What is the Airfield Drainage Systems Market Size?

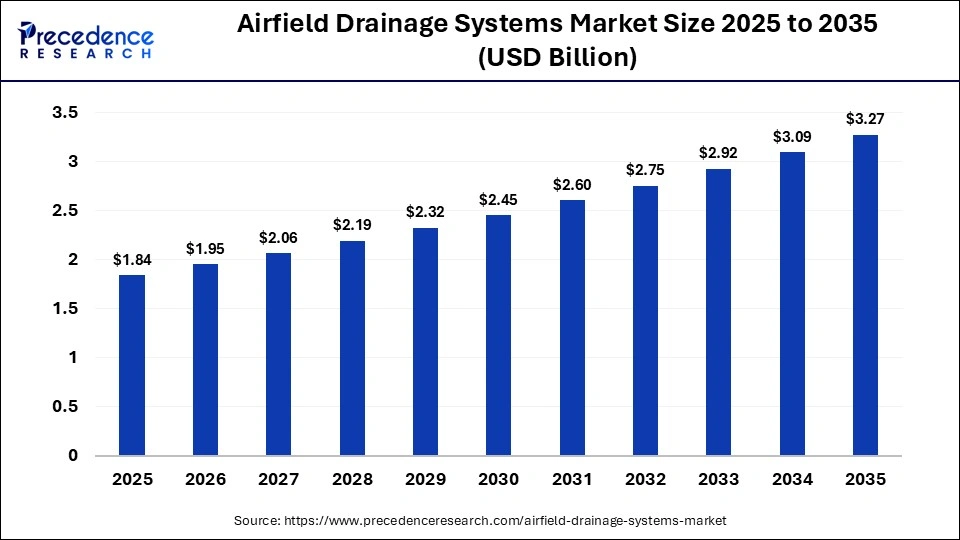

The global airfield drainage systems market size was calculated at USD 1.84 billion in 2025 and is predicted to increase from USD 1.95 billion in 2026 to approximately USD 3.27 billion by 2035, expanding at a CAGR of 5.93% from 2026 to 2035. The market is driven by the rising need to prevent runway flooding, enhance safety, and support the expansion of airport infrastructure.

Market Highlights

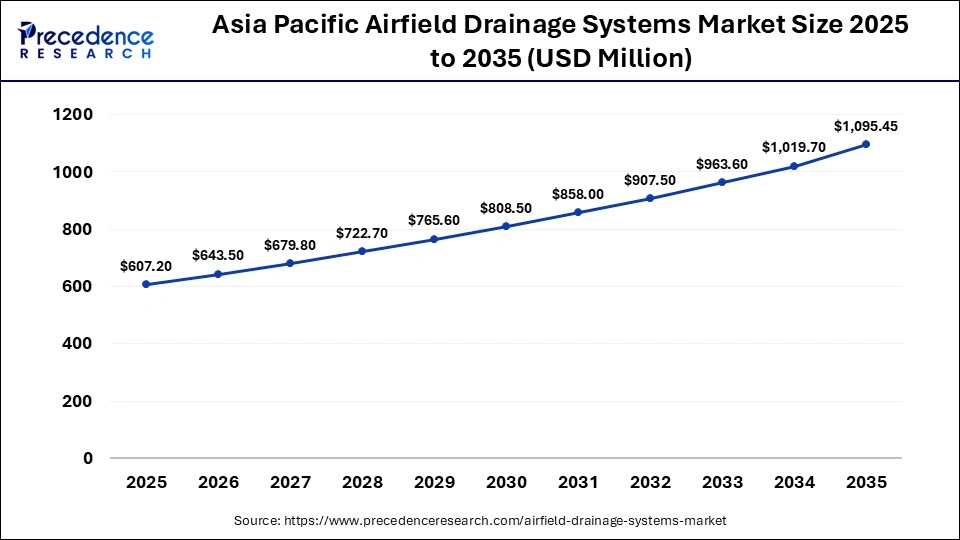

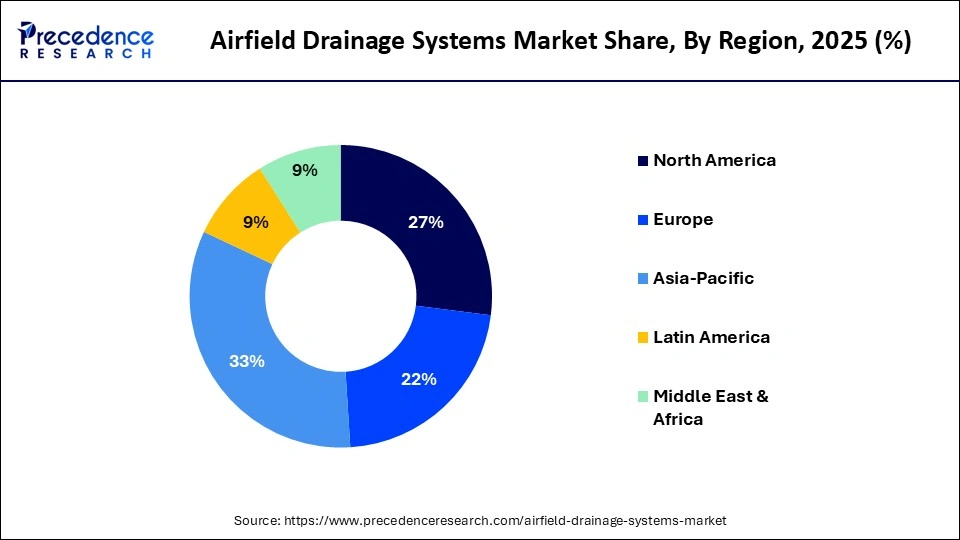

- Asia Pacific dominated the market, holding the largest share of 33% in 2025.

- The Middle East & Africa is expected to expand at the fastest CAGR between 2026 and 2035.

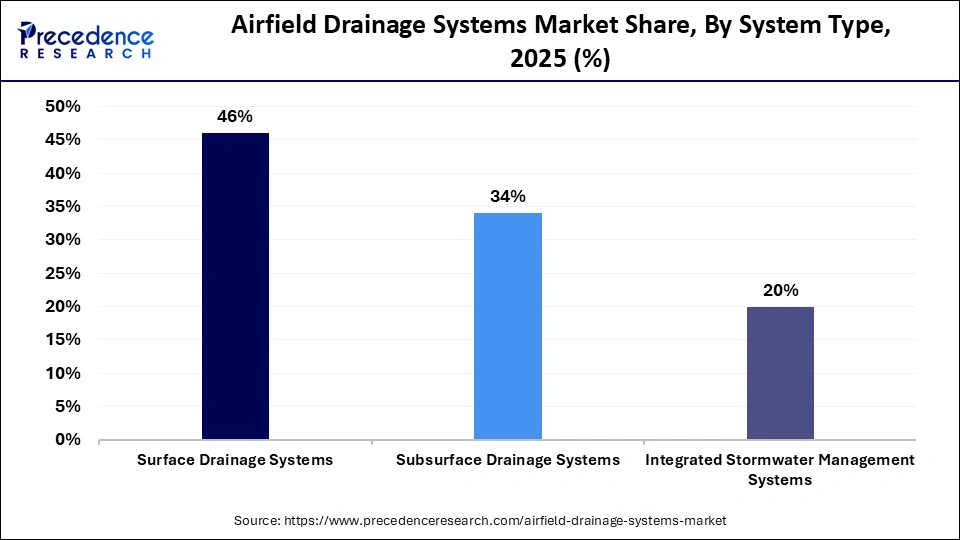

- By system type, the surface drainage systems segment held the largest market share of 46% in 2025.

- By system type, the integrated stormwater management systems segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By product type, the trench drains & linear channels segment held the largest market share of 32% in 2025.

- By product type, the oil-water separators & filtration units segment is expected to grow at a significant CAGR between 2026 and 2035.

- By material type, the concrete-based systems segment led the market, accounting for 38% in 2025.

- By material type, the polymer concrete systems segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By application area, the runways segment held the largest share of 34% in 2025.

- By application area, the aprons & parking stands segment is expected to grow at the highest CAGR between 2026 and 2035.

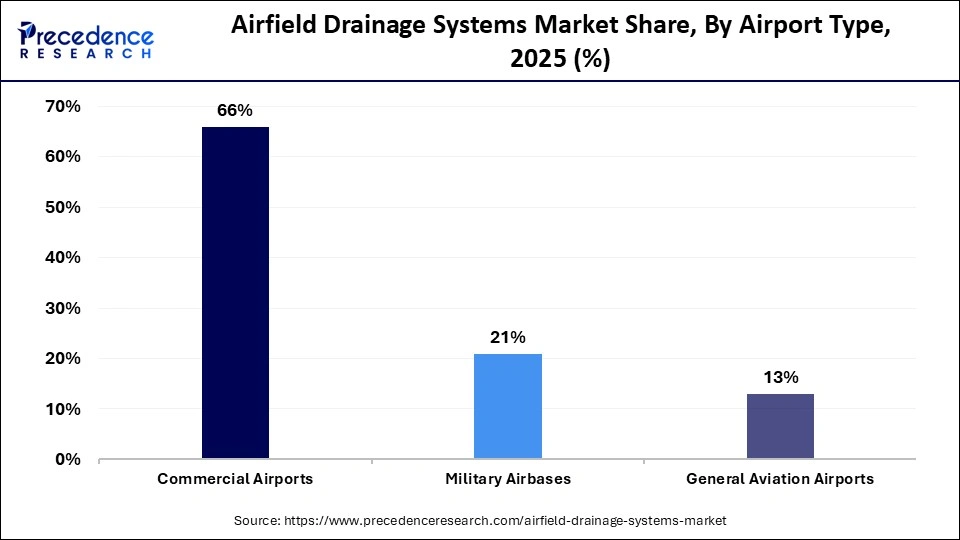

- By airport type, the commercial airports segment held the largest market share of 66% in 2025.

- By airport type, the military airbases segment is expected to expand at a remarkable CAGR between 2026 and 2035.

Market Overview

The global airfield drainage systems market encompasses infrastructure solutions designed to collect, channel, and discharge stormwater and surface runoff from airport operational areas such as runways, taxiways, aprons, terminals, and airside pavements, ensuring smooth and safe aircraft operations. These systems are critical for preventing water ponding, reducing hydroplaning risks, limiting pavement degradation, and minimizing operational disruptions. The growth of the market is driven by the development and modernization of airports worldwide to accommodate the rising number of passengers and cargo, particularly in emerging economies. Additionally, stricter regulatory standards on runway safety, environmental compliance, and water management are increasing demand for advanced airfield drainage solutions.

Major Trends in the Airfield Drainage Systems Market

- To manage high volumes of runway water during heavy rainfall, airports are rapidly implementing increased-capacity linear and slot drainage systems, minimizing waterlogging and enhancing aircraft safety in adverse weather.

- The use of corrosion-resistant materials such as polymer concrete, stainless steel, and advanced composites is improving system durability, reducing maintenance costs, and extending operational life.

- Sustainable designs, including permeable pavements and water recycling systems, are being adopted to minimize environmental impact and conserve water.

- The growth of emerging economies is driving airport expansion, creating demand for modular and prefabricated drainage solutions that allow faster installation, scalability, and minimal disruption to ongoing airport operations.

How AI Integration Influences the Airfield Drainage Systems Market?

The introduction of AI is revolutionizing the airfield drainage systems market by enhancing operational efficiency, safety, and infrastructure reliability. AI-based sensors and IoT cameras monitor water levels, debris, and structural stress in drainage systems, while integration with intelligent weather data enables automatic management of flow controls and pumping operations during heavy rainfall or storms. Advanced analytics also help airport authorities optimize maintenance schedules, extend asset lifespans, ensure regulatory compliance, and improve overall airfield safety.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size in 2026 | USD 1.95 Billion |

| Market Size by 2035 | USD 3.27 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type, Product type, Material Type, Application Area, Airport Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

System Type Insights

Why Did the Surface Drainage Systems Segment Dominate the Market in 2025?

The surface drainage systems segment dominated the airfield drainage systems market, holding the largest share of 46% in 2025, as these systems are critical for the rapid removal of stormwater from runways, taxiways, aprons, and terminal-side pavements. They serve as the first line of defense against water ponding and hydroplaning, ensuring aircraft safety and uninterrupted operations. Demand is further boosted by their flexibility in new airport construction and runway repair projects, as well as surface drainage channels and gratings that can be easily installed on existing pavements with minimal operational disruption.

The integrated stormwater management systems segment is expected to grow at the fastest rate in the coming years. This is mainly due to the rising regulatory requirements to reduce contamination of runoffs and achieve carbon and water management goals, which increased the adoption of these systems in major international airports. These systems increasingly incorporate digital monitoring, sensors, and automation, enabling predictive maintenance and real-time flow adjustments to improve long-term efficiency and reliability. Additionally, significant investments in green airports, climate-resilient infrastructure, and water-recycling projects across developed and emerging economies are supporting rapid market growth.

Product Type Insights

What Made Trench Drains & Linear Channels the Dominant Segment in the Market in 2025?

In 2025, the trench drains & linear channels segment dominated the airfield drainage systems market with a 32% revenue share, as they are the most effective way of collecting and directing surface runoff over long and continuous paved areas like runways, taxiways, and aprons. Their straight-line design ensures uniform water capture, preventing local flooding and reducing hydroplaning risks during heavy rainfall. Airports favor these systems due to their high load-bearing capacity, accommodating aircraft and heavy service vehicles without damage. The modular design also allows for quick installation and easy replacement during runway upgrades or expansions, minimizing operational downtime.

The oil-water separators & filtration units segment is expected to grow at the highest CAGR throughout the forecast period, driven by stricter environmental regulations and wastewater discharge standards for airport operations. Aircraft fueling, maintenance, and deicing activities generate runoff containing hydrocarbons, heavy metals, and chemical additives, which cannot be released untreated into natural water bodies. To comply with national environmental policies and global sustainability standards, airports are increasingly deploying these filtration and separation systems to treat contaminated runoff effectively.

Material Type Insights

Why Did the Concrete-based Systems Segment Lead the Airfield Drainage Systems Market?

The concrete-based systems segment led the market while holding the largest share of 38% in 2025. This is mainly due to the unmatched structural strength, reliability, and economic viability of these systems for huge airport projects. Concrete drainage channels, culverts, and pipelines withstand extreme dynamic and static loads from frequent aircraft landings and heavy ground-support equipment. They are also resistant to temperature variations, water vapor, and mechanical abrasion, making them suitable for harsh airfield conditions. Additionally, the widespread availability of concrete ensures stable supply chains and ease of construction.

The polymer concrete systems segment is expected to expand at the fastest rate during the projection period due to their high hydraulic efficiency, chemical resistance, and lightweight structural properties. Compared to conventional concrete, polymer concrete has a cleaner internal surface, which minimizes friction loss and maximizes the water flow capacity. These systems are very effective in dealing with heavy rainfall. Polymer concrete systems are increasingly used to support modular construction schemes, making them compatible with smart airport infrastructure upgrades. With airports focusing on sustainability, durability, and high-performance engineering, polymer concrete is emerging as a preferred modern drainage solution.

Application Area Insights

What Made Runways the Leading Segment in 2025?

The runways segment led the airfield drainage systems market with a major share of 34% in 2025 due to the critical role proper drainage plays in aircraft landing and take-off safety. Even small amounts of water on runway surfaces may cause hydroplaning, reduce braking efficiency, and disrupt flight operations. As a result, airport authorities prioritize high-performance drainage systems in runway areas to comply with strict international aviation safety standards. Additionally, ongoing runway expansions, resurfacing, and rehabilitation projects at major airports have further driven demand for advanced drainage infrastructure.

The aprons & parking stands segment is expected to expand rapidly in the upcoming period, as these areas handle high-intensity activities such as fueling, catering, maintenance, and passenger boarding that generate runoff containing fuel residues, oils, and chemicals. Effective drainage and filtration systems are essential to prevent surface and environmental pollution. The growth of low-cost carriers and expanding fleet sizes has increased apron congestion, driving the need for upgraded infrastructure. Additionally, aprons are being redesigned for larger aircraft and automated ground-handling systems, necessitating improved and modernized drainage solutions.

Airport Type Insights

Why Did the Commercial Airports Segment Lead the Airfield Drainage Systems Market?

The commercial airports segment dominated the market with a 66% share in 2025, driven by the growing number of passengers and ongoing investments in airport capacity expansion. Large commercial airports, with multiple runways, terminals, and aprons, require robust drainage systems to ensure safe and uninterrupted operations, even during adverse weather. Investments by governments and private operators in airport modernization, smart infrastructure, and sustainability programs have further increased the demand for advanced drainage solutions.

The military airbases segment is expected to grow at a significant CAGR over the forecast period, driven by the demand for all-weather operational capabilities that require efficient drainage systems for rapid aircraft deployment. Governments are upgrading runways and support infrastructure to accommodate larger transport planes, advanced fighter aircraft, and unmanned aerial vehicles, which impose higher load and safety demands on pavements and drainage systems. Investments in high-capacity, durable drainage solutions reflect a strategic focus on operational resiliency and climate adaptation.

Regional Insights

What is the Asia Pacific Airfield Drainage Systems Market Size?

The Asia Pacific airfield drainage systems market size is expected to be worth USD 1,095.45 million by 2035, increasing from USD 6.07.20 million by 2025, growing at a CAGR of 6.08% from 2026 to 2035.

What Made Asia Pacific the Leading Region in the Airfield Drainage Systems Market?

Asia Pacific led the airfield drainage systems market with a 33% share in 2025. This is because nations such as China, India, Indonesia, and Vietnam have been making huge investments in new airports, new runways, and capacity expansion to meet the rising domestic travel and international travel needs. Many countries have been incorporating modern drainage systems to meet international safety standards. The adoption of advanced, automated, and sensor-monitored drainage solutions is further promoted through government-backed smart airport and smart city initiatives. Additionally, the involvement of private investors and public-private partnerships is accelerating infrastructure development across the region.

How is the Opportunistic Rise of the Middle East & Africa in the Airfield Drainage Systems Market?

The Middle East & Africa (MEA) is expected to grow at the fastest rate in the market throughout the forecast period as a result of extensive airport expansion and modernization programs. Countries such as the UAE, Saudi Arabia, Qatar, and Egypt are investing heavily in new greenfield airports, runway extensions, and terminal upgrades to support tourism, trade, and regional connectivity. Increasing exposure to extreme weather events, including heavy rainfall and flash floods, has heightened the need for advanced drainage solutions. Furthermore, MEA airports are adopting sustainable and smart infrastructure, integrating high-capacity drainage systems with stormwater management and water-recycling technologies.

Why is North America Experiencing a Notable Growth in the Airfield Drainage Systems Market?

North America is expected to grow at a notable rate in the upcoming period, supported by the high concentration of major international airports and a well-developed aviation infrastructure. The presence of some of the world's busiest airports, operating continuously even during adverse weather, necessitates high-quality drainage systems to mitigate flooding risks. Frequent rainfall, snowmelt, and storms in the U.S. and Canada have driven demand for high-performance surface and subsurface drainage solutions to prevent runway flooding and pavement deterioration. Additionally, the widespread adoption of advanced materials and predictive maintenance technologies continues to strengthen the region's market position.

Who are the Major Players in the Global Airfield Drainage Systems Market?

The major players in the airfield drainage systems market include ACO Group, ABT Inc, EJ Group, Inc., MEA Group / MEA Water Management, Polieco Group, HAURATON GmbH & Co. KG, BIRCO GmbH, Advanced Drainage Systems, Inc., Contech Engineered Solutions, Dura Trench, ULMA Architectural Solutions, EPS Group, Capcon Engineering, Bucher Municipal, and POLYCAST.

Recent Developments

- In December 2024, Thiruvananthapuram International Airport (India) commissioned Wilboar, an automated stormwater drainage maintenance robotic system under the Adani Airport Holdings Limited. It was the first Indian airport to have the advanced robotic technology to clean the drainage system.

(Source: https://www.thehindu.com) - In 2024, the Ramp 21 Pavement Replacement project at Hartsfield-Jackson Atlanta International Airport (USA) was the 2024 project that added an 8-acre drainage area with 10 percent increased storage capacity than the mandated level. Another facility that was commissioned by the airport was a new South Deicing Facility, which had a glycol reclamation system that occupied an area of 42 acres to capture and process deicer runoff.(Source: https://www.atl.com)

Segments Covered in the Report

By System Type

- Surface Drainage Systems

- Open channels

- Slot/trench drains

- Grated drains

- Subsurface Drainage Systems

- Perforated pipes

- Sub-drains

- Drainage blankets/layers

- Integrated Stormwater Management Systems

By Product Type

- Trench Drains & Linear Channels

- Catch Basins / Inlets & Manholes

- Pipes & Culverts

- Oil-Water Separators & Filtration Units

- Other Drainage Components

By Material Type

- Concrete-based Systems

- Polymer Concrete Systems

- HDPE / PVC Plastic Systems

- Metal-based Systems (steel, ductile iron)

- Composite / Other Materials

By Application Area

- Runways

- Taxiways

- Aprons & Parking Stands

- Terminal Landside Areas

- Hangars & Maintenance Areas

By Airport Type

- Commercial Airports

- Military Airbases

- General Aviation Airports

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content