What is the UAV Parachute Recovery Systems Market Size?

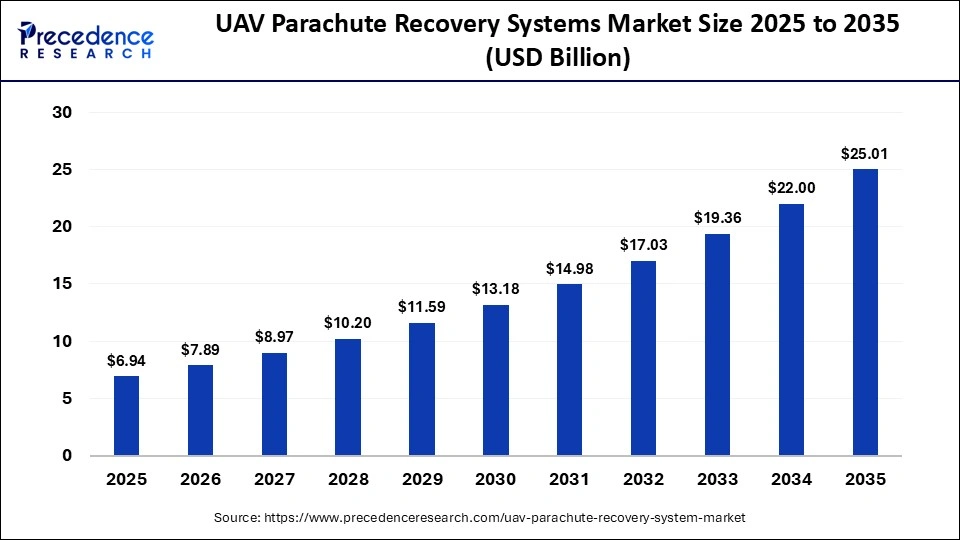

The global UAV parachute recovery systems market size accounted for USD 6.94 billion in 2025 and is predicted to increase from USD 7.89 billion in 2026 to approximately USD 25.01 billion by 2035, expanding at a CAGR of 13.68% from 2026 to 2035. The market growth is attributed to increasing regulatory mandates for certified UAV parachute recovery systems and rising drone deployments in commercial and defense sectors.

Market Highlights

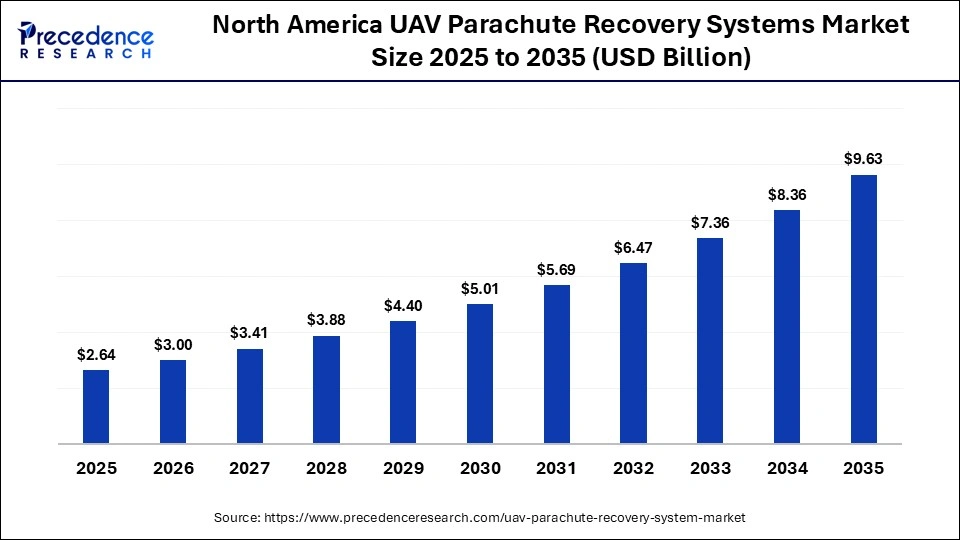

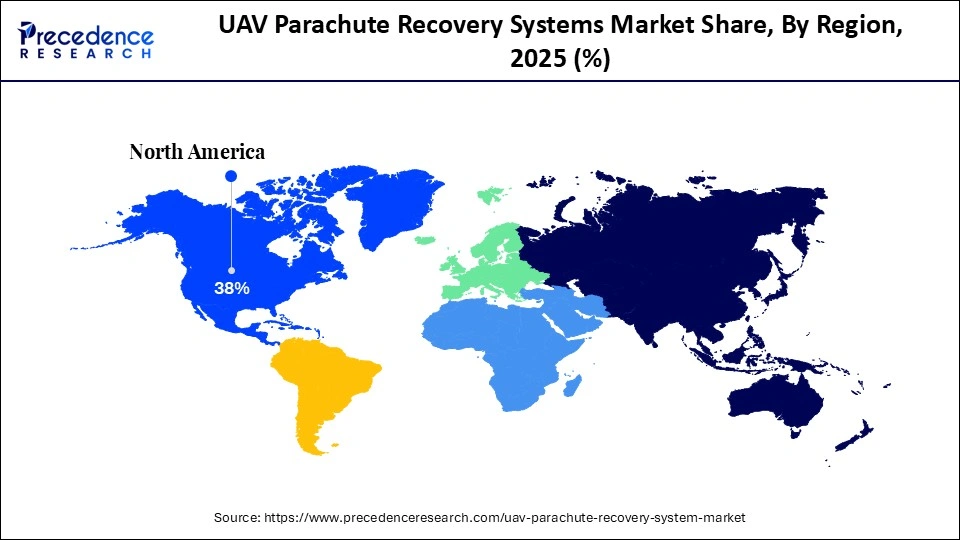

- North America segment accounted for the largest market share of 38% in 2025.

- The Asia Pacific segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By type, the fixed-wing UAVs segment accounted for a considerable share in 2025.

- By type, the rotary-wing UAVs segment is projected to grow at the highest CAGR between 2026 and 2035.

- By payload capacity, the medium payload segment led the market in 2025.

- By payload capacity, the light payload segment is growing at a solid CAGR from 2026 to 2035.

- By recovery method, the ballistic parachutes segment contributed the market share in 2025.

- By recovery method, the disc parachutes segment is growing at a highest CAGR from 2026 to 2035.

- By materials, the nylon segment dominated the market in 2025.

- By materials, the kevlar segment is projected to expand rapidly between 2026 and 2035.

- By application, the military and defense segment maintained a leading position in the market in 2025.

- By application, the civil and commercial segment is predicted to witness significant CAGR from 2026 to 2035.

UAV Parachute Recovery Systems Market Overview

The UAV parachute recovery systems market is expanding primarily due to stronger regulatory emphasis on operational safety and controlled emergency descent. Aviation authorities are increasingly positioning certified parachute recovery systems as a prerequisite for broader commercial drone deployment, particularly for missions conducted over people, infrastructure, and dense urban environments.

In North America, updates to small unmanned aircraft system regulations and safety guidance issued by the Federal Aviation Administration have clarified pathways for safe commercial operations in urban and mixed-use airspace. These regulatory adjustments are encouraging operators to adopt certified parachute recovery systems as a risk-mitigation measure to meet compliance requirements and reduce ground impact energy in failure scenarios.

Industry alignment with standards is also accelerating adoption. In early 2025, platforms such as the DJI M30 series successfully completed updated ASTM International F3322-24a parachute testing through independent, FAA-designated third-party test sites. This milestone highlighted increasing manufacturer compliance with recognized safety benchmarks and reinforced confidence among regulators and commercial operators.

Business industries such as logistics delivery, infrastructure inspection, agriculture, and emergency response are taking on parachute recovery solutions to boost the reliability of operations. The regulatory bodies are contributing factors to the market dynamics, with the North American, European, and some parts of Asia aviation authorities beginning to certify the safety requirements of certain UAV operations. Moreover, the institutional endorsement of parachute technology is driving adoption among commercial operators seeking to meet evolving safety standards.

Governments and aviation authorities are increasingly using parachute system compliance as a criterion to streamline approvals for advanced operations, including flights over people, infrastructure inspection, and urban public safety missions. This regulatory momentum is expected to continue driving adoption of UAV parachute recovery systems as a standard safety component across commercial drone fleets in the coming years.

Impact of Artificial Intelligence on the UAV Parachute Recovery Systems Market

The UAV parachute recovery systems market is evolving with the integration of artificial intelligence, which is improving the intelligence, responsiveness, and reliability of emergency recovery mechanisms. Manufacturers are embedding AI algorithms into flight control and safety modules to continuously monitor real-time flight parameters such as altitude, velocity, attitude, motor performance, and power anomalies, enabling faster and more accurate detection of failure conditions.

Machine learning models are increasingly used to analyze historical flight data alongside live telemetry to optimize parachute deployment timing and decision thresholds. This allows systems to distinguish between recoverable disturbances and critical failures, reducing false deployments while ensuring rapid response during genuine emergencies. By refining deployment logic, AI-enabled systems help minimize impact energy, reduce damage to the airframe and payload, and improve post-incident recovery outcomes.

As AI capabilities mature, recovery systems are becoming more adaptive and mission-aware, supporting complex operations such as urban flights, autonomous missions, and beyond-visual-line-of-sight use cases. This shift toward intelligent, data-driven safety systems is strengthening confidence among regulators and operators, accelerating adoption of advanced parachute recovery solutions across commercial UAV platforms.

UAV Parachute Recovery Systems MarketGrowth Factors

- Rising Adoption of Urban Air Mobility: Increasing drone traffic in cities is propelling the need for reliable parachute recovery systems.

- Growing Demand for BVLOS Operations: Expanding beyond visual line-of-sight flights is boosting the integration of certified emergency descent technologies.

- Advancements in Autonomous Deployment Systems: Innovation in sensor driven parachute activation is driving safer and more efficient UAV operations.

- Increasing Use of Heavy-Lift Drones: Rising deployment of payload-intensive UAVs is fueling demand for advanced parachute recovery mechanisms.

- Expansion of Defense and Tactical Applications: Growing military UAV programs are propelling investments in certified safety systems to protect assets.

UAV Parachute Recovery Systems Market Outlook

- Industry Growth Overview: The UAV parachute recovery systems market is witnessing considerable expansion as broader UAV deployments in commercial, industrial, and defense segments increasingly mandate advanced safety and loss mitigation technologies. The use of parachute systems has increased with the expansion of long-range operations and beyond-visual-line-of-sight operations. The safety of assets and compliance with regulations have become the major requirements of safe flight in crowded airspace among operators. Military use remains the leading force behind the demand for high-performance multi-stage parachute designs that best fit heavier UAV vehicles.

- Sustainability Trends: The concerns of sustainability are becoming issues in product development and implementation in the UAV parachute product ecosystem. Manufacturers are putting more emphasis on the low environmental footprint of the parachute systems by using recyclable and durable materials. This prolongs the performance of the lifecycle of the system with very little waste. Additionally, the shift to non-pyrotechnic and reusable deployment systems promotes the environmental objectives and cost-efficiency of operations in the market.

- Global Expansion: The market's global footprint continues to broaden as regions such as North America and Europe maintain strong adoption rates driven by stringent safety regulations and mature UAV industries. In North America, the prevalence of civilian use cases and regulatory focus on over-people and other BVLOS operations form the basis of the strong demand for certified recovery solutions. The Asia-Pacific markets of China, Japan, South Korea, and India are becoming the UAV fleets as the local regulations adapt to the introduction of standard safety requirements.

- Major Investors: Investor interest in the UAV parachute recovery space is becoming more pronounced, reflecting the rapid expansion of drone operations across enterprise, public infrastructure, and defense applications. Strategic investors such as Airbus Ventures and defense-linked investment arms have actively backed parachute recovery innovators, recognizing certified safety systems as a critical enabler for urban and complex drone missions. In parallel, private equity and growth-stage investors, including Valar Ventures, are allocating capital to companies with scalable recovery technologies and strong regulatory alignment. These funding patterns highlight growing confidence in the long-term adoption of parachute recovery systems as mandatory safety infrastructure across commercial and government UAV operations.

- Startup Ecosystem: The startup landscape for UAV parachute recovery solutions is becoming increasingly dynamic, with emerging companies focusing on autonomous deployment logic and deep integration with UAV flight control systems. Innovators such as ParaZero and Indemnis are developing AI-enhanced deployment software, sensor fusion architectures, and configurable parachute designs that support platforms ranging from micro-UAVs to heavy-payload drones. These startups are attracting backing from venture capital firms and strategic aerospace investors, including Lockheed Martin Ventures and Airbus Ventures, seeking to embed certified safety capabilities into next-generation UAV platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.94 Billion |

| Market Size in 2026 | USD 7.89 Billion |

| Market Size by 2035 | USD 25.01 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Materials, Application, Recovery Method, Payload Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Are Fixed-Wing UAVs Dominating Parachute Recovery Systems in 2025?

Fixed-Wing UAVs: The fixed-wing UAVs segment dominated the UAV parachute recovery systems market in 2025, as they comprised over half of all total UAV units in operational fleets worldwide, due to a long-standing tendency to adopt the long-range endurance mission.

Fixed-wing drones were found useful in the commercial industries, including mapping, infrastructure inspection, and environmental surveillance, in that predictable flight patterns enhanced the efficiency of emergency recovery operations. Furthermore, the aviation regulatory frameworks increasingly recognized the need for reliable recovery systems on long-endurance platforms, influencing operators to prioritize parachute integration on fixed-wing types.

Rotary-Wing UAVs: The rotary-wing UAV segment is expected to grow at the fastest rate in the coming years, owing to their vertical landing and takeoff, which make them useful in urban and constrained mission areas.

Rotary-wing platforms are growing in popularity in infrastructure inspection, emergency response, and operations at low precision and timing. Additionally, the regulation instructions regarding safe operations over people and infrastructure are expected to push the use of parachute systems on rotary-wing models rather than on fixed-wing types.

Materials Insights

Why Is Nylon Still the Leading Parachute Material, and Why Is Kevlar Rising Fast in the Market for UAV Parachute Recovery Systems?

Nylon: This segment held the largest revenue share in the UAV parachute recovery systems market in 2025, due to its high tensile strength at low weight and cost efficiency, making it ideal for general recovery system canopies. Ripstop nylon weaves had been optimized to provide greater resistance to tearing and control over airflow. This allows the application of nylon in the manufacture of parachutes to be more durable and resistant to mildew.

Kevlar: The segment is expected to grow at the fastest CAGR in the coming years, owing to its exceptional tensile strength and superior heat resistance compared with conventional nylon fabrics. Kevlar aramid-type fibers are used in parachute suspension lines, load tapes, and reinforcement bands with high loads and dynamic loads during high-speed deployments, with the greatest need. Moreover, the Kevlar fiber is also now being used in high-performance and tactical recovery modules, thus further boosting the segment growth.

Application Insights

Why Did Military Safety Use Lead, and Why Is Civil Adoption Rising Fast?

Military and Defense: This segment dominated the UAV parachute recovery systems market in 2025, driven by rising operational complexity and regulatory approvals that supported broader use of certified parachute recovery modules.

The late 2024 certification of SafeAir kits by ParaZero under the DVR/EASA made the use of certified parachute systems in military tactical missions and ISR operations more accepted. Furthermore, the categorized Category 2 and Category 3 operations over people FAA compliance pathways further assisted defense operators to incorporate parachutes into bigger fixed-wing and rotorcraft UAV fleets through the provision of solid certification structures.

Civil and Commercial: This segment is expected to grow at the fastest rate in the forecasted period, owing to the growing regulatory focus on operations instead of people and BVLOS missions under certified parachute systems. The sensor-enabled automatic deployment systems were used more in 2023-2025 as operators sought to have FAA- and EASA-approved safety compliance, allowing flights within populated areas with fewer waivers.

AVSS declared in mid-2025 that the FAA had granted Category 2 compliance of the parachute system on enterprise drones like the DJI Matrice 4 series. That commercial pilots could fly above people without additional waivers under the ASTM F3322 requirements. Furthermore, the trends projected strong civilian uptake beyond 2025, driven by safety expectations and evolving airspace rules.

Recovery Method Insights

Why Are Ballistic Parachutes Dominating Safety Deployments in the market for UAV parachute recovery systems during 2025?

Ballistic Parachutes: Ballistic parachute segment held the largest revenue share in the UAV parachute recovery systems market in 2025, due to the high increase in certified rapid-deployment mechanisms, which are combined with automatic fail-safe strategies.

Ballistic systems were very reliable in the urban and beyond-visual-line-of-sight flights. They offered a fast parachute recovery regardless of the power system of the UAV, an essential safety measure when operating in areas with high populations. Additionally, the autonomous deployment logic expansion also augmented the adoption of the ballistics, strengthening their position as the leading providers of safety systems in the portfolio.

Disc Parachutes: Disc parachute segments are expected to grow at the fastest CAGR in the coming years, as they possess a greater drag efficiency and can be deployed with a greater variety of flight profiles. UAV disc parachutes, such as annular and ellipsoid, have high coefficients of drag that cause a high rate of slowing down when landing and are appealing to civilians.

Industrial drones that fly at lower altitudes or have an area of operation where a controlled rate of descent is important. Furthermore, the further development of the canopy materials and tethers is likely to enhance the reliability of disc parachutes in diverse wind and turbulence environments to be used in UAV types.

Payload Capacity Insights

Why Is the Medium Payload Segment Dominating the UAVs Leading Safety Integrations in 2025?

Medium Payload (10-50 kg): This segment dominated the UAV parachute recovery solutions market in 2025 due to its extensive use across commercial, industrial, and public sector drone operations. Drones in this payload class are widely deployed for infrastructure inspection, surveying, mapping, public safety, and logistics, where flights often occur over people or critical assets, making certified safety systems essential. Regulatory frameworks increasingly require parachute recovery for drones operating in this weight range to enable approvals for urban and complex missions. In addition, medium payload UAVs carry higher-value sensors and payloads, increasing the need for reliable recovery systems to minimize asset loss and liability risks.

Light Payload (up to 10 kg): The segment is expected to be the fastest growing during the forecast period between 2026 and 2036, driven by the rapid proliferation of small commercial and prosumer drones. These UAVs are increasingly used for photography, inspection, agriculture monitoring, surveillance, and first-responder applications, many of which are expanding into semi-urban and urban environments. Evolving flight-over-people regulations and simplified certification pathways are encouraging operators to adopt lightweight parachute recovery systems to improve safety compliance. In addition, declining system costs and easier integration with compact UAV platforms are accelerating adoption among fleet operators and small enterprises.

Regional Insights

How Big is the North America UAV Parachute Recovery Systems Market Size?

The North America UAV parachute recovery systems market size is estimated at USD 2.64 billion in 2025 and is projected to reach approximately USD 9.63 billion by 2035, with a 13.82% CAGR from 2026 to 2035.

Why Are North American UAVs Leading in Certified Safety Deployments?

North America led the UAV parachute recovery systems market in 2025, capturing the largest revenue share due to early and widespread adoption of certified parachute safety systems across commercial, civil, and defense UAV fleets. Regulatory clarity and enforcement by the Federal Aviation Administration played a central role, as requirements tied to operations over people and complex airspace accelerated integration of parachute recovery modules as standard safety equipment.

Commercial enterprise operators and defense users in the United States invested heavily in ballistic parachute systems to protect high-value UAV platforms, sensors, and mission-critical payloads during infrastructure inspection, public safety missions, and tactical operations. These systems reduced operational risk, liability exposure, and asset loss, making them a preferred safety investment for medium and heavy UAV classes.

Technology advancement further reinforced regional leadership. U.S.-based companies such as Skydio, ParaZero, and AVSS significantly improved automated deployment logic, sensor fusion, and fault-detection algorithms. These enhancements increased reliability, reduced false deployments, and improved compliance with ASTM and FAA safety standards.

North America benefits from dense critical infrastructure, high UAV penetration across industries, mature defense procurement programs, and early regulatory pathways for advanced drone operations. Together, these factors sustained strong demand for certified parachute recovery systems and firmly positioned North America as the leading market for UAV safety solutions in 2025.

What is the Size of the U.S. UAV Parachute Recovery Systems Market?

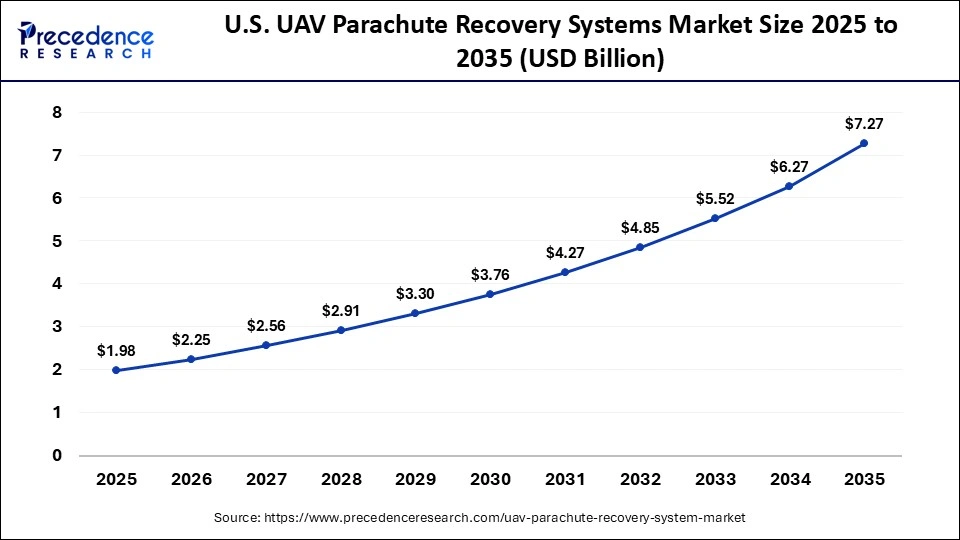

The U.S. UAV parachute recovery systems market size is calculated at USD 1.98 billion in 2025 and is expected to reach nearly USD 7.27 billion in 2035, accelerating at a strong CAGR of 13.89% between 2026 and 2035.

U.S. UAV Parachute Recovery Systems Market

The United States is a major player in the market, fueled by large-scale adoption across commercial, civil, and defense sectors. Defense agencies have incorporated ballistic parachute systems into ISR and tactical UAVs to protect high-value platforms operating in contested or high-risk mission environments. In parallel, clear regulatory pathways, favorable insurance requirements, and sustained R&D investment by companies such as Skydio, ParaZero, and AVSS have accelerated deployment rates.

Additionally, growing use of UAVs in infrastructure inspection, public safety, and urban operations is reinforcing demand for certified safety systems. Federal and state-level acceptance of parachute-equipped drones for flights over people is lowering operational barriers. These combined factors are expected to sustain strong adoption momentum in the U.S. market in the coming years.

What Is Expected to Fuel Growth of UAV Safety Systems Across the Asia Pacific During the Coming Years?

Asia Pacific is anticipated to grow at the fastest rate in the UAV parachute recovery systems market during the forecast period, driven by rapid UAV adoption across China, India, Japan, and South Korea. Strong demand for drones in logistics delivery, precision agriculture, infrastructure inspection, disaster response, and public safety is pushing manufacturers to supply certified parachute recovery systems tailored to local operational and regulatory requirements.

Between 2023 and 2025, countries such as Singapore, South Korea, and India introduced progressive UAV safety and airworthiness frameworks that increasingly mandate recovery solutions for higher-risk missions, including flights over people and dense infrastructure. These rules are accelerating adoption of parachute systems as a prerequisite for commercial approvals.

Industrial operators across the region are investing in larger multirotor fleets and heavier UAV platforms for industrial and government use, which has driven demand for modular, automated parachute systems across both light and medium payload classes. At the same time, collaboration between local aerospace firms, research institutes, and commercial drone manufacturers is supporting advances in deployment logic, system miniaturization, and regional certification compliance, reinforcing Asia Pacific's position as the fastest-growing market.

China Drives Rapid Expansion of Certified UAV Recovery Systems

China is leading the Asia Pacific UAV parachute recovery systems market, supported by large-scale expansion of industrial, commercial, and public-sector UAV operations. National safety requirements issued by the Civil Aviation Administration of China have promoted beyond-visual-line-of-sight operations while tightening safety expectations, effectively favoring UAV platforms equipped with certified recovery and emergency mitigation systems.

Market growth has been steep through 2025, driven by rapid fleet expansion across logistics, infrastructure inspection, energy, and public safety applications. Government mandates focused on airworthiness, operational risk reduction, and urban flight safety have accelerated adoption of parachute recovery systems, particularly for multirotor and medium-payload drones. In parallel, China's ongoing smart city and urban air mobility initiatives are reinforcing long-term demand for certified safety technologies, positioning the country as the regional leader in UAV parachute recovery deployment.

How Is Europe Driving Rapid Adoption of UAV Parachute Recovery Systems?

Europe is expected to hold a notable revenue share in the UAV parachute recovery systems market, driven by increasingly stringent aviation safety regulations and expanding urban drone operations. Regulatory updates issued between 2023 and 2025 by the European Union Aviation Safety Agency have required operators to adopt certified risk-mitigation measures, including parachute recovery systems, for flights over people and beyond-visual-line-of-sight missions.

These regulatory requirements are accelerating integration of certified parachute systems across both commercial and public-sector UAV fleets. Operators conducting infrastructure inspection, mapping, public safety, and logistics missions are increasingly deploying recovery solutions to meet airworthiness and operational approval criteria under European aviation frameworks.

The rising adoption of both multirotor and fixed-wing UAV platforms across Europe is supporting demand for modular parachute systems that can be adapted to different airframe types and payload classes. The flexibility, certification readiness, and compatibility of modular parachute solutions make them well suited to Europe's diverse commercial UAV ecosystem, reinforcing steady market growth across the region.

Germany Accelerates UAV Safety Adoption Across Europe

Germany is one of the leading countries in Europe when it comes to UAV use, driven by stringent EASA regulations for parachute-equipped UAVs. The operators of the industry used drones to conduct their inspection missions, logistics tasks in cities, and surveillance, which demanded strong descent solutions. The proactive certification activity and government-financed research on UAVs in Germany stimulated the use of UAVs by enterprise operators.

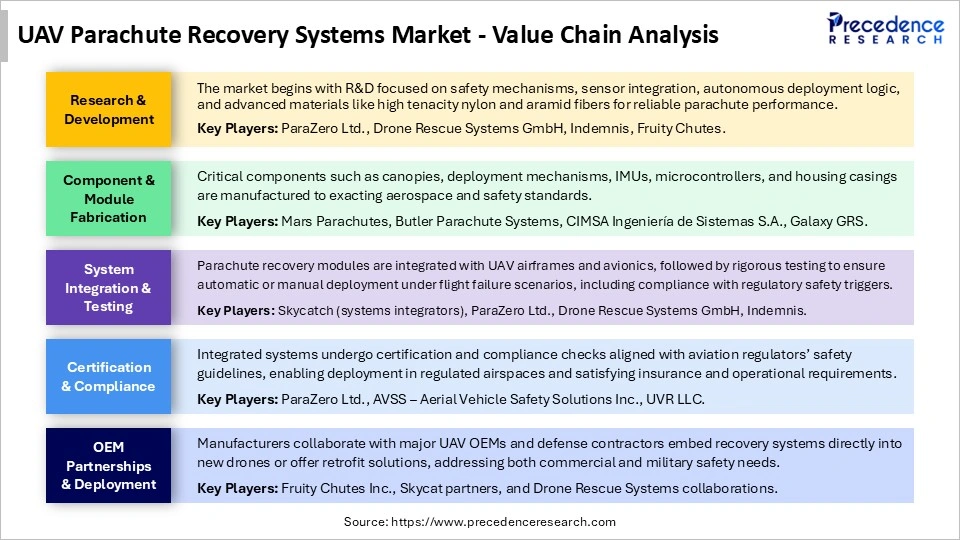

UAV Parachute Recovery Systems Market Value Chain

Top Vendors in the UAV Parachute Recovery Systems Market & Their Offerings

- Butler Parachute Systems

- CIMSA Ingeniería de Sistemas S.A.

- EKOFASTBA S.L.

- ParaZero Ltd.

- Fruity Chutes

- Drone Rescue Systems GmbH

- Galaxy GRS

- Indemnis

- Mars Parachutes

- Skycatch

Recent Developments

- In January 2025, Aerial Vehicle Safety Solutions Inc. (AVSS) announced the launch of the PRS-M4S, a Parachute Recovery System designed for the new DJI Matrice 4 Series. The system is compatible with both the DJI Matrice 4 Enterprise and the DJI Matrice 4 Thermal models. With the DJI Matrice 4 Series officially unveiled, AVSS takes pride in supporting this launch and offering the PRS-M4S to end users seeking compliance with flight-over-people regulations.(Source: https://avss.co)

- In April 2025, ParaZero Technologies Ltd. (Nasdaq: PRZO), a leading aerospace company specializing in safety systems for commercial UAVs and counter-UAS solutions, announced the launch of its latest innovation called the SafeAir M4. Fully compatible with the DJI Matrice 4 series, the SafeAir M4 is ParaZero's most advanced autonomous parachute recovery system, featuring aircraft-grade technology, a new airbag-based deployment mechanism, plug-and-play design, and multi-layered compliance with U.S. and European aviation standards.(Source: https://parazero.com)

Segments Covered in the Report

By Type

- Fixed-Wing UAVs

- Hybrid UAVs

- Rotary-Wing UAVs

By Materials

- Kevlar

- Nomex

- Nylon

- Polyester

By Application

- Civil and Commercial

- Military and Defense

- Research and Development

By Recovery Method

- Ballistic Parachutes

- Disc Parachutes

- Quadricycle Parachutes

- Ribbon Parachutes

By Payload Capacity

- Light Payload (up to 10 kg)

- Heavy Payload (over 50 kg)

- Medium Payload (10-50 kg)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting