What is the Pharmaceutical Packaging Testing Market Size?

The global pharmaceutical packaging testing market is fueled by the need to ensure product safety, durability, and compliance across global supply chains.The pharmaceutical packaging testing sector is driven by rising demand for safe, stable, compliant, and contamination-free drug packaging.

Market Highlights

- North America accounted for the largest share of the pharmaceutical packaging testing market in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By testing type/testing method, the physical/mechanical testing segment held a significant share in 2025.

- By testing type/testing method, the chemical testing segment is growing at a considerable growth between 2026 and 2035.

- By packaging material type, the plastic segment generated the biggest market share in 2025.

- By packaging material type, the glass segment is growing at a notable between 2026 and 2035.

- By end-user / client/customer, the pharmaceutical companies/drug manufacturers segment held a significant share in 2025.

- By end-user / client/customer, the research institutes/testing laboratories / contract-service providers segment is expanding at a healthy CAGR between 2026 and 2035.

- By application, the oral drugs & general oral/solid dosage packaging segment capture the highest market share in 2025.

- By application, the sterile injectables / biologics / sensitive drug packaging segment is expanding at a notable CAGR between 2026 and 2035.

Precision-Proofing Medicines: How Packaging Testing Is Powering the Future of Drug Safety

The pharmaceutical packaging testing market is in dynamic stages where drug manufacturers, regulators, and contract laboratories are exerting more effort on the integrity of the products, their sterility, and their chemical stability during the supply chain. With the growing global sense of pharmaceutical manufacture spurred by intricate biologics, temperature-sensitive products, injectables, and more sophisticated drug-delivery systems, there is a growing acuity of packaging validation. This transformation is developing robust opportunities for the firms that provide analysis services, material science skills, and high-precision testing platforms of high-precision.

The market growth is enhanced by the tightening of global compliance standards and requirements and the growing expectations of regulators like the FDA, the EMA, and the WHO, which require pharmaceutical companies to do extensive packaging qualification before commercialization. Personalized medicine, sterile injectables, cell and gene therapies, prefilled syringes, and this trend have increased the pressure on the packaging format to ensure stability during changeable storing and handling conditions. The prediction stability modeling, defect identification, real-time integrity testing, and robotized handling systems are available on AI-based platforms to minimize human error and shorten validation schedules.

Key AI Integration in the Pharmaceutical Packaging Testing Market

Pharmaceutical packaging testing is becoming more automated to improve accuracy, minimize human mistakes, and increase the speed of regulatory-compliant quality assurance. Artificial intelligence vision systems have become very common in identifying micro-faults, labeling errors, and defects in seals, much more effectively than other forms of inspection. Machine learning algorithms apply to predictive quality analytics, through which manufacturers can calculate early warning signs of packaging failures, material durability, and production parameters to boost production before errors happen. The automation through AI also facilitates the collection of real-time data and constant monitoring to ensure that the packaging of the pharmaceuticals is of high global standards. The performance of packaging in different environmental conditions can be tested with virtual twins and AI-powered simulation models, reducing costs and accelerating development, without the use of real prototypes.

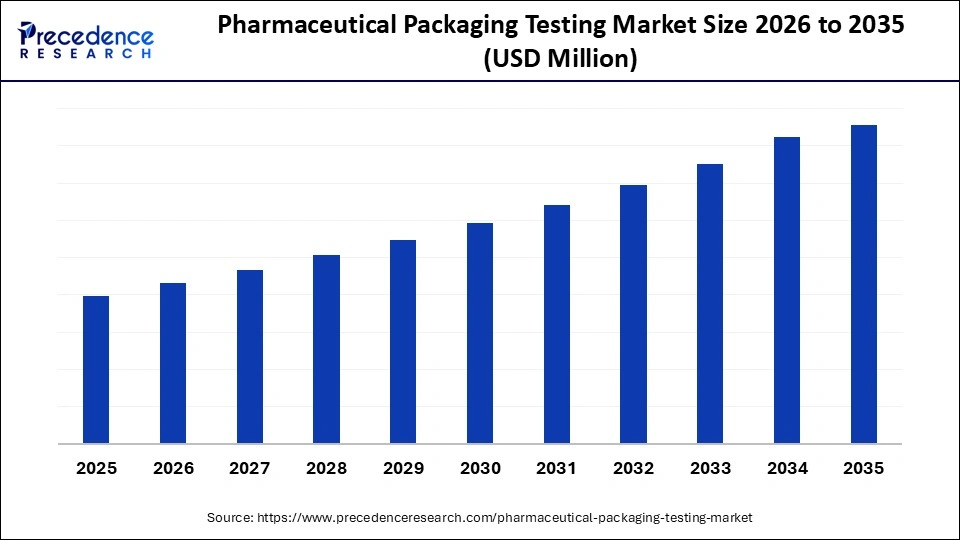

Pharmaceutical Packaging Testing Market Outlook

The technical factors that have facilitated the growth in the industry include the increasing production of biologics, injectables, and temperature-sensitive therapies that demand rigorous validation of packing. Tightening of the regulatory environment in key markets is also increasing the pace of adoption of high-tech testing technologies.

Global growth in the market is going to be achieved with pharmaceutical companies constructing new manufacturing and packaging centers in Asia, Europe, and North America. International distribution of drugs and international supply chains are driving the demand for international compliant testing standards.

Major organizations like SGS, Intertek, Eurofins, West Pharmaceutical Services, and Gerresheimer are spending heavily on modernized laboratories, robots, and digital analytics. Their strategic alliances with pharma companies enhance their capacity to do container-closure integrity, extractables/leachables, and stability testing.

New start-ups such as RapidMicro Biosystems, Valisure, and XRF Scientific are also implementing new innovations of automated inspection and micro-contamination detection, and material analysis. These emerging firms are on the rise with quicker, AI-based, and economical testing processes of the contemporary drug wrappings.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Testing Type/Testing Method, Packaging Material Type, End-User/Client/Customer, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical Packaging Testing Market Segment Insights

Testing Type/Testing Method Insights

Physical/Mechanical Testing: Pharmaceutical packaging testing is another market that is dominated by the physical/mechanical testing segment, which is important in ensuring the protection of the packaging integrity, durability, and its stress resistance. These tests are used to test the tensile strength, compression, drop resistance, and seal integrity to prevent leaking, breaking, or deformation during the transport, storage, and handling of the product. Physical testing as a standard of what products should be consumed should be a strict criterion for consumption rules and industry standards.

Chemical Testing: Chemical testing has become an important part of the pharmaceutical industry due to regulatory and safety requirements that have compelled the industry to increase the importance of chemical testing, including barrier testing and compatibility testing. Testing is conducted to make sure that the packaging materials are not reactive with drug formulations and are chemically stable, effective, and have a shelf-life. It analyzes the leachables, extractables, and interactions between drugs and packaging, which is of special concern to sensitive or biologic products. The increasing regulatory compliance demands and consumer safety concerns are catalyzing the use of chemical testing that assists manufacturers in avoiding contamination, degradation, or adverse reactions.

Microbiological/Sterility/Contamination Testing: Microbiological tests, sterility tests, and contamination tests are all necessary on sensitive pharmaceutical products such as sterile packaging, injectables, and vials, among others. These tests determine the existence of microbial contamination, the sterility, and guarantee that the packaging material to be used is good enough to keep the outside pathogens off the drug products during dark storage and transportation. The advanced microbiological tools, including rapid microbial detection and sterility assurance tools, allow manufacturers to adhere to rigid regimes, reduce the risks of contamination, and ensure a high level of quality, especially in hospitals, clinics, and critical care units.

Packaging Material Type Insights

Plastic: The pharmaceutical packaging testing market in 2024 was dominated by plastic since it is used with various and vast types of packaging packaging such as bottles, vials, blister packs, closures, and even flexible pouches. Its light weight, affordability, flexibility, and ability to be used with automated filling lines make it the choice of the manufacturers. The plastic packaging testing is aimed at durability, chemical compatibility, barrier performance, and mechanical integrity to provide product safety and regulatory conformity. The use of single-use systems, parenteral packaging, and consumer convenience products is also growing by creating pressure on demand.

Glass: The pharmaceutical testing packaging is a tremendous momentum of glass since it is an essential storage tool for injectable, biologic, and other sensitive drugs. Glass is more chemically resistant, inert, and barrier-sufficient, and it is the reason why glass is more appropriate in the formulations that require long-term stability and sterility. The glass packaging testing covers breakage test, thermal shock test, analysis of leachables/extractables, and sterility test to verify the safety of the product. Bio-logic growths, vaccinations, and high-value injectable drugs will increase the use of glass containers, thereby necessitating testing to ensure high-standard regulations and product efficacy.

Paper/Paperboard/Carton/Cardboard: The secondary pharmaceutical packaging consumes high paper, paperboard, carton, and cardboard as a box, cartons, as well as protective inserts. The materials provide support to the framework, branding, and rules and protect primary containers against physical damage during shipping and handling. Paper-based packaging testing is aimed at mechanical integrity, moisture, print, and environmental testing, which is gaining significance due to the importance of sustainable and recyclable materials. As the world moves towards environmentally-friendly packaging and the global regulatory aspect is putting pressure on the packaging material.

End-User/Client/Customer Insights

Pharmaceutical Companies/Drug Manufacturers: The Pharmaceutical packages testing market will be controlled by pharmaceutical companies and drug manufacturers in 2024 because they are the major producers of packaged drugs and the ones who are charged with the responsibility of ensuring the integrity of the packaging is maintained before the distribution of the drug. To operate to the requirements of regulation, to provide protection against product stability, and to be safe to the safety of the patient, they conduct vast quantities of physical, chemical, and microbiological testing. Their large volume of production, together with their interest in quality assurance, qualifies them as the largest revenue earners in the pharmaceutical packaging testing market.

Research Institutes/Testing Laboratories/Contract-Service Providers: The pharmaceutical packaging testing market will also grow fast as the demand for outsourced testing services will grow among research institutes, testing laboratories, and contract-service providers. These agencies offer chemical, physical, and microbiological expertise that is dedicated and helping pharmaceutical companies adhere to rigid rules. The need for testing advanced plans is triggered by new formulations, biologics, and vaccine development, which can be offered by these providers effectively.

Contract Packaging/Contract Manufacturing/Contract Testing Laboratories/CROs: CROs, contract packaging, contract manufacturing, contract testing laboratories and contract testing laboratories are all becoming important players in the pharmaceutical packaging testing industry. Such service providers assist the pharmaceutical companies with the packaging as well as quality assurance and testing under controlled conditions, usually providing specialized equipment, specialized technical knowledge, and scalability. Outsourcing enables a manufacturer to cut and simplify the operation, capital investment, and still meet the global standards without necessarily establishing in-house testing facilities.

Application Insights

Oral Drugs & General Oral/Solid Dosage Packaging: In 2024, oral drugs and general oral/solid dosage packaging generated the highest revenue due to the fact that they form a greater part of pharmaceutical products. The large volumes of their production and the large number of their distribution networks precondition the importance of the packaging integrity to guarantee drug stability, their safety, and their compliance with regulatory standards. These goods need to undergo rigorous physical, chemical, and barrier testing to avoid contamination, water uptake, or deterioration in the process of storage and transportation. The large number of blister packs, bottles, and other solid dosage containers distributed to the global markets fuels the need to test packaging and the need to test dosage.

Sterile Injectables/Biologics/Sensitive Drug Packaging: Sensitive drug packaging, sterile injectables, and biologics are likely to continue expanding significantly because of the increasing demand for biologics, vaccines, and state-of-the-art injectable therapies globally. These products have to be highly sterilized, tested in terms of integrity, and barrier to ensure patient safety and high standards of regulatory compliance. The handling, storage, and transportation of injectable and sensitive drugs pose complexity, which increases the urgency in the development of sophisticated solutions for packaging testing.

Liquid/Semi-Solid Therapeutics: Syrups, suspensions, creams, and ointments are also liquid and semi-solid therapeutics that require special packaging tests to ensure stability of the formulations and prevent contamination or leakages. Testing consists of evaluation of container closure integrity, chemical compatibility, and mechanical resilience during the conditions of storage and transportation. With the increasing patient demand for topical, oral liquid, and semi-solid medications, the necessity of an accurate packaging quality is on the rise.

Pharmaceutical Packaging Testing Market Region Insights

North America led the global pharmaceutical packaging testing market in 2024 because the region has one of the worlds most advanced and highly regulatedpharmaceutical manufacturing ecosystems. The stringent regulatory environment set by agencies like the U.S. Food and Drug Administration (FDA) and Health Canada requires continuous development and validation of next-generation testing technologies, including AI-controlled inspection systems, advanced material integrity testing, and environmentally controlled validation platforms that ensure product safety throughout the entire lifecycle.

The regions strong shift toward biologics, personalized medicines, and complex drug formulations also increases the need for highly specialized packaging systems that demand rigorous mechanical, chemical, and microbial testing. Growth is further supported by the substantial investment in research and development, a dense network of clinical trial activities, and the widespread adoption of laboratory automation and digital quality management tools across the pharmaceutical supply chain. North Americas well-established infrastructure of accredited testing laboratories and its rapid adoption of innovative packaging materials reinforce the regions leadership in the global market.

The U.S. market has the highest percentage of pharmaceutical product packaging testing in North America due to its wide capabilities of producing drugs and high rates of adopting new types of packaging technology. The U.S. is also home to numerous world leaders in the industry, pharmaceutical giants, as well as specialized testing laboratories and providers of solution-combining packaging that is regulated by the rules. Increasing numbers of product recalls, heightened regulatory audits, and a focus on anti-counterfeit packaging have also contributed to investment in high-level testing infrastructure. Besides, the U.S. is the world leader in the field of AI-based quality control, automated inspection systems, and digital validators, which enhances its role as the main force behind the development of the regional market.

Asia Pacific is projected to achieve the highest CAGR during the forecast period because the region is rapidly transforming into a major pharmaceutical manufacturing and export hub. Countries such as China, India, Japan, and South Korea are expanding large-scale production of generics, biosimilars, vaccines, and biologics, which significantly increases the need for comprehensive packaging validation processes, container closure integrity testing (CCIT), extractables and leachables analysis, and long-term stability testing. This expansion is supported by the regions rising healthcare expenditure, greater access to modern medical treatments, and the strong push toward international quality and safety compliance required to supply global markets.

The demand for high-performance primary and secondary packaging materials has grown substantially due to increased vaccine manufacturing, the scaling of injectable biologics, and the adoption of cold chain distribution systems that require precise verification of sterility assurance, barrier protection, moisture control, and temperature resilience. Governments across the Asia Pacific are strengthening GMP regulations, expanding regulatory inspections, and enforcing stricter compliance audits, which motivate pharmaceutical manufacturers and CROs to invest in advanced analytical technologies, automated inspection systems, and digital quality management tools. Continuous investments in research parks, biotech clusters, and specialized testing laboratories further accelerate the regions position as the fastest-growing market for pharmaceutical packaging testing.

China Pharmaceutical Packaging Testing Market Trends

With massive pharmaceutical manufacturing and growing biologics testing capacity, as well as enhanced regulatory control, China is becoming one of the most powerful markets in pharmaceutical packaging testing. The National Medical Products Administration (NMPA) keeps increasing the tightening of the requirements on packaging, safety, and quality that compel manufacturers to use more sophisticated testing instruments, including mechanical strength analysis, extractables and leachables testing, CCIT, and AI-driven visual inspection. International pharmaceutical packaging and testing technology partnering is hastening the adoption of technology and innovation. With the shift in China towards pharmaceutical production that is more value and innovation-based, the packaging testing is emerging as a strategic focus among both local and large-scale manufacturers.

The European pharmaceutical packaging testing market is witnessing sustainable growth because of the strict regulatory structures, a strong innovation pipeline, and the regions long-standing dominance in producing high-quality and compliant pharmaceutical packaging solutions. The European Medicines Agency (EMA) and country-specific authorities such as Germanys BfArM and Frances ANSM impose rigorous requirements on sterility testing, long-term stability evaluation, extractables and leachables analysis, and container closure integrity assessments, which elevates the need for advanced analytical methods. These regulatory conditions push manufacturers to adopt high-precision material testing platforms, automated inspection systems, digital validation tools, and chemical characterization technologies to ensure compliance.

Growth in Europe is further supported by the regions robust biologics and biosimilars sectors, which require highly controlled packaging systems and strict performance validation due to product sensitivity. Ongoing vaccine research and development activities continue to increase the demand for cold-chain packaging solutions, driving deeper investment in thermal performance testing, moisture barrier verification, and mechanical integrity assessments. In addition, the regions commitment to sustainability, the transition toward environmentally responsible packaging materials, and the advancement of a circular economy framework are compelling manufacturers to validate recyclability, material durability, and environmental compatibility. These combined drivers establish Europe as a stable and innovation-oriented hub for pharmaceutical packaging testing.

UK Pharmaceutical Packaging Testing Market Trends

The UK pharmaceutical packaging testing market is characterised by high-level regulatory requirements, high levels of research, and the fast introduction of next-generation testing methods. The UK has vibrant biologics, cell and gene therapy and vaccine development sectors that significantly increase the need to validate controlled environment packaging and integrity testing at varying temperatures and stress levels. Moreover, the priorities of the country in the field of digital quality management systems, laboratory workflow automation, and data-driven compliance auditing are changing the landscape of testing in the country. The collaboration between the UK universities, research institutes, and pharmaceutical companies also contributes to the faster process of innovation in the fields of packaging design, sustainability testing, and predictive modelling.

Pharmaceutical Packaging Testing Market Companies

- SGS SA

- Eurofins Scientific

- Intertek Group

- Nelson Labs

- West Pharmaceutical Services

- Gerresheimer AG

- AptarGroup

- Amcor plc

- Berry Global

- Nipro Corporation

- SCHOTT AG

- Catalent Inc.

- Thermo Fisher Scientific

- Pacific BioLabs

- DDL Inc.

- ALS Limited

- Labthink Instruments

- Qualitest International

- PTI Packaging Technologies & Inspection

- ALMAC Group

Recent Developments

- In October 2025, Intertek introduced new extractables and leachables (E&L) services in Switzerland in an attempt to assist its clients in meeting updated standards in the Korean Pharmacopeia. This increase enables the pharmaceutical and biotech companies that import or register in Korea to comply with the updated packaging-material safety standards under the mitigation of the GMP-compliant protocols.

- In May 2025, Intertek increased its pharmaceutical services laboratory in Melbourne, UK, to raise its ability to test inhaled biologics and intricate drug packaging. The expanded facility will provide new facilities with advanced mass spectrometry, particle characterization, and cell-based assay units to assist in rigorous testing of biologic and sterile drug packaging systems.

Pharmaceutical Packaging Testing MarketSegments Convered in the Report

By Testing Type/Testing Method

- Physical/Mechanical Testing

- Chemical/Chemical-compatibility/Migration/Residue/Barrier Testing

- Microbiological/Sterility/Contamination Testing

By Packaging Material Type

- Plastic (polymers) packaging

- Glass

- Paper/Paperboard/Carton/Cardboard

- Metal/Foils/Other materials

By End-User/Client/Customer

- Pharmaceutical Companies/Drug Manufacturers

- Contract Packaging/Contract Manufacturing/Contract Testing Laboratories/CROs

- Research Institutes/Testing Laboratories / QA-QC Labs

- Regulatory/Compliance/Third-party Testing Service Providers

By Application

- Sterile injectables

- Oral drug packaging

- Liquid/semi-solid therapeutics

- Biologics/specialty drugs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting