dashboard, serve as the primary interface for navigation, entertainment, and climate control. Growing consumer demand for connected vehicles and seamless digital experiences is fueling adoption across passenger and commercial vehicles. Increasing emphasis on safety, convenience, and driver assistance further strengthens the role of center stack displays in modern cars. Automakers are also leveraging these displays to differentiate products and enhance the overall user experience. As digital transformation accelerates in the automotive sector, the center stack display market is expected to witness robust growth in the coming years.

Market Key Trends

- Growing integration of multi-display cockpits for seamless driver and passenger interaction.

- Rising demand for OLED and AMOLED displays due to superior brightness and clarity.

- Increased use of touchless control technologies such as gesture and voice commands.

- Adoption of large-format displays with curved or flexible screens.

- Expansion of over-the-air updates, enabling continuous feature enhancements.

- Strong focus on sustainability, with energy-efficient displays gaining traction.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.63 Billion |

| Market Size in 2025 | USD 8.23 Billion |

| Market Size in 2024 | USD 7.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.94% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Display Technology, Screen Size, Resolution & Image Performance, ouch & HMI Input Type, User Interface / Software, Connectivity & IntegrationAutomotive Grade / Functional Safety, Vehicle Type / Application, Form Factor & Mounting, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Connected Cars Driving the Display Revolution

The growing adoption of connected cars is one of the strongest drivers for the center stack displays market. Consumers increasingly expect vehicles to mirror the seamless digital experiences they enjoy on smartphones and tablets. Center stack displays provide a hub for navigation, entertainment, and real-time communication, integrating with cloud-based services and mobile apps. Automakers are using them to deliver personalized experiences, integrating social media, music streaming, and e-commerce platforms. The rise of 5G is further amplifying this trend by enabling ultra-fast data transmission and real-time services. As connectivity becomes a cornerstone of vehicle design, center stack displays will remain central to the digital transformation of mobility.

Opportunity

Autonomous Vehicles Opening New Display Horizons

The emergence of autonomous and semi-autonomous vehicles presents a major opportunity for center stack displays. In self-driving cars, the role of displays shifts from driver assistance to passenger entertainment and productivity. This opens avenues for larger, high-resolution displays with advanced multimedia and Interactive capabilities. Augmented reality and virtual reality integration into center stack systems could redefine in-car experiences. Additionally, fleet operators and mobility service providers are likely to adopt enhanced displays to offer differentiated user experiences. As the boundary between transportation and entertainment blurs, center stack displays are set to become key enablers of next-generation mobility ecosystems.

Restraint

High Cost and Reliability concerns

Despite strong growth potential, the high cost of advanced center stack displays remains a key restraint. Premium OLED and AMOLED panels, coupled with touch and haptic technologies, significantly increase vehicle costs. Moreover, automotive environments expose displays to heat, vibration, and continuous usage, raising durability concerns. Failures in these systems can disrupt critical vehicle functions and compromise safety, deterring widespread adoption in entry-level segments. Cybersecurity is another challenge, as connected displays may be vulnerable to hacking and data breaches. Addressing these cost, reliability, and security concerns is crucial for sustaining long-term market growth.

Display Technology Insights

Why is TFT-LCD Dominating the Center Stack Display Industry?

The TFT-LCD has become a dominant force in the center stack display market, due to its cost-center stack display market due to its cost-effectiveness, reliability, and mature manufacturing ecosystem. Automakers rely on TFT LCDs because they provide a good balance between performance and affordability, making them suitable for both mid-range and entry-level vehicles. The technology offers adequate brightness, resolution, and durability to meet the requirements of automotive environments. Moreover, TFT LCD panels are widely available, ensuring a steady supply chain and large-scale production capabilities. Their long-standing presence in the market has allowed suppliers to optimize designs for better energy efficiency and robustness. This market is the go-to choice for most automakers seeking high-quality displays at competitive costs.

The widespread adoption of TFT LCDs is also supported by continuous incremental improvements in the technology. Manufacturers are enhancing contrast ratios, viewing angles, and backlight performance to narrow the gap with OLED panels. Additionally, TFT LCDS are less susceptible to burn-in issues, which is a concern in high-use automotive applications. Their compatibility with various touch technologies and infotainment systems also contributes to their popularity. As cost remains a critical factor in mass-market vehicles, TFT LCDs will maintain their dominance in the near term. The combination of affordability, reliability, and scalability ensures their stronghold in the center stack display segment.

The organic light-emitting diode (OLED) segment has become the fastest-growing segment in the market, due to its superior performance characteristics. They deliver exceptional contrast ratios, deep blacks, and vibrant colors, offering a premium visual experience. The flexibility of organic light-emitting diode technology enables the creation of curved and large-format displays, which are increasingly popular in next-generation digital cockpits. Automakers are leveraging OELD panels to differentiate premium vehicles, offering drivers and passengers a visually immersive experience. The ability to design thinner, lighter, and more energy-efficient displays further strengthens the appeal. As consumer expectations shift toward premium car experiences, OELD is rapidly gaining traction.

The growth of this sector is also fueled by increasing demand for luxury and electric vehicles, which often emphasize cutting-edge infotainment and cockpit design. While cost remains higher compared to any other technologies in use, falling panel prices and advancements in manufacturing are making organic light-emitting diodes more accessible. Automakers are investing in its adoption not just for aesthetics but also for enhanced visibility under different lighting conditions. Moreover, this technology integrates well with haptic feedback and touch innovations, further expanding its usability as the automotive sector moves towards a futuristic and connected cockpit, which will accelerate the organic light-emitting diode adoption.

Screen Size Insights

Why 7–10 inches Sub-Segment Dominating the Center Stack Display Market?

The 7–10-inch has become a dominant force in the center stack display market, because it strikes a perfect balance between visibility, ergonomics, and cost. This size range has become the industry standard across most mid-segment vehicles, ensuring drivers have easy access to infotainment and navigation without overwhelming dashboard space. Automakers prefer this format because it integrates well with the existing vehicle's architecture while maintaining affordability. The size is large enough to avoid driver distraction. Consumer familiarity with this format also reinforces its widespread adoption. As a result, the 7-10 inch range continues to be most widely deployed in mainstream vehicles worldwide.

The above 10 inches segment has become the fastest-growing segment in the market, due to rising demand for immersive, premium in-vehicle experiences. Large displays create a sense of luxury and align with digital cockpit trends in high-end and electric vehicles. Automakers are increasingly equipping flagship models with panoramic center stack displays to differentiate their products. The additional screen allows for advanced features such as split-screen operations, enhanced navigation visuals, and AI-driven personalization. Consumers also associate bigger displays with cutting-edge technology, boosting adoption in premium vehicle segments. This is making the 10-inch format a status symbol in next-gen vehicle design.

The growth of this segment is accelerated by the shift toward connected infotainment and smart cockpit systems, where larger screen real estate is an enabler of functionality. As the costs of high-resolution panels decline, the accessibility of large displays will expand beyond luxury vehicles. These screens also integrate better with emerging UI innovations like voice+AI control and haptic feedback. Automakers see them as an investment in future-proofing cockpit designs. The demand for seamless integration of entertainment, navigation, and connectivity features makes displays above 10-inch inches a strategic growth driver. Hence, while still niche compared to 7-10 inches, the category is expanding rapidly.

Resolution & Image Performance Insights

Why Is Standard Resolution Dominating the Center Stack Display Sector?

The standard resolution has become a dominant force in the center stack display sector, due to its affordability and proven reliability. They meet the core requirements of navigation, infotainment, and climate control without burdening automakers with high control without burdening automakers with high costs. This makes them an attractive option for mass-market vehicles where price sensitivity is high. Standard resolution is also adequate for smaller screens, such as those in the 7-10 inch range, delivering functional clarity without unnecessary expense. Their long-standing presence ensures robust supply chains and optimized production processes.

The high-resolution segment has become the fastest-growing segment in the market, due to sharper and more vibrant visuals. Drivers and passengers now expect smartphone-like clarity and image quality inside vehicles. Automakers are responding by incorporating high-resolution panels in premium models to enhance brand appeal. This technology significantly improves user experiences for advanced navigation, AI-driven interfaces, and entertainment streaming. Enhanced resolution also supports the integration of augmented reality features and dynamic UI designs. As expectations rise, high-resolution displays are becoming a key differentiation in the automotive market.

Touch & HMI Input Type Insights

Why Is Capacitive Multi-touch Dominating the Center Stack Display Market?

The capacitive multi-touch segment maintained a leading position in the market for center stack displays in 2024, enabling drivers and passengers to interact with displays using familiar smartphone-like gestures such as swipe, pinch, and zoom. Automakers prefer it due to its responsiveness and durability compared to older resistive touchscreens. The technology supports multi-finger input, enabling more advanced UI designs. Its wide adoption in consumer electronics has also accelerated its acceptance in vehicles. As a result, capacitive multi-touch has become the industry standard for modern center stack displays.

The haptics/force feedback touch segment has become the fastest-growing segment in the market as it provides tactile responses, which simulate the feeling of pressing physical buttons, reducing driver distraction. This feedback mechanism allows drivers to confirm inputs without constantly glancing at the screen. Automakers are adopting this technology to balance modern digital cockpit aesthetics with functional safety. It also opens the door for more innovative UI designs, enabling personalized haptic responses for different functions. As a result, haptic-enabled displays are gaining rapid traction in premium and futuristic vehicle models.

User Interface / Software Insights

Why Is Capacitive Connected Infotainment Dominating the Center Stack Display Market?

The capacitive connected infotainment segment led the market, due to its central role in delivering navigation, entertainment, and communication. They serve as the primary interface for drivers and passengers, integrating smartphone connectivity, streaming services, and real-time navigation updates. Automakers have standardized connected infotainment in most new vehicles, ensuring broad market coverage. The ability to update systems over-the-air (OTA) keeps them relevant and future-ready. Their cost-effectiveness and wide consumer acceptance reinforce their dominance. As such, connected infotainment remains the foundation of the center stack display ecosystem.

The voice + AI adaptive UI segment has become the fastest-growing in the center stack display market, due to its ability to deliver hands-free, personalized experiences. These systems use AI to learn driver preferences and adapt responses over time. This reduces distraction and enhances convenience by enabling natural language commands. Automakers are increasingly integrating voice assistants powered by AI to appeal to tech-savvy customers. As vehicles become smarter and more autonomous, adaptive AI-driven interfaces are becoming critical for differentiation. The demand for intuitive, intelligent interaction is pushing this segment's rapid growth.

Connectivity & Integration Insights

Why Are Vehicle Networks Dominating the Center Stack Display Market?

The vehicle networks have become a dominant force in the center stack display market, due to protocols such as CAN, LIN, and MOST being well established and widely integrated. Their proven reliability, low cost, and compatibility make them indispensable in automotive design. Automakers trust vehicle networks to manage communication across infotainment, safety, and powertrain systems. The infrastructure is mature, and supply chains are optimized for mass adoption. Hence, vehicle networks continue to dominate center stack display integration.

The automotive Ethernet segment has become the fastest-growing segment in the center stack display sector, due to its high bandwidth and scalability. It enables faster data transfer required by modern infotainment, ADAS, and connected vehicle features. As vehicles adopt high-resolution displays and AI-driven systems, Ethernet provides the necessary backbone. Automakers are leveraging it to support seamless multimedia streaming and over-the-air updates. Its ability to handle complex data flows makes it a future-ready solution. Thus, automotive Ethernet adoption is expanding rapidly in advanced vehicles.

Automotive Grade / Functional Safety Insights

Why Is Non-Safety-Critical Dominating the Market for Center Stack Display?

The non-safety-critical segment captured a significant portion of the market in 2024, driven by infotainment, comfort, and convenience functions. These systems are not directly tied to life-critical vehicle operations, which keeps development costs lower. Automakers have long focused on enhancing user experience without strict safety compliance for these features. The flexibility of design in non-safety-critical systems allows faster innovation. This has led to rapid deployment across a wide range of vehicle categories. Consequently, non-safety-critical applications represent the largest market share.

The safety-aware segment has become the fastest-growing segment in the center stack display market, advanced driver-assistance systems (ADAS), and safety-critical functions. Automakers are increasingly embedding warnings, driver monitoring, and AR-enhanced navigation into center stack displays. These functions require compliance with higher safety standards, pushing innovation in hardware and software reliability. Growing regulatory emphasis on reducing driver distraction is also driving this trend. As displays become central to situational awareness, safety-aware applications gain priority. This makes them the fastest-growing automotive-grade segment.

Vehicle Type / Application Insights

Why Are Passenger Cars Dominating the Center Stack Display Industry?

The passenger cars have become a dominant force in the center stack displays, due to high production volumes and widespread consumer adoption. Automakers have been integrating advanced infotainment systems into passenger vehicles to improve user experience and differentiate models. The demand for safety, navigation, and entertainment features has reinforced the role of displays as a key in-cabin technology. Luxury and mid-segment cars alike have adopted larger and more intuitive center stack displays. Standardization of connected infotainment in passenger cars further cements their dominance. This trend ensures that passenger cars remain the primary driver of overall market growth.

The electric vehicles segment has become the fastest-growing segment in the center stack display market, driven by their tech-centric positioning and advanced cockpit designs. EV manufacturers often integrate larger, high-resolution, and more interactive displays to highlight smart features and real-time energy monitoring. As EV adoption accelerates globally, so does the need for next-generation HMI (human-machine interface) systems. Displays in EVs are not just infotainment centers but also hubs for energy analytics and ADAS visualization. The integration of AI, cloud connectivity, and OTA updates is expanding display functionality in this segment. Consequently, EVs are setting new benchmarks for display sophistication and growth pace.

Form Factor & Mounting Insights

Why Are Integrated Flush-Mount Displays Dominating the Center Stack Display Market?

The integrated flush-mount displays have become a dominant force in the center stack display market, due to their sleek, built-in look that integrates seamlessly with the vehicle dashboard. Automakers prefer this form factor because it conveys a premium aesthetic while maintaining structural robustness. These displays enhance cabin design continuity and ergonomics, appealing to both luxury and mass market vehicles. Flush designs also reduce driver distraction by aligning with natural sightlines. Their widespread use across traditional vehicle platforms secures their dominance. Long-term reliance on this form factor ensures continued strong demand.

The floating tablet segment has become the fastest-growing segment in the market, positioned above the dashboard, they offer a modern, high-tech aesthetic often associated with EVs and premium vehicles. Their modular nature allows for larger screen sizes without redesigning the dashboard, making them cost-effective for OEMs. Floating tablets also offer flexible user interface layouts, supporting AI-driven and voice-enabled functions. Consumer preference for tablet-like interactions further drives this trend. Their rising use in EVs and premium passenger vehicles ensures accelerated growth.

Sales Channel Insights

Why Are OEM Direct Contracts Dominating the Center Stack Display Market?

The OEM direct contracts segment led the center stack display market in 2024. This approach ensures high reliability, seamless integration, and compliance with automotive-grade standards. Direct contracts also support co-development of custom interfaces, strengthening OEM-brand identity. OEM partnerships provide suppliers with stable, long-term demand pipelines. This model reduces compatibility risks compared to aftermarket options. As a result, OEM contracts remain the backbone of the market.

The aftermarket distributors/retrofit kits segment has become the fastest-growing segment in the center stack display space, fueled by consumer interest in upgrading older vehicles. Many drivers seek advanced infotainment systems with navigation, connectivity, and AI features not originally built into their vehicles. Retrofit kits offer an affordable option to modernize cars without replacing them. This segment is especially strong in emerging economies where vehicle replacement cycles are longer. Distributors are also innovating with modular, easy-to-install kits to attract DIY consumers. The rising tech-savvy aftermarket base ensures this channel's rapid growth trajectory.

Center Stack Display Market Companies

- Robert Bosch GmbH

- Continental AG

- Visteon Corporation

- Panasonic Automotive Systems (Panasonic Corporation)

- LG Display Co., Ltd.

- Denso Corporation

- Hyundai Mobis Co., Ltd.

- Valeo SA

- Magna International Inc.

- Harman International (Samsun Electonics)

- Preh GmbH

- Marelli (Calsonic Kansei / Magneti Marelli lineage)

- Behr-Hella Thermocontrol GmbH (BHTC) / Hella GmbH & Co. KGaA

- Aptiv PLC (formerly Delphi)

- Methode Electronics, Inc.

- Faurecia (now part of Forvia)

- Johnson Control

- Sharp Corporation / Sharp NEC Display Solutions (automotive displays)

- Samsung Display Co., Ltd.

- NXP Semiconductors

Segments Covered in the Report

By Display Technology

- TFT-LCD / TFT-LCD with IPS

- OLED / AMOLED

- Micro-LED / QLED / emerging emissive displays

- Projection / HUD-integrated center displays (when combined with HUD systems)

By Screen Size

- Up to 7 inches

- 7–10 inches

- Above 10 inches (large / tablet-style)

- Dual displays / multi-screen center stacks

By Resolution & Image Performance

- Standard resolution (HD / FWVGA)

- High resolution (Full HD / 1920×1080 and above)

- HDR / wide color gamut / high contrast

By Touch & HMI Input Type

- Capacitive multi-touch

- Resistive touch (legacy)

- Haptics/force feedback touch

- Gesture controls (camera/IR-based)

- Hybrid (touch + physical knobs/buttons)

By User Interface / Software

- Basic UI (menus, media, nav)

- Connected infotainment (smartphone mirroring, OTA updates)

- Voice assistants & natural language UI

- Adaptive UIs / customizable skins / multi-user profiles

- Integrated driver assistance telematics (ADAS status, sensor fusion displays)

- Voice + AI adaptive UI

By Connectivity & Integration

- Vehicle networks: CAN, LIN, MOST

- Automotive Ethernet / xMII (high bandwidth)

- Wireless: Bluetooth, Wi-Fi, cellular (embedded modem/NB-IoT/LTE-M)

- Integration with digital instrument cluster (combined cockpit)

- Cloud integration (OTA, telematics, remote diagnostics)

By Automotive Grade / Functional Safety

- Non-safety critical (infotainment only)

- Safety-aware (ISO 26262 ASIL support for integrated safety functions)

- Ruggedized / high-temperature automotive-grade modules

By Vehicle Type / Application

- Passenger cars (mass market)

- Premium/luxury cars (high-end CSD with larger screens and UX)

- Commercial vehicles (trucks, buses)

- Electric vehicles (EV/BEV specific integrated displays)

- Aftermarket/retrofit

By Form Factor & Mounting

- Integrated flush-mount displays (OEM dash)

- Floating tablet/portrait orientation (vertical)

- Curved/wraparound center stack

- Retractable/motorized displays

By Sales Channel

- OEM direct contracts (factory fit)

- Aftermarket distributors/retrofit kits

- Module/SoC licensing/software licensing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting