What is the Aerospace Fasteners Market Size?

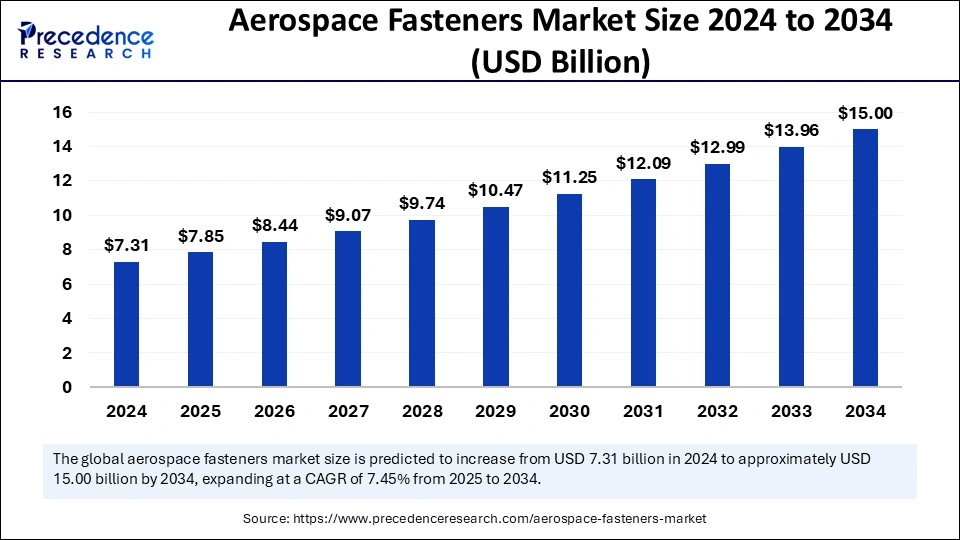

The global aerospace fasteners market size is valued at USD 7.85 billion in 2025 and is predicted to increase from USD 8.44 billion in 2026 to approximately USD 15.00 billion by 2034, expanding at a CAGR of 7.45% from 2025 to 2034. The ideal features of hardware components such as better adaptability to corrosion, pressure fluctuations, and extreme temperatures benefit aircraft and spacecraft construction which drives the growth of the aerospace fasteners market.

Aerospace Fasteners Market Key Takeaways

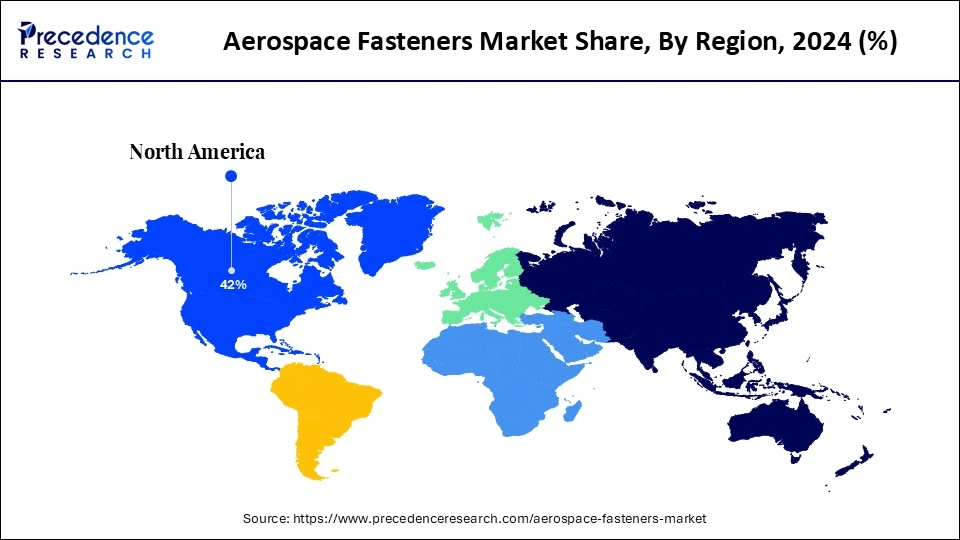

- North America dominated the global market with the largest market share of 42% in 2024.

- Asia Pacific is expected to grow rapidly during the forecast period.

- By product, the rivets segment led the market in 2024.

- By product, the screws segment is anticipated to expand rapidly in the coming years.

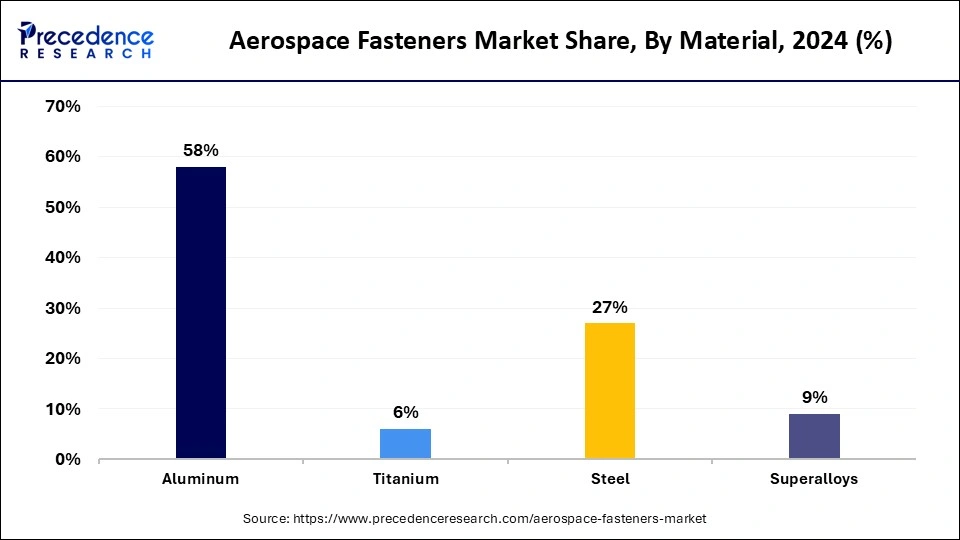

- By material, the aluminum segment held the major market share of 58% in 2024.

- By material, the titanium segment is expected to grow the fastest throughout the forecast period.

- By platform, the fixed-wing aircraft segment led the market in 2024.

- By platform, the rotary-wing aircraft segment is anticipated to expand rapidly over the forecast period.

What are the Benefits of AI in the Aerospace Fasteners Market?

Artificial intelligence plays a vital role in automated production lines where AI-driven automation enhances production efficiency and precision. Furthermore, AI helps in reducing costs and design cycle time, simulation, optimization, maintenance, etc. AI and machine learning contribute to the predictive maintenance and sizing of aircraft components. AI helps to optimize flight performance and improve fuel efficiency. AI can assist in the manufacturing of fast, efficient, and light-weight parts in the aerospace industry. AI and Machine Learning platforms also assist in efficient supply chain management and ensure improved quality control and quality assurance systems.

What are Aerospace Fasteners?

The aerospace fasteners refer to the hardware components that aid in providing structural integrity to aircraft and spacecraft construction. They are ideal for aviation and space applications. The various types of these components include standard fasteners like screws, bolts, nuts, etc., and specialty fasteners like blind rivets, blind bolts, etc. The extensive utilization of high-grade alloys, titanium, and other advanced materials makes them incredibly strong. These products meet compliance with quality standards like AS9100 to ensure safety and reliability.

- In November 2024, LignoSat announced the launch of the world's first wooden satellite which aims to test the viability of wood as an alternative solution to metals in satellite construction. Moreover, several workers of the Monogram Aerospace Fasteners (MAF) are dedicated to making bolts, screws, and fasteners for Boeing.

- In October 2024, the government of India announced the implementation of strict quality norms for certain screws to enhance domestic manufacturing, ensure consumer safety, and reduce the import of sub-standard products.

What are the Growth Factors in the Aerospace Fasteners Market?

- The increasing demand for commercial aircraft led to their growing production.

- The rise in air traffic, travel, and tourism raised a large number of flights for aviation.

- The insertion of raw materials, advanced components, and systems ensures compliance with quality standards.

- The utilization of floor panels, fasteners, alloys, aluminum, valves, etc. ensures timely delivery of products and services by meeting the high demands for them.

- The high preference for super alloys in aircraft, aerospace, nuclear reactors, marine, and chemical industries increased their importance in the global market.

Aerospace Fasteners Market Outlook

- Industry Growth Overview: The aerospace fastening market is projected to have steady growth from 2025 through 2030, driven by increasing aircraft production rates, modernization of aircraft fleets, and the need for lightweight, high-strength fastening alternatives in the aerospace industry. This anticipated growth is further driven by the continued expansion of commercial aviation in Asia-Pacific and in North America from maintained MRO conversions.

- Global Expansion: Key manufacturers are utilizing expansion opportunities throughout Southeast Asia, Eastern Europe, and the LATAM region to build supply-chain resilience and diversify manufacturing locations closer to commercial aircraft assembly lines. Some new facilities in Malaysia and Poland are enhancing aerostructure support with reduced logistics costs and manufacturing.

- Key Investors: Private equity and strategic investors seek aerospace components because of higher barriers to entry, recurring aftermarket demand, and stable defense-related markets. Recent reporting shows interest in fastener systems, precision machining, and aerospace-quality materials processing.

- Starting Ecosystem: New, innovative-led startups are coming forward in the area of additive-manufactured fasteners, smart fastener sensor options, and advanced alloys. Young and emerging firms in both the U.S. and in parts of Europe are garnering attention with lighter, stronger, and digitally trackable fastening solutions for next-generation aircraft platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 15.00 Billion |

| Market Size in 2025 | USD 7.85 Billion |

| Market Size in 2026 | USD 8.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.45% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Platform, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Expansion of Military Aviation Industries

The rapidly growing military aviation industry with the emerging need for efficient aerospace fasteners drives the growth of the aerospace fasteners market. The high preference for defense capabilities by countries and advanced activities in the military aviation industry boosts the market's expansion globally. Moreover, the upgradation of traditional aircraft into modernized forms by applying modern technologies accelerates the significance of the market. The introduction of more efficient, high-strength, and corrosion-resistant fasteners upsurges the global adoption of these products and services in different sectors. In March 2024, the F-35 Joint Strike Fighter Program reported full-rate production showcasing good performance and dependability. Furthermore, the growing demand for high-performance fasteners is driven by continuous technological advancements, increased defense budgets, and new military aircraft innovations.

- In February 2024, Atlas Copco announced the launch of a drill for aerospace manufacturing to optimize the quality and productivity of the aircraft assembly line.

Restraint

Dynamic Cost-Effectiveness of Raw Materials

The high demand for raw materials due to the emerging need for high-performance materials such as alloys, aluminum, and titanium impacts the costs of these materials. Apart from this, geopolitical concerns, mining circumstances, and product supply imbalance can hamper the aeronautical applications of these materials. The increased costs associated with titanium and titanium dioxide in China in the year 2023 can impose challenges in front of consumers from different sectors.

Opportunity

Expansive Reach of Commercial Aviation

The growing shift of people towards air travel and the commercial aviation sector drives the growth of the aerospace fasteners market significantly. The developing economic countries are raising the need for new aircraft and aerospace fasteners. The excellent role of these fasteners in ensuring strength, structural integrity, maintenance, airplane assembly, and safety boosts their expansive reach in the global market. Moreover, a strong economy, great family incomes, a growing population, and demographic characteristics drive the overall adoption of these products globally. The developments in airline fleets result in increased air travel incidents in new aircraft. The presence of major aircraft manufacturers like Airbus and Boeing imposes a high demand for aerospace fasteners in the future. China demands new aeroplanes by 2040 and India holds successive air travel experiences.

- In February 2025, Heliospace announced the successful launch of its hardware on the Blue Ghost Mission 1 (BGM1) lander.

Product Insights

By product, the rivets segment dominated the aerospace fasteners market in 2024 due to the growing utilization of rivets in aircraft manufacturing. The various advantages of rivets over other fasteners make them the preferred choice for consumers. They ensure high reliability and rigid connectivity to aerospace structures. They provide high safety to passengers through strong manufacturing and assembly of aerospace structures.

The essential features of rivets in the aerospace industry including strength make them important in aeroplane building. The provided structural integrity by rivets is crucial for safety and performance. The potential ability of rivets to evenly distribute loads reduces the risk of material failure. Advancements in riveting technology including improved rivet designs and automated riveting systems have enhanced the efficiency and precision of aircraft operations.

By product, the screws segment is anticipated to be the fastest-growing in the aerospace fasteners market over the forecast period. This segmental growth is driven by the potential features of these materials like adaptability and the ease of installation and removal. They offer strong joints and are adjustable which allows maintenance, repair, and modification for improved aircraft functioning.

Moreover, the wide utilization of screws in both commercial and military aircraft for several purposes drives their demand in the market. They offer fastening interior panels, avionics components, vital systems, and access panels that need regular maintenance or replacement. The easy removal and reinstallation of screws without causing structural damage boosts their adoption globally.

Material Insights

By material, the aluminum segment led the aerospace fasteners market in 2024 because of its exceptional properties, including lightweight composition, corrosion resistance, and a high strength-to-weight ratio. These properties make aluminum an ideal material for aerospace, spacecraft, defense, or military applications. These properties aid in reducing the weight of aircraft, boosting fuel efficiency, and reducing operational expenses. The wide utilization of aluminum fasteners in commercial and military aircraft drives the growth of the aluminum segment. The low cost and ease of manufacturing related to aluminum fasteners boost their demand in the market. The advancements in aluminum alloys also enhance performance and mechanical properties in complex situations.

The R&D efforts in aluminum metallurgy and the emergence of innovative manufacturing techniques drive the segmental growth in the market. The recyclable nature and sustainability efforts related to this material boost the growth of the aluminum segment. Advanced techniques such as additive manufacturing promote the increased adoption of aluminum fasteners in the aerospace industry sector.

By material, the titanium segment is observed to be the fastest-growing in the aerospace fasteners market during the forecast period. This segmental growth is due to the rising need for highly rigid and reliable fasteners for aerospace structure manufacturing. The growing demand for superalloys also boosts segmental growth in the market. The numerous advantages of titanium fasteners such as high rigidity in extreme conditions, low weight, and high heat resistance capacity drive the growth of the titanium segment.

Moreover, it offers high strength, corrosion resistance, low density, and adaptability to high temperatures. The vast applications of titanium in aerospace industries result in high performance and reliability. Furthermore, titanium fasteners including commercial jets like Boeing 787 Dreamliner and Airbus A350 and military aircraft like the F-35 Lightning II are in high demand due to high performance.

Platform Insights

By platform, the fixed-wing aircraft segment dominated the aerospace fasteners market in 2024 due to their vast applications in commercial, general, military, and business aircraft. They are widely expanding due to the rising demand for modern-generation fixed-wing aircraft for carrying passenger loads and cargo. The huge adoption of these platforms in commercial aircraft drives the expansion of the fixed-wing aircraft platform. The capability to travel a long distance at high altitudes without the need of refueling makes them suitable for passengers and transport goods. The better flight stability even under certain weather conditions such as strong winds, thunderstorms, and turbulence showcases the exceptional quality of these aircraft.

By platform, the rotary-wing aircraft segment is expected to grow rapidly in the aerospace fasteners market in the coming years. This growth is driven by the excellent advantages of these aircraft such as better maneuverability, vertical takeoffs and landings, and an ability to hover in place. The enhanced accessibility to these aircraft or helicopters in generally inaccessible areas to planes drives their importance significantly. The availability of assets in certain emergency services also boosts their adoption in the market. They offer assistance related to ground surveillance, assessment, and firefighting which makes them capable of performing operations efficiently.

Regional Insights

U.S. Aerospace Fasteners Market Size and Growth 2025 to 2034

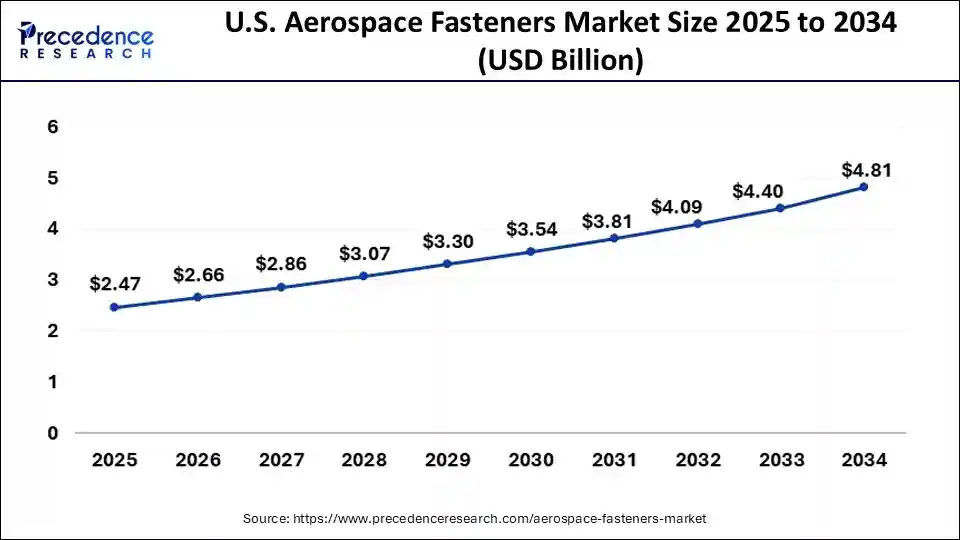

The U.S. aerospace fasteners market size is exhibited at USD 2.47 billion in 2025 and is projected to be worth around USD 4.81 billion by 2034, growing at a CAGR of 7.65% from 2025 to 2034.

North America dominated the aerospace fasteners market in 2024 due to the presence of leading aircraft manufacturers such as Tetron, Boeing, and Bombardier across this region. The adoption of next-generation manufacturing technologies and increased investments in R&D activities accelerate the market's growth significantly. The presence of military sectors and leading manufacturers impact the overall positive growth of the market. Lockheed Martin and Boeing are the major American aerospace businesses which highly demand for aerospace fasteners. Furthermore, technological innovations and developments in aircraft technology raised the demand for high-performance fasteners in this region. The U.S. from the North American region plays a vital role in the aerospace industry. The America-based company named Boeing is at the forefront of the aerospace sector. The world's best-selling commercial aircraft the 737 MAX series of Boeing needs several aerospace fasteners to maintain structural integrity and safety.

Supportive Government Initiatives in the U.S.

The Federal Aviation Administration (FAA) is committed to regulating civil aviation and U.S. commercial space transportation. It also maintains and operates navigation systems and air traffic control for both military and civil aircraft. Moreover, it aims to develop and organize programs for aviation safety and the National Airspace System. The U.S. government offers several design standards and many industries depend on standards from SAE, ISO, and ASTM. The imperial system is a standard and correct measurement system for fasteners in the U.S.

- In May 2024, General Inspection installed a Gi-100DT automated inspection system (AIS) for a large manufacturer of precision aerospace fasteners. This Gi-100DT is equipped with a total of 6 cameras providing complete dimensional inspection, internal and external visual defect detection, top and bottom surface inspection for a full range of turned aerospace collars.

- In December 2023, French spacecraft designer and manufacturer OPUS Aerospace has chosen to use premium screws from Swedish specialist fastener manufacturer BUMAX for its new suborbital rocket and future vehicles designed to send satellites into space.

Asia Pacific is observed to be the fastest-growing region in the aerospace fasteners market during the forecast period. This regional growth is attributed to the large number of original equipment manufacturers in North America and Europe. The growing aviation industries in countries like India and China support the growth of the APAC region. The rising disposable incomes of the middle-class public and the increased passenger traffic raise the demand for aeronautical fasteners. China and India uphold the global aviation business in the Asia Pacific region. The Commercial Aircraft Corporation of China (COMAC) aims to develop a narrow-body aircraft named the C919. The C919 model will be competing with popular models such as Airbus A320 and Boeing 737. India introduced the HAL Tejas light combat aircraft and a regional jet which upholds the defense and civil aviation efforts of the country.

- According to the article published by the Press Information Bureau (PIB), India's aviation industry has experienced significant growth in the past 10 years. The number of operational airports in the country has doubled from 74 in 2014 to 157 in 2024, and the aim is to increase this number to 350-400 by 2047. The domestic air passengers have more than doubled in the recent years, with Indian airlines significantly expanding their fleets.

Robust Business Association in China

The China Fastener Industry Association is the first industry association dealing with machinery products and is approved by the state economic commission. This association encompasses various companies engaged in fastener production and sales as members. It also collaborates with enterprises offering related appliances, materials, and services related to heat treatment, surface treatment, etc. It plays a vital role in the development, reforming, and revitalization of china fastener industry.

Europe was the second-largest shareholder in 2024 in the aerospace fasteners market and is expected to grow at a steady growth rate in the coming years. The increased demand for aerospace fasteners from developed European countries such as the United Kingdom, France, Russia, Italy, and Germany drives the regional market's growth significantly. The presence of major aircraft manufacturers such as Airbus SE, Leonardo SPA, and Dassault Aviation supports the market's expansion in Europe. European countries like Germany, France, and the United Kingdom contribute notably to the aerospace fasteners sector. The region focuses on sustainability and aircraft fuel efficiency to encourage the usage of lightweight materials. Airbus is the major player in this sector which is located in France. The world's largest passenger airliner the Airbus A380 is a brilliant example of a sophisticated aircraft requiring aerospace fasteners.

Major Industry Players in France

The LISI Aerospace is leading in high-technology aerospace components like fasteners. LISI Aerospace has a smart factory production line in Rugby to enhance productivity and performance. The other French companies like Arconic and B&B Specialties offer a wide range of fasteners like nuts, screws, bolts, latches, etc. for military, aerospace, and aircraft industries. Toulouse is the principal center for aerospace in Europe which encompasses over 500 aerospace companies and research centers.

Why did Latin America Grow Considerably in the Aerospace Fasteners Market?

Due to increased aircraft acquisition, expansion of regional airlines, and growth in MRO activities, Latin America witnessed considerable growth. Countries such as Brazil invested heavily in aerospace manufacturing, which created additional demand for advanced fasteners. Moreover, Latin America also worked on enhancing airport infrastructure and improving aviation safety standards. Altogether, these developments created opportunities for fastener suppliers to expand local production for fleet modernization and partnerships with local aerospace companies.

Brazil Aerospace Fasteners Market Trends

Brazil led the region as it has the largest and most complete aircraft manufacturing sector, with consistent government support for aerospace technology investment. Brazil's commercial aircraft programs gross national and regional demand for aerospace fasteners. Government support continues to promote the growth of production with local suppliers, which has subsequently assisted the Brazilian government in the improvement of its repair and maintenance capabilities, which have expanded the use of advanced fasteners in its MRO activities.

Why did the Middle East & Africa Region Grow at a Rapid Rate in the Aerospace Fasteners Market?

A significant increase in aircraft fleet expansion, passenger turnout, and capital investments in aviation infrastructure has contributed to the robust growth of the Middle East & Africa region. Gulf countries built and operated mega MRO facilities, as well as invested in developing defense modernization. In Africa, airlines continuously expanded their regional routes, contributing to growth.

The UAE Aerospace Fasteners Market Trends

The UAE led the region, as it capitalized on strong financial capital investment into aviation and expanded its fleet. The major airlines increased their maintenance capacity, thereby creating an increased demand for aerospace fasteners. The UAE's focus on defense aircraft supported its aerospace collaborative growth. Aligned with the UAE's significant logistical capabilities and one of the strongest international partner networks, investment opportunities in aerospace, quality fasteners, new service centers, and expanded supply chains exist.

Aerospace Fasteners Market Companies

- LISI Aerospace

- National Aerospace Fasteners Corporation

- B&B Specialties Inc.

- M.S. Aerospace

- TPS Aviation Inc.

- TriMas Corporation

- Howmet Aerospace Inc.

- TFI Aerospace Corporation

- Wurth Group

Latest Announcements by Leaders

- In September 2024, Ryan O'Neill, Chief Strategy Officer of Equity Energies proclaimed that the company is delighted to be supportive of LISI Aerospace on its excellent journey to net zero, energy management, and decarbonization solutions to improve further in the UK.

- In September 2024, Mark Capell, general manager at the Rugby site of LISI Aerospace announced that the company feels proud of its progress towards net zero due to the notable shift towards investments to reach net-carbon- neutrality within aviation.

Recent Developments in the Aerospace Fasteners Market

- In May 2025, ASAP Semiconductor announced the expansion of its aerospace fastener range. The company has broadened its selection of aerospace hardware and fasteners available through its website, Hardware & Fasteners, as part of a wider initiative to align with changing market needs. The company also stated that the expanded offering can assist aerospace professionals in streamlining sourcing processes and reducing the friction of multi-vendor procurement.

- In April 2025, Nafco Group unveiled its advanced aerospace manufacturing facility in Seremban, a US$40 million 10-year investment commitment. The initial 2.3-hectare (ha) (5.8-acre) complex features 3,500 sq m (37,674 sq ft) of advanced manufacturing space.

- In July 2024, Bossard announced the acquisition of Aero Negoce International (ANI). Bossard Group, a Switzerland-based distributor of fastener products, announced its intention to acquire ANI, a Béziers, France-based distributor of fastening solutions and logistics services in the aerospace industry. The acquisition aims to enhance its presence in the aerospace industry and France's Aerospace Valley.

- In August 2024, ASAP Semiconductor announced the commitment to enhance the supply of efficient aircraft parts through the excellent development and expansion of its website named ‘Aerospace Aviation 360'.

- In September 2024, LISI Aerospace announced the achievement in sales of €903.6 million in the first half of 2024 and the LISI Automotive Division confirmed its positioning in electromobility.

Segments Covered In the Report

By Product

- Rivets

- Screws

- Nuts & Bolts

- Others

By Material

- Aluminum

- Titanium

- Steel

- Superalloys

By Platform

- Fixed-wing Aircraft

- Commercial Aircraft

- Business Aircraft

- General Aviation Aircraft

- Military Aircraft

- Rotary-wing Aircraft

- Military Helicopters

- Civil Helicopters

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting