What is Fixed-Wing VTOL UAV Market Size?

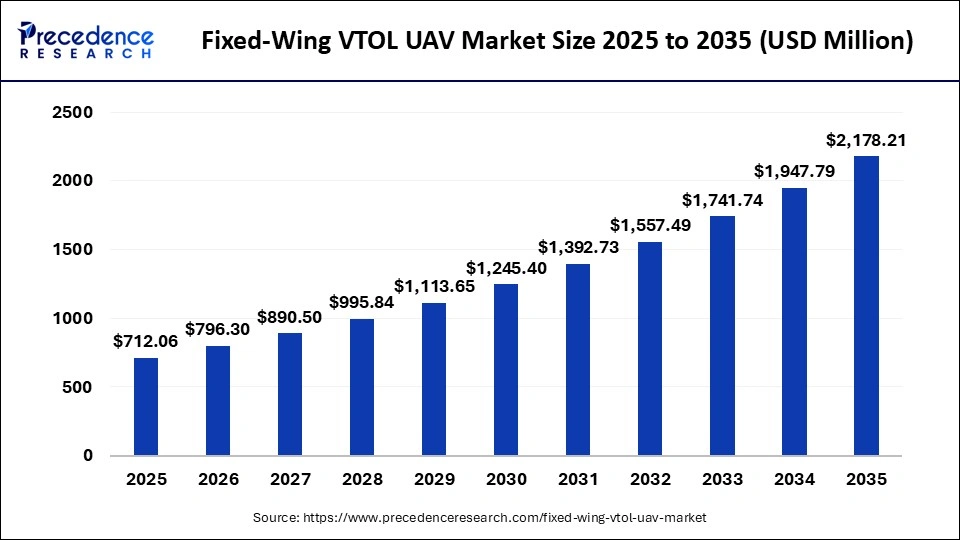

The global fixed-wing VTOL UAV market size accounted for USD 712.06 million in 2025 and is predicted to increase from USD 796.30 million in 2026 to approximately USD 2,178.21 million by 2035, expanding at a CAGR of 11.83% from 2026 to 2035. The market for fixed-wing VTOL UAVs is driven by increasing demand for versatile, long-endurance aerial surveillance and reconnaissance.

Market Highlights

- North America accounted for the largest share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 to 2035.

- By propulsion type, the gasoline segment contributed the highest market share in 2025.

- By propulsion type, the hybrid segment is growing at a strong CAGR from 2026 to 2035.

- By mode of operation, the remotely piloted segment recorded a significant share in 2025.

- By mode of operation, the optionally piloted segment is poised to grow at a considerable CAGR 2026 to 2035.

- By application, the military segment captured the major market share in 2025.

- By application, the commercial segment is growing at a notable CAGR from 2026 to 2035

Introduction and Growth Factors: Fixed-Wing VTOL UAV Market

The Fixed-Wing Vertical Takeoff and Landing (VTOL) Unmanned Aerial Vehicle (UAV) market is a potentially revolutionary niche within the global drone market, as it combines the capabilities of fixed-wing and rotary-wing platforms. This variant design enables VTOL UAVs to operate over long distances without runways, making them suitable for a wide range of applications, including military reconnaissance, border patrol, disaster response, agricultural monitoring, and even infrastructure inspection.

The simplicity of operation and the growing popularity of drones across both commercial and military sectors have placed Fixed-Wing VTOL UAVs among the most significant devices in modern aerial missions. As the application of unmanned systems continues to increase in the surveillance, data collection, and logistics sectors globally, governments and commercial businesses are driving consistent market expansion, driven by regulatory mandates, technology, and the rising demand for cost-effective, quick-response aerial solutions.

The further development of the market is driven by the constant innovations in UAV technology, such as the increased payload capacity, extended flight duration, AI-based navigation, and autopilot features. VTOL UAVs are becoming an investment opportunity due to the growing demand for a versatile aerial platform that can be used in a range of applications, including precision agriculture, environmental monitoring, and emergency response. The trend of minimizing operational expenses, maximizing energy conservation through hybrid propulsion engines, and improving mission reliability is driving both traditional and newer competitors to develop enhanced UAV solutions.

Key AI Integration in the Fixed-Wing VTOL UAV Market

Artificial Intelligenceis proving to be a significant factor in enhancing the capabilities and operational efficiency of Fixed-Wing VTOL UAVs. Flight control systems and maneuvering systems driven by AI enable this by autonomously planning paths, avoiding obstacles, and dynamically adapting missions without human operation. Machine learning algorithms leverage real-time sensor data to optimize flight paths, control energy use, and predict required maintenance, thereby enhancing overall reliability and operational life. Payload management is also incorporated into AI, enabling UAVs to analyze imagery for precision agriculture, disaster inspection, and infrastructure inspection. Moreover, AI-supported decision-support systems help operators prioritize targets, operate multiple UAVs simultaneously, and ensure missions remain within regulatory frameworks.

Fixed-Wing VTOL UAV Market Outlook

The fixed-wing VTOL UAV market is experiencing rapid growth owing to the growing need to have a variety of aerial platforms that are versatile, long-range, and efficient. Advancements in commercial, defense, and agricultural practices include hybrid propulsion, increased payload capacity, and autonomous operations.

The two best markets are North America and Europe, which have decent defense budgets, well-established manufacturers of UAVs, and have decent regulations. Asia-Pacific is growing at an accelerated rate, driven by increased investments in agriculture, infrastructure monitoring, and disaster management applications.

Boeing, Lockheed Martin, Textron Systems, Aurora Flight Sciences, and Vertical Aerospace are the major competitors. These companies are engaged in an ongoing struggle to develop their VTOL UAVs to perform even better and more reliably, as well as to expand the range of their missions.

The startups of Lightweight designs and AI-based navigation are being developed by Wingcopter, Quantum-Systems, and AltiGator, among others. These applications include last-mile delivery, environmental monitoring, and precision agriculture, which are specialized areas for these companies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 712.06 Million |

| Market Size in 2026 | USD 796.30 Million |

| Market Size by 2035 | USD 2,178.21 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Fixed-Wing VTOL UAV Market Segment Insights

Propulsion Type Insights

Gasoline: The gasoline segment led the fixed-wing VTOL UAV market and accounted for the largest revenue share in 2024, thanks to its high energy density, which enables longer flight duration and range, characteristics that apply to its electric counterparts. Gasoline engines are also dependable for heavy loads and long-distance missions; thus, they are useful for military surveillance, border patrol, and large-area surveillance. Fuel supply and maintenance infrastructure are also in place, which supports adoption. Also, VTOL UAVs powered by gasoline can be used in remote areas without frequent recharging and provide stable performance and flexibility, which contributed to their dominance in revenue in 2024.

Hybrid: The hybrid segment, which combines gasoline or diesel engines with electric propulsion, is likely to experience a high CAGR, as it can balance efficiency and versatility. The Hybrid VTOL UAVs offer longer flight time, lower fuel consumption, and lower emissions than gasoline-only systems. With the addition of electric motors, takeoffs and landings become quieter, which is suitable in an urban environment and for sensitive operations. Hybrid technologies are being invested in by an increasing interest in environmentally sustainable solutions and multi-mission applications. This tendency makes hybrid VTOL UAVs one of the rapidly expanding propulsion systems in the commercial and military community.

Electric: The electric propulsion segment is attracting significant interest because it is relatively quiet in operation, requires minimal maintenance, and produces no direct emissions. Electric VTOL UAVs are best used for short missions in precision agriculture, urban surveillance, and indoor inspections, where sound and clean performance is essential. The battery energy density and charging infrastructure are slowly enhancing flight capability, thus making electric systems more competitive. The growing environmental requirements and pressure to adopt green technologies across the business and government sectors are likely to support the stable growth of the electric propulsion market.

Mode Of Operation Insights

Remotely Piloted: The remotely piloted segment is a market leader in Fixed-Wing VTOL UAVs in 2024, thanks to its greater flexibility, reliability, and well-developed capabilities. These UAVs enable human operators to control complex missions, make real-time decisions, and conduct surveillance, reconnaissance, and disaster response. The easy access to already-developed control systems, training packages, and regulatory licenses facilitates their extensive use in the military, commercial, and government realms. Moreover, the remotely controlled VTOL UAVs offer predictable performance with lower risk than fully autonomous systems, which increases revenue and makes them the most popular line in the market.

Optionally Piloted: The optionally piloted segment will have a high CAGR, as it offers dual operational capability, allowing UAVs to be flown manually or autonomously as required. Such flexibility enhances mission compatibility and safety, particularly when switching between urban and remote settings. Controlled VTOL UAVs are gaining popularity in business logistics, emergency management, and research, as operators may need to take control at the moment due to complex or unforeseen circumstances. The segment is aided by ongoing technological advancements in autopilot systems, AI-based control, and safety provisions, making it one of the fastest-growing segments in the fixed-wing VTOL UAV market.

Fully Autonomous: The fully autonomous segment is maturing rapidly with advances in AI, machine learning, and sensor integration, making operations more reliable and decision-making more feasible. With mission management, autonomous VTOL UAVs reduce labor costs, minimize errors, and streamline fleet operations for large volumes of missions. Regulatory developments and real-time obstacle detection, navigation, and collision avoidance will drive steady adoption of fully autonomous systems, making this segment a major avenue of growth in the coming decade.

Application Insights

Military: In 2024, the fixed-wing VTOL UAV market was dominated by the military segment due to high demand for advanced surveillance, reconnaissance, and tactical support missions. VTOL UAVs are suitable for defense missions due to their long range, rapid deployment, and ability to operate in hard-to-reach areas without runways. The need for real-time intelligence gathering, ongoing investment in UAV technology, and high defense budgets contribute to further adoption. Moreover, the world's militaries are now focusing on hybrid and gasoline-fueled VTOL UAVs for long-range missions, thereby making them more reliable.

Commercial: The commercial sector will also experience significant growth owing to its increased use in agriculture, infrastructure inspection, logistics, and environmental monitoring. VTOL UAVs can help minimise operational costs, increase efficiency, and deliver accurate data to commercial operations. The growth of AI and payloads, along with autonomous capabilities, enables commercial operators to use UAVs for a variety of applications, such as crop analysis and industrial inspection. The increase in demand for green and efficient aerial solutions and the growth of urban and industrial applications position the commercial segment as a significant driver of the fixed-wing VTOL UAV market growth in the forecast period.

Government and Law Enforcement: The fixed-wing VTOL UAVs are gaining growing acceptance among government and law enforcement agencies for border monitoring, disaster response, traffic monitoring, and emergency management. VTOL UAVs are fast, have a long range, and can transmit data in real time, allowing authorities to improve situational awareness and decision-making. Connection with AI-based analytics and safe communication systems enhances efficiency in operation and the safety of the population. The increase in homeland security investments, smart city development, and emergency response infrastructure will drive consistent growth in this segment in the future, and government and law enforcement applications will become a significant growth driver in the market over the next few years.

Fixed-Wing VTOL UAV Market Regional Insights

North America held the largest market share in the global fixed-wing VTOL UAV market in 2024, driven by its strong technological foundation and defence expenditure. The U.S. boasts industry giants in the aerospace industry, intelligent designers of UAVs, and research facilities that have driven the technology behind drone operations. Among the major advances are AI-assisted navigation, intelligent sensor fusion, hybrid propulsion, and high-density batteries, which enhance the performance, longevity, and variety of UAVs. The region's advantage is a well-developed commercial sector and extensive use of UAVs for activities such as infrastructure inspection, disaster monitoring, agriculture, and logistics. Also, the focus on research and development in North America promotes innovation, as companies can develop next-generation VTOL UAVs that address the needs of the military and businesses, and it remains a market leader.

The United States has been a central player in the North American market for VTOL UAVs, mainly because the Department of Defense has made significant investments in reconnaissance, surveillance, and tactical applications of the UAVs. The defense budget for innovative UAV platforms is funding advanced systems that enable the state to conduct long-range operations and achieve autonomy. Favorable regulatory frameworks supported by the FAA can help integrate UAVs into the national airspace and simplify the conduct of commercial and military missions. Good collaboration among defense contractors, technology providers, and academic institutions also benefits the U.S. market by improving innovation in AI, payload control, and flight control. Together with a growing business ecosystem and an increasing number of industries adopting the technology, the U.S. remains well-positioned to drive revenue growth and lead the global fixed-wing VTOL UAV market.

Asia Pacific will record the highest CAGR in the fixed-wing VTOL UAV market over the forecast period, driven by rapid economic growth, industrialization, and the adoption of new technologies in countries such as China, India, Japan, and Southeast Asia. The demand for diverse UAV solutions is growing faster due to rising investments in infrastructure, precision agriculture, disaster management, and logistics. Increasing defense expenditures in these countries are also contributing to the use of sophisticated UAVs for surveillance and reconnaissance missions and tactical operations. Market expansion is also supported by the modernization of defense forces (including the integration of autonomous and hybrid VTOL systems). These strategic priorities in defense, industrial development, and a favorable policy environment make Asia Pacific the fastest-growing regional market for Fixed-Wing VTOL UAVs.

China Fixed-Wing VTOL UAV Market Trends

China has become a global powerhouse in UAV production, driving the Asia-Pacific Fixed-Wing VTOL UAV market to expand dramatically. The cost-effective, high-performance VTOL drones are being manufactured locally and can be used for defense, commercial, and industrial purposes. The operational capabilities of Chinese UAVs have been improved through continuous innovation in AI, navigation systems, hybrid propulsion, and payload management. The government's emphasis on technological independence and the adoption of UAVs in the defense, border monitoring, and agriculture industries are facilitating mass adoption. Also, alliances between local producers and foreign enterprises are accelerating the transfer of technology and enhancing design.

The European fixed-wing VTOL UAV market is experiencing sustainable growth due to growing applications in defense, commercial, and civil markets. The UK, Germany, France, and Italy are among the countries investing in high-tech UAV technologies for border surveillance, border control, disaster management, and infrastructure inspection. The focus on achieving both accurate engineering, safety standards, and technological development in the region is driving demand for hybrid and AI-powered VTOL UAVs. Moreover, Europe's growing interest in smart cities, environmental monitoring, and industrial automation is also opening new prospects for UAV use. Good coordination among defense departments, research organizations, and commercial technology sources further boosts development and adoption.

UK Fixed-Wing VTOL UAV Market Trends

The UK fixed-wing VTOL UAV market is booming due to significant investments in modernizing defense, autonomous systems, and progressive aerial surveillance. The British security agencies, as well as defense bodies, are adopting VTOL UAVs to enable swift deployment, intelligence gathering, and greater operational flexibility. The commercial industry is also taking advantage of UAVs for infrastructure inspection, environmental monitoring, and logistics, with the positive regulatory framework of the Civil Aviation Authority (CAA). Local innovation centers and technology startups are also helping integrate AI, optimize payloads, and develop hybrid propulsion. The trends, along with rising government funding and research efforts, make the UK a prime market for boosting and contributing to growth and innovation in the European Fixed-Wing VTOL UAV sector.

Fixed-Wing VTOL UAV Market Companies

- Parrot SA

- Lockheed Martin Corporation

- Wingtra

- Teledyne FLIR LLC

- DJI Innovations

- Textron Inc.

- Quantum Systems Gmb

- Aerovironment Inc.

- Carbonix

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Textron Inc.

- Avery Dennison Corporation (AVY)

- AeroVironment Inc.

- ideaForge Technology Ltd.

- Quantum-Systems GmbH

- Autel Robotics

- Elroy Air Inc.

Recent Developments

- In March 2024, Carbonix integrated the RIEGL VUX-120 LiDAR and Phase One iXM 100 medium-format camera into its fixed-wing VTOL platform, enabling advanced remote sensing and geospatial data acquisition. In Australia and the U.S., the system mapped more than 12,000 hectares using detailed, colourized 3D models of the infrastructure and mining uses. (Source: https://carbonix.com.au)

- In January 2024, T-DRONES presented the VA23 VAVTOL fixed-wing UAV with a range of 240 kilometers and level 5 resistance to wind. The UAV had a 2.5-kilogram payload that supported various sensors and equipment for specialized missions across different environments. (Source:https://www.unmannedsystemstechnology.com)

- In May 2023, AeroVironment announced the Puma VTOL kit, an add-on for the Puma 2 AE and Puma 3 AE SUAS that enabled vertical takeoff and landing on difficult terrain. This upgrade enabled the UAVs to operate without runways, enhancing their mobility during deployment in both military and commercial applications.(Source: https://thedefensepost.com)

Fixed-Wing VTOL UAV Market Segments Covered in the Report

By Propulsion Type

- Electric

- Gasoline

- Hybrid

By Mode Of Operation

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

By Range

- Beyond Line of Sight

- Extended Visual Line of Sight

- Visual Line of Sight

By Application

- Military

- Government and Law Enforcement

- Commercial

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting